DeFi and the AMM model are developing very rapidly, helping many people generate profits by providing liquidity and earning trading fees. However, without sufficient knowledge, investors can easily incur losses.

One of the most common risks in AMMs is impermanent loss (IL), a situation in which the value of assets when providing liquidity is lower than simply holding the assets. Therefore, understanding what impermanent loss is and why it occurs is very important before participating in AMMs.

What is Impermanent Loss?

Impermanent Loss (IL) is a risk that occurs when the value of assets held by liquidity providers in an AMM (automated market maker) becomes lower than if the assets were simply held, due to price fluctuations and the self-balancing mechanism of liquidity pools.

The cause of impermanent loss comes from changes in token prices within the pool compared to the time of deposit, forcing the AMM system to automatically adjust asset ratios to maintain balance. As a result, the portfolio value of liquidity providers may be lower than a simple holding strategy.

This loss is called “impermanent” because:

- It is only realized when the investor withdraws assets from the pool.

- If the price ratio between the two assets returns to its original level, impermanent loss may decrease or disappear.

However, in practice, most investors withdraw liquidity after the market has already moved, causing the loss to become real and to be considered an opportunity cost of participating in liquidity provision in AMMs.

How Does Impermanent Loss Work?

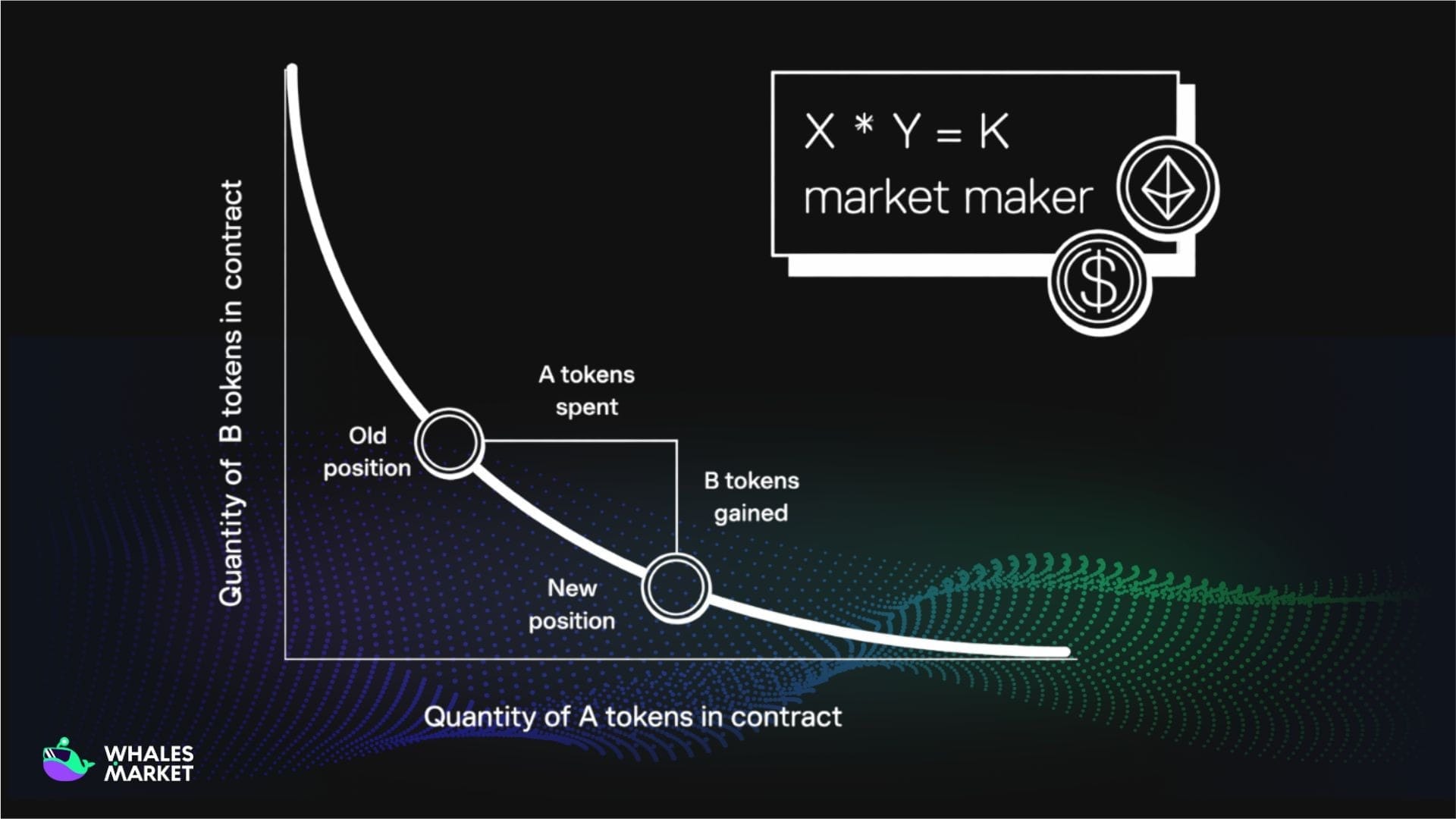

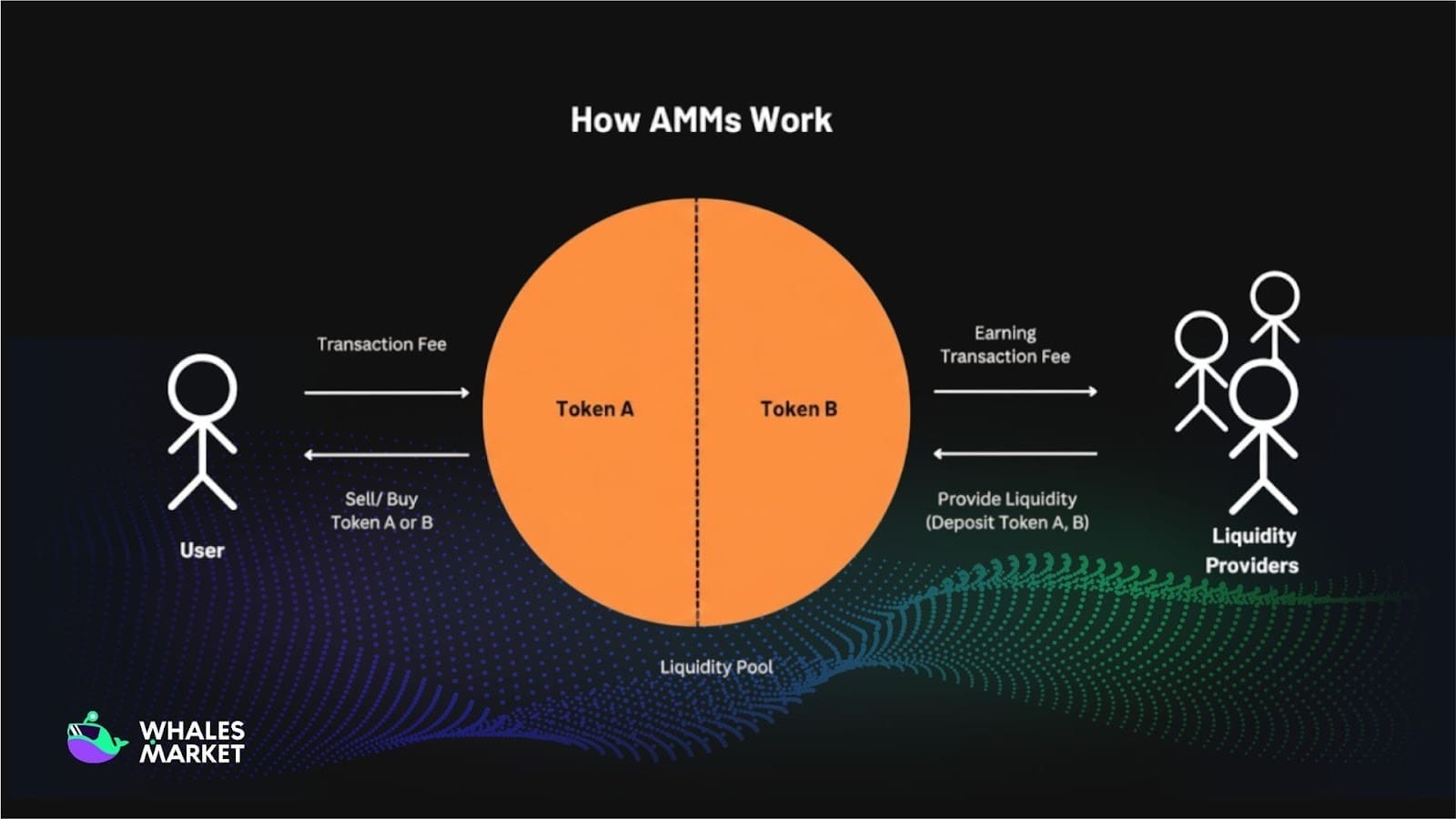

To understand how impermanent loss works, it is necessary to start from the nature of the automated market maker (AMM) model. Unlike traditional exchanges that use order books and professional market makers, AMMs rely entirely on a mathematical formula to determine prices and maintain liquidity.

- In the most common model, prices are determined by the invariant function: x * y = k

- Where x and y are the quantities of the two tokens in the pool, k is a constant.

So how does impermanent loss occur?

When users deposit assets into the pool, they provide two tokens according to the current market price ratio. At this moment, their portfolio is equivalent to simply holding the two tokens in a wallet.

- When the market price of one of the two tokens changes. The price inside the pool does not immediately reflect this change, creating a difference between the pool price and the external market price.

- Arbitrage traders trade with the pool to exploit this difference and push the pool price closer to the market price.

- Each arbitrage trade changes the pool composition: the token that increases in price is gradually removed from the pool, while the token that decreases in price is added. This process forces the pool to rebalance continuously to keep x*y constant.

- When liquidity providers withdraw at that moment, they no longer receive the original token ratio, but instead receive less of the appreciating asset and more of the depreciating asset. The total portfolio value is therefore lower than if they had simply held the tokens.

The difference between these two outcomes is impermanent loss, the direct result of the automatic rebalancing mechanism of AMMs.

Example of Impermanent Loss

When assets in the pool increase in price

Assume an investor initially provides liquidity to an ETH / DAI pool with:

- 10,000 DAI

- 20 ETH at a price of 500 USD per ETH

The total portfolio value at deposit is: 10,000 + 20 * 500 = 20,000 USD

Later, the market price of ETH increases to 550 USD. At this time, the pool price is still lower than the market price, creating an arbitrage opportunity.

Through arbitrage, the pool gradually adjusts its token ratios so that the pool price approaches 550 USD, while keeping x * y constant. After rebalancing:

- DAI increases to 10,488.09 DAI

- ETH decreases to 19.07 ETH

If the investor withdraws liquidity at this time, the total portfolio value is: 10,488.09 + 19.07 * 550 ≈ 20,976.59 USD

If the investor had simply held: 10,000 + 20 * 550 = 21,000 USD

Although the LP portfolio still increased in value, it is lower by 23.41 USD compared to holding. This difference is impermanent loss, the missed profit caused by the automatic rebalancing mechanism of AMMs.

When assets in the pool decrease in price

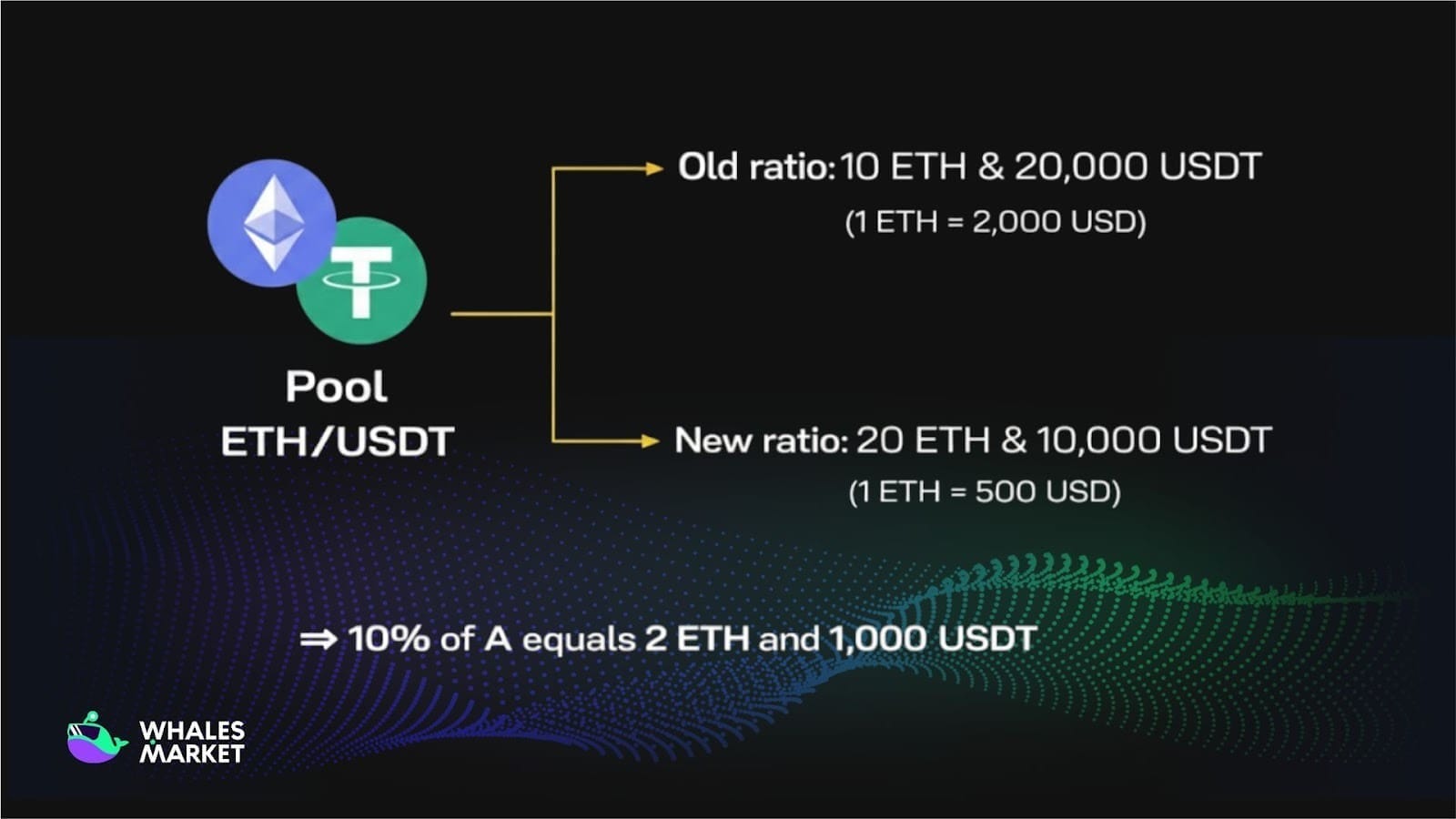

Assume the initial ETH / USDT pool ratio is:

- 10 ETH and 20,000 USD

- Corresponding to 1 ETH = 2,000 USD

The total pool value is 40,000 USD, and assume a liquidity provider owns 10% of the pool, equivalent to:

- 1 ETH

- 2,000 USDT

Later, the market price of ETH drops sharply to 500 USD. The pool price is still significantly higher than the market price, creating an arbitrage opportunity.

Arbitrage traders buy ETH cheaply outside and sell it into the pool at a higher price. ETH is added to the pool while USDT is withdrawn until the new ratio reflects the market price:

- 20 ETH and 10,000 USDT

- Corresponding to 1 ETH = 500 USD

The pool now holds more ETH and less USDT. A liquidity provider owning 10% of the pool can withdraw:

- 2 ETH

- 1,000 USDT

If user withdrawn: 2 * 500 + 1,000 = 2,000 USD

If user held:

- 1 ETH = 500

- 2,000 USDT = 2,000

- Total = 2,500 USD

The 500 USD difference is impermanent loss caused by automatic rebalancing when ETH decreases in price.

How to Calculate Actual Profit When Providing Liquidity

In previous examples, the analysis only compared portfolio values between providing liquidity and holding, without including trading fees and incentive rewards.

In reality, the profit or loss of an LP position depends on three components: trading fees, rewards, and impermanent loss.

The general formula is: PnL = Fees + Rewards − Impermanent Loss

- PnL is the net profit or loss when closing the position.

- Fees are the total trading fees earned.

- Rewards are incentive rewards if any.

- Impermanent Loss is the difference relative to holding.

Impermanent loss is not the final loss but only one component. A position can be profitable if fees and rewards are large enough to offset impermanent loss.

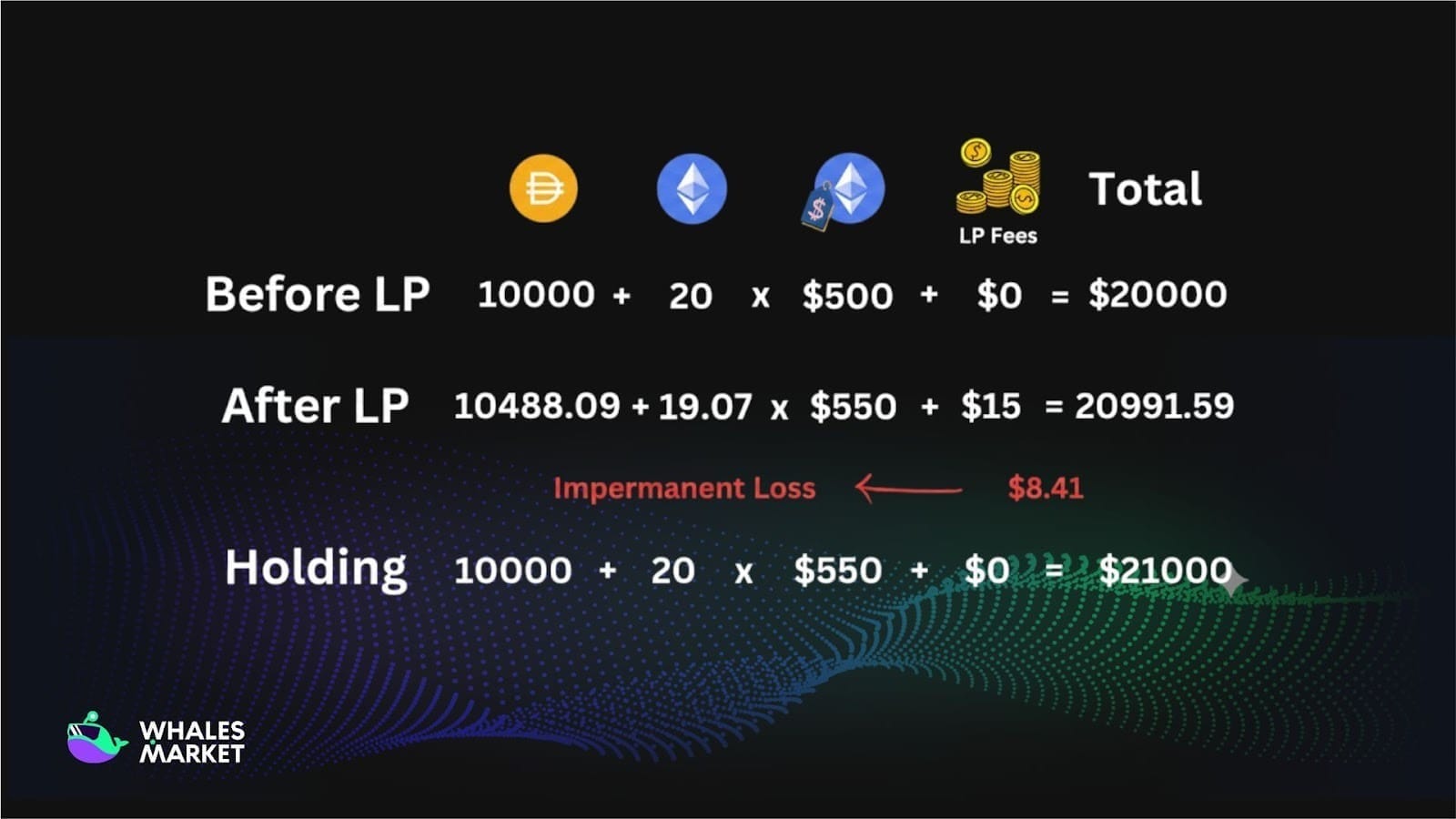

Example:

Initial deposit: 10,000 DAI and 20 ETH at 500 USD, total 20,000 USD. ETH increases to 550 USD.

On withdrawal:

- 10,488.09 DAI

- 19.07 ETH

- Fees from trading fee: 15 USD

Total value: 20,991.59 USD

If user just basic held: 21,000 USD

- Impermanent loss: 23.41 USD

- Fees offset: 15 USD

- Net Impermanent Loss: 8.41 USD

Trading fees can offset most impermanent loss, and net profit depends on the relationship between Fees and impermanent loss.

How to Reduce Impermanent Loss

Although impermanent loss is inherent to AMMs, liquidity providers can reduce risk by choosing suitable AMM models, assets, and pool structures.

Choosing appropriate AMM models and price ranges

Most early generation DEXs are based on the Uniswap v2 model, in which liquidity is distributed across the entire price range from zero to infinity. This model is simple and relatively safe, but capital efficiency is relatively low.

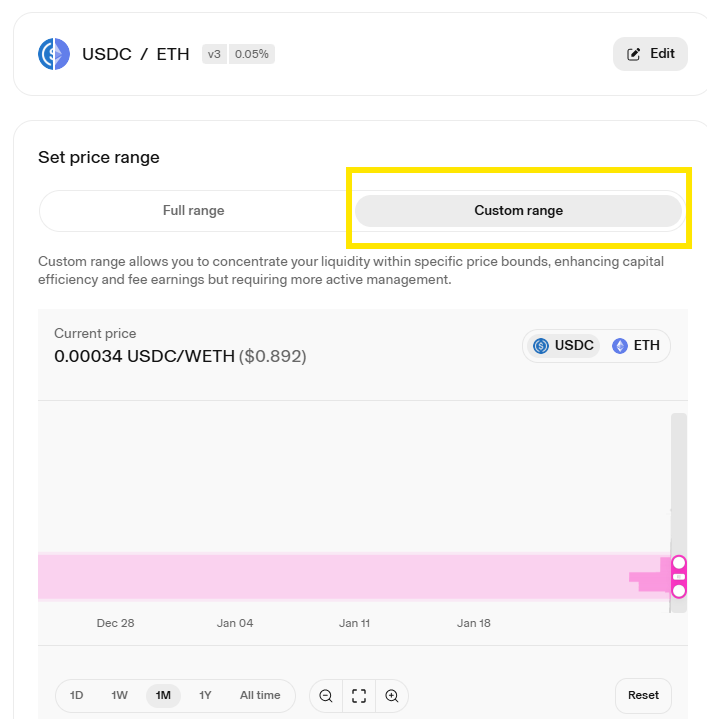

Uniswap v3 and its forks allow LPs to limit the price range in which they provide liquidity, thereby concentrating capital in the actual trading range and optimizing fee income. This is why this model is widely used by professional liquidity providers.

However, concentrated liquidity also comes with higher risk. When the price moves outside the selected range, LPs no longer earn fees and may face significantly higher impermanent loss if the market becomes highly volatile. Therefore, this strategy is only suitable for LPs who can closely monitor the market and actively manage their positions.

Prioritizing stable pools and pegged assets

One of the most effective ways to limit impermanent loss is to choose asset pairs with stable price ratios. Common asset groups include:

- Fiat pegged stablecoins: USDT, USDC, DAI

- Liquid staking tokens: stETH, rETH, cbETH

- Wrapped tokens: WBTC, WETH

In these pools, the price ratio between the two assets rarely changes, resulting in very small or nearly zero impermanent loss. In exchange, returns are usually lower due to high competition and limited profit margins.

This strategy is particularly suitable for investors who prioritize stability and capital preservation rather than seeking high short term returns.

Using weighted pools

Most traditional AMMs maintain a 50% and 50% asset ratio based on the x * y = k formula. However, platforms such as Balancer allow pools with flexible weights such as 80% and 20%, 70% and 30%, or 60% and 40%.

This structure allows LPs to reduce exposure to highly volatile assets, thereby limiting impermanent loss in markets with clear directional trends.

- In rising markets, allocating a higher weight to trending assets, for example 80% ETH and 20% USDC, helps LPs retain more upside compared to the 50% and 50% model.

- In falling markets, increasing the stablecoin weight, for example 70% USDC and 30% ETH, helps reduce portfolio drawdowns and limits the passive accumulation of depreciating assets.

This strategy essentially combines liquidity provision with active portfolio management.

Focusing on sideways market pairs

Impermanent Loss is lowest during sideways markets or when prices fluctuate within a narrow range. Therefore, selecting asset pairs that are likely to remain stable in the short and medium term is an important factor.

Through technical analysis, on chain analysis, or monitoring capital flows, investors can identify assets that are accumulating or trading within stable price ranges. In these conditions, liquidity provision becomes an optimal strategy for earning stable fees while keeping impermanent loss risk low.

In contrast, during strong trending markets, holding assets often outperforms liquidity provision.

Conclusion

Impermanent Loss is not a flaw of DeFi, but an inevitable consequence of the AMM mechanism. It reflects the cost of maintaining continuous liquidity and enabling trading without an order book.

Therefore, providing liquidity is not merely a passive fee earning activity, but an investment strategy that requires a clear understanding of AMM mechanics, risk management, and proper pool selection. Understanding impermanent loss correctly is the first step toward participating in DeFi in a sustainable and effective way.

FAQs

Q1. Is Impermanent Loss always negative for liquidity providers?

Impermanent Loss always reduces returns compared to holding, but it does not always lead to a net loss. Trading fees and rewards can offset or exceed it.

Q2. Can Impermanent Loss occur in stablecoin pools?

Impermanent Loss is minimal in stablecoin pools because price ratios rarely change, but it can still occur during depegging events.

Q3. Does Impermanent Loss depend on how long liquidity is provided?

Time alone does not cause impermanent loss. It depends on price divergence between assets during the period liquidity is provided.

Q4. Which type of assets cause the highest Impermanent Loss?

Highly volatile tokens and newly launched assets typically create the highest impermanent loss due to large price swings.

Q5. Can Impermanent Loss be completely eliminated?

It cannot be fully eliminated in AMMs, but it can be minimized through stable pools, weighted pools, and sideways market conditions.