The concept of "Altcoin Season" occupies a central place in cryptocurrency folklore, the highly anticipated phase when smaller assets generate exponential gains. Yet, as the market matures, the classic patterns of the 2017 and 2021 cycles are evolving. So what is altcoin season and does it still exist in this cycle? Let’s explore in this article.

Altcoin Season Definition: What Is Altcoin Season?

Altcoin season is a specific phase in the cryptocurrency market cycle when altcoins significantly outperform Bitcoin (BTC). This phenomenon occurs when capital rotation shifts liquidity away from BTC and into smaller cap altcoin markets, resulting in rapid price appreciation and heightened volatility.

This period, commonly referred to as Altseason, is marked by dramatic price surges; altcoins frequently experience increases of 2x, 3x, or even 10x over a short duration. Consequently, Altcoin Season is viewed as a crucial window for investors to realize substantial profits from their altcoin holdings by capitalizing on this sudden influx of liquidity.

What Causes an Alt Season?

Altseason is not a random occurrence, it is a predictable phase rooted in market psychology and liquidity mechanics that follows a specific sequence of events initiated by Bitcoin. This phenomenon requires two major factors to converge: a capital trigger and underlying market fuel.

The primary trigger: Capital rotation from Bitcoin.

Alt seasons often begin after a strong Bitcoin uptrend followed by consolidation. As BTC’s price stabilizes and its dominance stops rising or rolls over, traders seek higher beta to improve returns. Capital typically moves from BTC to ETH first because ETH offers deeper liquidity and a broader application surface, then spreads to large-cap alts, mid-caps, and finally small-caps.

This direct shift in funds reduces Bitcoin’s share of the total crypto market, which means BTC dominance (BTC.D) decreases, and initiates the widespread altcoin rally.

The sustaining fuel: New trends and project growth.

Altseasons are sustained by the emergence of new technological trends that inject liquidity and innovation into the market. Fresh primitives, incentive programs, or distribution waves expand the investable universe and attract users, developers, and liquidity.

- As projects launch and ship features, on-chain activity rises in the targeted ecosystems, TVL and fees increase, token listings broaden across venues.

- Incentives and early usage validate higher valuations, which draws in additional flows and encourages follow-on launches, creating a reflexive loop.

The continuous proliferation of these new projects, often accompanied by memecoins, provides the massive volume of diverse assets into which capital can successfully rotate.

In essence, Altseason requires both a stable Bitcoin price (the psychological trigger) and sustained innovation (the fuel) to commence the cycle of widespread altcoin outperformance.

It is crucial to note that Altcoin Season does not require Bitcoin's price to decline; it only requires altcoins to outperform BTC.

Key Signals an Altseason is Approaching

As mentioned, altcoin season usually follows a strong Bitcoin rally, when profits from BTC begin rotating into other crypto assets. Predicting the exact moment an Altcoin Season begins is challenging, yet several key structural and momentum indicators historically confirm that the market is preparing for a major rotation of capital.

- Decline in Bitcoin Dominance (BTC.D): BTC.D represents Bitcoin’s market share relative to the entire cryptocurrency market. A steady and gradual decline in this index indicates that investors are actively moving funds out of BTC and into altcoins, suggesting the market is primed for an altcoin rally.

- Large-cap altcoin leadership: When prominent, large-cap altcoins begin to significantly outperform Bitcoin, it serves as an essential early warning. This movement confirms that risk appetite is returning and liquidity is moving along the primary capital path (BTC to ETH to Alts).

- Volume and liquidity expansion across many alts: A visible spike in trading volumes for various altcoins reflects heightened investor activity and capital inflows, which drive momentum and fuel price gains. This includes the rising in spot and derivatives volume, deeper order books, and tighter spreads in multiple ecosystems

- Total Market Cap Indices (TOTAL 2 & 3): Analysts monitor specific market capitalization metrics to confirm growth legitimacy, in which:

- TOTAL 2 (Market Cap excluding BTC) confirms growth driven by Ethereum and the general altcoin market.

- TOTAL 3 (Market Cap excluding BTC and ETH) specifically reflects growth occurring within the mid and small-cap altcoin sector, not just Ether.

- Launch and narrative cadence accelerates: New themes and product releases bring listings and incentives that widen the investable universe and attract users, developers, and liquidity.

For example, the 2020–2021 surge was heavily fueled by the launch of numerous DeFi Layer 2s (Arbitrum, Optimism) and the proliferation of NFT-related projects, which created new asset classes for investment.

Risks of Altseason

While Altcoin Season offers the potential for high returns, it represents the most volatile and high-risk phase of the crypto market cycle. The promise of exponential gains is directly mirrored by the potential for rapid capital loss.

- Amplified volatility and extreme downside: Altcoins exhibit a significantly higher beta (sensitivity) to the overall market than Bitcoin. This means that while altcoins amplify gains during the initial rally, any sharp decline or correction in the price of Bitcoin typically results in far deeper percentage losses for altcoins.

- Liquidity risk and high slippage: Many mid and small-cap altcoins that experience the most extreme pumps inherently suffer from thin market liquidity. While entering these positions may be easy, exiting them during times of panic or market reversal is often difficult. Traders attempting to sell large positions quickly will face high slippage, meaning the executed price will be significantly lower than the quoted price, rapidly eroding potential profits.

- Exposure to fraud and low-quality projects: The euphoria of Altseason draws in capital, creating fertile ground for scams and unsustainable projects. Historically, major cycles (like the ICO era) saw widespread fraud, with analyses confirming 80% of projects were identified as scams.

During an Altseason, investors face the constant risk of allocating funds to projects with no viable working product, unsustainable tokenomics, smart contract vulnerabilities or immediate rug pulls.

Altcoin Season History

The cryptocurrency market has historically undergone multiple distinct Altcoin Season cycles, each fundamentally tied to major technological advancements. These cyclical shifts introduce new capital and utility, driving a massive rotation of funds across the market and fundamentally reshaping the asset landscape and Bitcoin's influence.

2017: The ICO/Utility Token Era

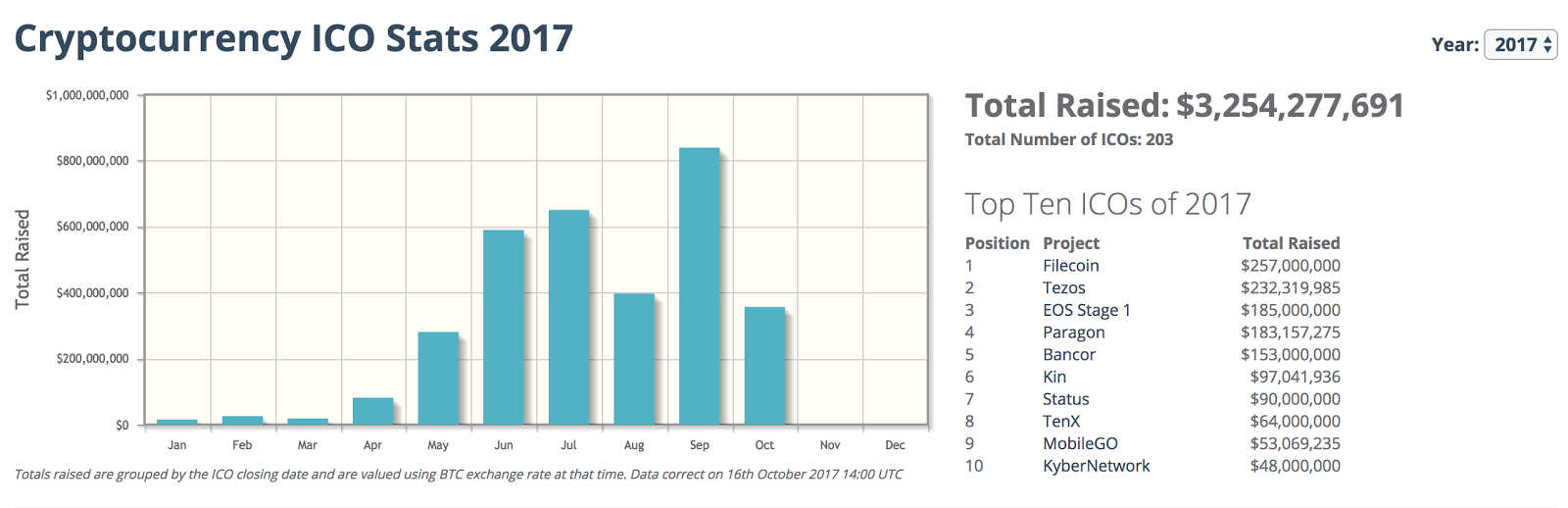

The first major altcoin season was defined by the rise of Initial Coin Offerings (ICOs), enabled by the Ethereum smart contract platform. The ICO mechanism provided a low-barrier avenue for startups to raise funds, leading to a massive influx of projects and a sharp decline in Bitcoin’s dominance level.

The scale of this boom was dramatic. The total capital raised by ICOs skyrocketed from only $96 million in all of 2016 to over $3.2 billion by late 2017, fueling the alt market's initial, massive expansion.

However, this era was highly speculative. An analysis by Satis Group found that a staggering 80% of all projects launched were identified as outright scams, contributing directly to the severity of the 2018 bear market.

2020–2021: DeFi Summer, NFTs, and Memecoins

The second major cycle was far broader and sustained by the maturation of multiple technological sectors. The boom was driven by the advent of Decentralized Finance (DeFi) and Non Fungible Tokens (NFTs). These sectors required new tokens to power independent financial products and digital collectibles, leading to the creation of countless new assets.

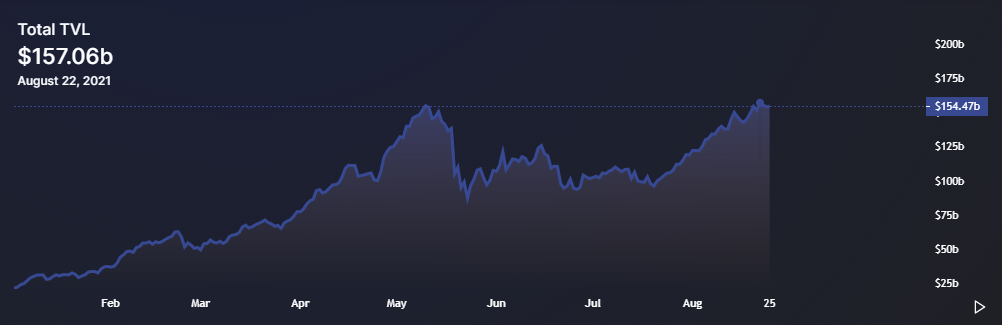

- DeFi Summer: Data from DeFiLlama shows that total value locked (TVL) in DeFi grew exponentially, climbing from approximately $9.1 billion in July 2020 to peak at over $157 billion by August 2021.

- NFTs: Data from NFT industry data aggregator CryptoSlam showed that the NFT market demonstrated explosive growth, with global sales volume rising from $250 million in 2020 to reach $18.5 billion in 2021, a 570x increase.

The frenzy intensified with the proliferation of memecoins (e.g., Shiba Inu, Floki), culminating in the existence of more than two million cryptocurrencies today.

Shiba Inu (SHIB) recorded an astonishing gain of 85,000,000% between August 2020 and its peak in October 2021. This exponential rally generated unprecedented returns for early investors, underscoring the extreme volatility and scale of capital rotation driven by the memecoin sector during that cycle.

What is Altcoin Season Index?

Altcoin Season Index is a tool used by analysts to quantify market sentiment and determine whether the overall environment favors Bitcoin or altcoins. It provides an objective, data-driven framework for understanding which phase of the crypto cycle the market is currently in.

The index runs from 0 to 100, and an Altcoin Season is confirmed when the index reaches 75 or higher (meaning 75% of the top 50 altcoins have outperformed Bitcoin over 90 days).

It is typically calculated based on several factors:

- Relative performance: Compares the performance of major altcoins against Bitcoin (BTC) to gauge altcoin outperformance.

- BTC Dominance (BTC.D): Tracks Bitcoin’s market share; a sustained decrease signals capital rotation into altcoins.

- Trading momentum: Measures significant increases in altcoin trading volume and price volatility, indicating heightened investor activity.

- Community sentiment: Analyzes social media discussions and news coverage for supplementary clues on rising retail interest.

Some public resources allow investors to track the Altcoin Season Index: Blockchaincenter, CoinMarketCap, CoinGlass, CryptoRank, TradingView…

Does Alt Season still exist?

The evidence suggests that a traditional, broad-based altcoin season (where most altcoins rise in a synchronized surge) is increasingly unlikely in the current market structure. This view follows from notable shifts in market dynamics and capital flows since the 2017 and 2021 cycles.

The structural landscape no longer supports a unified rally:

- First, the entry of institutional capital via regulated vehicles (such as ETFs) concentrates liquidity in Bitcoin and Ethereum.

- Second, the oversaturation of the market (with millions of tokens) dilutes any incremental inflows across a much wider base and shortens attention cycles.

As a result, the market appears to operate in a “hyper-accelerated regime.” Instead of a prolonged euphoric phase, investors now see shorter, narrative-driven bursts of momentum (often one to three months), followed by sharp corrections. Volatility persists, but the classic, multi-month, market-wide altcoin melt-up looks increasingly obsolete.

Tips for investing during Altseason

The current market demands a highly disciplined approach focused on speed and risk control. Successful navigation requires clear strategies for both maximizing gains and mitigating rapid losses.

How to grow your portfolio during Alt Season

Maximizing returns in this compressed cycle depends on active management and effective capital rotation:

- Identify high-conviction narratives: Focus capital on current, verifiable growth trends (e.g., specific DeFi primitives, L2 ecosystems, AI agents, Premarket) rather than broadly betting on all altcoins. Strong narratives attract liquidity and fuel the short, intense pumps characteristic of the new regime.

- Develop a comprehensive trading plan: Before entering, establish a strict trading plan that outlines entry and exit points, stop-loss limits, capital sizing, and most importantly, realistic profit goals. Goals must be rooted in analysis, not arbitrary targets.

- Identify high-conviction selections: Focus capital on a limited number of high-conviction assets (1-2 per sector) where liquidity is verified and the narrative is strong, rather than spreading funds thinly across too many small-cap bets.

- Prioritize liquidity and trading pairs: When trading smaller cap altcoins, prioritize projects with deep liquidity relative to their market cap. Utilize major trading pairs (e.g., ETH, stablecoins) to ensure you can efficiently enter and exit positions without incurring extreme slippage.

- Active capital rotation (Flipping): Systematically track the current stage of capital flow (BTC > ETH > Mid-Caps). Once initial profit targets are hit, actively re-deploy (flip) realized gains into high-potential assets that have not yet been pumped, leveraging the power of compounding returns.

How to avoid losses during Altcoin Season

Mitigating the amplified risks of the alt market requires strict adherence to risk management principles and rigorous project vetting.

First of all, you should define realistic exit goals and know when to stop. While holding for parabolic gains is tempting, the final profit target should be rational and knowledge-based, not an arbitrary number (like x100 or x1000). Set your target and realize profits incrementally.

Remember to strictly adhere to the stop-loss limits defined in your initial trading plan to preserve capital, especially during the swift, accelerated corrections common in this market regime.

Second, due diligence is paramount. Avoid projects if you observe any of the following critical red flags:

- The development team has a history of poor or fraudulent past actions.

- The website is minimal, shoddy, or uses unprofessional/inconsistent formatting.

- The project communication has a strong Multi-Level Marketing (MLM) structure or scent.

- The team promises specific, guaranteed future price targets (e.g., "list at $5 on Binance in three months").

- Community channels are unprofessional, absent, or clearly dominated by bots.

Conclusion

The traditional, prolonged Altcoin Season is now structurally improbable. This conclusion is rooted in market maturation and the concentration of institutional capital, which bypasses small caps and heavily dilutes incoming funds across a saturated market.

Consequently, the cycle has shifted to one defined by fragmented, short-duration bursts of momentum. Success hinges not on waiting for a broad market miracle, but on rigorous due diligence, rapid execution, and active capital rotation to capitalize on these shorter, more intense opportunities.

FAQs

What does Alt Season mean?

Altcoin Season is a phase in the cryptocurrency market cycle when altcoins (any coin other than Bitcoin) significantly outperform Bitcoin (BTC). This is caused by capital rotation, where funds move out of BTC and into smaller cap assets, resulting in widespread and rapid price appreciation across the altcoin market.

When is Altcoin Season? When will Alt Season start?

There is no fixed schedule. Historically it tends to follow a strong BTC rally and subsequent consolidation, plus visible declines in BTC dominance and rising liquidity across many alts. Analysts often use tools like the Altcoin Season Index (≥75 over 90 days) as a confirmation rather than a predictor.

How long does Alt Season last?

Durations vary widely. Past cycles ranged from a few weeks to several months; in recent cycles, rotations have been shorter and more narrative-specific (often one to three months) before sharp corrections. Investors should treat any timeline as probabilistic, not guaranteed.

When was the last Altseason?

The last major, prolonged Altcoin Season occurred during the 2020 to 2021 bull market cycle. This period was fueled by the massive growth of Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), and the Memecoin frenzy.