As crypto gradually becomes part of everyday life, projects that solve real usage problems tend to stand out. Tria has emerged as a crypto neobank focused on simplicity, while offering a clear airdrop opportunity for real users. This is why Tria is worth following and joining early.

Tria Overview?

Tria is a self-custodial crypto Neobank powered by a cross-chain routing engine. It enables gasless, seedless spending, staking, and swapping across 200+ chains, making onchain finance feel as simple and intuitive as modern banking.

Tria's key features:

- Spend, earn yield, and trade crypto across 200+ chains

- Use the Tria Card to pay with BTC, SOL, and 1000+ tokens

- Grow wealth with audited on-chain strategies and yield products

- BestPath AI routes cross-chain trades at lowest cost and fastest speed

- Earn Tria Points and on-chain rewards through usage and referrals

- Fully non-custodial, users keep full control of funds and keys

Why Are Users Hyped for the Tria Airdrop?

Strong foundation with reputable funding and team

Tria is built by a team with deep experience in technology and blockchain, notably CEO Vijit Katta, who previously worked at Microsoft and Polygon. Moreover, Tria has raised $12M from reputable backers such as Sandeep Nailwal and P2 Ventures, reflecting confidence in its long-term vision.

On the product side, Tria focuses on BestPath AI, an engine that optimizes cross-chain transactions across 200+ blockchains with gasless and seedless execution. In just four months of beta phase, Tria reached 150,000+ users, processed over $100M in transactions, and recorded annualized revenue exceeding $20M. These numbers show real traction backed by data.

Large market opportunity and High adoption potential

Crypto is steadily moving toward mass adoption, especially as global payments remain a $5.3T market still dominated by slow and fragmented systems. At the same time, onchain transaction volume is projected to reach $100T by 2030, signaling that crypto is increasingly used beyond speculation.

However, real-world usage is still limited by familiar problems like chain fragmentation, high fees, and security risks. Tria is built specifically to remove these barriers, making crypto practical for everyday payments rather than just an investment tool.

Airdrop mechanism focused on real users

The Tria airdrop is designed to reward real usage rather than simple click farming. Instead of completing empty tasks, users earn XP by actually using the app in everyday scenarios.

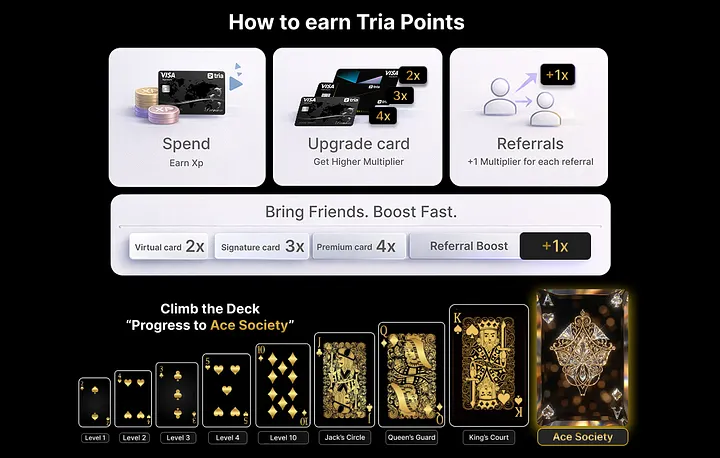

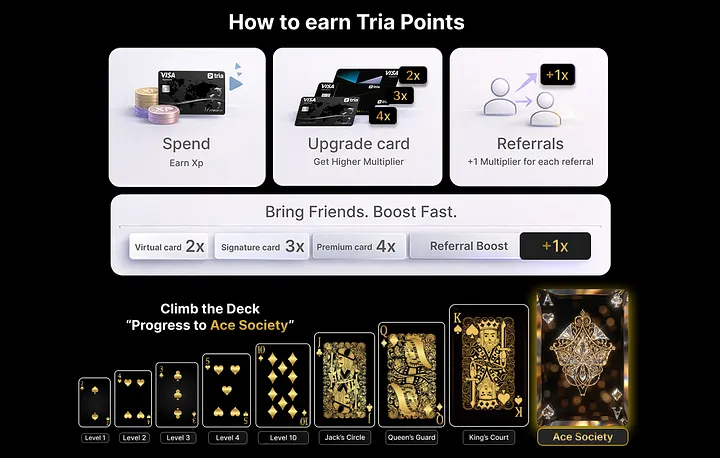

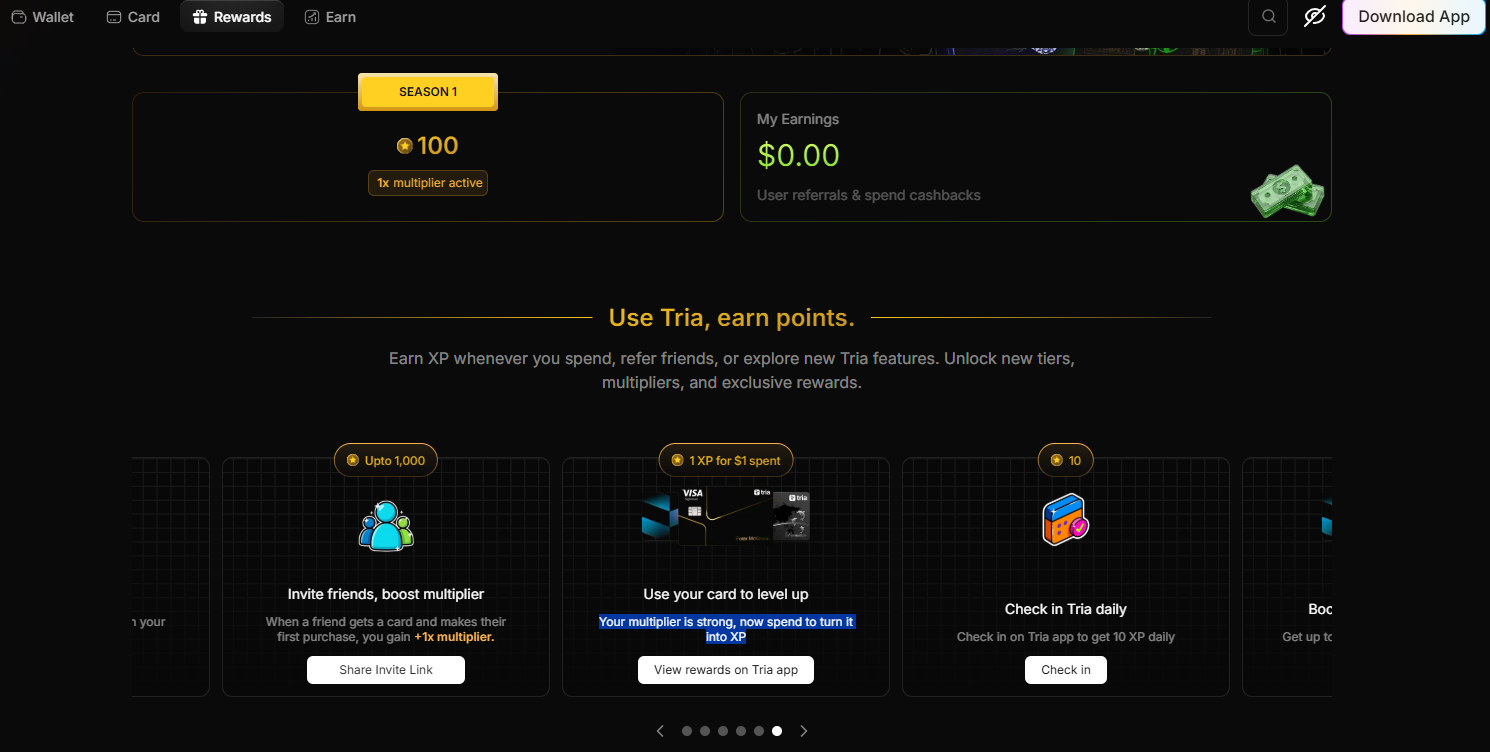

The Points system is structured across five seasons, with Season 1 running until the end of January 2026 and serving as the foundation. This initial season places emphasis on spending activity, card upgrades, and referrals, reflecting how users genuinely interact with Tria from day one.

3 simple ways to get Tria Airdrop?

Tria is currently running the Tria Points program, where users earn XP for a chance to receive the airdrop. The airdrop has been confirmed for card holders. There are five seasons in total, with Season 1 active until the end of January 2026.

airdrop confirmed for card holders 🫡

— Tria (@useTria) October 30, 2025

Make transactions

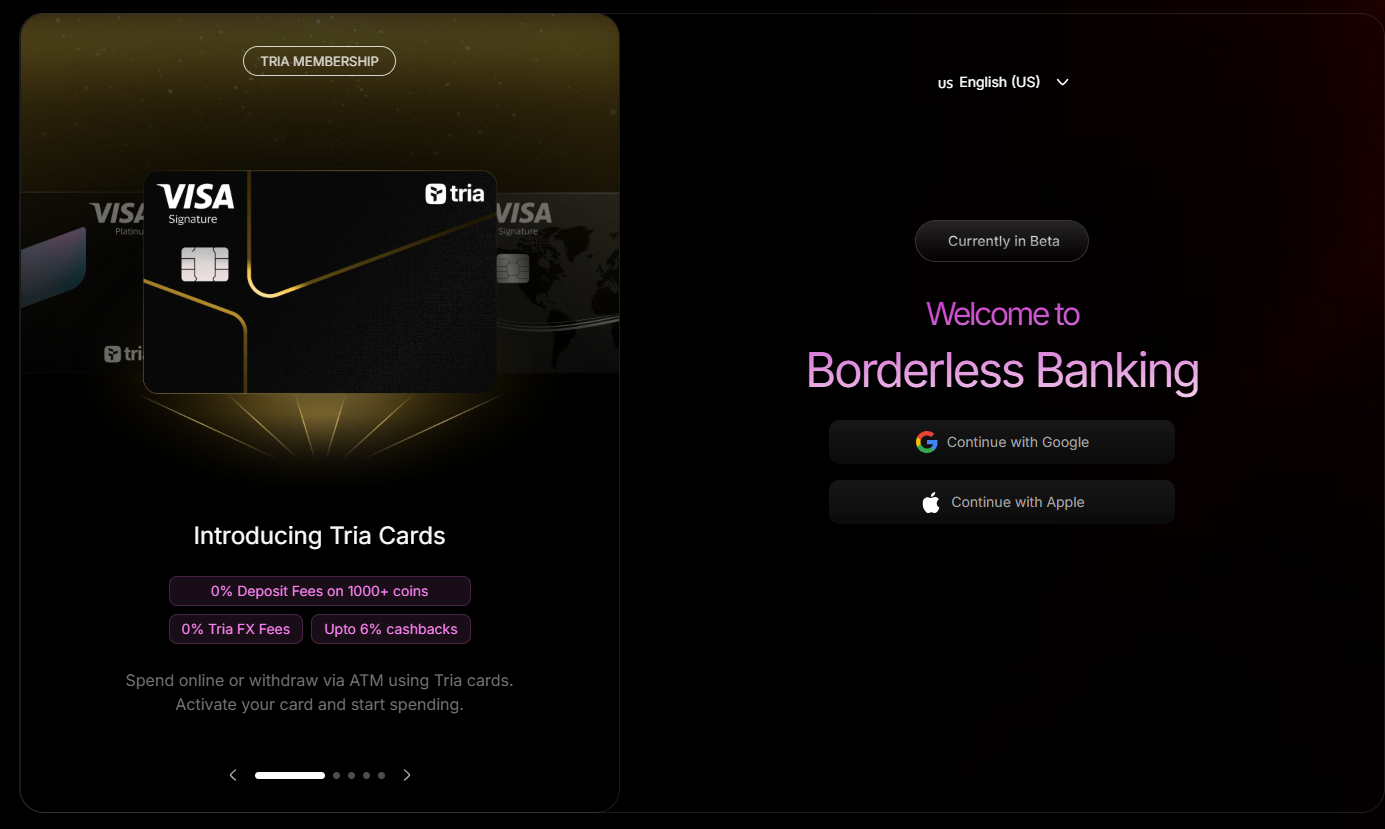

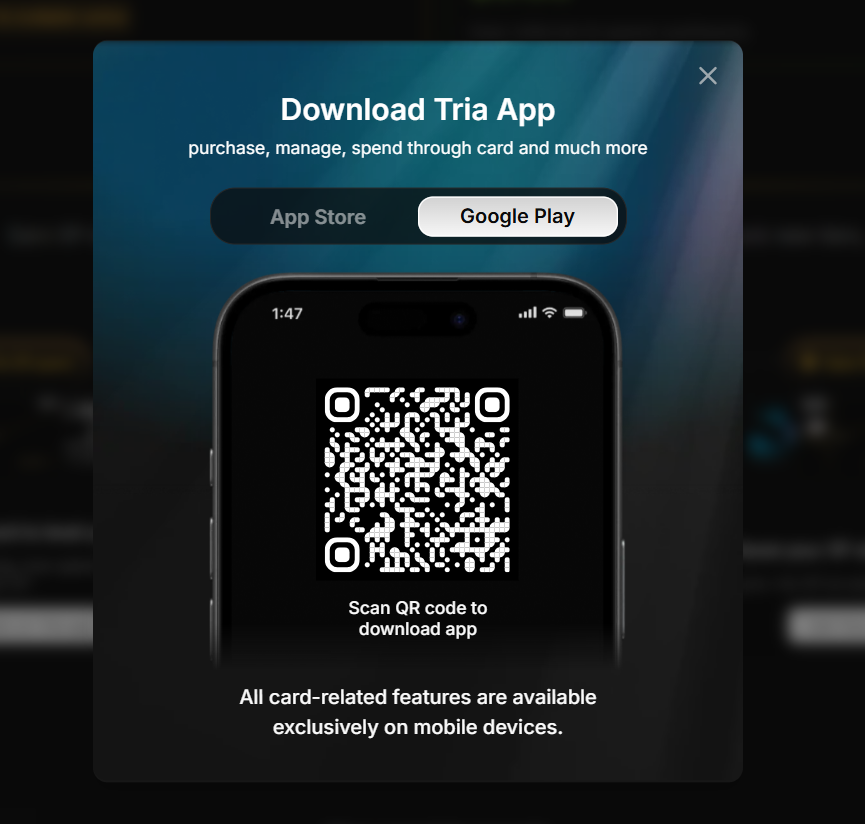

Step 1: Create an Account and Download the App

- Access Tria and register an account using an email address.

- Set a username.

- Go to the Download App section.

- Scan the QR code to download the Tria App from the App Store or Google Play.

- Log in using the email account created earlier.

Step 2: Deposit

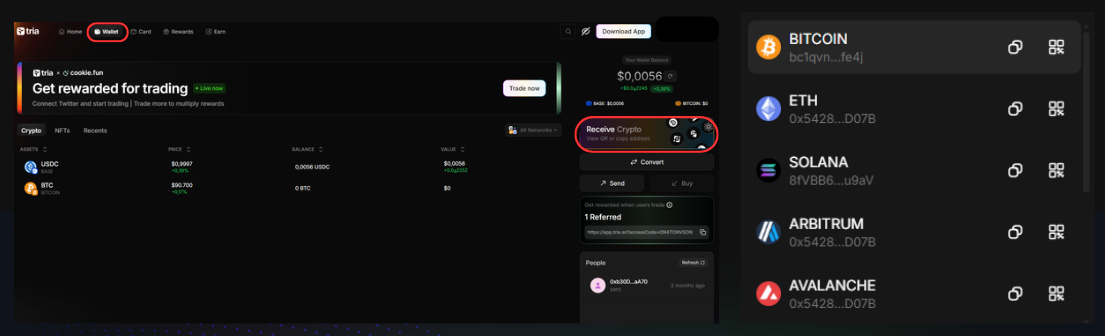

- Go to the Wallet section and select Receive Crypto to fund the wallet.

- Copy the wallet address for the selected network and send funds from another wallet to the Tria wallet.

Step 3: Make a Transaction

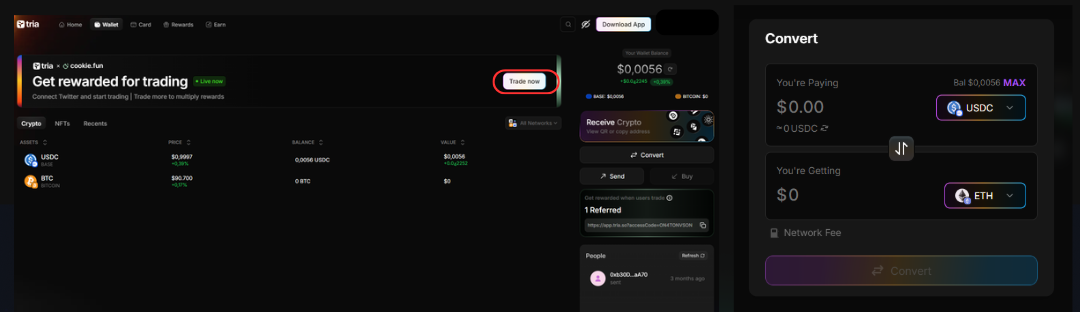

- Select Trade Now.

- Choose the trading pair to swap.

- Select Convert to execute the swap and complete the transaction.

Purchase and Activate a Tria Card

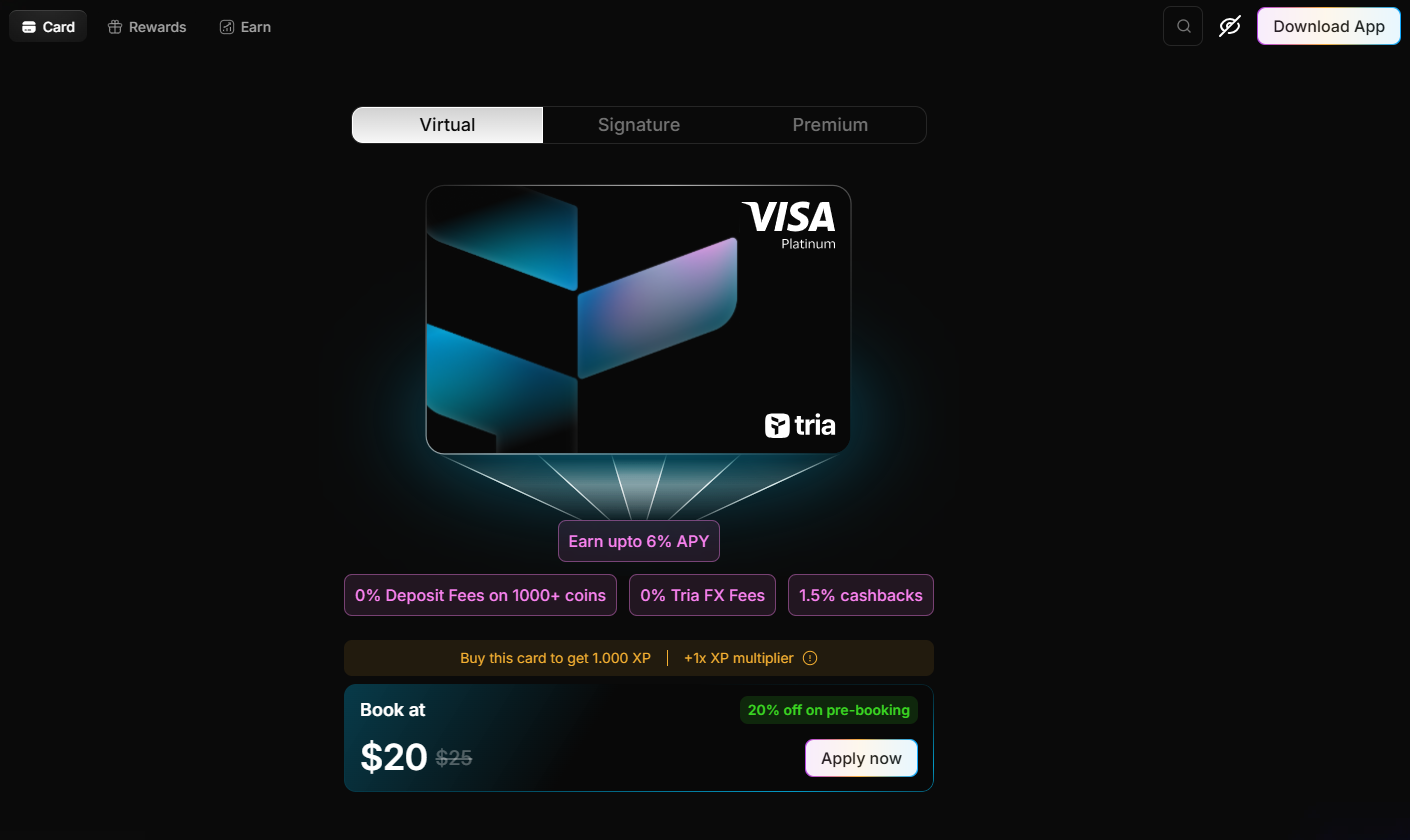

Go to the Card section and choose a card type:

- Virtual Card: $20, 2x XP multiplier. This is the lowest-cost option and is issued instantly.

- Plastic Card: $50, 3x XP multiplier. This is a physical card with delivery in 7 to 14 days.

- Metal Card (Premium): $200, 4x XP multiplier, 6% cashback, and lounge access.

Pay using crypto in the Tria wallet. Complete KYC in the app to activate the card.

Complete tasks and Earn points

Go to the Rewards section to complete tasks and earn points.

- Daily check-in on the Tria app grants 10 XP.

- XP can be boosted with Tria Cards, offering up to 3x XP on every dollar spent.

- Downloading the Tria mobile app grants 500 XP.

- The first wallet top-up grants 250 XP when receiving any token for the first time.

- Inviting friends increases the multiplier. When a referred friend gets a card and makes a first purchase, an additional 1x multiplier is added.

- Using the card converts the multiplier into XP through real spending.

Conclusion

Tria goes beyond a typical airdrop narrative. It represents a clear shift in crypto toward practical utility, sustainable cash flows, and genuine user activity. Early participation offers exposure to a new financial model and a strong position if Tria scales into a widely adopted onchain payments infrastructure.

FAQs

Q1. Does the Tria airdrop require a minimum amount of capital?

Tria does not set a fixed minimum capital requirement. However, a small amount of crypto is needed to trade and spend. Holding a Tria Card helps increase the XP multiplier and improves the efficiency of point accumulation.

Q2. Are Tria Points guaranteed to convert into tokens during the airdrop?

The project has confirmed an airdrop for card holders and uses Tria Points to measure contributions. While the conversion formula has not been announced, Points typically play a key role in token distribution.

Q3. Do Tria Card purchases count more than regular app activity for XP?

Card usage plays a significant role in XP accumulation. Spending with a Tria Card applies XP multipliers, meaning the same amount of activity can generate more points compared to basic actions like swaps or check-ins.

Q4. How secure is Tria compared to centralized financial platforms?

Tria operates under a non-custodial model, meaning users retain control of assets and private keys. Yield strategies are onchain and audited, reducing risks commonly associated with centralized platforms.