From an anonymous idea launched in 2009, Bitcoin quickly moved beyond the cypherpunk niche and stepped into global finance.

Within just a few years, major corporations such as Tesla, MicroStrategy and PayPal started adding BTC to their balance sheets, while US-approved spot Bitcoin ETFs opened the door for strong institutional capital inflows.

This shift from an “outsider” asset to a widely recognized macro asset class raises an important question: What is Bitcoin and where does its value come from?

What is Bitcoin?

Bitcoin is the world’s first cryptocurrency, created on blockchain technology by an anonymous figure known as Satoshi Nakamoto and introduced in 2009. Its launch laid the foundation for today’s crypto market.

Bitcoin operates as a peer to peer network, which means the sender transacts directly with the receiver without going through any intermediary. This cuts out unnecessary fees and makes each transaction much cheaper than traditional international transfers.

Bitcoin is denominated not only in BTC but also in a smaller unit called the satoshi (or sat), named after the creator of Bitcoin.

Satoshi to BTC conversion:

- 1 satoshi = 0.00000001 BTC

- 10 satoshis = 0.00000010 BTC

- 100 satoshis = 0.00000100 BTC

- 1,000 satoshis = 0.00001000 BTC

- 10,000 satoshis = 0.00010000 BTC

- 100,000 satoshis = 0.00100000 BTC

- 1,000,000 satoshis = 0.01000000 BTC

- 10,000,000 satoshis = 0.10000000 BTC

- 100,000,000 satoshis = 1.00000000 BTC

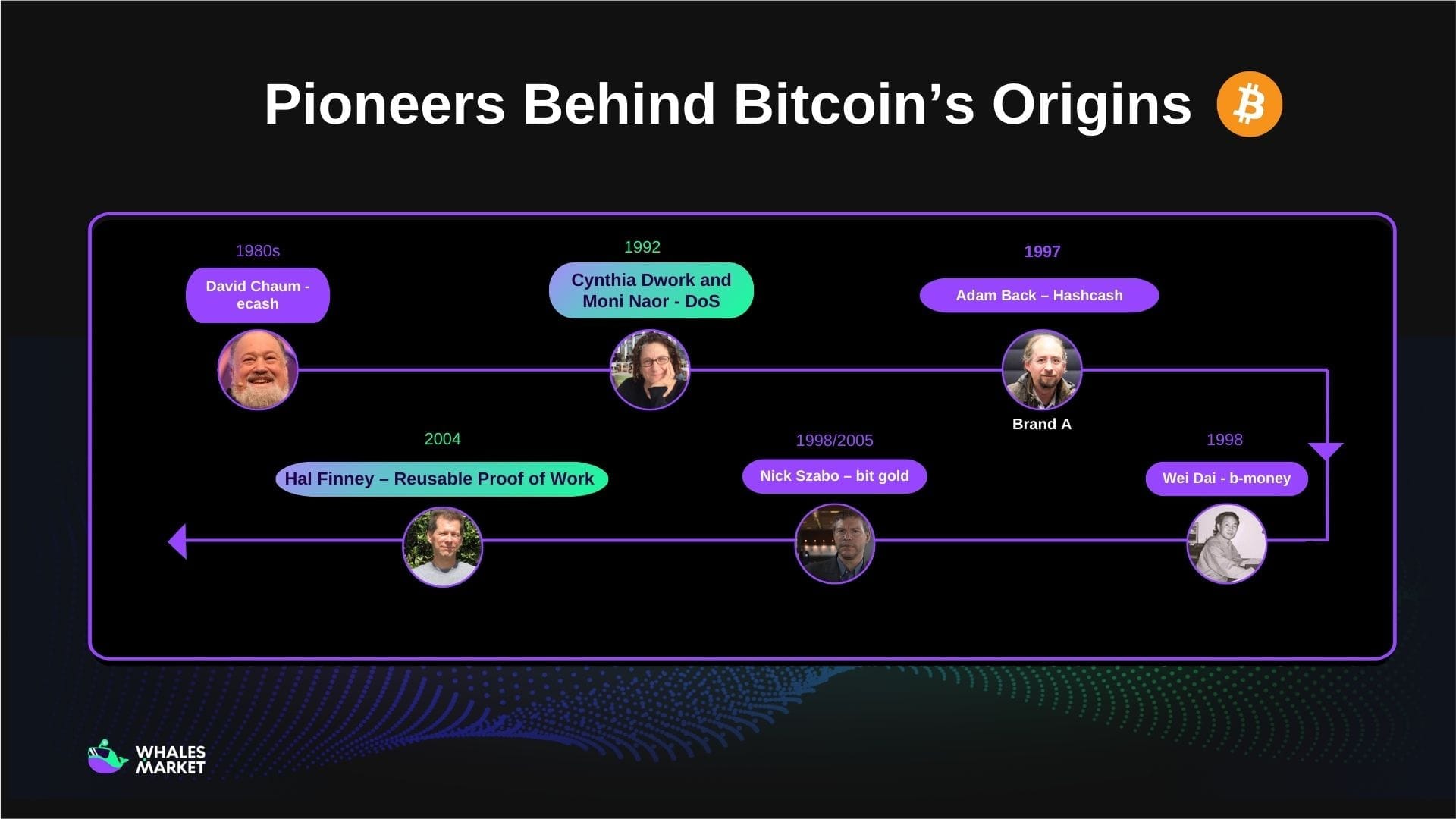

The Origins of Bitcoin

Bitcoin was not a completely sudden breakthrough. Satoshi Nakamoto designed it based on many earlier experiments:

- David Chaum and ecash (1980s): David Chaum founded DigiCash, a company that built eCash, one of the earliest anonymous digital money systems. eCash used blind signatures to provide payer anonymity while still relying on banks to issue and redeem the digital tokens, meaning the system remained centralized. Commercial adoption was limited, and only a few banks experimented with the technology. After several failed partnerships and insufficient traction, DigiCash ultimately filed for bankruptcy in 1998.

- Cynthia Dwork and Moni Naor – Proof of Work (1992): In 1992, Dwork and Naor proposed adding a small computational puzzle to each request as a way to fight spam and denial-of-service (DoS) attacks. The sender had to solve a moderately hard puzzle, while the receiver could verify it quickly. Although this idea was not widely adopted at the time, it later inspired proof-of-work systems such as Hashcash and, eventually, Bitcoin’s consensus mechanism.

- Adam Back – Hashcash (1997): Adam Back invented Hashcash as a practical PoW application to combat email spam and denial of service attacks, requiring the sender to find a nonce so that the hash starts with a certain number of leading zeros. Hashcash was never commercialized at scale, but it became the direct predecessor of Bitcoin’s PoW block mining mechanism.

- Wei Dai - b-money (1998): Wei Dai proposed b-money as a distributed digital money system, where users create coins through PoW and transact through a public ledger with digital signatures, without intermediaries. Although it remained theoretical and lacked a Sybil resistance mechanism, b-money was cited by Satoshi in the Bitcoin whitepaper as an important inspiration.

- Nick Szabo – bit gold (1998/2005): Nick Szabo introduced bit gold, where users “mine” strings of bits using PoW and store them on a distributed registry to prevent double spending, mimicking the scarcity of gold. The project was never fully implemented because of synchronization and double spending challenges, but it is considered the closest predecessor to Bitcoin with PoW and an immutable hash chain.

- Hal Finney – Reusable Proof of Work (2004): Hal Finney developed RPOW to allow PoW tokens to be reused and transferred multiple times, inspired by Hashcash and bit gold, with a central server ensuring that each token was only used once. Although it still relied on a centralized server and was not truly decentralized, RPOW was a step very close to digital currency and strongly influenced Bitcoin. Hal Finney was also the first person to receive a BTC transaction.

How does Bitcoin work?

Bitcoin operates on blockchain technology, a distributed ledger where all information is stored as a chain of blocks that are tightly linked together using the SHA-256 cryptographic hash algorithm.

The entire Bitcoin network is built from the following core components:

- Blockchain: The blockchain is a chronological chain of blocks starting from the genesis block. Each block groups a batch of transactions and becomes part of the permanent record of balances and history. Every block has a unique header that includes the previous block hash, a Merkle root of the transactions, a timestamp, and a nonce. Linking blocks with hashes makes it very hard to change past data.

- SHA-256 hash function: Bitcoin uses the SHA-256 algorithm to turn any input into a fixed-length 256-bit hash. Hashes are used in block headers, in the Proof of Work process, and when creating addresses, making any tampering with data easy to detect.

- UTXO model, addresses and transactions: Bitcoin tracks coins as Unspent Transaction Outputs (UTXOs). A transaction uses existing UTXOs and creates new ones, while wallet software calculates a user’s balance by summing the UTXOs controlled by their addresses.

- Nodes and miners: Full nodes store the entire blockchain, enforce Bitcoin’s consensus rules, and relay transactions across the network. Miners are nodes that additionally run Proof of Work, collecting valid transactions into blocks and proposing them to the network.

- Proof of Work and difficulty: In Proof of Work, miners repeatedly hash the block header with different nonce values until the result is below the current difficulty target. The difficulty automatically adjusts every 2,016 blocks so that, on average, one block is found roughly every 10 minutes.

- Mempool: Before transactions are written into a block, they sit in the mempool of each node once they are validated. Miners select transactions from this pool, usually prioritising those that pay higher fees, and include them in the next block they mine.

Bitcoin’s notable upgrades

Bitcoin has gone through several major upgrades over time that have improved its scalability, privacy, and usability. Some notable updates include:

- SegWit (Segregated Witness 2017) is an upgrade that moves signature data out of the main transaction, letting each block fit more transactions, lowering fees, and fixing transaction malleability so Layer-2 solutions like Lightning can work safely.

- Lightning Network (2018) is a Layer-2 payment network where users lock BTC on-chain and then send instant, low-fee payments off-chain through payment channels, only touching the blockchain when channels are opened, closed, or disputed.

- Taproot is a 2021 upgrade that uses Schnorr signatures and new script logic so complex spending conditions can look like simple payments, which improves privacy, reduces on-chain data, and makes batching more efficient.

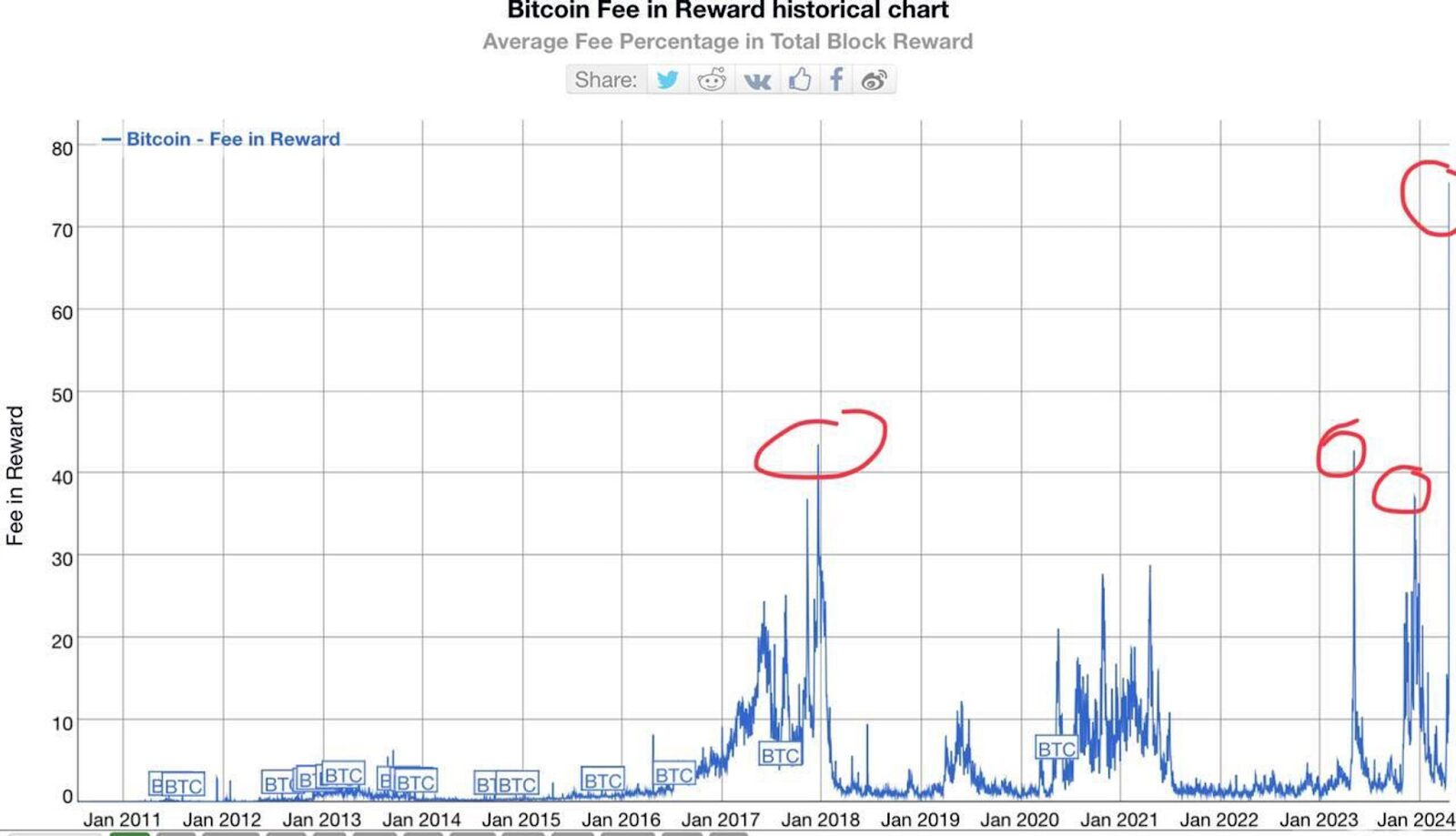

- Ordinals/Inscriptions (2023) are a way to give each satoshi (sats) a serial number and “inscribe” data onto it using Taproot. It enables NFTs and other digital artifacts directly on Bitcoin and increases demand for blockspace and miner fees.

- Runes Protocol (4/2024) is a fungible token standard that uses Bitcoin’s UTXO model to issue and transfer tokens directly on the base layer in a simpler, more efficient way than earlier designs, aiming to reduce UTXO bloat and make token issuance on Bitcoin cleaner for builders.

Bitcoin’s Features: Where Does Bitcoin’s Value Come From?

Scarcity

A key feature of Bitcoin is its fixed supply. There will only ever be 21M BTC. This supply cannot be changed or controlled by any individual or organization. When users transact with Bitcoin, their transaction data is recorded on the blockchain and cannot be altered, which helps ensure both security and transparency.

Mining BTC is getting increasingly difficult. When total network hashrate rises, the mining difficulty automatically adjusts upward, forcing miners to invest in more powerful hardware and optimize electricity and technology costs if they want to stay competitive and keep finding new blocks.

As of November 16, 2025, around 19,950,000 BTC have been mined and only about 1M BTC remain unmined.

Decentralization

Bitcoin is designed so that no single bank, company, or government is in charge of processing transactions. In practice, anyone in the world can run a node, verify the rules of the protocol, and broadcast transactions to the network.

Because these nodes and miners are spread across many countries and operators, no central party can unilaterally block payments, reverse transactions, or change users’ balances.

This decentralized structure reduces the concentration of power, limits the risk of censorship or manipulation, and keeps Bitcoin independent of any government, bank, or company. With no single point of failure, it is also much harder for hackers to attack and bring down the entire system.

Security

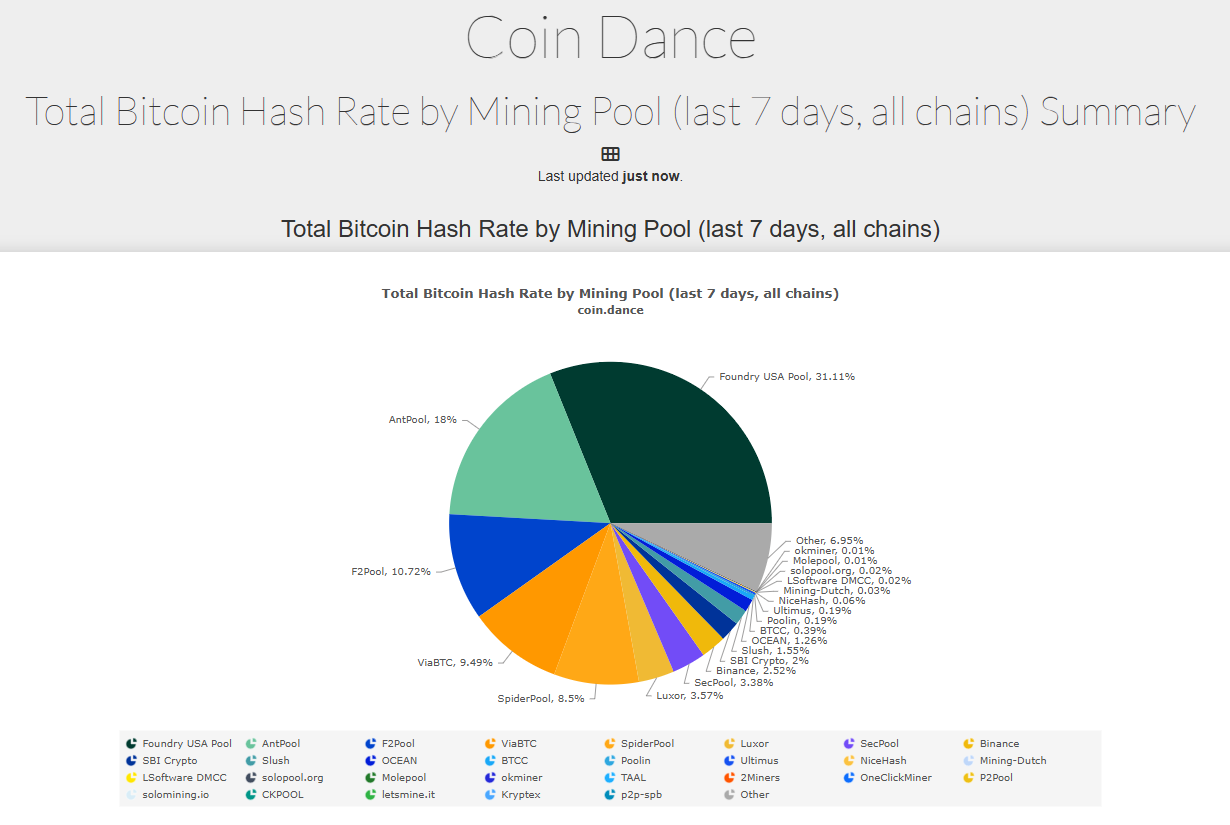

In theory, the Bitcoin network could be attacked in a few ways. One common example is a 51% attack, where a single miner or mining group controls more than half of the total hashrate*.

*Hashrate is the total computing power used by miners to secure a blockchain network.

With that much power, they could create a longer “alternative” version of recent blocks, temporarily censor certain transactions, or even reverse payments they themselves made by reorganizing the last few blocks.

One notable attack vector is a double-spending attack. In simple terms, this means trying to use the same BTC twice. For instance:

- Sending BTC to a merchant, receiving the goods.

- Then broadcasting or mining a conflicting transaction that sends those same coins back to the attacker. If the attacker’s version of the chain is accepted by the network, the merchant’s transaction disappears.

In practice, these attacks have been almost impossible so far due to the decentralization feature and others two main reasons:

- SHA-256 algorithm: This is a one-way hash function that is practically irreversible. Research from the University of Sussex estimates that a quantum computer would need about 317 million qubits to break Bitcoin within one hour, while the most powerful machines today are only around 127 qubits.

- Immutability of data: Once a transaction is written to the blockchain and has enough block confirmations, it is effectively etched in stone. No node or individual has the authority to modify, reverse, or reclaim those BTC, which makes successful double-spends extremely difficult.

Transparency

With fiat currencies such as USD, people only know the money supply from data published by central banks. It is very hard to independently verify it or track individual bills after issuance.

In contrast, all Bitcoin data is stored on the blockchain:

- Anyone can use a block explorer to view total supply, block count, transactions and addresses.

- Anyone can become a miner or run a node to verify data themselves instead of trusting a third party.

Property rights

Bitcoin strengthens property rights by giving individuals full control over their assets without relying on a bank, government, or third party. Because ownership is recorded on a decentralized blockchain and secured by private keys, no central authority can freeze, seize, or prevent someone from accessing their Bitcoin. As long as a person controls their private keys, they effectively control their funds anywhere in the world.

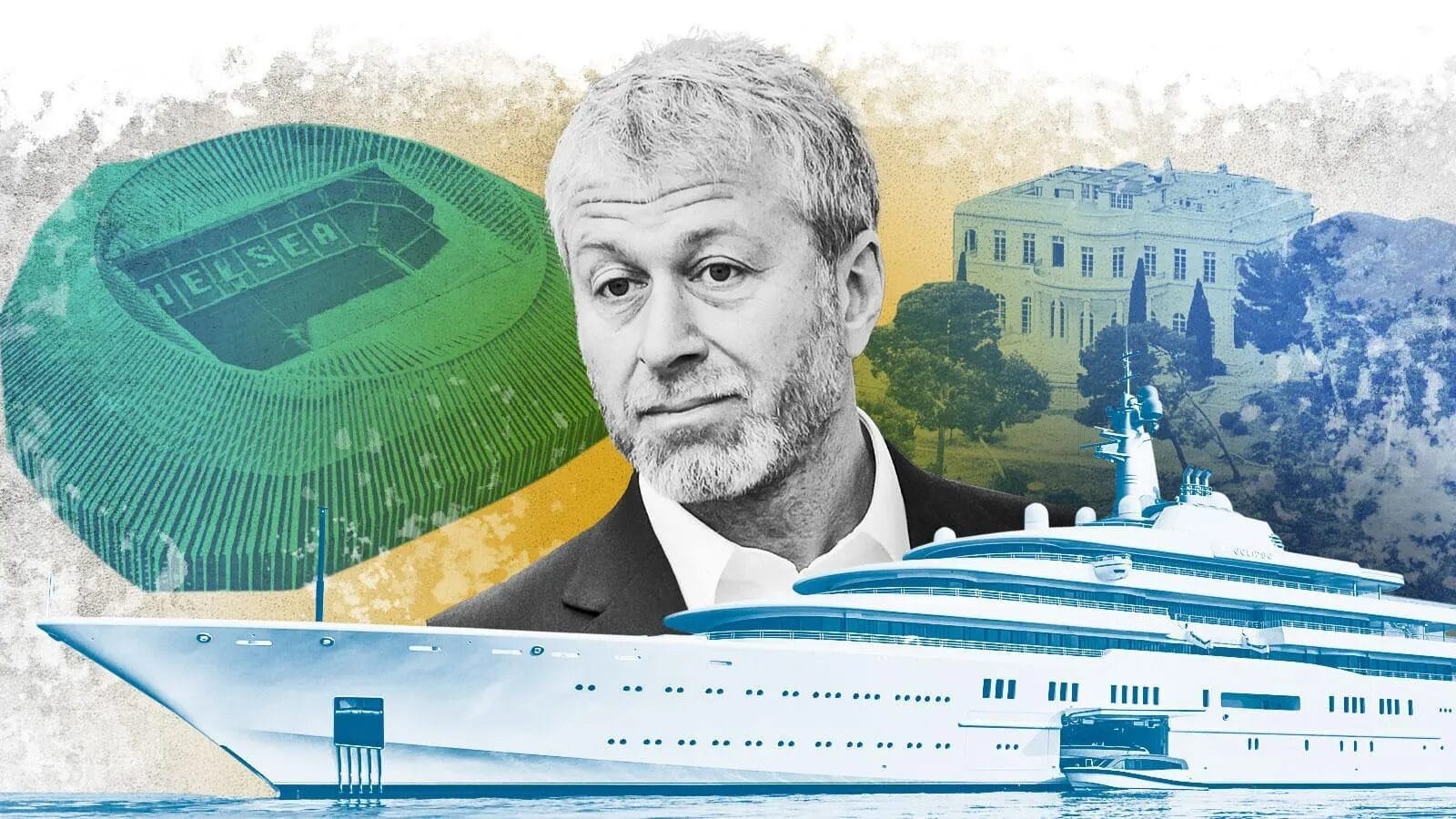

A real-world example that illustrates this contrast is the case of Roman Abramovic, a Russian billionaire who faced serious asset problems when the war between Russia and Ukraine broke out.

About £3.2B worth of his assets were frozen by the UK government even though he was the legal owner of those assets. He was not allowed to sell Chelsea Football Club or his houses in London.

In another example, imagine a family that owns houses, cars, gold in safes and real estate in any country. If civil war breaks out or the nation is invaded, what would everyone do?

- Leave assets behind and move to safety?

- Carry a huge amount of cash and flee with the crowd?

With Bitcoin, the story is different:

- Everyone truly owns BTC as long as they remember the 12 to 24 words of their wallet seed phrase.

- Users can carry those 24 words anywhere in the world.

- No one can confiscate or freeze their BTC.

Note: Seed phrase is a 12-24 word backup that can fully restore a Bitcoin or crypto wallet and all of its funds. It’s the ultimate key to ownership whoever controls the seed phrase controls the assets.

Because of that, a seed phrase must never be shared, photographed, stored online, or given to anyone, since if someone else gets it, they can immediately access, transfer, and permanently steal all of your crypto with no way to reverse it.

The Limitations of Bitcoin

Despite its advantages, the Bitcoin network still has several weaknesses:

- Low block size of 1 MB.

- Slow network with only about 7 to 10 transactions per second.

- High transaction fees, especially when network activity is high. During the Ordinals boom, there were times when fees spiked to several hundred dollars for a single transaction.

- Limited application layer because Bitcoin does not support smart contracts. This is also why Ethereum was created and became the foundation for many current Layer 1 blockchains. However, since 2024, Bitcoin ecosystem has started to expand, with developments/protocols such as Bitcoin Ordinals/Runes and emerging Bitcoin Layer 2 solutions gradually increasing what can be built on top of Bitcoin.

Since Bitcoin’s launch, many solutions have been introduced to address these limitations. Hard forks have not brought real value to Bitcoin itself, so attention often focuses on upgrades and external layers that have a direct impact, such as SegWit, SegWit2x and the Lightning Network.

The Role of BTC in Today’s Financial System

Bitcoin has gone through an extraordinary journey. It started as a crazy idea rejected by most financial institutions and governments, and has now become a mainstream asset widely recognized in the global financial system.

Corporate level: From balance sheets to ETFs

This shift began from the lowest level, with retail investors, and then expanded to corporations:

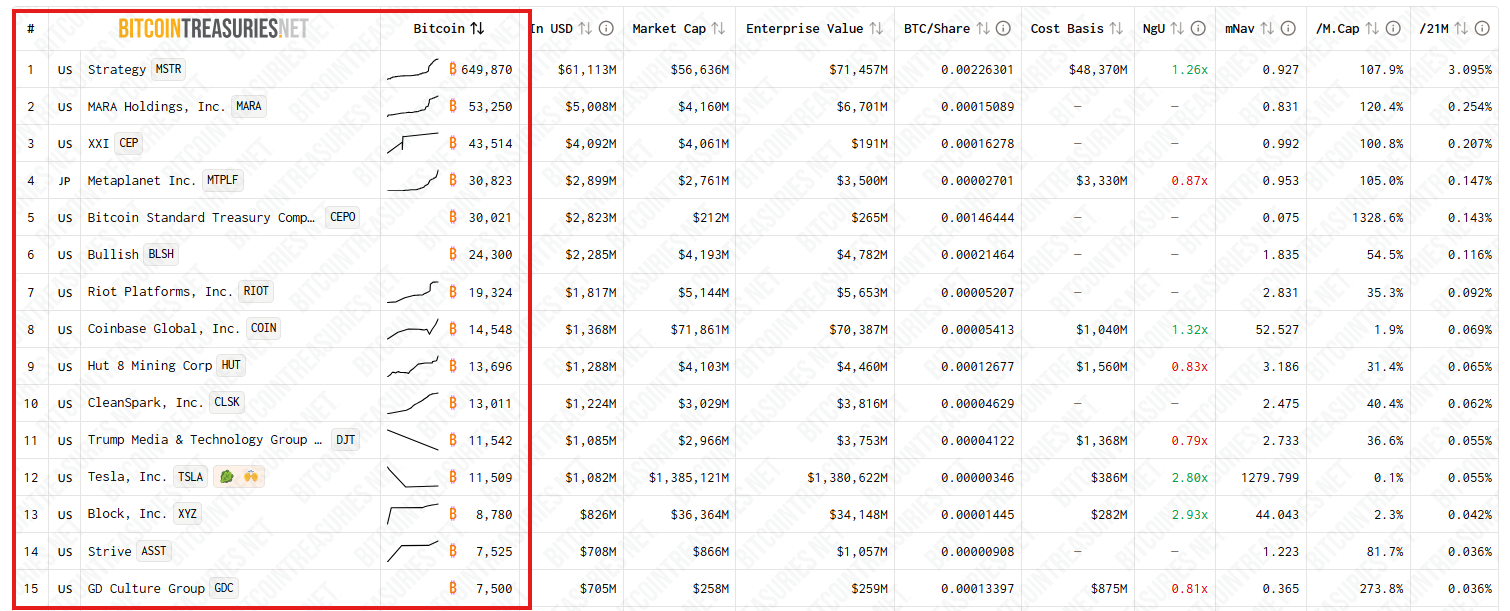

- From 2020 to 2021, large companies such as Tesla, which bought $1.5B worth of BTC, and MicroStrategy, which now holds over 640,000 BTC, began adding Bitcoin to their reserves and treating it as digital gold to hedge inflation.

- By 2025, according to bitcointreasuries.net, 209 public companies held BTC, while organizations like Square (now Block) and PayPal helped bring Bitcoin to millions of retail users.

The next turning point was the approval of spot Bitcoin ETFs in the United States in 2024, which opened the door for institutional capital. By November 2025, Bitcoin ETFs had recorded a total of $57.6B in net inflows, with BlackRock’s IBIT leading the group at roughly $62.7B in cumulative inflows.

A Bitcoin ETF (Exchange-Traded Fund) is an investment fund that tracks the price of Bitcoin and trades on traditional stock exchanges. Instead of buying and storing Bitcoin directly, investors can buy shares of the ETF, which represent exposure to Bitcoin’s price movements.

According to CDP, more than a quarter of the world's major asset managers indirectly own BTC through ETFs, which has helped Bitcoin increasingly be viewed as a mainstream asset class comparable to gold or equities, although there are still capital flow fluctuations and regulatory risks.

Nation states: From legal tender to early reserve experiments

At the highest level, on the nation state scale, El Salvador became the first country to adopt BTC as legal tender in 2021, kicking off a wave of Bitcoin accumulation by governments.

In 2025, under President Trump, the United States established a Strategic Bitcoin Reserve. Countries such as Luxembourg, the Czech Republic, Taiwan, Pakistan have been exploring or discussing policies related to Bitcoin, ranging from pilot purchases and draft legislation to reserve proposals but they have not yet officially confirmed large-scale BTC holdings as national reserves.

By November 2025, Bitcoin’s market capitalization exceeded $1.9T, accounting for more than 50 percent of the entire crypto market. Around 73 percent of the supply was held long term by institutions and governments.

Conclusion

Bitcoin has evolved from an experimental digital currency into a global asset watched by individuals, institutions, and even governments. Its fixed supply, open infrastructure, and growing liquidity continue to shape how people think about money and value on the internet.

Even though short-term price swings are hard to avoid, understanding the factors behind Bitcoin’s security and demand can help investors decide whether Bitcoin fits their long-term strategy.

FAQs

Q1. Why is Bitcoin considered a foundational asset in crypto?

Bitcoin is viewed as the foundation of the crypto ecosystem because it introduced the first decentralized digital currency model in 2009. Its design proved that a monetary system could operate securely without a central authority. This breakthrough inspired the development of thousands of new blockchain projects.

Q2. What makes Bitcoin different from traditional digital money?

Traditional digital money relies on banks or payment processors to approve and manage transactions. Bitcoin removes these intermediaries by using a peer-to-peer network and a public blockchain that anyone can verify. This means users can send value directly to each other without asking a third party for permission. As a result, Bitcoin enables more open, transparent, and censorship-resistant transactions.

Q3. Why does Bitcoin’s fixed supply matter?

Bitcoin’s maximum supply of 21M creates digital scarcity similar to precious metals. Because no one can print more BTC, it protects the asset from inflation caused by monetary expansion. This predictable supply schedule helps build trust among users and long-term investors. Over time, the fixed supply supports Bitcoin’s role as a potential store of value.

Q4. How does Bitcoin stay secure without a central authority?

Bitcoin’s security relies on the Proof of Work mechanism, where miners compete to validate transactions using computational power. Thousands of distributed nodes independently check every block, ensuring that no single actor can alter the ledger. Once recorded, blockchain data becomes tamper-resistant and extremely difficult to change. This collective verification process replaces the need for any central administrator.

Q5. Why do institutions and governments hold Bitcoin today?

Institutions and some governments view Bitcoin as a hedge against inflation and currency devaluation. Its limited supply and global liquidity make it an attractive long-term reserve asset. Bitcoin also offers diversification compared to traditional financial instruments. As adoption grows, it is increasingly seen as part of the broader digital-asset infrastructure.

Q6. Can I transfer Bitcoin to my bank account?

You can’t transfer Bitcoin directly to a bank account because Bitcoin exists on the blockchain, while bank accounts operate on the traditional banking system. However, you can convert your Bitcoin into local currency through an exchange. Once converted, the funds can be withdrawn to your bank like a normal transfer.