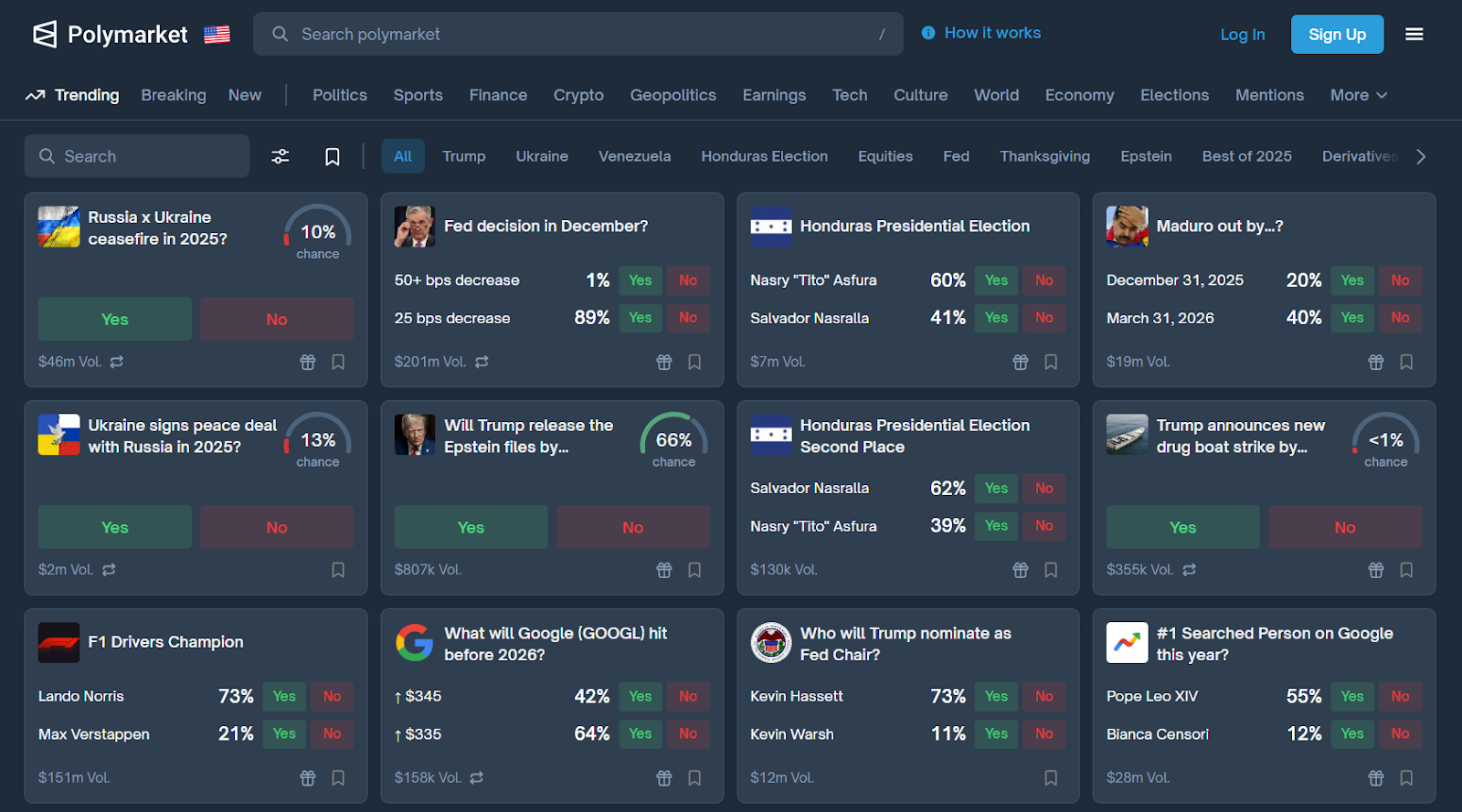

Polymarket isn’t a platform for lucky guesses. It’s a place where information moves first and profit follows after. Most users don’t lose because they’re wrong. They lose because they react late. The real edge is knowing before the crowd does.

So what actually helps users trade faster and think smarter in these markets? This article highlights the Top 5 useful tools on Polymarket that give users a clear edge.

Why tools matter on Polymarket

On Polymarket, the real competition is not about who predicts the outcome most often. The advantage comes from who reads the market faster and makes decisions based on data. Every market moves because of new information, capital flow, and the actions of large traders. If users only look at price, users always react one step later.

Tools give users a real edge:

- Gain information before the market reacts: Tools help read capital flow, price movement, top trader positions, and early signals faster than others.

- Avoid emotional decision making: Instead of betting based on gut feeling, tools provide historical data, wallet analysis, price differences, and trading metrics to support well informed decisions.

- Track smart money in real time: Users can see which wallets are entering or exiting, which traders are moving the market, and where important capital is flowing.

- Respond faster when markets move quickly: Tools provide instant alerts, auto copy strategies, wallet tracking, and direct execution through Telegram or X.

- Capture arbitrage and price gaps across prediction platforms: Tools highlight pricing inefficiencies, unbalanced flows, and temporary differences that can be taken advantage of.

- Reduce the chance of making the wrong decision: Stop loss, take profit, trade history, and win rate data from successful wallets improve decision accuracy.

- Increase the potential for consistent profit: Tools help optimize strategy, scale performance, and base decisions on data instead of emotion or luck.

Prediction markets are not about luck. They are driven by information and data. Tools are what transform normal traders into traders with a real competitive advantage.

Read More: How to Predict on Polymarket: Complete Beginner's Guide

Top 5 useful tools on Polymarket

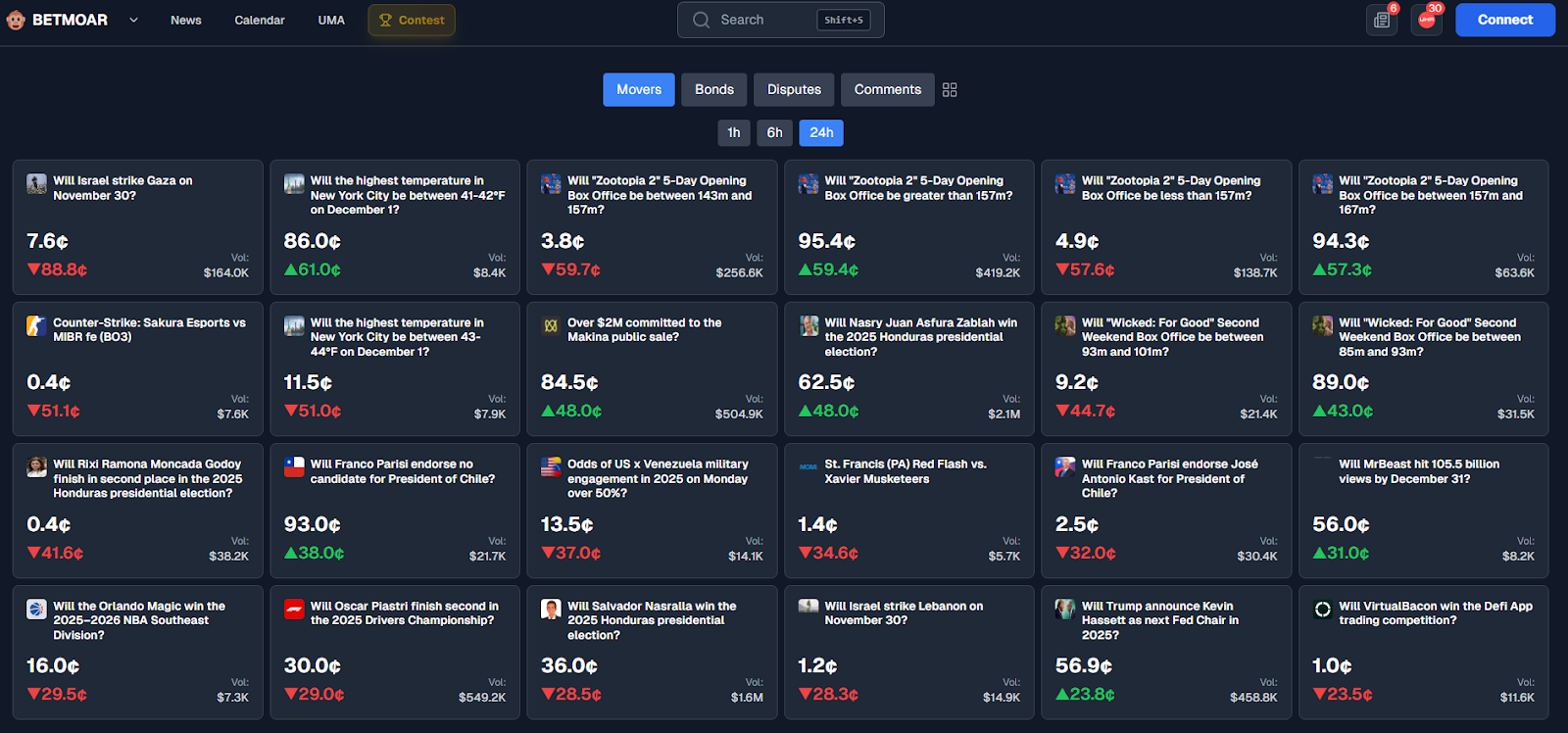

Betmoar

Betmoar is a web based trading terminal for Polymarket that combines a clean UI with market intelligence tools. It gives traders a unified interface for live trading, wallet analysis, and customizable market discovery. By pairing real time news with prediction market data, Betmoar helps users react quickly to market changes and events.

Betmoar currently drives 5% of Polymarket's monthly volume, around double of every other buidlor combined traction wise. With features like UMA dispute tracking, advanced filtering, and integrated trading, it’s designed for traders who want a fast and informed workflow.

Use Cases:

- News driven trading: Respond to breaking information and headlines that directly impact active Polymarket markets.

- Community traders: Access shared resources, watchlists, alerts, and execute trades directly through the terminal.

- Advanced prediction market traders: Analyze wallet profiles and detailed metrics to make better trading decisions.

- Insider tracking: Use top gains and losses to identify influential traders and adjust your strategies accordingly.

- Dispute watchers: Track UMA related disputes and whale activity to anticipate outcomes and voting behavior.

- Market researchers: Use filters and saved configurations to quickly discover the markets that match your criteria.

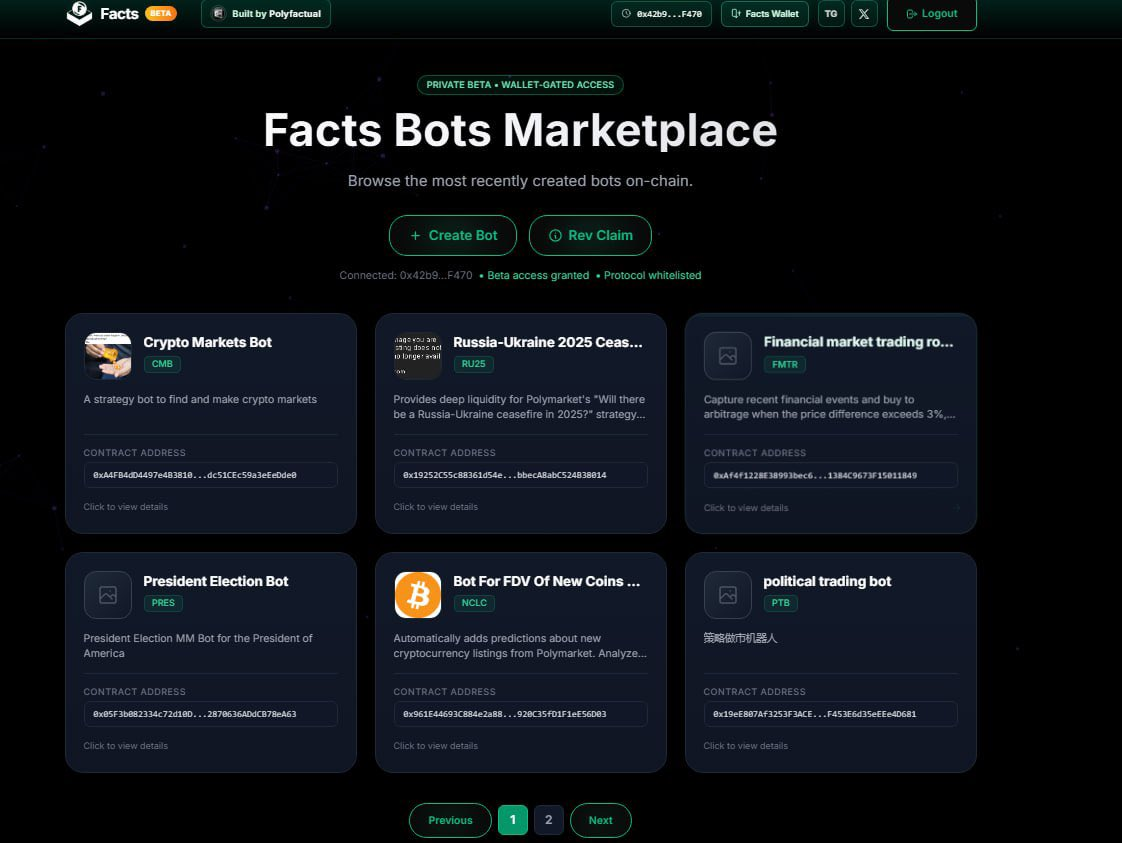

Polyfactual

Polyfactual is building tools that merge prediction markets with social verification. It lets users speculate on the accuracy of news, tweets, and narratives while pulling data from platforms like Polymarket and Kalshi. With AI driven analysis and live intelligence feeds, Polyfactual turns real world events and online content into tradable information.

Its upcoming products include Facts.trade, a system that allows people to invest directly in top predictors and AI bots. Each predictor or bot issues performance based tokens that users can buy.

By holding these tokens, backers earn a share of the profits generated from successful predictions, creating a market where accuracy is rewarded and poor calls are naturally priced out.

Use Cases:

- Market researchers: Track real time narrative shifts and validated information flow to improve forecasting and risk evaluation.

- Developers: Build infrastructure and AI agents that integrate with existing protocols and market systems.

- Advanced traders: Use arbitrage tools and AI curated signals to upgrade trading strategies across Kalshi and Polymarket.

- Content consumers: Get transparent signals on what’s credible versus noise, reducing misinformation in trading decisions.

- DeFi enthusiasts: Experiment with new primitives that combine prediction markets and insurance style risk management.

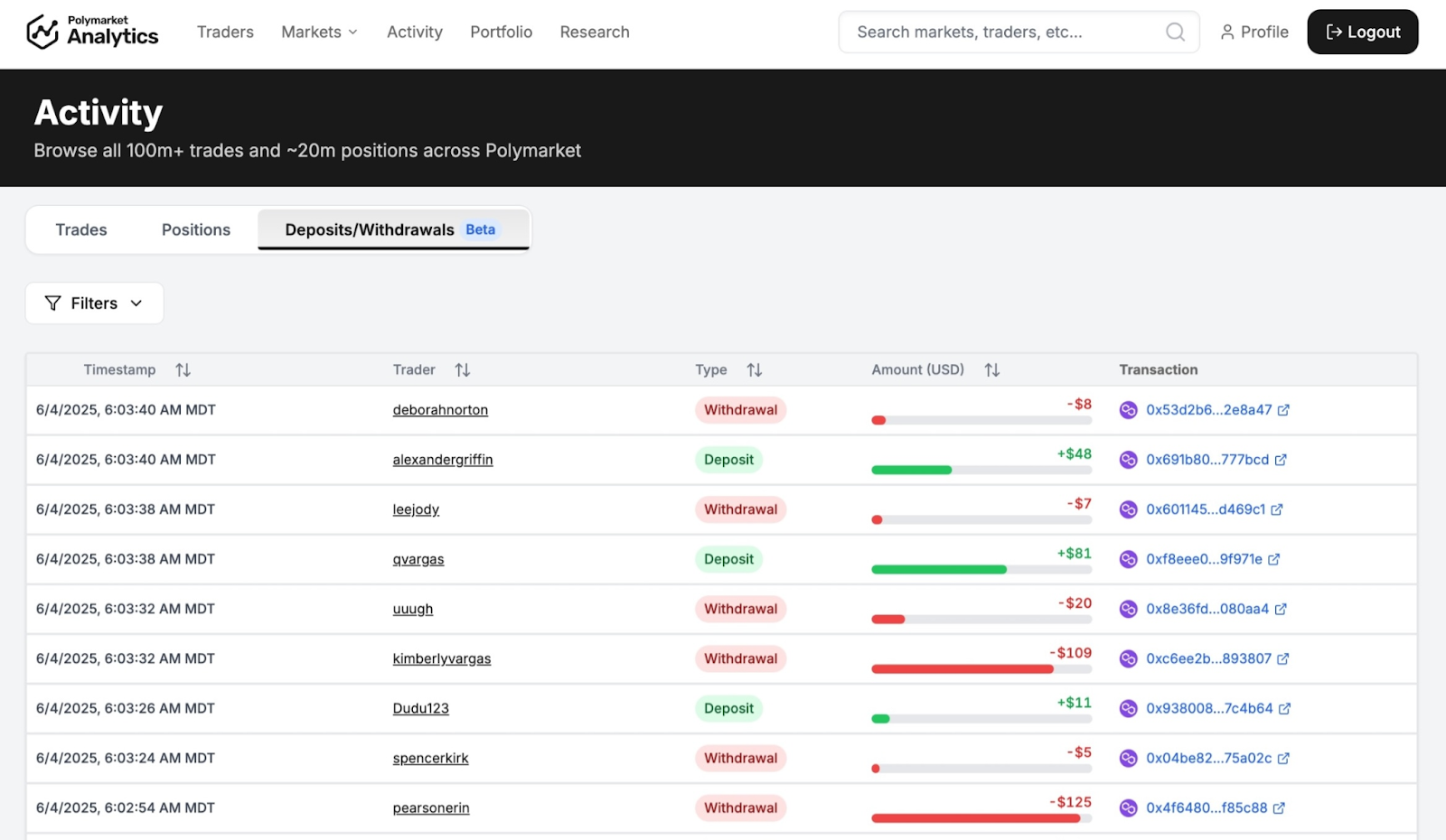

Polymarket Analytics

Polymarket Analytics is a data platform for prediction markets. It gives users visibility into money flow, top traders, and the behavior behind every market shift. This isn’t a place to trade. It’s where traders read the market before betting.

It pulls data across Polymarket and platforms like Kalshi, letting you analyze performance, portfolios, and capital movement in one clean interface. If you need signals, context, and a data driven view before placing a trade, this is where you start.

Use Cases:

- Professional traders: Spot top performers and reverse engineer their strategies. Less guessing. More signal.

- Market analysts: Use advanced filters to detect arbitrage and event driven opportunities. Let data show what headlines miss.

- Portfolio managers: Track multiple wallets and portfolios from one dashboard for clean performance insights.

- Insider flow trackers: Monitor deposits, withdrawals, and large orders. If insider money moves, you see it first.

- Copy traders: Integrate with copy trading bots and tools to follow proven traders easily.

- Data researchers: Pull structured multi platform data for research, reports, and prediction market modeling.

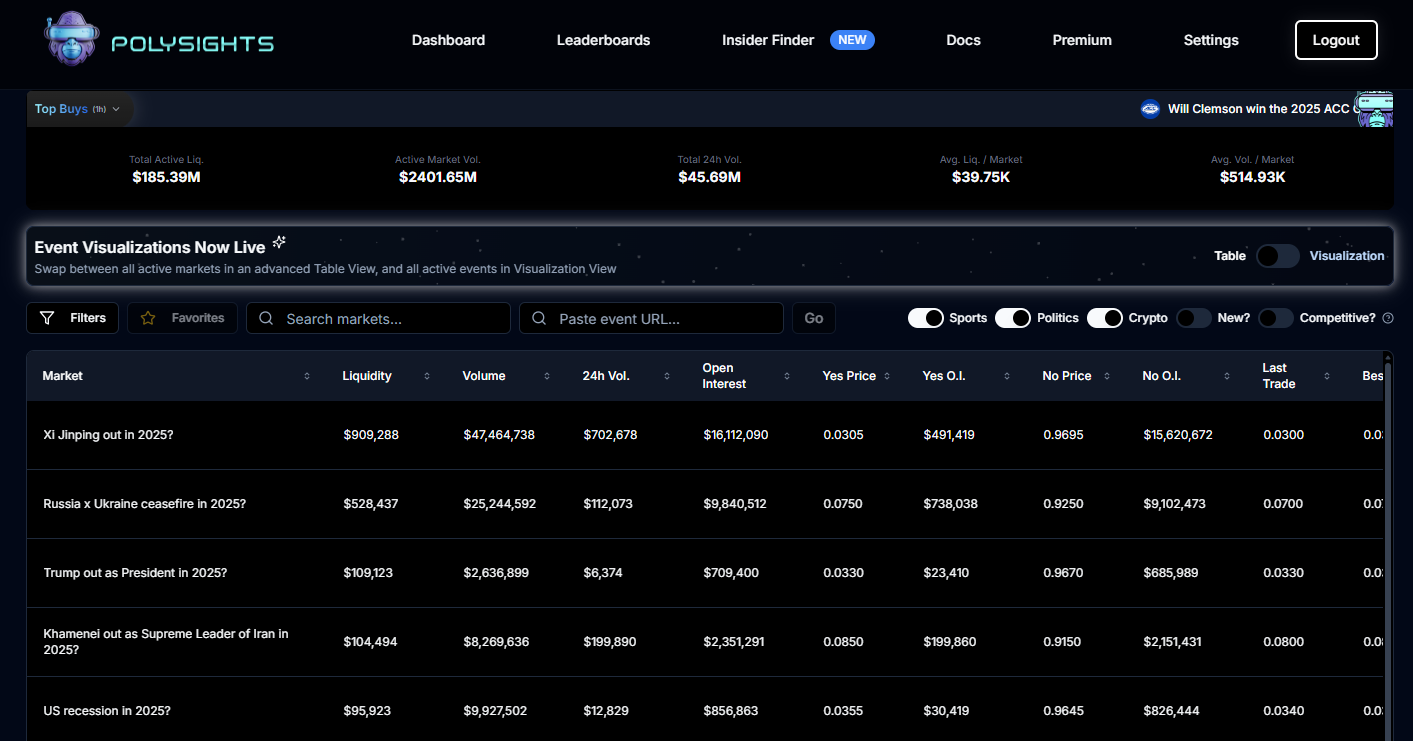

Polysights

Polysights is an analytics platform designed for serious Polymarket traders. It uses AI tools like Vertex AI, Gemini, and Perplexity to extract signals from market data fast. You get real time feeds, alerts, AI summaries, and more than 30 custom metrics that help you identify momentum, trend shifts, and high confidence setups.

Whether you are tracking whale positions, following insider wallets, or scanning for high probability trades, Polysights gives you the data to make better decisions without digging through noise.

Use Cases:

- Smart money trackers: Follow wallet activity, news signals, catalysts, and insider flow to read sentiment shifts early.

- Market watchers: Monitor key markets, top positions, and whale rotations in real time using watchlists and filtering tools.

- Data driven traders: Use AI generated insights and structured metrics to sharpen predictions and improve entry timing.

- Portfolio managers: Track the largest open positions and realized PnL across traders for better oversight and risk control.

- Insider activity hunters: Track unusual wallet behavior through the Insider Finder to spot signals that hint at information edges.

- Trader strategists: Study how top traders size positions and enter the market to refine your own playbook.

Parsec

Parsec is the analytics layer that lets Polymarket traders see everything the market is hiding. Real-time flow, live trades, top holders, open interest, multi-outcome views — all in one place. Dashboards are fully customizable, charts are clean, and the data hits instantly. Whether a degen, a serious trader, or a fund, Parsec gives the kind of on-chain visibility that turns market noise into actionable signals.

Use Cases:

- Degen flow hunters: Track big wallets and live trades the moment they hit, then strike before the market adjusts.

- Institutions and funds: Watch top holders, capital flow, and market structure through tailored analytics built for large books.

- Whale watchers: Break down who controls each market, spot YES/NO distribution, and see where big money is stacking positions.

- Data quants: Dive into step charts, candle views, and historical open interest to understand how markets actually move.

- Polymarket power users: Build trading dashboards from scratch, filter anything, visualize everything, and sharpen prediction edges.

- Wallet stalkers: Open any wallet profile, trace its moves, check balances, and see exactly where it’s exposed.

Read More: How to Increase Win Rates on Polymarket

Conclusion

Polymarket rewards speed, information and clear decision making. Choosing the right tools is not about complexity but about seeing opportunities others miss. When users combine data, signals and timing, prediction markets become less about guessing and more about building a repeatable advantage.

FAQs

Q1. Do tools require users to be professional traders?

No. Tools help reduce risk and improve information for all levels, even beginners.

Q2. Can tools replace market research?

No. Tools provide data and signals. Decisions still depend on the user’s strategy and understanding.

Q3. Can users combine multiple tools at the same time?

Yes. Many users mix tools to track wallet flow, whale activity, and market signals together.

Q4. How do tools help users react faster in active markets?

Tools send alerts, automate copy strategies, track wallets, and even allow direct execution on Telegram or X.

Q5. Can tools guarantee profit?

Nothing is guaranteed, but tools increase the chance of better decisions and reduce emotional mistakes.

Q6. Are tools useful for markets driven by news and real time events?

Yes. Some tools combine data and live news so users can catch trends earlier than the market.