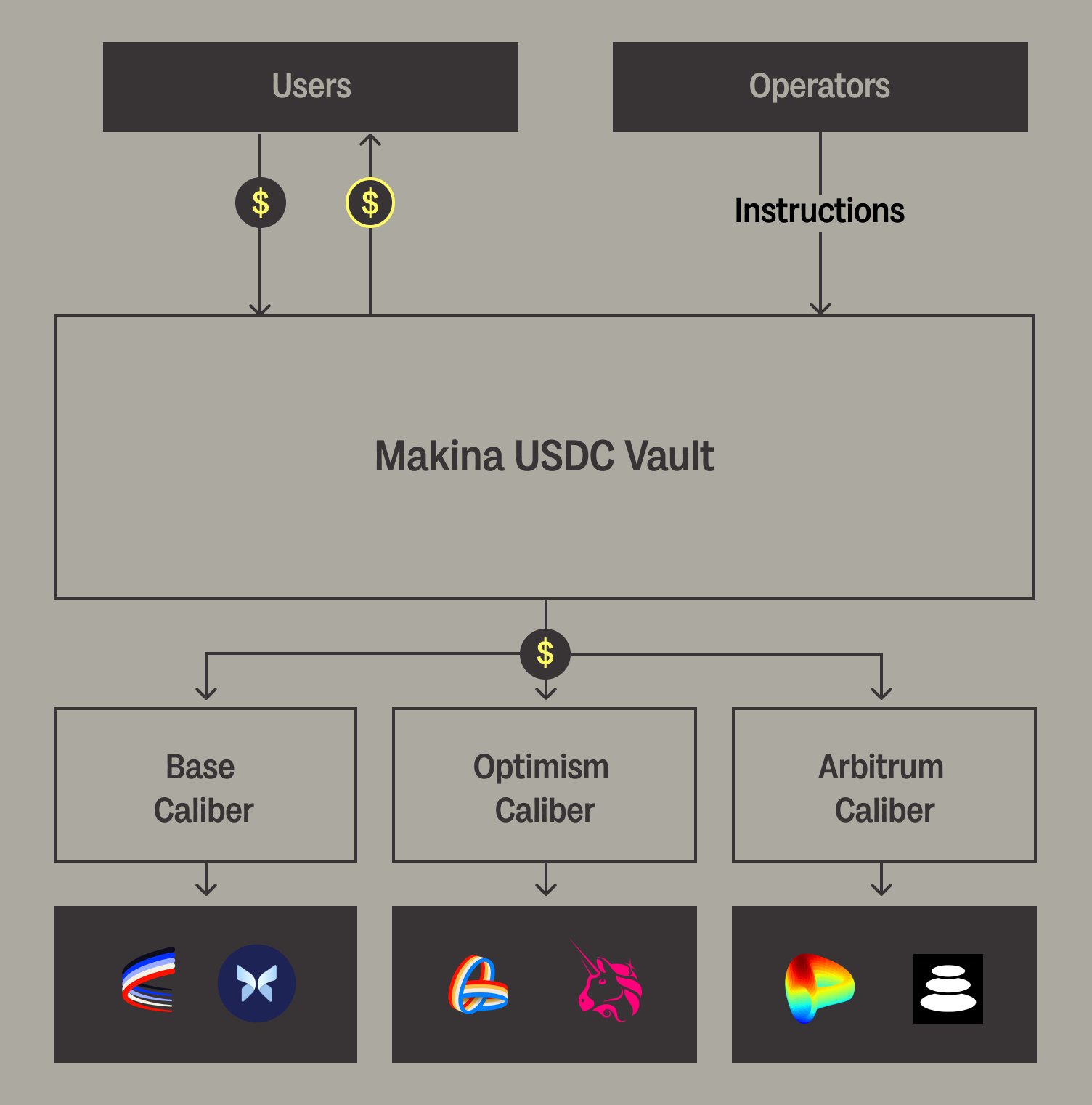

Makina provides an agile infrastructure for smart contract vaults, enabling a diverse range of cross-chain strategies. Its framework supports everything from on-chain yield aggregation and index products to long-short and delta-hedged strategies.

What is Makina?

Makina is a non-custodial DeFi execution engine that lets funds, DAOs, retail users deploy and manage diversified, risk-managed strategies across protocols & chains from a single interface. It removes the need to juggle venues, bridges, and manual operations while keeping accounting transparent and flows automated.

Users interact through Machines, which are specialized smart-contract vaults that tokenize deposits into Machine Tokens and run predefined mandates under on-chain risk policies. This structure enables straightforward entry, exit, automated cross-chain execution, and clear auditing.

How does Makina Work?

The Makina Architecture

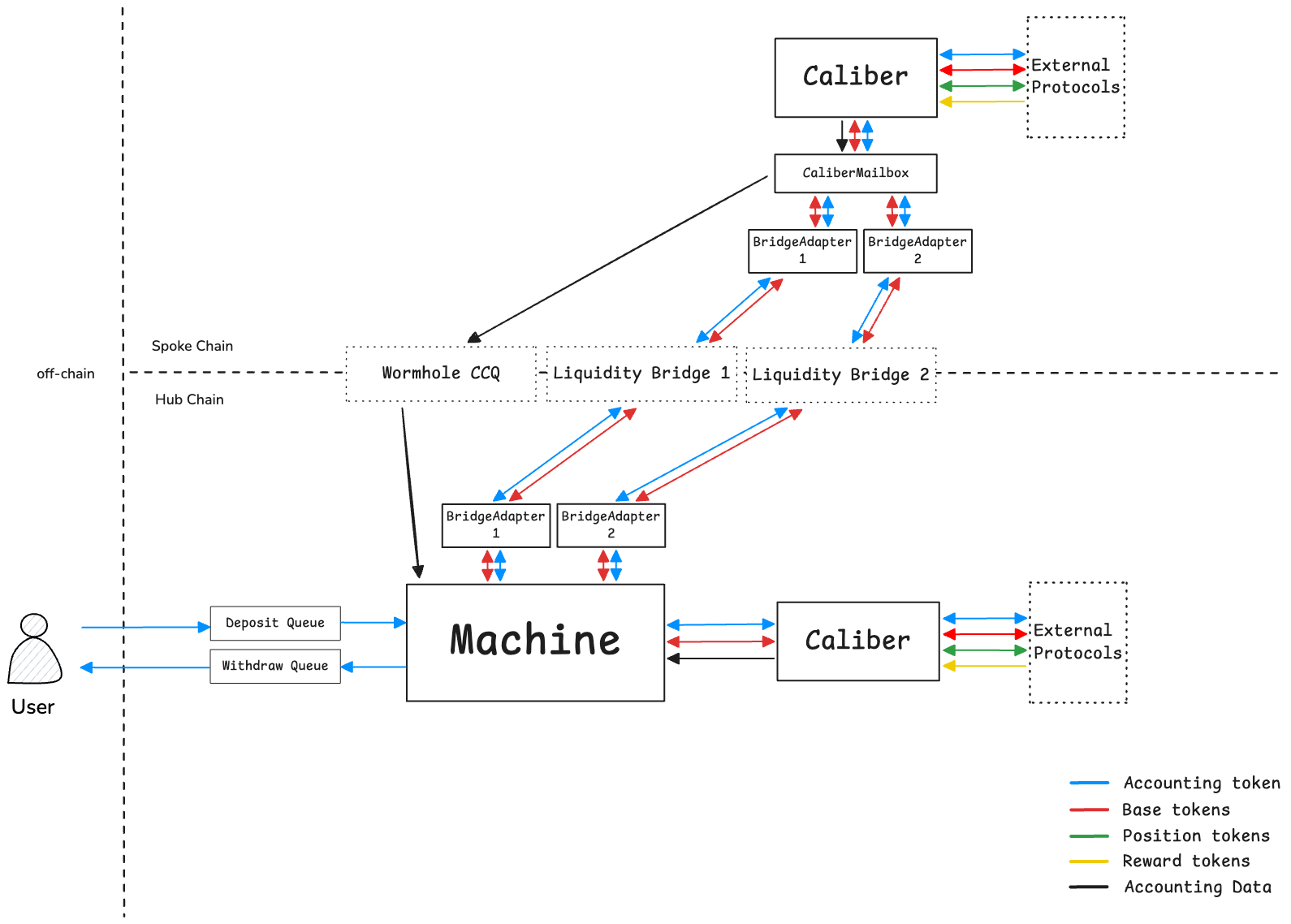

Makina functions as a programmable execution system designed to decouple strategy management from secure execution. Its modular architecture is layered, ensuring specialized components handle the strategy logic, cross-chain execution, and risk enforcement independently.

The architecture is built around three core layers:

Layer 1 - Strategy vault and governance: This layer serves as the central control hub and user interface, situated on the Hub Chain. The Machine is the core component, managing all global operations: accepting user deposits (via the Deposit Queue), issuing Machine Tokens (MTs), and hosting the definitive Risk Policy. It relies on the Wormhole CCQ mechanism to receive necessary accounting data from the execution chains (Spoke Chains).

Layer 2 - Cross-chain execution environment: This layer is responsible for dynamic capital deployment and execution across the multi-chain landscape (Spoke Chains).

- Calibers are the isolated execution environments on the Spoke Chains. Operators send Instructions (pre-approved command bundles) which are relayed to Calibers via the CaliberMailbox.

- The physical movement of capital between the Hub Chain and Spoke Chains is managed by Bridge Adapters interacting with underlying Liquidity Bridges 1/2, ensuring seamless and secure asset transfers.

Layer 3 - Security and risk enforcement: This layer provides trust-minimization and transparent accountability for the system.

- The system enforces safety through Optimistic Risk Control, utilizing community challenges and slashing to strictly enforce exposure limits.

- The Share Price Engine ensures transparent accounting. Calibers calculate local position values and use Wormhole CCQ to relay this accounting data back to the Machine (on the Hub Chain), where the aggregated Net Asset Value (NAV) is computed.

To execute a strategy, these architectural components transition from a static structure into a dynamic operational flow, orchestrating the steps from the user's initial deposit to the final strategy execution and withdrawal.

Makina operational flow: End-to-end lifecycle

The entire process is broken down into five core, trust-minimized steps:

- Deposit & tokenization: Users deposit assets (e.g., USDC, WETH) into the Machine (on the hub chain) and receive Machine Tokens (MTs), which are liquid shares of the strategy.

- Execution mandate: The Operator sends pre-approved Instructions for capital allocation, guided by the central Risk Policy.

- Cross-chain deployment: Calibers (isolated execution engines) securely execute these Instructions, moving capital across chains to access optimal yield opportunities.

- Accounting & NAV: The Share Price Engine calculates the strategy's Net Asset Value (NAV) using data relayed from all Calibers to the Machine for transparent accounting.

- Flexible withdrawal: Users redeem their MTs at any time to receive their principal plus accrued profits, simplifying active management into a passive token-holding experience.

Key Features of Makina

Here are some key features of Makina:

- Atomic execution: Makina ensures that a transaction is executed completely or not at all, providing a high level of safety and operational reliability.

- Cross-chain operations: Its hub-and-spoke architecture supports seamless activity across multiple blockchains, removing the need for users to manually bridge assets or manage several wallets.

- Non-custodial model: The system is non-custodial, transparent, and designed to minimize trust assumptions, allowing Operators to run strategies while users maintain control of their assets.

- Risk controls: It incorporates defined risk parameters to help limit exposure and support prudent management of user funds.

- Atomic operations: The architecture permits atomic operations, meaning only the components of a transaction validated within the current Merkle root can be executed.

Makina Token Information

Makina Token Key Metrics

- Token Name: Makina

- Ticker: $MAK

- Token Type: Governance

- Token Standard: ERC-20

- Total Supply: 1,000,000,000 $MAK

- Initial Circulating: TBA

- Contract Address (CA): TBA

Makina Token Use Case

$MAK is the native token of Makina, ensuring as the foundation for governance and economic participation throughout the ecosystem.

$MAK use case includes:

- Governance: The $MAK token enables on-chain governance through a staking system that allows holders to mint non-transferable veMAK tokens. veMAK tokens grant voting power based on the amount and duration of tokens locked.

- Incentives: Strategic $MAK emissions are allocated to Operators to incentivize specific behaviors (e.g., providing Machine Token liquidity or routing capital towards Pendle YTs). This drives growth and usage within the ecosystem.

Makina Token Airdrop

The $MAK airdrop is structured with 25% unlocked at TGE and the remaining 75% vested linearly over six months. Airdrop allocations are tied to user participation across Seasons 0 and 1, with point accumulation influencing the proportion of tokens received.

Makina Token Listing

Details regarding the official listing date for $MAK have not been announced yet.

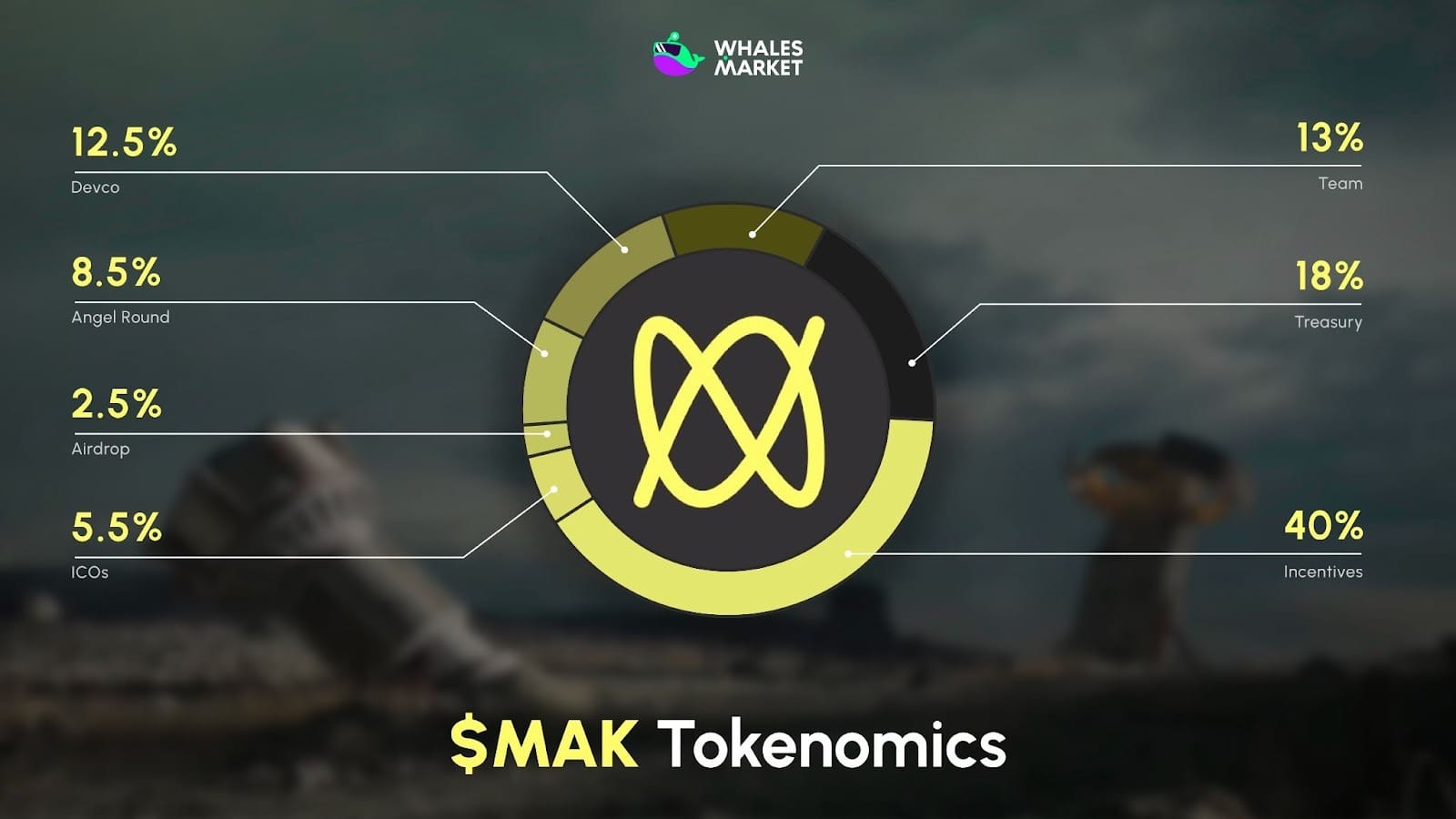

Makina Tokenomics & Fundraising

Tokenomics

Total supply: 1B $MAK, allocated according to the following breakdown:

- Incentives: 400M (40%)

- Treasury: 180M (18%)

- Team: 130M (13%)

- Developers: 125M (12.5%)

- Angel Round: 85M (8.5%)

- ICOs: 55M (5.5%)

- Airdrop: 25M (2.5%)

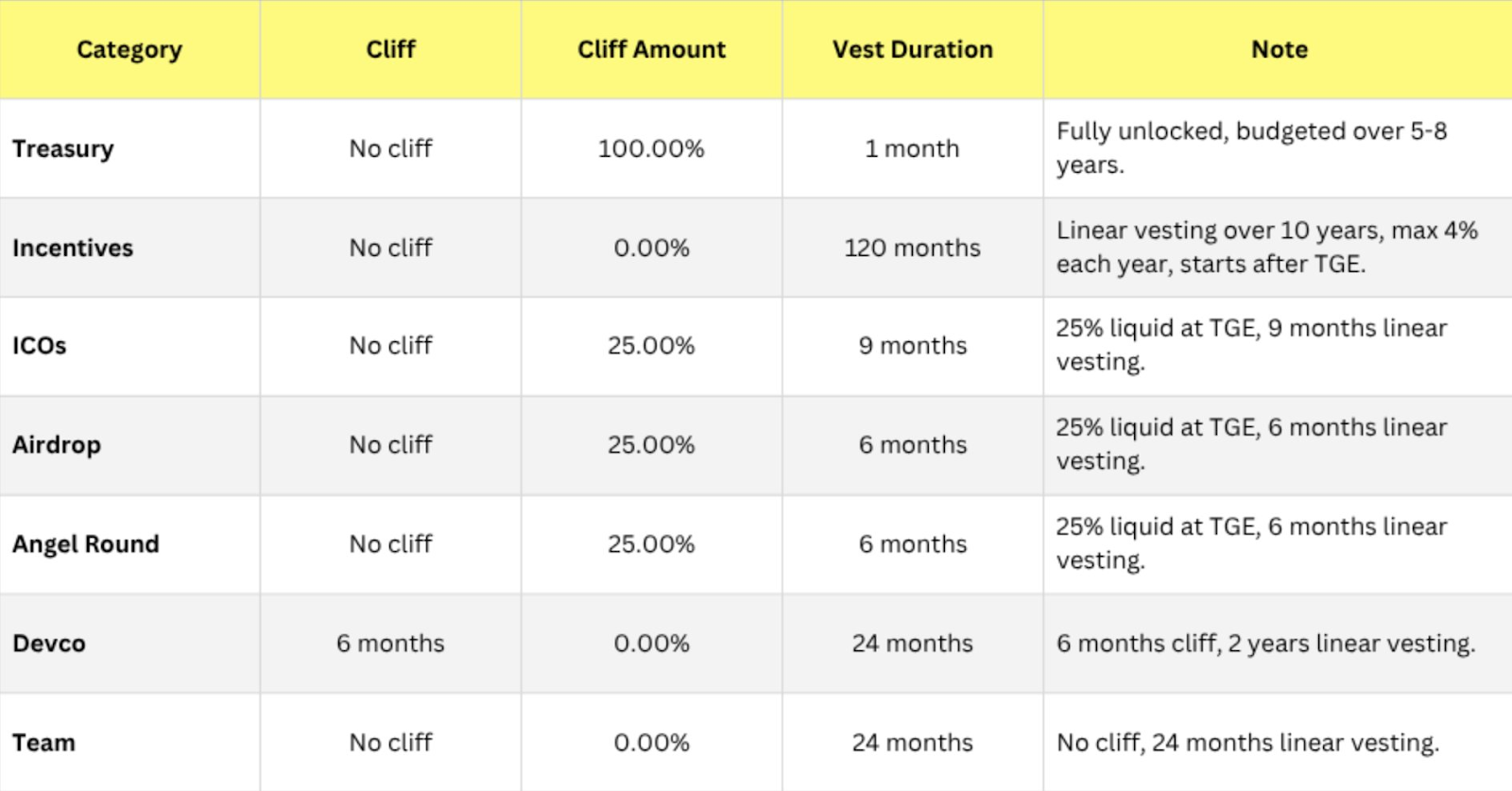

Vesting Schedule

Cliff and vesting schedules for each allocation will begin on the Token Generation Event (TGE) date, which is yet to be announced.

Fundraising

In June 2025, Makina Finance raised $3M in a strategic funding round. Key investors included Bodhi Ventures, Cyber Fund, Interop Ventures, Steakhouse Financial, Hypernative Labs, Kiln, Base DAO... This capital is being used to accelerate Makina’s development ahead of its 2025 product launch.

Makina Roadmap & Team

Roadmap

TBA

Core Team

TBA

Conclusion

Makina Finance is building a modular and non-custodial DeFi ecosystem designed to align incentives between operators and users through its native $MAK token. With a focus on on-chain governance, ve-tokenomics, and transparent fee structures, the protocol aims to provide both operational flexibility and sustainable value accrual.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

How does a Machine differ from a Vault?

While a Vault is a general on-chain capital container with limited strategic functionality, a Machine is an enhanced, tokenized vault enabling cross-chain strategies, on-chain risk controls, and execution via Makina’s sophisticated engine.

How do users deposit into a Machine?

Users can deposit by either purchasing Machine Tokens (MTs) on supported DEXs like Curve without KYC, or by completing KYC to deposit directly into the Machine and mint MTs. KYC requirements depend on the specific Operator of each Machine.

Is Makina audited?

Yes, Makina is fully non-custodial, with all assets managed by smart contracts in a trustless manner and governed by established protocol safeguards.

Is Makina non-custodial?

All Makina contracts have been audited by leading security firms, including Chainsecurity, Sigma Prime, Ottersec, and Cantina, with reports publicly available in the technical documentation.

What is the premarket price of $MAK?

$MAK has not been listed on Whales Market yet, so there is currently no pre-market price available. Once a token is confirmed and listed, users will be able to trade it on Whales Market, the leading pre-TGE DEX for token allocations, with over $300 million in on-chain, trustless volume.

Is there a $MAK Token Airdrop?

Yes. A $MAK airdrop planned: it started on October 27, 2025 at 12:00 UTC for users who participated in “Season 0” by depositing into pre‑launch Machines (DETH, DUSD, DBIT) and earning Tickets and Points.