Crypto faucets have evolved from giving away 5 BTC for free in 2010 to distributing testnet tokens for developers in 2026. This guide explains what crypto faucets are, how they work, their different types, real world examples supported by community stories, and what users need to understand before interacting with them.

What is a Faucet in Crypto?

A crypto faucet is a distribution mechanism that provides very small amounts of tokens, usually for free, in exchange for basic interactions with a blockchain network. These interactions can include CAPTCHA verification, wallet connection, social account linking, or simple on-chain actions.

Unlike airdrops or incentive campaigns, faucets are not designed to create strong financial motivation. Their primary function is to reduce barriers to entry, allowing users or developers to interact with a blockchain without initial capital. The faucet metaphor reflects this purpose: it releases tokens slowly, providing just enough to begin.

When were faucets introduced?

In June 2010, Bitcoin developer Gavin Andresen launched a simple website called The Bitcoin Faucet. The concept was straightforward: users visited the site, solved a CAPTCHA, and received 5 BTC for free. At the time, Bitcoin was worth less than $0.01, making each payout worth only a few cents.

By the time the faucet shut down in 2012, it had distributed approximately 19,700 BTC to thousands of early users. At February 2026 prices of roughly $70,000 per BTC, that amount would be worth around $1.38B. Each 5 BTC payout would now be worth approximately $350,000.

This origin story captures the core idea behind crypto faucets: low-barrier tools designed to introduce people to blockchain technology by placing real or simulated tokens directly into their wallets. While free Bitcoin giveaways no longer exist, faucets remain an important part of the crypto ecosystem in 2026, though in a very different form.

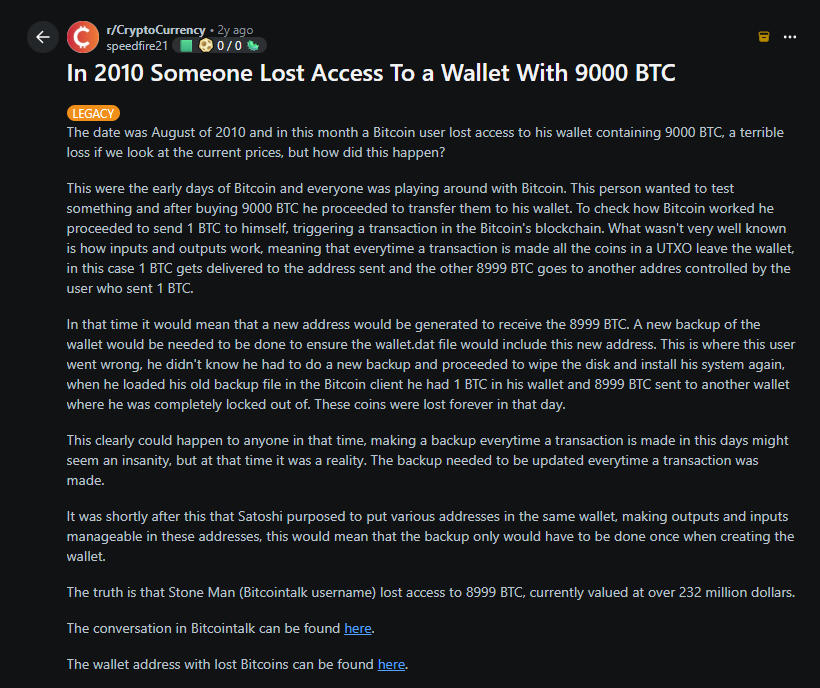

The legacy of The Bitcoin Faucet is reflected not only in numbers but also in personal stories from early users, many of whom later lost access to wallets holding significant amounts of BTC.

“I heard about Bitcoin back in 2010, even visited the faucet, but never thought those coins would be worth anything. Lost access to the wallet years ago. If only I had known...” - Reddit user, r/Bitcoin

Similar stories appear across r/Bitcoin and r/CryptoCurrency, including accounts of users losing wallets with thousands of BTC from early faucets. These experiences show that crypto faucets were more than promotional tools. For those who kept access to their wallets, they became one of the most asymmetric opportunities in financial history.

What Faucets really distribute in Crypto

The most important reframing for understanding faucets in 2026 is recognizing what they actually distribute. Faucets do not distribute financial value. They distribute on-chain behavior.

When a user receives a small amount of tokens from a faucet, they are required to practice the fundamental operations of blockchain systems. This includes setting up a wallet, managing keys, signing transactions, and understanding gas fees. These are skills that cannot be acquired through passive learning alone.

From an ecosystem design perspective, faucets serve as a tool to:

- Activate first-time on-chain interaction by turning observers into participants

- Convert passive interest into measurable activity that networks can analyze

- Generate initial transaction volume to stress-test infrastructure before mainnet

These outcomes cannot be replicated by traditional marketing channels such as advertisements, influencer posts, or social media campaigns. A faucet does not explain how blockchain works. It requires user to use it.

Builders Assemble 🛠️@CoinbaseWallet has just launched the Polygon Mumbai Faucet for you to get FREE testnet Matic.

— Polygon | POL (@0xPolygon) November 17, 2022

✅No Signup

✅No Personal Info

Get smooth access to secure and privacy preserving testnet faucets 🚰

Here’s how👇 pic.twitter.com/cQ3jHFSn5f

Faucets vs Airdrop: What’s the difference?

A common misconception is that faucets and airdrops are the same thing. They are not. The table below clarifies the key differences:

| Criteria | Faucet | Airdrop |

|---|---|---|

| Purpose | Onboarding & testing | Reward early users/holders |

| Timing | Continuous / on-demand | Scheduled (TGE or snapshot) |

| Token value | Negligible or zero | Real market value |

| Eligibility | Anyone (open access) | Criteria-based (activity, holding) |

| User action | Claim + basic task | Often retroactive (no action needed) |

| Strategic role | Bootstrap network activity | Distribute ownership & loyalty |

Understanding this distinction matters: faucets are access points, airdrops are rewards. However, as we’ll explore later, faucet activity can directly lead to airdrop eligibility, making them strategically linked despite being fundamentally different mechanisms.

In recent years, faucets have taken on a new strategic significance thanks to the rise of retroactive airdrops. Many projects now use testnet activity as a proxy for evaluating early user contribution.

In this framework, the faucet isn’t the reward, it’s the entry ticket. The real value comes from the on-chain interactions that faucet tokens enable, and those interactions may be reflected in token distributions at a later stage.

The typical workflow for airdrop-oriented faucet usage looks like this:

- Claim testnet tokens from the protocol’s faucet (e.g., Sepolia ETH on L2s)

- Interact with the testnet: swap tokens, bridge across chains, deploy contracts, provide liquidity

- Build on-chain history: consistent activity across multiple snapshots increases eligibility

- Receive an airdrop when the project launches its mainnet token

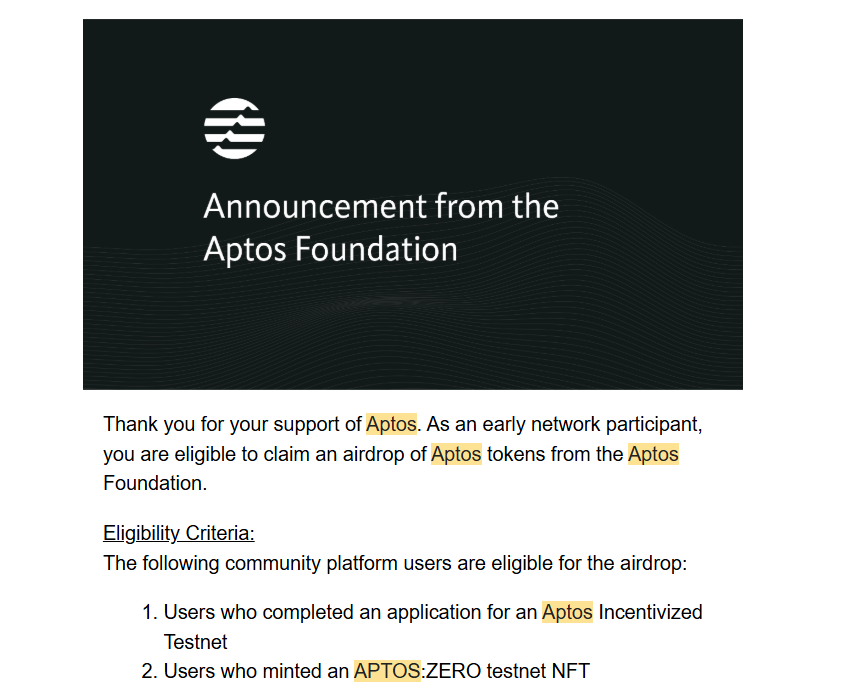

This strategy has generated real returns for early users of Aptos, Sui where testnet participants received allocations worth hundreds to thousands of dollars.

Users who minted NFTs on the Aptos testnet previously received airdrops valued at more than $1K per NFT. At the time, the only actions required were claiming APT testnet tokens from a faucet and minting NFTs.

The Role of Faucets in the Crypto Market

With this distinction in mind, the role of faucets in the broader crypto market becomes clearer.

Faucets are designed to operate continuously and on demand, providing open access to tokens with negligible or zero market value. Their role in the market is primarily focused on:

- Onboarding new users without requiring upfront capital

- Enabling early testing and experimentation

- Generating initial on-chain activity rather than financial incentives

From a market perspective, faucets function as entry points. They allow anyone to interact with a network, observe how users behave on-chain, and stress-test infrastructure under real conditions. This type of activity is especially valuable in the early stages of an ecosystem, when usage data matters more than token price.

Airdrops play a different role. They distribute economic value, formalize ownership, and align users with protocols after participation has already occurred. Faucets bootstrap network activity, while airdrops distribute value. Although faucet usage does not guarantee future rewards, the on-chain behavior it enables can later serve as a signal of contribution.

Risks, Limitations, and Hidden Costs of Faucets

Despite their role as low-friction onboarding tools, crypto faucets come with a set of structural limitations and risks that limit their effectiveness and, in some cases, introduce hidden costs to both users and ecosystems.

Phishing & Fake Sites

Many fake faucets are designed to closely resemble legitimate platforms such as FreeBitco.in, but their true purpose is to steal private keys or seed phrases. Users connect their wallets, after which scammers can drain all funds.

One common case involves sites that request users to verify their identity by sending a small amount of crypto first. This is a clear red flag, as legitimate faucets never require deposits.

Learn more: How to prevent Phishing in crypto

Malware & Intrusive Ads

Faucets often generate revenue through advertising, but some ads contain malware. When users click or interact with these ads, they may unknowingly download malicious software designed to steal wallet data.

In some cases, low quality faucet sites redirect users to compromised websites, leading to wallet exploits. According to reports, thousands of users have lost funds due to pop up ads on faucets such as Cointiply. While the core platform may be legitimate, third party ads introduce significant risk.

A developer has also highlighted a broader issue in blockchain security. Phishing attacks and malicious contracts can compromise an entire wallet through a single incorrect transaction.

The first generation blockhain problems have become so widespread that most people in crypto don’t even consider them to be “problems” anymore, just the de-facto state of blockchain.

— Robert Sasu | dev/acc (@SasuRobert) October 24, 2023

Not so long ago, a leader in the space was urging their users to create new wallets for… pic.twitter.com/WQve8WE1eh

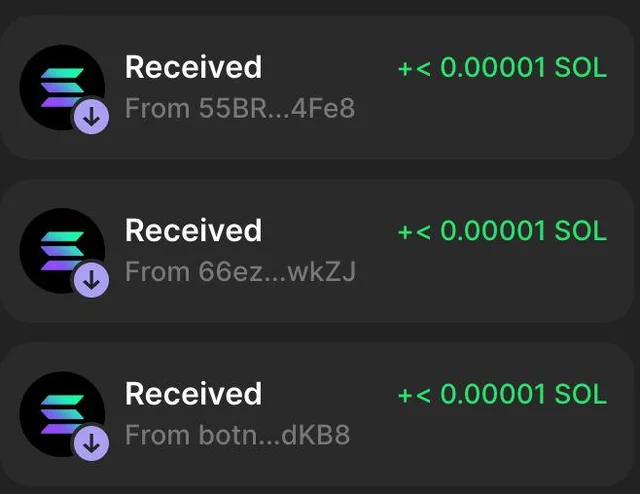

Address Poisoning

Scammers send tiny transactions such as 0.0001 ETH from addresses that closely resemble a user wallet address, differing by only a few characters. When users check transaction history on faucets or wallets, they may accidentally copy the scammer address and send real funds to it.

This risk is particularly high when using testnet faucets or multi coin faucets, where users frequently copy and paste addresses. This form of attack became especially common during the memecoin boom on Solana. Because Solana network fees are low, attackers can easily spam transactions to many wallet addresses at scale.

Conclusion

Crypto faucets are a deceptively simple mechanism that reflects the core philosophy of blockchain: lower barriers, encourage experimentation, and grow from user behavior. What Gavin Andresen built in 2010 wasn’t just a website that gave away Bitcoin, it was a prototype for how decentralized networks bootstrap themselves from zero.

Understanding faucets isn’t just understanding a technical tool. It’s understanding how crypto bootstraps networks from nothing.

FAQs

Q1. What is a faucet in crypto used for today?

A faucet in crypto is primarily used to onboard new users and developers by providing small amounts of tokens for testing, learning basic on-chain interactions, and accessing testnet environments without upfront capital.

Q2. Are crypto faucets safe to use?

Crypto faucets can be safe, but risks exist. Users should avoid faucets that request private keys or deposits, be cautious with intrusive ads, and use separate wallets to minimize exposure to phishing or malicious activity.

Q3. Do crypto faucets give real money?

Most modern crypto faucets distribute tokens with negligible or no market value, especially testnet tokens. Their purpose is functional rather than financial, enabling interaction rather than income generation.

Q4. Why do blockchain projects still use faucets?

Projects use faucets to bootstrap network activity, gather early usage data, stress-test infrastructure, and reduce friction for first-time users or developers entering an ecosystem.

Q5. Can using a faucet in crypto help with future rewards?

While faucets themselves do not guarantee rewards, the on-chain activity enabled by faucet tokens can later be considered in retroactive reward mechanisms such as airdrops.