Imagine clicking a few buttons, completing a few simple tasks, and suddenly earning hundred or even thousands of dollars. Sounds unreal, right? But it’s not fiction.

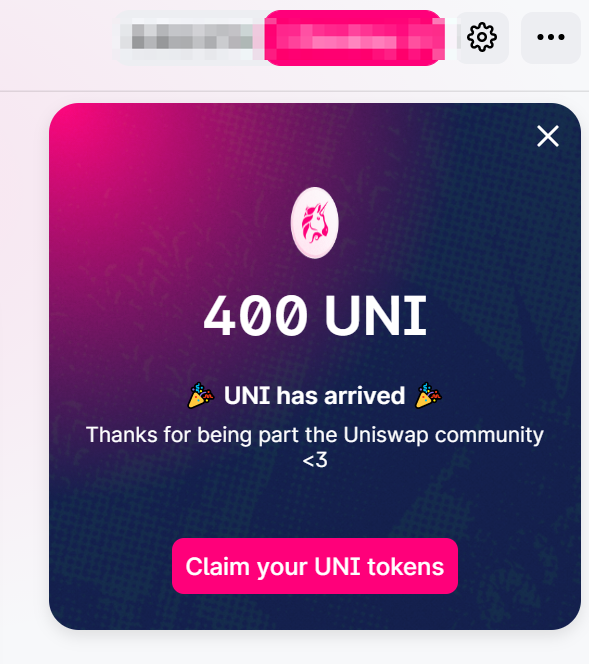

Many people have made life-changing money through crypto airdrops. For example, Uniswap gave 400 UNI per wallet while Hyperliquid averaged about 2,900 HYPE per user, worth thousands of dollars at the moment.

What is Crypto Airdrop?

A crypto airdrop is when blockchain projects distribute free tokens to users as a marketing strategy to promote their platform and grow their community. Instead of spending millions on traditional advertising, these projects “drop money from the sky” directly to users, creating massive buzz and attracting millions of new participants.

A prime example came in November 2024, when Hyperliquid shocked the crypto world with a total of $1.34B crypto airdrop of 31M HYPE tokens. Early users who simply tested or traded on the platform’s testnet walked away with hundreds of thousands of dollars in rewards, making it one of the biggest Crypto Airdrops in crypto history.

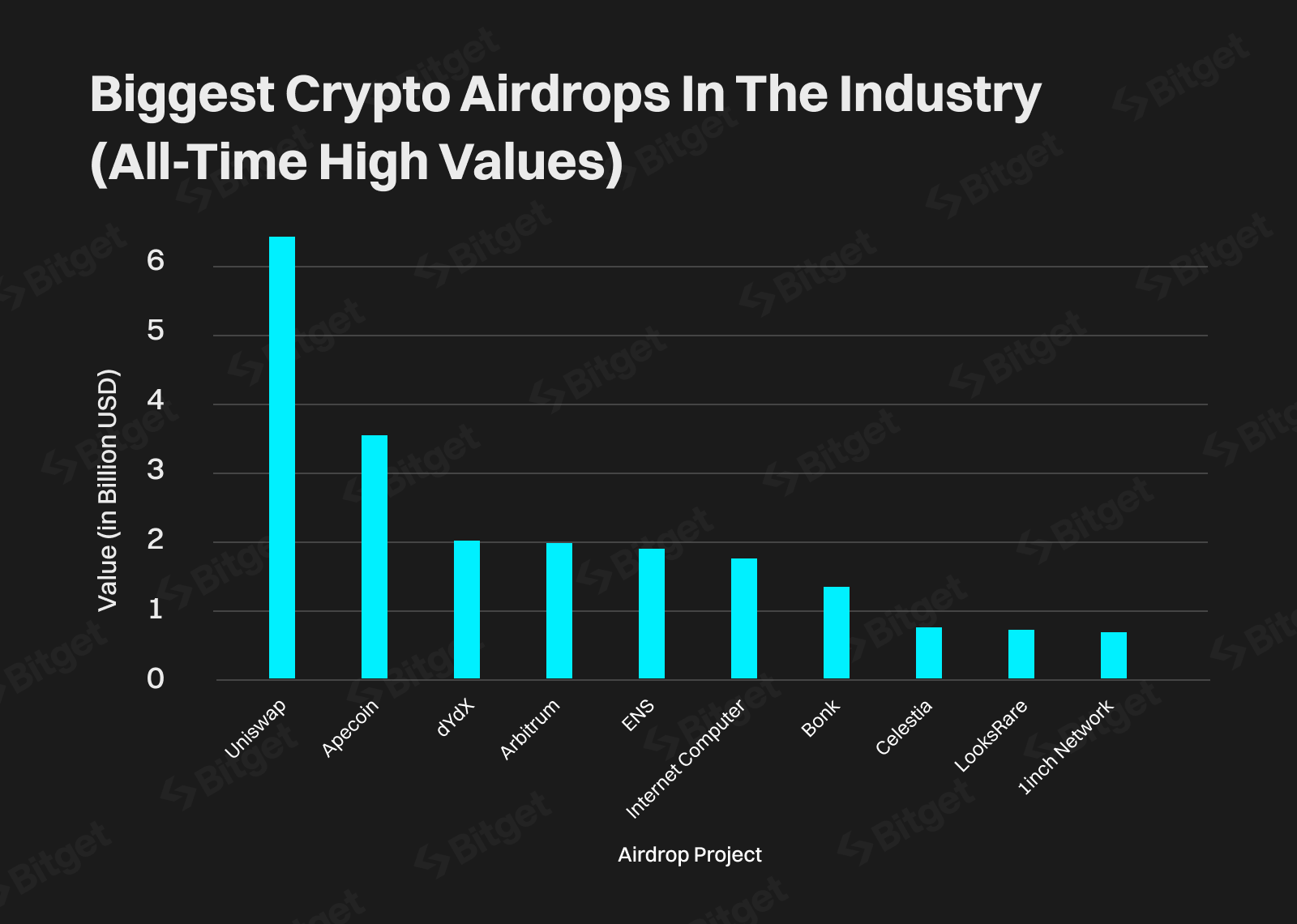

Some of the biggest crypto airdrops:

- Uniswap (UNI): Dropped $6.43B in tokens during DeFi Summer 2020. Early platform users got rewarded, sparking huge interest in DeFi apps and basically reviving the whole airdrop trend.

- Apecoin (APE): Handed out $3.54B in March 2022 to Bored Ape NFT holders. Some lucky folks claimed tokens worth over $250K - pretty wild rewards for jpeg owners.

- dYdX (DYDX): Distributed $2B worth in September 2021, but there's a catch - tokens unlock slowly over 5 years. Platform focused on margin trading features for DeFi enthusiasts.

- Arbitrum (ARB): Released $1.97B in governance tokens March 2023. The Layer-2 network saw activity explode 147%, becoming Ethereum's biggest scaling solution practically overnight.

- Bonk (BONK): Solana's meme coin dropped $1.33B in late 2022. Spread tokens across NFT holders (21%), DeFi users (15%), and developers (5.3%), making Solana blockchain buzz with activity.

- Celestia (TIA): Genesis Drop worth $0.73B gave 60M tokens to early supporters. GitHub contributors, Ethereum rollup users, and Cosmos stakers each got 20M tokens - no farming games needed.

Common Types of Crypto Airdrops

Testnet Crypto Airdrop

This is where most airdrop hunters spend their time grinding. Projects open their test networks for users to try out features before the official launch, using testnet* tokens that have no real value. Once the mainnet goes live, these early testers often receive official tokens as rewards for their participation and feedback.

*Testnet is a testing environment where developers deploy their blockchain projects before the official launch, allowing users to experiment with features using testnet tokens that have no monetary value.

Why hunters love this method: Users don't need any capital to participate, just time and effort. It's perfect for beginners who want to learn about new protocols without financial risk. Early testers often receive the most generous rewards since they helped shape the product.

Common activities users perform:

- Bridge testnet tokens between different networks

- Swap tokens on decentralized exchanges (DEXs)

- Provide liquidity to trading pools

- Mint NFTs or deploy smart contracts

- Complete specific quests or missions set by the project

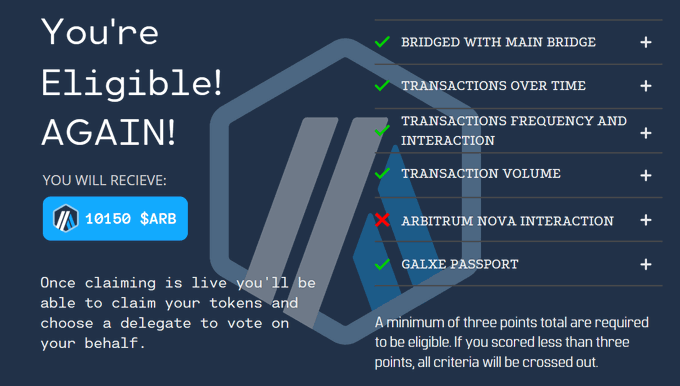

Example: Arbitrum required users to bridge funds to their testnet, make swaps on DEXs, and interact with different protocols. Active testers received between 625 to 10,250 ARB tokens (worth $800-$13,000 at peak) when the mainnet launched.

Mainnet Crypto Airdrop (Retroactive)

In this type of airdrop, users interact with projects already running on the live blockchain using real funds. The project takes snapshots of user activity at specific points and later distributes tokens to active participants based on their usage history.

The rewards come as tradeable tokens immediately upon distribution. While the financial risk is higher, successful retroactive airdrops often deliver substantial returns.

Common activities users perform:

- Trading tokens on the platform.

- Providing liquidity to pools.

- Borrowing or lending assets.

- Staking tokens for rewards.

- Referring new users to the platform.

Example: Uniswap surprised users in September 2020 by airdropping 400 UNI tokens (worth $3,200 at launch) to anyone who had used their DEX before the snapshot date, even if they only made a single swap.

Discord Role

Projects build communities on Discord and reward active members with airdrops based on their participation level and roles earned through engagement. They use Discord roles to identify their most loyal supporters. The more users contribute to the community, the higher their role level becomes, leading to better airdrop allocations.

Common activities users perform:

- Daily check-ins and message posting

- Participating in community discussions

- Completing weekly challenges or trivia

- Helping new members and answering questions

- Creating memes or fan art for contests

- Attending voice chat AMAs (Ask Me Anything sessions)

Example: Overworld distributed OVER tokens to Discord members based on their roles. Members with "OG" roles received 1,000 tokens, while those with "Active" roles got 500 tokens. Users earned these roles by chatting daily, joining game nights, and participating in community events over several months.

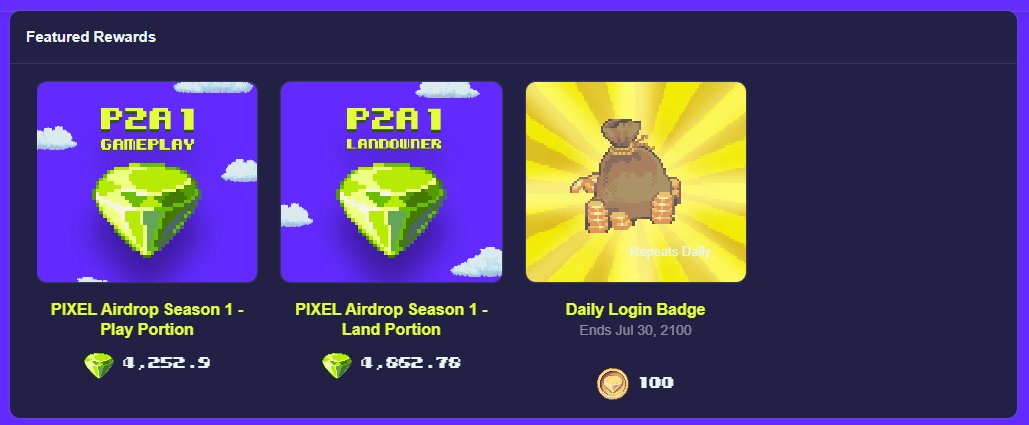

GameFi Crypto Airdrop

Web3 games distribute tokens or NFTs to players who actively participate in gameplay, helping attract new players while rewarding dedicated community members. These airdrops turn gaming time into potential profit. Players enjoy the game while positioning themselves for future token distributions based on their achievements and dedication.

Common activities users perform:

- Completing daily quests and missions

- Reaching specific player levels or ranks

- Participating in tournaments or PvP battles

- Collecting in-game items or resources

- Breeding or upgrading game characters

- Referring friends to join the game

Example: Pixels rewarded early players with PIXEL tokens based on their in-game achievements. Players who reached level 20, owned land plots, and completed special events received between 500-3,000 PIXEL tokens (worth $250-$1,500 at TGE).

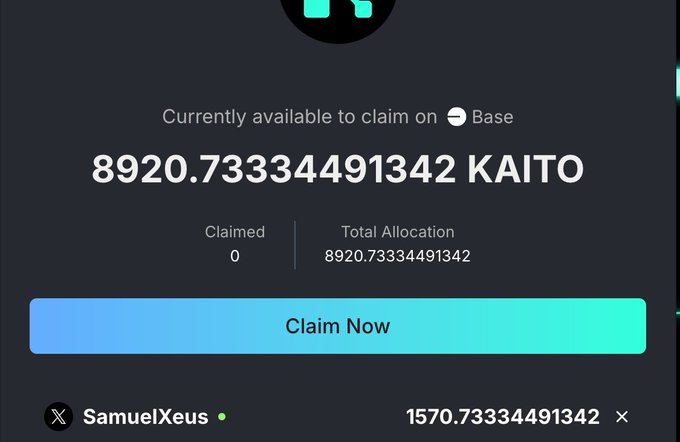

Content-to-Crypto Airdrop

The newest trend in 2025 rewards creators for producing crypto-related content, from market analysis to educational videos and project reviews. Quality content creators receive larger allocations than those who simply spam posts.

Successful participants focus on creating valuable content rather than spamming low-quality posts. They engage authentically with project teams, use relevant hashtags strategically, and build genuine followings that boost their influence scores.

Common activities users perform:

- Writing detailed project analysis threads

- Creating educational videos about DeFi concepts

- Producing infographics explaining tokenomics

- Recording podcast episodes featuring project teams

- Publishing research reports on emerging trends

- Building tools or dashboards for the community

Example: Kaito airdropped 100M KAITO (10% supply) based on Yaps Points (smart followers + verified engagement + content quality). Top yappers got up to 160K tokens (~$300K), regular users 500-5,000 KAITO

Notable platforms using this model: Kaito, Cookie3, Wall Chain, and several emerging Web3 social platforms actively reward content creators.

Airdrop Kaito - Source: @SamuelXues

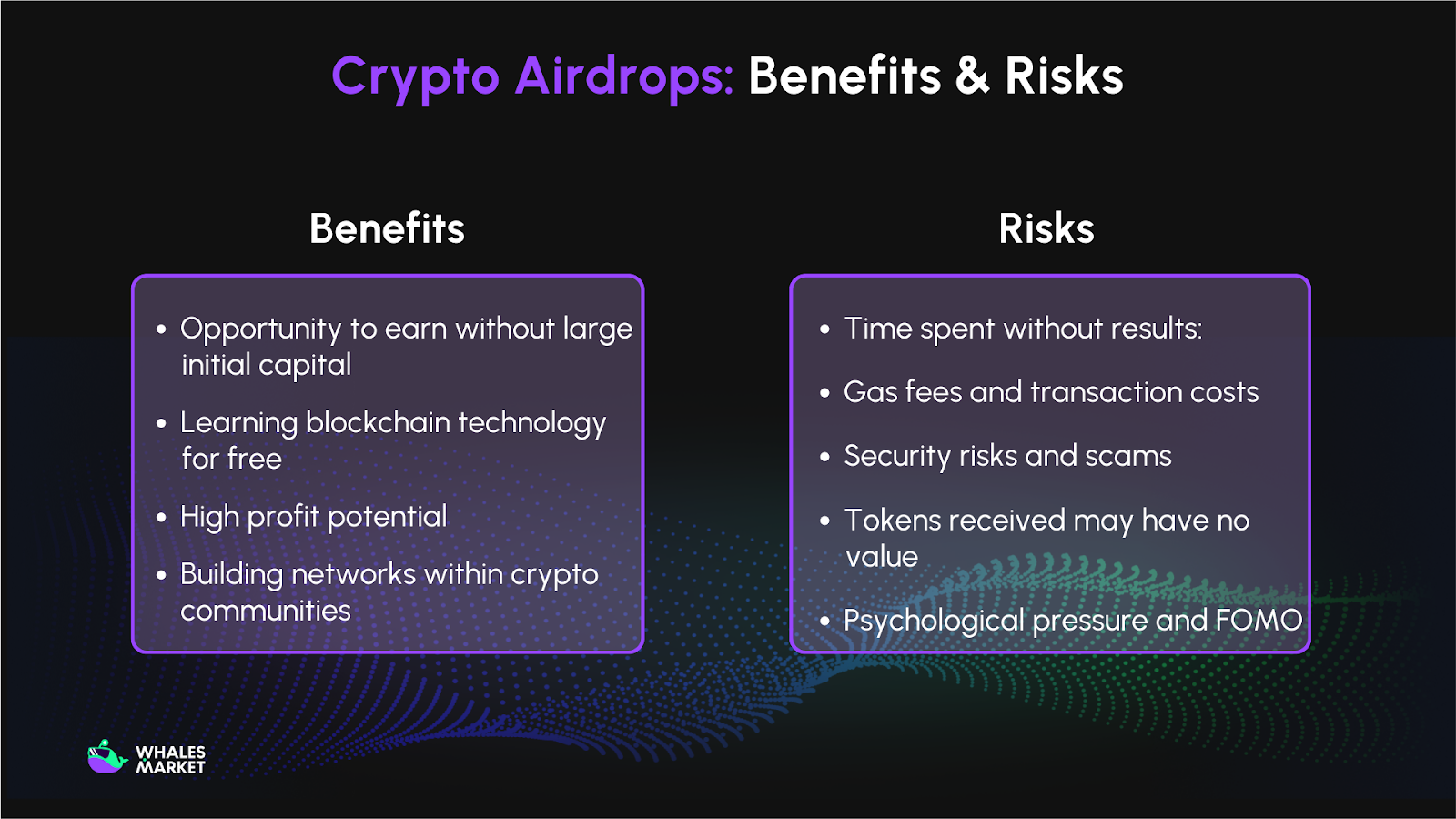

Benefits and Risks of Participating in Crypto Airdrops

Benefits

- Opportunity to earn without large initial capital: Many airdrops, especially testnets, don't require investment capital. Users only need time and effort to interact with projects. This makes it an ideal way for beginners to enter the crypto market without financial risk concerns.

- Learning blockchain technology for free: Through using new protocols, users get hands-on experience and deeper understanding of DeFi, NFTs, Layer 2s, and cutting-edge blockchain tech. This knowledge has longer-term value than the financial rewards themselves.

- High profit potential: Major airdrops like Uniswap, Arbitrum, or Optimism have delivered thousands to tens of thousands of dollars to early participants. Patient users with solid strategies often get rewarded handsomely for their efforts.

- Building networks within crypto communities: Participating in airdrops helps connect with communities, learn from experienced members, and stay updated on potential projects. These relationship networks can open up many other opportunities down the road.

Risks

- Time spent without results: Not every project does airdrops, and not everyone who participates qualifies to receive them. Users might spend months farming testnets only to receive nothing or very little in the end.

- Gas fees and transaction costs: Mainnet airdrops require real money for gas fees, which can be especially expensive on Ethereum. If users don't receive the airdrop or tokens have no value, this investment becomes a loss.

- Security risks and scams: The market is flooded with scam projects pretending to do airdrops to steal funds or personal information. Users can lose all assets if they connect wallets to fake websites or sign malicious transactions.

- Tokens received may have no value: Many airdrop tokens never get listed on major exchanges, have low liquidity, or crash in value right after distribution. Having tokens in the wallet doesn't mean having real money.

- Psychological pressure and FOMO: Constantly monitoring and participating in multiple projects can cause stress, sleep loss, and impact regular work. FOMO (fear of missing out) drives many people to over-invest in uncertain projects.

Essential Tips for Safe and Effective Airdrop Participation

- Use a dedicated airdrop wallet: Create a separate wallet exclusively for farming activities, keeping it isolated from main holdings. This strategy limits potential losses if the wallet gets compromised by malicious contracts or scams.

- Never share seed phrases or private keys: Legitimate projects NEVER request these - it's always a scam. Only provide public wallet addresses when needed, and carefully verify all transaction details before signing to avoid approving malicious contracts.

- Verify official sources religiously: Access projects only through links posted on verified Twitter/X accounts or official Discord channels. Bookmark authentic sites immediately, as scammers create near-identical domains to steal funds from unsuspecting users.

- Diversify across multiple projects: Since airdrop success rates hover around 10-20%, spread efforts across various protocols rather than going all-in on one. Focus on VC-backed projects (Paradigm, a16z) which typically offer better reward potential.

- Maintain realistic financial expectations: Treat airdrops as supplementary income only, never risking money needed for essentials. Remember that many tokens have lengthy vesting periods, and tax obligations apply in most jurisdictions - keep detailed records for compliance.

Conclusion

The era of “free money” in crypto isn’t over, it’s just evolved. Crypto Airdrops today are smarter and more selective. Instead of simply clicking a few buttons, users now need to be early adopters who truly understand the projects they support. Patience, consistency, and genuine participation remain the keys to catching the next big drop.

FAQs

Q1: How can users know which projects will have upcoming Crypto Airdrops?

Follow official X (Twitter) and Discord channels where projects typically announce airdrops first, along with snapshot dates and eligibility criteria. Additionally, track reputable crypto KOLs, monitor airdrop aggregator sites like Airdrops.io, and pay attention to projects that recently raised funding from major VCs like Paradigm or a16z.

Q2: Is KYC required to receive a Crypto Airdrop?

It depends on the project and regulatory requirements. Most testnet and retroactive airdrops don't require KYC to maintain user privacy, but larger projects or those targeting institutional users often implement KYC to prevent bot farming and ensure compliance with local regulations.

Q3: Are Crypto Airdrops always completely free?

Airdrops aren't entirely free despite not directly purchasing tokens. Mainnet airdrops require gas fees for transactions which can be expensive on Ethereum, plus users invest significant time completing tasks, maintaining minimum balances, or providing liquidity to qualify for rewards.

Q4: How can users check if their wallet is eligible for a Crypto Airdrop?

Always use the official checker link announced on the project's verified X account and Discord channels. Never trust checker tools sent via DMs or shared on unofficial channels as these are often phishing attempts designed to steal wallet funds or private keys.

Q5: Can users get scammed when joining Crypto Airdrops?

Yes, scams targeting airdrop hunters are extremely common through fake websites and phishing links. Only interact through official project channels, never share seed phrases under any circumstances, and carefully review all transaction details before signing to avoid losing funds.

Q6: Which wallet should be used to safely farm Crypto Airdrops?

Create a dedicated secondary wallet specifically for airdrop farming, completely separate from main asset holdings. Keep only minimal funds needed for gas fees and required interactions, ensuring that if the wallet gets compromised by malicious contracts, losses remain limited.