Dogecoin has evolved from an Internet joke into one of the most distinctive phenomena in the cryptocurrency market. Not only has DOGE survived while thousands of blockchain projects have emerged and disappeared, it has also contributed to the creation of an entirely new sector: memecoins.

By analyzing Dogecoin’s origins, technical architecture, community development, and its impact on the broader memecoin landscape, this article aims to explain how a project that began with virtually no utility was able to generate long-lasting and far-reaching influence within the crypto ecosystem.

What is Dogecoin (DOGE)?

Dogecoin is a decentralized cryptocurrency launched in December 2013. Created as a satirical response to the emerging crypto market, it is widely considered the first memecoin, originating from an internet meme and later gaining a large community and real-world use.

However, the sustained existence and development of DOGE over more than a decade has turned it into a notable subject of study, not only from a technical perspective but also through the lenses of economics, sociology, and media studies.

Although it originated as a lighthearted concept, Dogecoin gradually moved beyond its initial framework to become a digital asset with significant market capitalization, widely traded across global cryptocurrency markets.

This transformation makes DOGE a particularly interesting case, illustrating how financial value can emerge from Internet culture and collective psychology.

Origins & Development Philosophy of DOGE

In late 2013, as Bitcoin and early altcoins were attracting growing public attention, the cryptocurrency market began to reveal several concerning characteristics: high technical complexity, excessive speculation, and the over-glorification of blockchain technology.

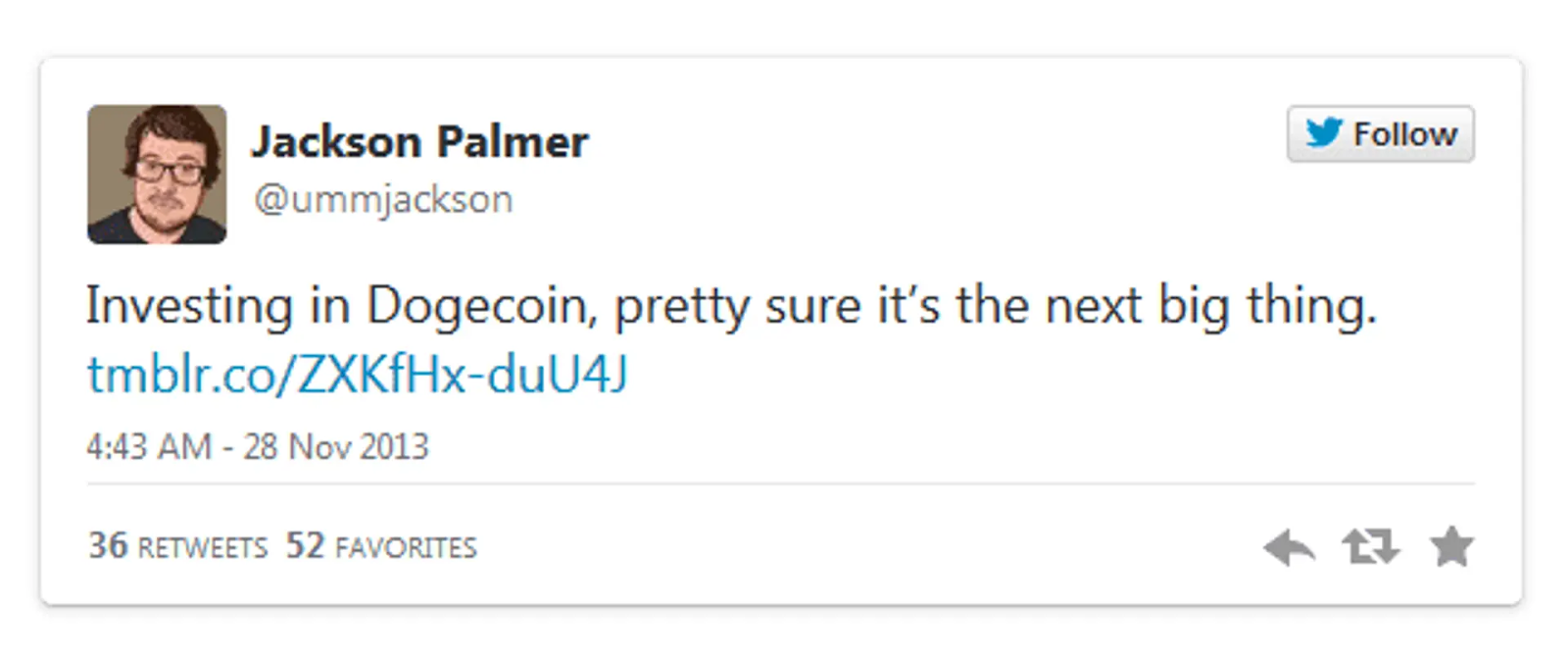

It was within this context that Billy Markus and Jackson Palmer launched Dogecoin in December 2013 as a symbolic form of critique. The decision to use the “Doge” meme featuring a Shiba Inu was not merely humorous; it served as an implicit commentary on how the market irrationally assigned value to digital assets.

At the time, Dogecoin traded around $0.0002-$0.0005, accurately reflecting its original identity as a joke.

However, an unexpected development soon followed. The meme-based imagery allowed Dogecoin to spread rapidly across Internet platforms, forming a tightly knit community driven not by investment goals but by shared culture and a playful spirit. Despite being created with virtually no utility, the Dogecoin community became remarkably enthusiastic and active.

During the first months of 2014, this community demonstrated its collective strength through several notable charitable initiatives. They donated more than $50K worth of Dogecoin to sponsor the Jamaican bobsled team’s participation in the Sochi Winter Olympics, fund clean water wells in Kenya, and support disaster relief efforts.

During this period, Dogecoin’s price also experienced modest fluctuations, reaching a peak of approximately $0.001-$0.002 by early-2014.

This phase represents the foundational period from 2013-2014. Dogecoin was not a major investment asset, but rather an Internet cultural phenomenon supported by a community united by humor and mutual goodwill, a notable paradox between its comedic origins and the genuine social value it produced.

Value of Dogecoin: Why DOGE became a Billion-Dollar Project

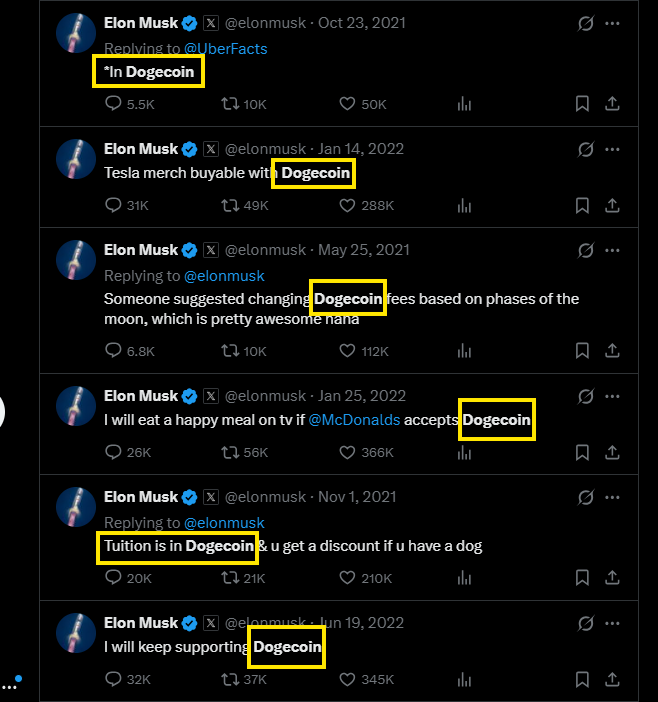

The most significant turning point in Dogecoin’s rise occurred in 2021, when Elon Musk, one of the world’s wealthiest and most influential figures, publicly expressed support for the coin on social media.

Short, symbolic messages quickly triggered waves of interest from both retail investors and individuals outside the crypto space, transforming Dogecoin from a fringe asset into a central market focus.

Dogecoin is the people’s crypto

— Elon Musk (@elonmusk) February 4, 2021

On Reddit, the r/dogecoin community grew from tens of thousands to millions of members. Enthusiasm surged as memes flooded the platform, slogans such as “To the Moon” and “Do Only Good Everyday” spread widely, and many new participants entered the market driven by FOMO.

The community began referring to Elon Musk as the “Dogefather”, viewing him as the figure who elevated Dogecoin from a playful meme to a serious asset. Numerous posts suggested that a single tweet from Elon could immediately trigger a price surge, while long-term holders felt validated.

Throughout 2021, Elon Musk repeatedly demonstrated his support for Dogecoin by commenting on numerous tweets related to the project on X.

As a result, DOGE’s price surged dramatically from $0.008 on January 28 to an all-time high of $0.73 on May 8, 2021.

From the perspective of media studies and behavioral economics, Dogecoin serves as a clear example of how the value of a financial asset can be amplified by accompanying narratives and symbols.

The Doge meme, with its simplicity and viral potential, allowed Dogecoin to transcend its identity as a technological product and become a mainstream cultural phenomenon.

Dogecoin’s popularity therefore emerged from the intersection of several factors:

- The influence of prominent individuals.

- Community-driven momentum.

- The viral nature of memes.

- And crowd psychology in digital financial environments.

From an innocuous joke, Dogecoin evolved into a symbol of how non-traditional elements can generate value, challenging classical assumptions about how financial assets should be formed and priced in the digital age.

Technical architecture of Dogecoin

From a technical standpoint, Dogecoin is built on the source code of Litecoin, thereby indirectly inheriting several architectural features from Bitcoin.

- Dogecoin uses the Proof of Work consensus mechanism with the Scrypt hashing algorithm.

- Unlike Bitcoin’s SHA-256, Scrypt was designed to require more memory during the mining process, which initially limited the advantage of specialized hardware such as ASICs.

The original goal of this design choice was to lower the barrier to entry for individual miners and help maintain a higher degree of decentralization across the network.

In addition, Dogecoin supports merge mining with Litecoin, meaning miners can simultaneously mine both networks without consuming significant additional computational resources.

This mechanism enhances Dogecoin’s security by leveraging Litecoin’s hash power while reducing the risk of a 51% attack on a relatively smaller blockchain.

Learn more: 51% Attack Is The Biggest Danger To Crypto

How to mine Dogecoin (DOGE)

To begin mining Dogecoin, miners must understand both the theoretical requirements and the practical constraints of current mining conditions.

Due to increased network difficulty and industrial-scale competition, mining DOGE today requires careful planning and significant capital investment.

Technical Requirements

Under current network conditions, mining Dogecoin with standard CPUs or GPUs is no longer economically viable. Miners are required to use Scrypt-compatible ASIC hardware, which has become the industry standard.

Mining hardware can generally be categorized into three groups:

- Industrial-scale ASIC miners: High-performance machines such as the Antminer L9 or Alphax DG2 Plus offer hash rates above 17–20 GH/s. These devices provide strong mining performance but generate substantial noise (around 75 dB), high heat output, and require specialized electrical and cooling infrastructure.

- Home-friendly ASIC miners: Devices such as the Alphax DG Home 1 or Flower Miner L1 are designed for residential use, featuring lower noise levels (approximately 45-50 dB) and reduced power consumption. While less powerful, they are more suitable for small-scale or hobbyist miners.

- Lottery miners: Compact and low-cost devices consume minimal electricity but offer extremely low probabilities of successfully mining a block. These devices are generally unsuitable for consistent income generation.

In addition to hardware, miners require mining software to manage hashing operations and connect to mining pools, as well as a secure Dogecoin wallet to receive and store rewards.

Mining Methods

There are two primary mining approaches used in practice:

- Merged mining: Dogecoin supports merged mining with Litecoin, allowing miners to mine DOGE and LTC simultaneously using the same computational power and energy input. This feature significantly improves mining efficiency and is one of Dogecoin’s key structural advantages.

- Mining pools: Solo mining is technically possible but rarely profitable due to low success probabilities. As a result, most miners join mining pools, where computational resources are combined and rewards are distributed proportionally. Mining pools typically charge fees of approximately 1%.

Practical Steps to Get Started

To begin mining Dogecoin in practice, miners typically follow these steps:

- Select an ASIC miner suitable for available power supply, noise tolerance, and budget

- Set up a secure wallet, preferably a hardware wallet, to store mined DOGE

- Configure mining software and connect the hardware to a reputable mining pool

- Monitor performance and profitability using online calculators and analytics tools

For individuals unable to manage noise, heat, or infrastructure requirements at home, hosting services provide an alternative solution. In this model, miners purchase ASIC hardware and place it in professional data centers, where electricity, cooling, and maintenance are handled externally for a recurring fee.

Although Dogecoin was originally designed to be accessible and easy to mine, increasing industrial participation has reduced profitability for individual miners. Consequently, Dogecoin mining should be approached as a capital-intensive, long-term investment strategy, often combined with a mine-and-hold (HODL) approach rather than short-term profit extraction.

Tokenomics of DOGE

DOGE does not have a max supply, meaning there is no hard cap on total issuance like Bitcoin’s 21 million limit.

- It follows an inflationary model. Each block has a fixed reward of 10,000 DOGE and there is no halving mechanism like Bitcoin.

- Around 5B DOGE are added to circulation every year, which means the inflation rate decreases over time as total supply grows. Currently, the inflation rate is approximately 3-4% per year and will continue to decline as supply increases.

As of early 2026, the circulating supply is roughly 168B DOGE depending on the data source, and it continues to rise.

Because the system is inflationary, miners retain long-term incentives, unlike Bitcoin, where block rewards will end around 2140 and miners will rely solely on transaction fees.

In the past, Elon Musk has responded to community criticism regarding Dogecoin’s inflation.

“This is a feature of Dogecoin, not a bug that needs to be fixed.”

Elon Musk argued that Dogecoin’s fixed inflation mechanism, meaning a fixed amount of Dogecoin issued each year, actually causes the inflation rate to decline over time as the total supply increases.

DOGE’s Influence on the Entire Memecoin Sector

The Inherited Memecoin Wave

Dogecoin’s relative success paved the way for an explosion of subsequent memecoin projects. Although these projects vary in seriousness and objectives, most have been directly or indirectly influenced by Dogecoin in their market approach and narrative construction.

In particular, memecoins centered on animals or Internet memes show clear similarities in imagery and viral strategy.

- Shiba Inu, launched in 2020, branded itself as a “Dogecoin killer” and developed its own ecosystem with Shibarium.

- Floki Inu, Baby Doge Coin, and many others carry direct or indirect imprints of Dogecoin’s formula.

- Pepe, launched in 2023, represents a newer generation of memecoins not limited to dog imagery.

- On Solana, Bonk and Dogwifhat gained significant traction during 2023 and 2024.

Dogecoin’s long-term presence established memecoins as a distinct segment within the crypto ecosystem. From a research perspective, DOGE functions as a prototype, enabling observation of how financial assets can form and sustain value through non-technical factors.

Shaping the Meme and Community Model

The core influence of Dogecoin on the memecoin sector lies in its meme-and-community model. Dogecoin demonstrated that strong community cohesion, viral symbolism, and humor can act as primary drivers of market interest and liquidity.

This model has since been adopted and adapted by many other memecoins, despite differences in blockchain infrastructure, branding narratives, and target audiences.

In this context, Dogecoin is not merely a standalone currency but a behavioral template in which value is maintained through continuous community engagement rather than long-term technological roadmaps.

Example: Milady Maker is an NFT collection on Ethereum notable for its “terminally online” ethos. In essence, Milady is a cultural NFT whose value lies in its role as a social identity marker within the Ethereum ecosystem, reflecting Internet culture shaped by irony and post-irony rather than utility or financialization.

Dogecoin also highlights the role of social media and influential individuals in shaping memecoin market behavior. DOGE’s price has repeatedly reacted strongly to media signals, particularly statements from Elon Musk, demonstrating the close relationship between public narratives and price volatility.

This phenomenon is not limited to Dogecoin but extends across the memecoin sector, where value is frequently amplified or diminished by information flows on social media platforms. This raises important questions about sustainability and pricing mechanisms in markets heavily influenced by media dynamics.

Example: Floki Inu, named after Elon Musk’s dog, illustrates how associating a memecoin with a personal symbol can generate significant price increases during periods of market enthusiasm, even without direct technical or organizational links to Musk.

My Shiba Inu will be named Floki

— Elon Musk (@elonmusk) June 25, 2021

Doge Price Prediction: Future of dogecoin

Predicting Dogecoin’s future price is inherently uncertain, as its value is shaped not only by market fundamentals but also by social sentiment and cultural relevance.

Unlike many cryptocurrencies driven by technological utility, Dogecoin’s price is often influenced by external and behavioral factors.

Key factors influencing Dogecoin’s price include:

- Market sentiment and social media trends, especially attention from influential public figures.

- Overall cryptocurrency market conditions, including Bitcoin and Ethereum price cycles.

- Community engagement and real-world use, such as payments or tipping.

- Speculative demand during meme-driven market phases.

Notably, Elon Musk has played a unique role in shaping Dogecoin’s price dynamics. As a billionaire tech entrepreneur with massive social influence, Musk’s public comments and online activity have repeatedly triggered sharp price movements in DOGE, highlighting how sentiment and celebrity influence can outweigh traditional fundamentals.

In an unusual example of Dogecoin’s cultural reach, even the U.S. government has referenced the “DOGE” concept, such as the use of the name Department of Government Efficiency (DOGE) in public policy discussions. While unrelated to the cryptocurrency itself, this reflects how deeply the DOGE meme has penetrated mainstream and institutional discourse, indirectly reinforcing Dogecoin’s visibility and speculative appeal.

Overall, Dogecoin’s future price is likely to remain highly volatile, shaped more by collective belief and cultural momentum than by traditional valuation models.

Conclusion

Dogecoin represents a unique case in cryptocurrency history, where a project initially created as satire evolved into a digital asset with tangible economic value and cultural influence.

From a research perspective, DOGE stands as a representative case study demonstrating that value in the crypto market can be shaped by culture and collective belief, not solely by technical factors.

FAQs

Q1. Is Dogecoin different from other cryptocurrencies?

Yes. Dogecoin differs mainly in purpose and perception. It was not created to solve technical limitations of blockchain but to function as a simple, community-driven digital currency shaped by Internet culture.

Q2. How can I buy Dogecoin (DOGE)?

Dogecoin can be purchased on most major cryptocurrency exchanges. Users typically create an account, complete identity verification, deposit fiat currency or crypto, and then trade for DOGE. After purchase, DOGE can be stored on the exchange or transferred to a personal wallet.

Q3. Does Dogecoin have a maximum supply?

No. Dogecoin does not have a fixed supply cap. New DOGE are continuously issued each year, which contrasts with capped-supply assets like Bitcoin.

Q4. Why is Dogecoin often associated with memes and humor?

Dogecoin was built around the Doge meme and intentionally embraced humor and irony. This identity became central to its community and long-term cultural relevance.

Q5. What role does Dogecoin play in the memecoin ecosystem?

Dogecoin serves as the original reference point for memecoins, establishing the model where cultural relevance and community momentum drive value.

Q6. Who owns Dogecoin?

No single individual or organization owns Dogecoin. It is a decentralized cryptocurrency maintained by an open-source community of developers, miners, and users, with ownership distributed among holders across the network.

Q7. Is Dogecoin a good investment?

Dogecoin is often viewed as a high-risk, speculative asset rather than a traditional long-term investment. Its value is heavily influenced by market sentiment, social media trends, and public figures, which can lead to significant price volatility.

While Dogecoin has a strong community and widespread recognition, it lacks a fixed supply cap and advanced technical features found in some other cryptocurrencies. As a result, potential investors should carefully consider their risk tolerance and conduct thorough research before investing.