Stablecoins are becoming the backbone of digital payments, and Arc steps into that shift with a clear mission. Instead of adding another chain to the noise, it aims to upgrade how stablecoins move online and unlock real utility for everyday transactions.

What is Arc?

Arc is a Stablecoin Chain built as a dedicated financial infrastructure for the internet, known as the Arc Network. Its core focus is optimizing for leading stablecoins such as USDC and EURC, addressing issues like fragmentation, high fees, slow settlement, and compliance risks.

The network is built to support millions of daily stablecoin users and handle massive transaction volumes. Beyond the technical capacity, the goal is to transform stablecoins from static digital assets into fast, final, and efficient payment tools, ultimately becoming a core layer for real-world digital payments.

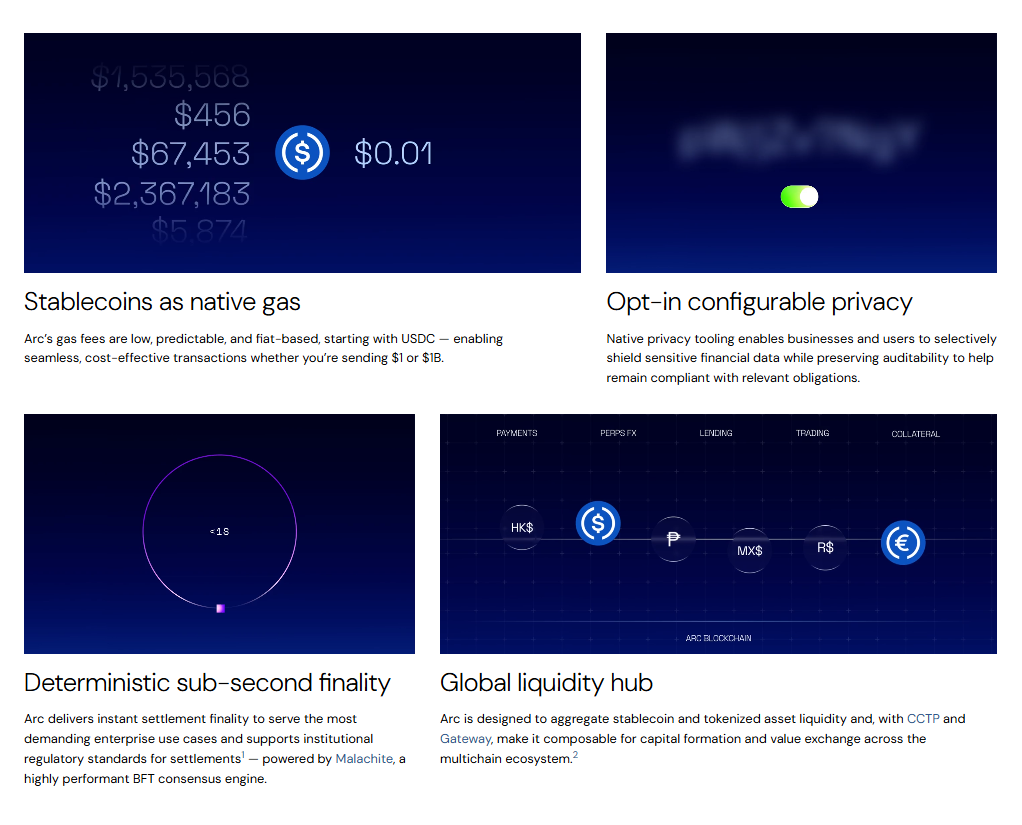

Specialities of Arc

- EVM-compatible blockchain

- Major stablecoins planned as gas fees

- Free peer-to-peer transfers

- Sub-1-second transaction confirmation

- Scalability above 100,000 TPS

- Strong focus on compliance and enterprise-grade security

These features make it easier for businesses to integrate global stablecoin payments without worrying about volatile gas costs.

Early Signals of a Future Token

While no token has been officially confirmed, the way Arc structures its Testnet, encourages on-chain activity, and expands its partner ecosystem has led many to expect a future token launch.

Exploring 👀

— Arc (@arc) November 12, 2025

Read More: How to Get the Arc Airdrop?

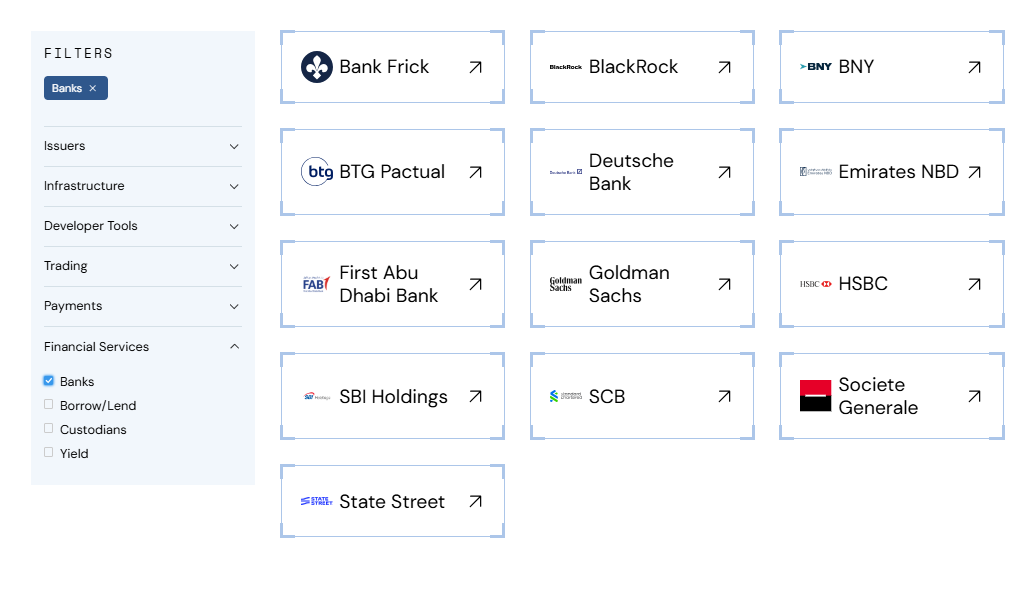

Arc’s Partners

Arc is collaborating with more than 100 major organizations worldwide. These partners include firms that manage hundreds of trillions of dollars in assets and process billions of transactions every day.

Notable testnet participants include BlackRock, Visa, Mastercard, Amazon Web Services, Goldman Sachs, HSBC, Anthropic, Uniswap Labs, Chainlink, and major banks such as Deutsche Bank an d Commerzbank.

There are also stablecoin issuers from Australia (AUDF), Brazil (BRLA), Canada (QCAD), Mexico (MXNB), and the Philippines (PHPC). These partners span the Americas, Asia, Europe, Africa, and the Middle East, helping Arc connect local markets to the global digital economy.

Arc Token Information

Arc Key Metrics

- Token Name: TBA

- Ticker: $TBA

- Token Type: TBA

- Total Supply: TBA

- Contract Address: TBA

Arc Token Use Case

No official use cases have been announced. Whale Market will update once Arc reveals more details.

Arc Token Listing

- Listing time: TBA

- Confirmed CEX listings: TBA

- Pre-market price on Whales Market: TBA

Arc Tokenomics & Fundraising

Tokenomics

- Total Supply: TBA

- Allocation: Not yet published

Fundraising

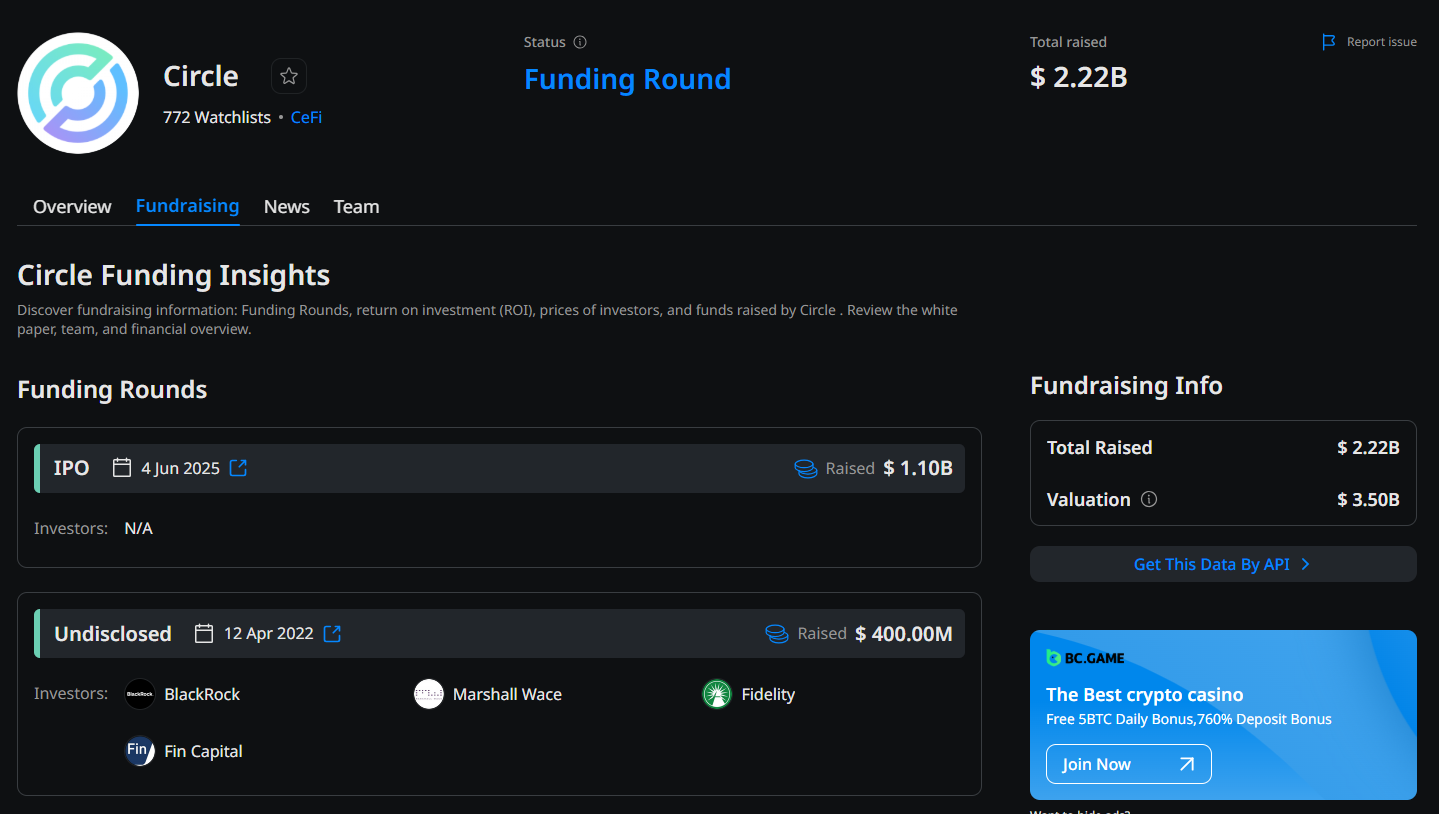

Developed by Circle, a company that has raised 2.2B USD from firms such as BlackRock, Pantera Capital, and Goldman Sachs, the Arc network is not a separately funded project. Instead, it receives direct backing from Circle along with support from strategic partners across fintech and Fortune 500 sectors.

Arc Roadmap & Team

Roadmap

A detailed roadmap has not been published. Arc launched its public testnet on October 28, 2025, focusing on features such as stablecoin gas fees, FX liquidity, and AI integrations. Whale Market will update as new information becomes available.

Team

Arc is developed by Circle and led by Jeremy Allaire, Co-founder and CEO of Circle.

Conclusion

Stablecoins are expanding rapidly, and Arc is positioning itself as a core infrastructure layer for global digital payments. With strong compliance foundations and backing from major industry players, the project aims to scale stablecoin utility and bring practical value to both everyday users and enterprises.

Disclaimer: This article is for informational purposes only and not investment advice. Whales Market is not responsible for investment decisions.

FAQs

Q1. What is the native token of Arc?

Arc has not announced an official native token but is exploring the possibility of launching one.

Q2. What is Arc’s pre-market token price?

There is no Arc token currently traded on pre-market platforms such as Whales Market.

Q3. What is the price of the Arc token today?

Arc does not have an official token yet, so no market price is available. Pre-market trading on Whales Market will open once a token is introduced.

Q4. How much has Arc raised?

Arc does not have a separate fundraising round. The project is developed by Circle, which has raised 2.2B USD from major investors including BlackRock.