From a niche experiment to an $18B phenomenon, prediction markets are transforming how we forecast everything from elections to earnings. Wall Street giants and Silicon Valley VCs are pouring billions into platforms that let anyone bet on anything.

What is Prediction Market?

Prediction Market is a platform that creates tradable markets for real-world events, allowing users to bet on outcomes ranging from political elections to sports results. Smart contracts and oracles replace centralized control, making markets transparent, tamper-resistant, and community-driven. Users trade shares that resolve to $1 for correct predictions or $0 for incorrect ones.

Key Highlights:

- Prediction market growth from $1.5B in 2024 to approximately $45-50B total trading volume in 2025, with weekly volume exceeding $2B and nearly $10B combined monthly volume (Kalshi + Polymarket) in November 2025.

- Over $3.6B traded on the 2024 U.S. election, making it history's largest election betting market.

- ICE's $2B investment in Polymarket at a $9B valuation.

- Robinhood surpassing 4B event contracts traded.

- Total sector TVL reaching $359M.

What are Top 5 crypto prediction markets?

Polymarket

Polymarket stands out as a global leader in prediction markets, enabling users to turn insights into profit by trading on the likelihood of future events across multiple sectors. Instead of relying on traditional analysis, it harnesses collective market activity to transform public sentiment, expert opinions, and data into real-time, evidence-based probability forecasts.

Read More: How to Increase Win Rates on Polymarket

Key Highlights:

- Daily active users surged to nearly 58,000 in October 2025 amid speculation about a $POLY token after CEO's post.

- November 2025 recorded $3.74B in monthly trading volume (ATH), with total cumulative volume surpassing $18.1B.

- Supports only USDC for settlements

- Currently over 85,000+ active markets on the platform.

- Secured $2.28B through seven funding rounds, including a $2B investment from Intercontinental Exchange (ICE) that valued Polymarket at $9B, with additional backing from Founders Fund, Vitalik Buterin, and Polychain Capital.

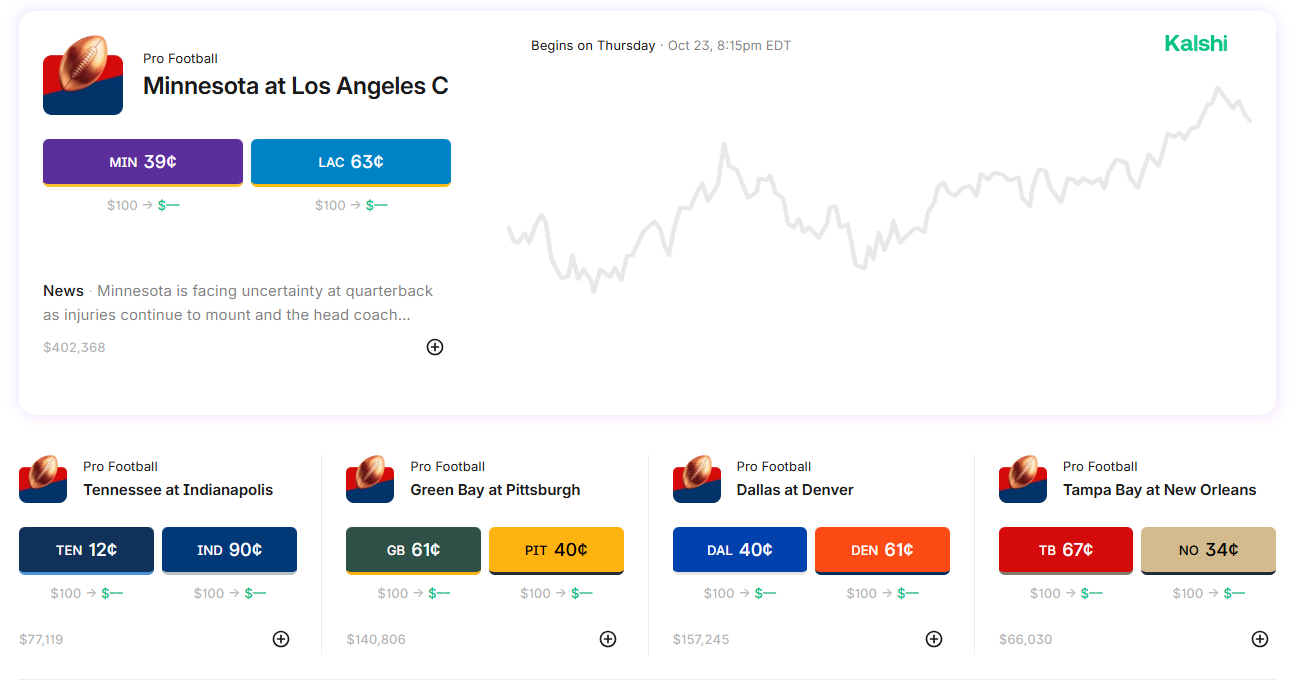

Kalshi

Kalshi is a CFTC-regulated prediction market platform enabling users to trade contracts on real-world event outcomes, such as elections or economic indicators, using USD. Launched in 2021, it offers transparent, market-driven forecasting with contract prices reflecting event probabilities. Unlike crypto-based platforms, Kalshi uses fiat currency, broadening access for tiểu raditional users.

The core team consists of Tarek Mansour (CEO and Co-Founder) and Luana Lopes Lara (COO and Co-Founder), both with backgrounds as financial analysts; Donald Trump Jr. serves as a strategic advisor since January 2025.

Read More: How to Predict on Kalshi: Step-by-Step Tutorial

Key Highlights

- Projected to achieve $50B in annualized trading volume by 2025, up significantly from $300M in 2024, holding a 62.2% global market share.

- Weekly trading volume in prediction markets reached a record $2B, positioning Kalshi as a close competitor to Polymarket.

- Sports volumes approaching $1B per week, with open interest regularly above $100M. Kalshi currently leads Polymarket in monthly volume.

- Expanded operations to over 140 countries and integrated with Robinhood for trading in areas like sports and policy events.

- Offers betting limits up to $100M on select markets, such as elections, to attract institutional participants.

- Total funding amounts to approximately $1.57B across three rounds, including a $1B Undisclosed round in November 2025 that pushed valuation to $11B. Previous rounds include a $300M Series D and a $185M Series C, backed by investors such as Sequoia Capital, a16z, Paradigm, CapitalG, and Coinbase Ventures.

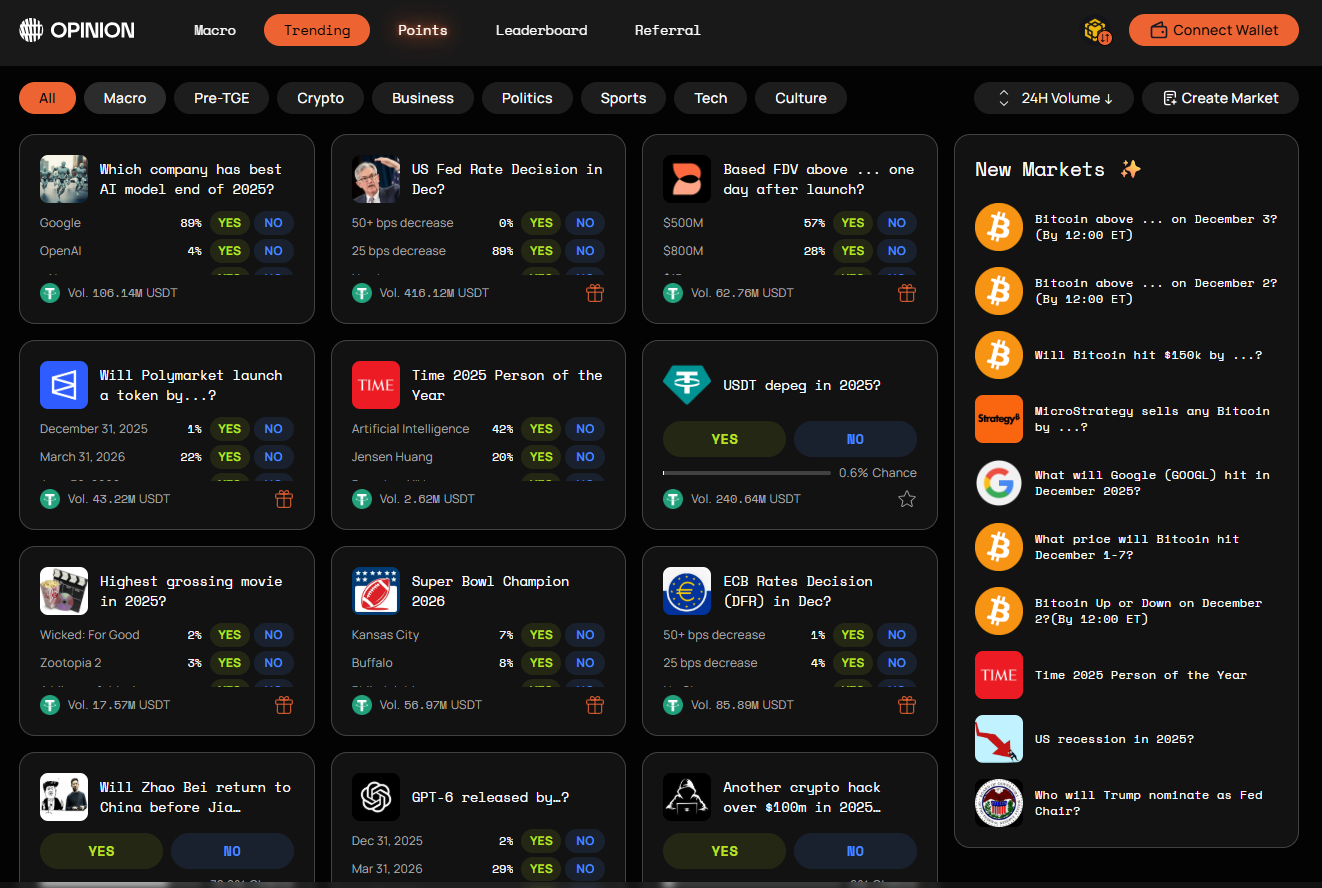

Opinion

Opinion is an onchain prediction platform backed by YZi Labs that lets users trade outcomes across politics, sports, finance, and crypto, converting collective sentiment and expert insights into live, market-priced probabilities.

The core team is led by Forrest (Founder), with YZi Labs as a strategic investor and ecosystem backer. The project continues to expand through community participation, trading incentives, and its OPN Points system while growing alongside the broader prediction market movement supported by CZ.

Read More: How to get Opinion ($OPN) Airdrop?

Key Highlights

- Backed by YZi Labs and positioned as a strong competitor to platforms like Kalshi and Polymarket.

- Reached $1B trading volume within just 10 days of launch.

- Users can predict outcomes in sectors such as economics, politics, sports, crypto, and finance.

- Platform has amassed over 1.6M active users across 600+ markets, with combined USDO and USDC trading exceeding $300M

- The OPN Points airdrop campaign incentivizes prediction activity and trading participation.

- Successfully raised $5M across two funding rounds, including a Seed Round led by YZi Labs with Amber Group, Animoca Brands, and other investors.

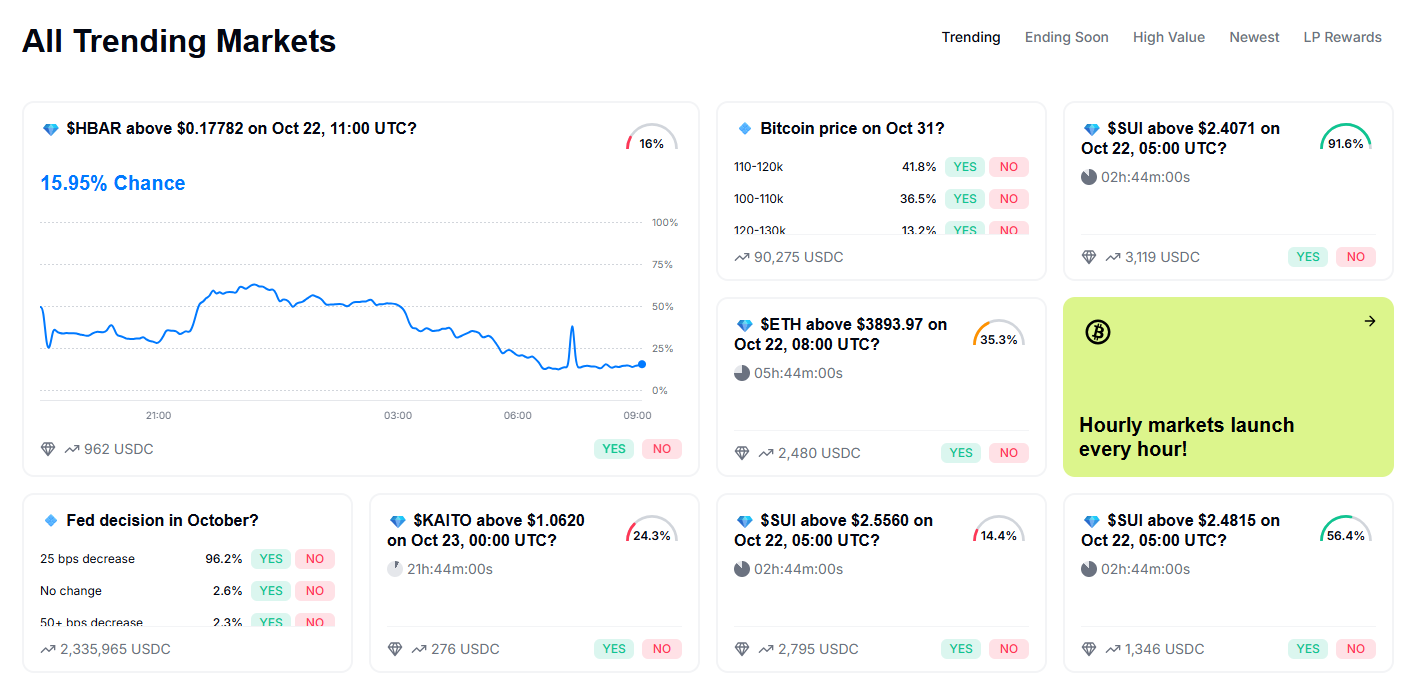

Limitless

Limitless is a decentralized prediction market platform built on the Bas blockchain, an Ethereum Layer 2 network, focusing on short-term trading of outcome shares for crypto and stock price movements through nonstop hourly and daily markets.

Launched in 2025, it combines a central limit order book (CLOB) interface for market and limit orders with on-chain settlement, using natural language conditions for market creation and Pyth oracles for resolution, offering instant payouts without liquidation risks or hidden fees.

The core team includes:

- CJ Hetherington (CEO and Co-Founder, focused on product and growth).

- Rev Miller (Co-Founder, former CEO contributing to strategy).

- Roman Mogylnyi (COO and Co-Founder).

- Dima Horshkov (CPO and Co-Founder).

Key Highlights

- Achieved over $600M in total trading volume, positioning it as the largest prediction market on Base with more than $100M bet on same-day trading.

- Recognized as the fastest-growing prediction market platform, offering short-term markets that settle instantly and plans to expand to even shorter timeframes like 15, 10 and 1 minute intervals.

- Implements a liquidity provider rewards program with daily USDC payouts for tight spreads, and runs a points system for airdrops in seasons, currently in Season 2 until January 2026, rewarding trading volume and accurate predictions.

- Features include mobile-optimized experience, 39,000 monthly active traders, and integration of real-world data for broader event-based trading beyond crypto prices.

- Total funding raised is $18M across four rounds, supported by prominent funds including 1confirmation, Coinbase Ventures, and Arrington Capital.

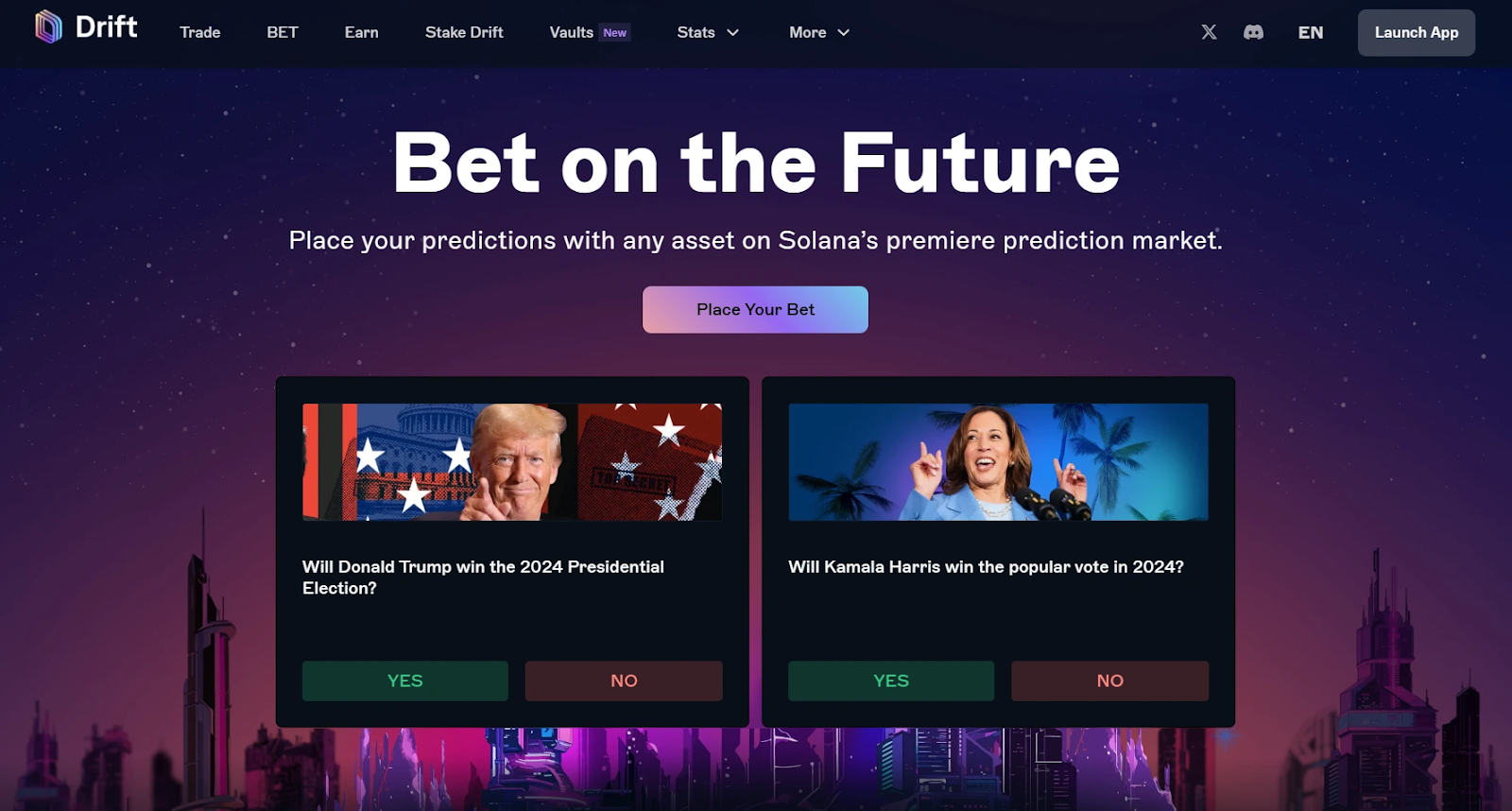

Drift Protocol

Drift Protocol is a decentralized finance (DeFi) platform built on the Solana blockchain, primarily functioning as an open-source perpetual futures exchange with features for spot trading, lending, borrowing, and token swaps.

Launched in 2021, it emphasizes capital efficiency and cross-margin trading. In August 2024, Drift introduced BET, a prediction market component allowing users to bet on real-world event outcomes using Yes/No shares, marking its expansion into prediction markets on Solana.

The core team include:

- Cindy Leow (Co-Founder and CEO).

- Chris Heaney (Co-Founder).

- David Lu (Co-Founder).

Key Highlights

- Launched BET in August 2024 as the first capital-efficient prediction market on Solana, enabling predictions on events with hybrid liquidity and cross-margin support.

- Positioned as a leading on-chain trading platform on Solana, offering perpetuals, spot markets, and prediction features, with integrations for yield-bearing systems and fast execution via Solana's 100ms finality.

- Expanded DeFi offerings in June 2025 to include institutional tools, prediction markets, and advanced trading, aiming to become a "super app" for crypto trading.

- Raised $52.3M across rounds, including a $25M Series B led by Multicoin Capital with major investors like Polychain and Blockchain Capital.

Conclusion

Prediction markets are transforming into a mainstream financial asset class valued in the Bs. Regulatory clarity emerges as platforms like Kalshi secure official approvals while DeFi alternatives expand globally. The integration with traditional brokerages signals Wall Street's acceptance, positioning prediction markets as the next trillion-dollar derivatives category.

FAQs

How much has the prediction market grown?

The market grew from $1.5B in 2024 to approximately $45-50B total trading volume in 2025.

Is Kalshi available globally?

Yes, Kalshi operates in over 140 countries, integrating with Robinhood for broader access.

What is Polymarket’s funding status?

Polymarket raised $2.28B, with a $2B investment from ICE valuing it at $9B.