By combining synthetic dollars with market-neutral strategies, OTC arbitrage, and DeFi-native yield techniques, Neutrl offers both individual and institutional users a transparent, capital-efficient way to earn consistent returns without taking on directional market risk.

What is Neutrl?

Neutrl is a synthetic-dollar protocol focused on market-neutral yield, issuing NUSD that is backed by crypto assets and offset with hedged futures positions. Returns are generated by a blended strategy utilizing discounted over-the-counter (OTC) arbitrage and on-chain delta-neutral trading. This approach aims to reduce directional market exposure and captures returns from structural market inefficiencies.

To clarify terms:

- Market-neutral is the strategic goal of generating returns uncorrelated with the overall market trend (up or down).

- Delta-neutral is the specific technical method used to achieve this. It involves simultaneously taking equal and opposite positions to eliminate sensitivity to price changes and lock in yield from the spread or funding rate, such as holding a spot asset long while shorting the equivalent future.

How does Neutrl Work?

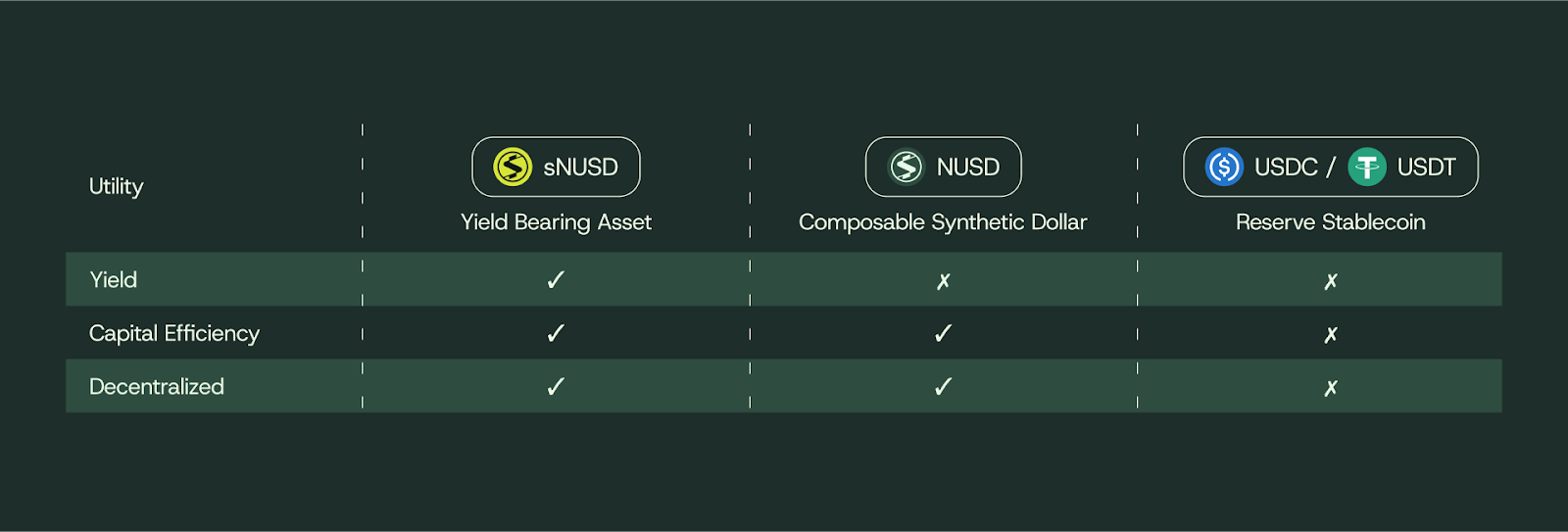

The Neutrl protocol operates with a dual-product system: NUSD, its core synthetic dollar, and sNUSD (staked NUSD), the crucial yield-bearing token. By ultilizing them, Neutrl allows users to access high and market-neutral yields.

How Neutrl Generates Yield

Neutrl achieves market neutrality by generating returns independently of the overall crypto market direction. This is accomplished by combining two primary strategies:

- OTC Arbitrage: Neutrl acquires token allocations in private OTC deals at a discount, often well below public market prices. To hedge price risk, it opens matching short positions in perpetual futures. When the tokens unlock, the trade is settled, and the profit comes from the spread between the discounted purchase price and public market value. This strategy forms the primary, stable source of yield for the protocol.

- Delta-Neutral Hedging: A portion of capital is deployed into on-chain, market-neutral strategies, including funding-rate and basis arbitrage. These positions involve going long on spot markets and shorting perpetual futures to capture funding premiums without directional risk. This layer adds liquidity and additional yield, while remaining largely uncorrelated with market movements.

NUSD and sNUSD: How Yield Is Accumulated

The generated yield is channeled to users through a two-token system:

- NUSD Issuance: Users deposit liquid collateral stablecoins (USDC, USDT, USDe) to mint NUSD at a 1:1 USD value basis. NUSD is the composable, spendable synthetic dollar. It can be held, traded, or staked.

- Yield Accrual (sNUSD): Users stake NUSD to receive sNUSD. All net revenue from the blended yield engine flows continuously into the staking contract. This causes the sNUSD token to automatically appreciate in value over time, reflecting the passively accrued yield. sNUSD can be unstaked and redeemed back into NUSD and then stablecoins.

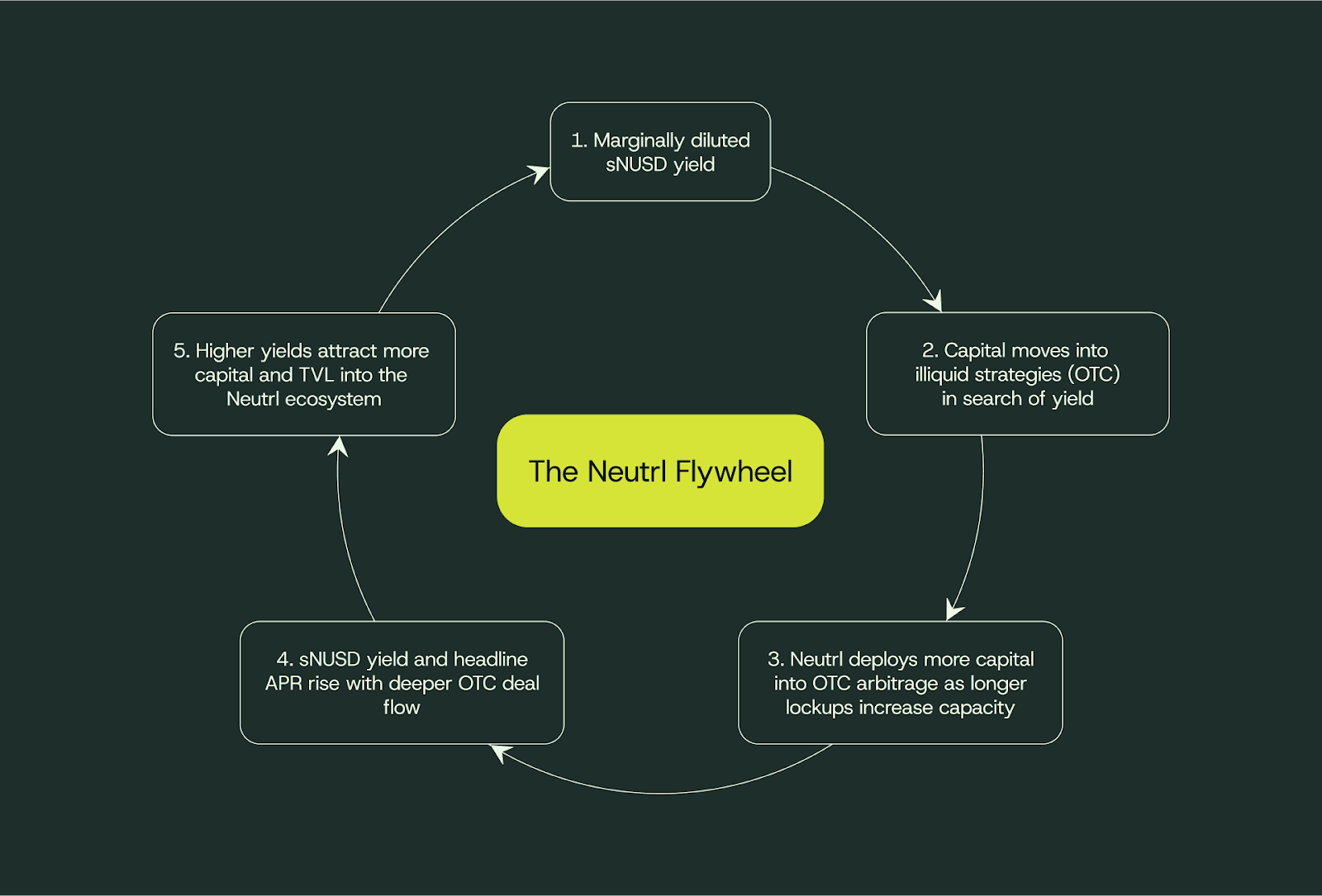

When new NUSD is minted or deposited, the yield for sNUSD is initially diluted. This can trigger a cycle where capital moves toward opportunities that offer higher returns.

As overall yields decrease, investors may look for better options by staking NUSD, converting it to sNUSD, or locking their funds for longer periods, such as 6, 9, or 12 months. Longer lock periods allow the protocol to participate in larger OTC deals and on-chain arbitrage opportunities that require more capital.

As more capital is deployed, yields increase, which can attract additional deposits. This cycle continues until the available longer-term opportunities are fully utilized. The process is automatic and helps manage liquidity while aiming to maintain consistent yields.

How NUSD Maintains Its Peg

Neutrl uses a simple, incentive-driven system combined with a risk-managed portfolio to keep NUSD stable:

- Arbitrage incentives:

- If NUSD < $1: Traders can buy it cheaply and redeem it for $1 in stablecoins.

- If NUSD > $1: Users can mint new NUSD at $1 and sell it at market price. These incentives naturally maintain the peg.

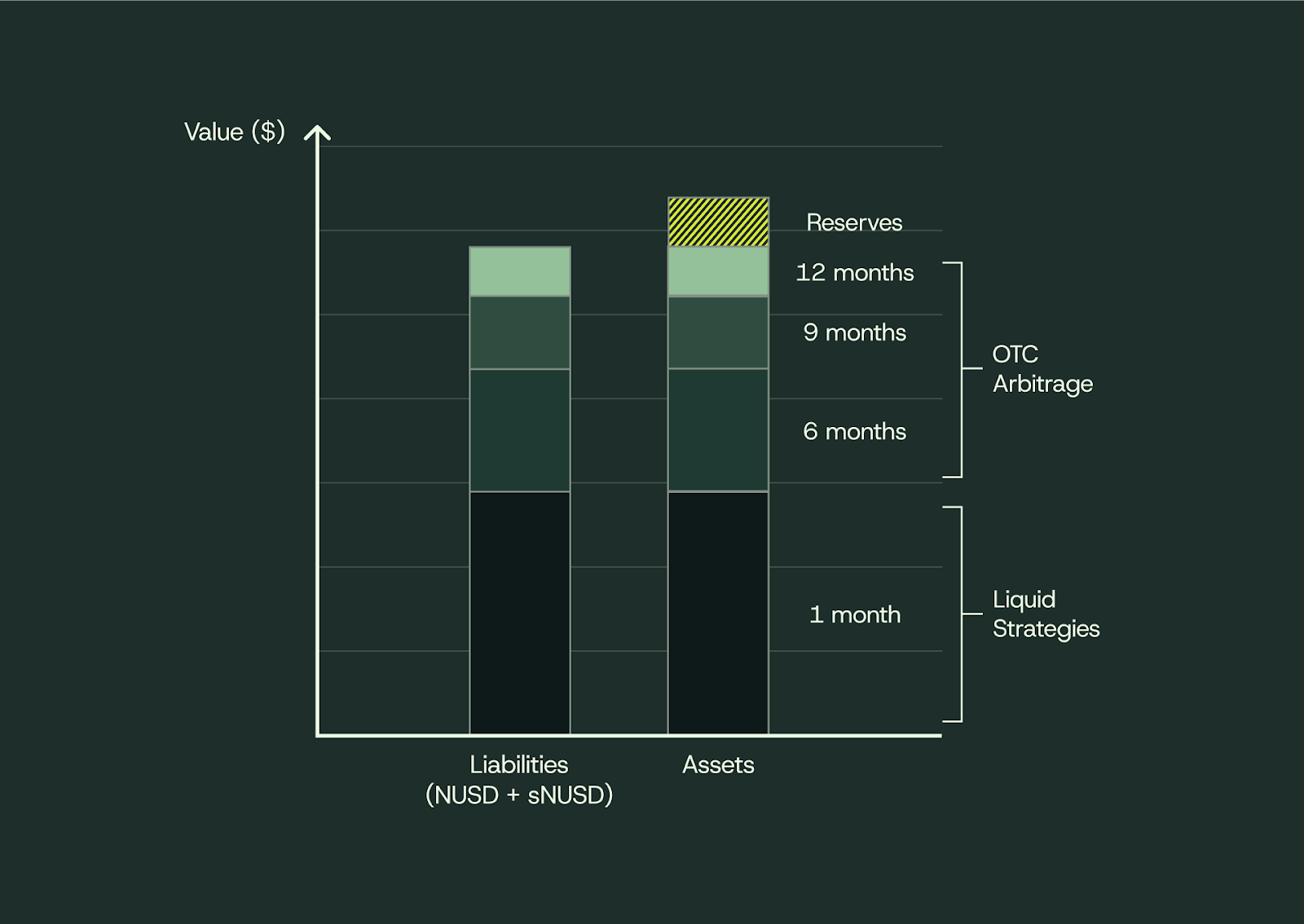

- Backed by redeemable assets: NUSD is supported by liquid stablecoins, hedged positions, and token allocations from OTC deals. A portion is held as immediately redeemable liquidity to ensure smooth withdrawals.

- Risk-managed portfolio: Exposure is diversified across OTC and delta-neutral strategies. All positions are hedged using derivatives. The portfolio is continuously hedged and uses regulated custodians and off-exchange settlement to reduce counterparty and exchange risks.

This layered approach ensures that NUSD holders can redeem at any time, while yield generation remains stable and resilient.

Key Features of Neutrl

By incorporating yield sources that are typically accessible only to larger market participants such as hedge funds and OTC desks, Neutrl aims to provide more consistent value retention for users. Some key features of Neutrl are:

- Fully-backed synthetic dollar: NUSD is a synthetic dollar fully backed by liquid stablecoins (USDC, USDT, USDe), crypto assets, and hedged positions using short perpetual futures. Unlike traditional fiat-backed stablecoins, NUSD relies on market-neutral strategies rather than fiat reserves for stability.

- sNUSD - Yield-bearing version: sNUSD is a version of NUSD that automatically accrues yield over time. Yield comes from the protocol’s OTC arbitrage and delta-neutral on-chain strategies, without exposing holders to market price risk.

- Peg stability mechanism: Maintains $1 peg through arbitrage incentives: buy below $1, redeem at $1; mint at $1, sell if price > $1. Furthermore, NUSD is fully redeemable for whitelisted participants with approved stablecoins, and backed by a risk-managed portfolio to support stability at all times.

- On-chain risk management: Aligns asset and liability maturities with a 1:1 duration ladder to reduce liquidity and maturity mismatches. Capital is diversified across OTC and on-chain strategies, and positions are continuously hedged.

- Equal access to institutional-level yield: All users, retail or institutional, access the same yield opportunities without special privileges. Both NUSD and sNUSD are capital-efficient, usable across on-chain applications while participating in yield generation.

Neutrl Token Information

- Token Name: Neutrl

- Ticker: TBA

- Token Type: TBA

- Token Standard: TBA

- Total Supply: TBA

- Initial Circulating: TBA

- Contract Address (CA): TBA

Neutrl Fundraising

Neutrl secured $5 million in a seed funding round led by STIX, a digital asset private marketplace, and venture firm Accomplice, with additional support from Amber Group, SCB Limited, Figment Capital, and Nascent.

Conclusion

Neutrl’s synthetic dollar offers high-quality, market-neutral returns through specialized OTC market strategies. By emphasizing transparency and stability, Neutrl advances crypto-native yield generation, making previously private strategies available to a broader audience.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

What is the native token of Neutrl?

Neutrl has not announced their native token yet. Whales Market will monitor and inform when they have official information.

What is $NUSD of Neutrl?

$NUSD is the stablecoin of Neutrl. It’s spendable synthetic dollar, maintaining stable value through a fully-backed structure that includes crypto assets, liquid synthetic dollars, and matching short futures positions. Approved participants can redeem NUSD for USDC or USDT at a 1:1 value.

How does Neutrl generate yield?

Neutrl combines multiple market-neutral strategies, including OTC arbitrage, basis trading, and funding-rate arbitrage. By pairing long spot positions with matching short futures, the system earns consistent yield while minimizing directional exposure.

Is $NUSD redeemable?

Yes. Whitelisted participants can redeem NUSD for USDC or USDT at any time. Smaller redemptions are processed instantly via the AssetReserve buffer, while larger redemptions are queued and typically completed within 48 hours.

How is Neutrl different from traditional stablecoins like USDC or USDT?

USDC and USDT are fiat-backed stablecoins, while NUSD is a crypto-backed synthetic dollar paired with short futures positions. This structure gives NUSD a fundamentally different risk profile and allows it to earn yield through market-neutral strategies.

Is there a Neutrl Token Airdrop?

Neutrl has not made any official announcement regarding a token airdrop, nor has the project denied the possibility. As a result, users can reasonably speculate about a potential airdrop and may explore opportunities such as minting and staking NUSD to position themselves if one occurs. More information will be added once confirmed from Neutrl.