Coins and tokens are two concepts that appear everywhere in the crypto market, but many investors still treat them as the same thing. Understanding the differences between coins and tokens not only makes whitepapers easier to read, it also helps avoid emotional investment decisions.

In this article, we will go through each basic concept and then look at the specific characteristics of each type.

What is a Token?

Token is a type of digital asset that is built and operates on a blockchain. Tokens do not have their own blockchain but are created through smart contracts. They can represent many different purposes such as utility, security, real world assets or access rights to a service.

Tokens can be fungible (every unit is the same) or non-fungible. Non-fungible tokens or NFTs are unique tokens that represent individual digital items or rights, such as artwork, in-game assets or membership passes.

Examples:

- UNI (Uniswap) and LDO (Lido) are tokens on Ethereum, a Layer 1 blockchain.

- JUP (Jupiter) and ME (Magic Eden) are tokens on Solana, a Layer 1 blockchain.

- AERO (Aerodrome) and MORPHO (Morpho) are tokens on Base, a Layer 2 blockchain.

- UNI, LDO, JUP, ME, AERO and MORPHO do not have their own blockchains, they operate directly on Layer 1 networks.

There are many types of tokens on the market and many ways to classify them. Below are the two most common types.

- Governance tokens: Users who hold the token have voting rights in the DAO.

- Utility tokens: Tokens that allow holders to access services or products developed by the issuer.

What is a coin?

Coin is a type of cryptocurrency that runs on its own blockchain. Coins are often used to pay transaction fees, reward validators or miners and participate in the network’s security and governance mechanisms. Each blockchain has a native coin with its own tokenomics, including supply, issuance mechanism and burn mechanism.

Examples:

- BTC on the Bitcoin blockchain.

- ETH on the Ethereum blockchain.

- SOL on the Solana blockchain.

From these blockchains, many other assets are created and run on top of them. These are the tokens mentioned above.

Differences between coins and tokens

Similarities

Coins and tokens have several similarities. Both are digital assets that exist on a blockchain. They can be stored in a wallet and transferred between users, and their ownership is recorded on-chain.

In terms of trading, both coins and tokens can be listed on centralized exchanges (CEX) and decentralized exchanges (DEX). Users can buy, sell or swap them in a similar way.

Finally, both can serve similar purposes in the Web3 ecosystem. They may be used as a means of payment, as an investment asset, or as a way to access and use specific products and services.

Differences

Applications of coins and tokens

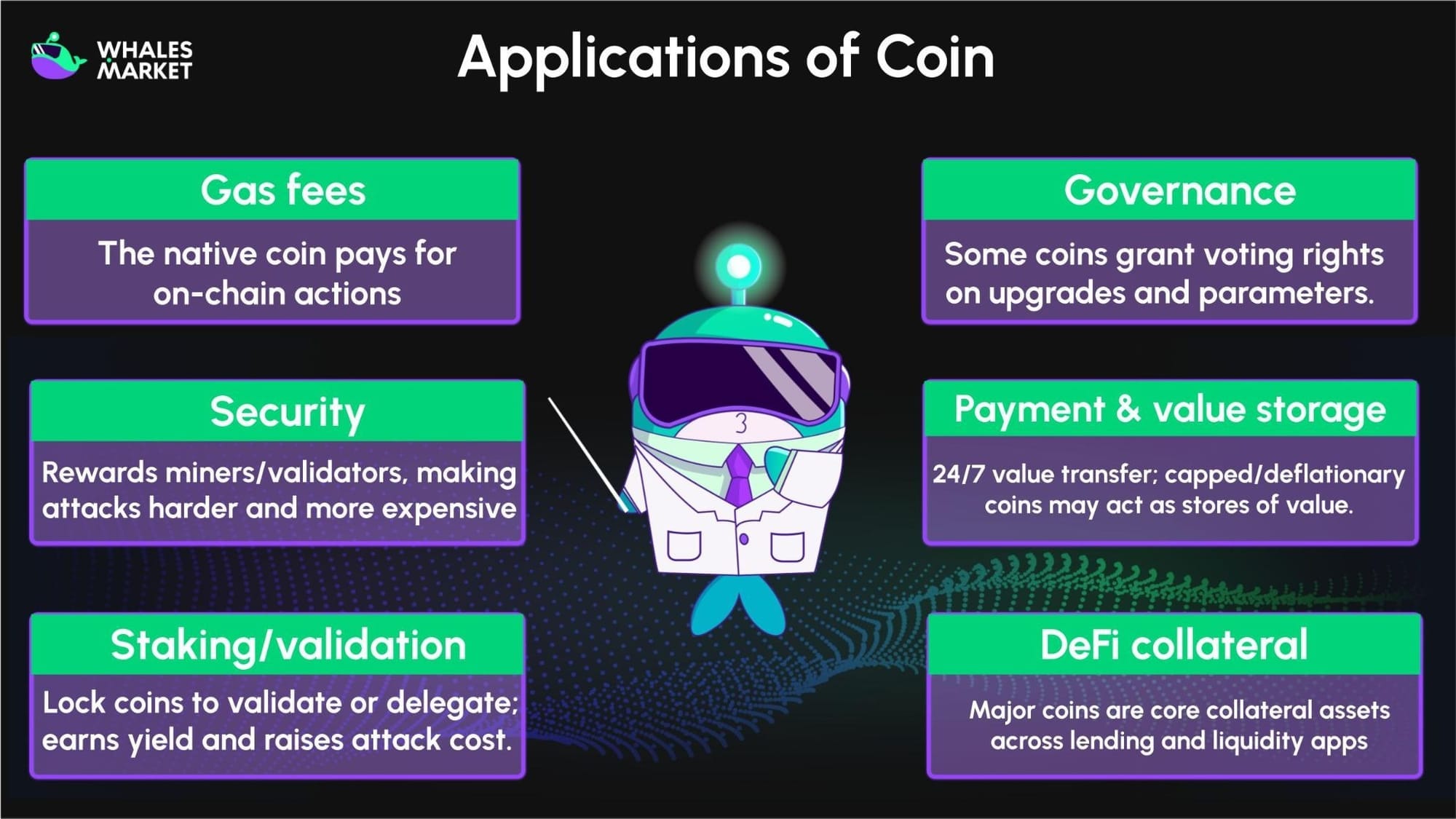

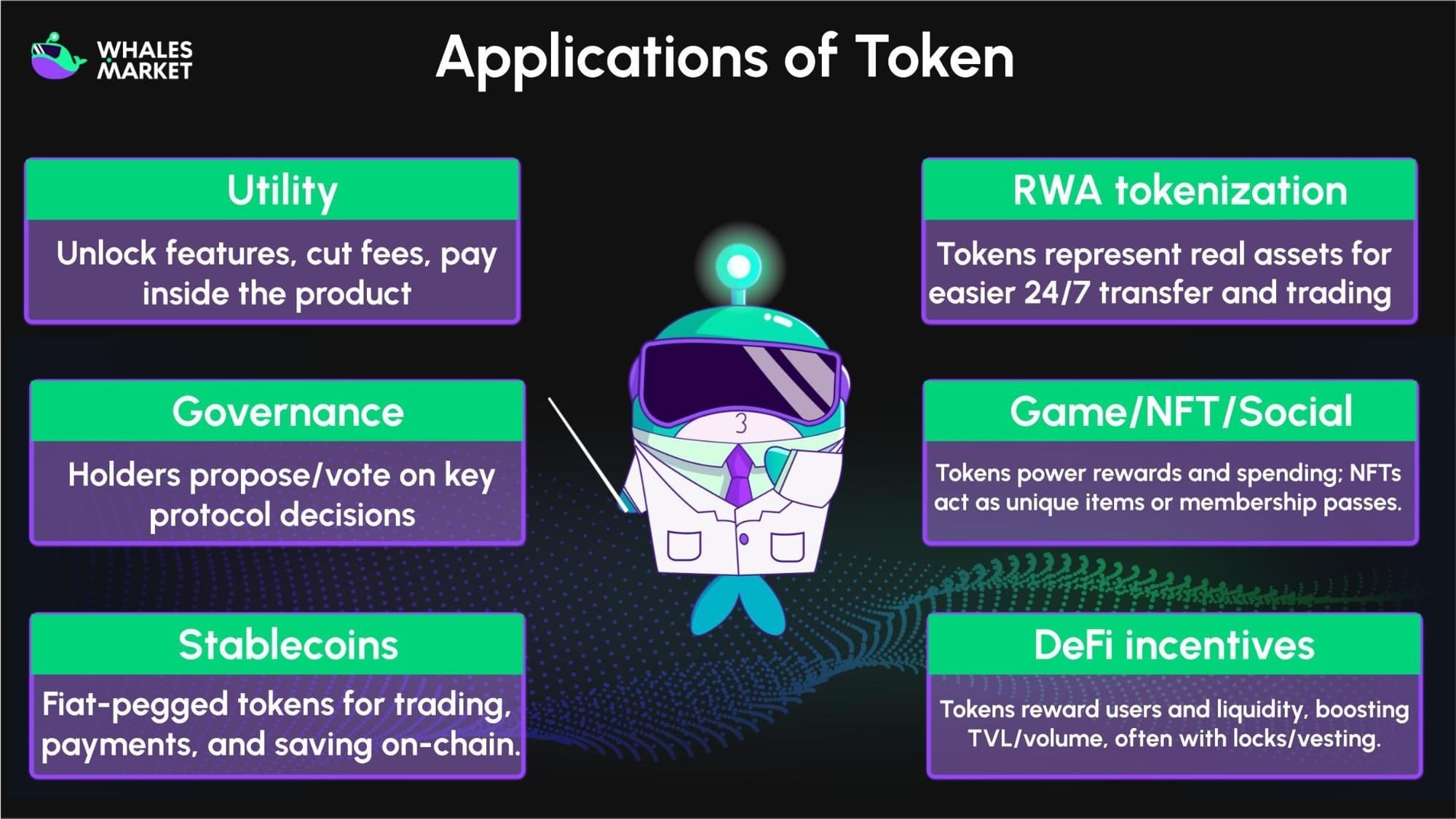

In practice, the biggest difference in applications between coins and tokens lies in their design purpose.

For coins, supply and issuance mechanisms must be carefully calculated to ensure network security. Coins need to be attractive enough to reward validators or miners, encouraging them to maintain, validate and protect the blockchain from attacks. Therefore, applications of coins mainly revolve around gas fees, staking, security and governance of the blockchain infrastructure itself.

In contrast, tokens are created to serve the building and expansion of applications on the blockchain. Tokens can be used to incentivize users, develop ecosystems, unlock features, govern projects or represent assets. Tokenomics is therefore more flexible, focusing on dApp growth, user experience and the business model of the protocol.

Applications of coin

By nature, coins are closely tied to blockchain infrastructure. The way coins are issued and used must satisfy two goals: securing the network and creating sufficient economic incentives for validators or miners.

- Paying transaction fees (gas fee): All on-chain operations such as sending coins, swapping tokens or minting NFTs require the native coin to pay gas. This creates natural demand for the coin and links its value to the level of blockchain activity.

- Securing the network: Coins are used as rewards for miners or validators. If the rewards are attractive, more nodes will participate in securing the network, making attacks more difficult and costly. For this reason, coin tokenomics must balance inflation and incentives for validators.

- Staking and transaction validation: In PoS or DPoS systems, users lock coins to participate in block validation or delegate to validators. Staking allows holders to earn rewards and increases the cost of attacking the network because an attacker must hold a very large amount of coins.

- Blockchain governance: Some networks allow coin holders to vote on upgrade proposals, parameter changes and gas fees. In this way, the coin also represents the right to take part in infrastructure governance.

- Means of payment and store of value: Coins can be used to transfer value across borders around the clock without banks or intermediaries. For coins with limited supply or deflationary mechanisms, some investors also view them as long term stores of value.

- Collateral in DeFi: Major coins such as BTC, ETH, SOL and BNB are commonly used as collateral in lending, margin, farming and liquidity provision protocols. This makes coins the base asset layer for the DeFi ecosystem built on top.

Example: ETH is used to pay gas, to reward validators and for staking on Ethereum. Likewise, SOL is used for fees, staking and network security on Solana.

Applications of token

Tokens are usually designed more flexibly than coins and focus on the application layer, including dApps, protocols, games and social platforms. Tokenomics here mainly revolves around attracting users, nurturing communities and optimising the project’s business model.

- Utility in products and services: Tokens can be used to unlock features, reduce fees, buy items, upgrade accounts and make internal payments. As a result, tokens are directly linked to product experience and user lifecycle.

- Governance: Token holders can propose and vote on important protocol decisions such as fee changes, treasury allocation or listing new products. This turns the community into shareholders who share responsibility with the project.

- Stablecoins: Tokens (like USDT, USDC and FDUSD) are pegged to fiat currencies and used for trading, payments, on-chain savings and hedging against the volatility of other crypto assets. They act as a stable monetary layer for the entire crypto ecosystem.

- Tokenization of real world assets: Tokens can represent stocks, bonds, gold, real estate and invoices, making it easier to split, trade and transfer traditional assets, which can then operate 24 hours a day on blockchain.

- In game, NFT and social tokens: In Web3 games, social communities or NFT collections, tokens are used as internal currencies to pay rewards, buy items and participate in events, while NFTs represent unique in-game assets, digital collectibles or membership passes that signal users’ reputation and contribution levels.

- Liquidity and incentives for DeFi: Many protocols issue tokens to reward liquidity providers, traders, lenders and borrowers. This attracts capital flows and increases TVL and volume for the product. In such cases, tokenomics often includes multiple lock, vesting and boost mechanisms to encourage long term commitment.

Example: UNI is the governance token of Uniswap, and holders can help decide the protocol’s direction.

Conclusion

Coins and tokens are both digital assets that operate on blockchain, but they serve very different roles. Understanding these differences helps investors read tokenomics more accurately, assess value correctly and reduce the risk of confusion.

Whether it is a coin or a token, the important point is what problem it solves, what role it plays in the network and whether there is real demand for its use. Once this foundation is clear, participating in the crypto market will be more proactive, confident and sustainable.

FAQs

Q1. Why does it matter to distinguish between coins and tokens?

If you treat all crypto assets as the same, you can easily invest based on hype instead of real utility. Knowing the difference helps you read whitepapers, understand what you are actually buying, and avoid emotional decisions.

Q2. On a technical level, how is a coin different from a token?

A coin is the native asset of its own blockchain, like BTC on Bitcoin or SOL on Solana. A token is created by smart contracts on an existing chain, such as UNI or JUP, and fully depends on that underlying network.

Q3. How do the tokenomics of coins and tokens usually differ?

Coin tokenomics are mainly designed to secure the network and pay miners or validators over the long term. Token tokenomics are more flexible and focus on utilities, incentives, governance, and ecosystem growth for a specific project.

Q4. In practice, when is the native coin more important than a project’s token?

The native coin is crucial whenever you pay gas fees, stake, or help secure and govern the base blockchain. Even if you only care about dApps, every on chain interaction still creates demand for the native coin of that network.

Q5. How are coins and tokens used differently in DeFi and Web3?

Coins often act as base collateral, gas assets, and sometimes long term stores of value in DeFi. Tokens usually live at the application layer, powering governance, discounts, in game economies, rewards, and asset representation.