Brevis Network focuses on building zero-knowledge (ZK) proof infrastructure to support powerful off-chain computation while maintaining transparent, trustless on-chain verification. The system is designed to remove the traditional trade-off between computational power and trust, allowing blockchain applications to become more flexible without sacrificing full decentralization.

What Is Brevis Network?

Brevis Network is a platform that lets developers run complex computations off-chain, generate ZK proofs to verify the results, and then submit those verified outputs on-chain.

This approach enables users to build more advanced dApps, such as DeFi yield optimization, AI data processing, or privacy-preserving transactions, without being constrained by on-chain limits or relying on trusted third parties.

How does Brevis Network Works?

Brevis Network built on a multi-layer architecture that combines ZK proofs with a distributed network of off-chain nodes running prover and verifier systems. This hybrid design creates an ecosystem that is more flexible and efficient than traditional blockchain platforms.

Pico zkVM

Pico zkVM is the core layer of Brevis. It is a modular ZK virtual machine that supports general-purpose computation. Pico zkVM allows any type of off-chain computation, such as financial analysis or blockchain verification, to be executed and then proven in a way that can be verified on-chain almost instantly.

The system supports on-chain escrow, dynamic network formation, and intelligent negotiation. These capabilities are designed for real-world use cases like cross-chain yield optimization, decentralized market creation, and efficient liquidity provision.

ProverNet

ProverNet is the top network layer of Brevis, where provers compete to handle requests through a TODA auction mechanism. This model uses machine learning and predictive techniques to continuously optimize performance, making the network smarter and more cost-efficient over time.

The components within ProverNet work together as a coordinated network:

- Specialized Provers: Collect and process real-time market data.

- Analytics System: Develops and refines strategies from aggregated data.

- Executor: Executes on-chain transactions based on approved strategies.

$BREV Token Information

$BREV Key Metrics

- Token Name: Brevis

- Ticker: $BREV

- Type: Utility and Governance

- Total Supply: 1,000,000,000 $BREV (based on published tokenomics)

- Contract Address: TBA (to be updated after TGE)

$BREV Use Cases

The project has not released detailed use cases yet. Whales Market will provide updates as soon as the project makes an official announcement.

$BREV Listing Details

- TGE Date: TBA

- CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

$BREV Tokenomics and Fundraising

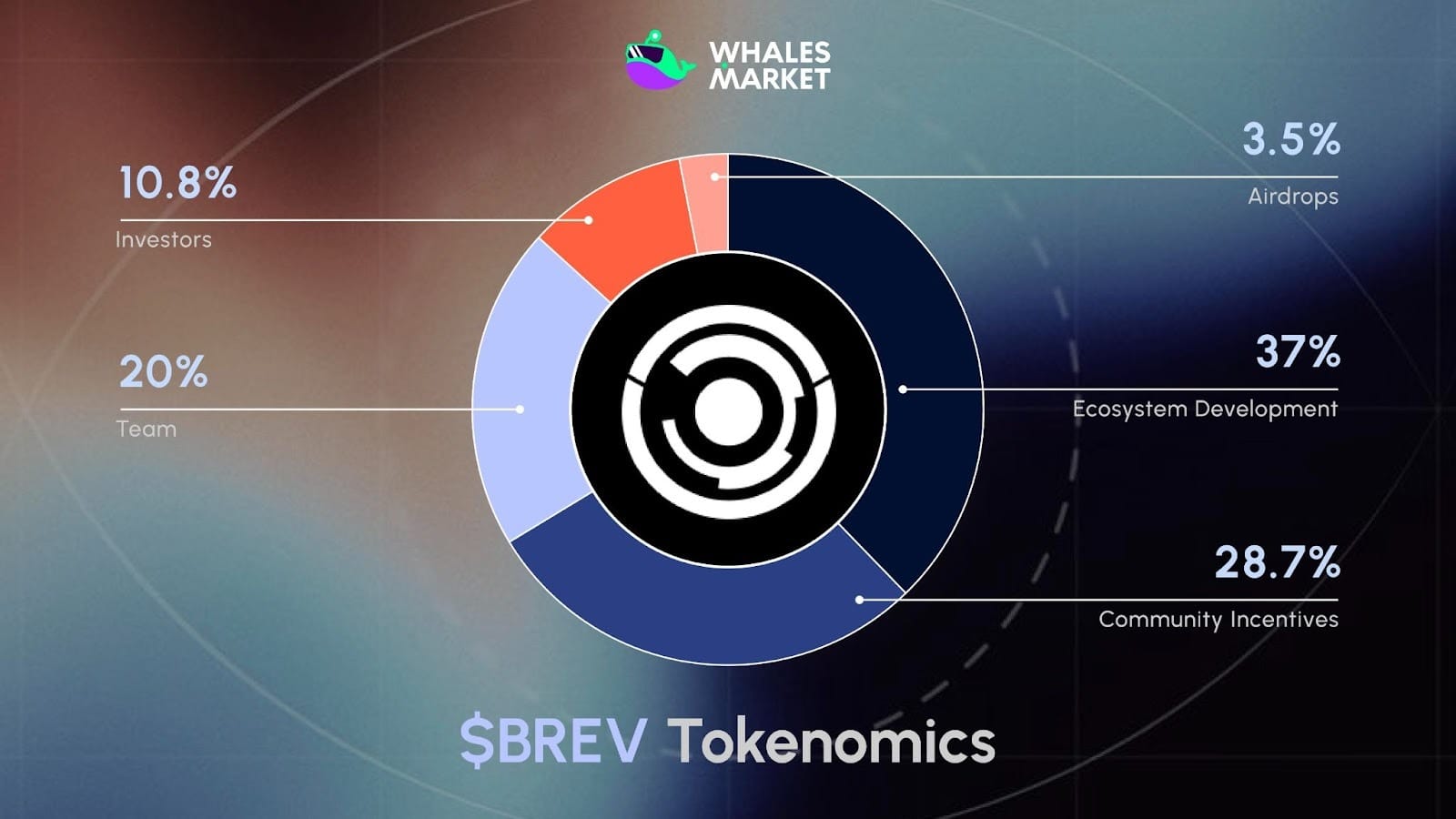

Tokenomics

- Total Supply: 1,000,000,000 $BREV

Allocation:

- Community: 28.7%.

- Ecosystem Development: 37%.

- Team: 20%.

- Investors: 10.8%.

- Airdrops: 3.5%.

Fundraising

Brevis raised a total of $7.5M in a seed round in November 2024. Investors include Polychain Capital, YZI Labs, and several other funds.

Roadmap and Team

Team

- Mo Dong – Co-Founder

Roadmap

Brevis has reached several key milestones, including the ProverNet mainnet beta launch in December 2025, the generation of more than 280M proofs, and integrations with over 100 partners.

Looking ahead, the roadmap includes migrating to a dedicated Brevis rollup, expanding use cases such as verifiable AI and privacy, and achieving efficient proving with fewer than 16 GPUs.

Conclusion

Brevis delivers a distributed ZK proof platform that emphasizes user experience, transparency, and intelligent automation. With a multi-chain approach and a strong focus on reducing human error, the system supports both new and experienced crypto users with safer and more adaptive financial tools.

FAQs

Q1. What benefits does ProverNet offer to DeFi users?

ProverNet automatically analyzes markets, refines strategies, and executes on-chain transactions, improving performance without the need for constant manual oversight.

Q2. How is Pico zkVM different from traditional zkVMs?

Pico zkVM uses a modular architecture with coprocessors, achieves a 99% real-time proving rate, and delivers higher performance with transparent logs that are easy to audit.

Q3. Who benefits most from using Brevis?

The platform is well suited for users seeking smart yield strategies, automated trading, or ZK-based capital allocation without managing multiple protocols manually.

Q4. How does Brevis differ from other automated ZK platforms?

Brevis relies on a distributed prover network rather than rigid scripts. Provers learn and adapt over time using machine learning, operate under strict on-chain safety rules, and provide full execution logs.

Q5. What is the current price of $BREV?

$BREV has not officially launched yet. There is currently no official trading price on major exchanges, but $BREV can be traded on Whales Market at this time.