Explore the dynamics of premarket crypto trading on Whales Market, the leading decentralized exchange (DEX) for secure OTC pre-market trading. Here, users can buy and sell early-stage tokens, vested allocations before official listings, unlocking unique investment opportunities in the crypto pre-market ecosystem.

Whether you’re an investor seeking early exposure or a trader looking for pre-market prices to gauge sentiment, understanding this mechanism is essential to getting in before the bell.

What is Pre-Market Crypto?

Premarket crypto refers to trading tokens before their official Token Generation Event (TGE) or centralized exchange listing.

Unlike traditional financial pre-market trading, which happens before the stock market opens, the crypto pre-market allows investors to buy and sell assets that aren’t yet publicly tradable. This early phase offers critical advantages in price discovery and early positioning.

CeFi vs. DeFi Pre-Market Trading

The approach to premarket crypto trading differs significantly between centralized (CeFi) and decentralized (DeFi) environments:

Whales Market: The Hub for Pre-Market Crypto Trading

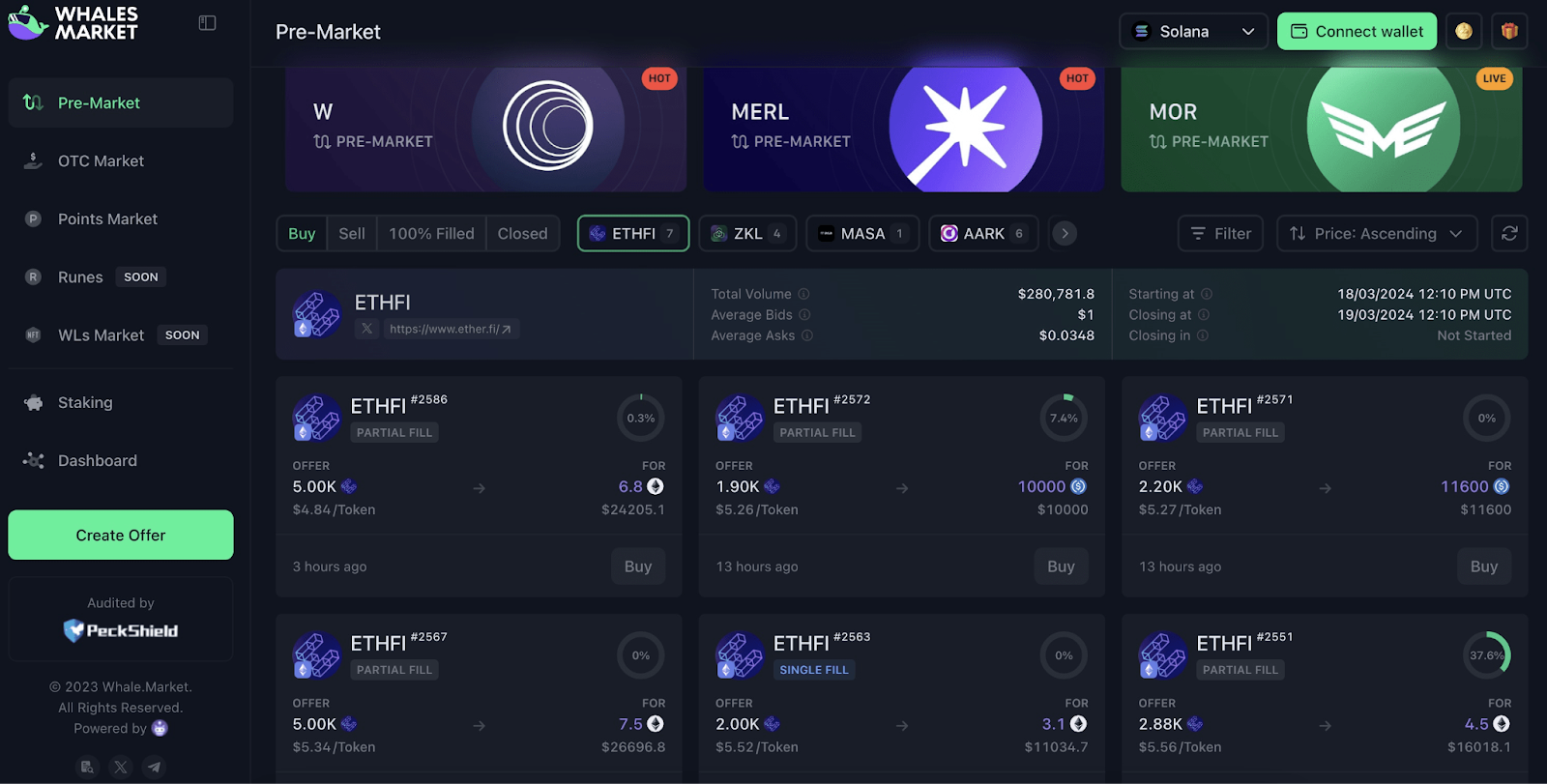

Whales Market is the leading decentralized OTC platform for premarket crypto trading. Launched in early 2024, it has processed over $300M in total volume, providing a transparent and secure on-chain environment for trading pre-TGE tokens before their official listings.

Unlike traditional crypto pre-market platforms that rely on centralized intermediaries, Whales Market uses audited smart contracts to enable users to buy and sell early-stage token allocations safely and globally, without KYC or custodial risk.

Pre-Market (Pre-TGE): The Core of Whales Market

The Pre-Market is the heart of Whales Market’s ecosystem. It allows traders to buy or sell tokens before their Token Generation Event (TGE), which offers access to early-stage projects and new market opportunities before they become publicly available.

This system is built entirely on-chain, giving participants a trustless OTC pre-market experience that ensures both sides of a trade are protected by collateral and transparent smart contracts.

How Pre-Market Trading Works on Whales Market

Whales Market operates as a decentralized exchange (DEX) across Solana, EVM-compatible chains, Sui and Aptos, handling all trades through immutable smart contracts.

Here’s how crypto pre-market trading works step by step:

- Connect Wallet on Whales Market: Visit Whales Market, connect your wallet, and select the token you want to trade in the premarket crypto section. This gives you access to verified pre-TGE listings and real-time pre-market prices.

- Create or Fill an Order: Choose whether you want to buy early allocations or sell your tokens before TGE. Simply click “Create Order” to list your offer or browse existing otc pre-market orders to fill.

- Set Price and Deposit Collateral: Define your price and amount, then lock collateral equal to the order value. This ensures every crypto pre-market trade is secure and trustless.

- Order Execution and Visibility: Once confirmed, your order becomes public on the platform, buyers and sellers can view, match, and execute trades instantly through on-chain smart contracts.

- Settlement After TGE: When the token officially launches, the settlement phase begins. Sellers must deliver tokens within the specified window, or their collateral is forfeited to the buyer, guaranteeing fairness across all pre-market crypto transactions.

Why Trade Pre-Market Tokens

Whales Market gives traders a head start on the next wave of crypto assets, offering access to pre-TGE allocations that were previously only available to private investors. All trades follow an on-chain OTC model, ensuring transparency, protection, and instant verification via blockchain records.

Benefits include:

- Early Access: Enter promising projects before their public listings.

- Transparent Pre-market Prices: Get real-time insight into what the market values a token pre-launch.

- Liquidity for Early Investors: Early investors can sell allocations to manage capital or risk.

- Secure Escrow System: All transactions are protected by on-chain collateral.

Risks of Crypto Pre-Market Trading

While the potential upside is high, crypto pre-market trading involves significant risks:

- High Volatility: Pre-market prices can shift quickly due to speculation.

- Lower Liquidity: Fewer participants can lead to wider price spreads.

- Default Risk: Sellers may fail to deliver tokens; however, Whales Market’s collateral system mitigates this by protecting buyers.

- Uncertainty: The final token value post-TGE can differ from pre-market valuations.

Always verify project information before trading and monitor official announcements for updates.

Conclusion

Whales Market has transformed pre-market crypto investing by creating a secure, transparent, and non-custodial trading environment. Through smart contract-based escrow and on-chain settlement, it empowers users to participate in OTC pre-market opportunities safely, discovering true pre-market prices before assets hit exchanges.

For traders seeking early exposure, Whales Market represents the future of premarket crypto trading: open, decentralized, and community-driven.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

What is Pre-market in crypto?

Pre-market crypto is the system of trading early-stage tokens on an OTC basis before their official public launch (TGE) on major spot exchanges. Platforms like Whales Market use smart contracts to facilitate this process securely.

How does Whales Market provide pre-market info?

Whales Market displays agreed-upon trade prices and volumes for tokens not yet launched, offering direct, real-time insights into market sentiment and initial valuation, which is critical pre-market info for investors.

How to trade on Whales Market?

To engage in pre-market trading on Whales Market, users connect their non-custodial wallet, create or accept a pre-TGE order, deposit collateral (seller) or funds (buyer) into the smart contract escrow, and wait for the post-listing settlement.