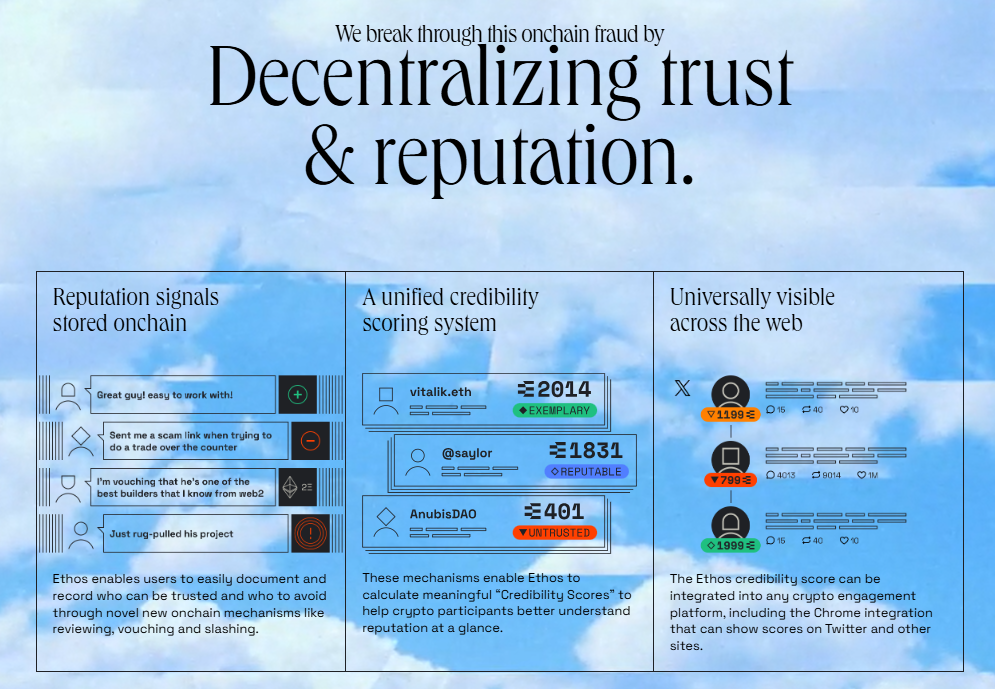

Reputation has always shaped who gets trusted, who gets ignored, and who gets a voice in crypto. The rules are changing fast, and on-chain signals are starting to matter more than claims. This is where Ethos steps in, offering a new way to think about trust and identity in Web3.

What is Ethos Network?

Ethos Network is the first on-chain platform that tracks and evaluates trust scores for accounts on X. The score is based on criteria such as account age, voting behavior, influence level, age of the X account, and more.

The goal of Ethos Network is to build a credit scoring system for Crypto, similar to what traditional finance has. This system helps filter out bot accounts, fake identities, Sybil attacks, and may even become a key criteria for projects to distribute whitelist or Airdrops fairly and transparently for the community.

Ethos Network Products

Credibility Score

Credibility Score is a system that lets users evaluate any X account and automatically aggregates trust scores through mechanisms such as:

- Review: The score is based on community reviews. Each review is classified into three levels: negative, neutral, and positive. If reviews are submitted by trusted accounts (high Ethos score), the score increases more. Ethos will adjust the score if all reviews lean too heavily to one side.

- Vote: Points are awarded based on a user’s review for others. One upvote gives +1 point and one downvote gives -1 point.

- Number of Vouchers: This is the number of users that have vouched for an account. To vouch, a user must stake ETH into another account’s profile. The more ETH staked, the higher the trust points. This ETH can be unstaked (unvouched) at any time. If fraud is detected, the user will be penalized through a Slash mechanism.

- Mutual Vouch: Extra points when two users vouch for each other. Both gain +1 point. The “reputation binding” mechanism also allows the inviter to receive 20% of the invitee’s reputation score (positive or negative) within the first 90 days.

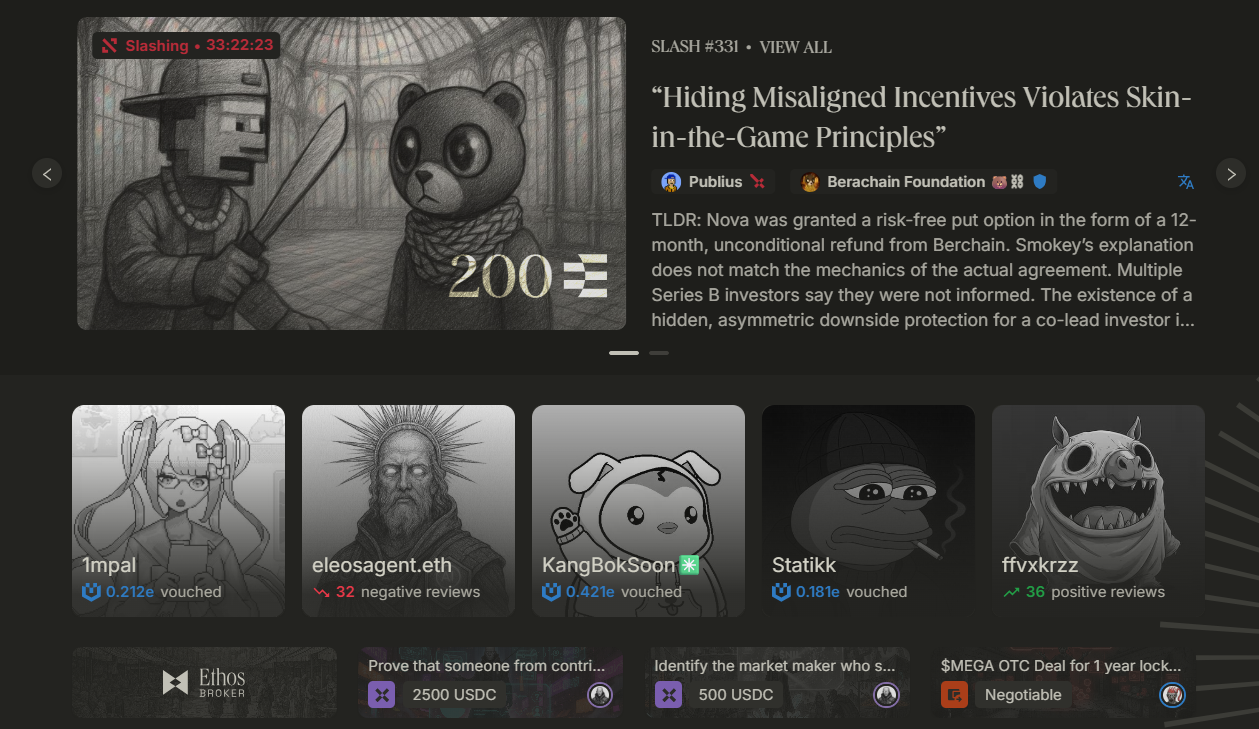

- Slash (Penalty Mechanism): If someone in the crypto community crosses the line, users can propose a slash. After voting, the person may lose part of the Ethereum staked in the network.

- Attest (Identity Verification): A mechanism for linking wallet and social accounts with an Ethos profile, proving identity or verifying through on-chain proofs.

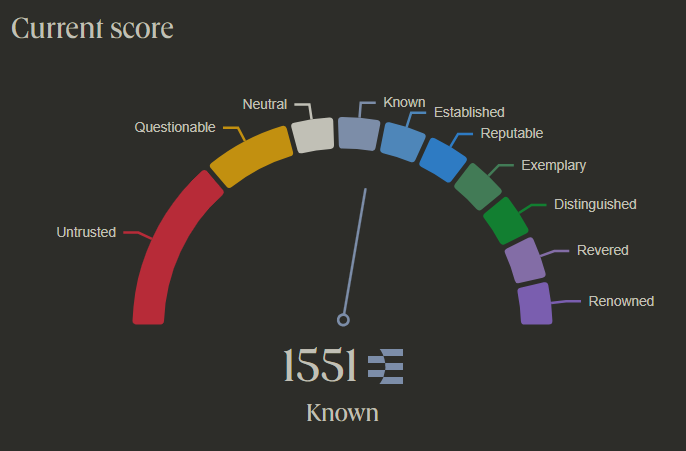

The trust score is divided into 10 levels:

- 0 - 799 (Untrusted)

- 800 - 1,199 (Questionable)

- 1200 - 1.399 (Neutral)

- 1.400 - 1,599 (Known)

- 1,600 - 1,799 (Established)

- 1.800 - 1.999 (Reputable)

- 2.000 - 2,199 (Exemplary)

- 2.200 - 2.399 (Distinguished)

- 2.400 - 2.599 (Revered)

- 2.600 - 2.800 (Renowned)

Users can check trust scores directly on Ethos, or install the Chrome extension to view scores directly on X. The trust score is displayed prominently on each account’s avatar.

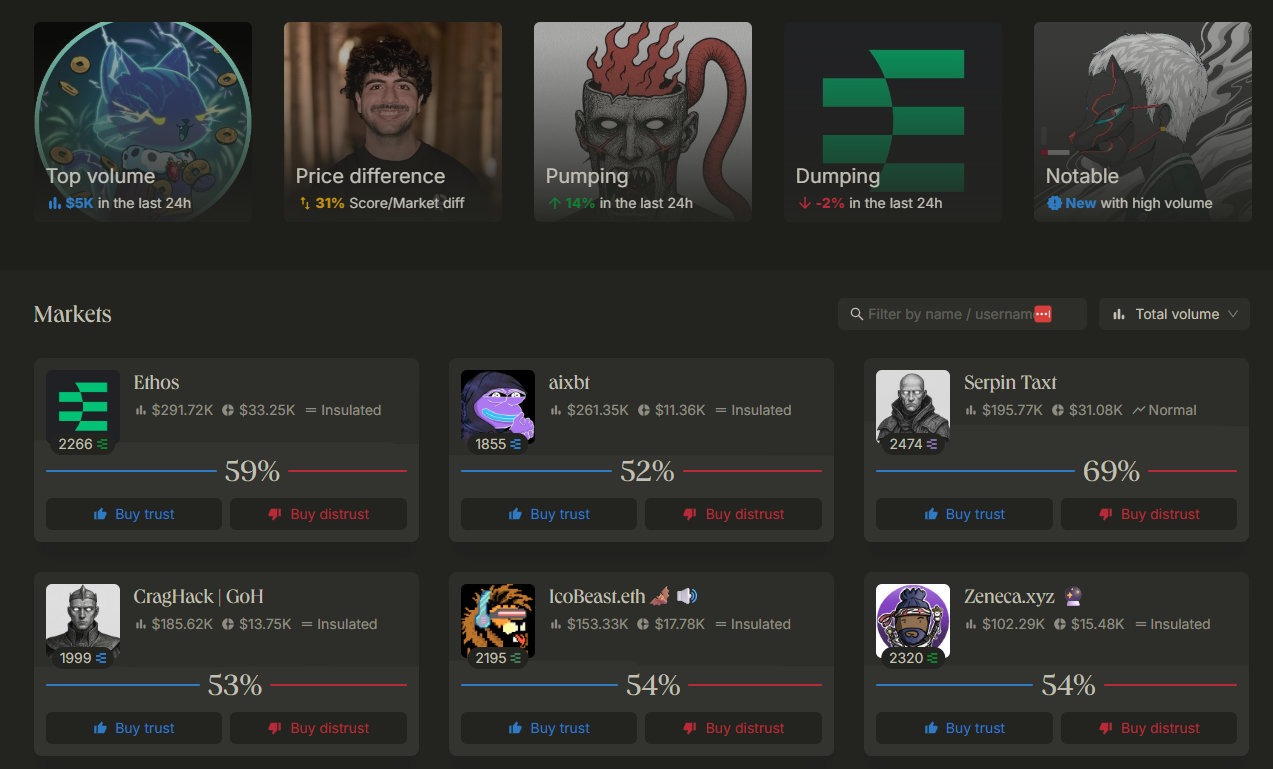

Ethos.Markets

Ethos.Markets launched on January 29, 2025, and is the second product built on the Ethos protocol. This platform allows users to financially speculate on trust scores associated with Ethos Profiles using an AMM powered by the Logarithmic Market Scoring Rule (LMSR), similar to Polymarket.

Users can buy and sell trust votes and distrust votes linked to specific Ethos Profiles, affecting real-time trust scores. The market begins at 50% trust and 50% distrust, and prices move dynamically based on trading activity.

Users can bet on specific outcomes, for example: “By the end of March 2025, Vitalik will have a 75% trust score.” Since reputation cannot be determined precisely at any given moment, the market keeps fluctuating and Ethos Market follows a permanent market design.

Contributor XP

When mainnet launched, Ethos introduced Contributor XP – a native recognition system for those who help the community identify who is trustworthy and who should be avoided.

Activities such as writing reviews, vouching for others, receiving reciprocal vouch, inviting new users, and maintaining reputation scores all affect Contributor XP. Contributor XP will have future functions within the Ethos protocol and is currently rewarded during the limited “First Season.”

Tokenomics & Fundraising

Tokenomics

There is currently no official information about Ethos tokenomics. Whale Market will update immediately once the project makes an announcement.

Fundraising

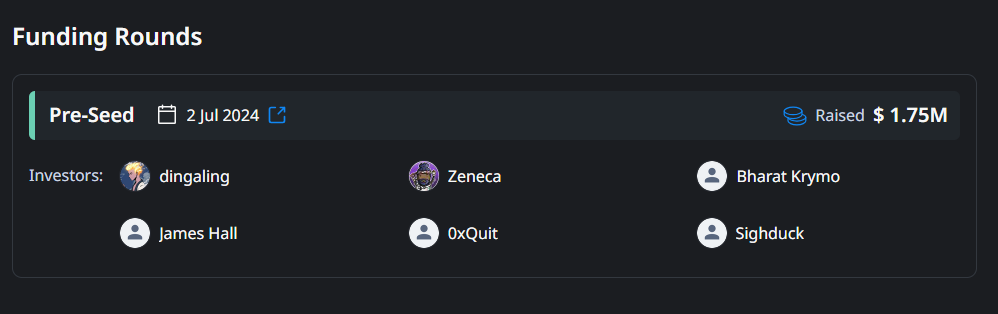

Ethos raised 1.75M USD in a Pre-Seed round from angel investors including well-known KOLs such as Dingaling, Bharat Krymo, Zeneca, James Hall, and others.

Roadmap & Team

Roadmap

Ethos officially launched Mainnet on January 22, 2025 on Base blockchain. However, the project has not yet announced a detailed development roadmap.

Team

- Trevor Thompson: Co-Founder & CEO.

- Ben Walther: Co-Founder & CTO.

Conclusion

Ethos Network has the potential to reshape reputation in crypto. The challenge is building fairness and trust at scale. With a strong community and transparent scoring, Ethos could become a core reputation layer for Web3.

FAQs

Q1. How to join Ethos Network?

Users need an invitation code from an existing participant to create an Ethos Profile and start using the platform’s features.

Q2. How does Ethos.Markets work?

Ethos.Markets allows users to buy and sell trust votes and distrust votes to speculate on trust scores of accounts, using the LMSR algorithm similar to Polymarket.

Q3. Why is Ethos Network special?

Ethos combines social proof-of-stake, on-chain community scoring, and penalty mechanisms to build a transparent reputation system that reduces fraud and increases trust in crypto.

Q4. What is the current price of Ethos token?

Ethos has not launched a token yet. If a token is released, early users may be able to trade it on the pre-market through Whales Market before it appears on major exchanges like Binance, Bybit, or OKX.