Many people wonder why a digital image sells for millions, or why collectors chase cartoon apes. Behind those stories is NFT, a technology that turns a digital file into a verifiable asset with real value. It sounds odd, yet the logic is solid.

What is NFT?

An NFT (Non-Fungible Token) is a unique digital asset on a blockchain, acting like a proof of ownership. Unlike interchangeable money or Bitcoin, each NFT has a distinct ID, like an original painting, not a copy. NFTs cover art, music, video, and in-game items.

The idea emerged around 2014 with standards like ERC-721 on Ethereum. CryptoPunks and CryptoKitties drew attention in 2017. In 2021, trading peaked above $15.7B. After a 2022–2023 slump, 2024–2025 saw recovery as real use cases expanded across sectors.

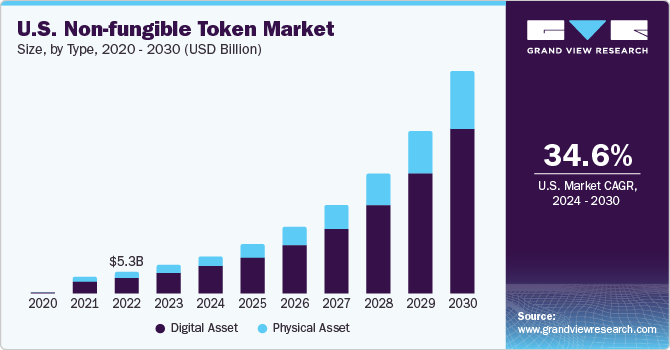

In 2025, “NFT 2.0” is rising: dynamic NFTs, AI integration, cross-chain movement, and broader industry adoption. NFTs are shifting from pure collectibles toward practical digital infrastructure with everyday utility. Some analysts forecast a market size near $56B by 2030, if adoption continues.

According to Grand View Research, they predict the NFT market could reach a scale of $56B by 2030.

How does NFT Work?

NFTs are minted and stored on blockchains. In 2025, Ethereum leads with ERC-721 and ERC-1155, while Solana, Polygon, and BNB Chain grow fast with low fees and speed, great for gaming. Smart contracts record ownership, royalties, and metadata with automatic, transparent rules.

The process of creating and trading NFTs:

- Minting: A creator uploads a digital file to platforms like OpenSea or Rarible. The file links to a unique on-chain token with metadata: name, description, and immutable ID. Ownership becomes verifiable instantly, which feels surprisingly empowering for creators.

- Buying/Selling: Users connect wallets (MetaMask, Phantom, Trust Wallet) and pay with the required token. Smart contracts handle settlement instantly and transparently. Counterfeits get filtered by on-chain provenance, which keeps markets cleaner over time.

- Verification: Each NFT carries a unique ID and a public transaction history. Anyone can audit ownership and transfers. This open ledger is the quiet superpower behind the entire model.

New Tech in 2025

- Dynamic NFTs: Content changes with real-world data or user activity, art that tracks weather, characters that evolve with achievements. It keeps assets alive, not static.

- Phygital NFTs: Bridge digital and physical. Buy an NFT and redeem real shoes, plus access to events. BAYC popularized community rights, live meetups, and metaverse perks alongside the image.

- Cross-Chain: Movement across blockchains expands liquidity and utility. Portability matters as ecosystems fragment and specialize.

What is the use case of NFT?

- Art and Collectibles: NFTs enable provable ownership for digital art. NBA Top Shot sold highlight moments at scale. CryptoPunks and BAYC became status symbols, like 1

- Music and Entertainment: Artists release exclusive albums, passes, or backstage access. In 2025, streaming links with NFTs so fans can hold rights or revenue shares. Engagement turns from passive listening into aligned participation.

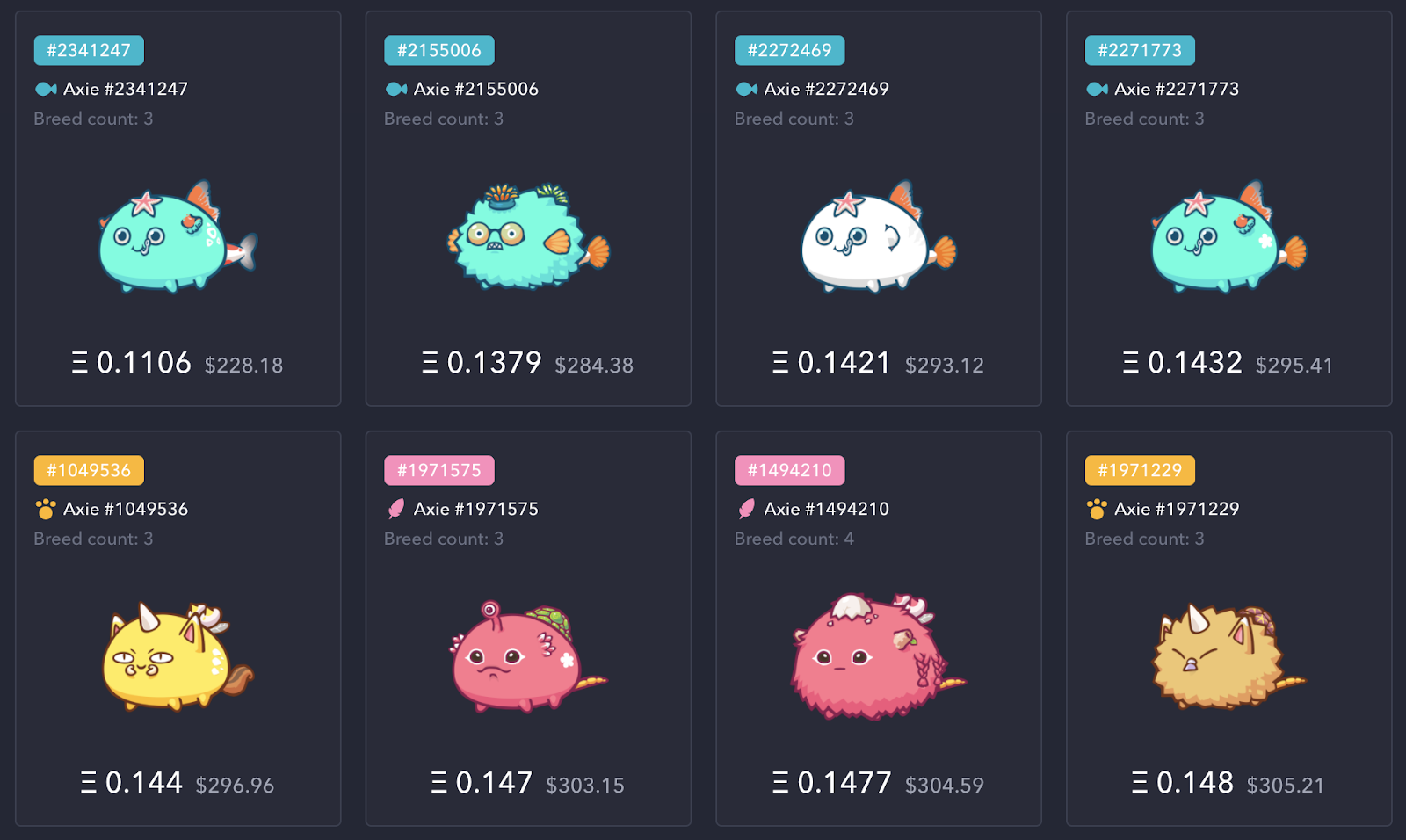

- Gaming and Metaverse: NFTs represent valuable in-game assets. Axie Infinity showed play-to-earn potential; Decentraland turned virtual land into tradable property. By 2025, Web3 gaming pushes interoperability so assets travel across titles.

- Real Estate and Tangible Assets: NFTs can represent property and fractionalize ownership. “Phygital” models connect tokens to real cars or real-estate deeds. Certificates live on-chain, while rights remain enforceable off-chain with proper structures.

- Other Uses: Carbon credits as NFTs for transparent tracking. In DeFi, NFTs serve as loan collateral. In education, verifiable certificates reduce fraud. E-commerce loyalty uses tokenized memberships. Digital fashion outfits avatars across worlds.

Overall, the market is shifting from collectibles to utility. Tokenized real-world assets keep expanding, turning NFTs from novelty into practical financial and identity rails.

Benefits and Risks

Benefits:

- Clear Ownership: Blockchains record every transfer, ensuring authenticity. Buyers truly own the asset, not just a file copy, which changes digital culture in subtle ways.

- Creator Income: Built-in royalties send a percentage on each resale, often 10–20%. This rewards creators long-term and aligns markets with creative work.

- Global Liquidity: Marketplaces connect millions, enabling fast trades. With growing cross-chain support, NFTs can move freely, increasing reach and price discovery.

Risks:

- Environmental Impact: Energy concerns improved after Ethereum’s Proof-of-Stake, yet sustainability remains a watching brief across chains.

- Legal Uncertainty: Tax and regulations are inconsistent. For example, the IRS treats NFTs as taxable property, requiring proper reporting.

- Research carefully, secure wallets, and only allocate capital a user can afford to lose. Start small, learn from communities, and prioritize risk control. Opportunities exist, but discipline decides outcomes.

Conclusion

NFTs provide a powerful way to own and trade digital assets with uniqueness, security, and growing utility. From art to metaverse to real-world assets, NFTs look less like a fad and more like foundational rails for a fairer digital economy.

FAQs

Q1: How to buy an NFT?

Users need a crypto wallet like MetaMask, connect to a marketplace (e.g., OpenSea), and pay with supported tokens.

Q2: Are NFTs safe?

Security comes from blockchain, but users must avoid scams and verify projects. Basic vigilance goes a long way.

Q3: How are NFTs used in games?

They represent items or characters that can be owned, traded, and sometimes used across multiple titles.

Q4: How do NFTs differ from cryptocurrencies?

NFTs are unique and non-interchangeable. Cryptocurrencies like BTC or ETH are interchangeable, one unit equals another unit.