In the crypto space, understanding market sentiment is just as important as analyzing charts and indicators. One of the most commonly used terms to describe positive market conditions is “bullish”, a concept that reflects not only rising prices but also investor confidence and expectations. Understanding the concept of "bullish" helps investors easily identify trends. So what is bullish? Let’s dive into this article.

What is Bullish?

Bullish is a term used to describe a rising market where the value of assets (stock, cryptocurrency…) tends to increase over an extended period. Bullish represents market sentiment, price trends, and investor expectations.

The term "bullish" originates from the behavior of bulls when attacking by butting upwards. This is why "bullish" is used to describe an upward price movement, in contrast to "bearish," when prices fall, similar to a bear's attack by pouncing downwards.

What factors drive a bullish market?

When discussing a bullish market in the crypto sector, it's important to understand that not only are internal factors within the crypto market important, but factors from traditional financial markets also play a significant role in driving this upward trend.

Influence from traditional financial markets

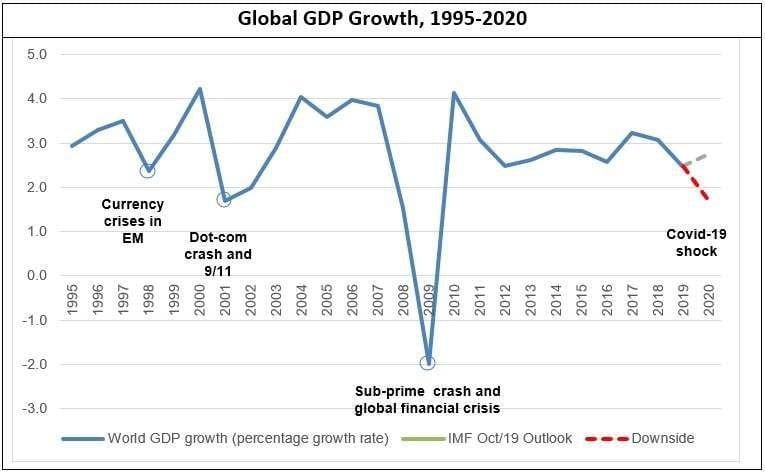

With the global economy experiencing strong growth, evidenced by indicators such as high GDP growth and low unemployment rates, people tend to spend and invest more. This creates a favorable environment for risky investments, including cryptocurrencies.

Between 2010 and 2015, the global economy recovered from the 2008 financial crisis. During this period, global GDP grew at an average rate of approximately. This recovery boosted investor confidence, and many began seeking new investment opportunities, including Bitcoin, contributing to a surge in Bitcoin's price from a few dollars to over $400 by the end of 2015.

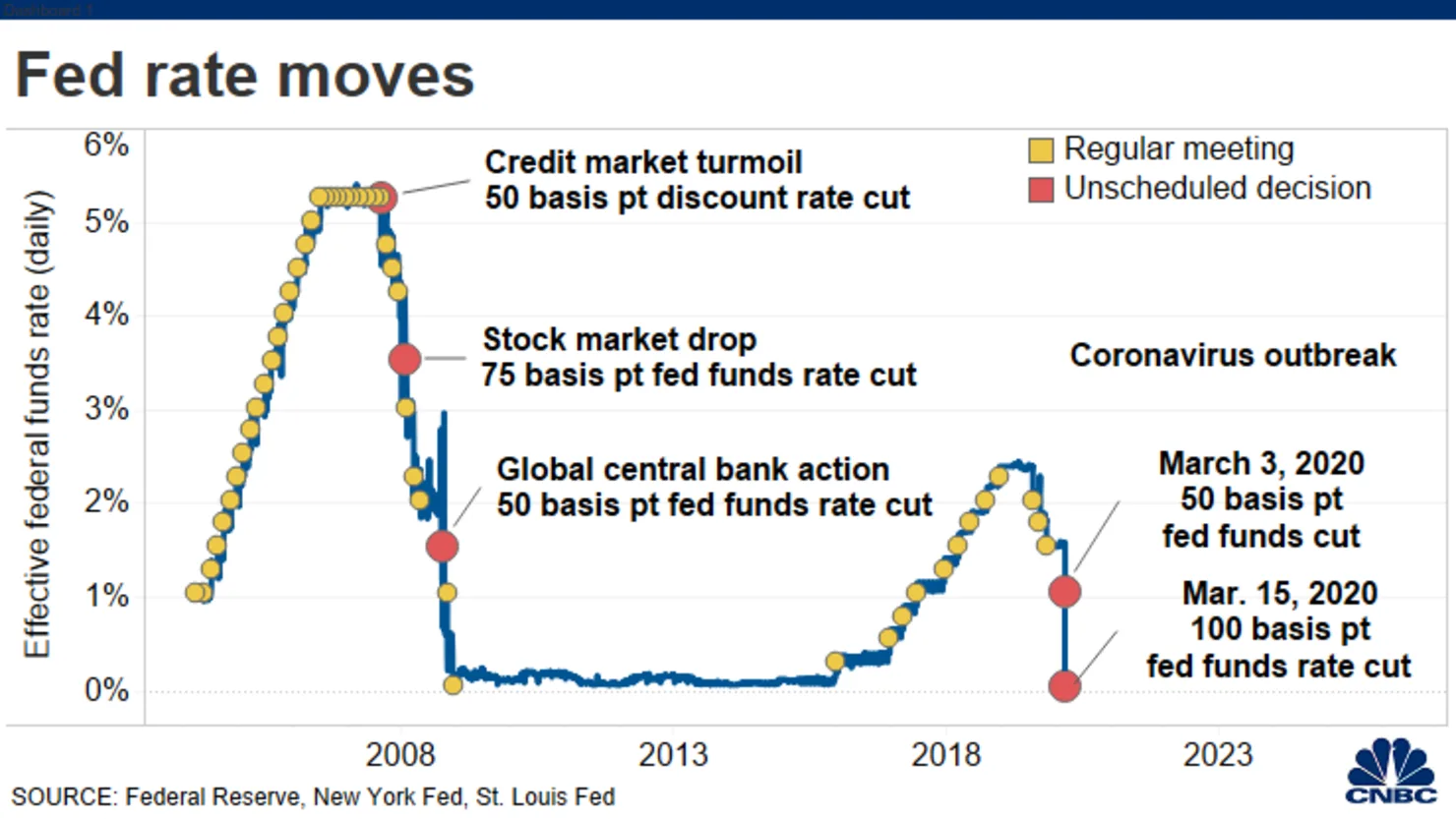

Loose Monetary Policy and Low Interest Rates

Central banks often employ loose monetary policies, such as lowering interest rates, to stimulate the economy. When interest rates are low, borrowing becomes easier, and investors tend to seek higher-yielding opportunities, often leading to investments in cryptocurrencies.

In 2020, when the COVID-19 pandemic broke out, the US Federal Reserve (FED) lowered interest rates to near 0% and implemented large economic stimulus packages. As a result, many investors shifted money into assets like Bitcoin, causing the price of Bitcoin to rise from around $9,000 at the beginning of 2020 to over $29,000 by the end of the year, a growth of nearly 220% in just one year.

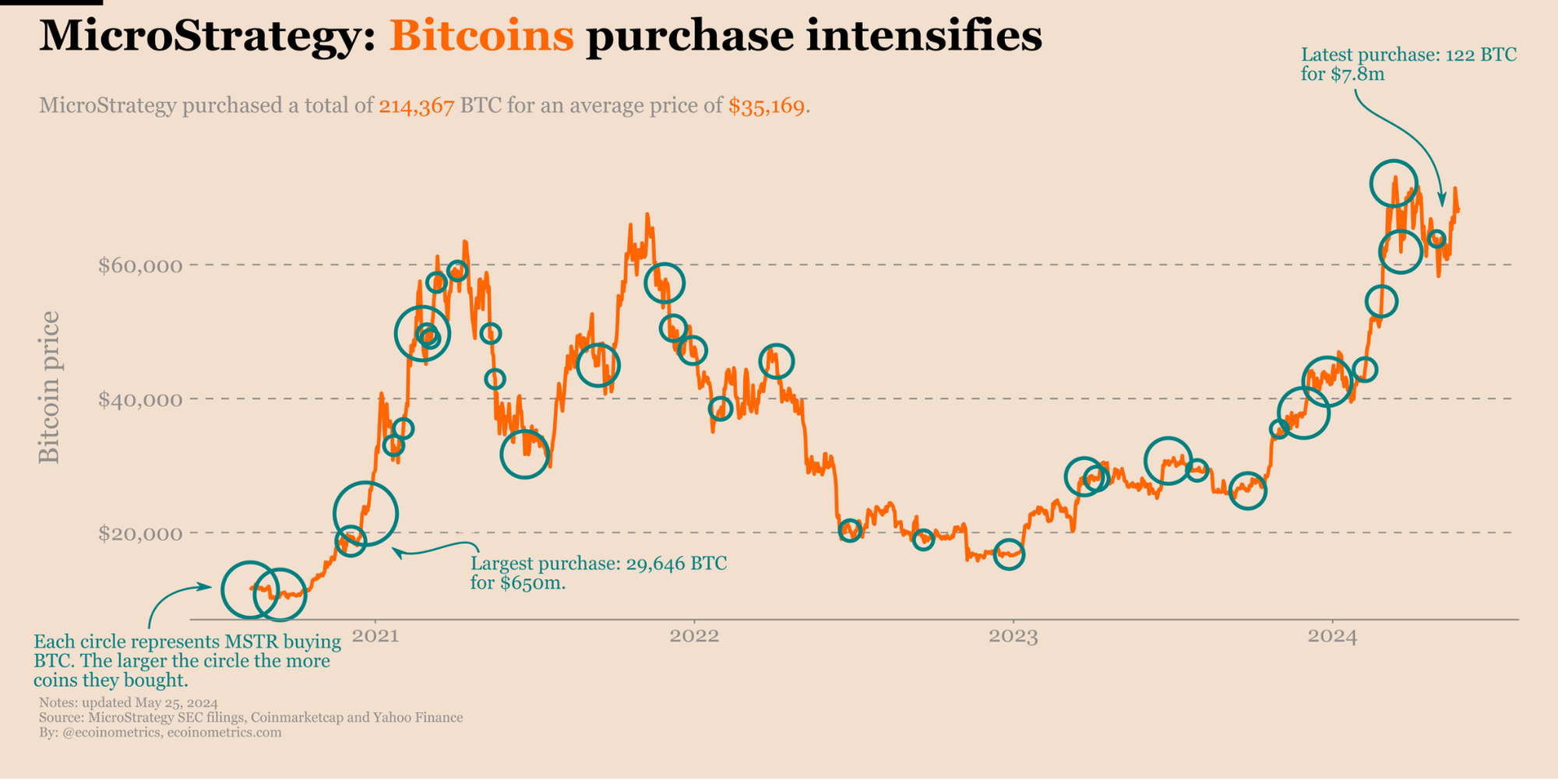

Institutional Involvement

The involvement of large financial institutions in the crypto market is one of the most important factors driving price increases. When these institutions invest in cryptocurrencies, it not only brings a large amount of capital into the market but also builds confidence among individual investors.

In August 2020, MicroStrategy announced that it had purchased 21,454 Bitcoin worth approximately $250 million. They subsequently continued to buy more, bringing their total Bitcoin holdings to over 70,000 BTC, worth over $650 million.

These moves boosted confidence in Bitcoin, causing its price to rise from around $11,000 in August 2020 to over $40,000 in January 2021.

Technological Innovation

The crypto market is constantly innovating with new technologies and products, attracting investor interest. Improvements in blockchain, smart contracts, and decentralized applications all contribute to boosting the value of cryptocurrencies.

Ethereum 2.0, launched in late 2020, brought significant improvements in scalability and security to the Ethereum network. This increased investor interest, pushing the price of Ethereum from around $600 to over $4,000 in May 2021, marking a strong bullish cycle for Ethereum.

The Stages of a Bullish Market

There's a rule investors need to remember: Every trend goes through three stages: beginning, boom, and bust. Bullish markets are no exception.

- The beginning stage: Typically, a bullish market begins at the end of a bearish phase. Price fluctuations start to appear. There will be short periods of slight increases. However, because it's still influenced by the bearish phase, the price won't rise too high. This is the time to accumulate potential for the next stage.

- The bustling stage: Once sufficient potential has been accumulated and buying pressure is strong enough to balance supply and demand, the price will experience significant growth. In this stage, the increase will be greater and the duration of the increase will be longer. However, it's important to note that the price increase needs to be maintained at a moderate level if you want to prolong the boom phase. If the numbers are pushed up too sharply, the bullish phase will last for a very short time.

- The recession phase: This is when the rate of price increase begins to slow down and gradually decline. When selling pressure increases sharply, the price will be pulled down. The market will reverse to a new trend at this point. A bullish phase will officially end at the end of its recession period.

Trading strategies in a bullish market

For Safe Risk Trading Strategies in the Crypto Market

When participating in financial markets, whether stocks or cryptocurrencies, investors must accept certain risks. To mitigate these risks and achieve stable profits while maintaining a safe risk management level (approximately -20% to -30%), offers three strategies you can consider:

- Invest in large-cap tokens: like Bitcoin and Ethereum to stabilize profits. These are projects that attract a lot of attention, so investors often buy and hold them.

- Risk diversification: Diversify your investment portfolio by investing in various sectors, industries, and asset classes. This minimizes risk and protects your capital in case one sector or asset doesn't perform as expected.

- Risk management: Set reasonable profit and loss limits for each trade to protect your investment capital. This ensures that you don't lose too much when the market doesn't perform as expected.

For High-Risk Trading Strategies in the Crypto Market

The "High Risk - High Return" investment strategy is often applied using asset leverage methods with financial instruments such as Lending and Borrowing, Margin, and Futures.

With the three financial instruments listed above, all have in common that the cash flow you use for investment will expand, giving you more capital to seize opportunities from a bullish market. However, with these methods, you face extremely high risk in risk management, because a single mistake can lead to the complete liquidation of your assets.

For Lending and Borrowing, you can use existing tokens as collateral for new investments. This allows you to create a loop to increase your capital.

For example: If you have $10,000 worth of BTC, you can use it as collateral to borrow $7,500 (in the crypto market, lending and borrowing typically only allows borrowing up to 75% of the collateral value) to buy more ETH and use that as further collateral. Your cash flow will increase, but the risk will also increase. When the market becomes volatile and your assets reach liquidation, your investment will be zero, resulting in a loss.

With the Margin and Futures method, you need to deposit a certain amount of collateral, meaning you use stablecoins like USDT instead of other volatile assets. The difference here is that your capital will increase exponentially, but so will the risk. This method is quite similar to the traditional financial market.

Things to Note to Avoid "Over-Bullish"

In a bullish market, especially in crypto, investors often experience FOMO (Fear of Missing Out), easily leading to "over-bullish" behavior without realizing that no market will rise forever. The most common result of "over-bullish" is losing all profits.

To avoid "over-bullish," you need to understand the trading psychology of other investors, and have knowledge of market supply and demand. This will help you stay level-headed when making effective profit-taking and stop-loss decisions in a bullish market.

Additionally, you need to follow news from reputable crypto news sources to access information objectively, helping you stay rational when making decisions. Don't blindly trust the investment community, as they may be even more prone to FOMO than you are. Make wise decisions when investing.

Furthermore, consider the risks when deciding whether to continue buying or selling to avoid asset losses. Assessing market trends, risk levels, expected returns, and investment timeframes are crucial considerations for any investor, especially when experiencing significant profits in a bullish market.

Conclusion

Through this article, you should have gained some basic information and an overview of bullish markets, allowing you to objectively assess future market trends and manage risks effectively when participating in such markets.

FAQs

1. How does a bullish market differ from a bearish one?

A bullish market indicates an upward trend and positive sentiment, while a bearish market represents a downward trend and pessimistic sentiment.

2. What factors drive a bullish market?

Key factors include: macroeconomic growth, low interest rates, loose monetary policy, large institutional participation, and technological innovations in blockchain.

3. What phases does a bullish market typically go through?

A bullish market usually consists of three phases: the initial phase (accumulation), the breakout phase (a sharp increase), and the weakening phase (a slowdown in momentum before a reversal).

4. Why is "Over-bullish" dangerous?

Over-bullish occurs when investors are overly optimistic, experience FOMO (fear of missing out), and ignore risks, often leading to lost profits or heavy losses when the market reverses.

5. How to avoid FOMO in a bullish market?

Maintain discipline, follow news from reliable sources, understand market psychology, and always have a clear profit-taking and stop-loss plan.

6. Will a bullish market last forever?

No. Every trend has a cycle. A bullish market will eventually end and move into a correction or bearish phase.