While cross-chain transfers have become more common, users still value solutions that are faster, cheaper, and easier to use. Owlto Finance focuses on improving the overall cross-chain experience by reducing friction and simplifying asset movement across networks.

What Is Owlto Finance?

Owlto Finance is a decentralized omni-chain liquidity protocol designed to remove friction from asset transfers between blockchains. Instead of forcing users to manually compare bridges or routes, Owlto applies AI-driven analysis, smart contracts, and zero-knowledge technology to automatically select the most efficient execution path based on user intent.

By coordinating liquidity across multiple decentralized venues, the protocol enables fast and cost-efficient transfers while maintaining a strong security standard. Even complex multi-chain transactions are handled smoothly in the background, allowing users to focus on results rather than technical steps.

Key highlights:

- Omnichain coverage: Supports more than 70 blockchain networks, including Ethereum, Bitcoin, Solana, and various Layer 2 networks.

- High speed: Over 90% of cross-chain transactions are completed within 30 seconds, with the fastest executions taking as little as 10 seconds.

- Security: Achieves an AA rating from CertiK, on par with Solana and Optimism, with no recorded incidents of user fund loss.

- Low cost: Offers some of the most competitive transaction fees in the market.

- Ease of use: One-click interface that does not require advanced technical knowledge.

- AI-powered: The first protocol to integrate AI agents directly into cross-chain interoperability.

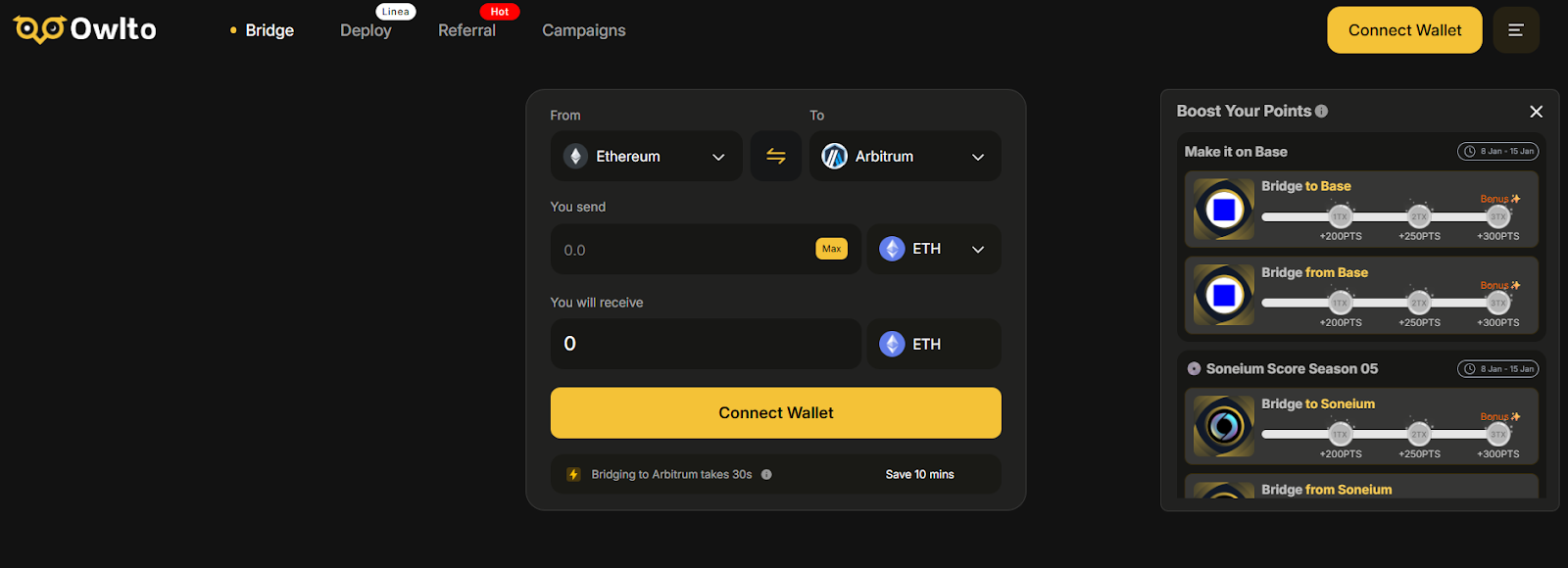

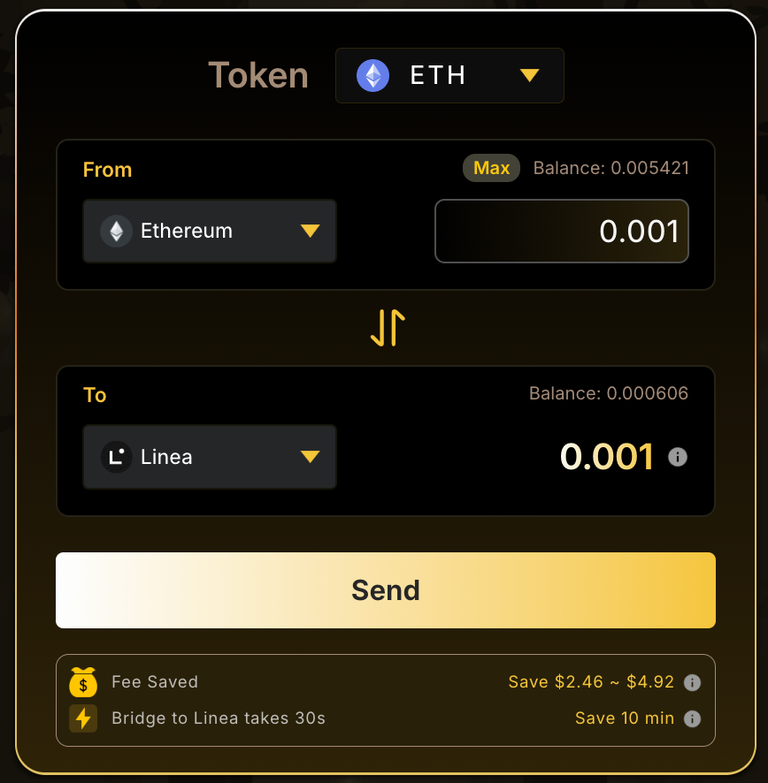

Bridge

Owlto Bridge functions as the backbone of Owlto’s cross-chain architecture, built to simplify asset movement across fragmented blockchain ecosystems. Through an adaptive routing engine, the protocol continuously evaluates liquidity availability and execution conditions to ensure fast, efficient, and reliable cross-chain transactions.

Key capabilities:

- Real-time analysis of liquidity and pricing across multiple routes to identify the most efficient execution path.

- Aggregation of liquidity from diverse sources to minimize slippage and reduce execution risk.

- Rapid transaction finality, enabling asset transfers to complete in seconds rather than minutes.

- Elimination of manual route selection, allowing users to achieve optimal outcomes with a single action.

- Support for advanced cross-chain use cases such as ecosystem migration, gas fee optimization, and multi-network asset management.

- A security-focused execution framework that balances frictionless transfers with strong reliability guarantees.

$OWL Token Information

$OWL Key Metrics

- Token name: Owlto Finance

- Ticker: $OWL

- Type: Utility and governance

- Total supply: 2B $OWL

- Contract address: TBA

$OWL Use Cases

- Governance: $OWL holders can stake tokens to participate in protocol governance, vote on key parameters, guide network expansion, and shape future development decisions.

- Revenue sharing: Owlto generates real on-chain fees through its interoperability engine. A portion of this revenue is distributed to $OWL stakers, directly linking protocol usage to long-term value.

- Fee discounts: Holding $OWL provides transaction fee discounts across supported chains, offering clear and practical benefits for frequent users.

$OWL Listing Details

- TGE date: TBA

- CEX listings: TBA

- Pre-market price (Whales Market): TBA

$OWL Tokenomics And Fundraising

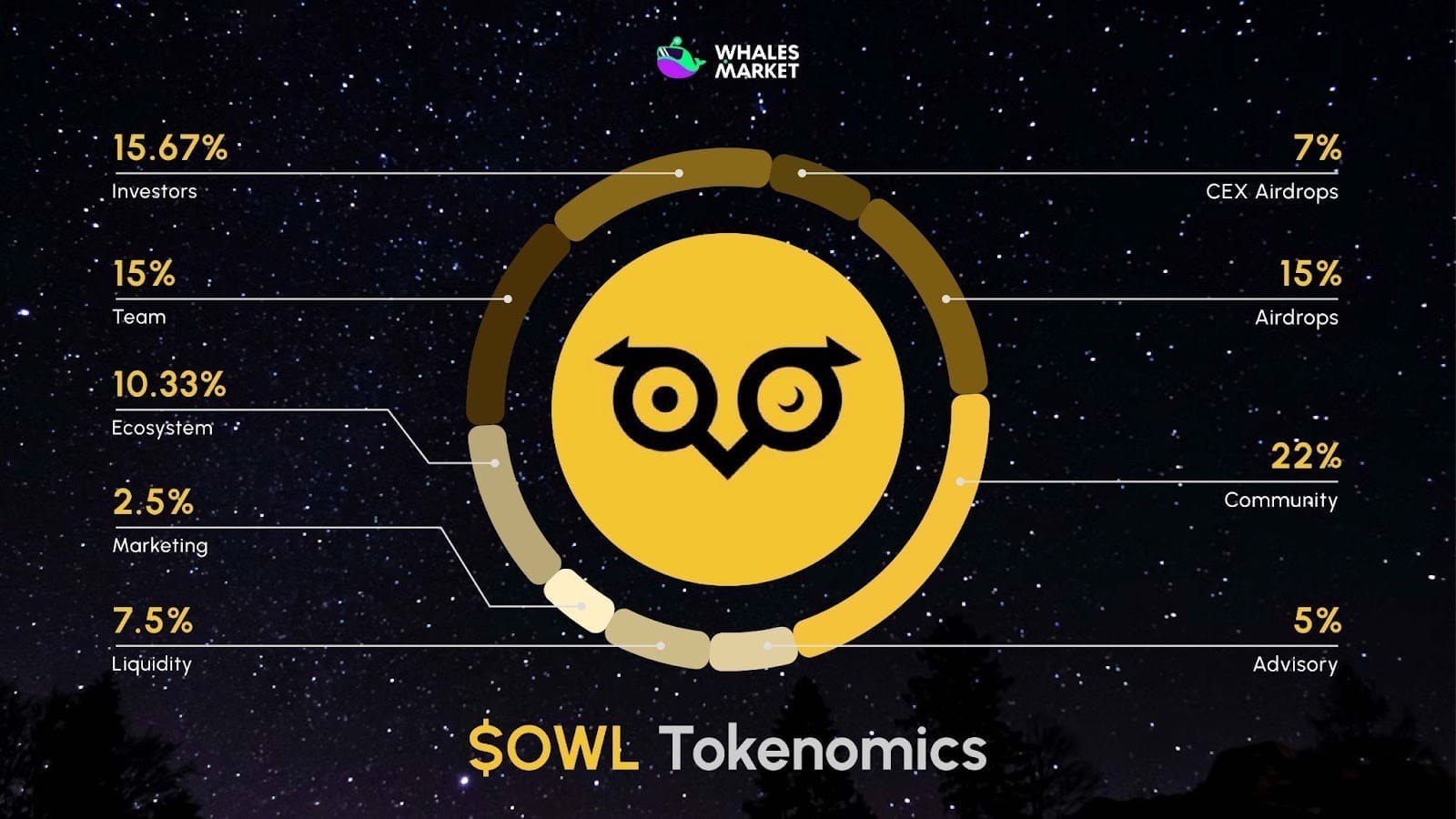

Tokenomics

- Total supply: 2B $OWL

Allocation:

- Community: 22%

- Investors: 15.67%

- Team: 15%

- Airdrop: 15%

- Ecosystem: 10.33%

- Liquidity: 7.5%

- CEX airdrop: 7%

- Advisory: 5%

- Marketing: 2.5%

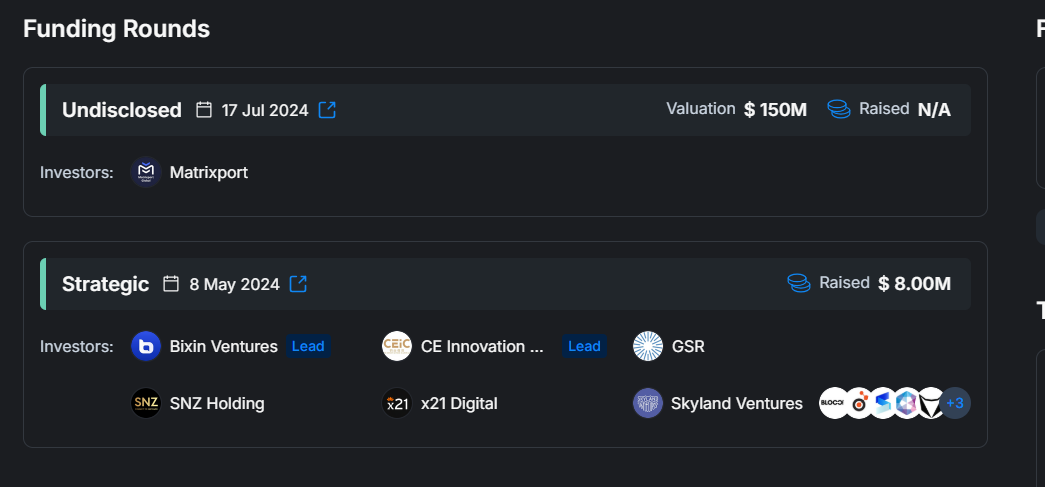

Fundraising

Owlto has publicly disclosed two major fundraising rounds.

- May 2024, the project completed a Strategic Round, raising $8M led by Bixin Ventures and CE Innovation, with participation from GSR, SNZ Holding, x21 Digital, and Skyland Ventures.

- July 2024, Owlto recorded an additional undisclosed investment round at an estimated valuation of around $150M. Matrixport was confirmed as an investor, while detailed fundraising figures for this round have not been publicly released.

Roadmap And Team

Team

The project has not yet publicly disclosed detailed information about its core team.

Roadmap

Owlto has not released a specific public roadmap.

Conclusion

Owlto Finance is positioning itself as a meaningful infrastructure layer within the multi-chain landscape, focusing on practical efficiency rather than technical showmanship. As interoperability continues to expand, Owlto has the potential to become a foundational component of the broader blockchain ecosystem.

FAQs

Q1. Which users is Owlto Finance best suited for?

Owlto is well suited for users who frequently move assets across multiple blockchains, multi-chain investors, and DeFi builders. The protocol helps reduce time, costs, and operational risk when interacting with different bridges.

Q2. What is the core difference between Owlto and traditional bridges?

Rather than acting as a simple bridge, Owlto operates as an intelligent liquidity coordination layer. The protocol automatically selects optimal routes using real-time data, removing the need for manual comparison or accepting high slippage.

Q3. What practical value does AI bring to Owlto?

AI in Owlto is not designed for show. It is used to analyze liquidity, pricing, and network conditions, enabling continuous optimization of routing decisions and delivering faster, more stable execution in volatile multi-chain environments.

Q4. What risks does Owlto face during its growth phase?

Like other infrastructure protocols, Owlto faces risks related to security, technological shifts, and market competition. However, its focus on safety, transparency, and early traction helps reduce systemic risk over time.

Q5. What is the current price of $OWL?

$OWL has not officially reached TGE and does not yet have an official listing price on major exchanges. However, the token is currently available on Whales Market in pre-market form, where pricing reflects early market expectations ahead of the official launch.