As Layer 2 scaling solutions continue to expand, the role of sequencers has become increasingly critical. While most rollups today rely on centralized sequencers, this design introduces censorship risks, single points of failure, and trust assumptions that go against the core ethos of decentralization.

Espresso aims to solve this problem by offering a decentralized sequencer and data availability system that rollups can easily integrate. By separating sequencing from execution and enabling shared, decentralized ordering across rollups, Espresso positions itself as key infrastructure for the next generation of scalable and trust-minimized Layer 2 ecosystems.

So what is Espresso? Let’s dive into this article.

What is Espresso?

Espresso is a decentralized sequencer and data system designed for layer 2 blockchains (rollups), enabling rollup projects to integrate directly with Espresso’s sequencer by modifying specific parts of their code to interact with and submit transactions to the system.

In parallel, the Espresso System actively collaborates with a wide range of rollups and offers multiple flexible implementation options, allowing projects to customize how they use sequencing, data availability, or control layers to match their own architecture and requirements.

How does Espresso work?

Components of Espresso

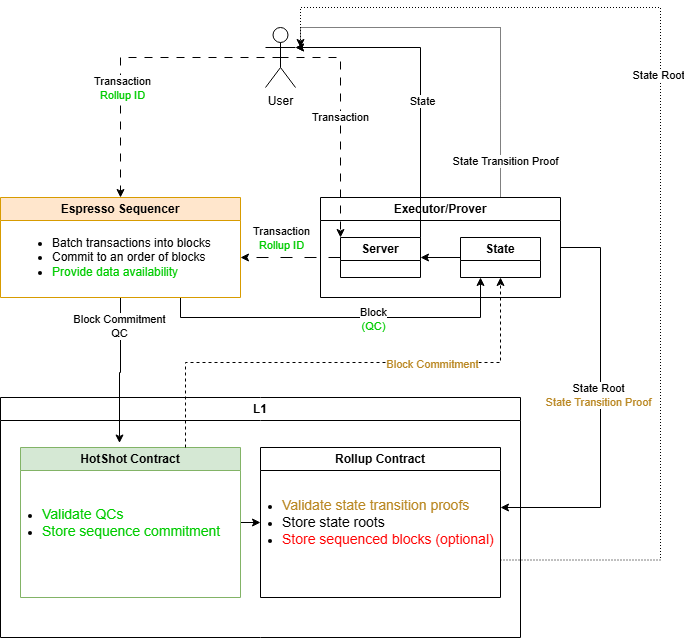

The components of the Espresso system include:

- Sequencer: Responsible for grouping transactions from multiple users into ordered blocks, then assigning a positional order to those blocks. The order can be arbitrary or follow specific constraints of rollups.

- Executor and prover: The main task of the executor and prover is to execute the function of transforming the state of transactions, where transactions represent programs to be executed. By executing this function, the executor calculates and stores a VM state as a determined result of the order of blocks produced by the sequencer.

- Rollups contract: The rollups contract confirms the ZK-proof created by the prover and stores the nearest certified state root in the repository of Layer 1 blockchains (such as Ethereum).

Transaction flow

To put it simply, we can divide the transaction flow into two cases as illustrated in the image:

User interacting directly with the Espresso sequencer: After the user initiates a transaction in the Espresso sequencer, these transactions are grouped into a batch and recorded in blocks. Next, the transaction is added to the order book. Then, the resulting output is sent to Layer 1.

User interacting with rollups using the Espresso sequencer: After the rollups receive the transaction, the executor and prover confirm the transaction status and send it to the server. From the server, this status is transferred to the Espresso sequencer, and the sequence is repeated as in the case above.

Key features of Espresso Systems

Decentralized ZK-Rollup Mechanism

Espresso integrates ZK-Rollup into its EVMs with the Proof of Stake consensus algorithm. ZK-Rollup is a solution that allows transactions to be processed off-chain based on zero-knowledge proofs.

In ZK-Rollup, a server merges multiple transactions into one for easier verification and creates a concise zero-knowledge proof (zk-SNARK) of their validity before sending it to the consensus protocol.

This compresses the amount of information and computation the consensus protocol needs to validate transactions. This reduces bandwidth and computation on the consensus protocol, while increasing transaction throughput. This method has become popular on the Ethereum blockchain through scaling solution providers such as StarkWare and zkSync.

Configurable Asset Privacy on Ethereum (CAPE)

To optimize user privacy, Espresso Systems has developed CAPE – Configurable Asset Privacy on Ethereum.

This application allows blockchain asset creators to customize access to sender and receiver addresses, as well as the quantity and type of assets held or moved. The privacy of these assets can be public, private, or only visible to certain groups.

CAPE can be used to create new assets or wrap existing assets on Ethereum, providing privacy for those assets. CAPE is particularly suitable for financial institutions or money service businesses that create blockchain-based assets, as they can balance customer privacy needs with their own risk management and compliance control needs.

$ESP Token Information

$ESP Key Metrics

Here is the information of $ESP

- Token Name: Espresso

- Ticker: $ESP

- Token Type: TBA

- Total Supply: TBA

- Contract address (CA): TBA

$ESP Use Case

Currently, Espresso has not announced any official use case of $ESP for the project. Whales Market will update immediately when the official Espresso website announces.

$ESP Listing

Here are important details revealed to $ESP:

- Listing time: TBA

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

Espresso Tokenomics & Fundraising

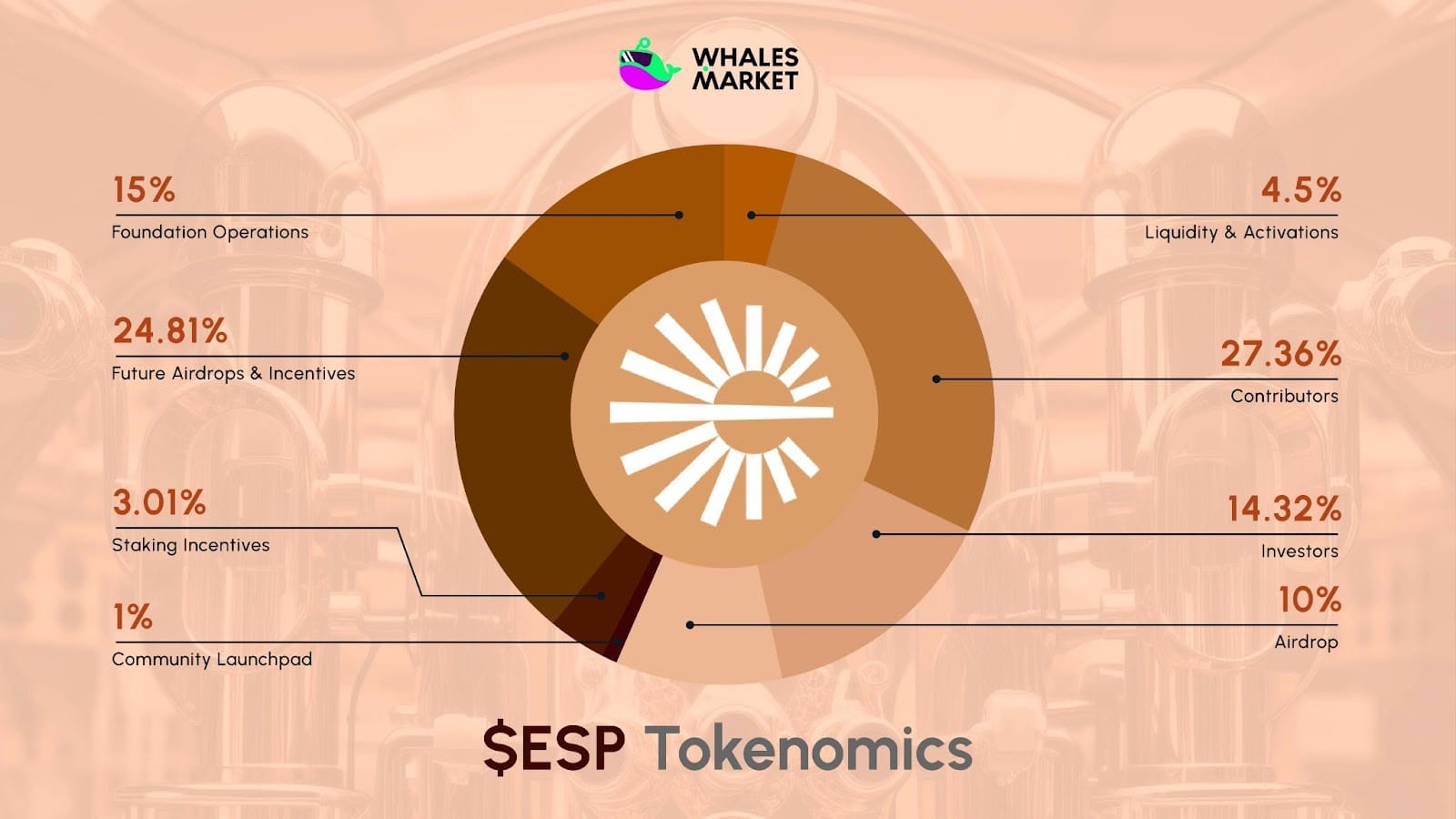

Tokenomics

Total Supply: 3.59B $ESP

Total Allocation:

- Liquidity & Activations: 4.5%

- Contributors: 27.36%

- Investors: 14.32%

- Airdrop: 10%

- Community Launchpad: 1%

- Staking Incentives: 3.01%

- Future Airdrops & Incentives: 24.81%

- Foundation Operations: 15%

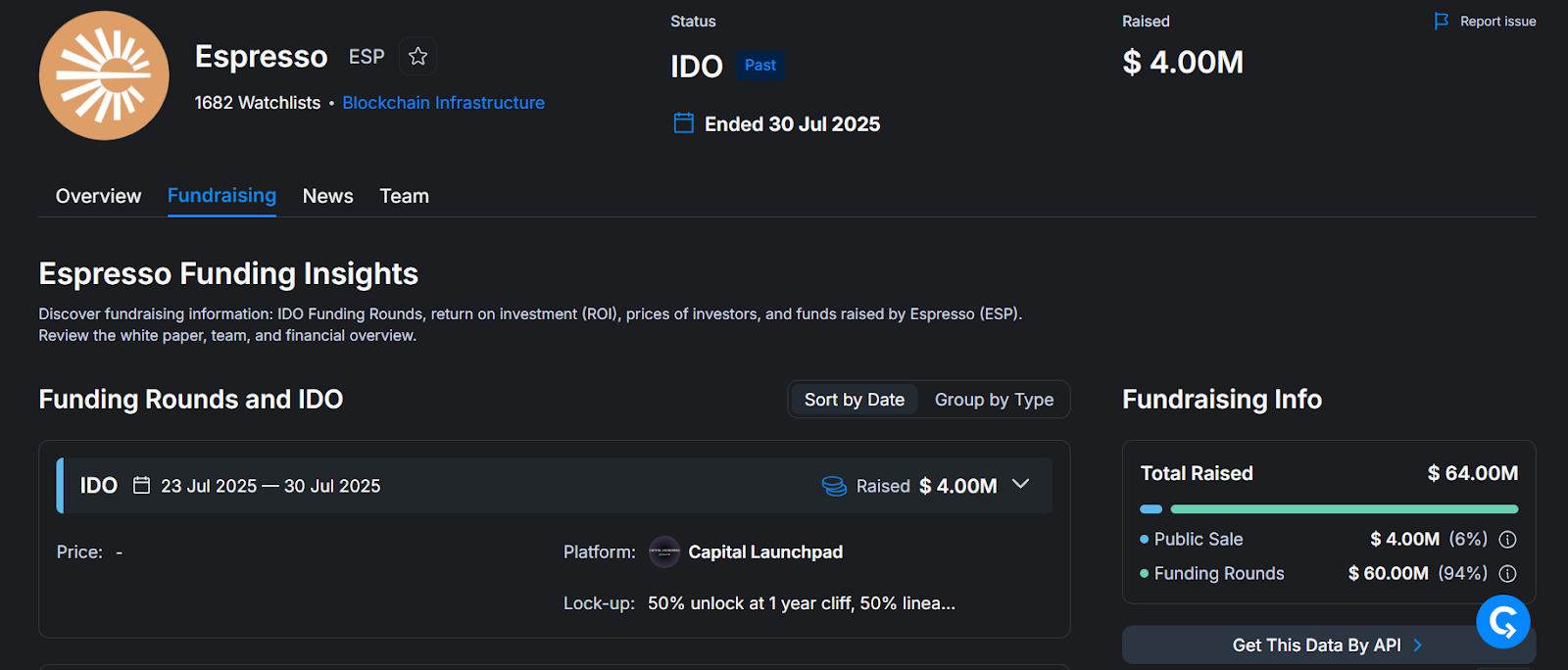

Fundraising

Espresso has raised successfully a total of $64M in the funding rounds, led by Sequoia Capital.

Espresso Roadmap & Team

Roadmap

Currently, Espresso has not announced any official roadmap for the project. Whales Market will update immediately when the official Espresso website announces.

Team

Here is Espresso team member:

- Ben Fisch: CEO

- Charles Lu: Co-founder

- Benedikt Bunz: Co-founder

Conclusion

Espresso is building foundational infrastructure that addresses one of the most overlooked bottlenecks in rollup design: centralized sequencing. Through its decentralized sequencer, ZK-powered architecture, and modular integration model, Espresso enables rollups to improve censorship resistance, reliability, and composability without redesigning their entire stack.

Beyond sequencing, innovations like Configurable Asset Privacy on Ethereum (CAPE) show Espresso’s ambition to push privacy and compliance-aware design at the infrastructure level. Combined with strong backing from leading investors and a growing ecosystem of rollup integrations, Espresso stands out as a long-term Layer 2 primitive rather than a short-term narrative play.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

1. What is the native token of Espresso?

The native token of Espresso is $ESP, used to facilitate coordination across the ecosystem.

2. What is the price of Espresso ($ESP) today?

While Espresso ($ESP) hasn't been listed yet, users can trade $ESP pre-market on Whales Market before the TGE. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain. Here you can trade $ESP before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

3. What is Espresso ($ESP) pre-market price?

Currently, $ESP is trading on Whales Market. Here you can trade $ESP before the asset gets listed on leading CEXes like Binance, Bybit or OKX.

4. How much has Espresso ($ESP) raised?

Espresso has raised successfully a total of $64M in the funding rounds, led by Sequoia Capital.

5. How can I trade $ESP before an official listing?

You can buy or sell pre-TGE $ESP on Whales Market by creating or filling orders with collateral-based settlement.