Instead of manually researching protocols, writing code, and maintaining bots, users can describe their goals in simple terms and rely on Almanak’s infrastructure to handle execution, risk parameters, and automation.

What is Almanak?

Almanak is a platform that uses AI to assist with the creation and management of financial strategies, particularly in the decentralized finance (DeFi) space. It is positioned as a tool that helps users translate investment goals into executable strategies.

Users can describe their objectives in simple terms, and the system supports the workflow from researching opportunities to coding, testing, and deploying strategies. This approach is intended to make systematic strategies more accessible to both individual users and institutions that may not have extensive coding resources.

The platform uses a non-custodial setup, so users retain control over their assets, and it supports interactions across multiple blockchain networks.

Features of Almanak

Almanak provides a set of tools centered around its AI Swarm - A network of specialized AI agents that handle different parts of strategy development. Key features include:

- Yield Maximization: Agents scan and evaluate yields across different chains and protocols, reallocating funds according to predefined parameters and performance signals.

- Asset Management Optimization: Portfolios can be adjusted dynamically based on market conditions and strategy rules, aiming for more efficient capital use.

- Autonomous Trading and Hedging: AI-driven strategies can operate continuously, with built-in risk parameters to manage volatility within user-defined constraints.

- Cross-Chain Compatibility: The platform supports interaction with multiple blockchains via agent-based account abstraction, accessible through a unified interface.

- Verifiable and Secure Execution: Strategies are represented as deterministic code and can be deployed in non-custodial environments, with options for privacy-preserving execution.

- Tokenized Vaults: Strategies can be wrapped into vaults that are composable with other DeFi tools, allowing others to deposit capital into the same approach.

- Bribe Market: Protocols can provide incentives for AI-driven volume to route toward their platforms, creating a marketplace where flows are influenced by bribes and emissions.

These components are designed to help users move from strategy ideas to on-chain implementations with lower operational and technical overhead.

How does AImanal work?

Almanak is built around four main components:

- Deployments: These are the automated applications that execute the actions requested by users. Today they focus on strategy execution (rebalancing, trading, allocating liquidity, etc.), and are designed to evolve toward more autonomous behavior as agent and AI features mature.

- Strategies: Strategies are Python-based applications that define the logic for a Deployment: what data to look at, how to respond to market movements, and how to size risk. They can incorporate different risk models and parameters and are intended to become more adaptive over time.

- Wallets: Almanak uses non-custodial wallets built on Safe and Zodiac. Users keep ownership of funds and only delegate specific permissions (for example, letting a Deployment trade within defined limits). This setup tries to balance automation with granular control.

- Vaults: Vaults are fully on-chain, permissionless and asynchronous. They allow users to package a profitable strategy from their Deployment into a tokenized product that others can deposit into or trade. Strategy creators can charge management and performance fees, while other users can speculate on the future performance of the vault via its tokens.

These components together support use cases such as yield optimization, cross-protocol interactions, liquidity provision and automated trading, all while keeping custody with the user.

$ALMANAK Token Information

$ALMANAK Key Metrics

- Token Name: ALMANAK

- Ticker: $ALMANAK

- Token Type: Utility & Gorvernance

- Total Supply: 1B $ALMANAK

- Contract Address (CA): TBA

$ALMANAK Use Case

$ALMANAK is the utility token of the Almanak AI DeFi agent platform. It is used to pay for:

- Platform resources (compute, storage, APIs).

- Access and boost incentives, and participate in governance.

- Holders can stake or lock ALMANAK (veALMANAK) to influence emissions toward specific vaults and strategies and receive discounts on compute costs as defined by governance.

$ALMANAK Token Listing

- Listing time: 11/12/2025

- Confirmed CEX listings: TBA

- Pre-market price (Whales Market): TBA

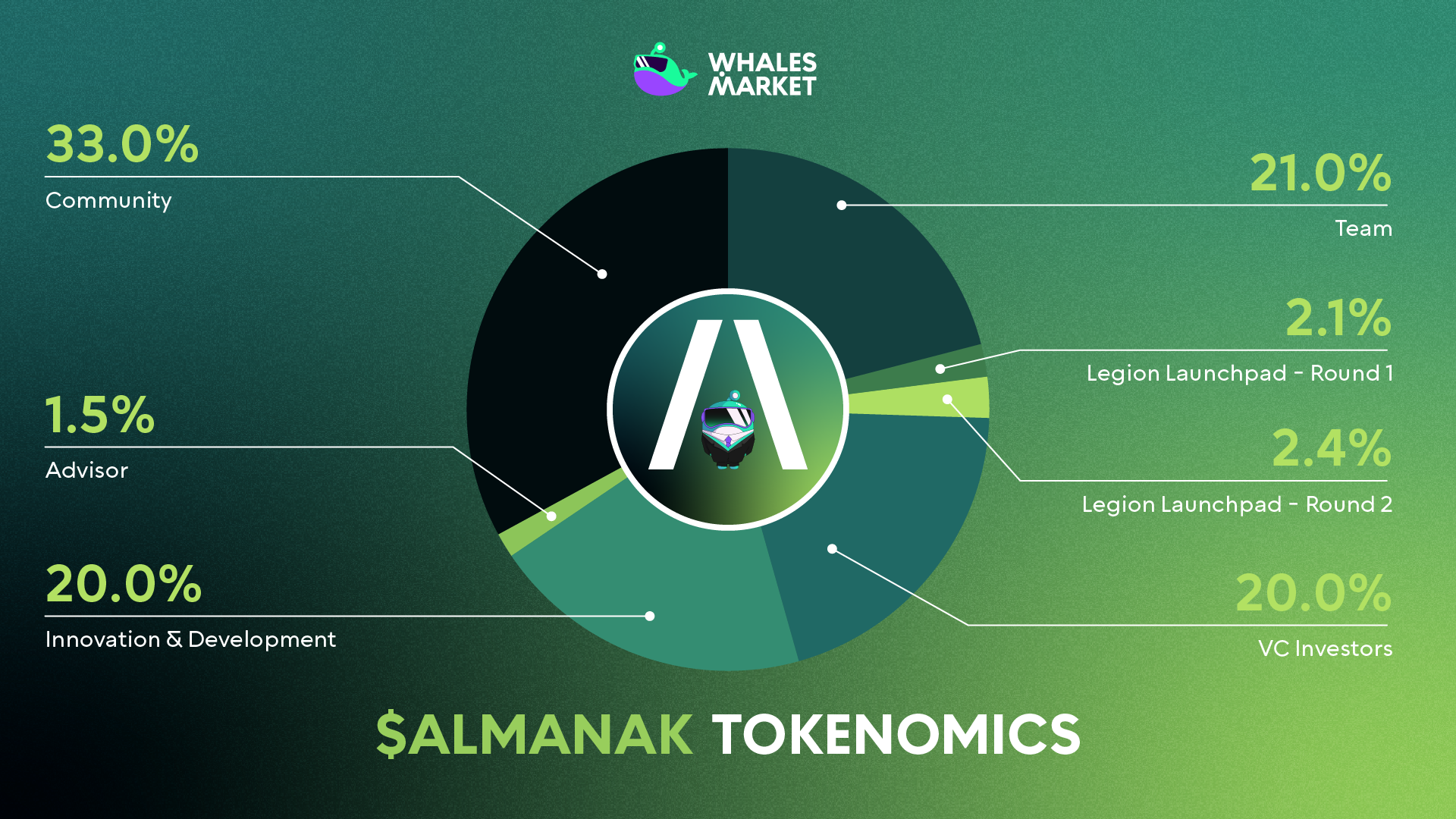

$ALMANAK Tokenomics & Fundraising

Tokenomics

Total Supply: 1B $ALMANAK

Allocation:

- Community: 33%

- Innovation & Development: 20%

- VC Investors: 20%

- Team: 21%

- Advisors: 1.5%

- Legion Round 1: 2.1% (community sale)

- Legion Round 2: 2.4% (pre-TGE community round)

Fundraising

According to Cryptorank, Almanak has successfully raised $11.45M from investment funds such as Delphi Labs, Near Foundation, Haskey Capital, and Shima Capital...

AImanak Roadmap & Team

Roadmap

- Multi-Agent System: A system where multiple AI agents collaborate to discover alpha and design optimized strategies.

- Trusted Execution Environments (TEEs): Verifiable, isolated execution environments that protect strategy code and intellectual property.

Team

- Michael Herzyk: Co-Founder & CEO

- Lars Suanet: Co-Founder & CTO

Conclusion

Almanak is an AI-assisted layer for DeFi strategies, combining agents, non-custodial wallets, and tokenized vaults in one platform. The $ALMANAK token acts as a utility and governance asset, used to pay for resources, direct emissions, and align incentives across the ecosystem.

As with any DeFi project, adoption and long-term value depend on real usage, security, and execution of the roadmap. This overview is informational only and should not be taken as financial advice.

FAQs

Q1. What is Almanak in simple terms?

Almanak is a non-custodial DeFi platform that uses AI agents to help users create, deploy, and manage on-chain strategies. Users define their objectives, and the system supports the rest of the workflow, from research and execution to monitoring.

Q2. Is Almanak a custodial platform?

No. Almanak is designed to be non-custodial. Funds stay in user-controlled wallets (built on Safe and Zodiac), and only specific permissions are granted to deployments so they can execute trades or rebalance within predefined limits.

Q3. What are the main use cases of Almanak?

Typical use cases include yield optimization, liquidity provision, cross-protocol interactions, and automated trading or hedging. Strategies can be wrapped into vaults so other users can deposit into the same approach.

Q4. What is the role of the $ALMANAK token?

$ALMANAK is a utility and governance token. It is used to pay for platform resources (such as compute and APIs), participate in governance through veALMANAK, influence how emissions are distributed across vaults, and potentially receive programmatic rewards for curation and liquidity.

Q5. What is $ALMANAK token pre-market price?

Currently, ALMANAK token is listing upcoming on Whales Market. Whales Market is the leading pre-market DEX platform to trade pre-TGE tokens and allocations, with over $300 million in volume, no middlemen, trustless and on-chain.