As ETFs are making waves with Bitcoin and Ethereum, RWA (Real World Assets) has become an inevitable narrative in the blockchain realm. Within the narrative, OpenEden has become a dominant name with the introduction of the US Treasury Bill on-chain.

Key Takeaways

- OpenEden’s mission is to bring real-world assets to DeFi to unlock trillions of dollars in value.

- OpenEden provides 24/7 on-chain access to tokenized US Treasuries, giving Web3 CFOs, DAOs, and institutions a low-risk, liquid solution for crypto cash management.

- The OpenEden Treasury Bills TBILL Vault ("TBILL Vault") is a smart contract vault that provides investors with direct exposure to a pool of short-dated U.S.

What is OpenEden?

OpenEden is a real-world asset (RWA) platform that bridges traditional finance and Web3, making safe, yield-bearing assets accessible on-chain. By tokenizing US Treasuries, it enables investors to manage cash efficiently while staying within the crypto ecosystem.

OpenEden provides 24/7 on-chain access to tokenized US Treasuries, giving Web3 CFOs, DAOs, and institutions a secure, liquid cash management tool. It is the first tokenized RWA issuer to earn a Moody’s “A-bf” bond fund rating and, since 2023, has grown into the largest issuer of tokenized US Treasuries in Asia and Europe. Through its licensed investment manager, OpenEden oversees a BVI-registered fund, issues $TBILL tokens, and safeguards assets with licensed custodians.

The OpenEden Treasury Bills TBILL Vault (“TBILL Vault”) is a smart contract that gives investors direct exposure to a pool of short-term U.S. Treasury Bills and overnight reverse repurchase agreements by minting the TBILL token. Each TBILL token is backed 1:1 by short-term U.S. T-Bills and a small reserve of U.S. dollars.

TBILL token holders will receive a return on their capital that reflects the returns generated by the underlying U.S. T-Bills portfolio held by the Fund. At any given time, the Fund will hold a portfolio of U.S. T-Bills and USD with designated regulated custodians.

OpenEden Mission

OpenEden’s mission is to bring real-world assets into DeFi and unlock trillions in value. It envisions internet-native money making these assets accessible to all, fostering a more inclusive, permissionless, and free-flowing economy.

The Stakeholders in the OpenEden ecosystem

There will be four key stakeholders in the OpenEden ecosystem

Investor

An investor acquires TBILL tokens by depositing USDC into the TBILL Vault and, in return, receives tokens held in their own wallet for full control and ownership. When redeeming, the investor exchanges their TBILL tokens back for USDC from the Vault.

Token Issuer

The Token Issuer is a professional fund registered under the British Virgin Islands Securities and Investment Business Act 2010 and is regulated by the British Virgin Islands Financial Services Commission.

Investment Manager

BNY Mellon Investment Management Singapore Pte. Limited is a fund management firm mandated to invest in short-dated U.S. Treasury Bills. Its exclusive role as Investment Manager is to allocate the Fund’s assets into segregated accounts held with top-tier, regulated, and qualified custodians.

Fintech Service Provider

River Labs Pte Ltd, the developer of the TBILL Vault, is a financial technology company that provides and services the underlying technology underpinning the TBILL Vault. It is not a regulated entity, depository, bank, or credit union.

USDO

The OpenEden OpenDollar (“USDO”) is a rebasing, yield-generating stablecoin issued by OpenEden Digital (“OED”), a digital asset issuer licensed by the Bermuda Monetary Authority (“BMA”). OED operates as a wholly owned subsidiary of OpenEden Group (“OEG”). Pegged at $1, USDO provides holders with stability while distributing yield derived from its reserve assets.

cUSDO

cUSDO is a wrapped version of USDO designed for platforms that don’t support rebasing tokens, while preserving USDO’s value and stability. Instead of daily rebasing, it compounds yield internally, increasing each token’s value over time. This makes cUSDO ideal for protocols needing stable values or rebasing compatibility, while remaining composable and interoperable.

OPENEDEN TRADING CAMPAIGN ON WHALES MARKET

To celebrate the listing of $EDEN - the leading RWA platform on BNB Chain with over $350M in total value locked – Whales Market is launching a special campaign. All trades participating in this campaign will be eligible to claim rewards if they meet the following conditions:

- Trade $EDEN on Whales Market and use cUSDO as collateral

- Reach at least $1000 in filled volume.

- Only filled orders are counted

The $EDEN Token

The $EDEN token is designed to power OpenEden’s next phase of growth, serving as the foundation for governance, staking, rewards, and ecosystem incentives. Holders will be able to participate in key decision-making processes, earn rewards through staking, and benefit from programs that encourage active engagement across the platform. Beyond community alignment, $EDEN will also function as a core utility token within the platform’s products and services, while a treasury buyback mechanism helps reinforce long-term value and sustainability for the ecosystem.

Token Key Metrics

Here is the information of $EDEN token

- Token Name: OpenEden

- Ticker: $EDEN

- Token Type: TBA

- Total Supply: 1B $EDEN

- Contract address: 0xdd50C053C096CB04A3e3362E2b622529EC5f2e8a

$EDEN airdrop

As part of the Bills Campaign Airdrop, 7.50% of $EDEN will go to Bills Campaign participants.

$EDEN Use Case

Here is main use case via $EDEN:

- Staking Rewards: Users staking EDEN tokens can receive staking rewards.

- Governance Design: From matters such as token emission schedule and discussion on future product roadmap, we will allow for governance voting from the community using governance tokens, building alignment between token holders and the issuer.

- Bootstrapping Growth: A portion of EDEN tokens remain earmarked for future reward emissions to bootstrap growth of new products launched by OpenEden

- Fee Discounts and Rebates: Holders of governance tokens may be entitled to fee discounts or rebates for using products and services within the OpenEden ecosystem. Holding xEDEN tokens may also open up access to premium product features and services.

$EDEN Listing Information

Here are important details revealed to $EDEN:

- Listing time: TBA

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): $0.549

On August 15th, 2025, OpenEden launched a Booster Campaign in conjunction with the Binance Booster Program, confirming its upcoming listing on Binance Alpha.

OpenEden Tokenomics & Fundraising

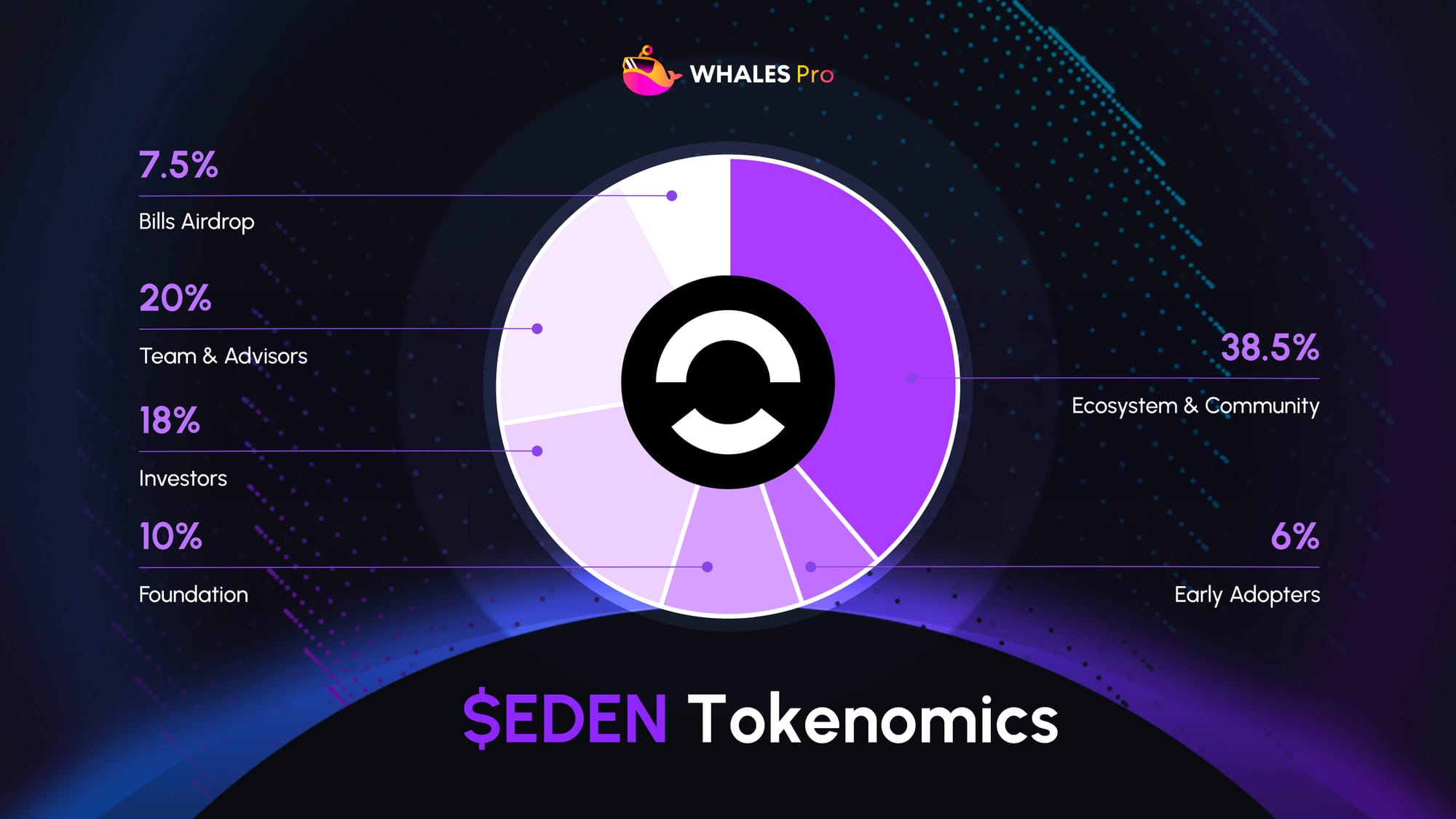

Tokenomics

- Total Supply: 1B $EDEN

- Token Allocation:

- Bills Airdrop: 7.5%

- Ecosystem & Community: 38.5%

- Early Adopters: 6%

- Foundation: 10%

- Investors: 18%

- Team & Advisors: 20%

Fundraising

OpenEden's sole investor is Yzi Labs, formerly known as Binance Labs. They also has raised total of $5M across 2 rounds, led by Yzi Labs.

OpenEden Roadmap & Team

Roadmap

Currently, LABtrade has not announced any official roadmap for the project. Whales Market will update immediately when the official LABtrade website announces

Team

The OpenEden core team include:

- Jeremy Ng: CEO

- Duke Du: CTO

- Frederick Chng: Head of Product

Conclusion

OpenEden is a tokenized US Treasury bond solution that aims to provide easy access anytime, anywhere to global investors through a decentralized financial system. OpenEden has a solid human foundation as the founding team are all people with extensive experience in both traditional finance and blockchain.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is OpenEden?

OpenEden operates a leading real-world asset (RWA) tokenization platform, renowned for its unmatched focus on regulatory standards and advanced financial technology.

2. What is the native token of OpenEden ($EDEN)?

The native token for OpenEden is $EDEN, which utilities including Governance, Staking Rewards, Ecosystem Incentives and Platform Utility.

3. What is OpenEden ($EDEN) price today?

While OpenEden ($EDEN) hasn't been listed yet, users can trade $EDEN pre-market on Whales Market at $0.52 before the TGE. Here you can trade $EDEN before the asset got listed on leading CEXes like Binance, Bybit or OKX.

4. What is OpenEden ($EDEN) pre-market price?

The pre-market price for OpenEden is currently $0.52 on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

5. What is OpenEden ($EDEN) tokenomics?

On August 14th 2025, OpenEden has announced the tokenomics for $EDEN. The $EDEN token has a total supply of 1 billion tokens. Of this allocation, 7.5% is reserved for the Bills airdrop, 38.5% is dedicated to the ecosystem and community, and 6% is allocated to early adopters. The Foundation holds 10% of the supply, while investors account for 18%. The remaining 20% is designated for the team and advisors.

6. What is the total supply of OpenEden ($EDEN)?

On August 14th 2025, the OpenEden team announced that the total supply for $EDEN will be 1 billion.

7. Will there be an airdrop for OpenEden ($EDEN)?

Yes, the OpenEden team will dedicate 7.5% of the total supply to airdrop for Bills campaign participants.