If you have ever seen the price of Bitcoin surge and rushed to buy without thinking twice, congratulations, you have experienced FOMO. This is one of the most common “conditions” in the crypto market. According to a late-2024 survey by Kraken, up to 84% of crypto investors admitted they had made trading decisions driven by FOMO.

So what exactly is FOMO? How can you recognize it and learn to overcome it? Let’s walk through it together in this article.

What Is FOMO?

FOMO, short for Fear of Missing Out, is a psychological state characterized by anxiety and unease over the possibility of missing out on something valuable. It occurs when individuals believe that others are gaining benefits, opportunities, or experiences that they are not part of. At its core, FOMO is driven by two powerful emotions: fear and greed. Fear of being left behind and greed for potential gains.

In the cryptocurrency market, FOMO becomes significantly more dangerous due to its extreme volatility. Crypto prices can rise or fall sharply within a very short period of time, creating strong emotional pressure to act quickly. This environment makes investors more likely to make impulsive decisions, often abandoning rational analysis and proper risk management.

FOMO in crypto tends to peak when the market is near the top of an uptrend. During these periods, optimism dominates market sentiment, prices continue to print consecutive green candles, and many participants believe the uptrend will continue indefinitely. As a result, investors rush in out of fear of missing the next big move, often just before the market reverses.

Common signs you are experiencing FOMO

FOMO often manifests through specific emotional and behavioral patterns that can strongly influence decision-making in the market.

- Constant anxiety and obsession: Investors repeatedly check token prices every few minutes, open trading apps dozens of times a day, and may even lose sleep worrying about open positions.

- Chasing social media: People feel compelled to follow every update on Twitter, Telegram, or Discord to avoid missing the next “golden opportunity.” Research shows that individuals with high levels of FOMO tend to spend more time on social media, creating a negative feedback loop.

- Rushed decisions: Investors buy assets simply because a coin is “hot” or because others are showcasing profits, without conducting proper research or assessing risk. According to a Kraken survey, 63% of investors reported that FOMO negatively affected their investment strategy.

How Is FOMO Created?

FOMO does not appear naturally. It is often deliberately created by projects, organizations, or influential individuals (KOLs) in the crypto market.

FOMO is used as a tool to push token prices higher and create liquidity so those generating FOMO can exit their positions. These actors often control or strongly influence multiple media channels, allowing them to shape the behavior of a large number of investors.

Common ways KOLs create FOMO:

- Exaggerating profit potential: Making unrealistic price predictions such as “this token will go x100 in one month, one week, or even a few days,” without solid analytical backing.

- Showing off profits: Posting screenshots of massive gains and rapidly growing wallet balances to trigger followers’ greed. This works well because people naturally compare themselves to others.

- Creating artificial scarcity: Using phrases like “last chance,” “only 24 hours left,” or “limited supply” to push people into quick buying decisions.

- Hosting exclusive events: Requiring participants to buy tokens to join VIP groups or receive early information.

Consumer psychology research shows that frequent exposure to influencer content can increase social anxiety, making followers feel inadequate and uneasy when comparing their lives to what they see online.

The Consequences of FOMO in Crypto

FOMO in crypto rarely appears on its own. It often comes with collective excitement, nonstop news flow, and the feeling that “if you do not enter right now, the opportunity will be gone forever.” This combination pushes many investors to trade logic for emotion.

- Prolonged psychological stress: FOMO keeps investors in a constant state of anxiety, fear of missing out before buying and fear of losses after entering a trade. Over time, this pressure harms sleep quality, focus, and mental health.

- Irrational decision-making: When driven by FOMO, investors buy simply because prices are rising or others are making money. These decisions often ignore analysis and original plans.

- Herd mentality: Seeing many people pile into the same asset creates a false sense of safety. Investors assume “the crowd cannot be wrong,” which leads them to underestimate real risks.

- Buying at unfavorable prices: FOMO is strongest after prices have already risen significantly. Entering late exposes investors to high risk as soon as the market corrects.

- Misjudging risk: Fear of missing profits pushes investors to take oversized positions, skip stop losses, or abandon risk management rules, amplifying losses when the market moves against expectations.

- Eroding self-confidence: Repeated impulsive losses make investors doubt their own judgment. As confidence fades, hesitation and confusion increase.

- Loss of independent thinking: Over time, FOMO-driven investors rely more on rumors, KOLs, or external signals instead of personal analysis and strategy.

3 Ways to overcome FOMO in Crypto investing

In reality, FOMO will never disappear completely. Even professional traders with years of experience still feel it from time to time. The key is learning how to control it and reduce its impact.

Make decisions based on research, not emotion

This is the most effective way to fight FOMO. When you truly understand a project, its tokenomics, development team, roadmap, and competitors, you can make decisions based on logic rather than emotion.

Combine technical analysis and fundamental analysis for a more complete view. Kraken research shows that 59% of investors use a DCA (Dollar Cost Averaging) strategy as a way to reduce emotional influence on trading decisions.

Always have a clear trading plan and stick to it

Before buying any token, ask yourself and answer these questions:

- Entry point: What price makes sense to buy?

- Take profit: What is your profit target, and at which price will you sell?

- Stop loss: What is the maximum loss you are willing to accept?

- Position size: What percentage of your portfolio will you allocate to this trade?

Write the plan down on paper or on your phone. Having something concrete to rely on helps when emotions start to take over.

Reduce the influence of news and the crowd

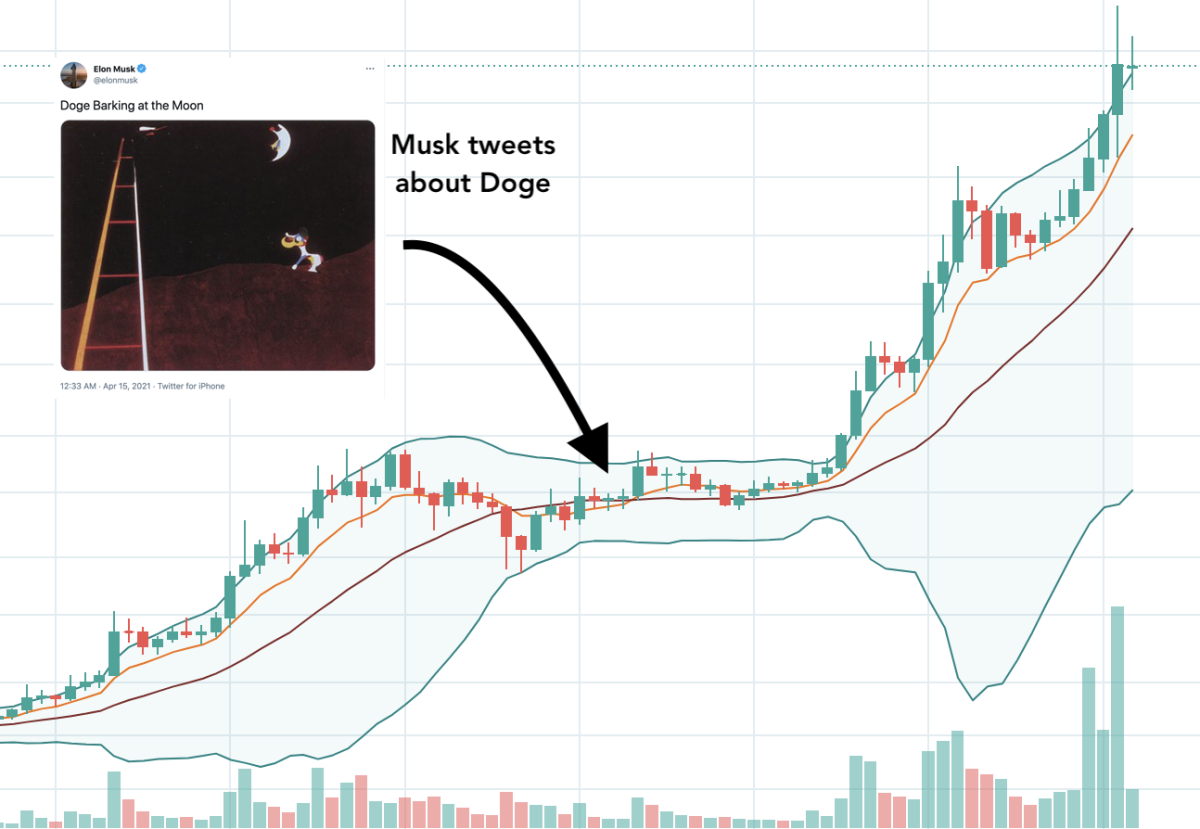

News and social media are the main sources of FOMO. A single tweet from Elon Musk can send Dogecoin soaring, and then crashing shortly after. If you trade based on this kind of information, you are playing a game you are almost guaranteed to lose.

Instead, step back and observe the market from a distance. Focus on long-term trends rather than short-term fluctuations. Build “market sensitivity” by recording and reviewing recurring price patterns over time.

You can also refer to the Fear & Greed Index, a tool that measures market sentiment on a scale from 0 (extreme fear) to 100 (extreme greed). When the index reaches “Extreme Greed,” it often signals a potential market correction, and peak FOMO.

Conclusion

FOMO is an unavoidable part of investing, especially in a highly volatile market like crypto. Recognizing and understanding FOMO is the first step toward controlling it.

Remember this: the crypto market is here to stay. There will always be new opportunities. Missing one opportunity today does not mean you will miss all opportunities tomorrow. But if you let FOMO drain your capital, you will have nothing left when real opportunities appear.

Smart investing is not about catching every opportunity. It is about choosing opportunities that fit your strategy and risk tolerance. Most importantly, keep a clear and calm mind, that is your most valuable asset in this market.

Note: This article is for informational and educational purposes only and does not constitute investment advice. Always do your own research before making any investment decisions.

FAQs

Q1. Does FOMO always lead to losses?

Not every FOMO-driven decision results in a loss, but over the long term, FOMO weakens discipline and increases the chance of mistakes. When emotions replace strategy, risk almost always outweighs expected returns.

Q2. Do experienced investors still feel FOMO?

Yes. FOMO does not disappear with experience; it is simply managed better. Even professional traders feel FOMO, but they rely on systems, plans, and discipline to prevent emotions from driving their actions.

Q3. How does FOMO affect long-term investing compared to short-term trading?

In long-term investing, FOMO leads to buying at suboptimal prices and breaking accumulation strategies. In short-term trading, it often causes late entries, price chasing, and unfavorable risk from the very start.

Q4. How can you tell if you are acting because of FOMO?

If you buy only because prices are rising, fear missing out if you do not act immediately, or cannot clearly explain your decision with analysis, there is a strong chance FOMO is influencing you.

Q5. How is FOMO related to risk management?

FOMO directly affects risk management. Fear of missing opportunities often leads to oversized positions, skipped stop losses, and broken risk–reward rules, which magnify losses when the market reverses.

Q6. Does controlling FOMO help increase profits?

Controlling FOMO does not help you make money faster, but it helps you lose less and survive longer. In crypto, survival and discipline matter far more than catching every short-term opportunity.