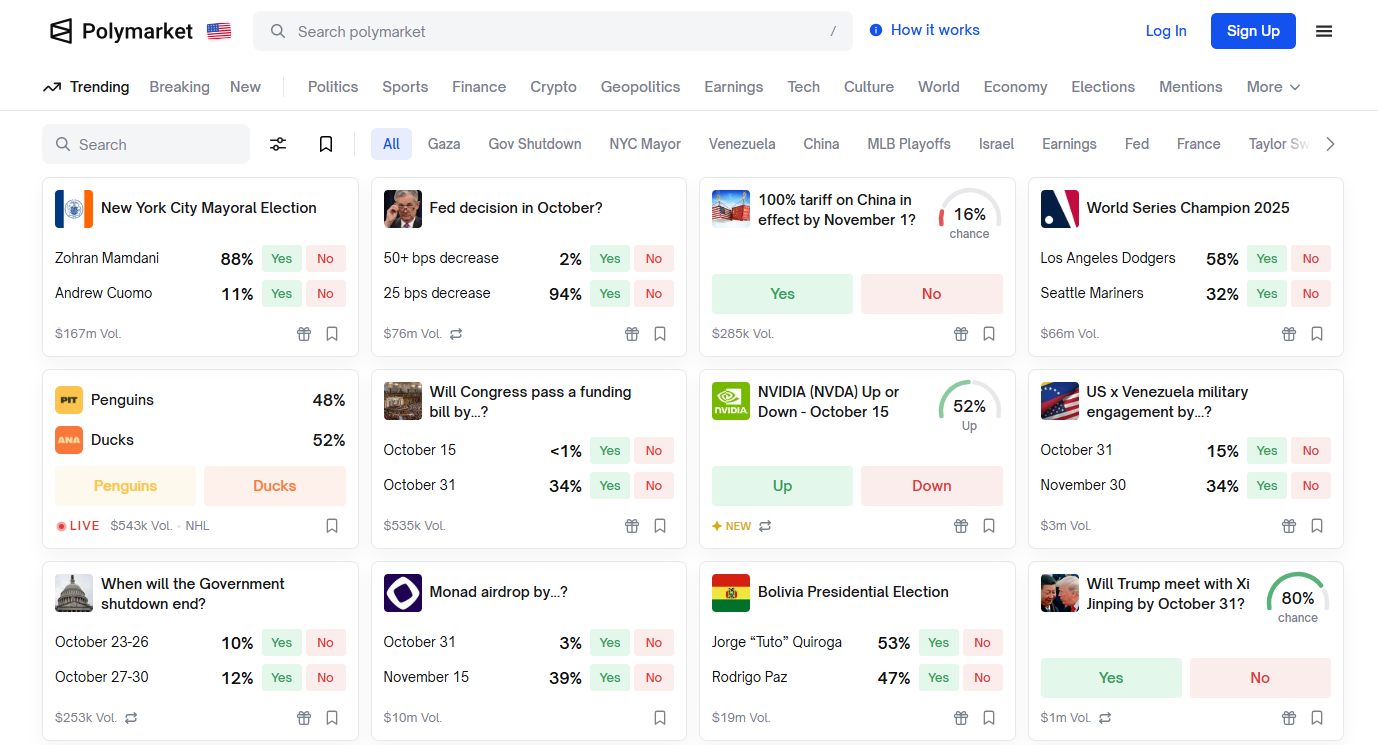

Ever wondered how people make money by predicting world events on the blockchain? Polymarket, the world’s largest onchain prediction platform, allows users to turn insights into profit from politics and sports to crypto and finance. Here’s how it works and why it’s shaping the future of decentralized forecasting.

What is Polymarket?

Polymarket is known as the world's largest prediction market platform, where users can stay updated with timely information and profit from their knowledge by betting on the outcomes of upcoming events across diverse fields.

Unlike conventional forecasting methods, this platform leverages market mechanisms to aggregate opinions from news, surveys, and experts, thereby creating accurate, objective probabilities that are continuously updated on important issues.

Key Features of Polymarket

Here are the standout features of Polymarket:

- Peer-to-Peer (P2P) Trading: No intermediaries, avoiding the risk of being banned for winning too much.

- Transparent Probability: Prices directly show the percentage chance of an event occurring in a clear and real time manner.

- Efficient Information Aggregation: Combines news, surveys, and expert opinions to achieve higher accuracy than traditional methods.

- Financial Guarantee: Each pair of outcomes is fully collateralized, reducing risk.

- Profit Opportunities: Allows those with deep knowledge in specific fields to earn money, while enhancing the overall market quality through incentive mechanisms.

How does Polymarket work

Here is the mechanism of Polymarket:

- Buying and Selling Prediction Shares: Users trade shares representing the outcome of an event. For example: "Will TikTok be banned in the US this year?". Each share is priced from 0 to 1 USDC, and each pair of outcomes (such as "Yes" and "No") is always guaranteed by 1 USDC.

- Creating Shares and Trading: Shares are formed when both parties agree on the odds, with the total amount equaling 1 USDC. Users trade directly with each other, without intermediaries like a "bookmaker."

- Pricing Reflects Probability: The share price represents the probability of the event occurring, based on supply and demand. For example: if the "Yes" share is priced at 0.18 USDC, it means the market assesses an 18% chance of it happening.

- Settlement and Risk: When the event concludes, the correct shares are paid out at 1 USDC each, while the incorrect ones lose value. Users can sell shares at any time to lock in profits or cut losses.

- Advantages in Accuracy: The mechanism encourages trading based on real information, leading to forecasts that are often more accurate than those from experts or public opinion polls, thanks to multi-source aggregation and economic incentives

$POLY Information

$POLY Key Metrics

- Token Name: TBA

- Ticker: TBA

- Token Type: TBA

- Total Supply: TBA

- Contract Address (CA): TBA

$POLY Use Case

Currently, Polymarket has not announced any official use case of $POLY for the project. Whales Market will update immediately when the official Polymarket website announces.

$POLY Listing

- Listing time: TBA

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

Polymarket Tokenomics & Fundraising

Tokenomics

Currently, Polymarket has not announced any official tokenomics for the project. Whales Market will update immediately when the official Momentum website announces.

Fundraising

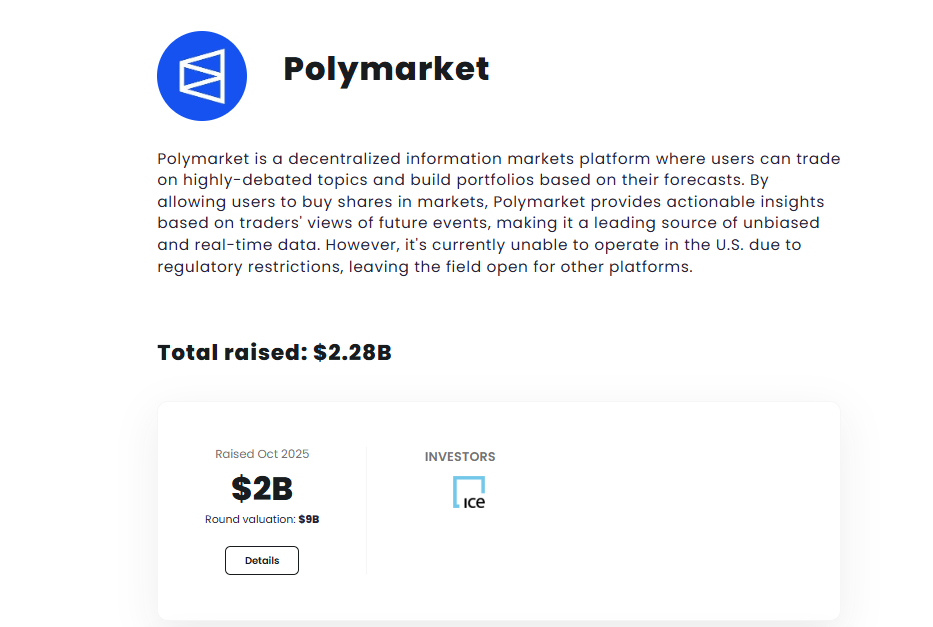

Polymarket has successfully raised a total of $2.28B through 7 funding rounds. The most notable one is the funding round that secured $2B with the participation of Intercontinental Exchange (ICE), the financial conglomerate behind the New York Stock Exchange (NYSE).

This agreement elevates Polymarket's valuation to $9B, while marking a significant milestone as traditional finance begins to delve deeply into the DeFi sector.

Polymarket Roadmap & Team

Roadmap

Based on official documentation and recent reports, Polymarket has not publicly detailed a long-term roadmap, but key developments as of October 2025 focus on regulatory compliance, U.S. market reentry, technological upgrades, and strategic partnerships.

Team

Here is core team of Polymarket:

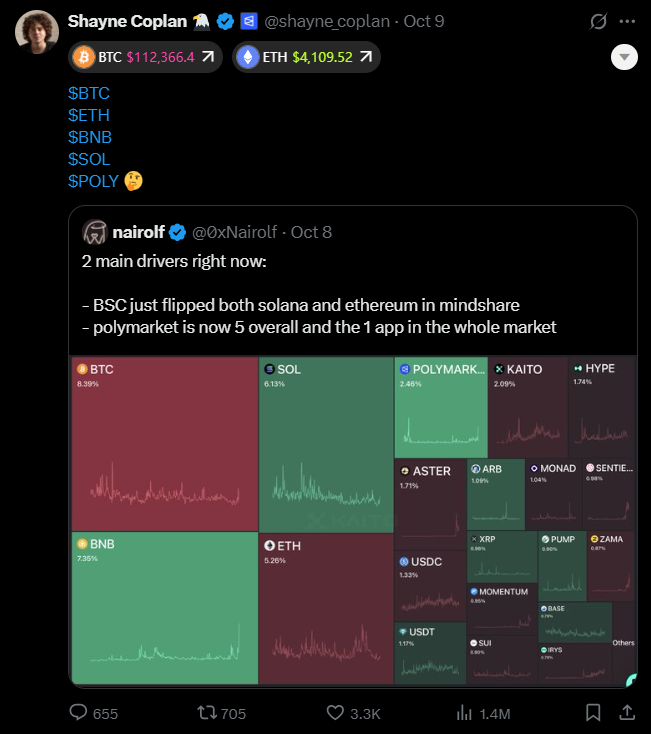

- Shayne Coplan: CEO

- Art Malkov: CMO

Conclusion

Polymarket with its reentry into the U.S. market, oracle upgrades, partnerships with MetaMask, X, and Stocktwits, and a $2B investment from ICE now has a strong foundation for scaling and building greater trust.

By maintaining regulatory transparency and driving continuous innovation, Polymarket has the potential to become a new global standard in financial prediction markets.

FAQs

Q1: What is the native token of Polymarket?

The native token of Polymarket is $POLY.

Q2: How does Polymarkte work?

Polymarket is a decentralized prediction platform where users trade “Yes” or “No” shares on real-world events. The price of each share (from $0 to $1) reflects the market’s perceived probability. Once the result is confirmed, winning shares pay $1, while losing ones become worthless, turning collective market sentiment into accurate real-time predictions.

Q3: What is Polymarket?

Polymarket is the world’s largest prediction platform, letting users profit from their knowledge by trading on the outcomes of real-world events across various fields.

Q4: How much has Polymarket raised?

According to CryptoRank , Polymarket has raised a total of $2.28B across 7 funding round.

Q5: What is $POLY pre-market price?

As of October 21, 2025, $POLY does not yet have a pre-market price. However, you will soon be able to trade it on Whales Market.

Q7: What is the price of $POLY today?

$POLY does not yet have an official market price since it has not been listed. However, you will soon be able to trade it on the leading pre-market platform, Whales Market. Here, you can buy more $POLY or sell to take profit before it is officially listed on CEXs like Binance or Bybit.