Treasury Secretary Bessent recently made remarks regarding the classification of tariffs, sparking discussion among economists and policymakers. The Secretary's statement challenges conventional understanding of tariffs and their economic impact. This announcement has implications for trade policy and international economic relations. The following sections will delve into the details of this statement and its potential consequences.

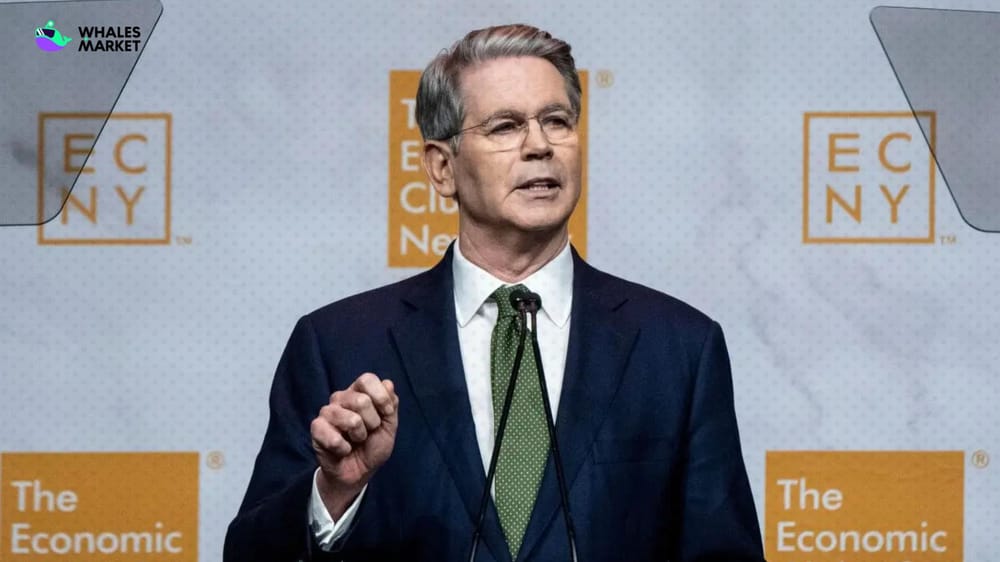

Secretary Bessent's Stance on Tariffs

Treasury Secretary Bessent stated that he does not believe tariffs are a tax. This assertion diverges from the common perception that tariffs, which are taxes imposed on imported goods or services, ultimately affect consumers and businesses through increased prices. The Secretary's perspective suggests a different understanding of how tariffs impact the economy, potentially focusing on benefits such as protecting domestic industries or incentivizing domestic production.

The implications of this viewpoint could influence future trade negotiations and policy decisions. It may also signal a shift in the administration's approach to international trade agreements. Further clarification from the Treasury Department is anticipated to fully understand the rationale behind this statement.

Economic Context of Tariff Discussions

Tariffs have historically been a tool used by governments to regulate international trade. They can serve various purposes, including protecting domestic industries from foreign competition, generating revenue for the government, or retaliating against unfair trade practices. However, tariffs can also lead to higher prices for consumers, reduced trade volumes, and strained international relations.

Economists often debate the net economic impact of tariffs, with some arguing that they can create jobs and boost domestic production, while others contend that they ultimately harm the economy by increasing costs and reducing overall efficiency. The current global economic climate, characterized by supply chain disruptions and inflationary pressures, adds complexity to the discussion surrounding tariffs.

Potential Policy Implications

Secretary Bessent's statement could signal a willingness to utilize tariffs more aggressively as a policy tool. This could lead to increased trade tensions with other countries, particularly those that rely heavily on exports to the United States. It may also prompt retaliatory measures from other nations, resulting in a cycle of escalating tariffs and trade barriers.

Alternatively, the statement could be interpreted as a negotiating tactic aimed at gaining leverage in trade negotiations. By challenging the conventional understanding of tariffs, the administration may be seeking to reshape the terms of trade agreements and secure more favorable outcomes for the United States.

Conclusion

The Treasury Secretary's remarks on tariffs have introduced a new dimension to the ongoing debate about international trade policy. The long-term effects of this perspective remain to be seen, but it is likely to influence future trade negotiations and policy decisions. Monitoring the administration's actions and statements in the coming months will be crucial to understanding the full implications of this development.

FAQs

What exactly is a tariff?

A tariff is a tax imposed by a government on imported goods or services. Tariffs are typically levied as a percentage of the value of the imported item (ad valorem tariff) or as a fixed amount per unit (specific tariff). They are a common tool used in international trade to regulate the flow of goods and protect domestic industries. The revenue generated from tariffs goes to the government imposing them.

How do tariffs affect consumers?

Tariffs generally lead to higher prices for consumers. When imported goods are subject to tariffs, the cost of those goods increases, and this cost is often passed on to consumers in the form of higher retail prices. This can reduce consumers' purchasing power and lead to decreased demand for certain products. The extent of the impact depends on the size of the tariff and the elasticity of demand for the affected goods.

What are some potential benefits of tariffs?

Proponents of tariffs argue that they can protect domestic industries from foreign competition, leading to increased domestic production and job creation. Tariffs can also generate revenue for the government, which can be used to fund public services or reduce other taxes. Additionally, tariffs can be used as a tool to retaliate against unfair trade practices by other countries, incentivizing them to adopt more equitable trade policies.

What are some potential drawbacks of tariffs?

Tariffs can lead to higher prices for consumers, reduced trade volumes, and strained international relations. They can also distort markets by artificially inflating the cost of imported goods, leading to inefficient resource allocation. Furthermore, tariffs can provoke retaliatory measures from other countries, resulting in a trade war that harms all parties involved. The overall economic impact of tariffs is often debated, with economists holding differing views on their net effects.