DeFi, NFTs, and many popular blockchain applications all rely on smart contracts to function. But what exactly is a smart contract, how does it work, and why is it considered a core foundation of Web3?

What Is a Smart Contract?

A smart contract is a computer program that automatically executes the terms of an agreement, which is written in code and stored on a blockchain. It works like a “digital agreement” that automates verification, execution, and settlement without relying on third-party intermediaries such as banks or government agencies.

The smart contract concept was first proposed by computer scientist Nick Szabo in 1994. However, smart contracts only began to gain widespread adoption after Ethereum launched in 2015.

Simple example: Two friends make a bet on a football match. A smart contract automatically transfers funds to the winner once the result is confirmed by a trusted data source, without any human intervention.

How Do Smart Contracts Work?

Smart contracts operate on an “if this, then that” logic, similar to a vending machine. Money goes in, a selection is made, and the machine delivers the result automatically.

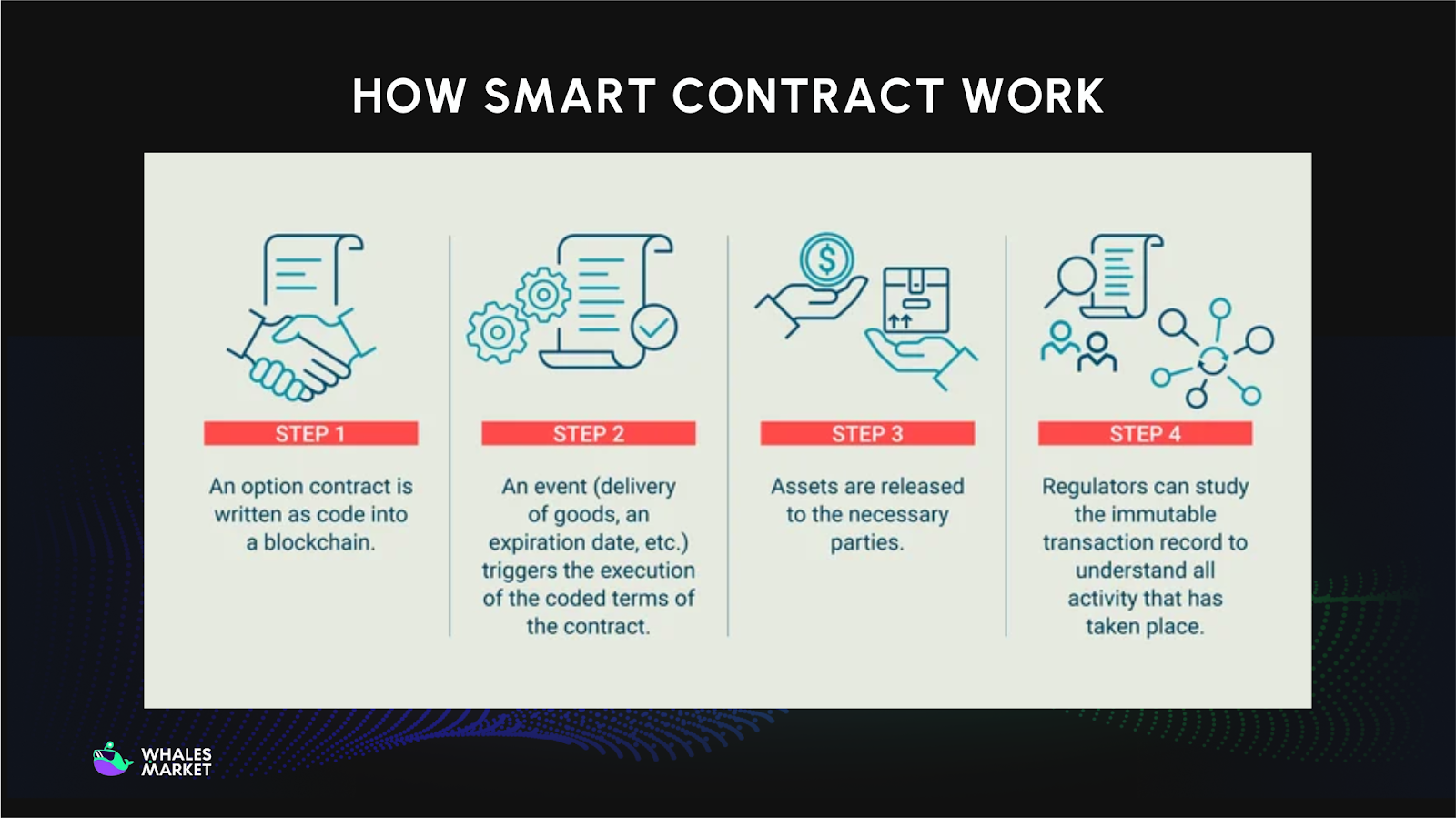

Step 1: Writing the code

The involved parties agree on the terms, then developers translate those terms into code, often using languages like Solidity (on Ethereum), Rust (on Solana), Move (on Aptos, Sui)... The code defines clear rules, such as: “If A sends 1 ETH to B, then B transfers ownership of a digital asset to A.”

Step 2: Storing on the blockchain

The code is deployed to a blockchain network such as Ethereum, Solana, Aptos... Once deployed, it becomes immutable, meaning it cannot be edited or deleted.

Step 3: Automatic execution & Settlement

When predefined conditions are met, such as a deadline or external data from an oracle like asset prices, the smart contract activates automatically. The transaction is permanently recorded on the blockchain, ensuring transparency and irreversibility.

Example: When User A wants to swap Token X for Token Y on a decentralized exchange, they send a transaction to a smart contract that defines all swap rules, including pricing, fees, and liquidity conditions. The contract checks approvals and pool balances, then automatically executes the swap.

Blockchain nodes verify the transaction by strictly following the smart contract logic. Invalid transactions are rejected, and nodes that violate protocol rules may be penalized. Once confirmed, the result is permanently recorded on the blockchain and cannot be altered.

Key Characteristics of Smart Contracts

- Immutable: Once deployed, a smart contract’s code cannot be changed. The rules remain fixed, which protects fairness, but also means bugs cannot be patched directly.

- Transparent: All code and transaction history are publicly visible on the blockchain. Anyone can verify the logic, with no hidden clauses.

- Autonomous: Smart contracts execute automatically when conditions are met. They operate 24/7 without human involvement and cannot be delayed or manually altered.

- Decentralized: There is no central server. Thousands of nodes validate and run the contract together, removing single points of failure.

- Trustless: There is no need to trust a counterparty or intermediary. Trust is placed in the code itself, which is publicly verifiable.

Popular Smart Contract Platforms

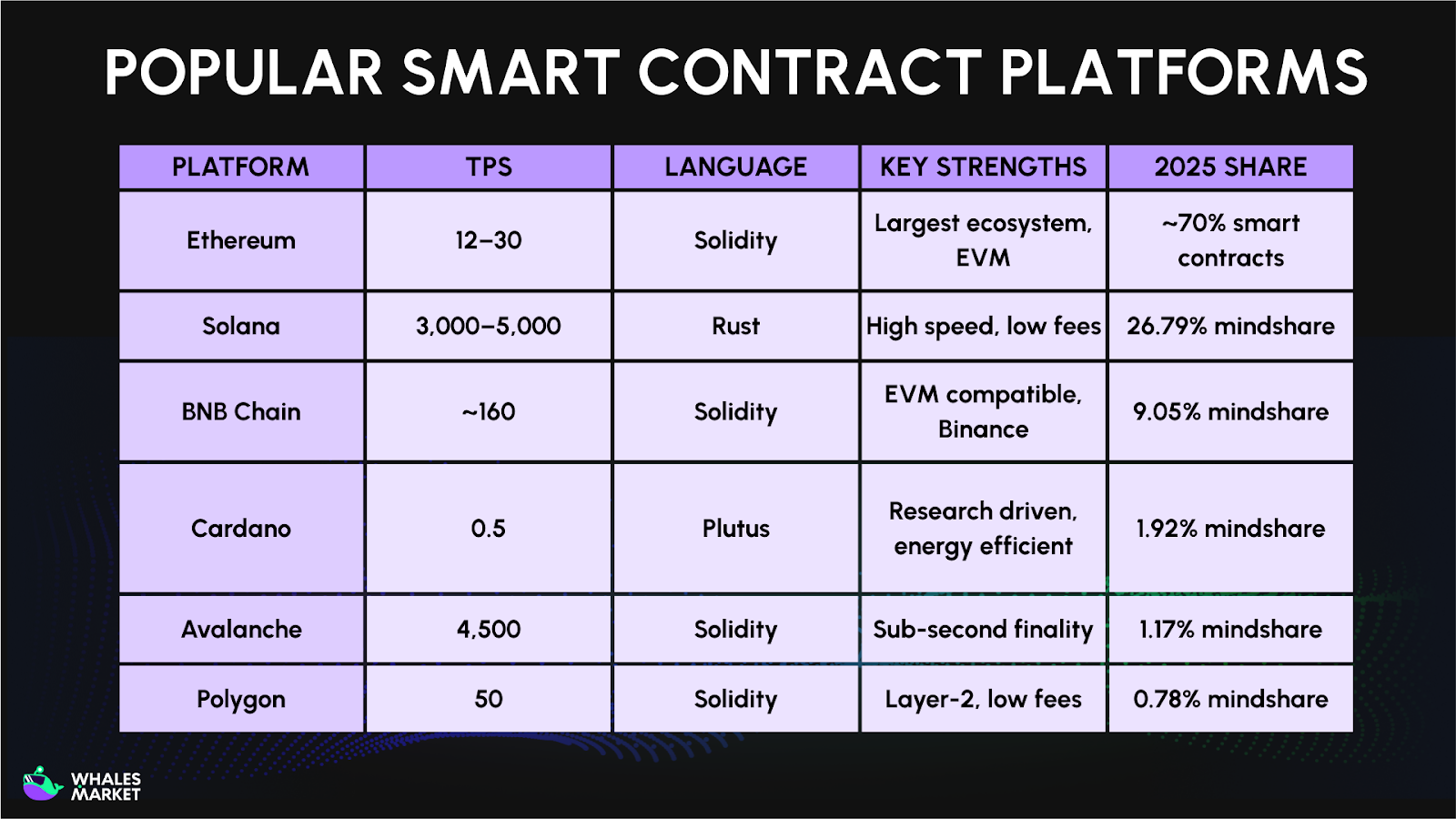

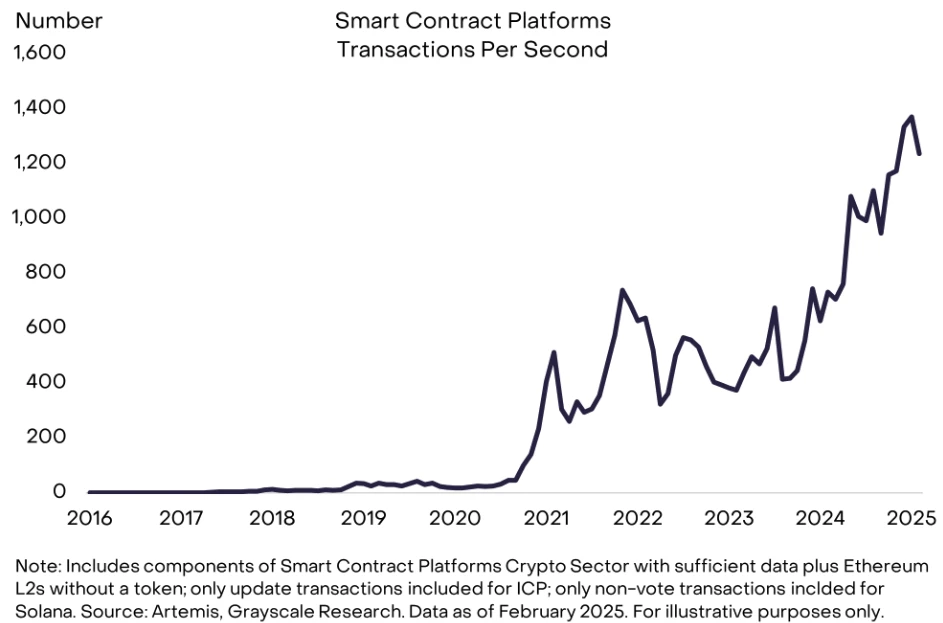

Based on recent data from CoinGecko and market research sources, the leading smart contract platforms include:

Ethereum continues to lead with 50-70% of the smart contract market (Precedence Research 2024, AInvest 2025), supported by a mature ecosystem and strong developer community. Meanwhile, Solana stands out for investor attention in 2025 with 26.79% mindshare (CoinGecko Research, Dec 2025), driven by speed and low transaction costs.

Real-World Applications of Smart Contracts

Smart contracts are not just a technological innovation, they are the foundational infrastructure powering a new wave of decentralized applications across multiple industries. By automating agreements, eliminating intermediaries, and ensuring trustless execution, smart contracts are fundamentally reshaping how value is transferred, verified, and managed globally.

Decentralized Finance (DeFi): The Foundation of Programmable Money

Smart contracts can be considered the backbone of DeFi, without them, decentralized finance simply would not exist. Every lending protocol, decentralized exchange (DEX), and yield farming strategy operates entirely through self-executing code, replacing traditional banks, brokers, and clearinghouses.

The explosion of DeFi demonstrates smart contracts' transformative power:

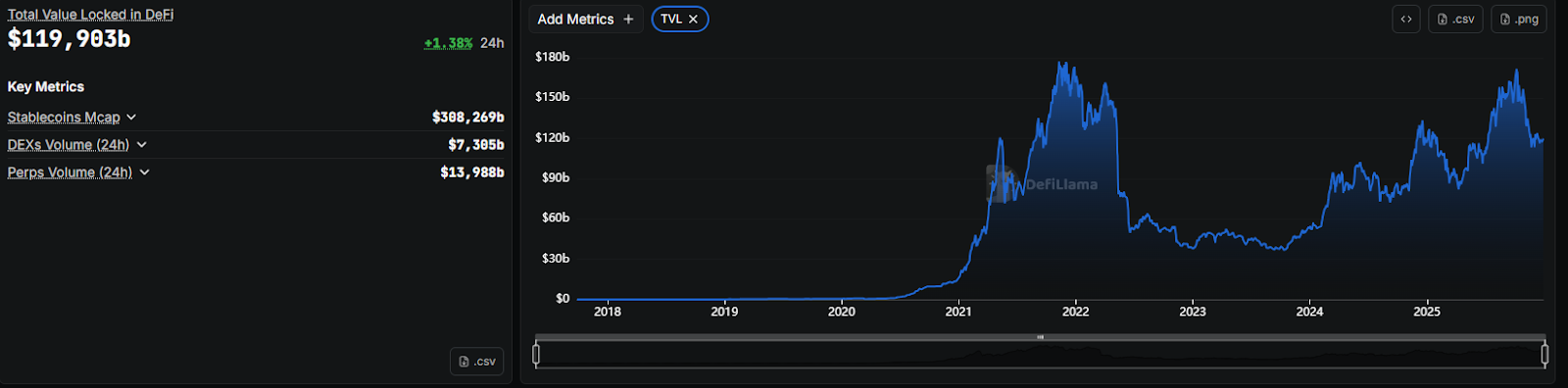

- DeFi reached an all-time high TVL (Total Value Locked) of $177 billion in November 2021, growing from just $300 million in late 2018, a 590x increase in three years (DefiLlama).

- As of late 2024, DeFi TVL recovered to over $133 billion, marking a 150% increase year-to-date (Coinspeaker, December 2024).

- By September 2025, TVL approached $161 billion, nearing its 2021 peak (The Currency Analytics).

What smart contracts enable in DeFi:

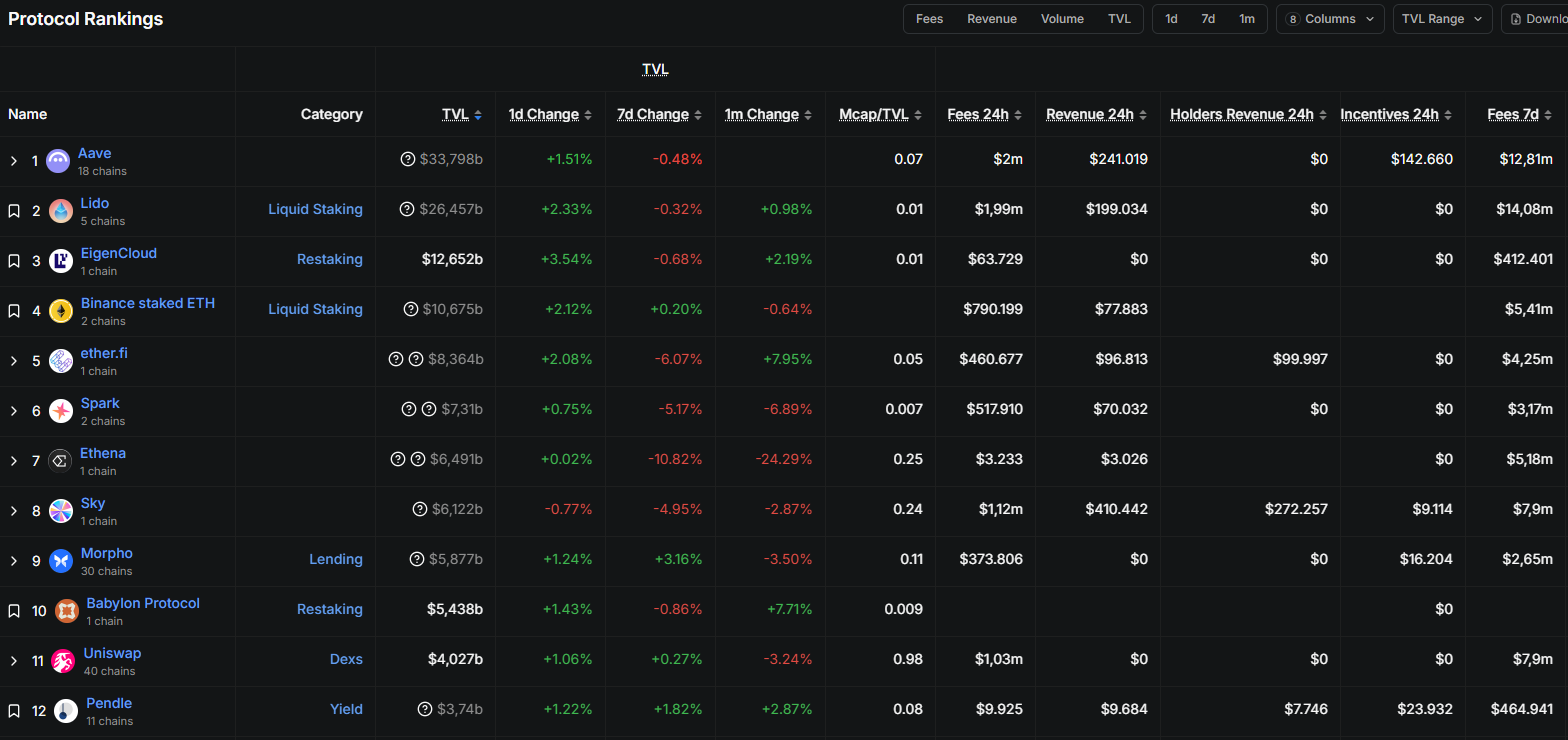

- Automated lending/borrowing: Protocols like Aave and Compound use smart contracts to automatically calculate interest rates based on supply and demand, no human intervention required. Lenders deposit assets, borrowers post collateral, and the smart contract handles everything from interest accrual to liquidations.

- Decentralized exchanges: Uniswap pioneered the Automated Market Maker (AMM) model, where smart contracts replace traditional order books. Liquidity providers deposit token pairs, and the algorithm automatically determines prices based on pool ratios.

- Yield farming and liquid staking: Protocols like Lido (with ~$40 billion staked) allow users to stake ETH while receiving liquid staking tokens (stETH) that can be used elsewhere in DeFi, all governed by smart contracts.

Key projects: Aave, Compound, Uniswap, MakerDAO, Lido, Curve Finance.

Real Estate: From Months to Minutes

Traditional real estate transactions are notoriously slow, expensive, and paper-heavy. A typical home purchase involves lawyers, escrow agents, title companies, notaries, and can take 30-60 days to close. Smart contracts are compressing this timeline dramatically.

How smart contracts transform real estate:

- Automated settlement: Smart contracts can execute ownership transfers the moment payment is confirmed, reducing settlement from weeks to minutes.

- Fractional ownership: Tokenization enables a single property to be divided into thousands of digital tokens, allowing investors to own fractions of high-value real estate.

- Reduced fraud: Immutable blockchain records eliminate title disputes and forgery risks.

Market data and adoption:

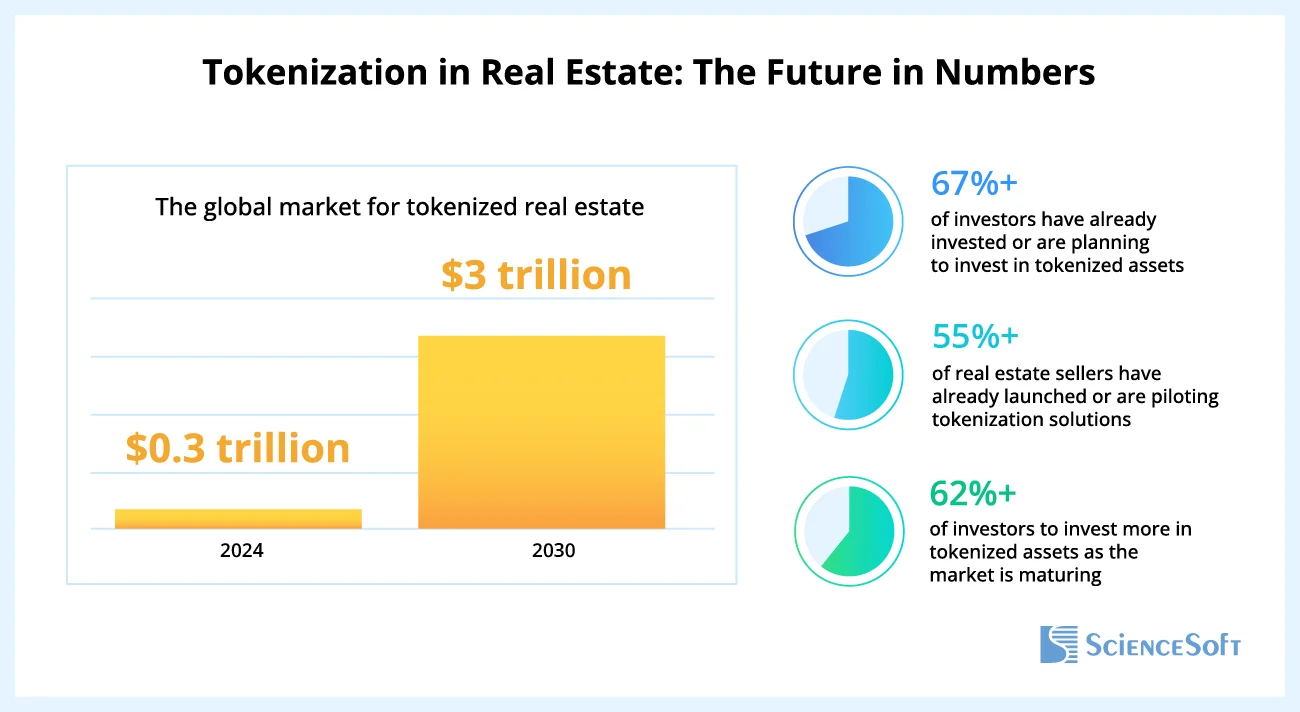

- The global real estate tokenization market was valued at $3.5 billion in 2024 and is projected to reach $19.4 billion by 2033 (CAGR 21%), CMI Research.

- Deloitte projects tokenized private real estate funds could reach $1 trillion by 2035.

- As of June 2024, 12% of real estate firms globally had implemented tokenization, with another 46% actively piloting such solutions (Deloitte).

- BCG expects real estate tokenization to grow from ~$120 billion (2023) to $3.2 trillion by 2030 (~49% CAGR).

Case study:

Propy, credited by University of Oxford Research as one of the companies behind the world's first blockchain-based property transaction (2018, California), has transformed real estate closings. Their AI-powered platform reduced 40% of manual labor in title and escrow processes (Propy 2025 Roadmap).

In January 2025, Propy announced an instant on-chain loan for tokenized real estate in Hawaii, eliminating the standard 30-day escrow period entirely.

Supply Chain: 7 Days to 2.2 Seconds

Supply chain management suffers from fragmented data, opaque intermediaries, and costly recall processes. Smart contracts, combined with blockchain's immutable ledger, create unprecedented transparency from farm to fork.

The problem smart contracts solve: In 2016, when Walmart's Vice President of Food Safety asked his team to trace a package of sliced mangoes to its source, it took 6 days, 18 hours, and 26 minutes using traditional systems.

After implementing blockchain-based smart contracts:

- The same trace now takes 2.2 seconds (IBM Food Trust / Hyperledger Fabric).

- For pork tracking in China, blockchain enabled uploading certificates of authenticity, significantly reducing food fraud in a market historically plagued by safety scandals.

Adoption at scale:

- Walmart now traces over 25 products from 5+ suppliers including mangoes, strawberries, leafy greens, chicken, pork, dairy, packaged salads, and baby foods.

- IBM Food Trust has onboarded over 300 suppliers and buyers, accounting for millions of food products on shelves.

- Major participants include Nestlé, Unilever, Tyson Foods, and Carrefour.

- By 2020, Walmart mandated all fresh leafy greens suppliers to implement blockchain traceability.

- Walmart China launched a separate platform (2019) on VeChain blockchain, initially testing 23 product lines.

Impact: Blockchain's traceability could help address the staggering 1.05 billion tons of food wasted annually (worth ~$1 trillion) by enabling precise recall targeting rather than broad, expensive product pulls (Vision Magazine, 2024).

Insurance: Claims in Seconds, Not Weeks

Traditional insurance claims involve paperwork, manual verification, back-and-forth negotiations, and sometimes months of waiting. Smart contracts enable parametric insurance, policies that automatically pay out when predefined conditions are met, verified by external data sources (oracles).

How it works: Instead of filing a claim and waiting for an adjuster, the smart contract automatically triggers payment when data confirms the triggering event (flight delay, rainfall below threshold, earthquake magnitude, etc.).

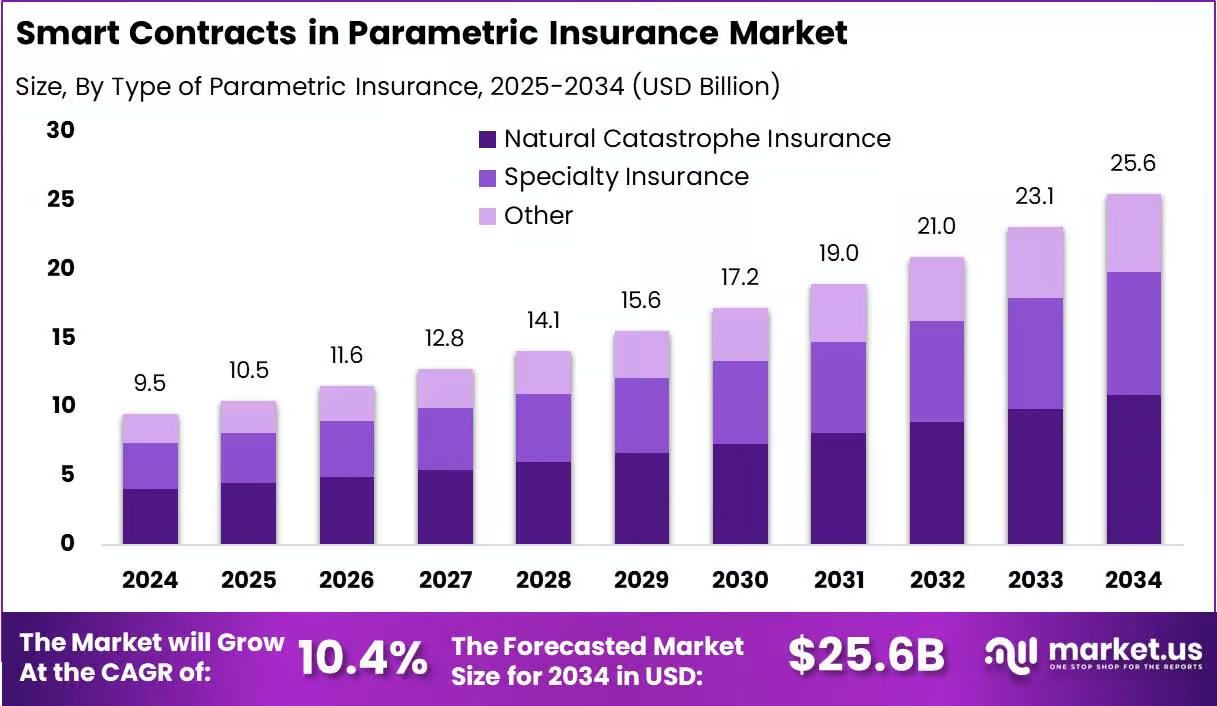

Market growth:

- The Smart Contracts in Parametric Insurance Market was valued at $9.5 billion in 2024 and is projected to reach $25.6 billion by 2034 (CAGR 10.4%), Market.us.

- Blockchain-based smart contracts command 55.6% market share in this sector.

Case study, Etherisc: Etherisc, a Munich-based decentralized insurance protocol, has pioneered several breakthrough products:

- FlightDelay: Travelers purchase policies online, and if their flight is delayed more than 45 minutes (verified via Chainlink oracles pulling FlightStats data), the smart contract automatically issues payment to their wallet, no claim filing required. Available for 80+ airlines globally.

- Crop Insurance (ACRE Africa): Etherisc partnered with ACRE Africa to provide blockchain-based crop insurance to 17,000+ Kenyan farmers, with premiums as low as $0.50 payable in installments. The initiative, supported by Chainlink, Ethereum Foundation, and Mercy Corps Ventures, aims to cover 250,000 farmers in East Africa.

Benefits:

- Eliminates conflict of interest (no claims managers trying to minimize payouts)

- Reduces administrative costs by up to 40% through automation

- Provides instant payouts rather than weeks/months of processing

NFTs and Digital Ownership: The $25 Billion Market

Smart contracts are the invisible engine behind NFTs (Non-Fungible Tokens), enabling verifiable digital ownership, royalty automation, and programmable scarcity for art, music, gaming, and collectibles.

What smart contracts enable:

- Provenance verification: Every NFT's creation, ownership history, and transfer is permanently recorded.

- Automatic royalties: Artists can program smart contracts to automatically receive royalties (e.g., 5-10%) on every secondary sale, forever.

- Programmable utility: NFTs can grant access, unlock content, or represent membership rights.

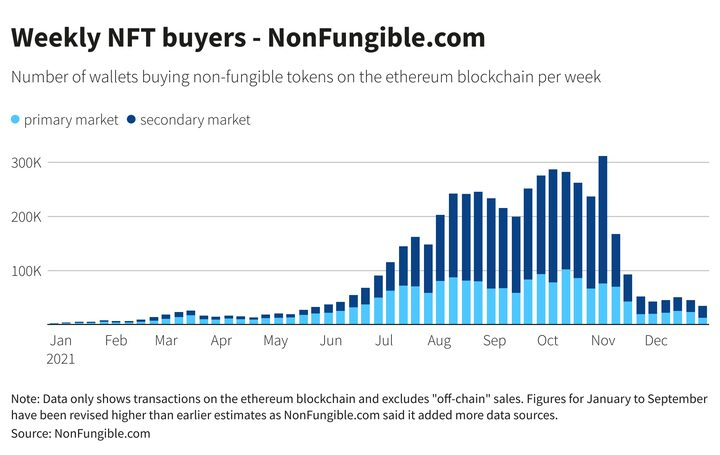

Market explosion:

- NFT sales volume reached $24.9 billion in 2021, up from just $94.9 million in 2020, a 262x increase (DemandSage).

- Wallets trading NFTs expanded from ~545,000 (2020) to 28.6 million (2021).

- The most expensive NFT ever sold: "The Merge" by Pak, $91.8 million (December 2021), purchased by 28,000 collectors.

- "Everydays: The First 5000 Days" by Beeple sold for $69.3 million at Christie's (March 2021), making it the third-most expensive artwork by a living artist.

- NFT market cap grew 3,000% between 2020 and 2021.

Key platforms: OpenSea (hosting 80+ million NFTs), Blur, LooksRare, Foundation, Rarible.

DAOs and Governance: Billions Under Community Control

Decentralized Autonomous Organizations (DAOs) use smart contracts to enable transparent, programmable governance, allowing token holders to vote on proposals, allocate treasury funds, and shape protocol development without centralized leadership.

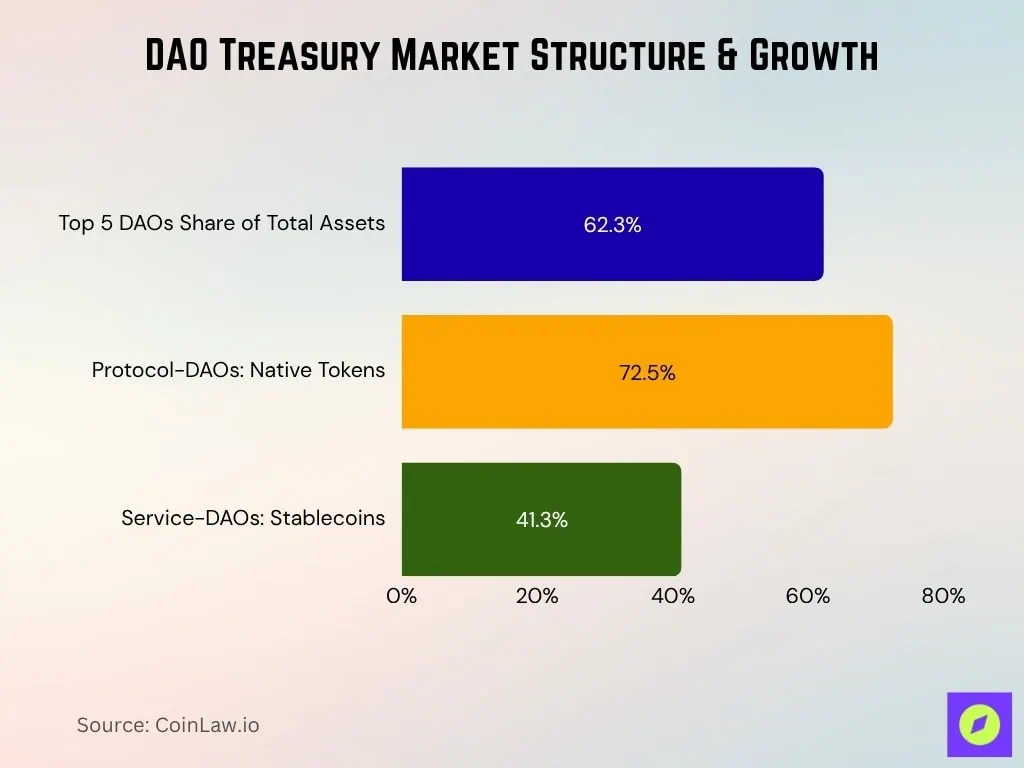

Scale of DAO treasuries (as of 2025):

- Total DAO treasury assets: ~$24-35 billion across all DAOs globally (DeepDAO, CoinLaw).

- Uniswap DAO: $5.4 billion treasury (largest), 356,900 token holders, 35,600 active governance participants.

- Optimism Collective: ~$1.5 billion.

- Arbitrum DAO: ~$1.4-1.8 billion.

- ENS DAO: ~$1.1 billion.

- MakerDAO (Sky): Allocated $1.25 billion into U.S. Treasuries via Monetalis, turning DAO treasury into a revenue engine.

Adoption metrics:

- Over 13,000 DAOs established globally, with 6,000+ exhibiting regular activity.

- 11.3 million holders eligible for governance across various DAOs.

- DAO count grew at ~30% CAGR between 2021-2024.

- Gitcoin DAO has distributed over $45 million in grants to open-source developers.

How smart contracts enable DAOs:

- Proposal submission and voting: Token-weighted voting with transparent on-chain results.

- Treasury management: Multi-sig wallets (Gnosis Safe) require multiple approvals for fund transfers.

- Automatic execution: Passed proposals can trigger immediate on-chain actions.

Challenges: The 2024 Compound DAO attack by "Golden Boys", where attackers accumulated enough COMP tokens to force through a $24 million transfer, highlights the need for governance security measures like veto councils and proposal staking.

Enterprise Adoption: Stablecoins and Global Payments

Major corporations are integrating smart contracts into payment infrastructure to accelerate settlement and reduce costs.

Key developments (2025):

- April 2025: Mastercard unveiled end-to-end stablecoin acceptance and payments capabilities, partnering with Circle, Paxos, Nuvei, and crypto platforms like MetaMask, Binance, OKX, Kraken, and Gemini. Merchants can now receive payments in stablecoins at over 150 million Mastercard locations worldwide.

- June 2025: Mastercard announced support for multiple stablecoins including USDC, PYUSD (PayPal), USDG (Paxos), and FIUSD (Fiserv). The Mastercard Multi-Token Network (MTN) powers programmable payments and stablecoin settlement for B2B applications.

- November 2025: Mastercard partnered with Thunes to enable near real-time payouts to stablecoin wallets via Mastercard Move, reaching 200+ markets and 150+ currencies .

This represents the convergence of traditional finance (TradFi) with blockchain infrastructure, a trend accelerating as regulatory clarity improves.

Advantages and Disadvantages of Smart Contracts

Advantages

Smart contracts automate complex processes, enforce transparency through immutable blockchain records, and leverage cryptographic security, all without intermediaries. Once deployed, they execute automatically when conditions are met, eliminating paperwork, manual verification, and lengthy negotiations typical of traditional agreements.

The cost savings are substantial. Smart contracts reduce processing time by up to 50%, cut cross-border payment times by 80% (from days to minutes), and slash real estate transaction costs by up to 50%.

Beyond efficiency, smart contracts offer global accessibility without geographic restrictions. Anyone with internet access can participate, from farmers in Kenya receiving automatic crop insurance payouts to investors purchasing tokenized real estate across continents, all operating 24/7 unlike traditional banking.

Disadvantages

Nothing is perfect, and smart contracts have limitations users should understand. While smart contracts offer numerous advantages, they also come with significant challenges that can lead to severe consequences if not properly addressed.

Code Vulnerabilitiess

Smart contracts are written in programming languages like Solidity, and like any software, they can contain bugs. However, unlike traditional software that can be patched, smart contracts on blockchain are immutable, once deployed, the code cannot be changed. This means a single vulnerability can be exploited repeatedly until all funds are drained.

Example: Ronin Bridge Hack (2022), $620M lost. Attackers used social engineering to compromise 5 of 9 validator keys and exploit outdated allowlist permissions, forging withdrawals of 173,600 ETH and 25.5M USDC. The breach remained undiscovered for six days.

Lack of Flexibility

Once a smart contract is deployed to the blockchain, it becomes permanent and unchangeable. This immutability is both a feature and a flaw. While it ensures no one can tamper with the contract's logic, it also means:

• Bugs cannot be patched: If a vulnerability is discovered after deployment, you cannot simply "update" the contract. You must deploy an entirely new contract and convince all users to migrate, a complex, expensive, and often incomplete process.

• Laws change, but contracts don't: Real-world regulations evolve constantly. A smart contract written in 2020 cannot automatically adapt to new tax laws in 2024 or new KYC/AML requirements. Traditional contracts can be amended; smart contracts must be replaced.

• Business terms can't be renegotiated: In traditional business, contracts are often amended when circumstances change. If both parties agree to extend a deadline or change payment terms, they simply sign an amendment. With smart contracts, such flexibility requires deploying a completely new contract (Ethereum.org, OpenZeppelin).

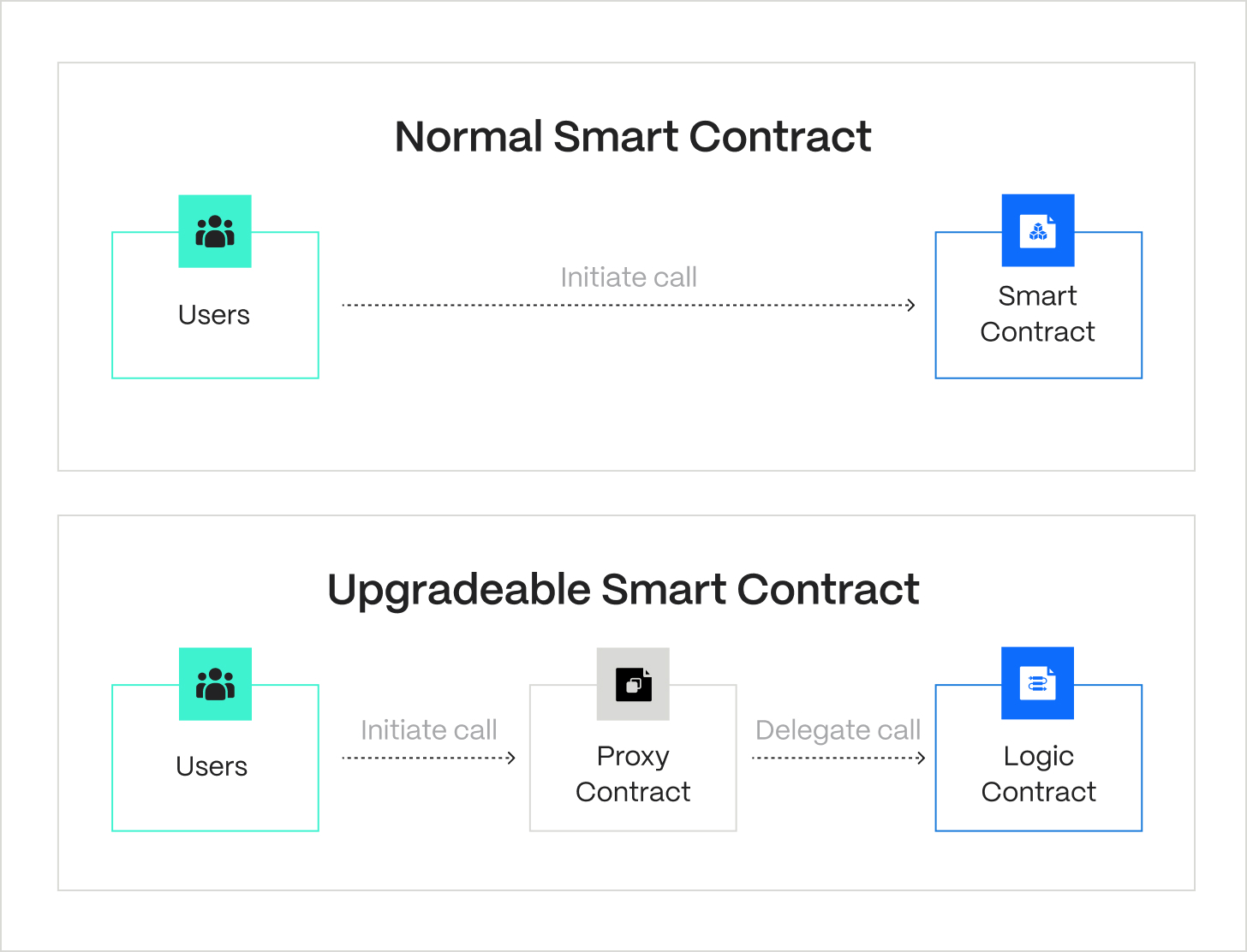

Modern solutions like "proxy patterns" allow upgradeable contracts by separating data storage from logic. However, this introduces a trust trade-off: someone must have the power to upgrade, which undermines the "trustless" promise of blockchain. As Hacken notes, "Upgradeable contracts build trust among parties since even the contract's creator can alter it, but this also means they can be updated, posing risks".

Oracle Dependency

Smart contracts live on the blockchain, a closed, isolated system that cannot directly access real-world data like stock prices, weather conditions, or sports scores. To get external information, they rely on "oracles", third-party services that feed data into the blockchain. This creates a critical vulnerability: if the oracle provides wrong data (whether by error or manipulation), the smart contract will execute based on false information.

Mango Markets Exploit (2022), $117M lost. An attacker manipulated the MNGO price using self-trading and thin liquidity, tricking the oracle into inflating collateral value and draining platform assets within 40 minutes. The incident highlighted severe risks from oracle dependence and price manipulation.

Conclusion

Smart contracts represent a major step forward, turning traditional agreements into automated, secure, and efficient digital systems. While challenges remain, the current pace of development suggests they will continue to reshape how everyday transactions are conducted.

FAQs

Q1. Do smart contracts have legal validity?

Smart contracts are primarily technical tools that execute code on a blockchain. Legal recognition depends on national laws, digital signature frameworks, and whether businesses pair smart contracts with off-chain legal agreements.

Q2. Can smart contracts be hacked?

Blockchains are difficult to alter, but smart contracts can be exploited if code contains bugs, flawed logic, or weak administrative controls. Most risks come from programming and governance errors rather than blockchain weaknesses.

Q3. How long does it take to write a smart contract?

The time required depends on complexity. Simple smart contracts may take a few hours or days, while production-grade contracts for finance or enterprise use often require weeks of development, testing, and security auditing.

Q4. Can non-programmers use smart contracts?

Yes. Most users interact through wallets and application interfaces. The smart contract logic runs in the background, though basic knowledge of gas fees, token approvals, and contract risks remains important.

Q5. Where are smart contracts stored?

Smart contracts are stored directly on a blockchain as immutable code. Once deployed, the contract’s bytecode and state are maintained across all nodes in the network and cannot be altered without predefined upgrade mechanisms.