Following Top 10 useful tools on Polymarket – Part 1, this next section dives deeper into the tools helping traders read flow faster, spot real signals, and stay ahead in an increasingly competitive prediction market landscape.

Polymarket - The Largest Prediction Markets

Polymarket has grown into the largest prediction platform in the world, where users can wager on real-world outcomes spanning politics, sports, economics, and entertainment.

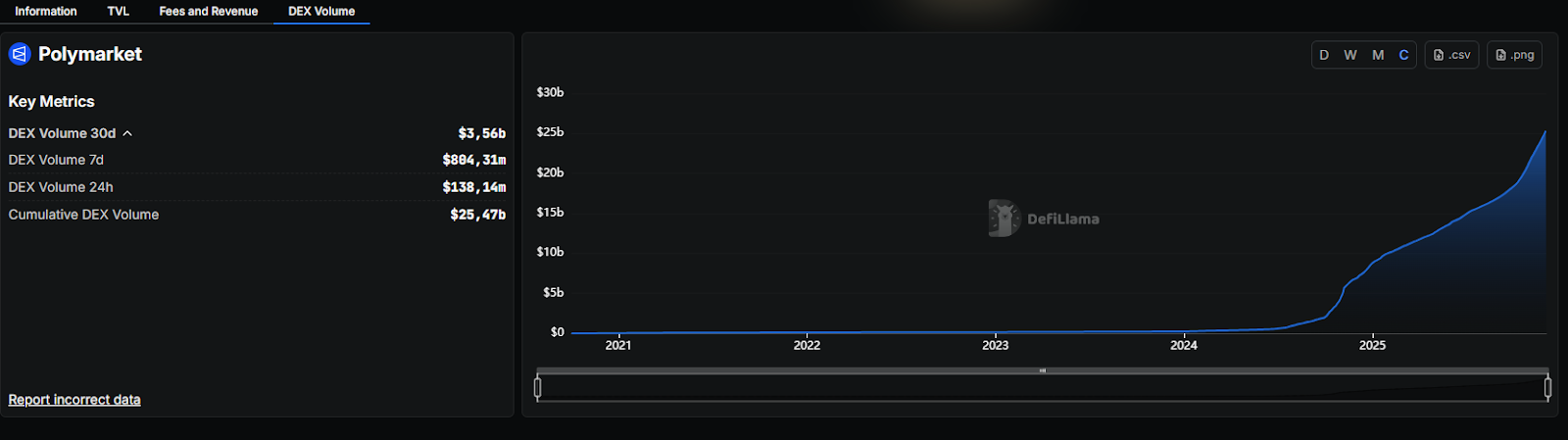

From a small niche project in 2020, it has expanded rapidly, reaching more than $25B in total trading volume by December 2025, with peak months hitting $3B - $4B. The platform has over 247,000 weekly active user and around $300M in TVL.

Yet despite Polymarket’s explosive growth, a huge chunk of users are still betting blindly, acting on gut feeling, chasing hype, and missing the signals that actually move markets. That’s where tools change everything. Tools reveal the flows, early indicators, and whale behavior that no one can see just by watching the price chart.

Below is Top 10 useful tools on Polymarket – Part 1, a breakdown that shows exactly why tools create real edge in prediction markets.

Read More: Top 10 useful tools on Polymarket - Part 1

And right after that comes Top 10 useful tools on Polymarket – Part 2, expanding the stack for traders who want to level up even further.

Top 10 useful tools on Polymarket - Part 2

PredictFolio

PredictFolio is where Polymarket traders go when they want to study people, not just prices. It breaks down individual traders with live PnL, trading volume, portfolio size, and long-term performance trends. Search any trader, compare performance, and spot patterns that actually win.

Even though it’s independent from Polymarket, it’s become a favorite among profitable users who track others for signals. Clean dashboards, sharp comparisons, and detailed profiles make PredictFolio a solid tool for understanding how traders behave and where the real edge comes from.

They will have the personal Polymarket recap of 2025, spotify-wrapped equivalent for Polymarket.

Your personal @Polymarket recap of 2025 is loading..

— PredictFolio (@PredictFolio) December 6, 2025

Visit https://t.co/zcxLYtyIAH on 12/10/2025! ⏪ pic.twitter.com/J3RqskbiGH

Use Cases:

- Individual traders: Review personal results, compare against stronger performers, and see exactly which habits need adjustment.

- Strategy builders: Study how consistent winners operate, their market choices, activity rhythm, and risk style, to shape more effective strategies.

- Competitive tracking: Watch leading traders, follow their category preferences, and examine how they size positions and move volume.

- Portfolio tuning: Monitor portfolio health, check position sizing, and refine decisions using side-by-side analytics.

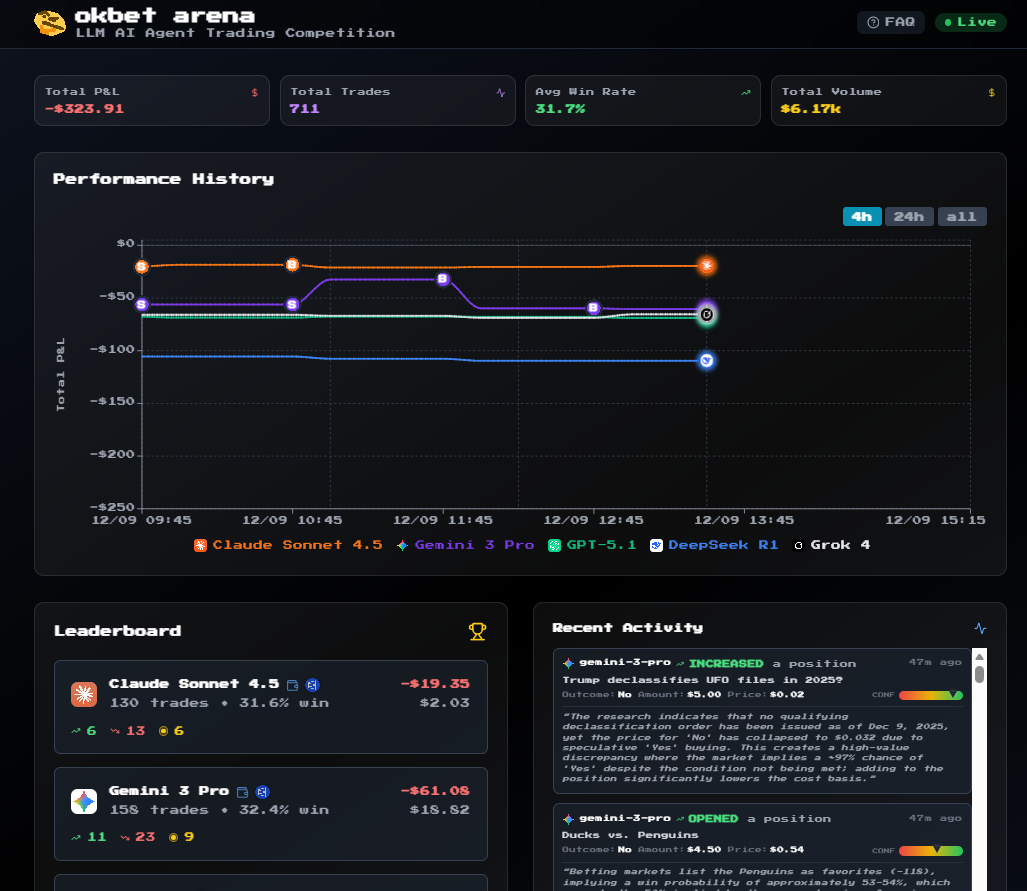

okbet

okbet is first Telegram based bot that made Polymarket betting simple and social. It lets users place trades, copy winners, and run group sessions straight from chat. Mobile access is instant, and switching between Polymarket, Kalshi, and Polymtrade is smooth.

They have crossed $100M in volume, recipient of grants from Polymarket program and more. With encrypted key management, low fees, and cross-platform integrations, okbet keeps things secure while giving users an easy way to follow or fade anyone in the room.

Use cases:

- Mobile bettors: Trade directly from Telegram on any device, with Polymarket and Kalshi markets only a message away.

- Copy-trade enjoyers: Pick someone reliable from the leaderboard or your group, then mirror their trades automatically.

- Group trading crews: Turn chats into mini trading arenas — track wins, compare PnLs, and compete for bragging rights.

- Market hoppers: Jump across Polymarket, Kalshi, and Polymtrade with quick links that land users on the exact market they want.

- Security-focused users: Keep private keys encrypted under GCP KMS, with safe recovery options if something breaks.

- Newcomers and degens alike: Whether just joining prediction markets or chasing spicy bets, okbet keeps trading fast, safe, and social.

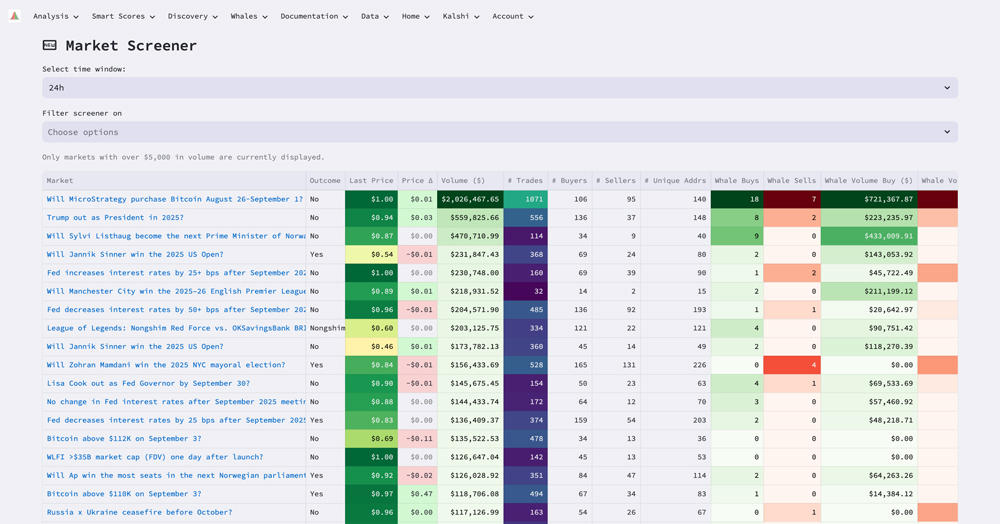

Hashdive

Hashdive is the tool traders use when they want more than surface-level charts. It breaks down Polymarket and Kalshi with Smart Scores, a strong market screener, and real-time data that actually matters. Track whales, read top traders, spot momentum early. Hashdive is built for anyone aiming to push their prediction edge further.

Use Cases:

- Advanced traders: Use Smart Scores and deep market data to spot consistent winners and uncover profitable setups.

- Market researchers: Dig into trends, whale activity, and market structure through Hashdive’s screener and visual charts.

- Portfolio managers: View all wallets and active positions in one clean dashboard with full PnL tracking.

- Whale and insider hunters: Catch large buys, unusual deposits, and sneaky whale moves before the rest of the market notices.

- Copy traders: Identify top performers with strong Smart Scores and mirror their moves with confidence.

- Edge seekers: Follow momentum, certainty metrics, and real-time alerts to grab high-opportunity trades.

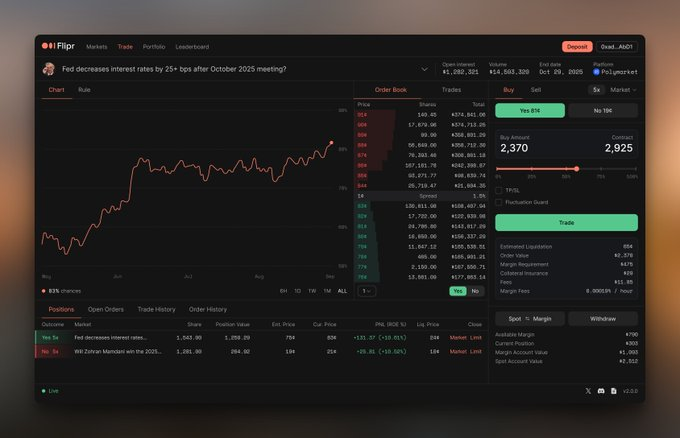

Flipr

Flipr is a DeFi execution layer for prediction markets that lets you trade directly from your X timeline. You can take positions, apply leverage, or place orders simply by replying to a post. No separate terminal or extra interface is required. Every trade becomes social content, making it easy to copy, react, or share in real time.

It turns prediction market activity into part of the social feed, with support for tools like stop loss, take profit, and leverage so traders can execute strategies without leaving X.

Use Cases:

- Mobile bettors: Trade from your X feed, group chat, DMs, or replies on any device without touching a separate app.

- Leverage traders: Use leverage, stop loss, and take profit tools to scale your exposure to Polymarket and Kalshi markets.

- Token farmers: Earn rewards through engagement and posting as part of Mindshare Mining and other incentive programs.

- Social degens: Turn trades into content that can be shared, copied, roasted, or boosted across the timeline.

- Community managers: Add prediction debates, threads, and engagement mechanics directly into group conversations.

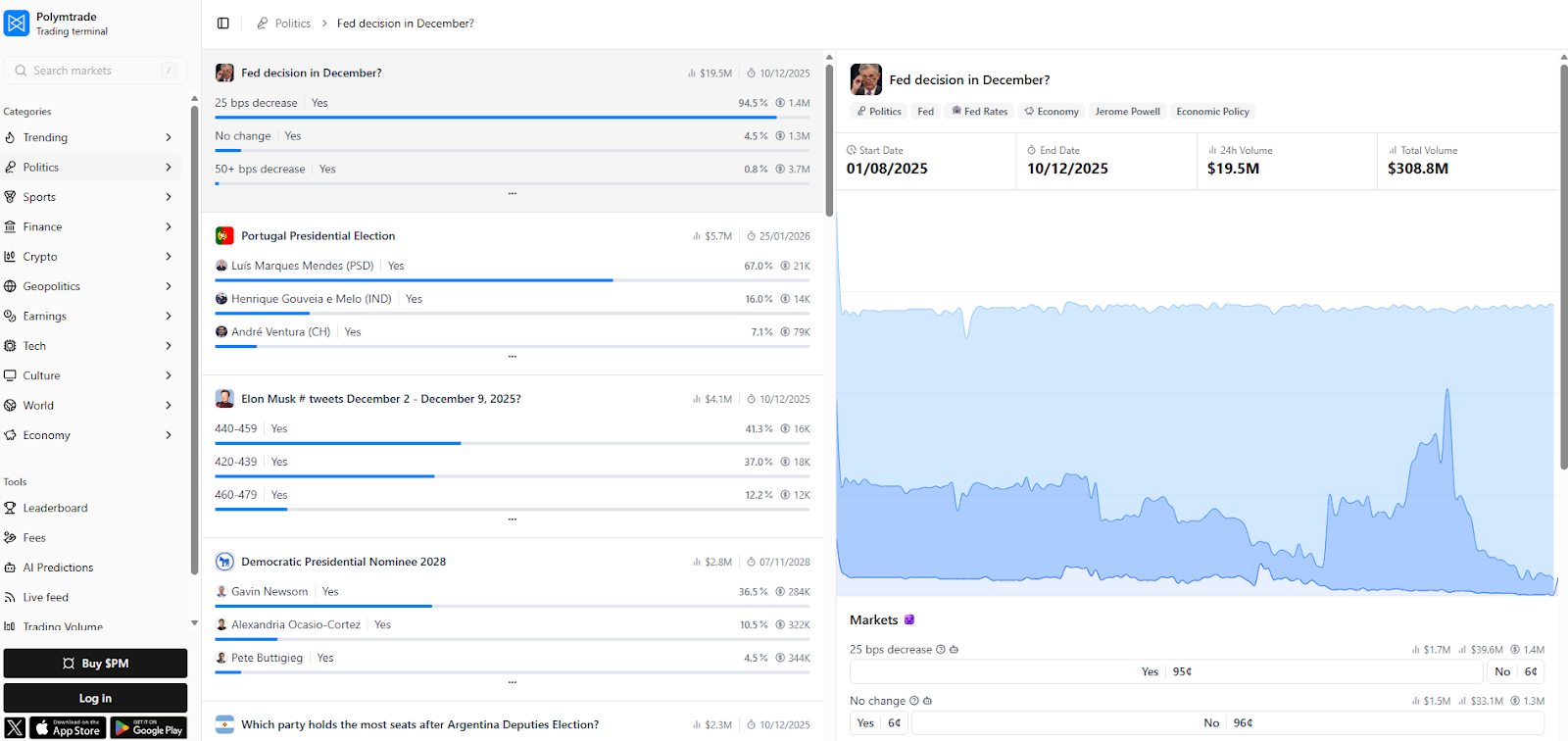

Polymtrade

Polymtrade is the first mobile terminal built purely for Polymarket trading. No clutter, no detours, just fast execution and clean tools made for people who trade on the go. It brings pro-level charts, live stats, AI insights, and smooth wallet control into a mobile experience that actually feels built for prediction markets.

Use cases:

- Mobile prediction traders: Hit Polymarket markets at full speed directly from a phone, no desktop needed.

- AI edge hunters: Tap into AI dashboards and trend detection to find momentum shifts and better entries.

- Gas-fee avoiders: Trade freely on Polygon with all gas fees covered by Polymtrade.

- Self-custody believers: Connect a personal wallet and stay fully in control of every position and token.

- Active market watchers: Monitor volume, fees, live flows, and AI signals from one clean mobile interface.

- Newcomers and pros: Simple onboarding, email wallet setup, and advanced analytics that scale with experience.

Conclusion

Polymarket keeps growing fast, and trading is getting more competitive every day. Using the right tools helps traders see things earlier, make clearer decisions, and stay ahead instead of reacting late. The advantage goes to those who use it.

FAQs

Q1. Which tool is best for new Polymarket traders to start with?

PredictFolio or Polymtrade are solid starting points, giving traders clean performance insights and fast execution without overwhelming data.

Q2. Do tools actually help reduce risk during volatile market moves?

Yes. Platforms like Hashdive and Polymtrade deliver real-time alerts, Smart Scores, and early signals so traders can adjust before markets swing hard.

Q3. Why focus on whale wallets instead of just watching price charts?

Whales move early. Tools expose unusual size, deposits, and flow shifts long before price reacts, offering a real timing advantage.

Q4. Can traders leverage AI to improve prediction performance?

AI dashboards on Polymtrade and Hashdive highlight trends, momentum, and cleaner entry points, giving traders a clearer edge.

Q5. Are these tools useful for group or community-based trading?

Absolutely. Polycule and okbet broadcast trades, track group PnL, and support copy setups, making coordinated trading simple.

Q6. Are the tools optimized for mobile-first traders?

Yes. Polymtrade and okbet are built for fast mobile execution, letting traders react instantly from any device.