HumidiFi has quickly become a dominant force in the Solana DeFi ecosystem, transforming decentralized trading with its proprietary automated market maker approach.

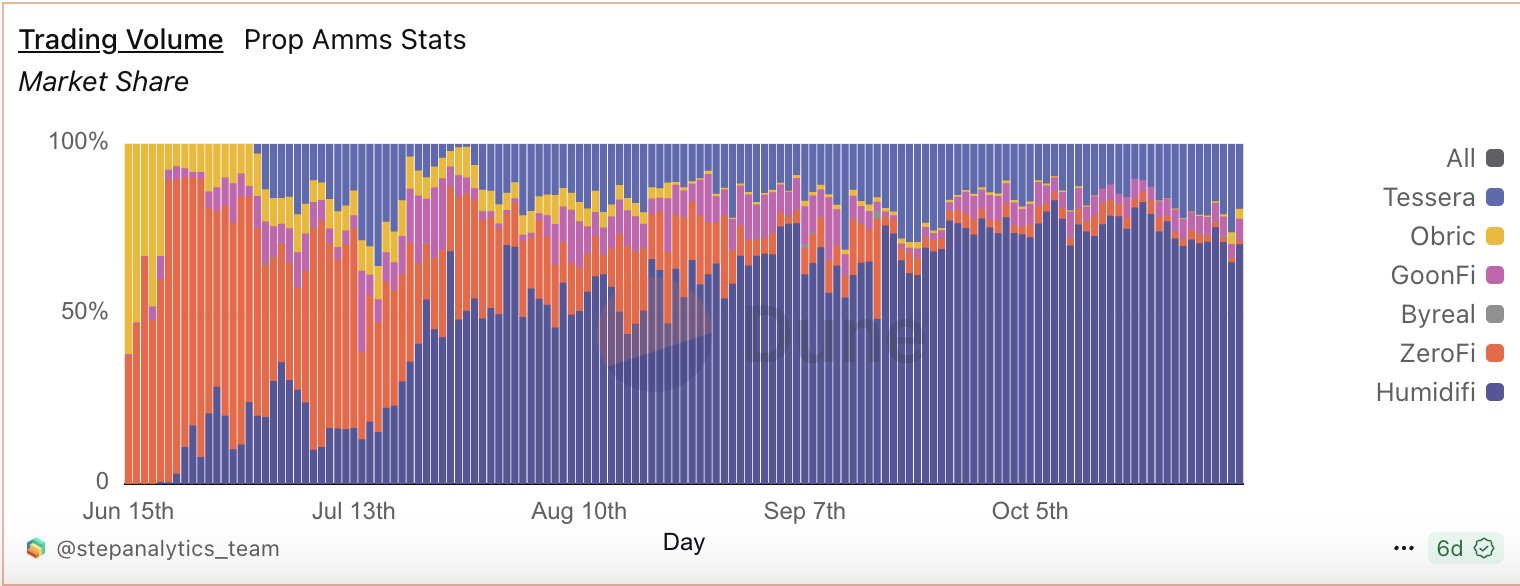

As the top AMM on Solana, it captures a substantial portion of the chain's DEX volume through a low-profile, high-efficiency model focused on superior execution and liquidity.

So, what is HumidiFi? Let’s find out in this article!

What is HumidiFi?

HumidiFi is a proprietary automated market maker (AMM) protocol on Solana, designed to offer private liquidity for decentralized trades. Unlike standard AMMs that rely on community-provided liquidity pools, HumidiFi uses internal vaults managed by professional market makers, resulting in narrower spreads and reduced slippage.

It launched in mid-June 2025 and rapidly secured nearly half of all Prop AMM volume on Solana, integrating with routers like Jupiter for seamless access.

Without a public frontend, HumidiFi maintains a secretive profile to prioritize performance and evade unnecessary oversight.

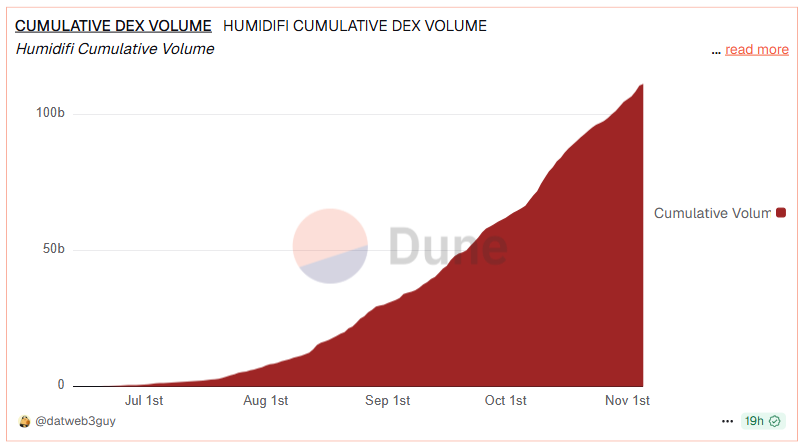

Its growth is underscored by handling billions in volume with low TVL, establishing it as a key player in Solana's DeFi scene.

How Does HumidiFi Work?

HumidiFi employs a self-contained system where liquidity comes exclusively from pro market makers, sidestepping retail LP issues like impermanent loss. Trades flow through aggregators like Jupiter, which funnels them to HumidiFi for best-in-class pricing without direct user interaction.

HumidiFi's core product is its Prop AMM platform, functioning as a dark liquidity provider for Solana trades.

How Does HumidiFi Work?

- Users: Spot trades → Route via Jupiter → Get low-slippage executions.

- Market Makers: Supply internal liquidity → Dynamically tweak prices → Actively balance positions.

- System: Delivers on-chain verifiability, cost-effective operations, and broad Solana compatibility.

Why self-managed liquidity matters for HumidiFi?

- Tighter spreads. With better capital allocation, the bid, ask gap compresses, making trades more efficient.

- Lower slippage on size. Liquidity is steered to where it’s needed, so big orders move the price less.

- Higher capital productivity. The same assets can work harder, extracting more return per unit of liquidity.

- Minimal MEV risk (Dark AMM). Because liquidity isn’t posted in public pools, MEV bots have far fewer opportunities to front-run large orders, one reason whales prefer executing through HumidiFi for cleaner, safer pricing.

In the first five months, HumidiFi racked up $100B in cumulative trades. It now accounts for 40%+ of all DEX volume on the network, making it the chain’s top AMM DEX.

$WET Information

$WET Key Metrics:

- Token Name: WET

- Ticker: $WET

- Token Type: Governance and Utility

- Total Supply: 1B $WET

- Contract address (CA): TBA

$WET Token Use Case

$WET is used for staking with purposes such as:

- Receiving trading rebates within the HumidiFi system.

- Reducing overall trading fees for traders.

- Upgrading on-chain staking tiers to access higher, more lucrative rebate levels.

Note: WET is a utility token for staking and fee rebates and should not be viewed as an investment.

$WET Listing

- Listing time: Expected to be December 5, 2025

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

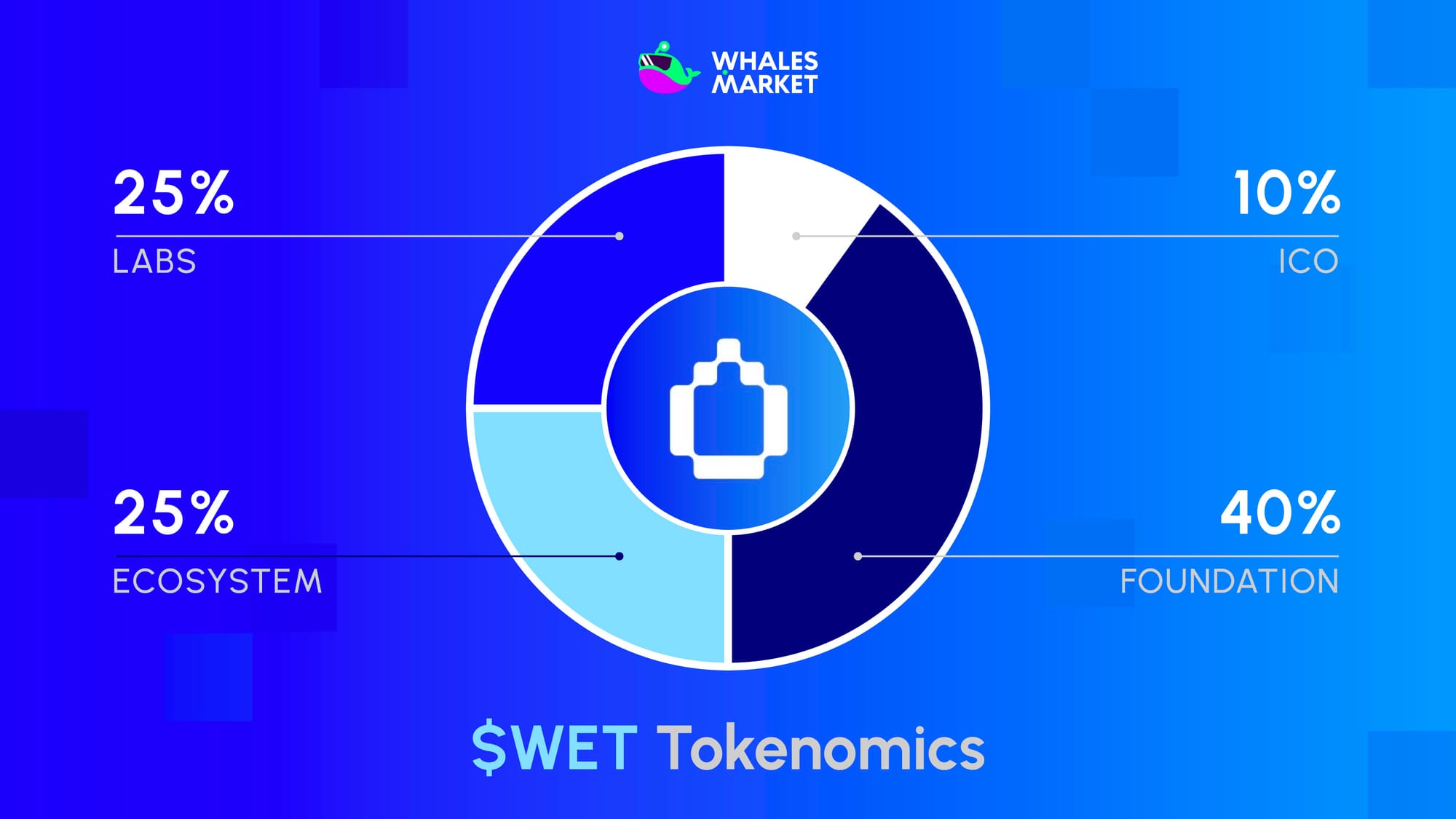

HumidiFi Tokenomics & Fundraising

Tokenomics

Total Supply: 1B $WET

Token Allocation:

- ICO: 10%

- Foundation: 40%

- Ecosystem: 25%

- Labs: 25%

Fundraising

HumidiFi is funded via a public ICO on Jupiter's DTF platform, bypassing private or VC rounds for fairness. The USDC-based sale features phases: whitelist, JUP stakers, and open public, ensuring broad access.

BREAKING:

— Jupiter (🐱, 🐐) (@JupiterExchange) October 29, 2025

The first ICO on our DTF platform will be @humidifi_

They're a prop AMM responsible for nearly 35% of ALL volume on Solana.

So let us know: Who's ready to get $WET? pic.twitter.com/cb8pwMo37O

The first ICO on Jupiter DTF is HumidiFi

HumidiFi Roadmap and Team

Roadmap

A comprehensive roadmap isn't publicly available. Near-term focuses include the $WET launch on Jupiter DTF (Decentralized Token Formation) in November 2025, with instant trading on Meteora post-sale.

Team

HumidiFi has not disclosed any information about its development team members.

Conclusion

HumidiFi represents a leap in Solana DeFi, merging pro market making with blockchain openness to lead in DEX volumes. Its Prop AMM innovation boosts trading efficiency and redefines liquidity standards in the crypto space.

Hopefully, this piece offers a clear understanding of what HumidiFi is, as well as an objective look at its strengths and weaknesses.

FAQs

Q1. Does HumidiFi have a public interface?

No. HumidiFi does not offer a direct front end for regular users. Instead, trades are routed to HumidiFi behind the scenes through supported aggregators and routers (for example, Jupiter), so users interact with the interfaces they already know while HumidiFi handles execution in the background.

Q2. Who supplies liquidity on HumidiFi?

Liquidity on HumidiFi comes from professional market makers using internal vaults. These are institutional or advanced trading firms that manage their own inventory and pricing. There are no retail LPs depositing into public pools, so liquidity is concentrated in a smaller set of specialized providers.

Q3. How do users interact with HumidiFi?

Users do not connect to HumidiFi directly. They submit swaps through integrated routers or aggregators, which then route eligible orders to HumidiFi. The protocol executes these trades on the user’s behalf and aims to deliver the best available pricing from its internal liquidity.

Q4. Does HumidiFi mitigate MEV?

Yes. HumidiFi’s private liquidity design reduces exposure to the public mempool, which limits typical front-running and sandwich opportunities. Because liquidity is not posted in open AMM-style pools, it is harder for MEV bots to see and exploit user orders before they are filled.

Q5: What is the price of $WET today?

$WET does not yet have an official market price since it has not been listed. However, you will soon be able to trade it on the leading pre-market platform, Whales Market. Here, you can buy more $WET or sell to take profit before it is officially listed on CEXs like Binance or Bybit.

Q6: What is the $WET pre-market price?

As of December 2nd 2025, $WET does not yet have a pre-market price. However, you will soon be able to trade it on Whales Market.