The crypto market is gradually proving its core values through transparency, 24/7 operations enabled by DeFi, stablecoins, and tokenization.

The next step the entire industry needs to push forward is simplifying user experience and making it as friendly as possible for users in traditional markets. Neobank is becoming a prominent narrative in bringing DeFi closer to users. So what is a neobank?

Neobank Definition: What is a Neobank?

A neobank is a type of financial institution that provides banking services entirely through digital platforms without traditional physical branches. Neobanks operate mainly through mobile applications and websites, offering products such as savings accounts, checking accounts, debit cards, personal loans, investment services, and even business banking.

They differ from traditional banks by focusing on reducing operating costs through branchless models, offering lower fees, higher interest rates, and a more user-friendly experience.

Neobanks emerged alongside the strong rise of fintech in the 2010s, with pioneering names such as Chime (USA, 2013), Revolut (UK, 2015), and N26 (Germany, 2013).

With the emergence of DeFi, neobanks gain additional relevance when they integrate blockchain to support digital assets such as tokens and stablecoins. Processes are automated through smart contracts, allowing users to self-custody assets and receive higher and more flexible yields through DeFi.

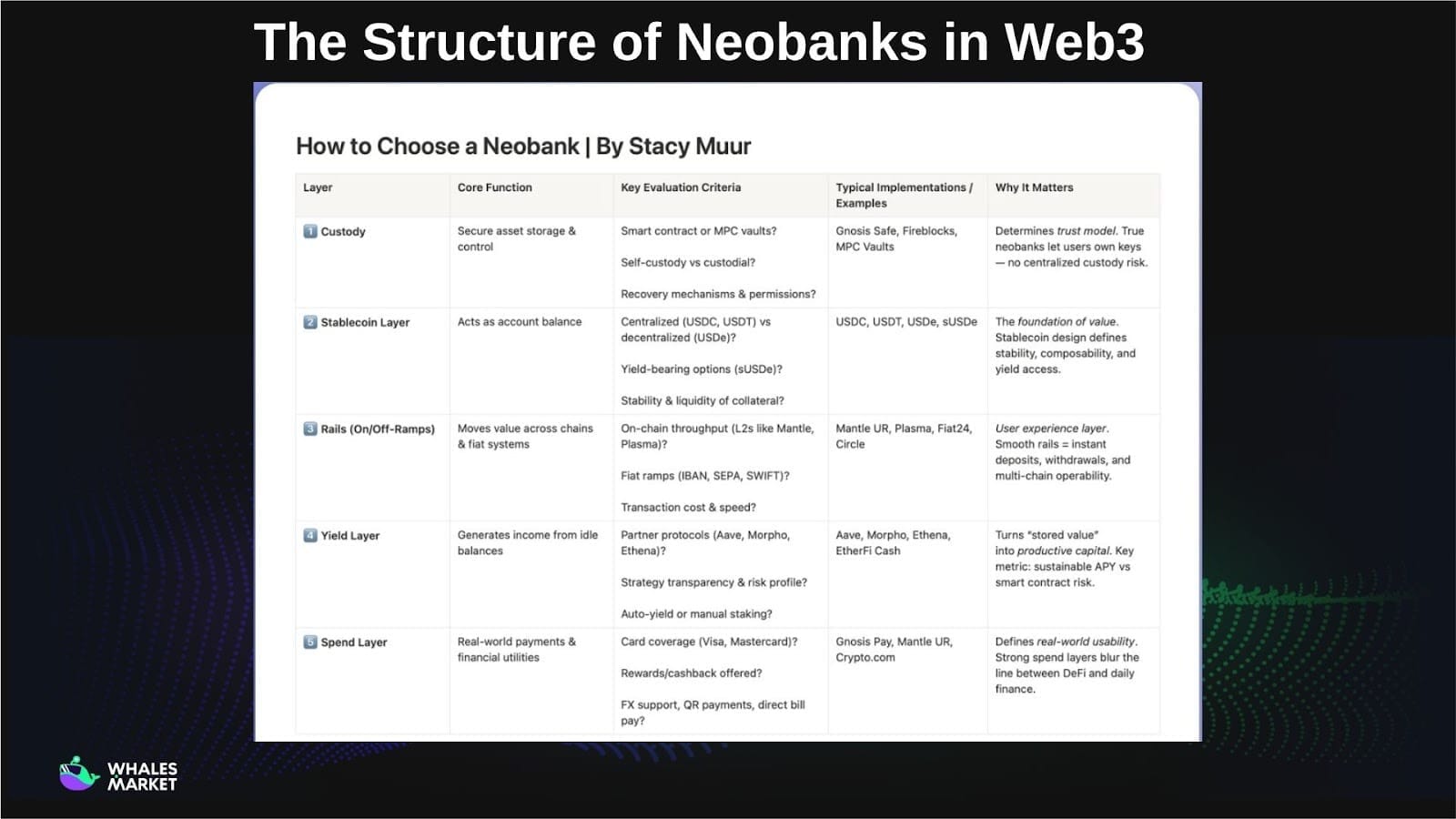

Structure of a Web3 Neobank

To operate effectively in the Web3 environment, a neobank is built on multiple technology layers that form a complete ecosystem. Each layer performs a specific role, from asset protection to spending optimization.

Asset custody layer

This layer focuses on storing and protecting user assets, including both fiat and digital assets. In Web3, neobanks use self-custody wallets so users control private keys, reducing third-party risk.

Tools such as multisig wallets and deposit insurance (similar to FDIC but for crypto) are integrated to minimize risks from hacks and losses.

For example, neobanks may partner with projects like Ledger or Fireblocks to enhance safety, allowing users to store everything from Bitcoin to stablecoins without losing ownership.

Stablecoin layer

Stablecoin is a foundational element for value stability within the Web3 neobank ecosystem. This layer allows neobanks to natively provide stablecoins such as USDC or USDT.

Neobanks can integrate minting and burning mechanisms based on collateralized assets while also supporting instant conversion between fiat and stablecoins. This is particularly useful for international payments, where stablecoins reduce costs and settlement time compared to traditional bank transfers.

Payment infrastructure layer (on/off-ramp)

This layer supports conversion between fiat and crypto or stablecoins, referred to as on-ramp when depositing into crypto and off-ramp when withdrawing back to fiat. Neobanks use APIs from providers such as Stripe or Circle to support card payments, bank transfers, and e-wallet transactions.

In Web3, this payment infrastructure integrates blockchain to conduct cross-border transactions with far more competitive fees than traditional banking. This allows neobanks to deliver a seamless experience when moving funds across platforms.

Yield-generation layer

This layer focuses on helping user assets grow through staking, lending, and DeFi protocols, offering returns that may reach 5-10% APY. Traditional banks, by contrast, rely heavily on benchmark rates set by central banks.

Users can, for example, stake ETH, BNB, or SOL for rewards or lend USDC through major lending protocols such as Aave, Morpho, and Spark. These services are integrated directly into the application.

Spending layer

The final layer is spending. Neobanks provide physical cards such as Visa or Mastercard, or virtual cards such as Apple Pay, which act as the direct connection to users and allow them to pay with stablecoins or tokens without manually converting to fiat.

Potential of Neobanks

Neobanks are not a new concept, as they were introduced and launched in the 2010s. However, during that period their development mainly focused on cost optimization by reducing physical branches.

They become truly promising when combined with blockchain and today’s diverse DeFi ecosystem, which together create application layers from stablecoins to yield generation and spending. This combination brings several advantages compared to traditional banking.

Beyond improved returns, neobanks also give users full control of their assets, something traditional banks cannot provide. Many bank runs have caused significant user losses, such as the collapse of Silicon Valley Bank (SVB) on March 10, 2023, or the shutdown of Signature Bank by regulators on March 12, 2023.

In addition to benefits from DeFi integration, neobanks also take advantage of a world where mobile devices have become essential to most people.

- Neobanks, operating entirely through mobile apps and the web, are maximizing the increasingly common smartphone usage habits of global users. According to Demandsage, the number of smartphone users worldwide has reached approximately 5.78 billion people, accounting for 70.1% of the global population, with total devices reaching 7.43 billion.

- According to Statista, users spend more than 4.5 hours per day on smartphones on average, with 62.5% of global web traffic coming from mobile devices, excluding tablets. In the United States, 98% of adults own a mobile phone, of which 91% are smartphones, up from only 35% in 2011.

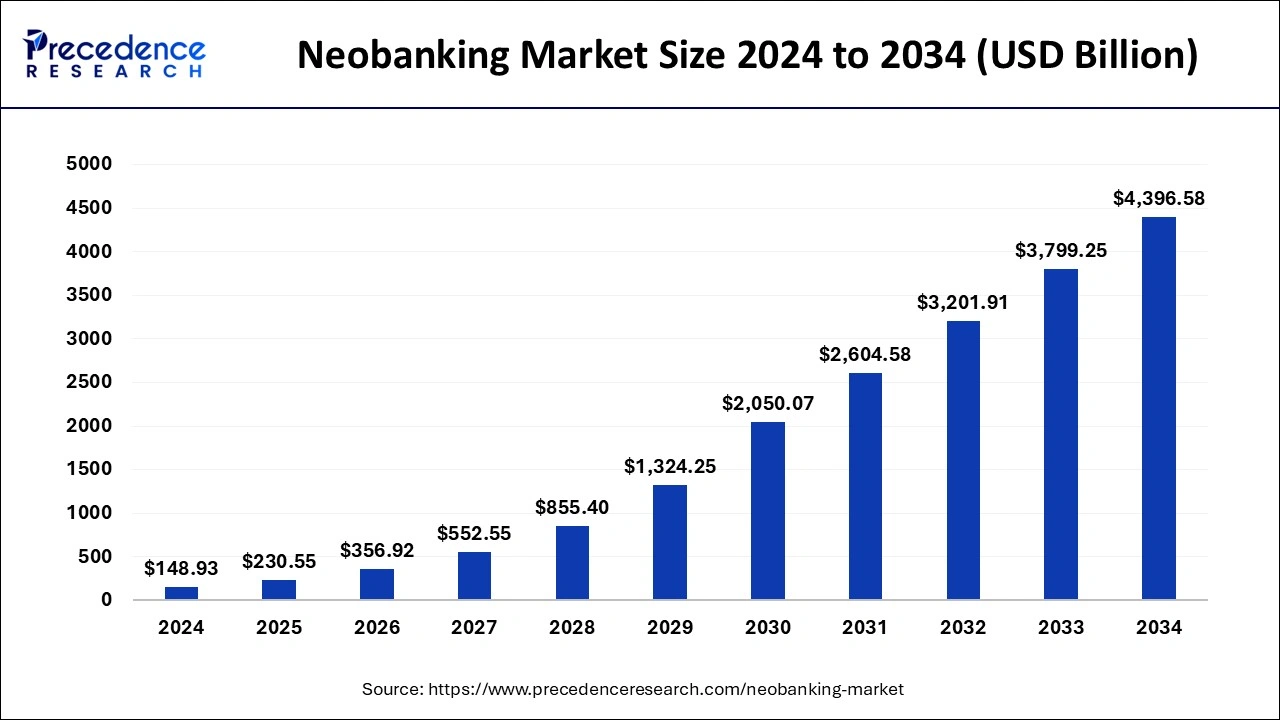

- Additionally, according to Precedence Research, the global neobank market reached $230B in 2025 and is expected to exceed $4.396T by 2034, equivalent to nearly 40% compound annual growth.

- Surveys from Consensys Global Survey and Circle Report show that 30%-40% of crypto users want a banking-like experience directly within Web3, including storing assets, earning yield, and spending like with a traditional bank account.

Therefore, Web3 neobanks combine the simple user experience of traditional neobanks with the transparency and yield potential of DeFi. Users can deposit fiat directly into a Web3 wallet, convert to stablecoins, allocate into yield-generating protocols, and then spend with a Visa or Mastercard, all within a single platform.

More importantly, the experience remains compliant with regulations while users retain asset ownership instead of relying entirely on intermediaries.

This vision is not far-fetched. It is technically feasible today and in reality many crypto projects are rapidly developing in the neobank direction.

Risks of Neobank

Like any narrative that promises to fix traditional finance, neobanks also come with a set of trade offs. The story sounds simple on the surface: higher yield, better UX, self custody. In reality, a Web3 neobank sits at the intersection of banking, securities, and crypto regulation, which is one of the most sensitive areas today.

- Regulatory and compliance risk: A Web3 neobank has to comply with KYC, AML, securities and payments rules across multiple jurisdictions at the same time. A change in regulation in just one major market can force the platform to restrict services, delist certain assets, or halt onboarding for specific countries.

- Self custody and user security risk: Self custody is a double edged sword. Users control their funds, but they also take on the risk of losing private keys, falling for phishing, or signing malicious transactions.

- Smart contract and protocol risk: Behind the friendly interface, most Web3 neobanks are routing user funds into DeFi protocols. Any bug, governance exploit, oracle failure, or liquidity shock on these protocols can cause losses that are hard to recover, even if the neobank itself is not technically “hacked”.

- Stablecoin and liquidity risk: Stablecoins are the core settlement layer. If a major stablecoin issuer faces reserve issues, regulatory pressure, or banking problems, a depeg event can freeze withdrawals and create liquidity stress for the entire platform. Users who treat stablecoin balances like insured bank deposits may underestimate this risk.

- Business model and sustainability risk: Many neobanks are still subsidizing fees and yields using venture funding to grow. If they fail to reach sustainable revenue from interchange, yield spreads, or premium services, they may cut rewards, add new fees, or shut down. Unlike traditional banks with deposit insurance and long operating history, young Web3 neobanks offer fewer explicit guarantees if the company fails.

- Operational and dependency risk: A neobank stack depends on card networks, cloud providers, fiat on/off ramp partners, node operators, and DeFi protocols. Outages or policy changes at any layer can temporarily block spending, deposits, or withdrawals exactly when users need them most.

Beyond these technical and business risks, there is also a more subtle expectation risk. The “bank, but better” narrative can make users assume they enjoy the same level of protection as with a regulated bank, while in practice they are interacting with a mix of regulated and unregulated components.

Web3 neobanks may provide a smoother interface to DeFi, but they do not remove smart contract risk, market risk, or regulatory risk. Users need to treat them as powerful tools, not guaranteed safe havens, and size exposure accordingly.

Conclusion

Neobanks are products with many improvements compared to traditional banks and carry relatively large potential. However, to develop and move toward mass adoption, they still need to overcome several challenges, such as:

- Concerns regarding the stability and safety of the DeFi system.

- Many projects are currently competing primarily through incentives like cashback, while actual profitability after costs remains uncertain.

Nevertheless, this remains a narrative investors may continue to observe because it has real users, real revenue, and real demand.

FAQs

Q1. How is a neobank different from a traditional bank?

A neobank operates fully online without physical branches and focuses on lower fees, higher deposit rates, and a smoother app experience, while traditional banks still rely heavily on branch networks and legacy systems.

Q2. What makes a Web3 neobank different from a normal neobank?

A Web3 neobank integrates blockchain and DeFi. It supports tokens and stablecoins, lets users self-custody assets, and can route deposits into on-chain protocols for yield instead of keeping everything in a closed banking stack.

Q3. How do Web3 neobanks generate yield for users?

They connect user funds to DeFi strategies such as staking, lending, and liquidity provision on protocols like Aave, Morpho, or restaking platforms. Returns are then passed back to users in the form of APY on stablecoins or other supported assets.

Q4. Are Web3 neobanks safe to use?

They reduce some custodial risks by using self-custody wallets and multisig setups, but users still face smart contract risk, market volatility, and potential failures in integrated DeFi protocols. Understanding how funds are held and where yield comes from is essential.

Q5. Who might benefit most from using a Web3 neobank?

Users who already hold crypto or stablecoins and want banking-like services such as saving, card payments, and cross border transfers can benefit, especially if they value self custody and are comfortable with DeFi risk.

Q6. How do on ramps and off ramps work in a Web3 neobank?

On ramps let users convert fiat into crypto or stablecoins via cards, bank transfers, or payment providers. Off ramps do the reverse, turning on-chain assets back into fiat that can be withdrawn to bank accounts or spent with cards.