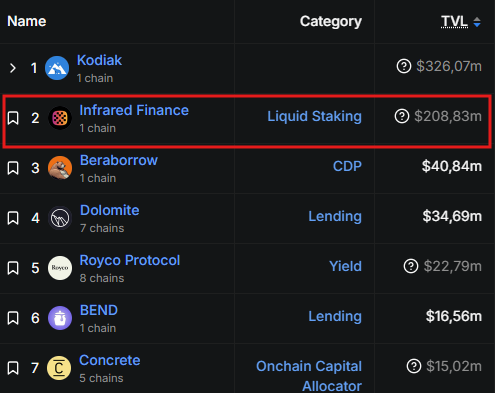

Within the Berachain ecosystem, Infrared ranks as the second-largest protocol by Total Value Locked (TVL), providing liquid staking solutions that simplify access to the Proof of Liquidity (PoL) mechanism.

What Is Infrared?

Infrared is the first and largest liquid staking protocol built on Berachain, an EVM-compatible Layer 1 blockchain powered by the novel Proof of Liquidity (PoL) consensus. This protocol helps users maximize staking rewards on Berachain without requiring deep technical knowledge of the underlying mechanisms.

Launched alongside the Berachain mainnet in February 2025, Infrared addresses a common challenge faced by many DeFi users. While Berachain’s PoL model is innovative, it can be complex to interact with in practice. Many users struggle with managing BGT rewards, delegating to validators, and optimizing yield efficiently.

Infrared Finance focuses on solving several core issues:

- The complexity of BGT: BGT, the Berachain Governance Token, is soulbound and non-transferable. Infrared introduces iBGT, a liquid and freely tradable representation of BGT.

- Technical barriers to staking: Instead of running validator nodes or fully understanding PoL mechanics, users can simply deposit assets into Infrared vaults.

- Yield optimization: Infrared automatically allocates BGT to validators and manages rewards, helping users achieve more efficient returns.

How Does Infrared Work?

Infrared builds a full product stack around Berachain’s Proof of Liquidity system, including liquid staking tokens, PoL vaults, and node infrastructure.

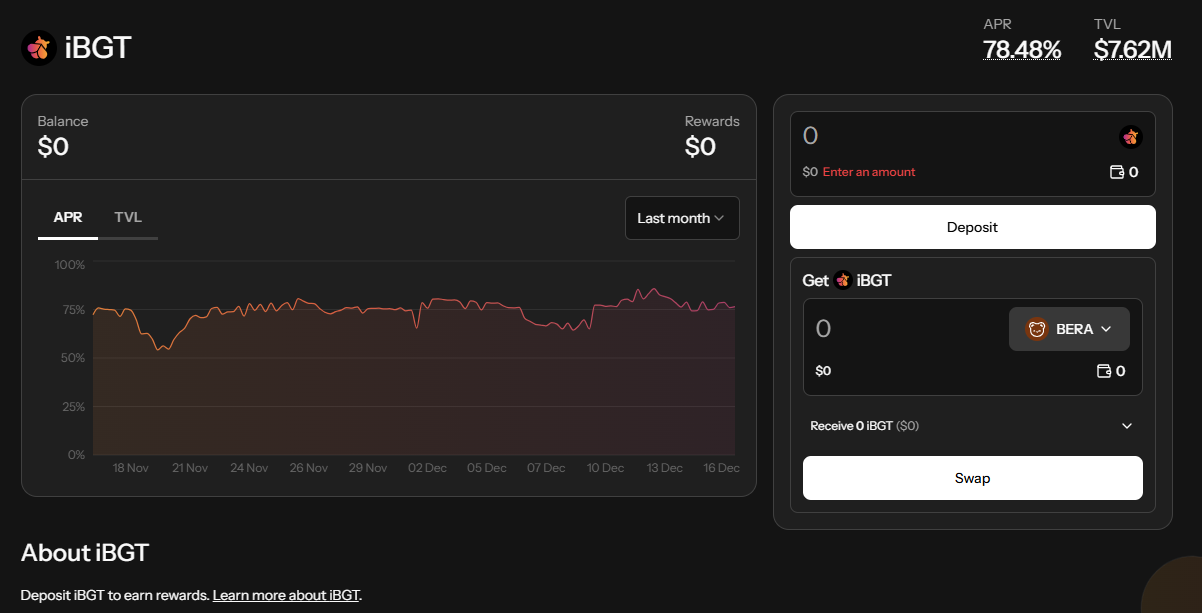

iBGT

iBGT is Infrared’s flagship product. It is a liquid version of Berachain Governance Token (BGT), backed 1:1 by real BGT.

BGT is Berachain’s governance token with a soulbound property. Once received, BGT is permanently tied to a wallet address and cannot be transferred. To realize its value, BGT must be burned to receive BERA.

iBGT solves this limitation. When users deposit liquidity into Infrared vaults, iBGT is received instead of BGT. iBGT can be:

- Freely traded on DEXs.

- Used as collateral in lending protocols.

- Staked to earn additional rewards such as HONEY and wBERA.

- Integrated into other DeFi products.

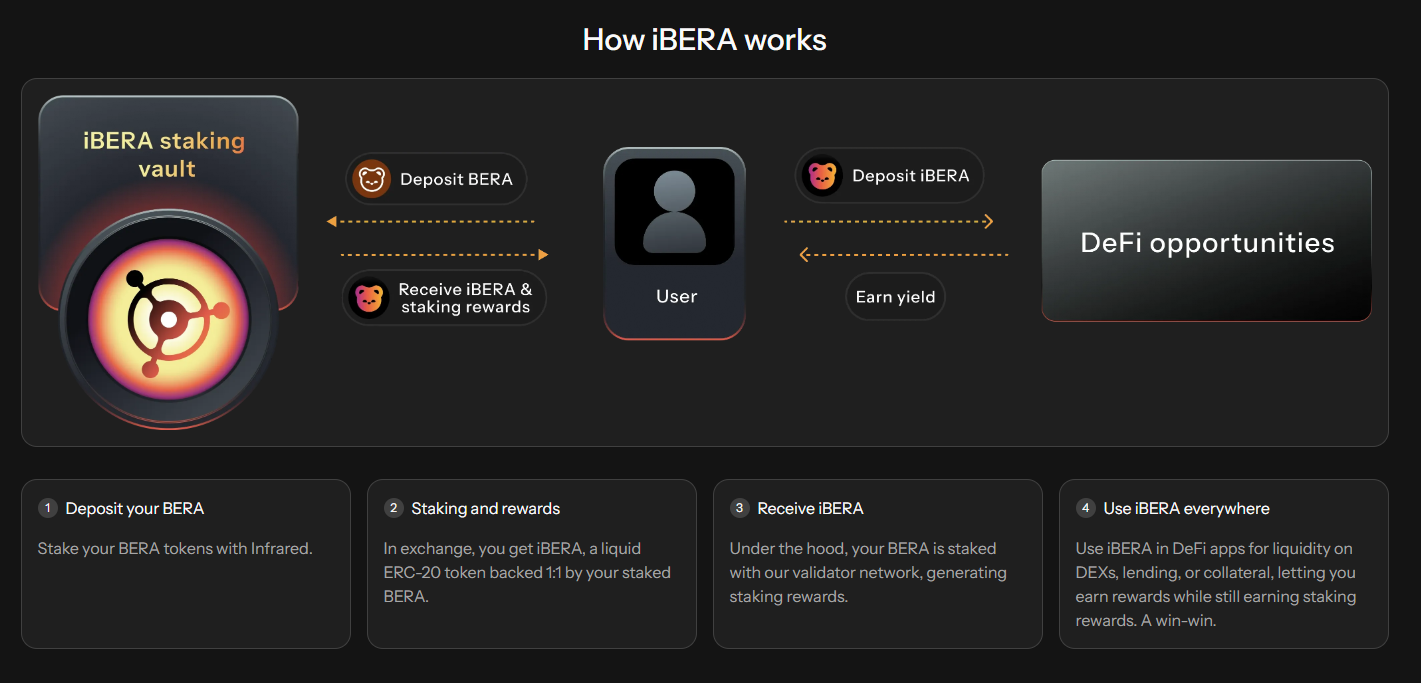

iBERA

iBERA is Infrared’s liquid staking solution for BERA, the native gas token of Berachain. When users stake BERA with Infrared:

- iBERA is received at a 1:1 ratio

- BERA is staked across Infrared’s validator set

- Staking rewards are automatically accrued into the value of iBERA

iBERA can be used across DeFi applications such as lending, borrowing, trading, and liquidity provision. iBERA is an auto-compounding token, with yield accumulated internally and reflected through the gradual appreciation of iBERA relative to BERA.

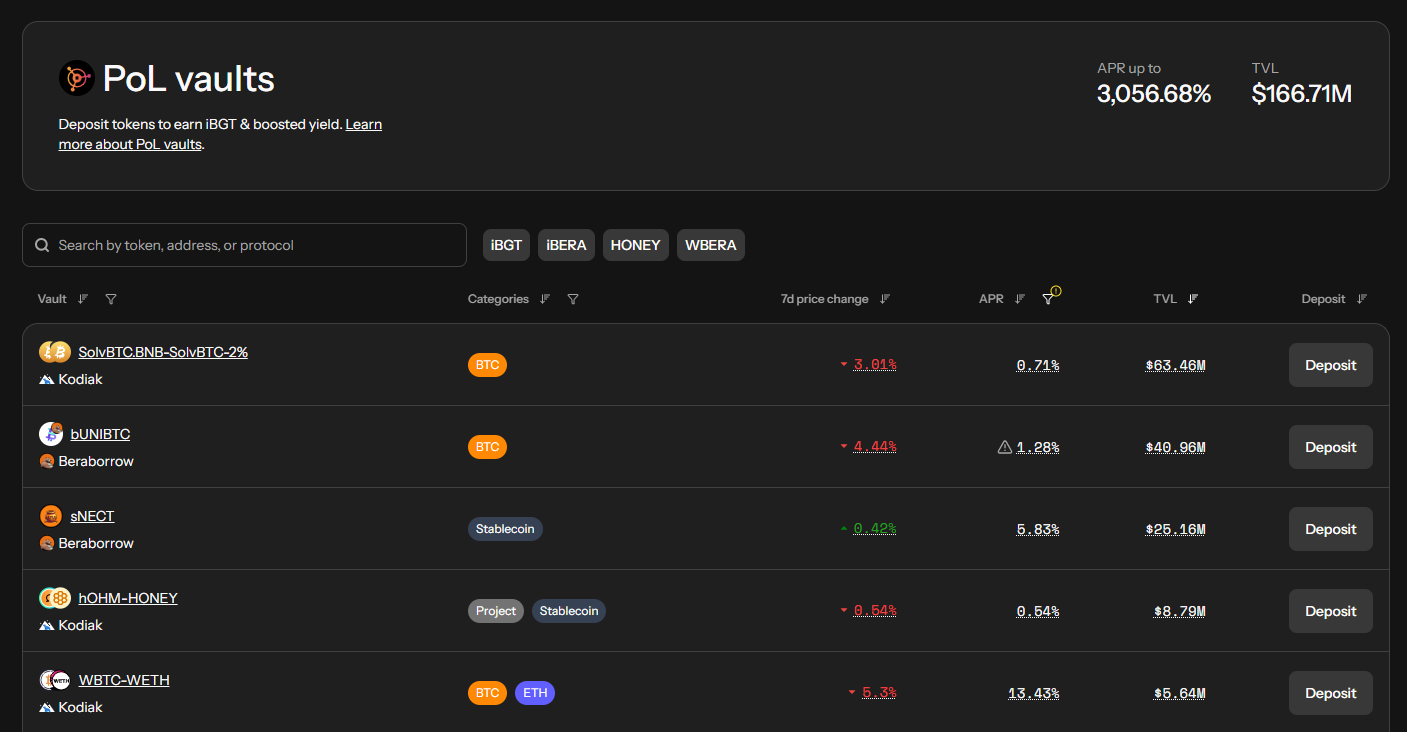

PoL Vaults

Infrared vaults are optimized smart contracts designed to simplify participation in Proof of Liquidity:

- Users deposit liquidity provider tokens from DEXs such as BEX or Kodiak.

- Vaults automatically delegate LP tokens into Berachain’s PoL system.

- Users receive iBGT rewards instead of BGT.

- No manual delegation or reward claiming is required.

$IR Token Information

$IR Key Metrics

- Token Name: Infrared

- Ticker: $IR

- Type: TBA

- Total Supply: TBA

- Contract Address: TBA

$IR Use Cases

Specific use cases for $IR have not yet been officially announced.

$IR Listing Details

- TGE Date: TBA

- CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

Tokenomics and Fundraising

Tokenomics

Detailed tokenomics have not yet been disclosed. Whales Market will update information once official details are released.

Fundraising

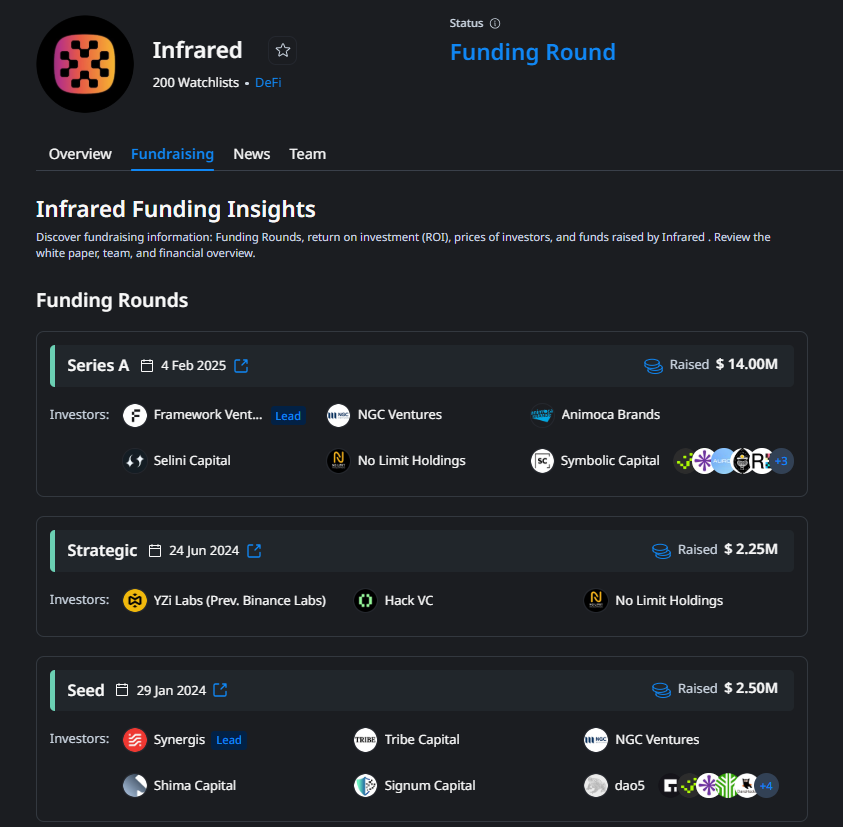

Infrared has completed three major fundraising rounds, raising approximately $18.75M in total.

- Seed round (January 29, 2024): Raised $2.5M, led by Synergis, with participation from Tribe Capital, NGC Ventures, Shima Capital, Signum Capital, dao5, and other investors.

- Strategic round (June 24, 2024): Raised $2.25M, with participation from YZi Labs (formerly Binance Labs), Hack VC, and No Limit Holdings.

- Series A (February 4, 2025): Raised $14M, led by Framework Ventures, alongside NGC Ventures, Animoca Brands, Selini Capital, No Limit Holdings, Symbolic Capital, and other strategic investors.

Conclusion

Infrared is positioning itself as a core infrastructure layer within the Berachain ecosystem. With a leading TVL position, backing from top-tier investors such as Binance Labs and Framework Ventures, and being the first project incubated by the Berachain Foundation, Infrared has built a strong foundation for long-term growth.

FAQs

Q1. Which user groups are Infrared designed for within the Berachain ecosystem?

Infrared is suitable for DeFi users seeking to optimize PoL returns without managing complex technical processes such as delegation or manual reward management.

Q2. What advantages does iBGT offer compared to holding BGT directly?

iBGT transforms non-transferable BGT into a liquid asset that can be traded, used in DeFi, or deployed as collateral.

Q3. What role does Infrared play in Berachain’s Proof of Liquidity system?

Infrared acts as a middleware layer, automating liquidity allocation and PoL management to improve efficiency and user accessibility.

Q4. Where do Infrared yields come from?

Returns are generated through staking rewards, PoL incentives, and optimized liquidity allocation across vaults and validator infrastructure.

Q5. Does $IR currently have a market price?

$IR has not been officially launched. Pre-market pricing will be available once the token opens for pre-TGE trading on Whales Market.

Q6. Can $IR be traded before official listing?

$IR can be traded pre-TGE on Whales Market through collateral-backed orders, enabling transparent and risk-reduced pre-market transactions.