Crypto lending has grown from simple experiments into one of the core pillars of DeFi. Built on smart contracts and running around the clock, it connects lenders and borrowers worldwide, creating a transparent, efficient market that reshapes how digital assets are used.

What is Lending?

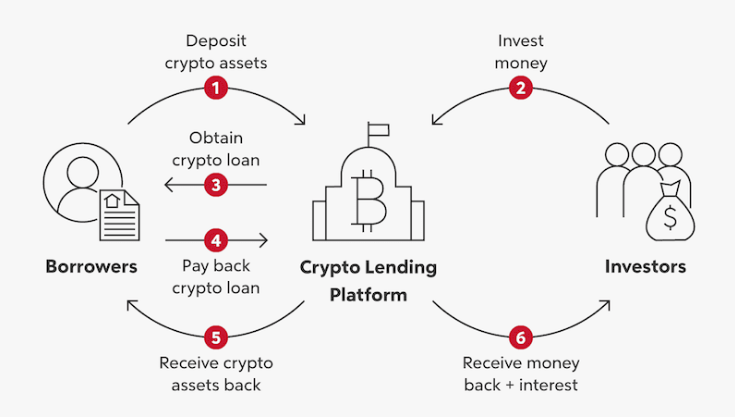

Crypto lending is the practice of borrowing and lending digital assets through blockchain protocols. Users who hold crypto can lend their tokens to earn passive interest, while borrowers can put up collateral to access liquidity. No banks, no endless paperwork, services run 24/7 worldwide.

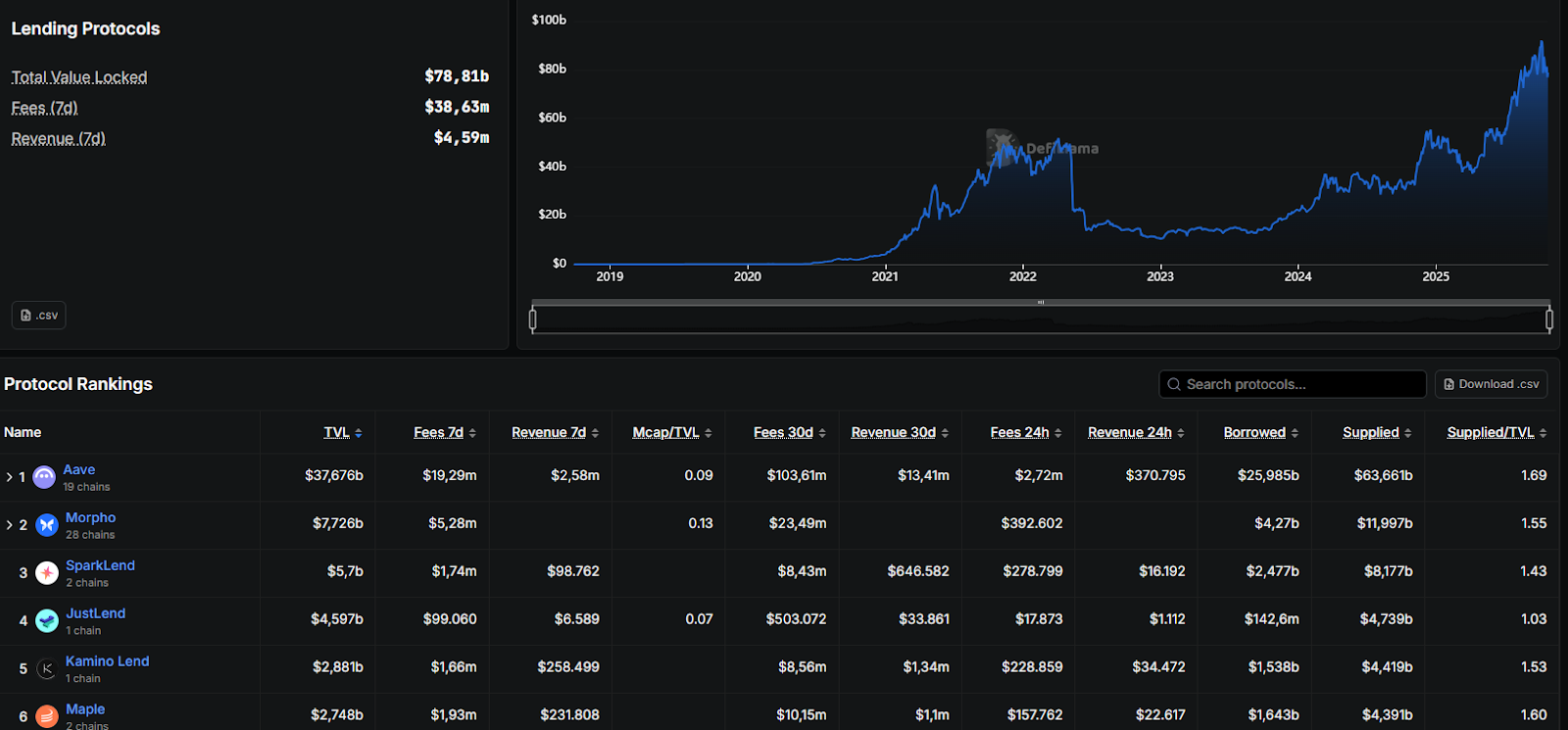

As of October 2025, data from DeFiLlama shows the crypto lending market has reached $78B, making it one of the most important pillars of DeFi, accounting for nearly 50% of total DeFi TVL.

Crypto lending began with CeFi in 2017–2018, took off in 2019 with MakerDAO, and exploded in DeFi Summer 2020 via Compound and Aave. Powered by smart contracts, lenders provide liquidity, borrowers post collateral, and rates shift automatically with supply and demand.

How Does Lending Work?

For lenders

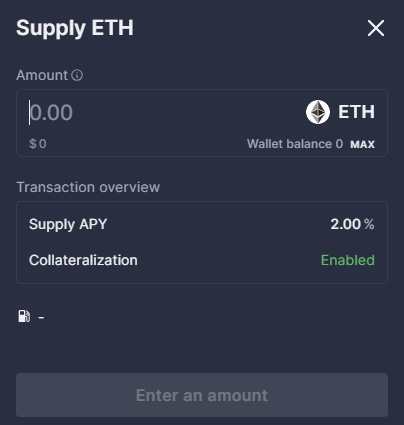

When users decide to lend, they deposit crypto into a lending pool. In return, they receive “interest-bearing tokens” that represent their deposit plus the interest it generates.

For example, depositing ETH into Aave can give users interest-bearing tokens that increase in value over time. These tokens can be redeemed anytime for the original crypto plus accrued interest, no fixed term like in traditional banks.

For borrowers

To borrow, users must over-collateralize their loan, meaning the collateral value is higher than the loan amount. For example, locking $1,000 worth of BTC to borrow $500 in stablecoins.

Interest must be paid continuously, and if collateral falls below safety thresholds due to price volatility, it can be partially or fully liquidated to protect lenders.

Why Does Lending Matter?

Lending creates an efficient capital market for crypto. Long-term holders can earn passive income instead of letting assets sit idle. Typical lending yields range from 4% to 20% APY depending on the asset and market conditions.

For borrowers, lending unlocks liquidity without selling their assets. This is especially useful if users expect the asset to rise in value but still need immediate cash. Some also use borrowing as leverage for further investments.

Key features of lending include:

- No KYC (for DeFi): Only a wallet is needed to participate

- 24/7 access: No business hours or regional restrictions

- Full transparency: All transactions are on-chain

- Dynamic interest rates: Adjusted in real time by supply and demand

- Composability: Easily integrated with other DeFi protocols

Common Terms in Lending

- TVL (Total Value Locked): Total assets locked in a protocol. A core measure of trust and scale. As of October 2025, lending TVL is $54.2B, with Aave leading (~$15B).

- LTV (Loan-to-Value Ratio): Ratio of loan amount to collateral. Higher LTV = higher liquidation risk. Stablecoins often allow 75–80%, while volatile altcoins only 30–50%.

- Health Factor: Safety score of a loan, usually 0–2. Below 1 means liquidation risk; above 1.5 is safer.

- Liquidation: Automatic selling of collateral when value drops. Liquidators earn 5–15% rewards.

- APY vs APR: APR = simple annual interest; APY = compounded annual yield. APY is always higher.

- Utilization Rate: Loaned amount ÷ supplied amount. High utilization (>80%) drives interest rates up.

Types of Lending

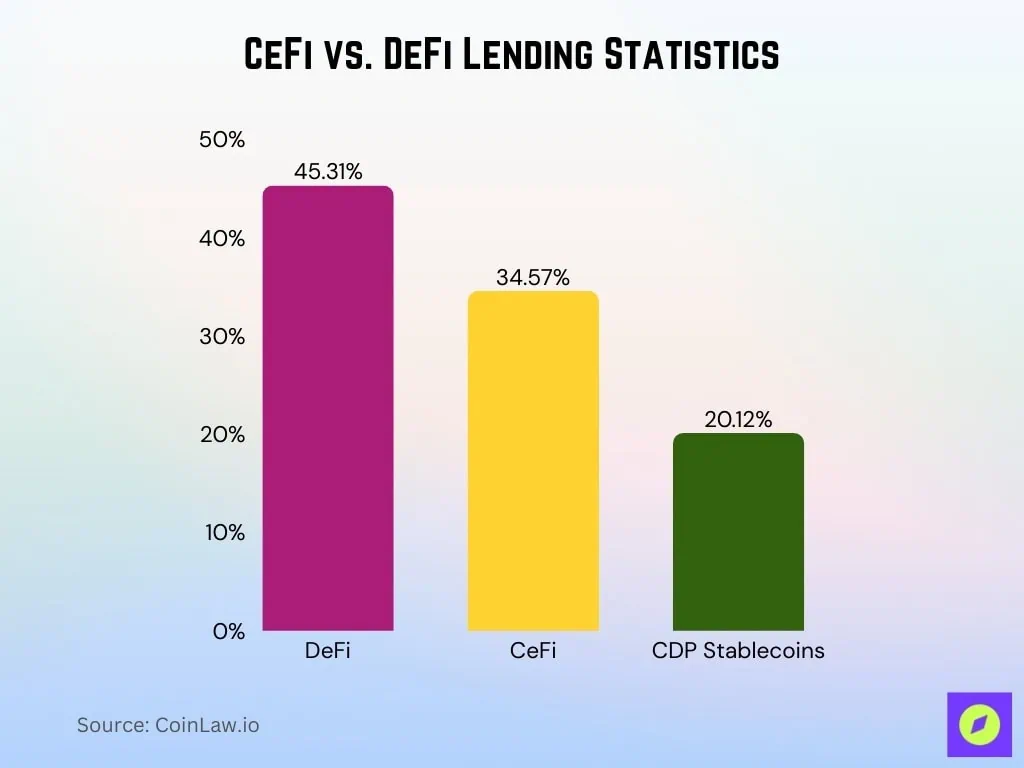

DeFi Lending

Runs fully decentralized on smart contracts. Users keep control of private keys and assets. Leading protocols: Aave, Compound, MakerDAO. Benefits include transparency, no KYC, borderless access, and composability. Downsides: higher responsibility, gas fees, and technical learning curve.

CeFi Lending Managed by centralized exchanges like Binance, Bybit, or OKX. Users must KYC and deposit funds into custodial wallets. Interest is often fixed, and the interface is user-friendly for beginners.

Flash Loans

A unique DeFi feature, borrowing millions without collateral, as long as the loan is repaid within one blockchain transaction. If repayment fails, the entire transaction is reverted. Flash loans are mainly used for arbitrage, liquidation, or exploiting protocol vulnerabilities. Powerful but risky, requiring smart contract expertise.

Read more: What is Uptober in Crypto? The Bullish October Phenomenon

Useful Tools for Lending

- DeFiLlama (defillama.com): Real-time TVL and APY stats across protocols.

- Dune Analytics: On-chain dashboards with lending volume, liquidations, and user behavior.

- DeBank: Portfolio tracker to monitor lending positions across chains.

Where to Buy Lending Tokens?

Governance tokens of lending protocols are widely available:

- Centralized exchanges (CEX): Binance, Coinbase, OKX, Bybit list AAVE, COMP, MKR with high liquidity and lwallets.

- Decentralized exchanges (DEX): Uniswap, SushiSwap, PancakeSwap, no KYC, but higher gas costs and need for Web3 wallets.

- Pre-TGE (Pre-market): If users want early exposure, lending tokens can be traded on Whales Market before TGE, grab opportunities ahead of CEX and DEX listings.

Popular Lending Investment Strategies

- Yield Farming (Lending Farming): Optimizing returns by moving assets across protocols. Complex strategies can yield 20–50% APY but come with risks like smart contract bugs, impermanent loss, and gas fees.

- Holding Governance Tokens: Long-term exposure to protocol growth. Token holders can vote on proposals and sometimes earn revenue shares. Example: AAVE surged from $50 (2020) to $666 (2021), but tokens can also crash 90% in bear markets.

- Trend Trading & Arbitrage: Trading narratives (buy low TVL, sell during hype) or arbitraging rate differences across chains/protocols. Requires fast reactions, fee calculations, and monitoring tools like DeFiLlama, DeBank, Zapper.

Conclusion

Crypto lending has grown from simple CeFi platforms into a $50B+ market with hundreds of protocols. DeFi leads with 50% market share thanks to transparency and composability. The future points toward RWA tokenization, cross-chain lending, AI-powered risk management, and broader global adoption.

FAQs

Q1: Is crypto lending safe?

Relatively safe with audited protocols like Aave or Compound. Main risks: smart contract exploits, liquidations from price drops, and untested new platforms. CeFi adds counterparty risk (e.g., bankruptcies).

Q2: What are typical lending rates?

Stablecoins: 4–8% APY (DeFi), 8–12% (CeFi). BTC/ETH: 1–3% APY. Altcoins: 5–20% APY. Rates shift in real time, often highest in bull markets due to leverage demand.

Q3: How much is needed to start?

No minimum. The more borrowed, the more collateral required.

Q4: How to avoid liquidation?

Maintain Health Factor >2, keep loans at 30–40% LTV max, monitor markets, and be ready to add collateral or repay debt. Stablecoin collateral reduces risk.

Q5: Which is better: DeFi or CeFi lending?

DeFi offers transparency, no KYC, and composability but requires technical understanding and personal responsibility. CeFi is simpler with customer support but carries counterparty risk. It depends on user needs and experience.