Bitcoin, Ethereum, Solana, and many other breakthrough products such as DeFi, RWAs, and prediction markets share one thing in common: they are built on blockchain, a technology that brought a major shift to financial markets. So what is blockchain technology?

What is Blockchain?

Blockchain is a distributed database system that records and stores digital asset data in blocks in a transparent and immutable way. These blocks are linked together through cryptographic hashing and arranged in chronological order to form a chain.

Blockchain technology is also known as Distributed Ledger Technology (DLT), because it is not controlled by any single authority or intermediary.

Who invented blockchain? When was Blockchain created?

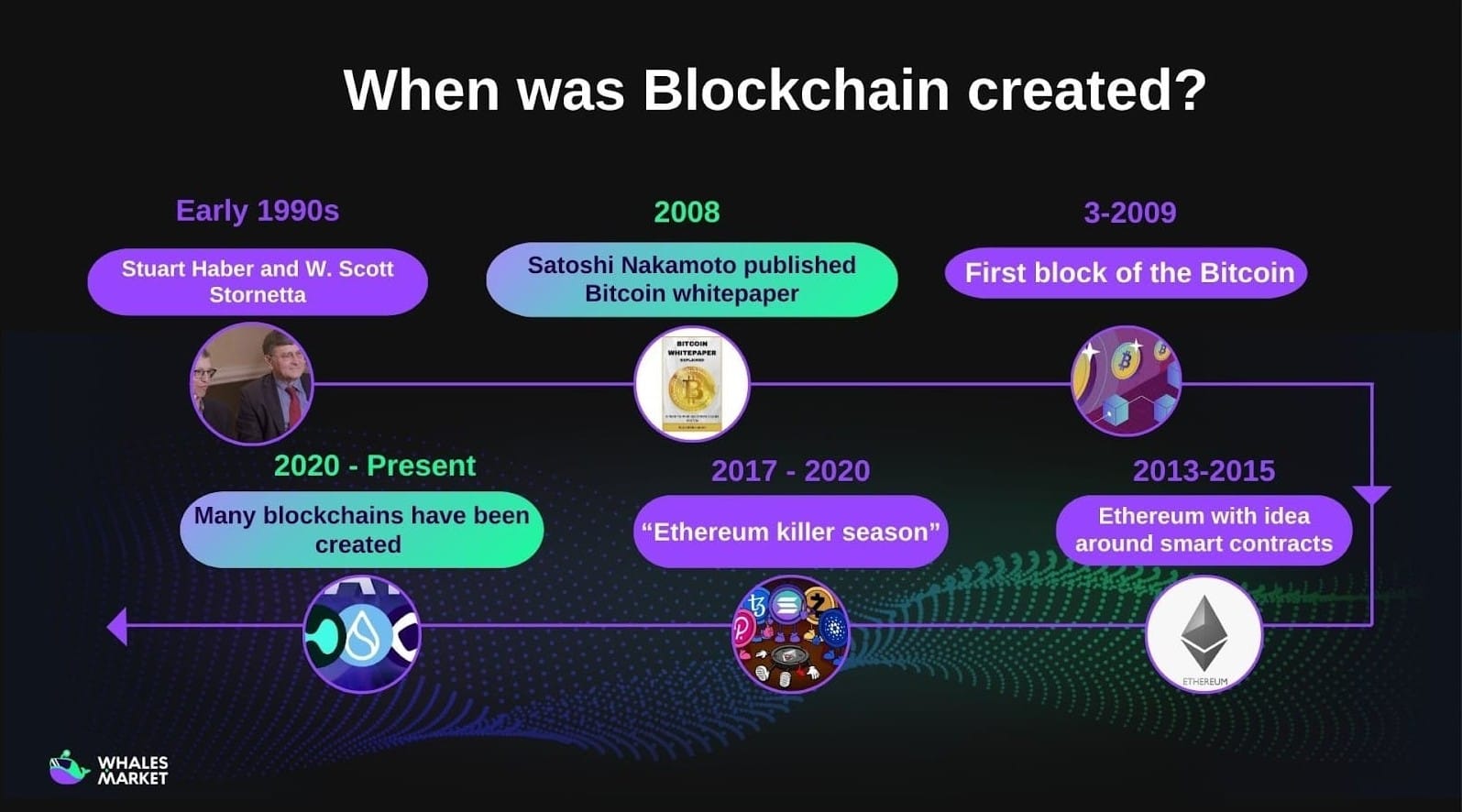

Many people think blockchain was born with the creation of Bitcoin, but the core ideas appeared earlier:

- In the early 1990s, the idea behind blockchain was discussed by Stuart Haber and W. Scott Stornetta, related to a time stamping approach for data.

- In 2008, Satoshi Nakamoto published the Bitcoin whitepaper, clearly describing how blockchain works and presenting it as a practical structure for peer to peer (P2P) transfers.

- On January 3, 2009, the first block of the Bitcoin blockchain (the Genesis Block) was created, and on January 12, 2009, the first Bitcoin transaction took place (Satoshi sent 10 BTC to Hal Finney).

- From 2013 to 2015, Ethereum emerged with a breakthrough idea around smart contracts, helping form the DeFi ecosystem seen today.

- From 2017 to the present, many blockchains have been created for different purposes. They can be broadly grouped into two types: general purpose blockchains such as Solana, BNB Chain, Avalanche, Monad, and more specific blockchains such as Hyperliquid, dYdX, and Ronin.

A core reason blockchain matters is that it solves the double spending* problem without requiring a third party (such as a bank or payment gateway) to verify transactions.

*Double spending happens when a user attempts to spend the same unit of currency in two different transactions at the same time. Traditionally, preventing double spending requires a third party to verify transaction information. Blockchain solves this problem without needing an intermediary.

Difference between Blockchain and Cryptocurrency

Blockchain is the underlying technology: a shared database (ledger) where many computers store the same records and agree on updates using consensus rules. It is designed to make data hard to tamper with and easy to audit.

Cryptocurrency is one of the most common applications built on top of blockchain. It is a digital asset used to transfer value, where blockchain keeps track of ownership and transactions.

Key differences:

- Purpose: Blockchain is an infrastructure; cryptocurrency is a product/asset running on that infrastructure.

- Scope: Blockchain can store more than payments (e.g., smart contracts, supply chain records, digital identity). Crypto focuses on value transfer and token economics.

- Dependency: Many cryptocurrencies need blockchain to function, but blockchain can exist without a native currency (e.g., private/permissioned blockchains in enterprise settings).

- Examples: Bitcoin is both a blockchain network and a cryptocurrency. USDC is a cryptocurrency token that runs on existing blockchains (e.g., Ethereum), rather than having its own standalone chain.

How Blockchain Technology Works

Blockchain Structure: A Chain of Blocks

You can think of blockchain like a journal: each page is a block, and each page is tightly linked to the previous page through a digital fingerprint.

A blockchain contains many blocks linked into a chain. Each block stores transaction data, and the number of blocks grows over time. In a block, the key identifying part is the block header, which commonly includes:

- Previous Hash: the hash of the previous block, which creates the link that forms the chain.

- Timestamp: the time the block was created.

- Nonce: a value used during block creation, often mentioned in the context of mining.

- Merkle Root: the final aggregated hash of transactions in the Merkle Tree.

In short, the hash and its link to the previous block’s hash are what make the chain strongly bound and difficult to alter.

How blockchain processes transactions

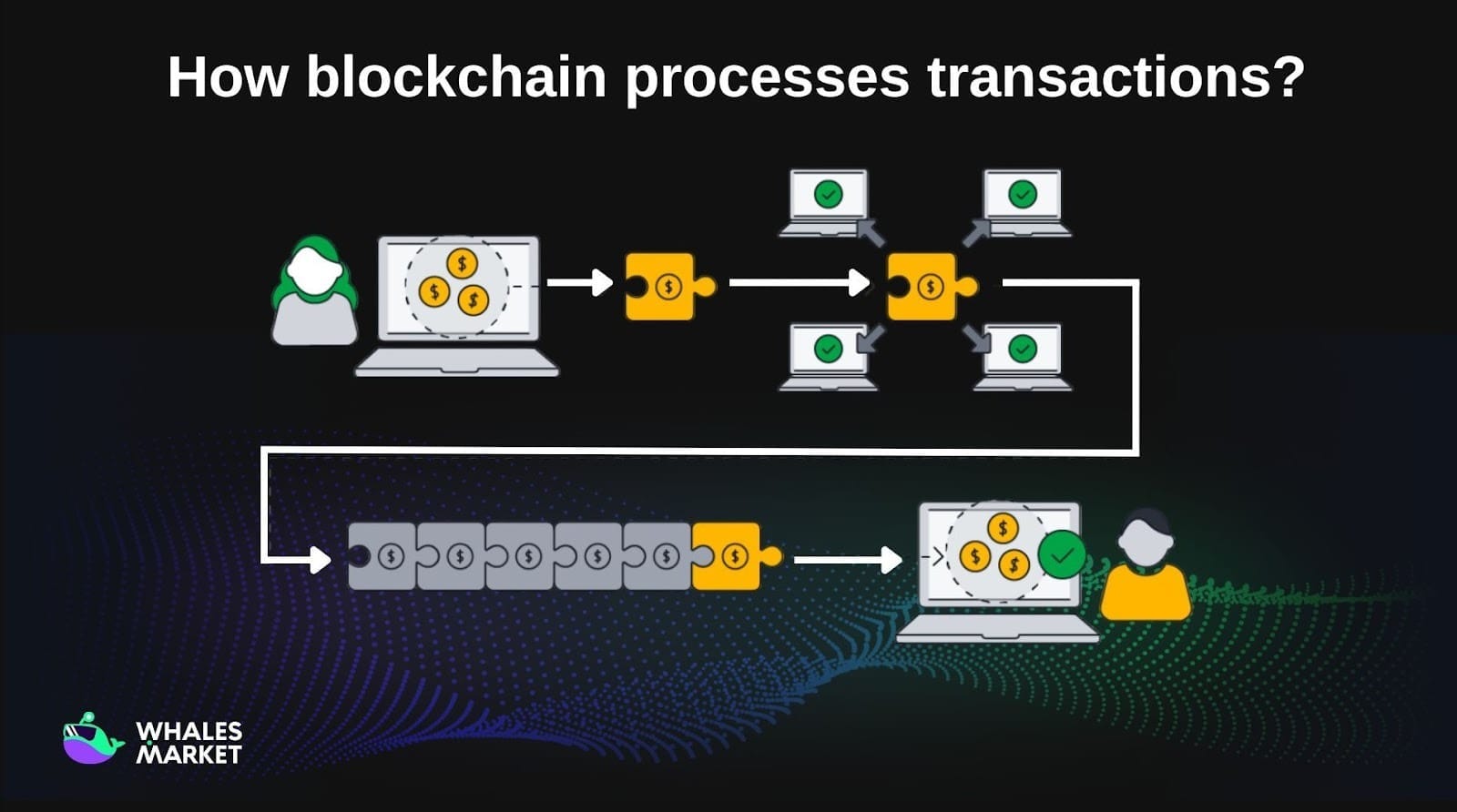

The transaction process on blockchain typically works as follows:

Step 1: A user requests a transaction. The transaction information is recorded as a record and sent to nodes for verification.

Step 2: Computers in the system, called nodes, verify transaction records according to the blockchain consensus algorithm.

Step 3: Verified records are stored in a block.

Step 4: The newly created block is added to the chain by linking the block’s Previous Hash to the hash of the previous block, forming a blockchain.

Example: Suppose a user wants to make a transaction of 1 BTC.

Nodes verify whether the wallet has at least 1 BTC. If it does, the transaction can be proceeded and recorded into the block.

If the wallet has less than 1 BTC, nodes determine the wallet does not have enough Bitcoin, and the transaction will not be executed.

The first block in the chain is called the Genesis Block.

Key Characteristics of Blockchain Technology

Because blockchain technology was created to address limitations in traditional transaction systems, it has the following properties:

- Decentralization: Blockchain is not controlled by any single authority or organization. It operates based on algorithms and validating nodes to maintain decentralization.

- Distribution: The blockchain network is maintained by nodes globally, distributing computing power across many machines.

- Immutability: Once data is recorded in a blockchain block, it cannot be changed due to the consensus mechanism and hashing.

- Security: Blockchain protects information using cryptography, hashing stored data. Each block has its own hash and the hash of the block before it. Changing or attempting to forge data would require changing all related hash IDs, which is not feasible.

- Transparency: Transaction information on blockchain is public, allowing anyone to check and trace transaction history quickly.

- Trustlessness: The blockchain network runs through nodes that automatically validate transactions based on algorithmic rules and cryptography. Nodes do not need to trust each other, they only need to follow the protocol rules to maintain the network.

The development stages of blockchain technology

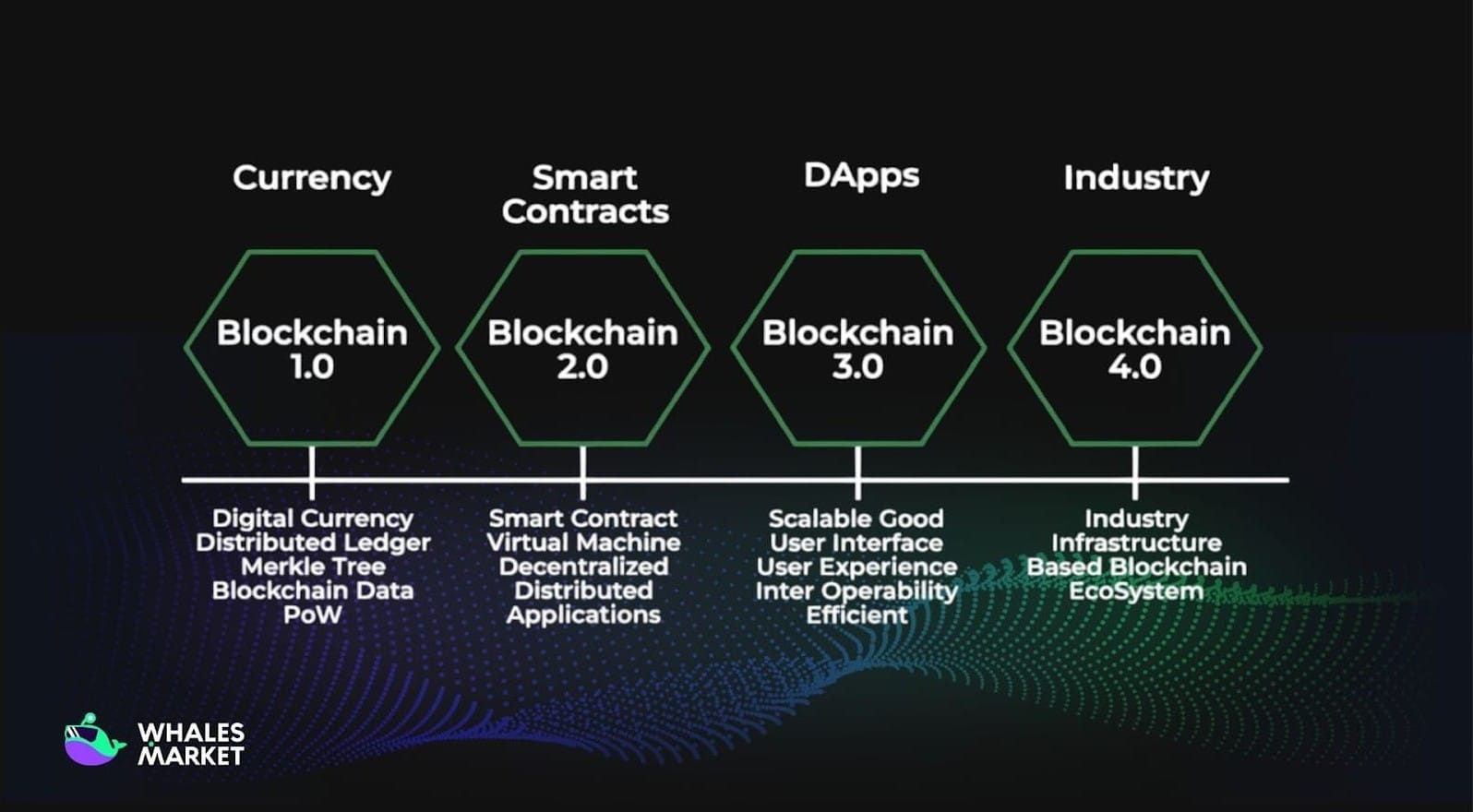

Up to now, blockchain technology has evolved through multiple stages, with different types of applications including currency, smart contracts, decentralized applications, and industry.

Blockchain 1.0: Currency

Currency is the first stage of blockchain technology. By applying a decentralized distributed ledger, transactions on blockchain can be processed quickly and transparently.

Blockchain 1.0 introduced a different model: a decentralized ledger where value can be transferred peer-to-peer, recorded transparently, and validated by the network instead of a single institution. The goal was simple but ambitious, turning money into something that behaves more like the internet: global, always-on, and native to digital systems.

Bitcoin is the most recognizable example of this stage. It showed that a network can maintain a consistent record of ownership and transfers without relying on a trusted central party. Once that proved possible, a natural limitation became clear: this system could move value, but it could not natively express complex conditions.

Payments were still mostly “if A sends, then B receives,” without richer logic such as escrow, automated settlement rules, or programmable workflows.

That gap is exactly where the next stage began.

Blockchain 2.0: Smart contracts

The second stage expanded blockchain from a payment ledger into a programmable platform. Instead of recording transfers only, blockchain could now record and execute rules.

Smart contracts made it possible to embed “if/then” logic directly into the network, so agreements can be enforced by code rather than by manual checks, paperwork, or trusted intermediaries.

This upgrade addressed the main constraint of Blockchain 1.0: the lack of native automation for conditional actions. With smart contracts, tasks that used to require verification layers (escrow services, settlement agents, compliance steps, operational approvals) can be modeled as on-chain logic. When conditions are met, execution happens automatically, and the result is recorded transparently.

Ethereum is a typical example of this stage. It introduced a general-purpose environment where developers can build applications on top of blockchain logic, not just send tokens. In other words:

- Blockchain 1.0 made value transferable without a central operator.

- Blockchain 2.0 made that value programmable, enabling more complex financial products and digital services to run on-chain.

Blockchain 3.0: Decentralized applications

Once smart contracts became possible, blockchain stopped being only a place to record transactions and started becoming a place to run applications. This is the shift that defines Blockchain 3.0: the rise of decentralized applications (dApps), where the “business logic” is executed by smart contracts and the outcomes are recorded on-chain.

Decentralized application (dApp) is software deployed independently, not hosted on a single server. Instead, they are stored in a distributed way on decentralized storage systems and can be written in any programming language.

A typical dApp stack looks like this:

- Smart contracts handle core rules, state changes, and settlement.

- A user interface (web or mobile) lets people interact with those contracts.

- Decentralized storage may be used for files that do not fit on-chain efficiently (images, metadata, large documents).

This stage also turned blockchain into an “on-chain economy” layer. Instead of simply transferring tokens, users could swap assets, lend and borrow, provide liquidity, trade, or mint digital items, with the rules enforced transparently by code.

Examples help make this concrete:

- Uniswap is a decentralized exchange (DEXs) that enables token swaps through smart contracts, without an order-matching company acting as the central intermediary.

- Aave enables borrowing and lending based on collateral rules executed by smart contracts.

In short, Blockchain 3.0 is where blockchain becomes a practical application platform: not just money, not just rules, but complete products that can operate in a more open and self-running way.

Blockchain 4.0: Industry

If Blockchain 3.0 was about proving that dApps can exist, Blockchain 4.0 is about making blockchain systems usable at real-world scale. This stage focuses less on “cool experiments” and more on production requirements: reliability, performance, user experience, compliance, and integration with existing business systems.

Many early dApps worked, but they were not always practical for mainstream adoption. Fees could spike, transactions could be slow during congestion, and the user journey often required technical knowledge (wallet setup, gas management, seed phrases).

Blockchain 4.0 is the response to those bottlenecks: improving the infrastructure so blockchain can support everyday products and business operations without forcing users to think about blockchain at all.

In practice, this stage is characterized by:

- Higher throughput and lower fees through scaling solutions (Layer 2 rollups, better execution environments, more efficient data handling). Better UX such as account abstraction, smoother onboarding, and embedded wallets, so interactions feel closer to normal apps.

- Enterprise readiness with clearer permissioning options, auditability, and integration into existing workflows (ERP, payments, logistics, identity systems).

- Real-world connectivity via oracles and tokenization, linking on-chain logic to off-chain data and assets (prices, delivery status, invoices, credentials).

Concrete examples make the shift easier to see:

- Payments and settlement: Stablecoin-based transfers for faster cross-border settlement, treasury management, and merchant payments.

- Supply chain and provenance: Tracking batches, certifications, or ownership handoffs with an auditable trail that multiple parties can share.

- Tokenization of real-world assets: Representing financial instruments or asset ownership on-chain to simplify transfer, collateral, and settlement processes.

- Digital identity and credentials: Issuing verifiable certificates (education, compliance, membership) that can be checked without relying on a single database.

In short, Blockchain 4.0 is where blockchain moves from “applications that run on-chain” to “systems that can support real business outcomes.” The technology becomes less visible to end users, while the benefits (auditability, automation, shared truth across parties) become more practical and easier to adopt.

Blockchain Applications

Some representative applications of blockchain include:

- Cryptocurrency: The first and most popular application of blockchain. Crypto transactions are executed on blockchain to ensure transparency, security, and speed.

- Smart contracts: Built on blockchain to automatically execute terms and rules written in a smart contract once predefined conditions are met. No one can prevent or cancel smart contracts.

- Supply chain management systems: Blockchain improves transparency and makes it easier to trace product origins.

- Digital identity: Blockchain enables secure verification that is difficult to forge while protecting users’ personal information.

- Real estate: Blockchain can simplify property transactions, reduce fees, and save time.

- Copyright: Blockchain can protect intellectual property by ensuring recorded information cannot be altered.

- Banking and finance transactions: Blockchain can reduce fees, reduce processing time, and improve efficiency in financial transactions.

Conclusion

In simple terms, blockchain like a shared ledger: many computers maintain the same record, and new updates are only added when the network reaches consensus. This allows users to validate whether data is correct without relying on a central intermediary.

If you want, I can also tighten the intro and the 2017 to present paragraph so the flow feels more “blog-like” while keeping the exact same ideas and not adding anything new.

FAQs

Q1. What is the purpose of blockchain technology?

Blockchain helps multiple parties share the same records without a central authority. Its purpose is to make data verifiable, time-stamped, and hard to tamper with, so transactions and agreements can run with less reliance on intermediaries.

Q2. Who invented blockchain?

Blockchain became widely known through Bitcoin, introduced in 2008 by the pseudonymous creator Satoshi Nakamoto. Earlier research explored similar cryptographic ideas, but Bitcoin was the first major public system to implement blockchain at scale.

Q3. Is blockchain the same thing as cryptocurrency?

No. Crypto is an application built on blockchain. Blockchain is the underlying ledger technology that can support many use cases beyond currencies.

Q4. Why is hashing so important in a blockchain?

Hashing creates a “digital fingerprint” for each block and links it to the previous block, making the chain hard to alter without breaking those links.

Q5. What happens if someone tries to change data in an old block?

Because blocks are linked by hashes and protected by consensus, changing old data would require redoing the related hashes and getting the network to accept it, which is not practical.