According to the FBI's 2024 Internet Crime Report, U.S. users lost $9.3 billion to crypto scams, a 66% increase compared to 2023. This staggering number exceeds the GDP of many small countries, highlighting the severity of the threat.

Even more alarming, 2025 is on track to break that record, with Chainalysis estimating that generative AI is making scams more scalable and affordable for bad actors. Many users believe scams only target beginners, but reality shows that even experienced investors regularly fall victim. Understanding what crypto scams are and how they work is essential for protecting personal assets.

What is a Crypto Scam?

Crypto scam is a deceptive scheme designed to steal digital assets, private keys, or sensitive information from cryptocurrency users. Unlike technical hacks that exploit software vulnerabilities, scams rely heavily on psychology, trust manipulation, and social engineering to trick victims into willingly transferring their funds or revealing access credentials.

According to TRM Labs' 2025 Crypto Crime Report, scams remained the dominant form of illicit activity on-chain in 2024, with at least $10.7 billion in crypto funds sent to fraudulent schemes. The FBI's Internet Crime Complaint Center received nearly 150,000 complaints linked to cryptocurrency in 2024 alone.

Key characteristics of Crypto Scam:

- Psychological manipulation: Exploiting emotions such as greed, fear of missing out (FOMO), or trust in authority figures.

- Unrealistic promises: Guaranteeing returns of 10% to 40% per month or more, often through "automated trading bots" or "AI systems".

- Irreversible transactions: Blockchain transactions cannot be reversed, making recovery nearly impossible once funds are transferred.

- Fast execution: Scammers move funds across multiple wallets, chains, and mixing services within minutes.

- AI-enhanced deception: Modern scams use AI-generated content, deepfakes, and automated systems to appear more legitimate.

Crypto scams do not target only newcomers. According to FBI data, individuals over 60 reported the highest losses at $2.8 billion in 2024, but victims span all age groups and experience levels. In 2024, 75% of victims lost more than half of their net worth due to these schemes.

Popular Crypto Scam Types

Below are the most common and dangerous scam types reported in 2024-2025 by the FBI, Chainalysis, and security researchers.

Rug Pull

A rug pull is a classic scam prevalent in memecoin and DeFi culture. Developers create a token, heavily promote it through social media and influencers, artificially inflate the price, then suddenly withdraw all liquidity or dump their entire token holdings. This leaves the token worthless and investors with nothing.

How rug pulls work:

- Developers create a token with appealing branding, often riding popular trends or memes.

- Initial liquidity is added to a decentralized exchange to enable trading.

- Aggressive marketing via paid influencers, Telegram groups, and social media creates hype.

- As more investors buy in, the price rises sharply.

- Developers remove liquidity or dump their tokens, crashing the price to near zero.

Warning signs of rug pull in crypto:

- Anonymous teams with no verifiable track record.

- Non-transparent token allocation with founders holding oversized portions.

- Unlocked or fake liquidity pools.

- Heavy promotion from unreliable influencers.

- AI-generated whitepapers and promotional materials.

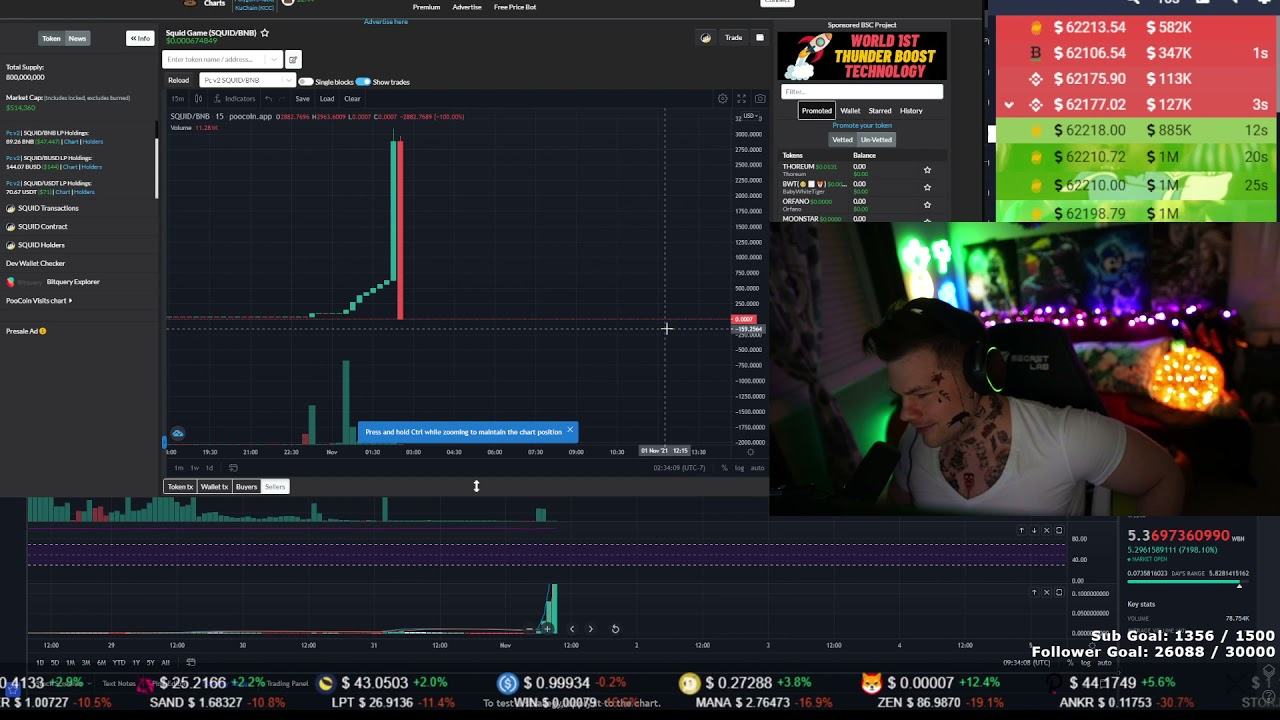

Example: The $SQUID token (Squid Game Token) in 2021 exploited the popularity of the Netflix series. The token surged from a few cents to over $2,860 before the team vanished and drained all liquidity, leaving investors with worthless tokens. Losses exceeded $3.3 million.

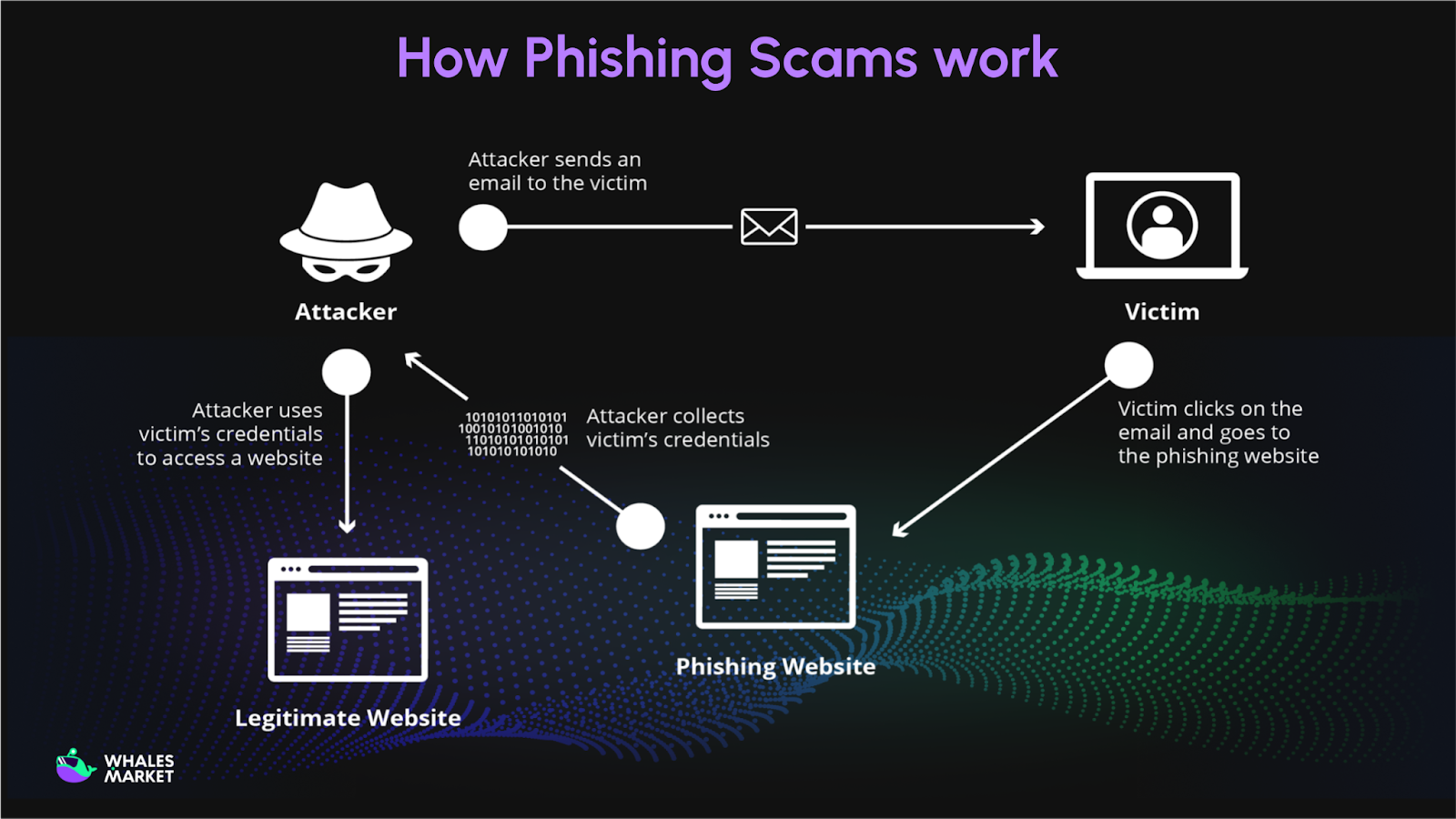

Phishing Scam

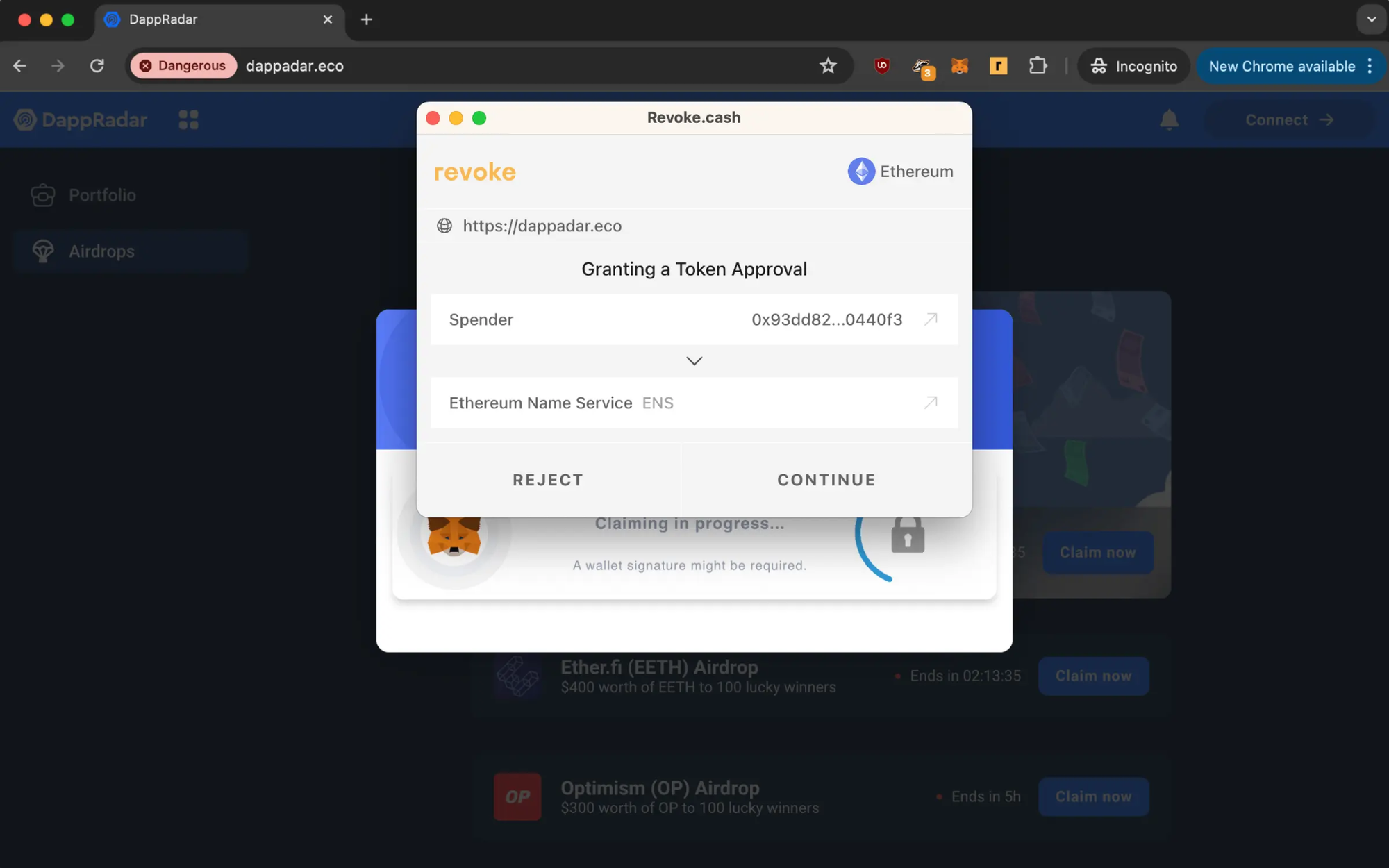

Phishing scam is the most widespread crypto scam, accounting for over $1 billion in losses in 2024 alone. Scammers send fake emails, messages, or create counterfeit websites pretending to be major exchanges like Binance, Coinbase, or popular DeFi protocols. These lure users into entering seed phrases, passwords, or approving malicious wallet connections.

Common phishing tactics:

- Fake airdrop announcements promising free tokens if users connect their wallets.

- Urgent security alerts claiming an account compromise and demanding immediate verification.

- System upgrade notices faking platform migrations that request seed phrase entry.

- Customer support impersonation, with scammers posing as official staff on social media.

- Address poisoning by sending small transactions from similar-looking wallet addresses.

How to recognize phishing scam in crypto:

- Suspicious URLs with small typos, such as binace.com or coiinbase.com.

- Emails from unofficial or unusual sender addresses.

- Strong pressure to act immediately or “before it’s too late.”

- Requests for seed phrases, which legitimate platforms never ask for.

Example: A crypto investor lost $3M after signing a malicious transaction without checking the contract address.

Someone fell victim to a phishing attack, signed a malicious transfer, and lost 3.05M $USDT!

— Lookonchain (@lookonchain) August 6, 2025

Stay alert, stay safe. One wrong click can drain your wallet.

Never sign a transaction you don’t fully understand.

Double-check the URL, double-check all signature requests

Verify… pic.twitter.com/39YYe1LAoz

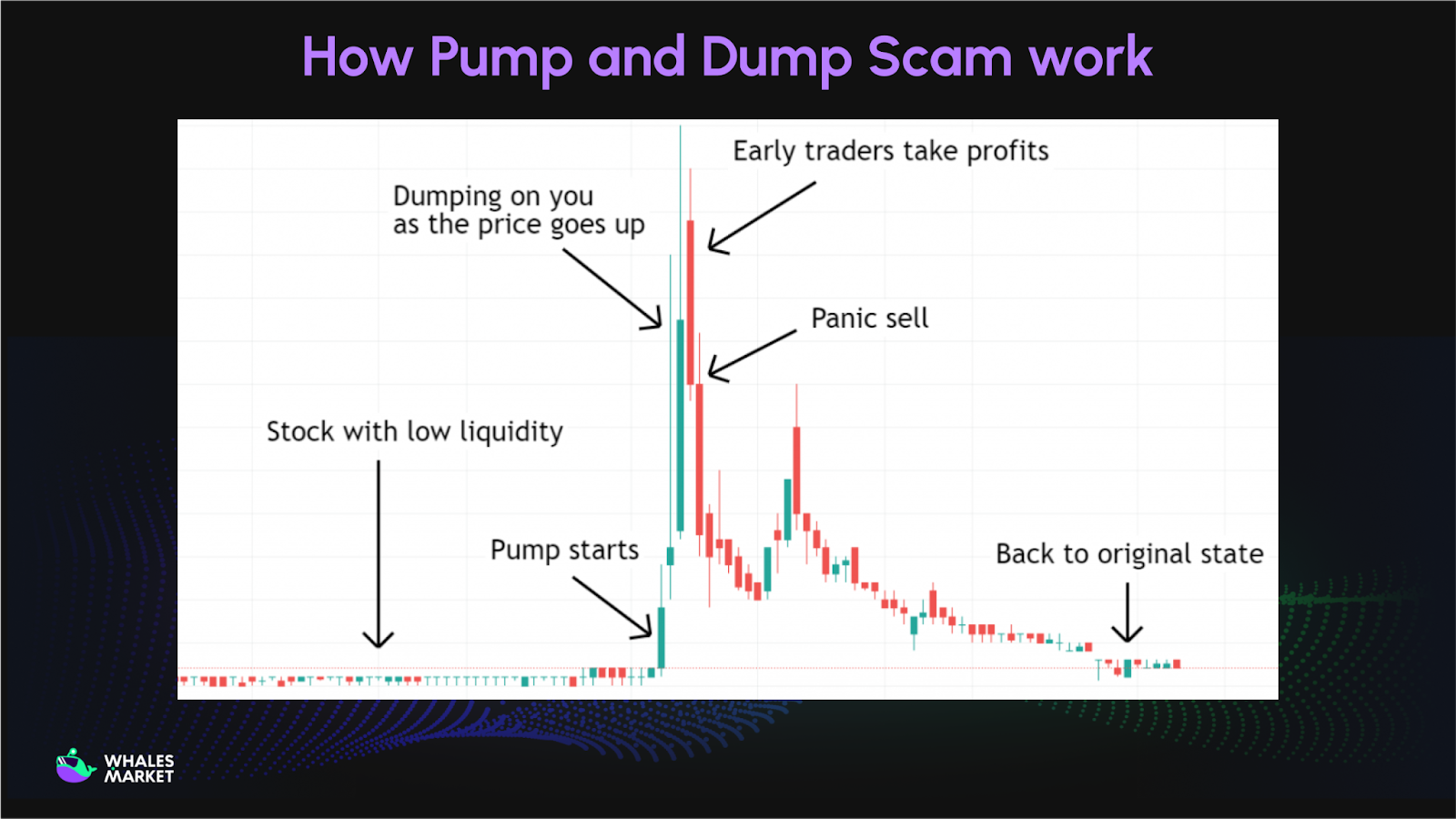

Pump and Dump Scam

Pump and dump schemes involve coordinated groups buying large amounts of low-liquidity tokens, pushing hype through influencers, social media, and bots, then selling at the peak. Prices crash instantly after their exit, leaving late participants with massive losses.

How pump and dump scam works in crypto:

- Organizers identify a low-cap, low-liquidity token.

- They accumulate large positions quietly.

- Coordinated promotion begins across Telegram, Discord, and Twitter/X.

- Paid influencers create FOMO among their followers.

- As retail investors pile in, organizers sell their holdings.

- The price collapses, leaving late buyers with worthless tokens.

Warning signs:

- Private groups encouraging urgent buying.

- Unusual price spikes without real news or development updates.

- Sudden volume surges driven by a few wallets.

- “Last chance” messaging and artificial urgency.

Example: In 2024-2025, influencer-led pump and dump schemes caused millions in losses, with some notable cases involving celebrity-endorsed tokens. The Hawk Tuah Coin scheme led by influencers caused significant losses to retail investors who bought during the hype phase.

JUST IN: "Hawk Tuah" girl Haliey Welch says SEC closed its investigation into her crypto meme coin that crashed 95% hours after launch.

— Watcher.Guru (@WatcherGuru) March 28, 2025

She says they will not pursue any charges or monetary sanctions. pic.twitter.com/RNxzf6IDjb

Pig Butchering: Crypto Romance Scam

"Pig butchering" is a long-term confidence scam that combines romance fraud with fake investment platforms. The name refers to "fattening the pig before slaughter" - scammers invest weeks or months building emotional trust before extracting maximum funds. According to the FBI, pig butchering scams were responsible for $5.8 billion in victim losses in 2024 alone.

How pig butchering works:

- Scammers make initial contact through dating apps, social media, or “wrong number” messages.

- They build trust over weeks or months via daily conversations, shared photos, and emotional bonding.

- Crypto investments are casually introduced, often backed by fake profit screenshots.

- Victims are directed to fraudulent trading platforms that look legitimate.

- Small withdrawals are allowed at first to build confidence.

- Victims are pushed to invest more, sometimes using savings or borrowed funds.

- When larger withdrawals are attempted, fake taxes or fees appear, accounts are frozen, and scammers vanish.

Warning signs:

- Strangers becoming overly friendly very quickly.

- Claims of crypto wealth supported by profit screenshots.

- Pressure to invest in a so-called “golden opportunity.”

- Use of deepfake technology during video calls.

- Avoidance or reluctance to meet in person.

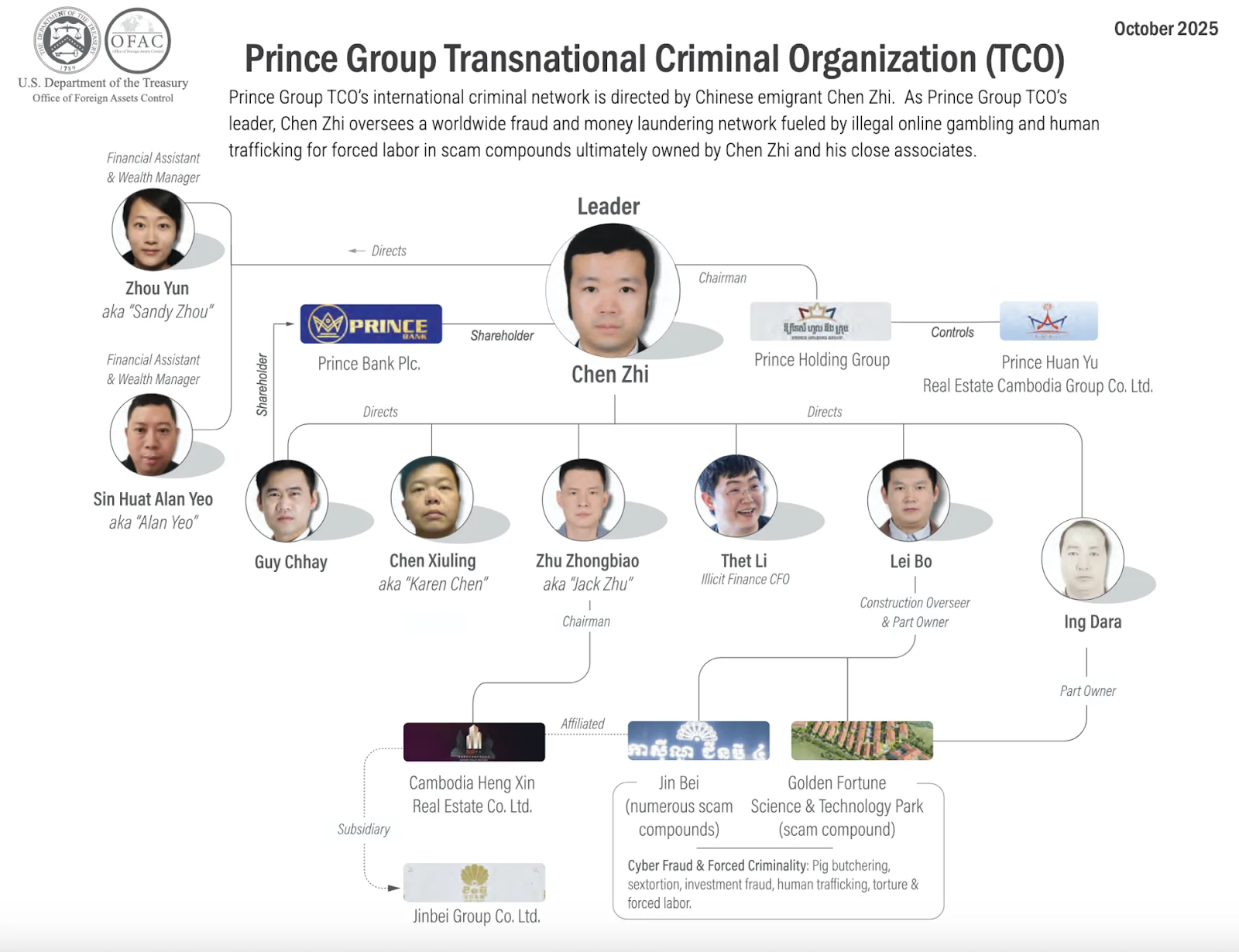

Example: In 2025, investigations linked major pig-butchering operations to compound sites in Cambodia, responsible for millions in losses.

Honeypot Crypto Scam

A honeypot scam involves a malicious smart contract that allows users to buy tokens but prevents them from selling. The token appears legitimate with price movement, liquidity, and trading activity, but victims find their funds permanently trapped. In February 2024 alone, a single scammer executed multiple honeypot scams stealing approximately $3.2 million from victims.

Types of honeypot scams:

- Smart contract honeypots that allow buying but secretly block selling through hidden code restrictions.

- High sell tax honeypots where selling is possible but triggers 99–100% fees.

- Blacklist honeypots that automatically add buyers to a blacklist, preventing sales.

- Threshold honeypots with minimum sell amounts set impossibly high.

- Wallet sweeper honeypots where leaked seed phrases lure victims, then scripts drain any deposited gas funds.

How to recognize honeypots:

- All-green price charts with no visible sell transactions.

- Rapid price increases with no logical explanation.

- Anonymous developers with no verifiable history.

- Smart contract code that deviates from standard ERC-20 or SPL patterns.

Example: On Feb 26, 2024, Dechat mistakenly shared a honeypot PancakeSwap pool during its token launch. The 100% sell-tax scam was exposed by ZachXBT, prompting refunds for affected users.

You clowns literally linked a honeypot for your own token launch. pic.twitter.com/ioUYRryMuR

— ZachXBT (@zachxbt) February 26, 2024

Biggest Scams in Crypto

The cryptocurrency industry has witnessed some of the most devastating financial frauds in history. These cases demonstrate that even the largest, most trusted platforms can fail, and underscore the importance of due diligence.

FTX (2022)

FTX, once valued at $32 billion, collapsed in November 2022 in what federal prosecutors called "one of the biggest financial frauds in American history." Founder Sam Bankman-Fried secretly diverted billions in customer deposits to his hedge fund Alameda Research. Up to $9 billion in customer deposits went missing.

Bankman-Fried was convicted of fraud and sentenced to 25 years in prison in March 2024, ordered to forfeit $11 billion. The collapse triggered a cascade of failures across the crypto industry, including BlockFi, Genesis, and Voyager.

Terra/Luna Collapse (2022)

In May 2022, the algorithmic stablecoin TerraUSD (UST) lost its dollar peg, triggering a death spiral. Within days, Luna's price crashed from $116 to essentially zero, and UST collapsed to $0.02. The total value destruction exceeded $40 billion, wiping out life savings for hundreds of thousands of retail investors. The collapse triggered broader market contagion, contributing to the failures of Celsius Network and ultimately FTX.

Co-founder Do Kwon was arrested in Montenegro in March 2023 while attempting to travel with falsified documents. He pleaded guilty to fraud charges and was sentenced to 15 years in prison in December 2025. The judge called it "fraud on an epic, generational scale."

OneCoin (2014-2017)

OneCoin is the largest cryptocurrency Ponzi scheme in history. Founded by Ruja Ignatova, the "Crypto Queen," OneCoin claimed to be a legitimate cryptocurrency but never had a functional blockchain.

The scheme used multi-level marketing to attract investors with promises of massive returns. Over $4 billion was stolen from approximately 3.5 million victims worldwide. Ignatova disappeared in 2017 and remains on the FBI's most-wanted list. Her brother, Konstantin Ignatov, pleaded guilty to fraud charges.

BitConnect (2018)

BitConnect promised investors daily returns of up to 1% through a proprietary "trading bot." At its peak, the BCC token had a market cap exceeding $2 billion. When the scheme collapsed in January 2018, the token lost 96% of its value overnight. The SEC filed lawsuits against BitConnect promoters, with founder Satish Kumbhani indicted for defrauding U.S. investors of $2.4 billion.

How to Recognize Crypto Scam

Signals of a Crypto Scam

Recognizing crypto scams requires vigilance and awareness of common red flags. While scammers constantly evolve their tactics, certain warning signs remain consistent.

- Unrealistic promises: Guaranteed high returns, “risk-free” claims, or consistent profits regardless of market conditions

- Pressure and urgency: FOMO tactics, limited-time offers, or forcing quick decisions without proper research

- Lack of transparency: Anonymous teams, unclear tokenomics, low-quality or AI-generated whitepapers, no audits

- Technical red flags: Suspicious smart contract functions, concentrated or unlocked liquidity, oversized founder allocations

- Communication red flags: Unsolicited messages, requests for private keys or seed phrases, Telegram-only channels, fake celebrity endorsements

Crypto Scam Checker Tools

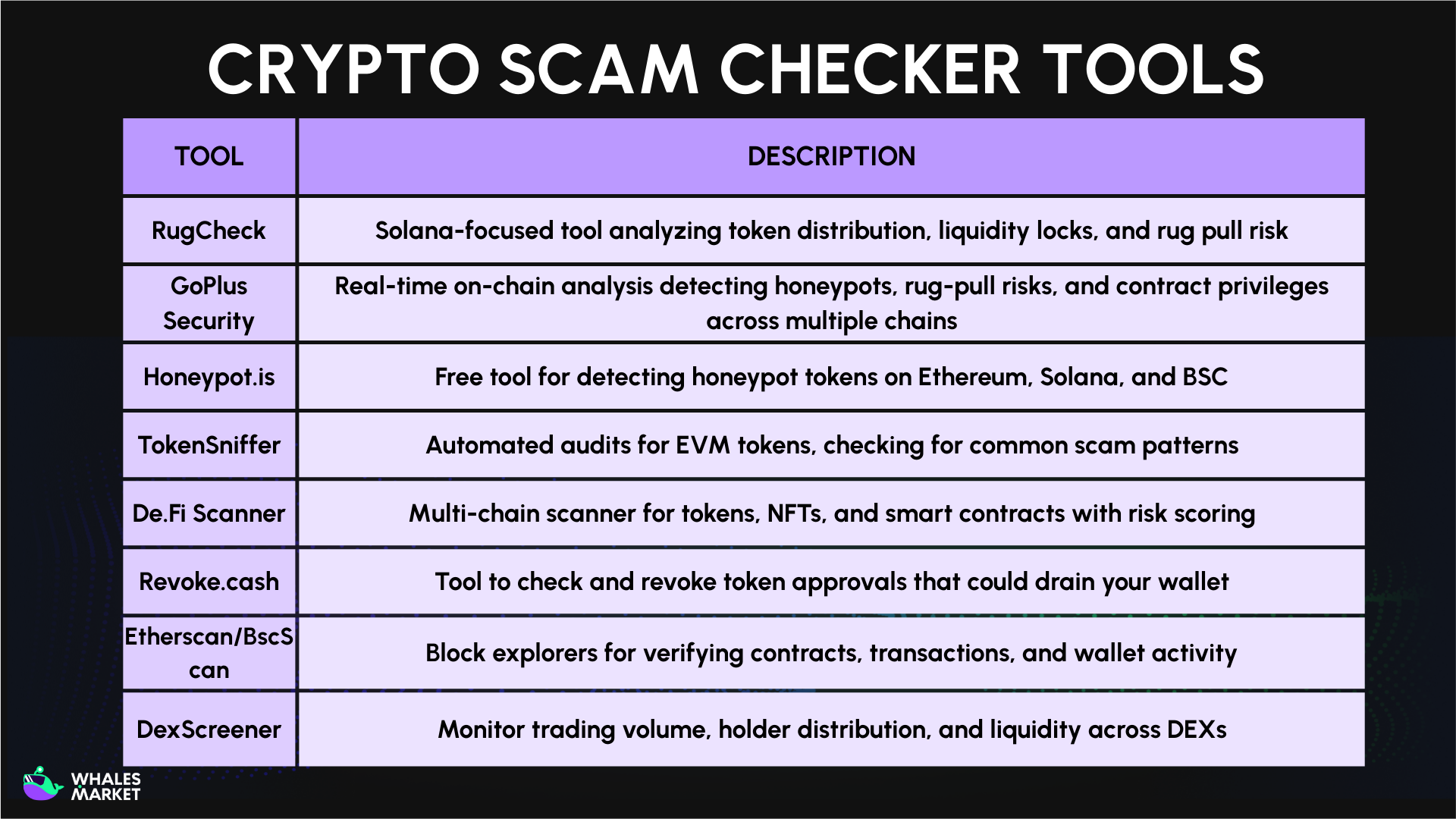

Several tools can help verify token legitimacy before investing. These tools analyze smart contracts, liquidity, holder distribution, and other factors to assess risk.

How to Stay Safe from Crypto Scams

Protecting yourself from crypto scams requires a combination of technical precautions, behavioral habits, and ongoing vigilance. Following these best practices significantly reduces your risk of becoming a victim.

- Secure your access: Never share your seed phrase, enable 2FA using authenticator apps, and use hardware wallets for large holdings. Always create strong, unique passwords for every platform.

- Verify everything: Manually type and bookmark URLs, confirm contract addresses from official sources, and double-check wallet addresses before sending funds to avoid address poisoning.

- Research before investing: Use tools like RugCheck, GoPlus, and TokenSniffer. Verify team credibility, audits, liquidity locks, and ensure token distribution looks reasonable.

- Behavioral safeguards: Only invest what you can afford to lose, ignore unsolicited advice, resist FOMO, and take time to evaluate “urgent” opportunities before acting.

Golden rule: Before clicking "Send" or "Approve," ask yourself: "If this is a scam, how much would I lose, and is it worth the risk?" This simple pause can prevent major losses.

How to Recover Money from Crypto Scam

Important reality check: Due to the irreversible nature of blockchain transactions, recovering stolen cryptocurrency is extremely difficult and often impossible. However, there are legitimate steps you can take to maximize your chances and prevent further losses.

Immediate actions (first 24–48 hours are critical):

- Stop all contact with scammers and do not send any additional funds, including fake “fees” or “taxes.”

- Secure remaining assets by moving funds to a new, safe wallet with fresh seed phrases.

- Document everything, including transaction IDs, wallet addresses, screenshots, and all communications.

- Revoke token approvals using Revoke.cash to remove any malicious wallet permissions.

Report to authorities:

- FBI’s IC3 by filing a complaint at ic3.gov, for U.S. victims.

- Local law enforcement by submitting a formal police report.

- Financial regulators, such as the SEC, CFTC, or your country’s financial authority.

- Crypto exchanges, if funds reached a centralized platform, as some exchanges can freeze accounts quickly.

Legitimate recovery options:

- Blockchain forensics firms, such as Chainalysis, which work with law enforcement to trace stolen funds.

- The FBI’s Operation Level Up, an initiative that saved potential victims approximately $285 million between January 2024 and January 2025.

- Class action lawsuits, where victims in major fraud cases may be able to join collective legal action.

Warning - Beware of recovery scams:

Scammers specifically target previous victims with fake "recovery services." According to the FBI, these "asset recovery scams" add hundreds of millions to yearly losses.

Red flags include: upfront fees, guaranteed recovery promises, contact via social media or messaging apps, pressure to act quickly, and requests for seed phrases. Legitimate recovery services never guarantee results, never ask for upfront fees, and work through proper legal channels.

FAQs

Q1. Why are crypto scams becoming harder to detect?

Scammers now use AI to create extremely realistic websites, messages, deepfake videos, and identities. AI-generated content, including whitepapers and promotional materials, makes it increasingly difficult to distinguish legitimate projects from fraudulent ones. Additionally, scam tactics evolve rapidly as criminals adapt to new detection methods.

Q2. What are the signs of a high-risk crypto scam project?

Key warning signs include: anonymous or unverifiable teams, unclear tokenomics with founders holding oversized portions, unrealistic profit promises (10-40% monthly returns), absence of independent audits, heavy reliance on influencer hype, unlocked liquidity, newly created social media accounts, and pressure to invest quickly.

Q3. Can money lost to crypto scams be recovered?

Recovery is extremely difficult but not always impossible. Blockchain transactions cannot be reversed, and scammers typically move funds across multiple wallets, chains, and mixing services to erase traces. However, if funds are sent to centralized exchanges, quick action may allow authorities to freeze accounts. The FBI's Operation Level Up has saved victims approximately $285 million. Report immediately to authorities and relevant exchanges.

Q4. Why do experienced investors also fall for crypto scams?

Even sophisticated investors can be deceived by well-crafted scams that exploit emotions like greed and FOMO. Pig butchering scams, in particular, invest months building trust before introducing fraud. Complex smart contract exploits may not be obvious even to technical users. The largest known individual loss, $238 million, was from an experienced investor. Overconfidence can actually increase vulnerability.

Q5. Which platforms are most targeted by crypto scammers?

Scammers heavily target: social media platforms (Twitter/X, Instagram, Facebook), dating apps (Tinder, Hinge, Bumble), messaging apps (Telegram, Discord, WhatsApp), email, and even SMS. These platforms make impersonation easy and allow wide distribution of malicious links. Telegram and Discord crypto groups are particularly dangerous vectors for pump-and-dump schemes.

Q6. Which tools help check the safety of tokens or projects?

Essential tools include: RugCheck (Solana tokens), GoPlus Security (multi-chain analysis), Honeypot.is (honeypot detection), TokenSniffer (EVM token audits), De.Fi Scanner (multi-chain security scoring), Revoke.cash (token approval management), Etherscan/BscScan (contract verification), and DexScreener (liquidity and trading analysis). Using multiple tools provides better protection than relying on any single source.

Q7. What should I do immediately after realizing I've been scammed?

Act within the first 24-48 hours:

1) Stop all contact with scammers - never send more money for "fees,"

2) Move remaining assets to a new wallet with fresh seed phrases,

3) Revoke token approvals using Revoke.cash,

4) Document everything (transaction IDs, wallet addresses, screenshots),

5) Report to FBI's IC3 (ic3.gov), local police, and any exchanges involved. The faster you act, the better chance of freezing funds.