Intuition emerges as a decentralized system designed to bring structure, transparency, and verifiability to data on the internet. So what is Intuition? Let’s dive into this article.

What is Intuition?

Intuition is a decentralized system that makes attestations viable as a meta for digital expression. Instead of information living as unstructured, siloed, minimally-attributable data in Web2 platforms, Intuition turns information into verifiable, tokenized, and portable objects that can flow across apps, chains, and agents.

Specialities Of Intuition

Atoms

Intuition starts by breaking down all knowledge into the smallest units called Atoms. Atoms represent concepts like people, time, organizations, or attributes. Each Atom has a unique identifier (using technologies like Decentralized Identifiers – DIDs) and exists independently. Each Atom also stores information about the contributor, allowing for verification of who added what data and when.

The reason for breaking down knowledge into Atoms is obvious. Information often appears in complex sentences. Machines (like agents) have limited ability to analyze and understand these structures on their own. They also have difficulty determining which parts are correct and which are incorrect.

Token Curated Registries (TCRs)

Token Curated Registries (TCRs) filter data based on what the community values, and the token staking mechanism reflects those values. Users stake $TRUST, Intuition’s native token, when proposing new Atoms, Triples, or data structures. Others can stake up if they find the proposal useful, or down if they don’t.

TCRs not only verify individual contributions, but also effectively solve the problem of ontology standardization. This is the task of deciding which representation becomes the common standard when multiple options exist. With decentralized systems, the big challenge is how to reach consensus without a centralized coordinator.

Signal

Signals accumulate in three ways:

- Explicit signals: intentional user judgments, like staking tokens.

- Implicit signals: formed by user behavior, like data being repeatedly queried.

- Transitive signals: creating a relationship effect, when someone I trust confirms information, I tend to trust them more.

- These three forms combine to form a trust-based knowledge network that shows who believes what, to what extent, and under what circumstances.

Reality Tunnels

Reality Tunnels allow users to have a personalized perspective when accessing data. Users can set up “tunnels” to prioritize expert reviews, value from close friends, or certain community knowledge. Agents can also use specialized tunnels for specific purposes, for example, choosing a tunnel that reflects Vitalik Buterin’s trust network to make decisions based on “Vitalik’s perspective.”

All signals are recorded on-chain. Users can transparently verify why a piece of information is trustworthy: which address is the source, who confirmed it, how many tokens have been staked. This transparent trust-building process allows users to directly compare evidence instead of blindly accepting it.

$TRUST Information

$TRUST Key Metrics

Here is the information of $TRUST

- Token Name: Intuition

- Ticker: $TRUST

- Token Type: TBA

- Total Supply: 1B $TRUST

- Contract address (CA): TBA

$TRUST Use Case

Here is $TRUST use case:

- Data Creation: Stake $TRUST to publish and monetize claims or facts as tokenized assets, earning query fees.

- Curation/Validation: Stake $TRUST to back or challenge claims, with rewards for accurate curation and slashing for errors.

- Data Access: Pay $TRUST micro-fees to query verifiable data, benefiting authors and curators.

- Network Operation: Bond $TRUST to run nodes, earning fees for reliable service.

- Governance: Use $TRUST to vote on protocol upgrades and policies.

$TRUST Listing Information

Here are important details revealed to $TRUST:

- Listing time: TBA

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

$TRUST Tokenomics & Fundraising

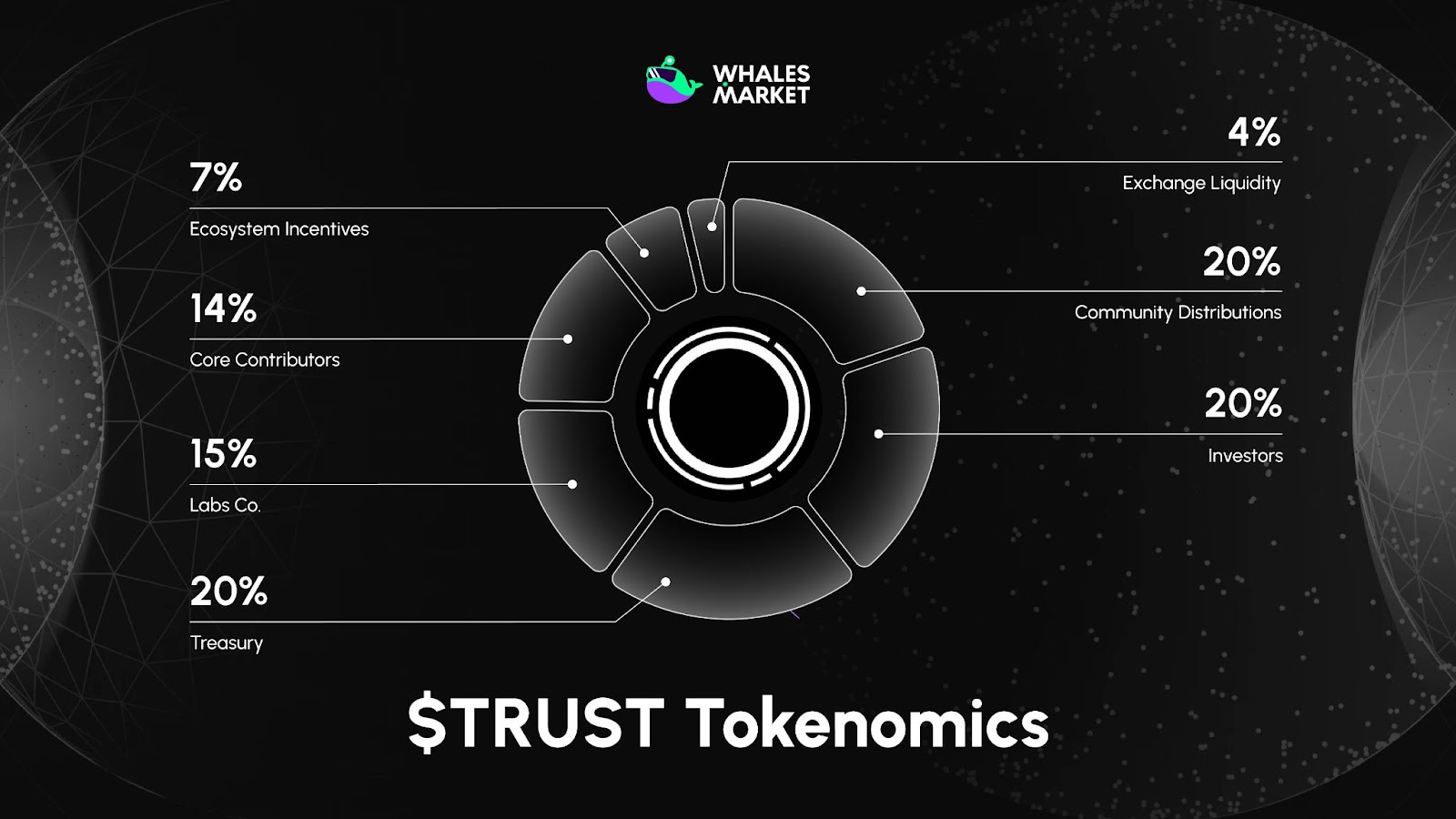

$TRUST Tokenomics

- Total Supply: 1B $TRUST

- $TRUST Allocation:

- Ecosystem Incentives: 7%

- Core Contributors: 14%

- Labs Co.: 15%

- Treasury: 20%

- Investors: 20%

- Community Distributions: 20%

- Exchange Liquidity: 4%

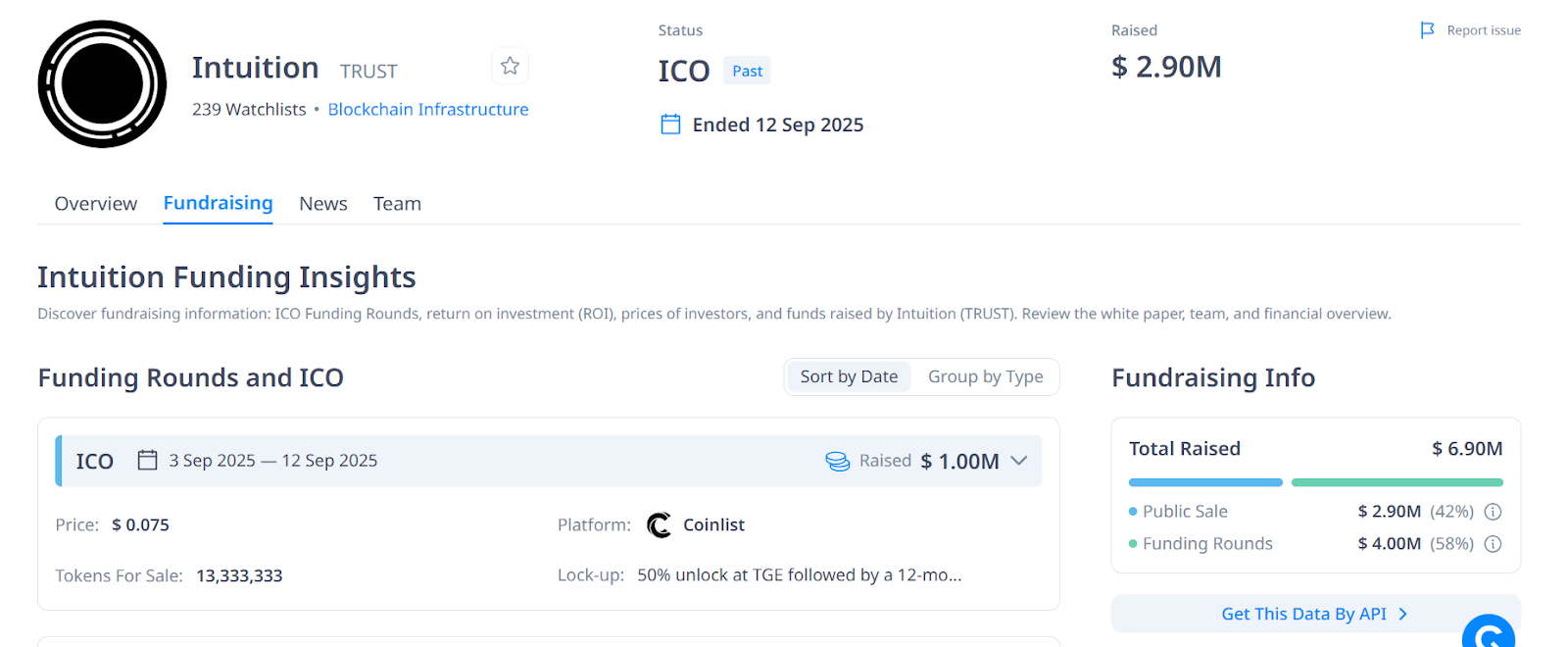

Intuition Fundraising

Intuition has raised successfully total of $6.9M across the funding rounds, led by ConsenSys.

Intuition Team & Roadmap

Team

Here is the core team of Intuition:

- William Luedtke: CEO

- Andrew Cox: Co-founder

- Kelly Moran: Head of Product

- Matthew Kaye: Head of Strategy

Roadmap

Currently, Intuition has not announced any official roadmap for the project. Whales Market will update immediately when the official Intuition website announces.

Conclusion

Intuition stands at the forefront of building a more reliable knowledge infrastructure for Web3. Through its concepts like Atoms, Token Curated Registries, and Reality Tunnels, Intuition doesn’t just decentralize data, it decentralizes trust itself.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is the native token of Intuition?

The native token of Intuition is $TRUST, used to facilitate coordination across the ecosystem.

2. What is Intuition ($TRUST) pre-market price?

Currently, $TRUST is trading on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.

3. What is the price of Intuition ($TRUST) today?

While Intuition ($TRUST) hasn't been listed yet, users can trade $TRUST pre-market on Whales Market before the TGE. Here you can trade $TRUST before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

4. What is Intuition?

Intuition is a decentralized system that makes attestations viable as a meta for digital expression.

5. How much has Intuition ($TRUST) raised?

Intuition has raised successfully total of $6.9M across the funding rounds, led by ConsenSys.

6. What is $TRUST allocation?

The $TRUST token is distributed as follows: 20% each to the treasury, investors, and community, 15% to Labs Co., 14% to core contributors, 7% for ecosystem incentives, and 4% for exchange liquidity.