Kalshi, America's first federally regulated prediction market, allows users to trade directly on real-world outcomes using USD. Here's how it works and why it's becoming the future of event-based trading.

What is Kalshi?

Kalshi is the first CFTC-regulated prediction market platform based in the United States, where users can trade binary event contracts on outcomes of real-world events. Launched in July 2021 after receiving its Designated Contract Market license from the Commodity Futures Trading Commission, Kalshi operates as one of only 16 such regulated exchanges in America.

Unlike crypto-based platforms, Kalshi uses USD and offers Wall Street-grade regulatory oversight, making it accessible to both retail investors and institutional traders who want exposure to events ranging from elections and Federal Reserve decisions to sports outcomes and entertainment awards.

Key Features of Kalshi

- CFTC-Regulated Exchange: Fully compliant with federal regulations as a Designated Contract Market, providing legal certainty and protection for all participants.

- Market-Driven Pricing: Unlike traditional bookmakers who set odds, Kalshi operates like a stock market where buyers and sellers determine prices through their trading activity.

- Binary Contracts: Simple Yes/No contracts priced between $0.01 and $0.99, with each correct prediction paying out $1 per contract.

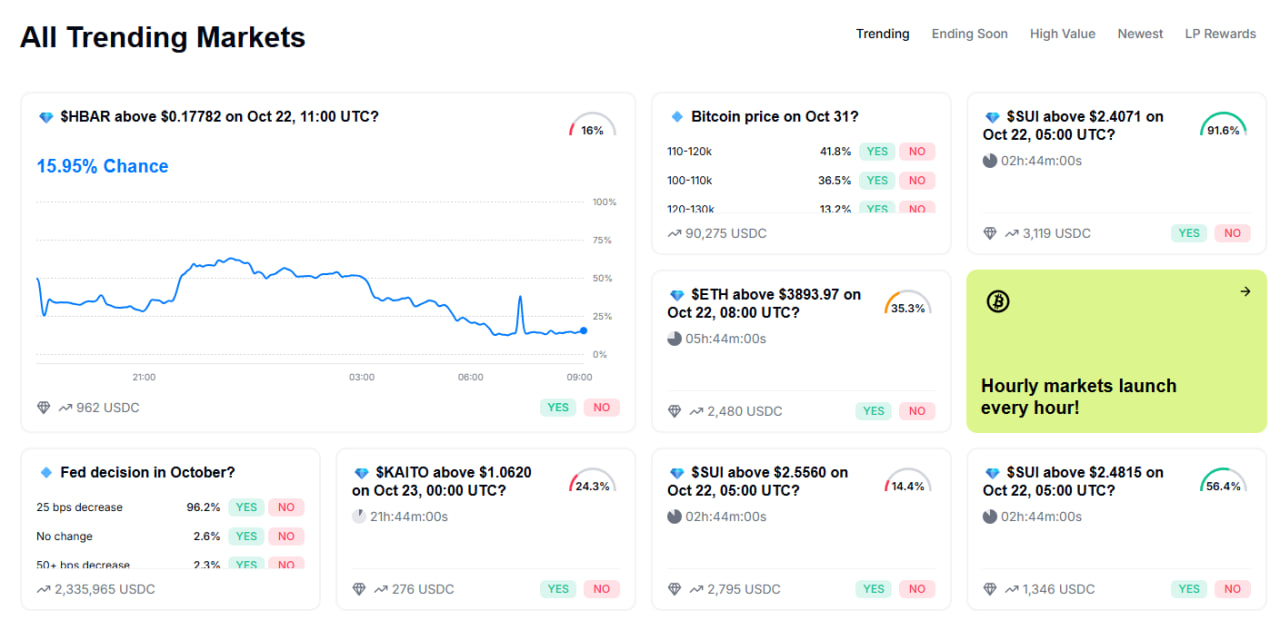

- Broad Market Coverage: Over 2,800 markets spanning politics, economics, sports, entertainment, weather, and cryptocurrency.

- Zero Debt Risk: Fully cash-collateralized system means users can only trade with deposited funds and never incur debt regardless of outcomes.

- Institutional Liquidity: Backed by institutional market makers like Susquehanna International Group to ensure consistent liquidity.

How Does Kalshi Work?

Here's the mechanism behind Kalshi:

- Trading Event Contracts: Users trade contracts representing whether an event will happen or not. For example: "Will the Fed cut rates in May?" Each contract is priced from $0.01 to $0.99 in USD.

- Market-Set Prices: Prices are determined by collective trader activity, with the platform matching participants who want opposite positions. Users select their side (Yes or No), set their price, and choose the number of contracts.

- Price = Probability: Contract prices directly reflect the market's perceived probability of an event occurring. For example, if a "Yes" contract trades at $0.65, the market estimates a 65% chance of that outcome.

- Settlement and Payouts: When an event concludes, correct predictions pay $1 per contract while incorrect ones become worthless. Users can sell positions anytime before settlement to lock in gains or minimize losses.

- Real-Time Trading: Contract values fluctuate in real-time based on news, polls, and market sentiment, allowing active trading strategies.

Kalshi Token Information

Currently, Kalshi has not announced any official use case for a project token. The platform operates on a traditional fee-based business model with equity ownership through venture capital funding.

Whales Market will update immediately when the official Kalshi website announces token utility details.

Read more: What is Printr? Multi-Chain Token Launchpad

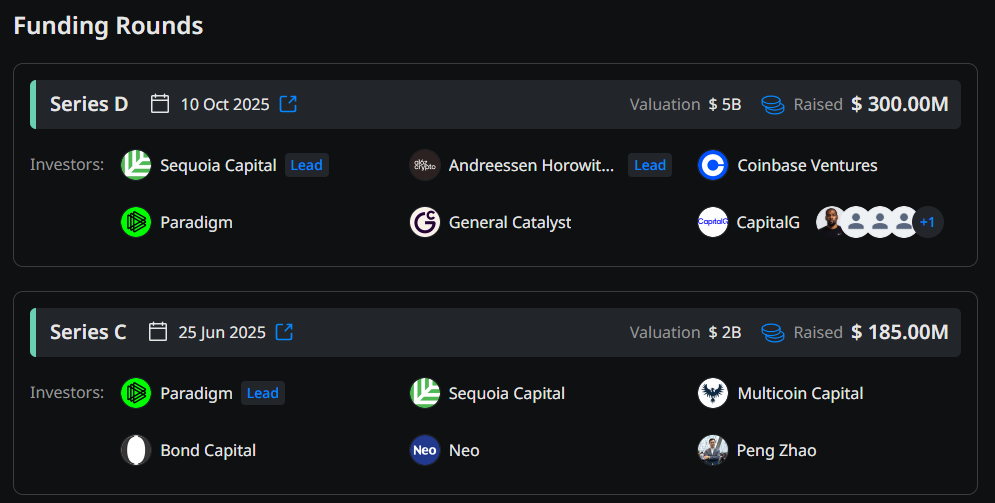

Fundraising

Kalshi has secured roughly $565M through seven funding rounds. The most significant was a $300M Series D in October 2025, led by Sequoia and Andreessen Horowitz, boosting the company’s valuation to $5B (up from $2B in June). Other investors include CapitalG, Coinbase Ventures, and General Catalyst.

Kalshi Roadmap & Team

Roadmap

Based on recent developments, Kalshi's focus as of October 2025 includes:

- Global Expansion: Successfully launched in 140+ countries with unified liquidity pool

- Sports Markets: Expanding NFL, NCAA, and player prop contracts

- Platform Integration: Deepening partnerships with Robinhood, Webull, and crypto apps

- Institutional Growth: Onboarding more market makers and institutional traders

- Regulatory Compliance: Navigating state-level challenges while maintaining federal approval

Team

- Tarek Mansour (CEO & Co-Founder): MIT graduate with experience as a quantitative trader at Goldman Sachs and Citadel. The idea for Kalshi emerged during his 2016 Goldman internship when he observed institutions struggling to hedge Brexit risks.

- Luana Lopes Lara (COO & Co-Founder): Holds an MEng in Computer Science from MIT and previously worked as a quantitative trader at Citadel Securities and researcher at MIT's Brain and Cognitive Sciences Center.

- Donald Trump Jr. (Strategic Advisor): Joined in January 2025 to advise on partnerships and market strategy, after using Kalshi to track election results in real-time.

Conclusion

Kalshi, with its CFTC regulation, $5B valuation, and partnerships with platforms like Robinhood, has established a strong foundation in prediction market space, competing directly with Polymarket. Its 62% global market share and $50B projected volume demonstrate that event-based trading is transitioning from experimental concept to legitimate financial asset class.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1: What is Kalshi?

Kalshi is America's first CFTC-regulated prediction market where users trade USD-based binary contracts on real-world event outcomes.

Q2: How does Kalshi work?

Users trade Yes/No contracts priced $0.01-$0.99; correct predictions pay $1 per contract at settlement.

Q3: How much has Kalshi raised?

Approximately $565M total, with latest $300M Series D valuing company at $5B.

Q4: Is Kalshi legal in the US?

Yes, CFTC-approved as Designated Contract Market since 2020; federal court approved election markets in 2024.

Q5: What is the pre-market price of a Kalshi token?

As of October 22, 2025, Kalshi has not released any details about a native token and operates exclusively with USD. Whales Market will provide updates if Kalshi shares token-related plans in the future.