Aria Protocol designed to tap into the $80 trillion intellectual property (IP) asset market. By tokenizing these IPs, Aria enables fractional ownership, allowing users and investors to earn profits from royalties and creative derivatives in a transparent way.

Can IP assets hold as much potential as other RWA categories? Let’s find out in the article below.

What is Aria Protocol?

Aria Protocol is an RWA (Real-World Asset) project built on the Story Protocol ecosystem, enabling users to own and profit from intellectual property (IP) assets, such as publishing rights, performance rights, and royalties from music or artistic works.

The project aims to optimize and "unlock" the value of these assets by bringing them onto the blockchain. This allows them to be traded, fractionalized, and managed transparently in compliance with legal regulations.

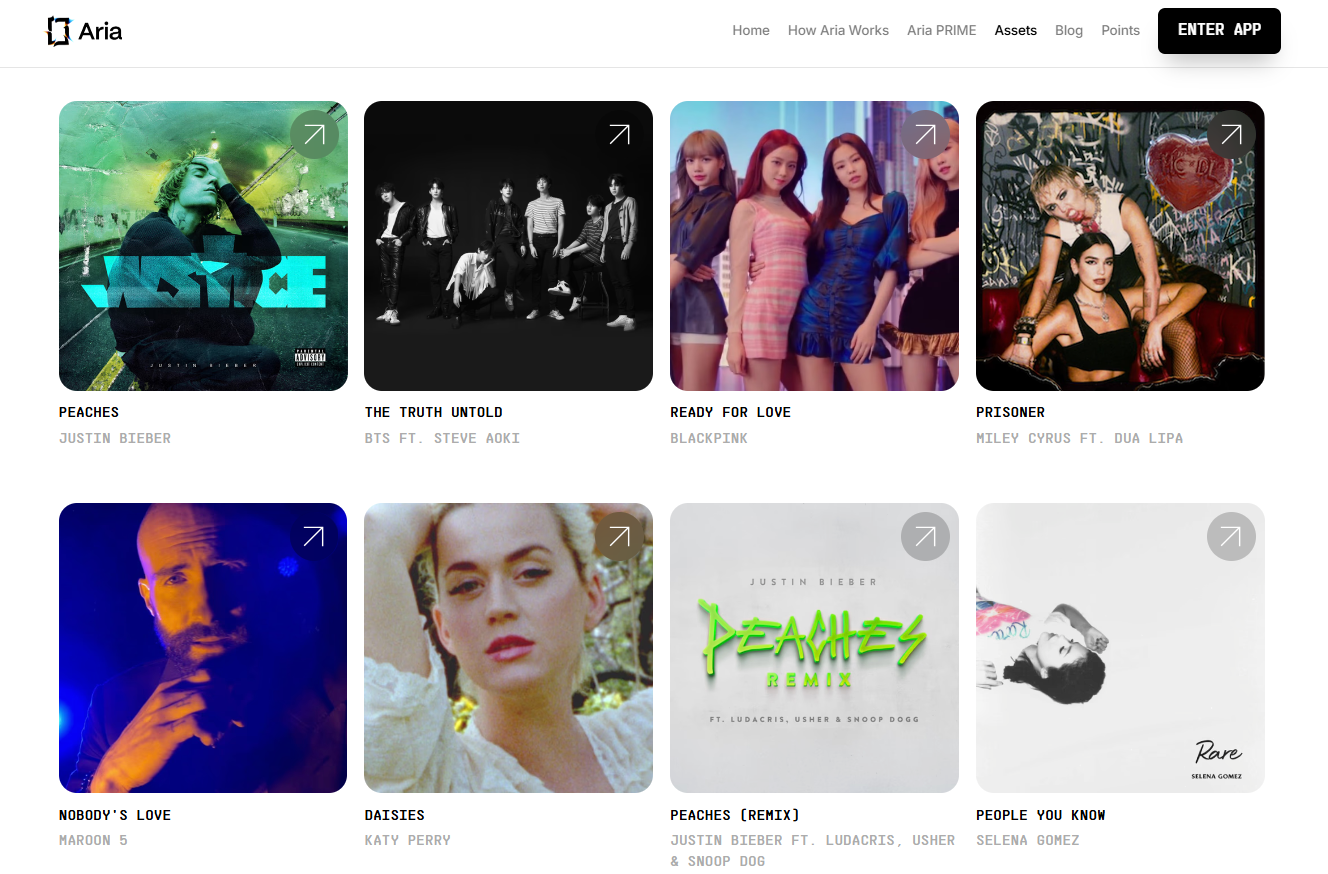

Aria Protocol has officially tokenized Justin Bieber’s hit song “Peaches” and has dropped hints about collaborations with BlackPink and other artists. This makes Aria Protocol a standout project in the innovative Story Protocol ecosystem.

How Does Aria Protocol Work?

The core product of Aria Protocol is tokens representing fractional ownership of real-world intellectual property assets. For instance, in its upcoming launch, users can invest to own a portion of publishing rights, performance rights, and royalties from Justin Bieber’s “Peaches.”

These products are not only investment opportunities but also allow token holders to participate in decision-making processes related to the assets, such as creating derivative works or repurposing content to increase revenue.

The operational mechanism of Aria Protocol can be summarized as follows:

- Tokenization and Fractionalization: Intellectual property assets are tokenized on the Story Protocol and split into smaller fractions, enabling multiple individuals to own a share.

- Investment: Users can invest in IP by purchasing IPRWA tokens (e.g., $APL) or participating in vaults (pooled investment funds containing multiple IPs). IPRWA tokens are fungible assets representing partial ownership and income rights from the IP.

- Trading Market: Users can buy, sell, or exchange these tokens on secondary markets provided by Aria Protocol or its partner platforms.

- Lending System: Tokens can be used as collateral for loans, enhancing their utility.

- Governance: Token holders can vote or provide input on how the assets are utilized, such as reallocating rewards or determining the scope of product usage.

A virtuous cycle is created between creators and investors:

- Users: Discover IP → Purchase/stake IPRWA tokens → Receive royalties or trade tokens.

- Artists: Tokenize IP → Receive investment fund → Share revenue with investors.

- System: Bridges Web2 revenue with Web3 composability, ensuring transparency and efficiency.

Example:

Suppose a user invests $10K in $APL tokens, which represent a portfolio including songs by BTS, Justin Bieber, and Dua Lipa. The user receives $10K worth of $APL tokens and stakes them.

Each quarter, the user earns $150 - $200 in royalties (depending on streaming performance), equivalent to a 6% annual yield. If the value of $APL increases due to market demand, the user can sell the tokens for additional profit. In the future, the user could use $APL to license a remix of a BTS song, generating further revenue from the remix.

$ARIAIP Information

$ARIAIP Key Metrics:

Here is the information of $ARIAIP:

- Token Name: Aria Protocol

- Ticker: $ARIAIP

- Token Type: TBA

- Total Supply: TBA

- Contract address (CA): TBA

$ARIAIP Token Use Case

Currently, Aria Protocol has not announced any official use case of $ARIAIP for the project. Whales Market will update immediately when the official Aria Protocol website announces.

$ARIAIP Listing

Here are important listing details:

- Listing time: TBA

- Confirmed CEX Listings: TBA

- Pre-market Price (Whales Market): TBA

Aria Protocol Tokenomics & Fundraising

Tokenomics

Currently, Aria Protocol has not announced any official tokenomics for the project. Whales Market will update immediately when the official Aria Protocol website announces.

Fundraising

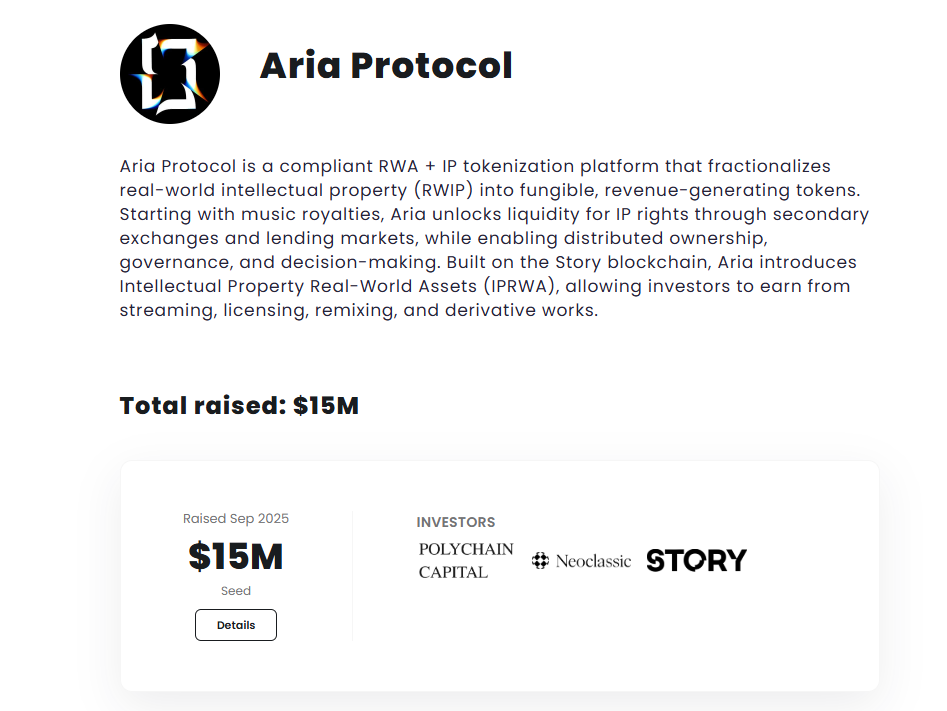

According to Crypto Fundraising, Aria Protocol has raised $15 million from Polychain Capital, Neoclassic, and Story.

Aria Protocol Roadmap and Team

Roadmap

Aria Protocol has not yet published a detailed development roadmap for the future.

Team

- RWAkefeller: Co-Founder

Conclusion

Aria Protocol is arguably the most prominent project in the Story Protocol ecosystem, directly generating revenue from intellectual property assets. This not only creates sustainable investment opportunities for users but also demonstrates the potential of blockchain technology in unlocking value from traditional markets.

FAQs

Q1: What makes Aria Protocol unique?

It’s one of the first projects to tokenize music rights from top global artists such as Justin Bieber and BLACKPINK, bridging Web2 entertainment with Web3 transparency.

Q2. Who invested in Aria Protocol?

Aria Protocol has raised $15M from major funds including Polychain Capital, Neoclassic, and Story, highlighting strong institutional confidence in its vision.

Q3: What is $ARIAIP pre-market price?

Currently, $ARIAIP hasn't been listed yet. For the most accurate and updated information, please refer to the official Aria Protocol website and social channels. Once the token launches, you can trade it on leading CEXes like Binance, Bybit or OKX.

Q4: What is the price of $ARIAIP today?

While $ARIAIP hasn't been listed yet. For the most accurate and updated information, please refer to the official Aria Protocol website and social channels.