Market capitalization (market cap) is one of the most fundamental metrics in the cryptocurrency market, often used as a quick indicator to evaluate the size, value, and relative risk of a crypto asset.

Whether you are a beginner or an experienced investor, understanding market cap helps you avoid common misconceptions such as assuming a low token price means a project is cheap. So what is Marketcap? Let’s dive into this article.

What is Market cap in Crypto?

Market cap is short for market capitalization, representing the total value of an asset (such as cryptocurrency, stock…) or its underlying company, calculated based on the current circulating supply.

In the crypto market, market capitalization is an important metric for assessing the size and potential of a cryptocurrency project. Projects with large market capitalization (large cap) are generally considered safer and more stable, while projects with small market capitalization (low cap) have high profit potential but often carry greater risk.

Along with FDV, market cap is commonly used to evaluate and compare the value of different crypto assets. These are the simplest and most basic ways to determine whether a token is undervalued, overvalued, or correctly priced.

How to calculate Crypto Marketcap

The marketcap of a project is calculated by the current token price multiplying the total value of all tokens currently in circulation. The formula for calculating market capitalization is:

- Marketcap = Current token price x Circulating supply

- Circulating supply = Total supply - token locked - token burned (if any)

For example, if the price of Bitcoin is $30,000 and the circulating supply of Bitcoins is 20 million, then the marketcap of Bitcoin is:

Marketcap = $30,000 x 20 million = $600 billion

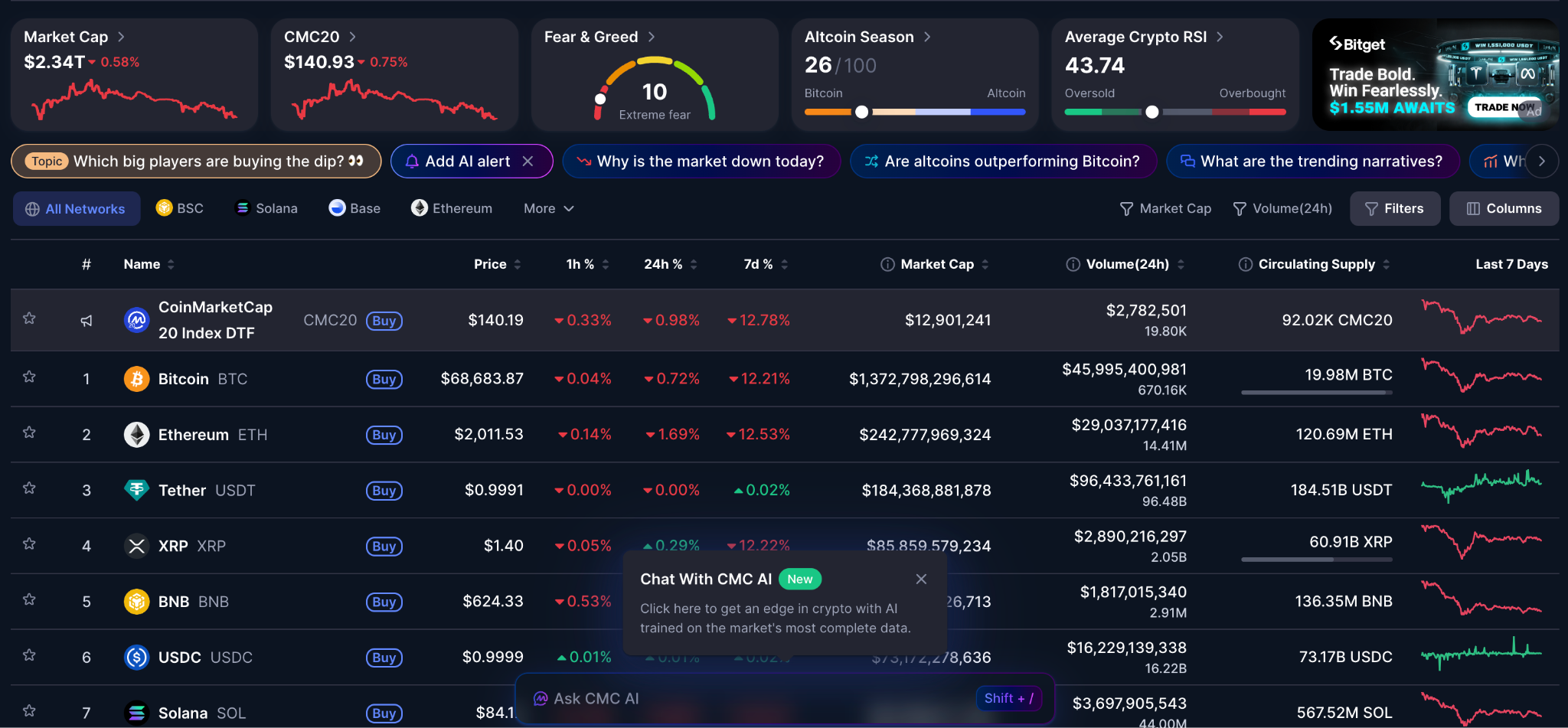

Additionally, there are many places to view market cap information without having to calculate it yourself, including:

- Crypto Market Cap Calculator tools: Coincodex, MarketCapOf...

- Crypto project information aggregation sites: Coinmarketcap, Coingecko...

Why Market cap is important in Crypto Investing

Metric to assess project potential

Market capitalization helps investors assess the potential for future profits a project can generate. Often, projects with lower market capitalization have the potential to yield higher returns than those with higher market capitalization. Because low-capitalization projects have significant growth potential, even small capital inflows or increased acceptance levels can generate larger price increases compared to already high-capitalization projects with stable growth.

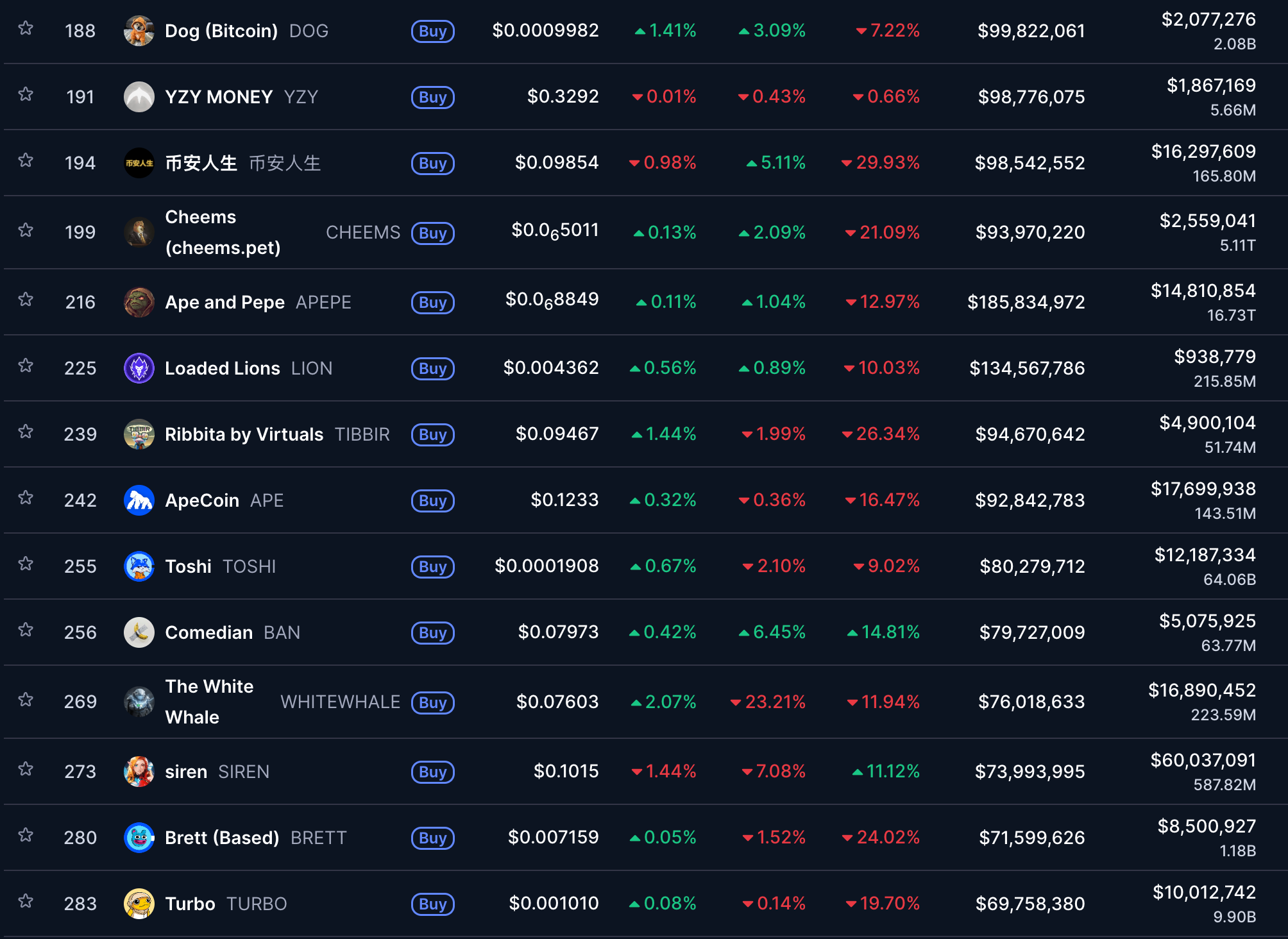

However, low-capitalization projects do not always guarantee high returns; for example, memecoins often carry high risks, such as high volatility and rug pulls. Therefore, to accurately assess a project's potential, we need to consider many other factors, not only market capitalization.

Comparing projects in the same sector

By comparing the market capitalization of cryptocurrency projects within the same category, investors can determine its popularity and growth potential. Leading projects in terms of market capitalization within a category can serve as a benchmark for comparison with other projects in the same category. These projects are often seen as representative of the potential and development trends of that sector.

In practice, investors often compare projects within the same sector by using the market leader as a valuation benchmark. For example, in the on-chain perpetual DEX, Hyperliquid is widely regarded as the leading project, with a market capitalization in the multi-billion USD range and strong real trading activity. When newer projects enter the same space, such as Aster or Lighter, their valuation is often assessed relative to Hyperliquid.

Reflecting liquidity of tokens

Market cap also reflects the liquidity of a coin and price stability during periods of high volatility. Projects with large market capitalization generally have higher liquidity and are less prone to slippage, while projects with low market capitalization tend to have low liquidity and are more susceptible to slippage. This is something investors need to consider before making trading decisions.

When choosing platforms to swap tokens, users tend to opt for larger platforms because of their high liquidity and lower slippage.

As a basis for investment decisions

Market capitalization can be used as a basis for investment decisions. Investors often buy cryptocurrencies with large market capitalization (BTC, ETH) for long-term investment purposes because of their stability and safety.

For short-term and medium-term investments, investors often choose projects with low to medium market capitalization because these are asset classes that can yield high returns but also carry high volatility and risk.

For example, Peanut, a memecoin on Solana, was founded with a low market capitalization. It quickly surged in price after being listed on Binance, and then plummeted shortly afterward.

Project Classification by Market Capitalization

Mega-cap

Mega-cap projects have the largest market capitalization in crypto market, from $100 billion and above. These projects account for the majority of the entire cryptocurrency market capitalization, similar to blue-chip stocks in the traditional stock market. Projects in this segment have the highest liquidity, and their volatility can influence (and sometimes represent) the trend of the entire crypto market.

Currently, only Bitcoin, Ethereum and USDT fall into this category, according to Coinmarketcap.

Large-cap

These are projects with a market capitalization ranging from $10 billion to $100 billion and are typically among the top 10 cryptocurrency projects by marketcap. However, this depends on the current market conditions.

For example, at the time of writing, include BNB, XRP, USDC, Solana, TRON and Dogecoin are large-cap projects.

Micro-cap

These are projects with a market capitalization under $100 million. Most projects in this group are relatively new to the market, having been around for less than 5 years and still in their development phase. Projects in this group are often memecoins, newly launched DeFi projects, and are usually traded on decentralized exchanges (DEXs). This group also has the highest volatility and risk in the market.

Projects under $10 million carry higher risks, especially those not listed on CEXs, but only on DEXs corresponding to the chains they launch.

Applying Market cap in Crypto Investing

Marketcap is only a reference indicator; investors need to consider other factors such as the project's fundamental analysis, growth potential, market trends, and risk management before making investment decisions.

Marketcap can change over time, so it's necessary to regularly update market capitalization information to make accurate investment decisions, especially in high volatility periods.

The smaller the market capitalization of a project, the higher the risk. Therefore, investors should carefully research and consider before investing in small and micro-capitalization projects.

Conclusion

Market capitalization provides a high-level snapshot of a cryptocurrency’s size, liquidity, and relative market position. It helps investors compare projects, assess risk levels, and understand potential upside or downside across different market segments.

However, market cap should never be used in isolation. While large-cap projects often offer stability and liquidity, smaller-cap projects may deliver higher returns but come with significantly higher risk. To make informed decisions, investors should combine market cap analysis with fundamental research, tokenomics, market trends, and proper risk management.

FAQs

How is market cap different from token price?

Token price only reflects the cost of a single unit, while market cap represents the overall value of the project. A low-priced token can still have a high market cap if its supply is large.

What is the difference between Market Cap and FDV?

Market Cap uses circulating supply, while Fully Diluted Valuation (FDV) uses the total supply if all tokens were released. FDV often reflects potential future valuation.

Why is market cap important for investors?

Market cap helps investors assess project size, risk level, liquidity, and growth potential, making it easier to compare assets within the same category.

Are low market cap projects better investments?

Not necessarily. Low-cap projects may offer higher upside but also carry higher risks such as low liquidity, volatility, and potential scams.

Which market cap category is the safest?

Large-cap and mega-cap projects are generally considered safer due to higher liquidity, stronger adoption, and lower volatility compared to smaller-cap assets.