For users following prediction markets like Polymarket, Kalshi, and other forecasting platforms, the term BPS appears constantly, especially in markets tied to Federal Reserve interest rate decisions. So what exactly is BPS and why is it so important?

This article explains what BPS means, how it functions on prediction platforms, and why it brings real value to users.

What is BPS?

BPS (stands for Basis Points) is a small measurement unit in finance equal to 1/100 of 1%, or 0.01%. It is used instead of regular percentages because it expresses small movements more clearly and avoids confusion. For example:

- 1% = 100 BPS, 0.25% = 25 BPS, 0.5% = 50 BPS.

- When interest rates rise from 4% to 4.01%, the change is described as an increase of 1 BPS. This is a cleaner way to communicate a 0.01% move.

The concept has existed for decades in banking and investing. As of 2025, BPS remains a global financial standard and is used by major institutions such as the U.S. Federal Reserve to announce rate adjustments. The definition has not changed in recent years.

BPS on Prediction Markets

Prediction markets allow users to trade outcomes of real events, where the price of a contract reflects the probability (called Odds) of that event occurring. For example, a price of 50 cents implies a 50% chance. In these markets, Basis Point (BPS) becomes the standard unit of measurement used to quantify changes in financial variables, particularly interest rates or bond yields.

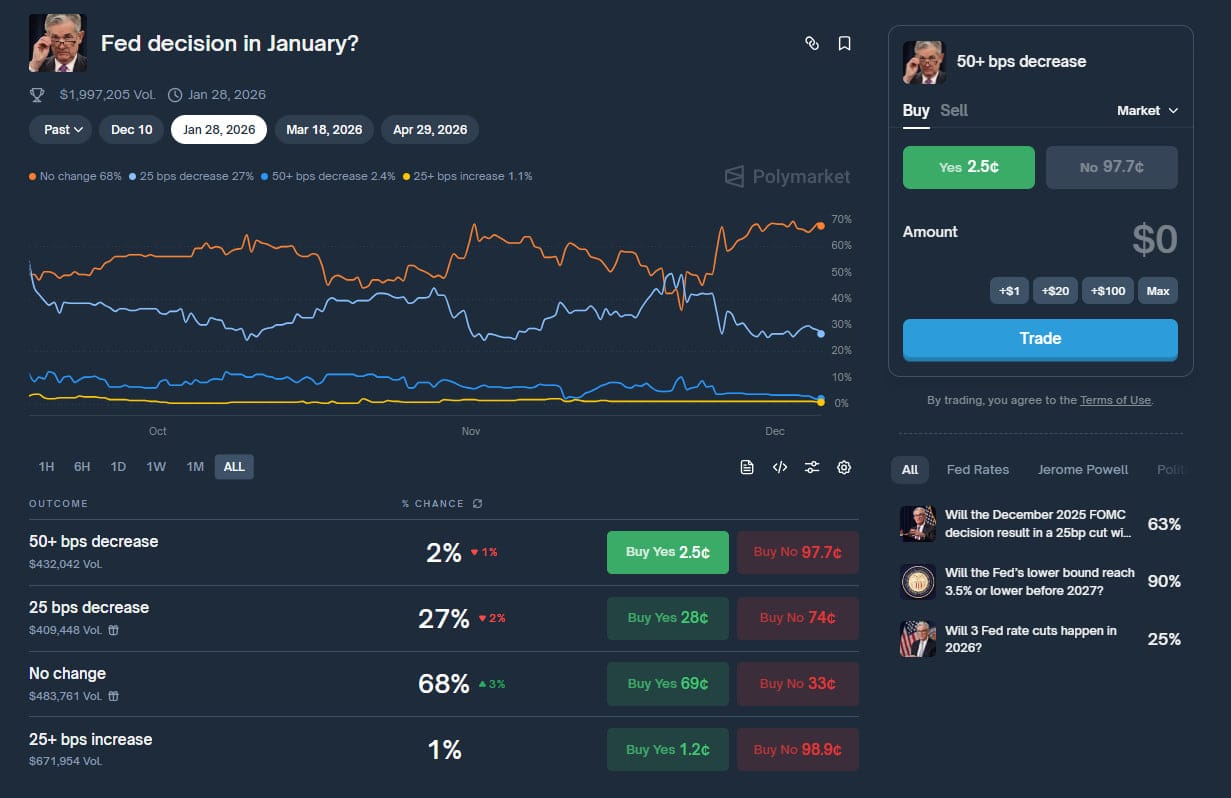

On platforms like Polymarket, one of the world’s largest prediction markets with billions of dollars in volume by 2025, BPS is used to describe expected rate cuts or hikes. For example:

- Users can place bets on whether the Fed will cut interest rates by 25 BPS (equivalent to 0.25%) in the January 2026 meeting.

- According to Polymarket data, user predictions showed a 27% probability of a 25 BPS cut in January 2026, while the probability of a 50 BPS cut was only around 2%.

BPS matters because prediction markets reflect collective expectations. Analysts often use Polymarket data to anticipate Fed actions, as the prices aggregate real-time crowd predictions that can outperform traditional survey-based forecasts. By 2025, Polymarket also expanded into earnings prediction and macroeconomic events where BPS helps quantify risk more precisely.

Compared to platforms like Kalshi, Polymarket is notable for its crypto-native design using USDC. The use of BPS also allows for direct comparison of these probabilities with traditional financial tools such as the CME FedWatch Tool.

Read More: How to Increase Win Rates on Polymarket

Real-World Example

Imagine you open Polymarket and see a market titled: “Fed decision in December?”

Crowd sentiment may look like this:

- 25 BPS cut at 93% (Yes at 93 cents, No at 6 cents)

- No change at 8% (Yes at 8 cents)

- 50 BPS cut or more under 1% (Yes at 0.5 cent, which shows very low expectation)

- 25 BPS hike or more under 1% (Yes at 0.2 cent)

Interpretation of possible trades:

- If convinced the Fed will cut exactly 25 BPS, users might buy Yes at 93 cents. If correct, payout becomes 100 cents with a 7 cent profit per share.

- If expecting no change, users can buy Yes at 8 cents. A correct outcome pays 100 cents, returning more than 12 times the initial cost.

- If extremely dovish and expecting a 50 BPS cut or more, users might buy Yes at 0.5 cent. If correct, 1 unit becomes 100 units, representing a 20,000% return.

Market sentiment is also reflected in the Change section where heavy movement signals rising attention.

Benefits of BPS in Prediction Markets

- Precision and clarity: BPS makes it easier to follow small interest rate movements without confusion, especially during volatile periods.

- Economic forecasting: Prediction markets use BPS to estimate expectations about inflation, GDP, and macro conditions, helping individual investors understand broader trends.

- Beginner friendly: New users only need to remember that 100 BPS equals 1% to start exploring rate-based markets.

- Risk and opportunity: The clarity of BPS encourages research-driven decisions. However, prediction markets carry risk and funds used should always be discretionary.

Conclusion

BPS is a simple and efficient way to measure small percentage shifts. It helps users interpret prediction market probabilities and compare them with real financial indicators. With a clear understanding of BPS, users gain more confidence when navigating platforms like Polymarket or Kalshi. Knowledge helps guide better decisions than relying on luck alone.

FAQs

Q1. Does BPS directly affect Yes and No pricing on prediction markets?

Yes. When collective expectations about upcoming BPS adjustments shift significantly, the market recalculates probabilities instantly, causing Yes and No prices to move in real time based on the updated interest rate outlook.

Q2. Why is the 25 BPS difference so important in rate prediction markets?

The 25 BPS step is important because it represents the Federal Reserve’s standard adjustment size, and even a single 25 BPS move can reshape sentiment across equities, crypto assets, and global bond markets within minutes.

Q3. Which indicators should beginners watch before entering BPS-related markets?

Beginners should regularly track CME FedWatch, the official FOMC meeting calendar, and monthly CPI releases because these indicators strongly influence interest rate expectations and directly shape probability movements in BPS-related markets.

Q4. Which BPS levels appear most frequently in macro prediction markets?

The levels most commonly seen are 0 BPS, 25 BPS, and 50 BPS because these ranges match the typical policy adjustments made by the Federal Reserve during most decision cycles throughout the year.

Q5. Outside of the Fed, where else is BPS commonly used?

BPS is widely used in predictions involving interest rate decisions from the ECB, BoE, and BoJ, as well as forecasts for U.S. 10-year Treasury yields and various mortgage rate markets across the financial sector.