Bitcoin halving - One of the most important mechanisms shaping Bitcoin’s four-year cycle. It is a core concept every investor should understand before entering the crypto market.

Beyond its direct impact on price, Bitcoin halving is part of a broader set of mechanisms that interact to shape the entire Bitcoin network. So what exactly is Bitcoin halving?

What Is Bitcoin Halving?

Bitcoin halving is a pre-programmed event in the Bitcoin protocol that cuts the block reward for miners by half every time 210,000 blocks are mined, which takes roughly four years since each block takes around 10 minutes to complete.

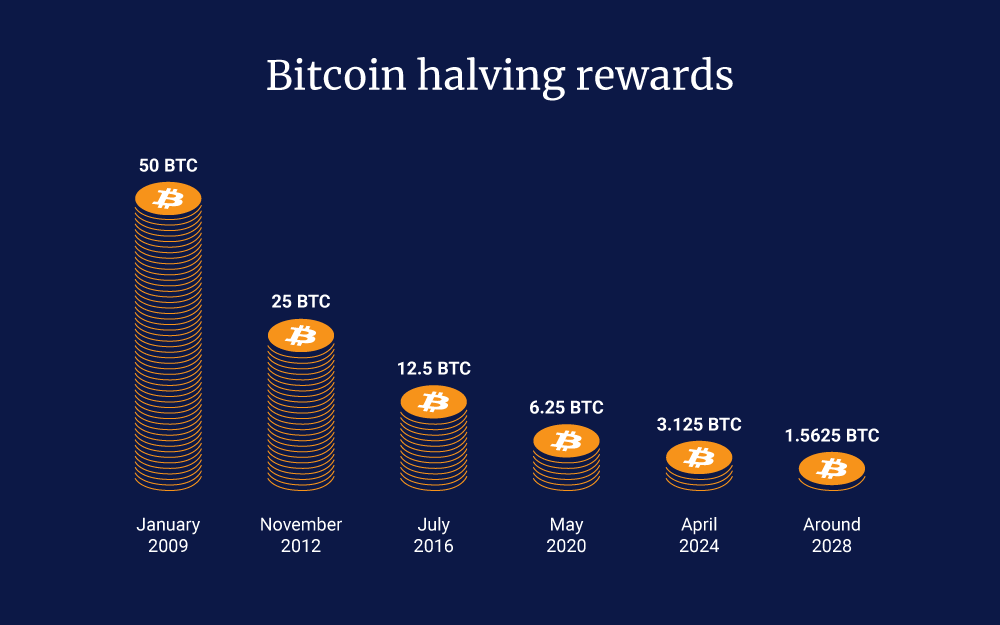

At launch, miners earned 50 BTC per block. After each halving, this reward is reduced by half. In the most recent halving in April 2024, the block reward dropped from 6.25 BTC to 3.125 BTC.

From a philosophical perspective, halving acts as an automatic supply-tightening mechanism inspired by gold mining: the deeper you dig, the harder it becomes, but the value rises because of scarcity.

Unlike fiat currencies that can be printed endlessly, Bitcoin uses halving to preserve long-term sustainability, turning it into a form of digital gold without the need for central banks.

Past Bitcoin Halving Events

Looking back, halving is not just a technical event; it often acts as the spark that ignites major market cycles. The first halving in 2012 drew early investor attention and showed that scarcity could push prices up hundreds of times.

By the second halving in 2016, the market witnessed a historic bull run with Bitcoin surging 30x and crypto adoption accelerating worldwide.

The third halving in 2020 took place during the COVID-19 pandemic and pushed Bitcoin to a new all-time high, rising around 8× thanks to economic stimulus and institutional demand. The fourth halving in 2024 has so far been followed by a post-halving peak of around $126K

Halving 1 - November 28, 2012

- Block height: 210.000

- Reward: 50 BTC → 25 BTC

- Price before halving: ~ $12

- Peak after halving: ~ $1.150 (Dec 2013)

Halving 2 - July 9, 2016

- Block height: 420.000

- Reward: 25 BTC → 12.5 BTC

- Price before halving: ~ $650

- Peak after halving: ~ $19.800 (Dec 2017)

Halving 3 - May 11, 2020

- Block height: 630.000

- Reward: 12.5 BTC → 6.25 BTC

- Price before halving: ~ $8.800

- Peak after halving: ~ $69.000 (Nov 2021)

Halving 4 - April 19, 2024

- Block height: 840.000

- Reward: 6.25 BTC → 3.125 BTC

- Price before halving: ~ $64.000

- Peak after halving: ~ $126.000 (Oct 2025)

History shows that the strongest impact of each halving usually appears 12 to 18 months later, once the tighter supply has had time to work through the market. From a cycle perspective, a halving typically marks the start of a new accumulation phase, followed by a bull run, then a period of distribution, and finally a bear market that lasts until the next halving.

The current cycle after the 2024 Bitcoin halving, however, already looks different from previous ones. Bitcoin reached a new all-time high before halving instead of many months after it, and this cycle is unfolding in a market with spot Bitcoin ETFs, larger institutional participation and a more mature derivatives structure.

These factors can both speed up price discovery and reduce some of the extreme volatility seen in earlier cycles, so investors should not assume that post-halving performance will simply repeat the patterns of 2012, 2016 or 2020.

Why Does Bitcoin Halving Matter?

The Role of Bitcoin Halving

Bitcoin halving is one of the key mechanisms that defines how Bitcoin works.

- It gradually slows down the rate of new Bitcoin entering circulation, making BTC more scarce over time.

- Every four years, the block reward that miners receive is cut in half, which reduces the supply of new coins from mining.

This predictable schedule is what separates Bitcoin from traditional currencies. Central banks can increase or decrease money supply at any time, but Bitcoin’s issuance is coded and transparent. For many investors, halvings act as “checkpoints” that reinforce the narrative of Bitcoin as a scarce, programmable form of money similar to digital gold.

Halving events also force the mining industry to rebalance.

- When rewards are cut, only miners with efficient operations and access to cheap energy can stay profitable.

- Over time, this tends to push the network toward more professional, long-term players, which can improve security and stability for the entire ecosystem.

Impact of Bitcoin Halving on Bitcoin and Altcoin Prices

From a market perspective, halving matters because it changes the balance between supply and demand. When daily new supply drops while demand holds steady or increases, there is less Bitcoin available for buyers, which historically has supported higher prices over the following months. This effect is not instant, but it often shapes the medium-term trend for each cycle.

Halving also influences how capital moves between Bitcoin and the rest of the crypto market.

- In many past cycles, liquidity first flowed into Bitcoin as investors positioned around the halving narrative.

- If Bitcoin performed well and confidence increased, part of that capital later rotated into altcoins, creating separate “altcoin seasons” with higher volatility and returns.

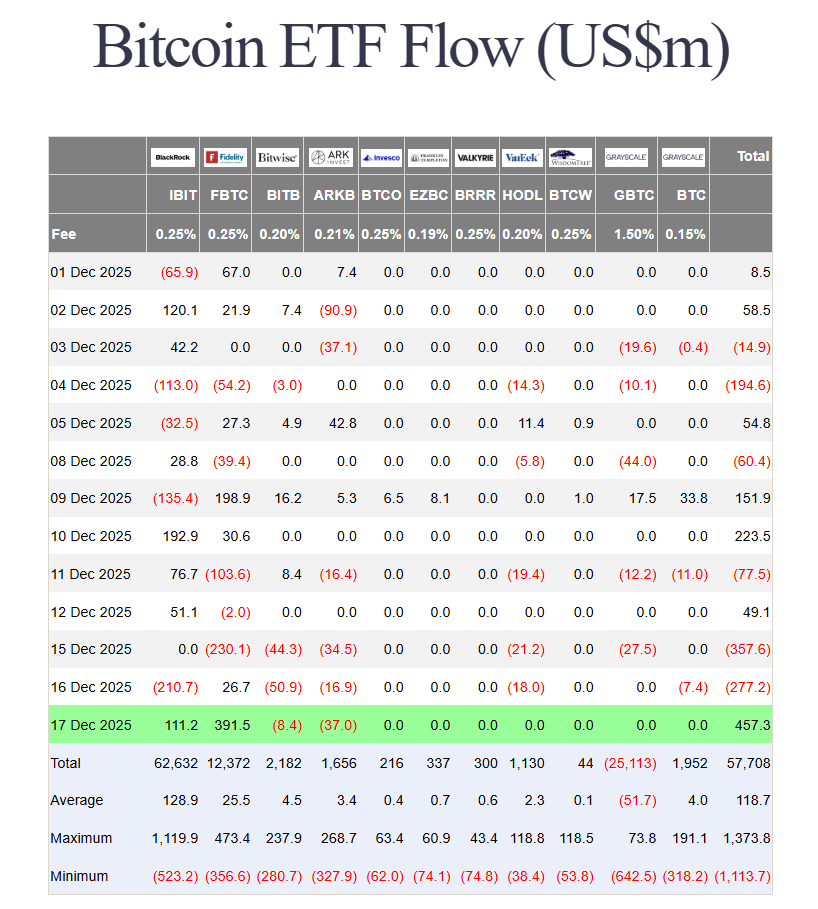

However, the impact is not guaranteed and each cycle has its own context. Macroeconomic conditions, regulation, ETF flows and overall risk appetite can amplify or weaken the typical post-halving pattern. That is why halving should be seen as an important structural factor, but not the only driver of Bitcoin and altcoin prices.

Economic Perspective on Halving

Halving is essentially a supply shock: the issuance of new Bitcoin drops from about 900 BTC/day to 450 BTC/day after the 2024 halving. If demand stays the same or increases, price tends to rise based on basic supply - demand principles.

But the effects are not always smooth. In practice, halving can trigger short-term price drops because miners sell coins to cover costs, or because traders take profits after a strong pre-halving rally

Miners are the group most directly affected. Their revenue is instantly cut, while electricity and hardware costs remain high. Smaller miners may shut down or be absorbed by larger ones, making the industry more concentrated.

On the positive side, halving pushes miners toward innovation using renewable energy to reduce costs, improving efficiency, and relying more on transaction fees to compensate for shrinking rewards. Overall energy consumption may also decrease as inefficient miners exit, improving Bitcoin’s environmental footprint.

What Happens When the Block Reward Gets Too Small?

The current block reward is 3.125 BTC. By the next halving in 2028, it will drop to 1.5625 BTC, and then to 0.78125 BTC in 2032.

The obvious question is:

“Will such small block rewards still be enough to keep miners securing the network?”

Bitcoin is secure today because miners verify transactions and maintain the network. They earn money through two sources:

- Block rewards for validating new blocks.

- Transaction fees collected from network activity.

In the first ~15 years, nearly 20M BTC has already been mined out of the total supply of 21M. Based on current math, all Bitcoins will be fully mined around 2140. That means from 2025 to 2140, only about 1M BTC remains to be mined.

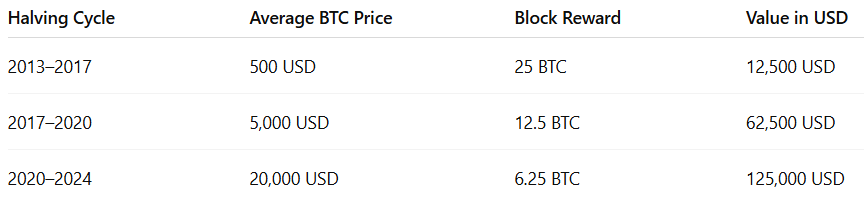

To understand the sustainability of mining, Bitcoin’s price over time should be considered. The table shows that although block rewards shrink, the value of those rewards keeps rising because Bitcoin’s price tends to increase over long periods helping keep mining profitable enough to secure the network.

As long as Bitcoin demand persists, and new supply keeps declining, prices can remain high enough to support miners.

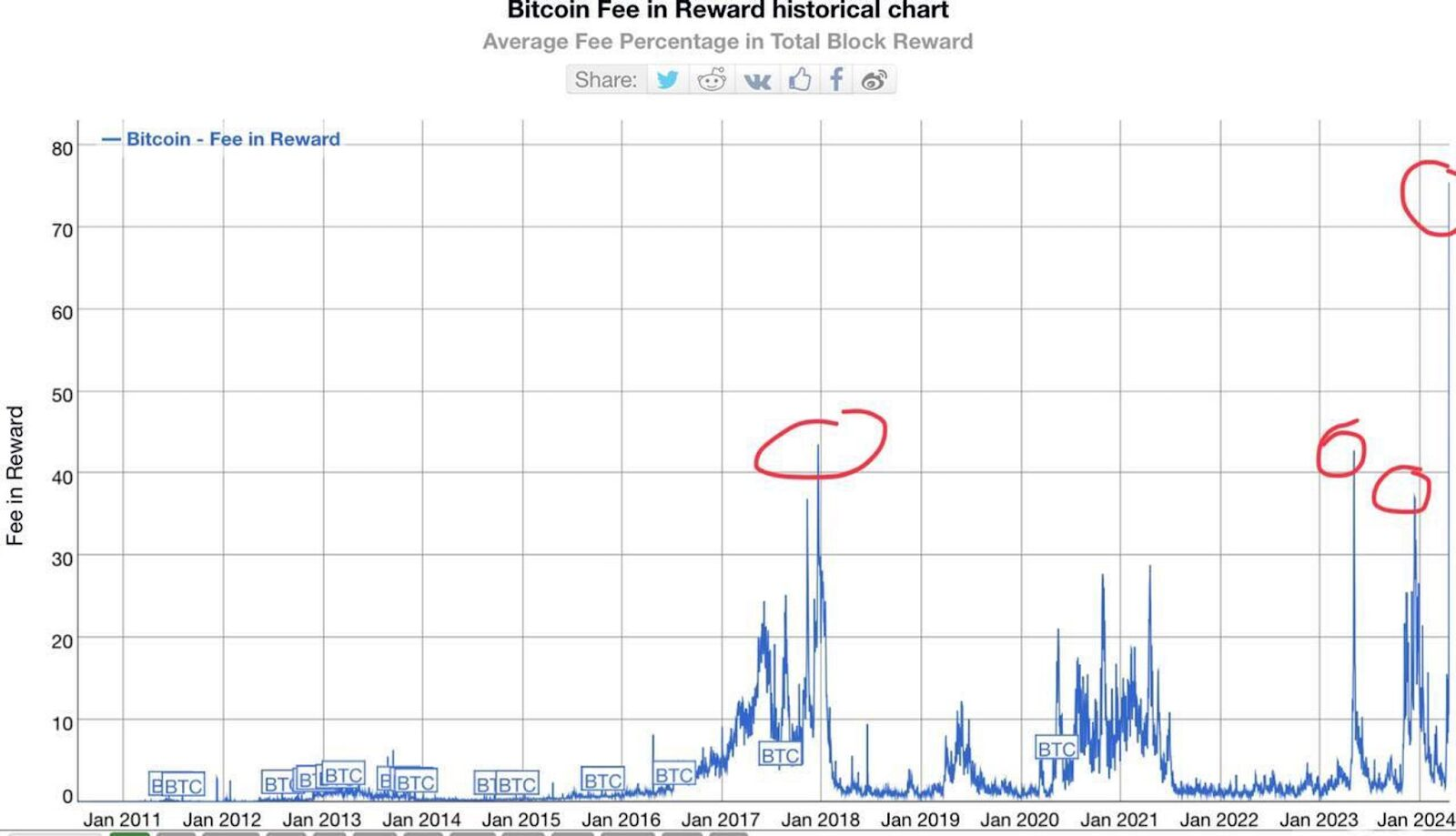

When all BTC is mined (around 2140), miners will rely entirely on transaction fees.Although transaction demand on Bitcoin Layer 1 isn’t high today, new trends such as Ordinals, BRC-20, and BTCFi are increasing on-chain activity.

During peak periods, Bitcoin fees can range from a few hundred dollars to more than a thousand dollars per transaction, creating meaningful revenue for miners.

Conclusion

Bitcoin Halving is far more than a technical milestone, it is a living symbol of programmed scarcity that shapes the long-term value of digital gold.

Across historical cycles, economic behavior, and miner dynamics, we can clearly see that halving drives innovation, controls inflation, and reinforces Bitcoin’s cyclical growth patterns.

However, in the volatile global environment of 2025, halving also reminds investors of the need for patience, research, and risk awareness, because scarcity does not guarantee an instant “moonshot.”

FAQs

Q1: Why is Bitcoin halving considered such an important event?

Bitcoin halving reduces the amount of new BTC created every day. This makes Bitcoin more scarce over time. Because of that, halving can influence long-term price trends, miner behavior, and even how the whole Bitcoin ecosystem develops.

Q2: Does Bitcoin halving always make the price go up?

No, halving does not guarantee that the price will go up immediately. In past cycles, strong bull runs often happened months after halving, not on the exact day. There can be short-term dumps, sideways price action, or long consolidation before any major move.

Q3: How exactly does Bitcoin halving affect miners?

When a halving happens, miners receive only half the previous block reward, while their costs for electricity, machines, and maintenance stay the same. This squeezes their profit margins, forcing less efficient miners to shut down or upgrade, and pushing the industry toward larger and more professional mining operations.

Q4: What are the main risks if block rewards keep getting smaller?

As block rewards shrink, some miners might find it no longer profitable to secure the network. If too many miners drop out, hash rate and security could be affected. The network would then rely more heavily on transaction fees and on a smaller group of mining players, which may raise concerns about centralization.

Q5: How will Bitcoin stay secure after all 21M BTC are mined?

Once all BTC has been issued, miners will earn only from transaction fees. For the network to remain secure, there must be enough on-chain activity and enough users willing to pay fees. New use cases like Ordinals, BRC-20, and BTCFi may help create that long-term demand for block space

Q6. What is the next Bitcoin halving?

The next Bitcoin halving is expected around 2028. At that point, the block reward paid to miners will drop from 3.125 BTC to 1.5625 BTC per block. By cutting new issuance in half, the halving slows the rate at which new Bitcoin enters circulation and strengthens its built-in scarcity over time. This programmed schedule is a key part of Bitcoin’s monetary design and one reason it is often compared to scarce assets like gold.