In less than three years, Perpetual DEXs have moved from the edge of DeFi to the core of the derivatives market. In 2024, on-chain perpetual trading volume surpassed $1.5T, and by 2025, some days saw nearly $100B processed on Perp DEXs. Behind these numbers lies a fundamental shift in how traders approach leverage, control, and risk.

So what exactly is a Perpetual DEX, how does it work, and why has this narrative become one of the hottest themes in 2025?

What is a Perp DEX?

Perpetual DEX (Perp DEX) is a decentralized exchange that allows users to trade perpetual futures directly on-chain. Unlike traditional futures contracts with fixed expiration dates, perpetual futures never expire, meaning positions can be held as long as users choose, with users able to go long when expecting prices to rise or go short when anticipating price declines.

Perp DEXs ultimately blend DeFi-level asset control with the professional trading experience commonly associated with centralized exchanges.

8 Key Features of Perpetual DEXs

- Self-custody: Users keep crypto assets in their own wallets without depositing funds to a third party. Trades are executed directly from wallets, removing risks tied to exchange collapses, hacks, or asset freezes, as seen in cases like FTX.

- No KYC: Most Perp DEXs allow trading immediately after wallet connection, without identity verification. This setup favors users who value privacy and unrestricted global market access.

- Full transparency: All trades, funding rates, and liquidations are recorded on-chain and publicly verifiable. There is no black box behavior, as users can see exactly how the system operates at all times.

- CEX-level performance: Leading Perp DEXs such as Hyperliquid process up to 200,000 orders per second with sub-second latency. BTC and ETH spreads typically sit around 0.1-0.2 basis points, close to Binance.

- Competitive fees: Hyperliquid charges just 0.01% maker and 0.035% taker fees, while Lighter operates with zero fees. Compared with the CEX average of 0.04%, Perp DEXs are no longer more expensive.

- DeFi composability: Perpetual trading can be combined with yield farming, lending, or other DeFi strategies within the same ecosystem, enabling workflows that centralized exchanges cannot support.

- Expanding product range: Beyond crypto, some Perp DEXs now offer stock perpetuals for 24/7 equity trading, along with forex and commodities, expanding opportunities well beyond traditional crypto markets.

- Attractive airdrop opportunities: Many newer Perp DEXs such as Variational, EdgeX, and Paradex run points programs. Users trade to accumulate points and receive token airdrops at TGE, a model that fueled Hyperliquid’s surge in late 2024.

Read More: Top 10 Perp DEX Airdrops You Shouldn’t Miss (2026)

The Rise of the Perp DEX

The year 2024 marked a historic milestone. Total trading volume across the top 10 Perp DEXs reached $1.5T, up more than 138% from $647.6B in 2023. In December 2024 alone, trading volume hit $344.75B, according to CoinGecko report.

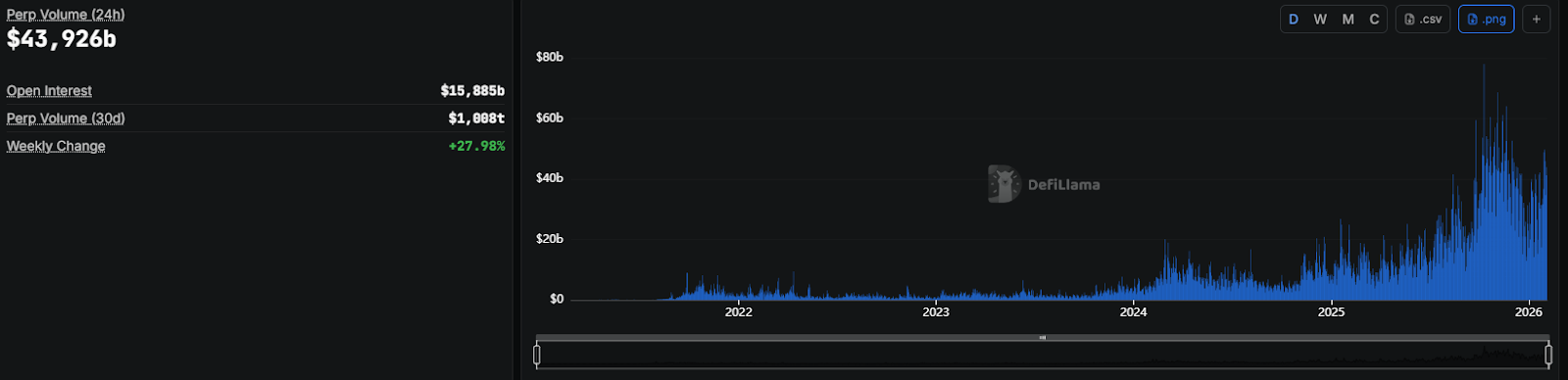

By September 2025, daily Perp DEX trading volume reached $96.97B, with monthly volume nearing $1.064T. Perp DEXs now account for roughly 26% of the crypto derivatives market, up from single digits the year before.

Overall, decentralized derivatives have experienced a sharp expansion in trading volume rather than market capitalization. As stated by DefiLlama, by late 2025, Perp DEXs were processing:

- Roughly $44B in daily volume.

- Over $1T in rolling 30-day volume.

- With open interest approaching $16B.

These statistics signal strong capital commitment to perpetual protocols.

How do Perpetual DEXs work?

To fully understand Perp DEXs, it is essential to understand their core building.

What are Perpetual Futures?

Perpetual futures, often called perps, are derivative contracts that allow traders to speculate on the future price of an asset by taking a long or short position, without owning it and any expiration date.

The concept was first proposed in 1991 by Nobel Prize-winning economist Robert Shiller, but it only gained real traction in 2016 when BitMEX introduced it to the crypto market. Today, perpetual futures are the most widely used derivative instrument in crypto, with daily trading volumes exceeding $100B, according to Digital Chamber.

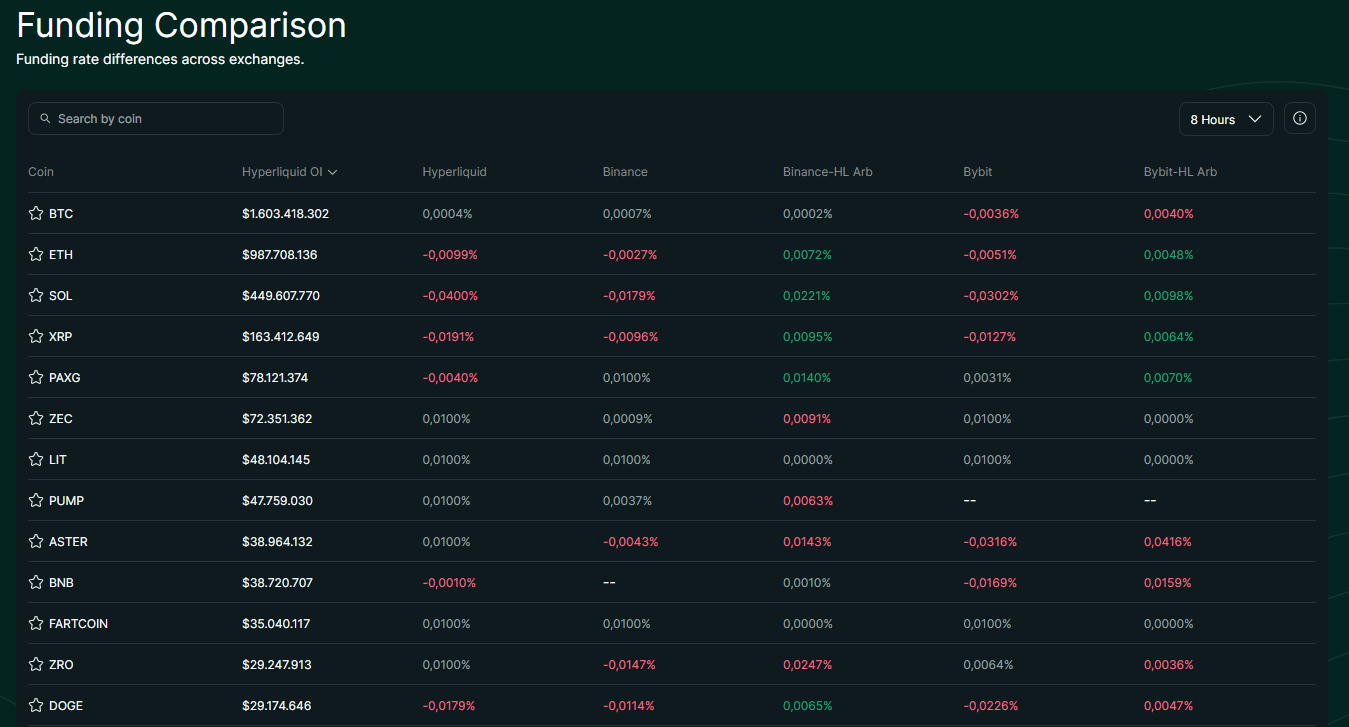

The Funding Rate Mechanism

Because perpetual futures have no expiration date to naturally align prices with the spot market, they rely on a special mechanism called the funding rate.

Funding rates work as follows:

- Funding is a periodic payment, typically every eight hours, exchanged between long and short position holders.

- When the perpetual price is higher than the spot price, known as contango, the funding rate is positive and long positions pay shorts.

- When the perpetual price is lower than the spot price, known as backwardation, the funding rate is negative and shorts pay longs.

This mechanism incentivizes traders to take opposing positions, pulling the perpetual price back toward the spot price.

Example: If Bitcoin spot trades at $30,000 while the perpetual price is pushed up to $31,000 due to strong long demand, the funding rate becomes positive. Long holders pay shorts, encouraging traders to open short positions or close longs, which pushes the perpetual price back toward spot.

Funding costs can add up quickly.

With a funding rate of +0.01% every eight hours, a $50,000 position pays $5 per interval, or roughly $15 per day. Annualized, a 0.01% per eight-hour rate equals about 11% per year, a significant cost for long-term positions.

Leverage

Leverage is one of the most attractive features of perpetuals. Most perp platforms offer leverage from 5x-100x, and some, like Aster, go as high as 1,001x, though with extreme risk.

Leverage works as follows:

- Users put $1,000 in margin and choose the 10x leverage, then it means they control a $10,000 position.

- If price increases by 10%, the gain is 100%, or $1,000 profit on $1,000 capital.

- If price drops by 10%, the entire margin is lost and the position is liquidated.

In summary, perpetual futures rely on funding rates and leverage to stay aligned with spot prices. This structure offers flexibility and liquidity, but it also introduces holding costs and significant liquidation risk, especially when leverage is high.

Top Perpetual Decentralized Exchanges (Perp DEXs)

As of February 2026, based on DefiLlama data, the following are the four leading Perp DEXs by cumulative trading volume:

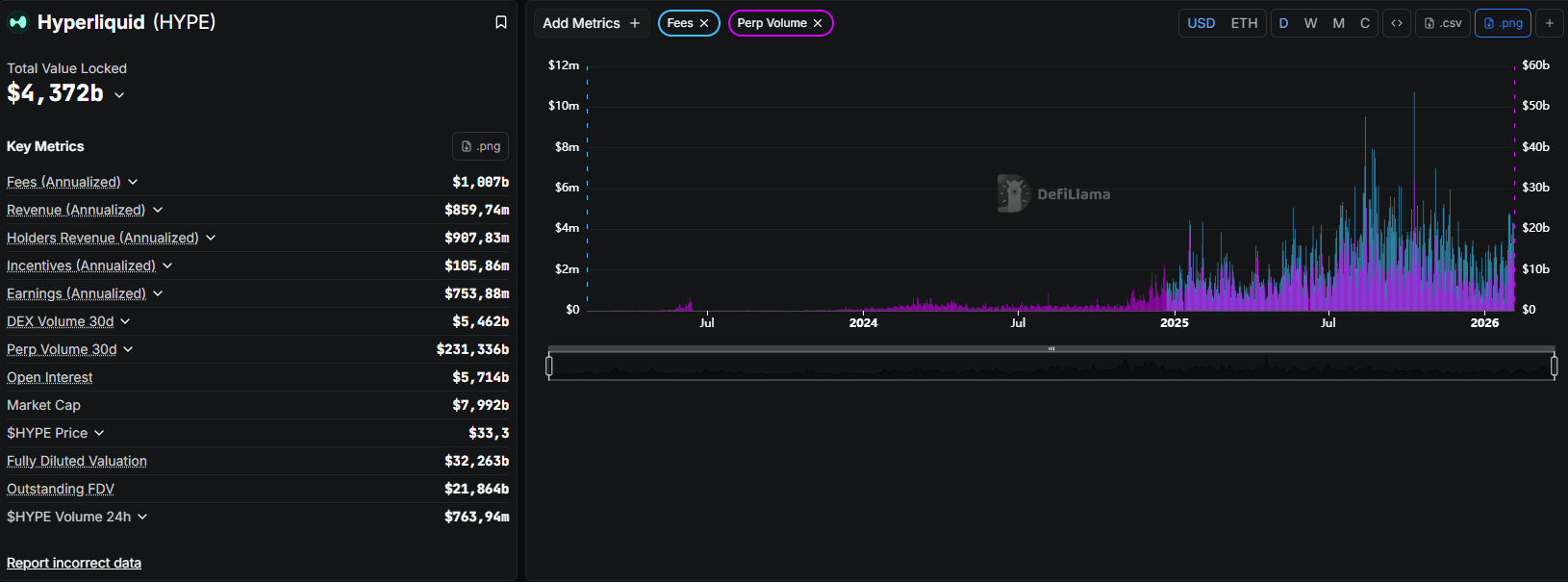

Hyperliquid

Hyperliquid is a Layer 1 blockchain built specifically for derivatives trading, using its proprietary HyperBFT consensus. Unlike most Perp DEXs that operate on Ethereum or Arbitrum, Hyperliquid runs as an independent chain fully optimized for trading performance.

Key metrics:

- Cumulative trading volume: over $3.7T.

- Open interest: around $5B, representing more than 54% of the total Perp DEX market (Cryptopolitan).

- TVL: approximately $4.5B.

- Order throughput: up to 200,000 orders per second.

- Latency: roughly 0.2 seconds.

- Trading fees: 0.01% maker / 0.035% taker.

Notable points:

- Capital structure: No venture capital funding. The project is fully self-funded by the founding team, avoiding token unlock driven sell pressure.

- Community distribution: The HYPE token was airdropped to users in late 2024, creating a major market event.

- Market quality: BTC and ETH spreads typically range between 0.1 and 0.2 basis points, comparable to top centralized exchanges.

- Transparency: A fully on-chain order book allows real-time visibility into large trader activity. BingX Research reported that a trader known as “The White Whale” generated over $50M in profit within 30 days, with trades visible to the entire market.

- Product expansion: Ongoing development of HIP-3, enabling perpetual markets backed by real-world assets, alongside USDH, a stablecoin backed by US Treasuries.

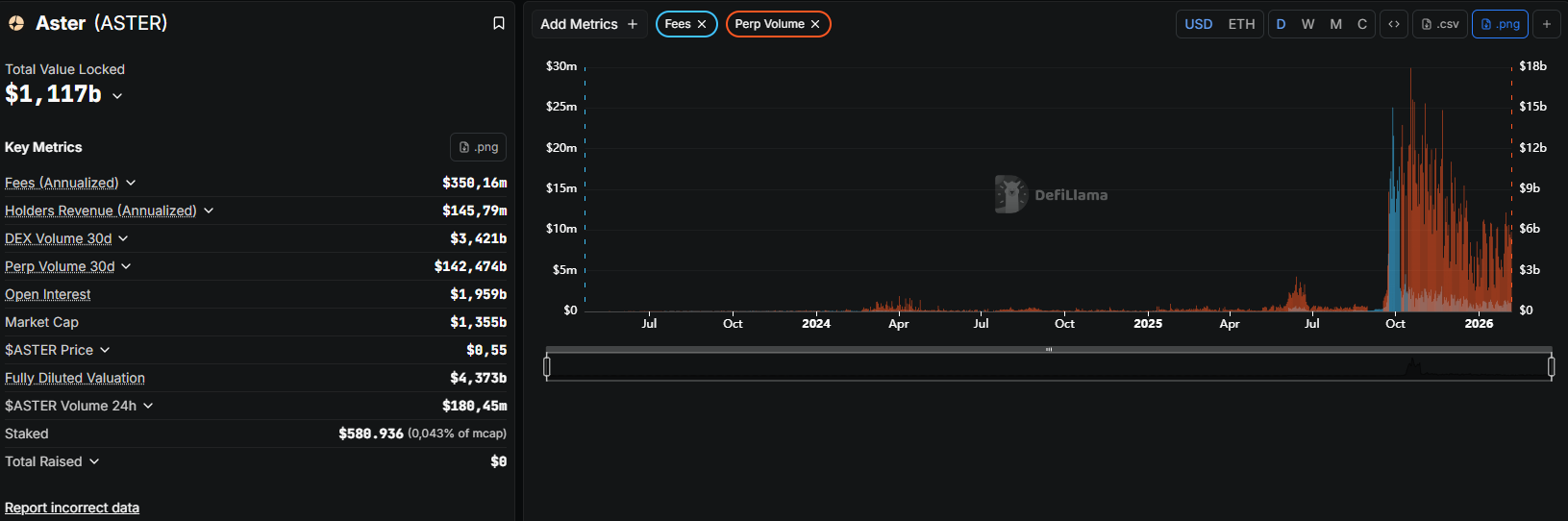

Aster

Aster is a multi-chain perpetual trading platform formed through the merger of Asterus and APX Finance in late 2024. It combines APX’s perpetual trading engine with Asterus’s liquidity infrastructure, allowing users to trade across multiple chains without bridging assets.

Key metrics:

- Cumulative trading volume: over $1T.

- Open interest: close to $2B.

- TVL: around $1.5B.

Notable points:

- Leverage offering: Supports leverage up to 1,001x, catering to high-risk trading strategies.

- User experience: Enables multi-chain deposits without asset bridging, reducing friction for traders.

- Strategic backing: Supported by CZ, founder of Binance, through YZi Labs.

- Product differentiation: Among the first platforms to offer 24/7 stock perpetuals, allowing continuous trading of equities such as Apple and Tesla.

Read more: Aster vs HyperLiquid: Who Is the Winner?

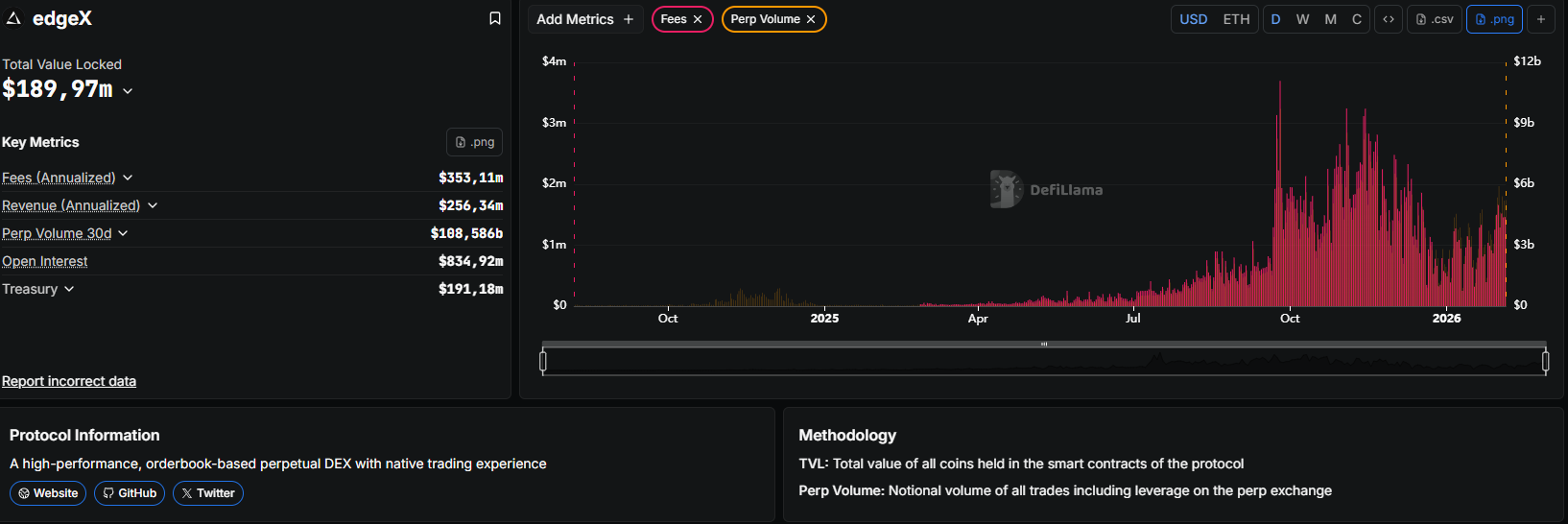

EdgeX

EdgeX is an order book–based Perp DEX built on Ethereum Layer 2, designed specifically for high-frequency trading. Its architecture separates custody, execution, and liquidity aggregation into distinct layers to improve performance and capital efficiency.

Key metrics:

- Cumulative trading volume: over $700B.

- Open interest: more than $800M.

- TVL: approximately $200M.

- LP yield: up to 57% APY.

Notable points:

- Chain coverage: Supports more than 70 blockchains, offering one of the broadest multi-chain footprints among Perp DEXs.

- Leverage limits: Up to 100x leverage on BTC trading pairs.

- Security: Backed by Amber Group and audited by PeckShield and SlowMist.

- Financial resilience: Treasury operations remain profitable even under stress test scenarios, reflecting a focus on long-term sustainability.

Read more: How to Get edgeX Airdrop? A Detailed Guide

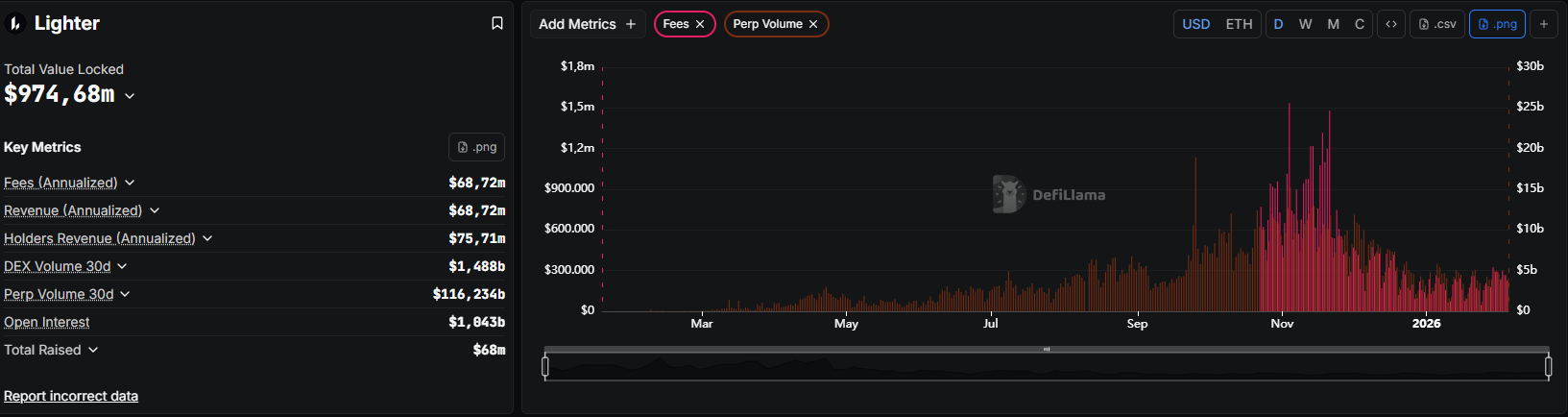

Lighter

Lighter is a Perp DEX built on zk-rollup technology, known for its zero-fee trading model. Founded by Vladimir Novakovski in 2022, the platform launched its public mainnet in late 2025.

Key metrics:

- Cumulative trading volume: over $1.4T.

- Open interest: above $1B.

- TVL: close to $1B.

Notable points:

- Funding: Raised $68M from a16z and other investors.

- Fee strategy: Eliminates direct trading fees to attract volume, monetizing primarily through spreads.

- Technology stack: Uses zk-rollups to achieve high throughput while maintaining user privacy.

Learn more: Lighter vs Hyperliquid: Who Is the Winner?

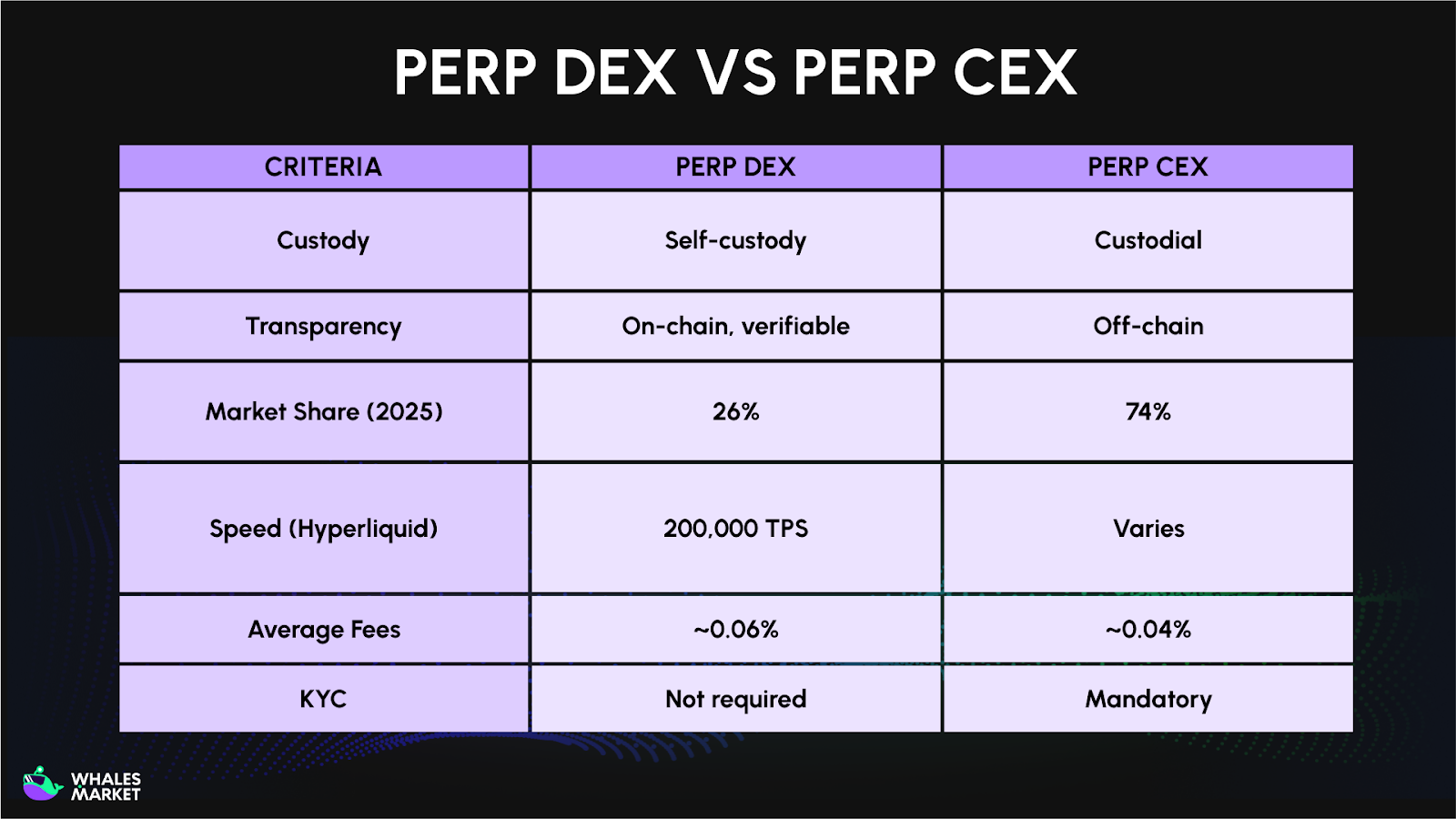

Perp DEX vs Perp CEX: Which is better?

The big picture

In 2022, Perp DEXs accounted for just 1% of the crypto derivatives market. By mid-2025, that share had grown to 26%. In other words, one out of every four perpetual contracts traded globally now runs on decentralized infrastructure.

What is driving this shift? Let’s deep dive into how Perp DEX vs Perp CEX is different.

Who holds the funds?

On Perp CEXs, when users deposit funds to platforms like Binance or Bybit, they trust the exchange to hold those assets. Users do not truly own the crypto; they hold an IOU from the exchange. If the exchange is hacked, goes bankrupt, or freezes accounts, funds can become inaccessible. FTX remains the most expensive lesson.

On Perp DEXs, funds stay in user wallets until trades are executed. Smart contracts only interact with assets when necessary. According to the ApeX Blog, this is the core trade-off: CEX users face full custodial risk, while DEX users retain control but must manage technical smart contract risk.

After the FTX collapse, capital flowed rapidly into Perp DEXs. Cryptopolitan noted that growth was driven by “the move away from centralized exchanges after regulatory crackdowns and past collapses like FTX.”

Transparency

On Perp CEXs, the order book shown may not reflect reality. Exchanges can trade against users, front-run large orders, or manipulate liquidations, and there is no way to verify this behavior.

On Perp DEXs, everything is on-chain and verifiable. Every trade is visible, auditable, and managed through code rather than intermediaries. Hyperliquid even offers real-time leaderboards, making whale activity visible to everyone.

This transparency fuels whale watching. Well-known traders like James Wynn and The White Whale, who reportedly earned over $50M in profit within 30 days on Hyperliquid, became market focal points.

James Wynn did it.

— Lucky ☘️ (@LuckyXBT__) May 21, 2025

The first notional position of $1b *ever* on Hyperliquid.

$25m of margin, on 40x. Absolute mad man.

Best of luck. https://t.co/6gCZlp2uCd pic.twitter.com/p4FHPYt9xN

Speed and Liquidity

Perp CEXs still dominates in absolute liquidity. In May 2025, Binance processed about $1.7T in monthly volume, while Hyperliquid handled roughly 9% of that figure, according to AiCoin.

On Perp DEXs, the gap is closing. Atomic Wallet Research reports that Hyperliquid processes 200,000 orders per second with around 0.2-second latency. BTC and ETH spreads remain at 0.1 to 0.2 basis points. LBank Analysis also confirms Hyperliquid’s speed advantage over dYdX, which runs at around 2,000 TPS on Cosmos.

Trading Fees

According to Mettalex, average CEX fees in 2025 were around 0.04%, or four basis points, with high-volume traders sometimes paying as low as 0.02%.

Using the same Mettalex data sourced from Grayscale, average DEX fees were around 0.06%. However, Publish0x reports that Hyperliquid charges only 0.01% maker and 0.035% taker fees, lower than many CEXs. With $1M in monthly volume, fees on Hyperliquid total about $350, compared with over $1,000 on GMX.

KYC & Accessibility

Perp CEXs require full KYC. While Perp DEXs allow users to trade perpetual futures directly from crypto wallets without KYC. This lowers entry barriers, enhances privacy, and opens derivatives trading to global participants without reliance on traditional financial systems.

There is no universal answer to whether DEXs or CEXs are better. The right choice depends on individual needs.

- Perp DEXs are highly feasible for professional and experienced traders but carry smart contract risks.

- Perp CEXs are often easier for beginners but have faced hacks and shutdowns.

Risks of Trading on Perpetual DEXs

Perp DEXs offer freedom, but freedom comes with risks and responsibility. According to QuillAudits, more than $3.2B in losses occurred in 2025 alone due to oracle manipulation, flash loan attacks, and mass liquidations.

- Smart contract risk: Assets are locked in smart contracts. If logic or access control flaws exist, attackers can exploit them and drain entire pools, leading to irreversible losses. KiloEx was exploited for $7.4M in April 2025 due to an access control flaw in its oracle. The attacker manipulated the ETH price inside the contract from $100 to $10,000, opened a long position, and then closed it for a massive profit.

- Oracle manipulation risk: Weak or AMM-dependent oracles can be manipulated through flash loans, resulting in distorted price feeds, unfair liquidations, and abnormal profits for attackers.

- Liquidation cascade and ADL risk: During extreme volatility, mass liquidations can trigger domino effects. When insurance funds are overwhelmed, systems may forcibly close even profitable positions to maintain solvency.

- Funding rate risk: Prolonged positive funding rates cause holding costs to accumulate over time, quietly eroding profits for medium and long-term position holders.

- Liquidity gap risk: On lower-liquidity DEXs, large orders can cause severe slippage. Users may be unable to exit positions at expected prices during stressed market conditions.

- Regulatory risk: Perp DEXs operate within unclear regulatory environments across many regions. Sudden restrictions or policy changes can directly affect access and trading availability.

- Leverage misuse risk: Leverage amplifies both gains and losses. High trading volume does not guarantee effective strategies, and excessive leverage in volatile markets often leads users to losses.

Conclusion

Perp DEXs are not a short-lived trend but a natural response to growing demand for asset control, transparency, and capital efficiency in derivatives markets. They create new opportunities while exposing clear risks. Understanding the mechanics, choosing the right platforms, and managing leverage responsibly define the line between advantage and loss.

FAQs

Q1. Which type of trader is Perp DEX most suitable for?

Perp DEXs suit traders familiar with wallet management and the mechanics of leverage and funding rates. Users who prioritize self-custody, on-chain transparency, and active risk control benefit most from this model.

Q2. Should new traders start with Perp DEXs?

New traders can participate but should begin with low leverage, small position sizes, and high-liquidity pairs. Understanding liquidation mechanics, funding rates, and on-chain interfaces is essential before scaling capital.

Q3. What makes Perp DEXs different from traditional DeFi platforms?

Perp DEXs go beyond spot trading by combining leverage, deep liquidity, and derivatives mechanics. They offer an experience close to centralized exchanges while preserving DeFi principles of control and transparency.

Q4. Why are funding rates important for long-term traders?

Funding rates directly affect position holding costs. When funding stays positive for extended periods, profits can shrink significantly even if market direction is predicted correctly, weakening long-term strategies.

Q5. What is the biggest risk when trading on Perp DEXs?

The largest risk lies in how leverage is used. High volatility, thin liquidity, or oracle failures can trigger liquidations faster than users can react.

Q6. Will Perp DEXs continue to grow in the future?

Trends suggest continued growth driven by better performance, deeper liquidity, and new products like stock and forex perpetuals. Long-term sustainability depends on risk management and evolving regulatory frameworks.

Q7. Which is the best perp dex: aster or hyperliquid?

There is no single best choice. Hyperliquid excels in liquidity and execution quality, while Aster offers higher leverage and broader multi-chain flexibility for different trading strategies.