In the crypto market, identifying and understanding the signs of a bearish market can help traders adjust their strategies to manage risk or take advantage of opportunities from price dips. So what is Bearish? Let’s dive into this article.

What is Bearish in Crypto?

Bearish is a term describing a market state or trend where asset prices tend to fall. When a trader or investor says they have a bearish view, it means they predict that the price of an asset, stock, cryptocurrency, or market in general will fall in the near future.

The crypto market often experiences distinctly bearish periods when the prices of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), or other altcoins decline continuously for an extended period.

- Bitcoin (BTC): After peaking at nearly $20,000 in December 2017, Bitcoin experienced a massive price drop that lasted through 2018, losing over 80% of its value to around $3,000 by the end of the year. Then, Bitcoin reached $45,000 and plummeted to $16,000 following news of the FTX exchange's bankruptcy and the arrest of CEO Sam Bankman-Fried.

- Ethereum (ETH): After peaking at around $4,800 in late 2021, Ethereum fell to around $1,000 in mid-2022 during a strong bearish market.

Characteristics of a Bearish Market in Crypto

A bearish market in the cryptocurrency sector has the following prominent characteristics:

- Continuous price decline over an extended period: A bearish market can begin after a major sell-off, causing asset prices to fall rapidly, then continue to decline gradually or fluctuate slightly before falling again.

- Decreasing trading volume gradually: This indicates that investors are no longer willing to buy and selling pressure increases as investors try to exit the market. For example, trading volume in 2021 decreased over 70% after BTC hit $16,000.

- Negative market sentiment: During a bearish market, market sentiment is often very negative. Investors become anxious and sell off assets to minimize losses. Negative news tends to circulate more widely during bearish periods. Media coverage often emphasizes market risks, regulatory challenges, or project failures, increasing fear and uncertainty among investors. In this market, traders use Fear & Greed Index as a useful indicator to check the market sentiment.

- Increased market volatility: Bear markets often experience high volatility, with sharp price drops followed by brief and limited recoveries. These temporary rebounds are usually not strong enough to change the overall downward trend.

- Strong selling pressure: Selling pressure dominates the market as the number of sellers significantly exceeds buyers. This imbalance leads to oversupply, making it difficult for prices to stabilize or recover.

These characteristics create a vicious cycle, where negative sentiment and selling pressure reinforce each other, causing the market to continue to decline until sufficiently strong positive factors emerge to reverse the trend.

What Causes a Bearish Market in Crypto?

A bearish market in crypto is not merely the result of falling prices. It is a structural phase driven by shifts in liquidity, risk appetite, and collective psychology. Much like bull and alt cycles, bearish markets follow a recognizable pattern where capital retreats, narratives weaken, and confidence erodes across the ecosystem.

This process typically unfolds when both a capital withdrawal trigger and persistent negative pressure converge.

The primary trigger: Capital contraction and risk-off behavior

Bearish markets often begin when global liquidity tightens and investors shift into risk-off mode. During periods of economic slowdown or recession, disposable income declines and capital preservation becomes the priority. As a result, exposure to high-volatility assets like cryptocurrencies is reduced first.

Macroeconomic stress such as rising interest rates, tightening monetary policy, or declining growth expectations increases the opportunity cost of holding speculative assets. Capital flows out of crypto into cash, bonds, or traditional safe havens, shrinking overall market liquidity.

At the same time, regulatory and political developments can accelerate this withdrawal. Government restrictions, enforcement actions, or unclear legal frameworks introduce uncertainty that discourages new inflows and pushes existing participants to exit. Even the perception of regulatory risk is often enough to trigger widespread selling.

This initial contraction reduces trading volume, weakens price support, and sets the stage for a broader bearish phase.

The reinforcing pressure: Sentiment breakdown and structural stress

Once capital begins to exit, bearish markets are sustained by a deterioration in sentiment and market structure. Negative news cycles amplify fear, while pessimistic forecasts reinforce the belief that prices will continue to fall. Investors shift from seeking returns to minimizing losses, creating a self-reinforcing sell pressure.

Speculation plays a critical role in this phase. During prior bull cycles, excessive leverage and speculative excess often inflate asset prices beyond sustainable levels. When these bubbles burst, forced liquidations cascade through the market, accelerating downside momentum and erasing confidence.

Operational and structural stress further compounds the decline. Fluctuations in energy and raw material costs can impact mining economics, reducing network profitability and adding sell pressure from miners. Technical failures, exchange outages, or security breaches such as hacks undermine trust in market infrastructure, often triggering abrupt exits.

As liquidity thins, volatility increases, making recovery attempts fragile and short-lived. Projects delay development, user activity declines, and innovation slows, removing the fundamental drivers that could otherwise stabilize valuations.

Best Crypto Trading Strategies in a Bearish Market

Although a bearish market can be worrying for investors, it also presents many opportunities if the right strategies are applied. Below are some ways to capitalize on or protect assets during this period.

Short Selling

One of the most popular strategies in a bearish market is short selling. This strategy involves a trader borrowing an asset (crypto), selling it at the current price, and then buying it back at a lower price to repay the loan, profiting from the price difference.

How to apply Short Selling:

- Borrow the asset from an exchange that supports margin trading or derivatives trading.

- Sell the asset at the current price.

- Buy back the asset when the price falls, return the borrowed asset, and keep the difference as profit.

For example: You hold $10,000 worth of BTC. When the market falls, you open a short position selling the same amount of Bitcoin. As a result, your overall portfolio is not negatively impacted. Then, you use the profit from the short selling to increase your Bitcoin holdings.

DCA (Dollar-Cost Averaging)

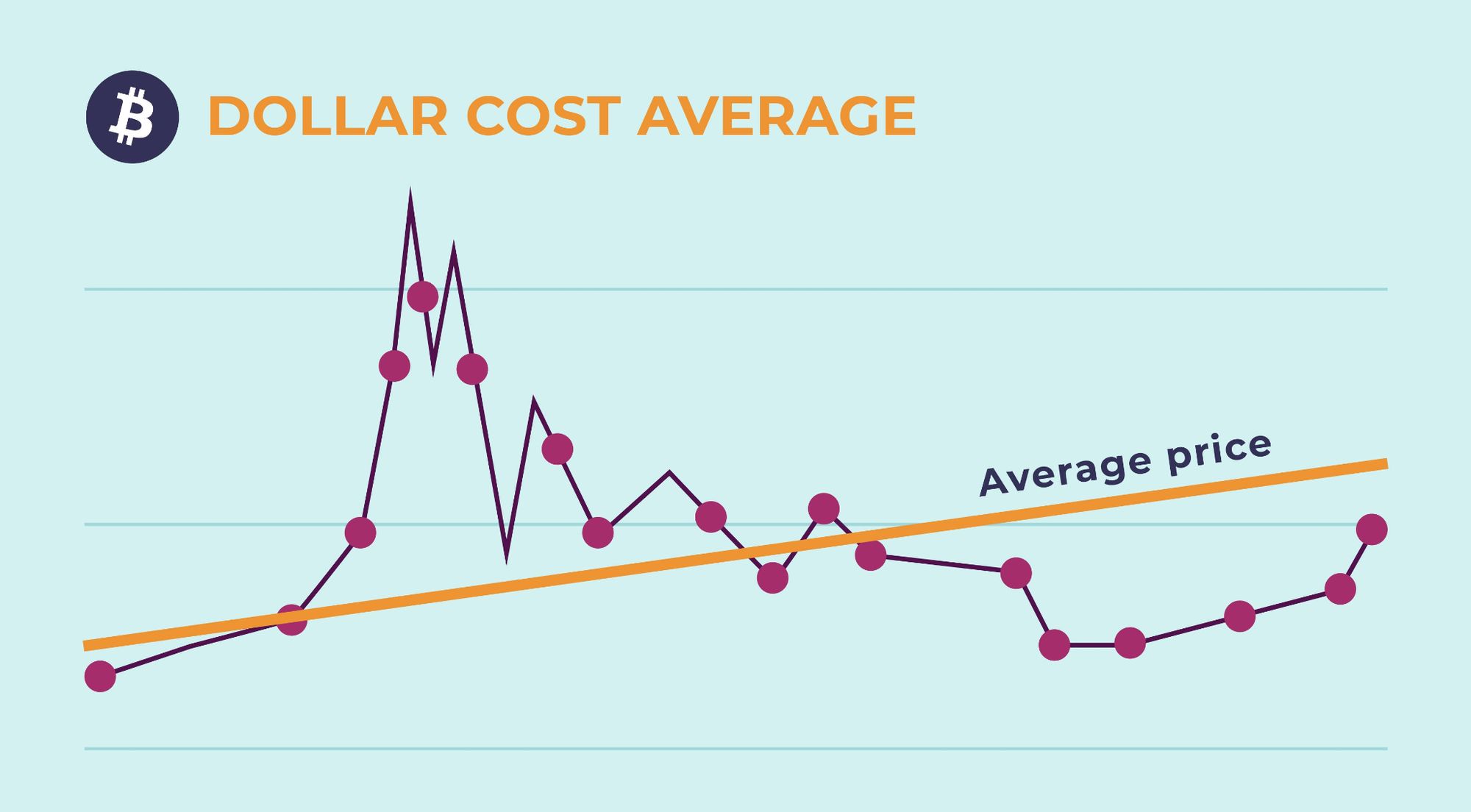

Use the DCA (Dollar-Cost Averaging) strategy by buying small amounts of the asset periodically, regardless of price. In a bearish market, this strategy helps investors average down their purchase price, minimize the risk of buying at the peak, and take advantage of low prices to accumulate assets for the long term.

If you believe in the long-term potential of Bitcoin but are unsure when the price will bottom out, you can buy small amounts of BTC weekly or monthly to reduce the impact of short-term price fluctuations.

Staking and Yield Farming

Instead of selling assets, investors can choose staking or yield farming. This method locks assets to receive rewards, helping to generate additional profits while waiting for the market to recover.

However, do not blindly rush into protocols that offer unusually high yields and lack a sustainable tokenomics model. These could be signs of a Ponzi scheme.

Learn more: How to earn by Staking Crypto

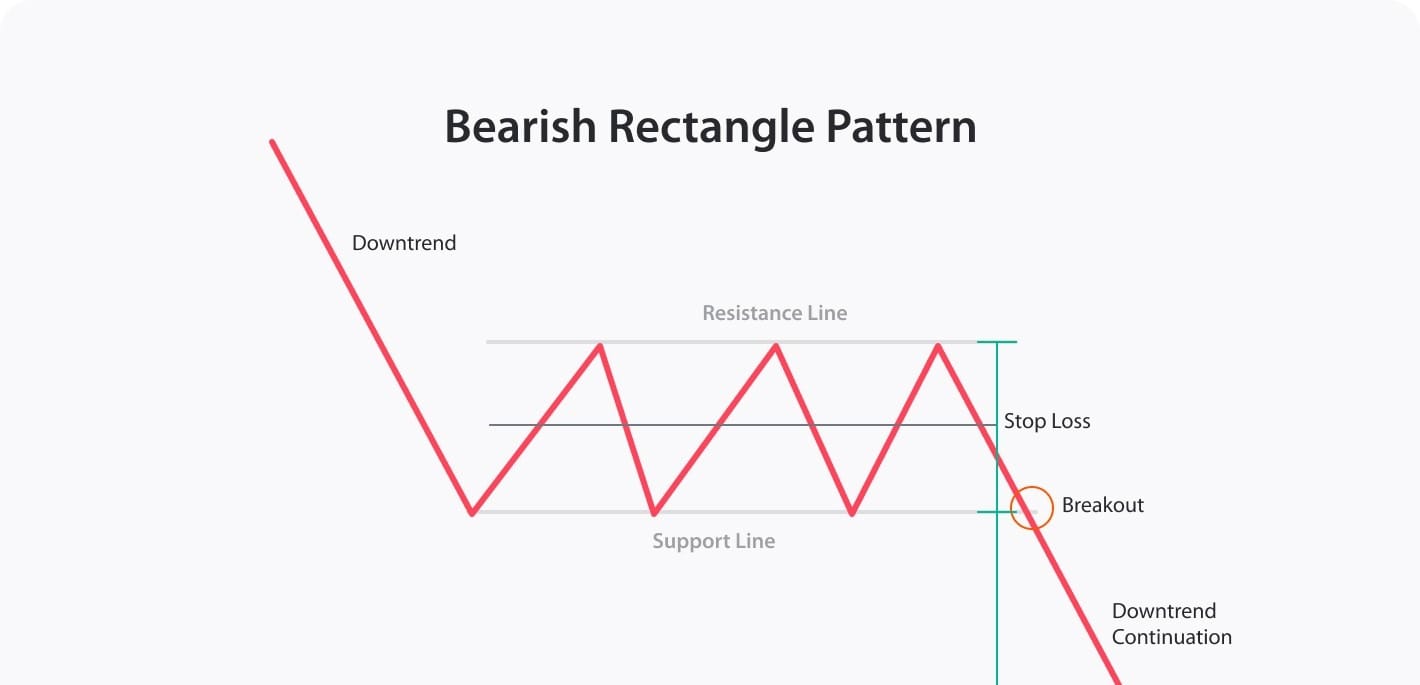

Price Cycle Trading

Some traders in a bearish market will employ swing trading strategies to profit from short-term fluctuations within a downtrend. This includes buying on slight price rebounds and selling before further price drops.

Long-Term Investment (Hodl)

For investors who believe in the long-term potential of cryptocurrencies, the HODL (Hold On for Dear Life) strategy is often applied during bearish phases. Investors continue to hold the asset unaffected by short-term price declines, hoping that the price will recover and rise in the long term.

Psychology and Risk Management in a Bearish Market

In a bearish market, controlling psychology and managing risk is crucial for protecting capital and maintaining investment efficiency. Strong fluctuations and widespread pessimism often lead investors to anxiety, resulting in irrational trading decisions. To succeed in this phase, investors need to focus on maintaining discipline and applying sound risk management strategies.

One of the biggest challenges is controlling psychology. Emotions such as fear of missing out (FOMO) or worry, uncertainty, and doubt (FUD) often cause investors to act hastily, leading to mistakes. Maintaining composure and adhering to the established trading plan is paramount.

Furthermore, investors should avoid letting negative information influence their judgment. Instead, relying on reliable analysis and data will help make more rational decisions.

At the same time, risk management is indispensable. Using stop-loss orders is an effective way to limit losses, especially in situations where market movements are unpredictable.

In addition, diversifying your investment portfolio also plays a crucial role in minimizing risk. Allocating capital to different asset classes such as stocks, gold, or other cryptocurrencies will help balance losses when one asset experiences a sharp price drop.

Another important strategy is to determine the risk/reward ratio before each trade. This helps investors control the acceptable level of risk compared to expected returns, thereby avoiding overly risky trades. Furthermore, choosing reputable exchanges with high security is also essential to minimize risks related to fraud or cyberattacks.

What should we do in a Bearish Market?

A bearish market negatively impacts the psychology of most investors as profits gradually diminish and losses accumulate, leading investors to potentially leave the market. Here are some things to keep in mind:

- Don't panic: This is the most important thing when participating in a Bearish market. You might panic if you wake up one day to find a zero missing from the end of your portfolio. However, at this time, you shouldn't sell off all your assets. Stay calm, restructure your portfolio, and find a solution.

- Diversify your portfolio: Diversifying your portfolio will help you react quickly to market fluctuations and minimize risk if one of your investments loses value. This is a golden rule when investing.

- Stay updated and continuously learn new knowledge: In the financial market, especially in crypto, information and knowledge are constantly being updated, so having a certain level of understanding will help you recognize golden opportunities in a bearish market.

- Be patient: Bearish markets can last for months or even years. It's crucial to be patient and not give up on your investments. The market will eventually recover, and you'll be glad you persevered.

Conclusion

A bearish market is not just a challenging period, it also presents opportunities for investors who know how to capitalize on and manage risk effectively. Understanding and applying the right knowledge will help you not only protect your capital but also find profitable opportunities even during volatile times.

FAQs

Why are investors worried about a bearish market?

A bearish market typically causes asset values to fall, increasing the risk of losses and creating a pessimistic sentiment, leading investors to lack confidence in their trading decisions.

How long does a bearish market last?

The duration of a bearish market varies greatly, from a few weeks to several years, depending on economic, political, and market sentiment factors.

What are the early signs of a bearish market?

Common signs include continuously falling prices, declining trading volume, widespread negative news, and weak rallies that are insufficient to reverse the trend.

Should investors buy in a bearish market?

This depends on strategy and risk tolerance. Many long-term investors use DCA to gradually accumulate at low prices, rather than trying to buy at the bottom.

Is a bearish market always bad?

Not necessarily. Bearish markets help eliminate excessive speculation and create opportunities to buy assets at reasonable valuations for patient investors with good risk management.