Understanding a bull trap matters because it leads to real losses, not just missed opportunities. According to liquidation data reported by MEXC, a single bull trap driven move has wiped out over $580M in leveraged positions in one day, with nearly 90% coming from long orders after a short-lived price rebound.

As technical rebounds appear more frequently, distinguishing between a genuine trend reversal and a temporary trap has become more important than ever. This is why bull traps remain a concept that is frequently discussed in crypto trading.

What is a Bull Trap?

A bull trap is a term used to describe a situation in which the price of an asset, after a sharp decline, suddenly rebounds strongly enough to convince many investors that an uptrend has returned. In reality, this move is only a temporary recovery.

Behind what appears to be a positive rebound is a lack of sustainable buying pressure. When market expectations peak, price quickly reverses, trapping traders who entered too early.

In relatively small markets such as crypto, where high volatility is already a defining characteristic, bull traps tend to occur more frequently. In particular, after deep double-digit declines in BTC, the market often experiences strong technical rebounds that create the impression of a trend reversal.

This short-term recovery often causes investors to confuse a genuine reversal signal with a bullish trap, leading them to unintentionally fall into a bull trap.

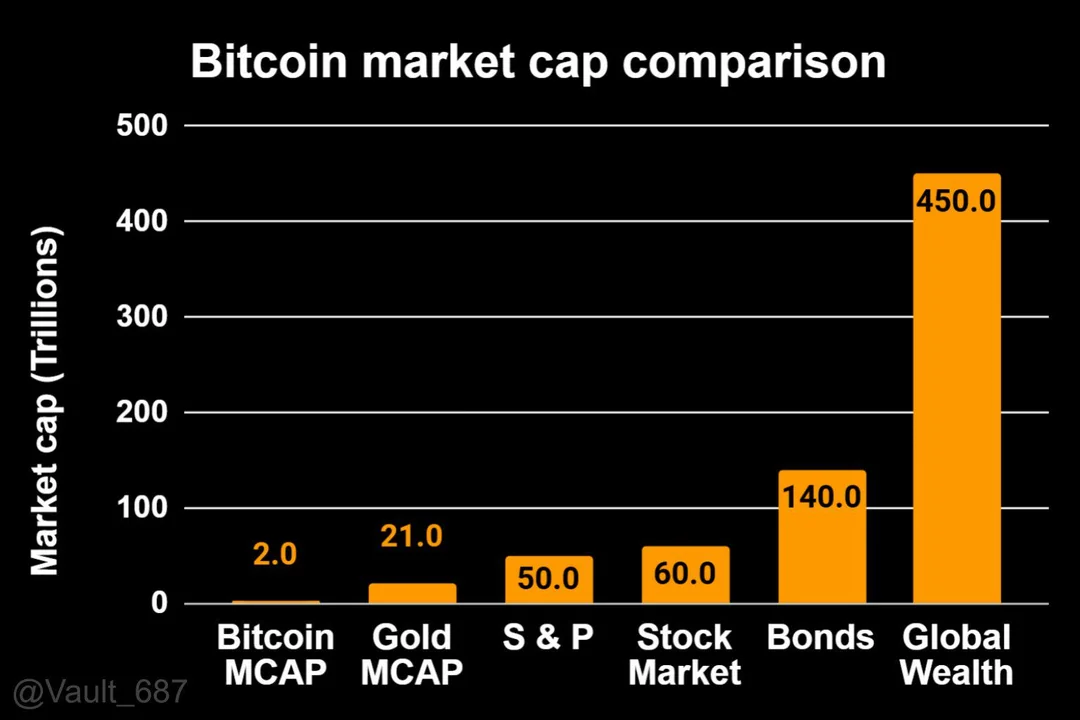

Bull Trap in the Crypto Market vs Stock

Compared to stock or forex markets, the crypto market is smaller in size and more volatile, making it an ideal environment for bull traps to occur frequently. With only a modest amount of capital, price can be pushed sharply higher in a short period, creating the illusion that an uptrend has returned.

Another important factor is the role of whales. In crypto, a small number of large wallets can influence price, especially during periods of low liquidity. Short-term pumps created by whales can easily be mistaken for genuine breakouts, while in reality they are often distribution moves.

In addition, FOMO (fear of missing out) among retail investors in crypto is generally stronger than in traditional markets. After sharp declines, even a quick and aggressive rebound can cause many traders to rush into long positions with the expectation of catching the bottom, unintentionally becoming liquidity for a bull trap.

Finally, low liquidity in many altcoins further exacerbates the problem. For small-cap assets, thin trading volume makes prices easier to manipulate, fake breakouts occur more frequently, and technical signals are far less reliable than in highly liquid markets.

The combination of high volatility, whales, FOMO, and low liquidity makes bull traps in crypto more dangerous and harder to identify than in other markets.

Common Bull Trap Indicators

A bull trap often appears convincing in its early stages, which is why many traders are caught off guard. Price action may initially signal a breakout or trend reversal, encouraging traders to enter long positions.

However, without proper confirmation, these moves frequently reverse, trapping buyers at unfavorable prices. Recognizing warning signs early can help traders avoid unnecessary losses.

Breakout Without Strong Volume

One of the most common indicators of a bull trap is a price breakout that lacks strong volume support. While price may move above a key resistance level, the absence of meaningful buying pressure suggests that the breakout is not driven by genuine demand.

Typical characteristics include:

- Price briefly moves above a well-defined resistance level.

- Trading volume remains low, flat, or fades quickly after the breakout.

- Buyers fail to follow through with sustained momentum.

- Price struggles to hold above the breakout level.

For Examples:

In this case, price appears to confirm a bullish breakout, but the move lacks strong volume support and ultimately turns into a bull trap. A clear resistance zone is established around $2.80-$2.90, and once price breaks above this level, it rallies sharply from approximately $2.10 to $3.30, creating the impression that a new bullish leg is underway.

This rapid advance attracts breakout traders who interpret the move above $2.90 as confirmation of renewed demand.

However, volume behavior does not confirm the breakout. While volume expands briefly during the initial impulse, it fails to continue rising as price pushes higher toward $3.20-$3.30.

Instead, volume begins to fade, signaling weakening buying pressure and a lack of strong participation at higher prices. This divergence between price and volume suggests that the breakout is not supported by genuine demand.

As a result, price struggles to maintain acceptance above the resistance zone. Multiple daily candles fail to hold above $2.90, and price reverses sharply from the $3.30 area back below former resistance, confirming the breakout failure. Once price falls below $2.90, the bull trap is fully validated, trapping late buyers and leading to a broader decline toward $2.00-$1.50.

Failure to Hold Above Resistance

In a bull trap scenario, price often appears to break above resistance, giving traders the impression that a bullish continuation or trend reversal is underway. However, this move frequently lacks the strength needed to sustain itself.

In a typical bull trap, price behavior includes:

- A brief push above a clearly defined resistance level.

- Inability to maintain price above that level.

- A quick return below resistance within a small number of candles.

This behavior suggests that buyers lack real control. If price cannot hold above resistance for multiple candles or sessions, the breakout is likely false. Instead of attracting sustained buying interest, the move often exhausts quickly as early buyers take profits and sellers step back in.

For Example:

In this example, price briefly breaks above a clearly defined resistance near $94K-$94.15k creating the impression that a bullish continuation is underway. The breakout attracts buyers as price pushes slightly higher, but the move lacks follow-through and fails to establish acceptance above resistance. This initial push gives the market a false signal of strength.

Shortly after the breakout, price was unable to hold above the $94klevel. Within a small number of candles, price reverses and falls back below resistance, signaling that buyers lack real control. The rejection occurs quickly, indicating that the breakout is driven more by short-term positioning than sustained demand.

Once price returns below resistance, selling pressure increases and the bull trap is confirmed. What initially appeared to be a bullish continuation turns into a failed breakout, as early buyers take profits and sellers step back in. This loss of acceptance above resistance ultimately leads to a broader decline toward the $91K-$90K region.

RSI or Momentum Divergence

Momentum indicators such as RSI or MACD often provide early warning signals before price reversals occur. While price action alone may suggest continued strength, momentum divergence can reveal underlying weakness in buying pressure.

- What this indicator represents: RSI or MACD measures the strength and speed of price movements. When these indicators fail to confirm new price highs, it signals that bullish momentum is deteriorating beneath the surface.

- What it tells traders: Momentum divergence suggests that the uptrend is losing participation and conviction. Even if price continues to rise, the probability of a reversal or bull trap increases as fewer buyers are willing to push price higher.

In a typical bearish divergence setup:

- Price continues to make higher highs

- RSI or MACD forms lower highs over the same period

- Momentum weakens even as price appears to trend upward

For Example:

In this example, price continues to trend upward and creates the appearance of strong bullish momentum, but momentum indicators reveal early signs of weakness. During the rally, OP price pushes to a higher high around $4.80-$4.85, suggesting a potential continuation of the uptrend and attracting late breakout buyers.

However, momentum fails to confirm the move. While price makes a clear higher high, RSI forms a lower high, dropping from the previous peak near 70 to around 60. This bearish divergence signals that buying pressure is weakening despite rising prices, indicating that fewer participants are willing to chase higher levels. The uptrend becomes increasingly driven by late buyers rather than strong, broad-based demand.

Following this divergence, price reverses sharply from the $4.80 region and transitions into a sustained downtrend, eventually declining toward $1.00 and below. Traders who entered long positions based solely on price strength are trapped as momentum turns decisively bearish.

This example highlights how RSI divergence often appears near the end of a rally and serves as an early warning of a potential bull trap, especially when price is approaching key resistance or moving aggressively higher.

Timeframe Context and Liquidity Mechanism

An important factor when analyzing bull traps is timeframe context. A bull trap on the 15-minute timeframe may simply be a normal pullback on the 4-hour or daily timeframe.

Bull traps are most dangerous when they occur on higher timeframes or near major resistance levels within the primary trend. Failing to distinguish timeframe context can cause traders to apply signals mechanically and misinterpret market behavior.

From a structural perspective, bull traps are often associated with liquidity hunting. When price breaks above resistance, stop losses from short positions and breakout buy orders are triggered, creating liquidity for larger players to distribute positions. Once this upside liquidity is absorbed, the market reverses quickly.

Bull Trap vs Bear Trap

Bull traps and bear traps are both false signals designed to attract liquidity.

- A bull trap lures traders into long positions before price reverses lower.

- A bear trap causes traders to sell or short before price rapidly reverses upward.

Both exploit FOMO and fear of loss, making traders vulnerable to short-term price movements that lack proper confirmation.

How to Avoid a Bull Trap in Crypto

Avoiding a bull trap requires more than reacting to price movement alone. Traders must focus on confirmation, context, and risk management rather than chasing apparent breakouts.

- First, always wait for confirmation before entering a trade. A valid bullish breakout should show acceptance above resistance, with price holding above the level for multiple candles.

- Second, confirm breakouts with volume and momentum. Rising price without expanding volume or with weakening momentum often signals a false move. Indicators such as RSI or MACD should support the breakout rather than diverge.

- Third, pay attention to market structure. Bull traps commonly occur near major resistance levels or after extended rallies. If the broader trend remains bearish, upside breakouts are more likely to fail.

- Finally, manage risk strictly. Use predefined stop losses and appropriate position sizing so you can exit quickly if the breakout fails. Even strong setups can fail, but disciplined risk management prevents a single bull trap from causing significant damage.

By combining confirmation, momentum analysis, structural awareness, and risk control, traders can significantly reduce the likelihood of falling into a bull trap and improve long-term trading consistency.

Conclusion

Bull traps occur frequently during periods of high volatility and low liquidity. Understanding bull traps and recognizing signs such as weak-volume breakouts, failure to hold resistance, and momentum divergence helps traders avoid emotional decisions.

Rather than attempting to predict market tops or bottoms, traders should focus on signal confirmation and risk management. In trading, avoiding bull traps is just as important as finding profitable opportunities.

FAQs

Q1. Why do bull traps occur so frequently in crypto markets?

Bull traps occur frequently in crypto due to high volatility, lower liquidity compared to traditional markets, and strong retail-driven FOMO, which makes price easier to manipulate.

Q2. Can a bull trap occur during a long-term uptrend?

Yes. A bull trap can still occur within a long-term uptrend, especially near major resistance levels or during overheated market conditions with weakening momentum.

Q3. Is a bull trap more common on lower timeframes?

Bull traps appear more often on lower timeframes, but traps on higher timeframes are generally more impactful and harder for traders to recover from.

Q4. How can traders confirm that a bull trap is forming?

Traders often look for weak volume, failure to hold above resistance, momentum divergence, and rejection from key price levels to confirm a bull trap.

Q5. Are bull traps intentional market manipulation?

Bull traps are not always deliberate manipulation. They often result from liquidity-seeking behavior and collective market psychology rather than coordinated actions.