JPMorgan Chase, the world's leading investment bank has issued a prediction that Base could reach a token valuation of $12B–$34B.

This valuation is based on Base being backed by Coinbase, as well as the upcoming strategic change in utilizing interest from USDC, where a portion of the profits will be used to promote the DeFi ecosystem. Currently, Base is generating about $400M/year profits from USDC.

This also elevates the valuation of projects within the Base ecosystem, especially the backbone projects of the system. So, what are those projects? Let's explore through the article below:

Overview of the Base Ecosystem

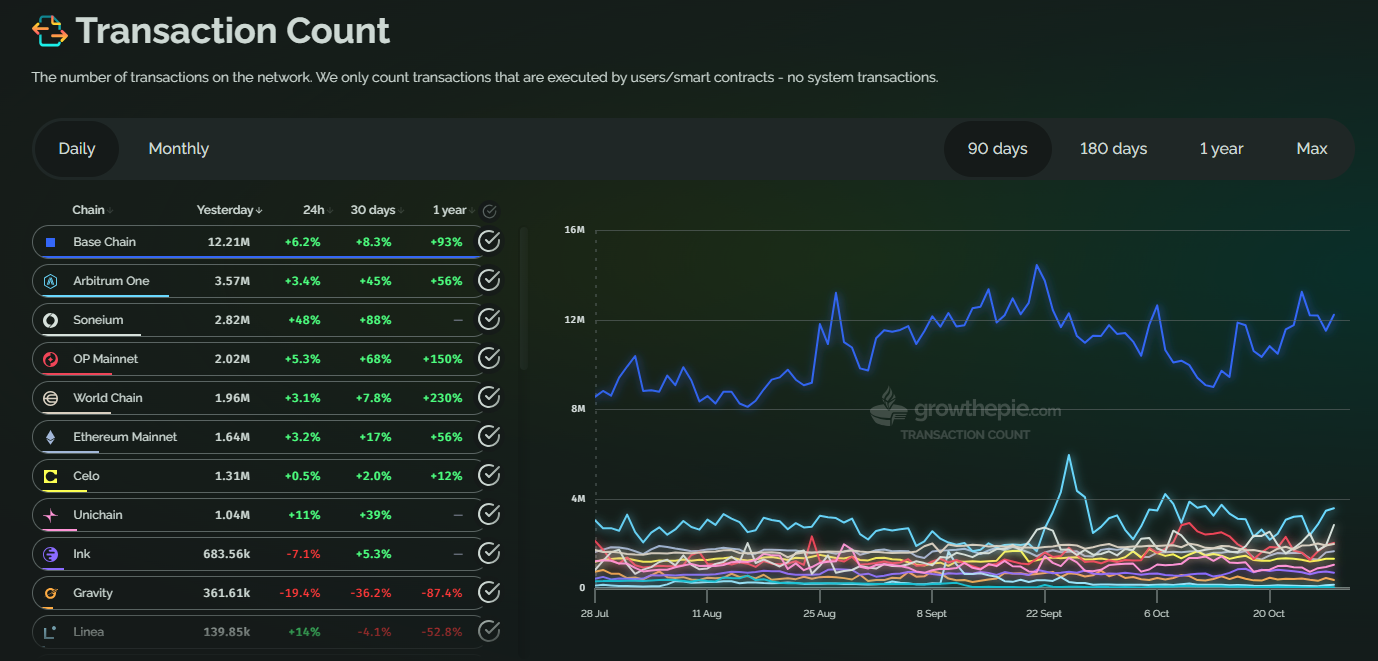

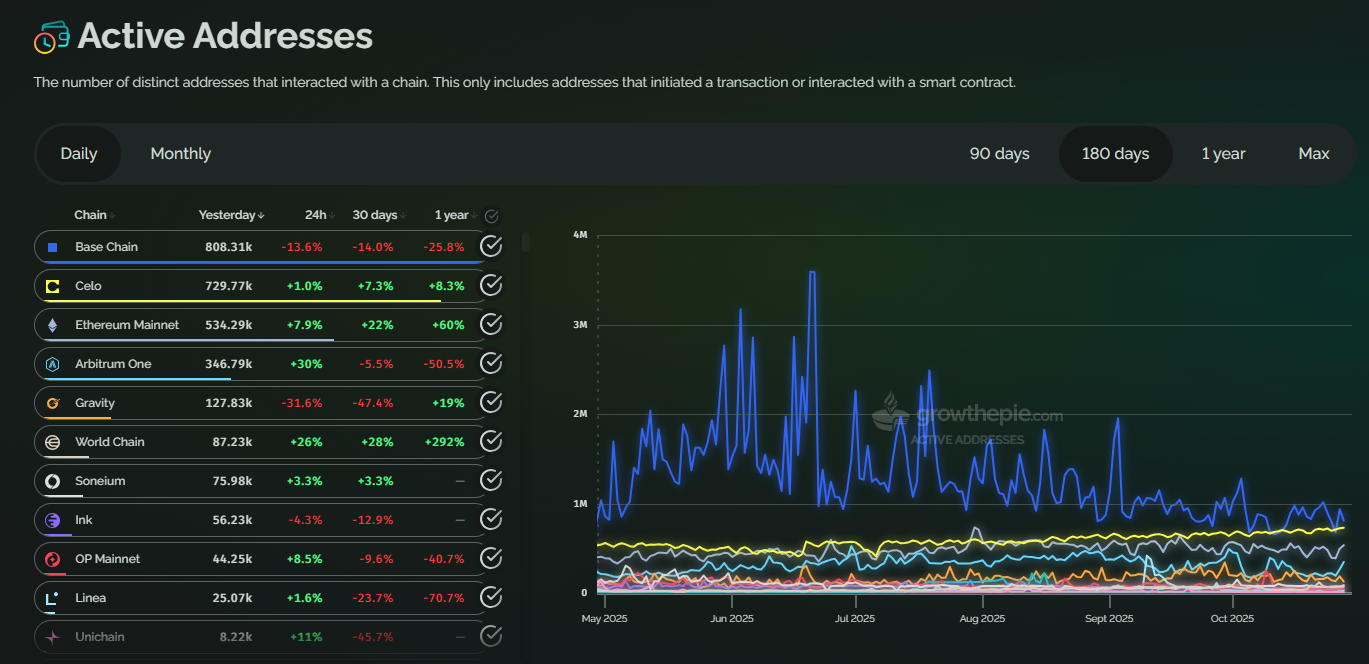

Overall, all network activity metrics for Base are relatively stable. Base is always the Layer 2 with the highest number of active wallet addresses as well as the highest number of transactions compared to other Layer 2s.

This indicates that Base is a preferred destination for many individuals in the crypto market. Opportunities are abundant in the Base ecosystem.

If look at Arbitrum, Optimism, or Starknet, users will see these networks have relatively few consumer apps. This is completely the opposite on Base, where:

- Farcaster, with many miniapps from entertainment to betting and even DeFi miniapps, has contributed significantly to these metrics.

- Zora - the Web3 Instagram is also one of the dApps that plays a significant role in the overall picture of Base.

- Limitless - A Prediction Market Platform.

- Football.fun - A game combining football, prediction market, and betting.

- Virtual Protocol - One of the most successful AI Agent Launchpads in the market, always leading waves of increases related to narratives along with a diverse ecosystem.

More importantly, Base has active members on X who are ready to shill low-cap coins to create games. Notable in this trend is Jesse.

The stablecoin capitalization of the entire network is still growing steadily and surely. Out of $4.6B in stablecoins on Base, USDC has accounted for nearly $4.2B.

Base is also the Layer 2 with the highest stablecoin capitalization compared to many other L2s, even higher than L1s like Sui, Aptos, Sei, or Avalanche.

It can be seen that the Base ecosystem is extremely rich and diverse with many applications spanning all niches of the market. So, what are the TOP 5 notable projects in the Base ecosystem? Let's find out below:

Read more: Base Ecosystem: Where Are the Opportunities?

TOP 5 Projects on Base Ecosystem

Aerodrome Finance

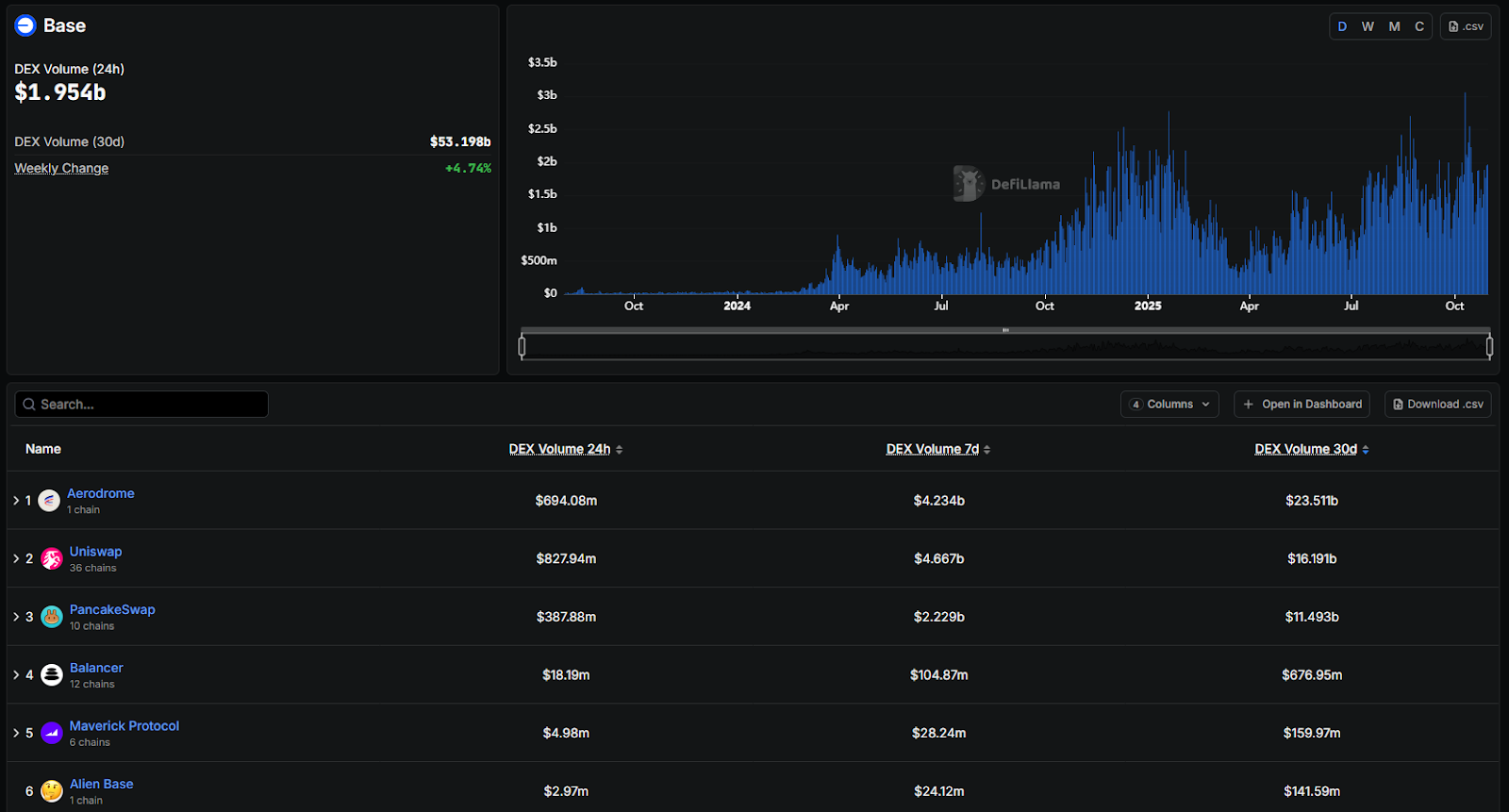

Aerodrome is a leading DEX on Base, forked from Velodrome Finance. This DEX attracts institutional adoption, thanks to the integration with Coinbase, Aerodrome becoming the most incentives and vibrant activities DEX on Base.

So, why should users pay attention to Aerodrome?

- Aerodrome is a DEX project with only one investor, which is Base. Therefore, it's highly likely that this is a "homegrown" project created by Base itself to prevent market share from falling into the hands of other multichain DEXs like Uniswap or PancakeSwap.

- Base is very strong in memecoin trends, creator coins, or more accurately, it's a playground for true degens. In that environment, DEXs will benefit immensely from trading activities on the network. The metrics clearly show that in the past 30 days, Aerodrome has had a volume of up to $23B.

Base has not yet fully exploded; the Base App is about to launch along with countless promising narratives such as x402, ERC-8004, AI Agents with Virtual, or Prediction Market DeFi... and DEXs will be the beneficiaries of the entire picture. More opportunities → more users → increased trading volume → Aerodrome benefits.

Morpho

Morpho is a lending protocol on Ethereum and Base, with a modular model and permissionless market creation (anyone can create a separate lending market without approval).

The standout feature is P2P (peer-to-peer) lending that optimizes interest rates and risks. Currently, Morpho is also the protocol have highest TVL on Base, with $2B locked in the protocol.

Why does Morpho have potential while Aave is also deployed on Base?

- Flexibility: Instead of Aave/Compound’s mostly variable-rate pools, Morpho V2 lets counterparties set the deal they want: fixed rate, fixed maturity, and multi-collateral options much closer to a TradFi loan desk. That makes it useful for interest-rate hedging and institutional mandate management.

- Capital efficiency and less fragmentation: With offered liquidity and intent matching, lenders aren’t forced to park idle capital while waiting to be filled, and order flow aggregates rather than splintering across numerous isolated pools (a common issue in Aave V3).

Besides, Morpho is strongly backed by Base, and this lending protocol stands out on this L2:

- It leads Base by TVL, at roughly $2B.

- Coinbase enables institutions to post cbBTC on Base as collateral for borrowing on Morpho.

- Morpho is natively available in the Base App, Coinbase’s all-in-one interface.

If Aerodrome plays the role of where money flows and changes, then Morpho in the future will be positioned as a digital bank of the Coinbase ecosystem.

And it's not just ordinary forks from other lending protocols; Morpho truly has improvements in its model and strong connections with Coinbase.

Get ready for 🦋 on @baseapp pic.twitter.com/sVhxit2gHc

— Morpho 🦋 (@MorphoLabs) July 18, 2025

Morpho Mini App on BaseApp

Farcaster

Farcaster is a decentralized social network (SocialFi) like "Twitter on-chain," with an open architecture for multiple clients (like Warpcast), allowing users to own their data and identity.

As the leading decentralized social project on Base, Farcaster expands its user base with features like channels and interactive posts, promoting meme culture (such as the DEGEN token for rewards).

With 200K+ users and a $1B valuation, it is a "high-conviction bet" for the future of social media, competing with Mastodon/Lens.

Abundant financial resources are also a strength of Farcaster, backed by a16z crypto, Paradigm, and Variant with funding up to $180M.

Some additional points that make Farcaster worth noting include:

- It is continuously used by Vitalik, C-level executives of Coinbase, and Base.

- Farcaster is a strategic asset in expanding Base's onchain business. More precisely, Farcaster is a place for users to interact, use DeFi through miniapps (e.g., Morpho miniapp), gaming, and later possibly betting through prediction market miniapps in Farcaster.

- Farcaster is also an expanded revenue source for Base as they can sell Farcaster Pro, allow running ads, transaction fees from wallets... This makes the project receive a lot of support from Base as well as Coinbase, and that's happening.

It can be seen that Farcaster plays an extremely important role and is almost the center of the Base App.

Having its own SocialFi platform also helps Coinbase and Base reduce dependence on X, thereby making content creation and the implementation of campaigns easier because they don't have to comply with the legacy of third parties.

For example: Users can directly track/follow whales/KOLs on Farcaster to copy trade.

Additionally, if you look at the models of other CEXs like Binance, OKX, Bybit, only Coinbase has a real SocialFi application. Binance Square is still far behind in terms of UI/UX, applicability, as well as incentives to attract users.

Currently, Farcaster has not launched a token yet, but users can use the application to have a chance to receive airdrops from the platform.

Zora

Zora is a decentralized platform focused on the creator economy and SocialFi on Base. Launched in 2020, Zora has evolved from a simple NFT marketplace into a comprehensive ecosystem for tokenizing social content, where every post can become a tradable token or NFT.

By 2025, Zora is leading the "every post is a coin" trend, allowing creators to turn content into financial assets, with a focus on bonding curves where prices increase with demand.

The project emphasizes empowering creators through revenue sharing and easy-to-use tools, helping them earn money directly from the community without intermediaries like Instagram or TikTok.

Zora has also raised over $60M with many large VCs, notably including Coinbase Ventures.

So, why is Zora a platform that users should pay attention to?

- The project plays a strategic role in Base's onchain picture by helping users earn money from content, similar to how YouTube, TikTok, or other Web2 platforms do it.

- KOLs on Base all use Zora to educate users, and the platform can be seen as a counterweight to pump.fun on Solana as both help creators earn profits more effectively than Web2 models.

- Additionally, the Zora development team are all ex-Coinbase, which makes the project receive enthusiastic support from this exchange.

Zora's flywheel is as follows:

Quality content → attracts fans to buy coins → increases liquidity and value → creators earn money from fees → creators create more content → repeat.

Clanker

Clanker is an AI-powered bot designed to simplify the token creation process on the Base blockchain. The special feature of Clanker is that users don't need to write code or have technical knowledge; they just post a Cast on the decentralized social network Farcaster.

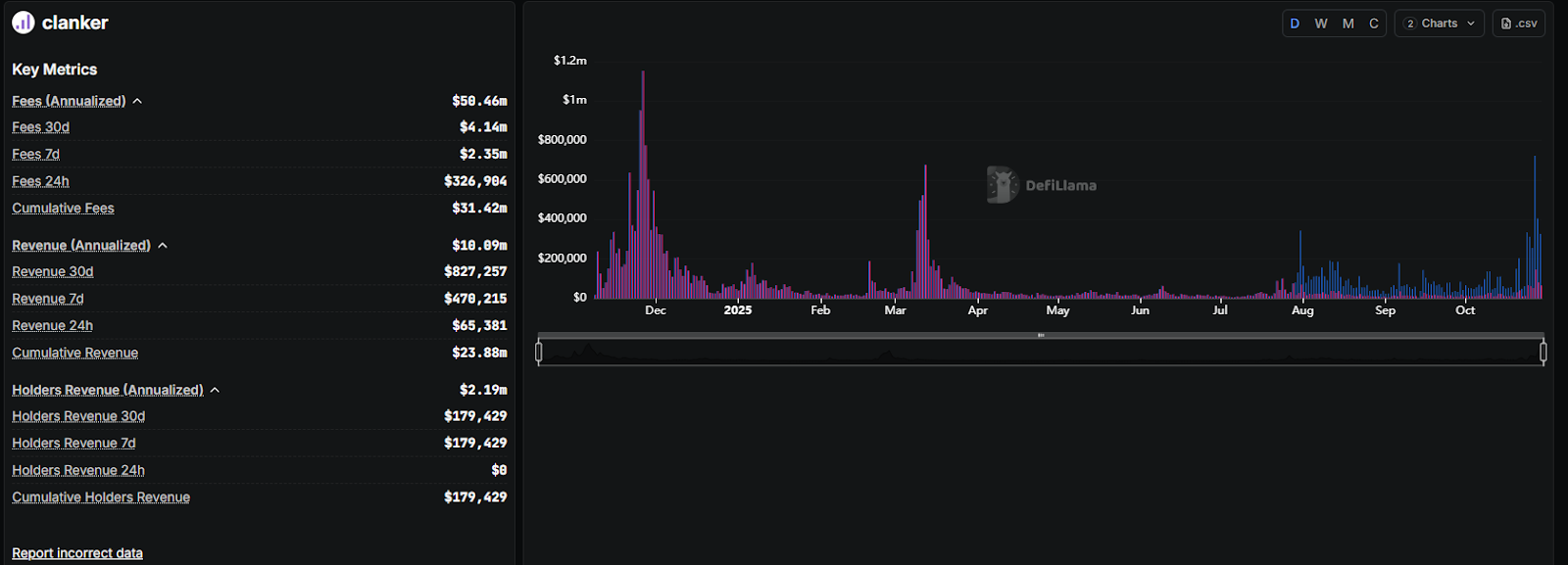

Token $CLANKER has a fixed supply of 1M token (100% circulating, no unlocks). The special point of Clanker is its massive revenue, specifically:

- Clanker has accumulated over $50M in transaction fees since its launch in November 2024.

- Actual revenue (after sharing) for the Clanker team (now under Farcaster) is estimated at about 50% of total fees, meaning over $25M all-time based on $50M fees.

- Farcaster recently announced a discreet acquisition of Clanker. The Clanker team (including Dish and Lily – @lobstermindset) expressed excitement, sharing "Clanker was only possible because of Farcaster."

- Before that, in August 2025, Rainbow approached Clanker with an acquisition offer, including 4% supply of the upcoming RNBW token (valuation around $100-$200M for Clanker). However, the Clanker team declined because it didn't fit culturally.

- For the $CLANKER token, a new flywheel is activated where 2/3 (about 66.7%) of all protocol fees (from current and future Clanker) will be used to buy back and hold $CLANKER permanently, creating upward pressure on the price.

Dan Romero also shared some reasons why Farcaster decided to acquire Clanker:

- Farcaster wants to turn Clanker into the "best token deployment framework" integrated directly, helping it compete with other launchpads like Pump.fun or Padre. This also supports Base by increasing volume and liquidity for meme tokens.

- Clanker has created over 355K tokens, generating more than $34M USD fees from $2.7B USD on-chain volume. The acquisition helps Farcaster upgrade social token launch features (deploy tokens via Farcaster Frames or tags).

Conclusion

Above are the TOP 5 notable projects on Base. Each project has its own strengths, weaknesses, and roles in the Base ecosystem. Together, they create an overall picture that Base, as well as Coinbase, is building not only for the present but for the next 5-10 years.

Hopefully, through this article, readers have gained more useful insights to serve their investment process.

Disclaimer: This article is for informational purposes only, not investment advice, and Whales Market is not responsible for any of your investment decisions.

FAQs

Q1. Why is Base getting a $12B–$34B valuation estimate?

Because it’s backed by Coinbase and will redirect part of USDC yield to grow DeFi. Base reportedly earns ~$400M/year from USDC interest, which could fund ecosystem incentives.

Q2. Does strong network activity actually show up on-chain?

Yes. Base consistently leads L2s by active wallets and transactions, helped by consumer apps (Farcaster, Zora) and onchain entertainment/betting apps.

Q3. What makes Base different from Arbitrum/Optimism/Starknet right now?

More consumer-facing apps and social surfaces (e.g., Farcaster miniapps, Zora social tokens), which drive daily engagement beyond pure DeFi farming.

Q4. Which stablecoin dominates Base?

USDC. Of the ~$4.6B stablecoin cap on Base, ~$4.2B is USDC, supporting liquidity, payments, and yield flows across the ecosystem.

Q5: What is the price of $BASE today?

$BASE does not yet have an official market price since it has not been listed. However, you will soon be able to trade it on the leading pre-market platform, Whales Market. Here, you can buy more $BASE or sell to take profit before it is officially listed on CEXs like Binance or Bybit.