Greed typically leads to upward trends, while fear leads to negative trends. Human psychology is predictable because many individuals tend to react similarly in specific situations.

The Fear and Greed Index attempts to address and quantify market sentiment, making it useful and easy to understand for traders.

What is Fear & Greed Index?

The Fear and Greed Index is one of the most widely used indicators to understand market sentiment. As the name suggests, this index helps you determine whether the market is currently fearful or greedy, allowing you to develop a suitable trading strategy.

The Crypto Fear and Greed Index is based on Bitcoin and other major altcoins, combines social signals and market patterns to estimate the overall sentiment of the cryptocurrency market. It's an index because it integrates multiple data sources into a single model.

This index assigns a score from 0 to 100 to cryptocurrency sentiment, ranging from extreme fear to extreme greed. Many cryptocurrency traders use this index to determine the best times to enter and exit the cryptocurrency market.

How is the Fear & Greed Index calculated?

To calculate the Fear and Greed Index, we will rely on the following 5 parameters:

- Voltality: Measured by comparing the current price volatility and maximum price drop of BTC with the corresponding average values of the previous 30 and 90 days.

- Market Momentum/Volume: Combines the current momentum and trading volume of BTC, then compares it to the average of the previous 30 and 90 days.

- Social Media: This index is based on social media metrics such as likes, hashtags, what people are talking about, the number of posts, etc. Therefore, if the above indicators increase, it corresponds to a market that is gradually becoming greedy. Currently, it is only measured on Twitter.

- Dominance: Dominance here refers to BTC, meaning the percentage of market capitalization that BTC currently holds compared to the total cryptocurrency market capitalization, also known as BTC Dominance.

- Trend: Alternative.me takes Google Trend data for various Bitcoin-related search queries and processes those numbers, particularly changes in search volume as well as other suggested popular searches.

Why do Fear and Greed Index matter?

The cryptocurrency market is highly susceptible to many factors. When the market is rising, people become greedy, leading to FOMO (fear of missing out). Additionally, people often sell their assets impulsively when they see red numbers, leading to FUD (fear, uncertainty, doubt). The F&G index aims to protect you from these emotional overreactions. Traders often make two simple assumptions:

- Extreme fear: This indicates that investors are overly anxious. This could be a good time to buy.

- Extreme greed: When investors are in a state of extreme greed, the market is ripe for a correction.

Therefore, the Fear and Greed Index assesses the current state of the Bitcoin market and converts the data into a simple measure from 0 to 100.

How to use the Fear and Greed Index in Crypto

The Crypto Fear and Greed Index can be more effective for short-term research on the cryptocurrency market. Multiple Fear and Greed cycles can occur within a bull or bear market.

For trend traders, the Fear and Greed Index is a very beneficial tool when combined with technical analysis tools such as Fibonacci retracements, as well as other market indicators and oscillators.

However, this index has been shown to be inaccurate in predicting long-term market reversals or transitions from bull to bear markets and vice versa.

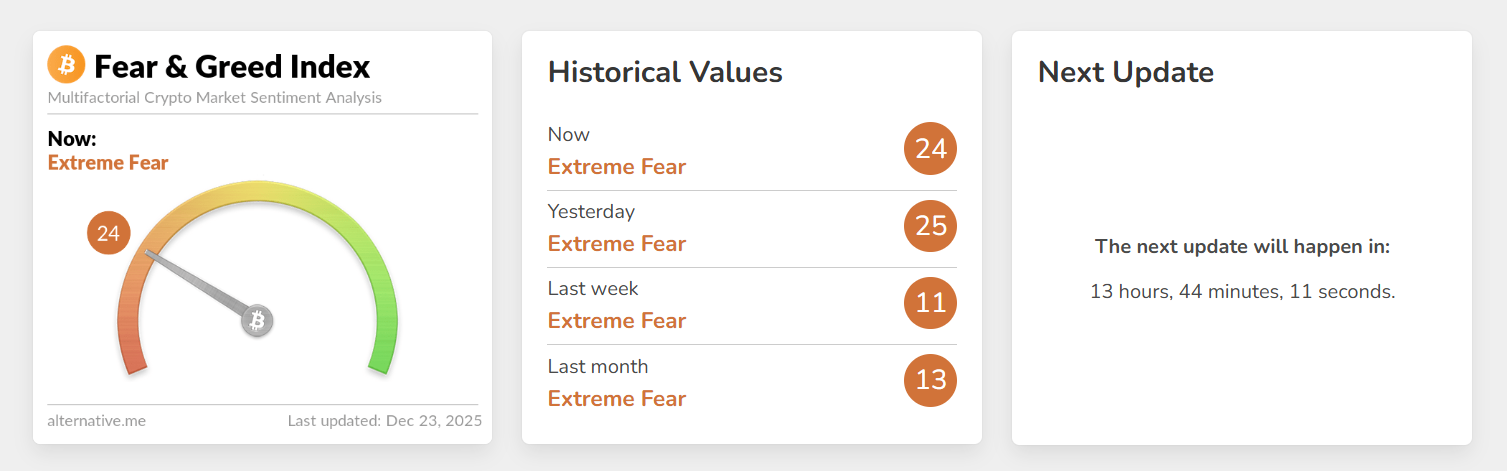

From left to right:

- Figure 1: Fear & Greed Index Chart.

- Figure 2: Fear & Greed Index Values: Current, Yesterday, Last Week, Last Month.

- Figure 3: Next Fear & Greed Index Update Time.

The Fear & Greed Index is a number ranging from 0 to 100:

- 0-49 represents Fear.

- 51-100 represents Greed.

- 50 corresponds to a neutral market.

However, if broken down further, the colors on the chart have the following meanings:

- 0-24: Extreme Fear (orange).

- 25-49: Fear (yellow).

- 50-74: Greed (light blue).

- 75-100: Extreme Greed (green).

Fear means the market is showing negative signs, most asset values are falling, and people tend to sell everything off.

Conversely, a greedy market is one where everyone rushes to buy everything due to FOMO (fear of missing out), and asset prices are constantly rising.

How accurate is Fear and Greed Index in Crypto?

Similar to other indicators, the Fear & Greed Index has high accuracy, but it's not always right. To make trading decisions, analysts often combine it with other indicators such as chart analysis, on-chain data of BTC and ETH to see the overall situation, on-chain data of the asset being traded, etc.

Because the Fear & Greed Index only reflects the general market situation and updates very slowly, this index only provides an overview of the market, suitable for long-term traders. If you are a short-term trader, closing trades within a day or a few days, this index is not necessarily necessary.

In addition, there is no data showing what level the index will reach before a market change occurs. This means we all know that when the market is greedy, there will be a period of sharp correction.

The question is, at what level will the Fear & Greed Index reach before a correction? That's something we don't know. Therefore, the Fear & Greed Index is not used to help you predict when the market will correct.

Furthermore, in a bull or bear market, we sometimes see the indicator leaning in the opposite direction. But that doesn't mean the market has ended its trend and reversed. It could be a small correction to establish a larger, more sustainable uptrend/downtrend.

Conclusion

The cryptocurrency fear and greed index is a powerful tool in the trading toolkit, but it needs to be used wisely, combined with a solid trading strategy, consistent discipline, and a continuous learning attitude. By combining all of these, you can increase your chances of success in the exciting yet challenging world of cryptocurrency trading.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

What factors are used to calculate the Crypto Fear & Greed Index?

This index combines five main factors: price volatility, volume & market momentum, social media, BTC dominance, and Google search trends.

What does a high or low Fear & Greed score indicate?

A low score (Extreme Fear) indicates market panic, potentially presenting a buying opportunity. A high score (Extreme Greed) reflects strong FOMO and increased risk of a correction.

Can the Fear & Greed Index be used to predict market bottoms or tops?

No. This index reflects current market sentiment and does not accurately predict market reversals.

Which traders are suitable for the Fear & Greed Index?

This index is more suitable for medium- and long-term traders to assess the overall market context, rather than for short-term trading.