Gas fee spikes, stuck transactions in the mempool, and the familiar feeling of bidding wars have become major friction points on Ethereum. In that context, ETHGas emerges with an approach to blockspace and transaction confirmation speed.

What is ETHGas?

ETHGas is an infrastructure platform that allows users to trade, buy, sell, and hedge Ethereum blockspace. Instead of competing in the mempool with unpredictable gas fees, users can reserve space in future blocks, ensuring transactions are executed at a predictable cost.

This approach gives DeFi applications, traders, and everyday users a smoother transaction experience, without worrying about sudden gas spikes or transactions getting stuck in the mempool.

How Does ETHGas Work?

ETHGas built on a multi-layer architecture, combining a blockspace trading marketplace with pre-confirmation mechanisms to create a more flexible and efficient ecosystem compared to Ethereum’s traditional gas model.

Realtime Ethereum (Pillar 1)

This is the core layer of ETHGas, using “Inclusion Preconfirmations” technology to reduce transaction confirmation time from around 12 seconds to roughly 3 milliseconds. Users can swap tokens or place NFT orders with near-instant confirmation as soon as a transaction is signed.

The system currently has more than $10B in TVL locked through EigenLayer Vision AVS, providing economic security backed by ETH restaked by validators worldwide.

Blockspace Trading Platform (Pillar 2)

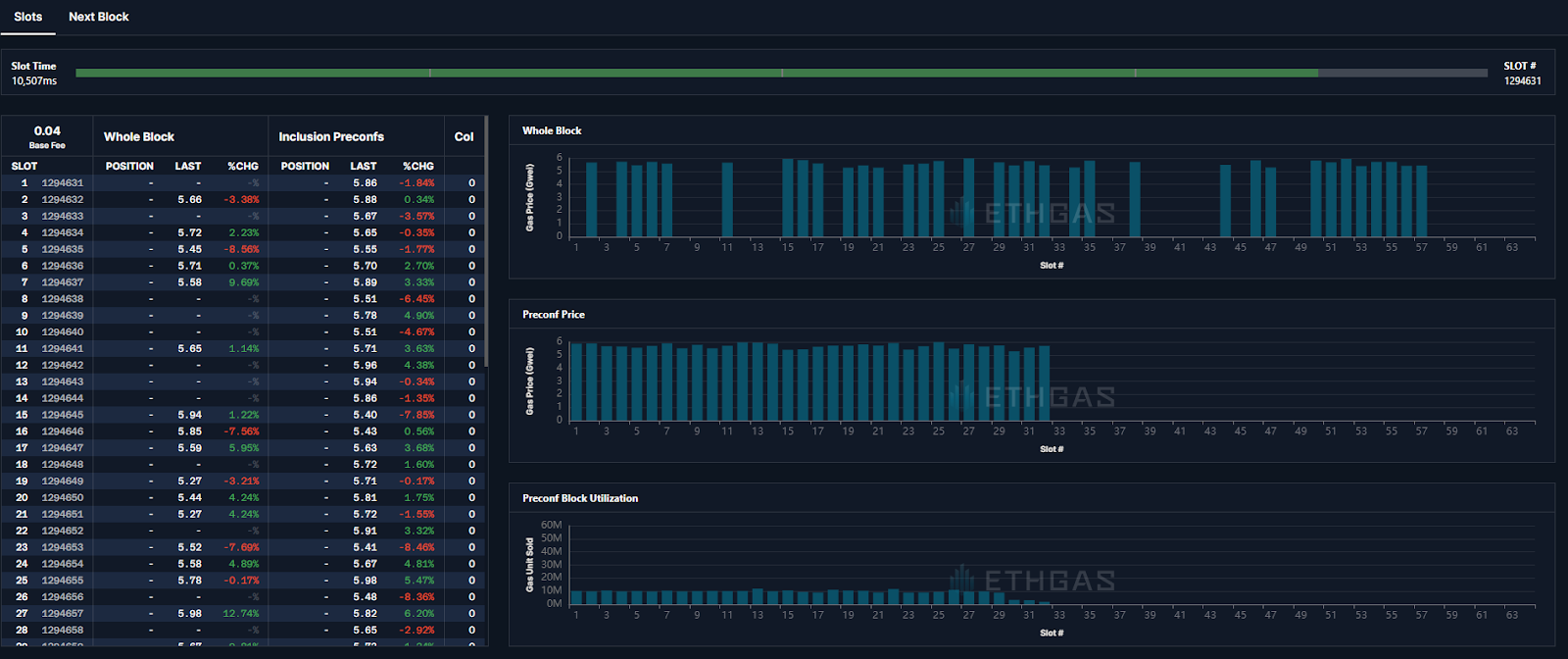

ETHGas introduces a standardized marketplace for blockspace commitments. Key products include:

- Whole Block Commitments: Buyers gain exclusive rights to an entire future block, up to approximately 36 million gas units. They control transaction ordering and can split or resell the block. The market opens up to 64 slots in advance.

- Inclusion Preconfirmations: Guarantees that a transaction will be included in a specific block with a defined gas limit. The market opens 32 slots ahead and supports secondary market trading.

- Execution Preconfirmations (Coming Soon): Ensures not only transaction inclusion, but also that a specific on-chain state or outcome is achieved.

Superior Predictable Yield (Pillar 3)

Validators can connect to ETHGas through the Commit Boost module to sell their blockspace on the exchange. This creates a stable and predictable income stream, on top of traditional staking rewards and MEV.

Open Gas Initiative (Pillar 4)

This program allows protocols to sponsor gas fees for their users without writing additional code. Early OG partners include EigenLayer, Ether.fi, Pendle, and Velvet Capital. The long-term goal is to completely remove gas fees from the end-user experience.

$GWEI Token Information

$GWEI Key Metrics

- Token Name: ETHGas

- Ticker: $GWEI

- Type: Utility and Governance

- Total Supply: 10,000,000,000 $GWEI

- Contract Address: TBA

$GWEI Use Cases

$GWEI is the governance token of the ETHGas ecosystem, enabling holders to participate in shaping the protocol’s direction:

- On-chain Decision Making: Stake $GWEI to receive $veGWEI and vote on proposals.

- Delegation: Delegate voting power without transferring tokens.

- Protocol Parameters: Vote on parameter changes and incentive structures.

- Treasury Management: Decide how budgets are allocated for grants and partnerships.

- Emergency Powers: Ultimate authority over upgrades and emergency actions.

$GWEI Listing Details

- TGE Date: TBA

- CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

$GWEI Tokenomics and Fundraising

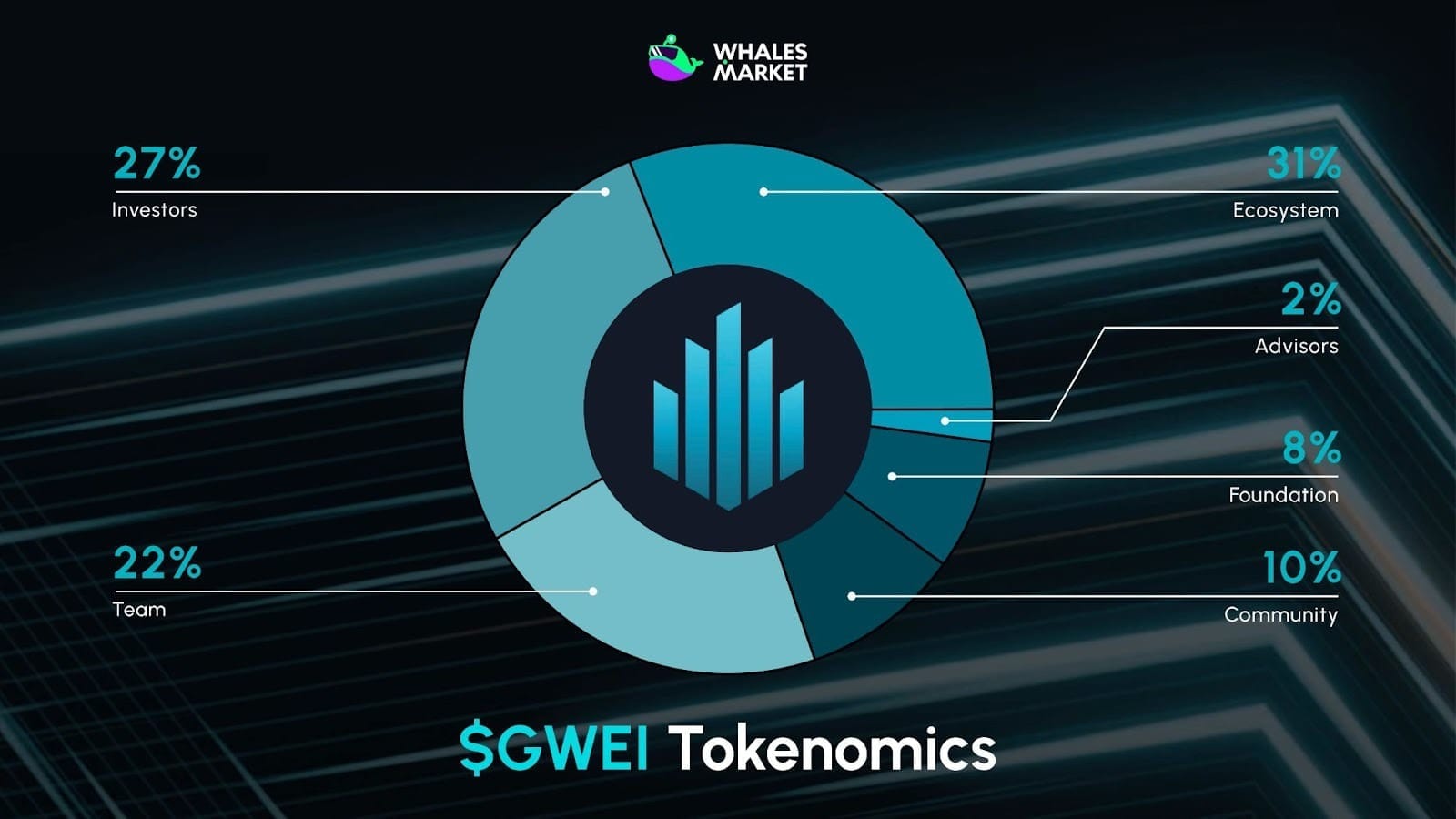

Tokenomics

Total Supply: 10,000,000,000 $GWEI

Allocation:

- Ecosystem: 31%.

- Investors: 27%.

- Team: 22%.

- Community: 10%.

- Foundation: 8%.

- Advisors: 2%.

Fundraising

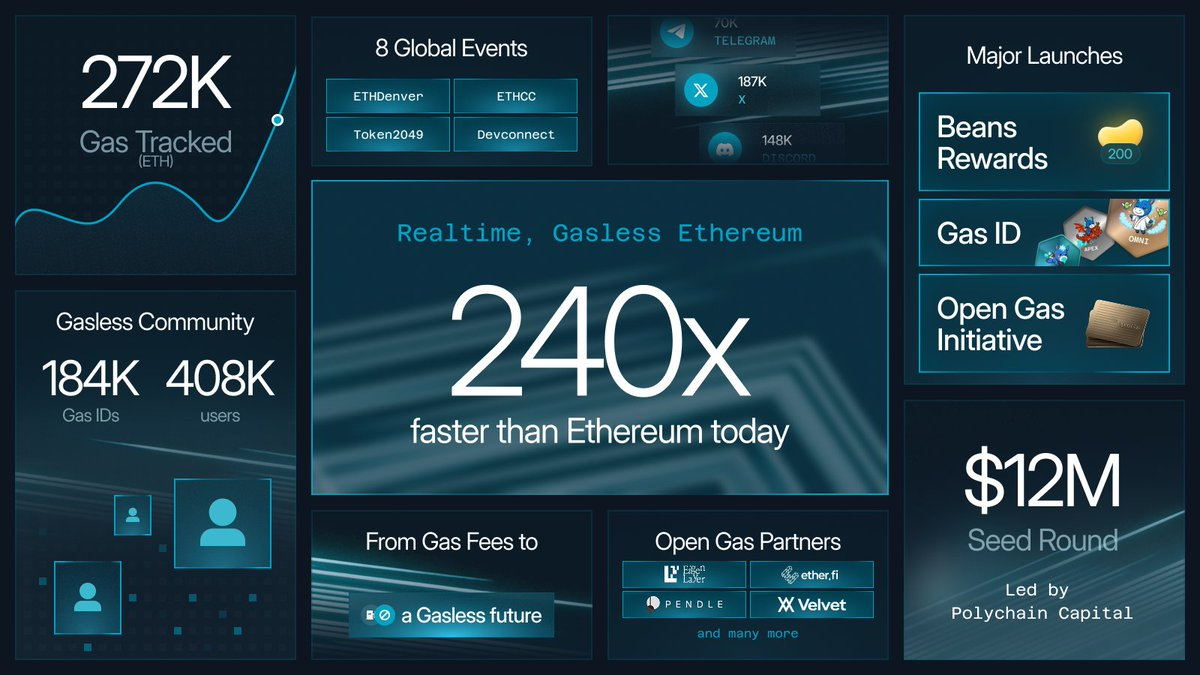

ETHGas raised a total of $12M in December 2025 from Polychain Capital, Stake Capital, BlueYard Capital, Amber Group, and other investment funds.

Today, we’re excited to announce that ETHGas has raised a $12M seed round, led by @Polychain, to build Ethereum’s blockspace futures market.

— ETHGAS (@ETHGasOfficial) December 17, 2025

We’ve also received $800M in commitments from leading Ethereum builders to support ETHGas’ marketplace and product development. pic.twitter.com/OHe8O8trh7

Team & Roadmap

Team

- Kevin Lepsoe – Founder & CEO

- Rosanna Man - CTO

Roadmap

Achieved Milestones

- Launched the first Blockspace Futures Market for Ethereum in December 2025.

- Completed a $12M seed round led by Polychain Capital.

- Attracted $800M in liquidity commitments from the ecosystem.

- Built a community of more than 283,000 users.

- Integrated with major partners including EigenLayer, Ether.fi, Pendle, and Velvet Capital.

- Reached over $10B in TVL through EigenLayer Vision AVS.

Upcoming Roadmap

- Q1 2026: $GWEI TGE and launch of the governance framework.

- Expansion of the Open Gas Initiative with more protocol partners.

- Development of Execution Preconfirmations.

- Base Fee Futures, allowing dApps to lock in future gas costs.

- Expansion into new use cases such as verifiable AI and privacy.

Conclusion

ETHGas delivers a distributed blockspace market platform that emphasizes user experience, transparency, and smart automation. With a multi-chain approach and a strong focus on reducing human error, the system supports both newcomers and advanced crypto users with safer, more adaptive financial tools.

FAQs

Q1. Which user groups benefit the most from ETHGas on Ethereum?

ETHGas is well suited for DeFi dApps, high-frequency traders, NFT platforms, and protocols that require certainty around transaction timing and cost. Everyday users also benefit from smoother transactions without worrying about mempool congestion.

Q2. How is ETHGas different from the traditional gas fee model on Ethereum?

Instead of competing on gas fees in real time, ETHGas allows users and applications to reserve future blockspace in advance. This removes uncertainty, reduces gas spike risk, and enables more effective on-chain transaction planning.

Q3. Does blockspace trading affect Ethereum’s decentralization?

ETHGas does not alter Ethereum’s core consensus mechanism. The system operates through voluntarily participating validators and is secured by economic guarantees from restaked ETH, preserving the permissionless nature of the network.

Q4. What value does the Open Gas Initiative bring to protocols and end users?

The Open Gas Initiative allows protocols to sponsor gas fees for users without modifying code. This simplifies onboarding, improves overall UX, and enables real-world “gasless experience” models on Ethereum.

Q5. What benefits do validators gain from participating in ETHGas?

Validators can sell blockspace in advance to generate stable, predictable revenue streams, rather than relying solely on staking rewards and MEV. This helps balance risk and optimize long-term returns.

Q6. What is the current price of $GWEI?

$GWEI has not officially launched yet. There is no official trading price on major exchanges, but $GWEI is currently being traded on a pre-market basis on Whales Market.