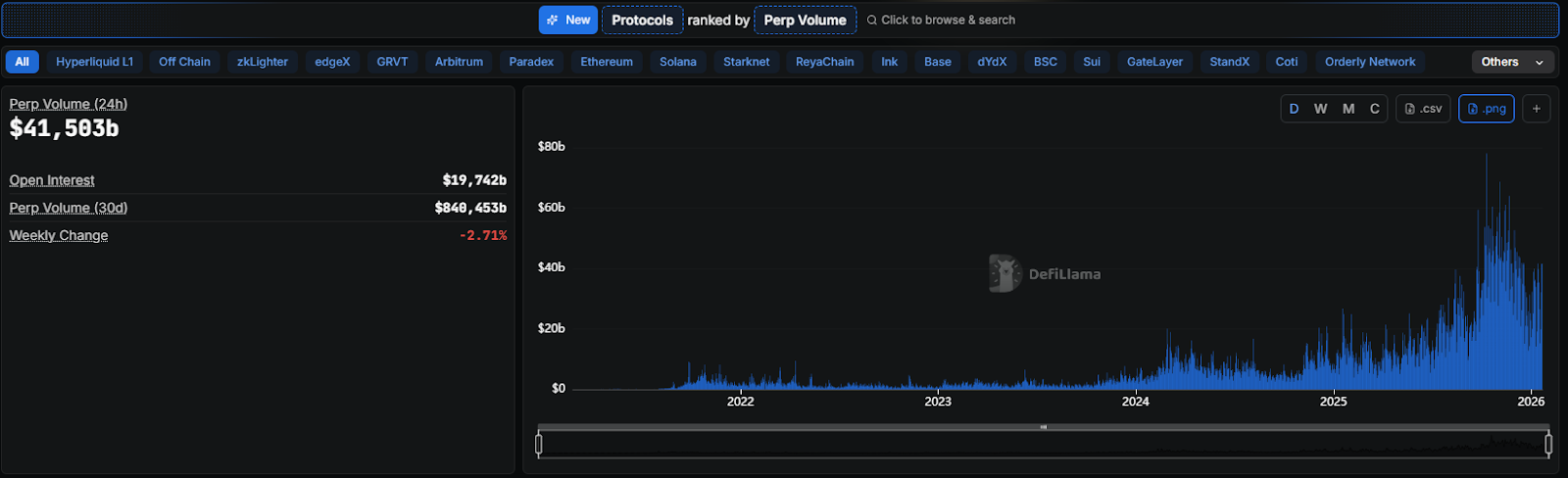

In 2025 alone, Perp DEX is trading volume reached around $8T, accounting for 65% of total historical volume, and on many days, its daily volume went above $70B.

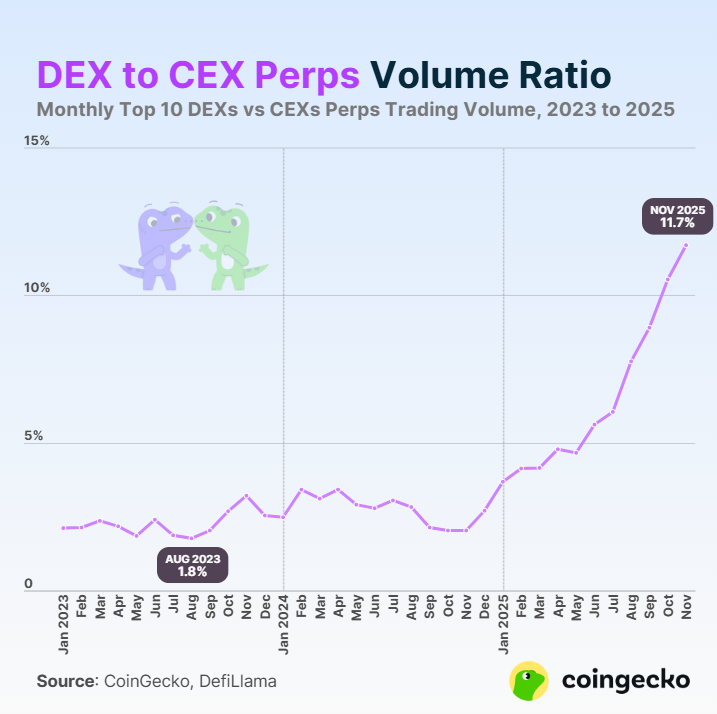

At the same time, the DEX/CEX ratio increased by nearly 6x in less than 3 years, showing a very clear shift of both capital and users. In that context, 2026 is widely seen as a “golden season” for Perp DEX airdrops, and below is the Top 10 most promising Perp trading projects for airdrop hunting that you should not overlook.

Perp DEX Is Eating Into CEX Market Share

If you have been following crypto lately, you have probably heard a lot about “Perp DEX.” And what happened in 2025 in this sector was remarkable from a market-structure perspective.

A perp DEX (perpetual decentralized exchange) is a decentralized exchange focused on perpetual contracts, a type of derivative that lets you speculate on an asset's price without actually owning it, and importantly, there is no expiry date.

To picture how big the boom is: according to DefiLlama, total Perp DEX trading volume in 2025 reached around $8T, which represents 65% of all Perp DEX volume ever recorded. In other words, in just one year, decentralized perpetual trading grew more than 3x compared to the combined growth of the previous four years.

October 2025 marked a historic milestone. For the first time, monthly Perp DEX volume crossed $1T, reaching $1.3T, with some days seeing daily volume exceed $70B.

One of the most notable indicators is the volume ratio between DEX and CEX. According to a CoinGecko report, this ratio rose from 2.1% in January 2023 to 11.7% in November 2025, meaning it increased by nearly 6x in less than 3 years.

The explosion of Perp DEXs is driven by five key factors:

- The tech is finally mature enough: The rise of Hyperliquid shows on-chain infrastructure is now close to CEX standards. The HyperCore engine processes up to 200,000 orders/second, with latency as low as 0.2 seconds, basically wiping out the old “DEX is slow” stereotype.

- Lower fees than CEX: Perp DEX has a major edge thanks to cheaper trading costs. Hyperliquid charges 0.035% taker and 0.01% maker, much lower than Binance (~0.10%). Some platforms like Lighter are even testing a zero-fee model.

- Self-custody and no KYC: After the FTX collapse, trust in centralized exchanges dropped hard. Perp DEX lets traders fully control their assets, no need to deposit with a third party, and trading is completely no-KYC, which fits the true decentralized spirit of crypto.

- Airdrop as a growth engine: The Perp DEX airdrop narrative was supercharged by Hyperliquid’s massive airdrop, setting a new benchmark for the sector. Since then, a large share of Perp DEX volume has been driven by airdrop hunters farming points and rotating liquidity. Projects launch point programs and hint at upcoming airdrops to attract liquidity, creating a network effect and accelerating early user growth.

There’s no denying how hot Perp DEX will be in 2026. And this will likely stay one of the most attractive areas for airdrop hunting if you are looking for opportunities in 2026.

So among all the Perp DEXs in the market, which ones are actually worth your time?

Top 10 Perp DEX Airdrops in 2026

Paradex

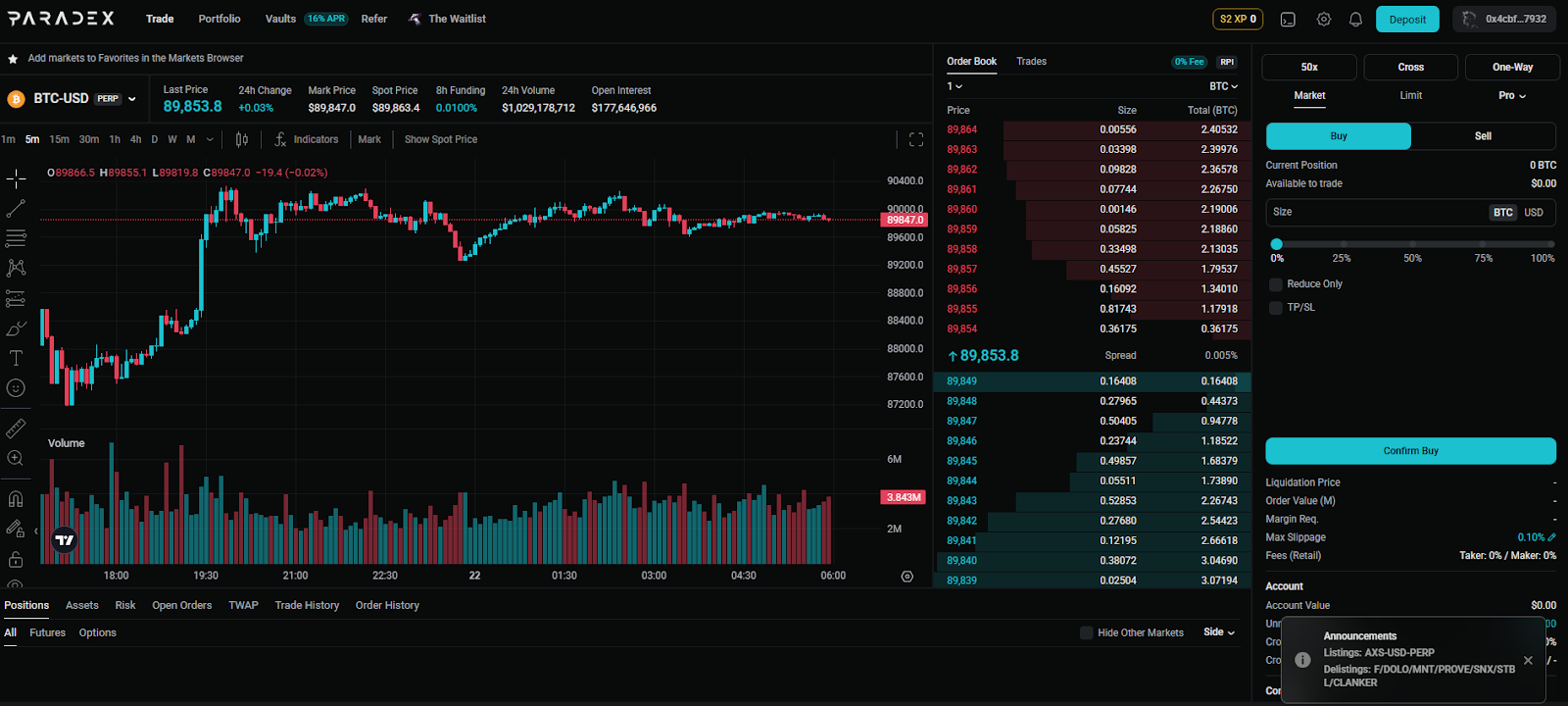

Paradex is a Perp DEX built on Paradex Chain, its own appchain on Starknet. It offers zero-fee trading for retail traders, supports unified portfolio margin across spot, perps, and options in one account, and includes privacy features via zk-encrypted accounts that hide positions, entry, exit, and liquidation levels.

Paradex is incubated directly by Paradigm and benefits from Paradigm's network of over 3,000 institutions. The platform has processed over $210B in cumulative volume, with around $200M TVL and over $600M Open Interest.

Paradex is currently in Season 2 of its XP program, distributing 4M XP per week (Friday). The DIME token will allocate 20% of supply to the Genesis Airdrop (5% for Season 1, 15% for Season 2).

Season 2 has been extended by 6 months (expected to end around Q1/2026). Users earn XP through trading, providing liquidity, keeping open positions, and depositing collateral.

XP Season 2: Week 53

— Paradex (@paradex) January 9, 2026

+ 4M XP was distributed across 18,933 wallets for activity during the period of Jan2-Jan8 (+35.7% w-o-w)

+ 457K XP was distributed to referral codes and affiliates of which 190K XP was distributed to referred users

+Fee-paying volume was overweighted this… pic.twitter.com/k0KETEv2X1

Here are some steps on how to get the Paradex airdrop:

- Visit app.paradex.trade and connect an EVM wallet.

- Deposit USDC from any supported chain.

- Trade perps (zero-fee) to earn XP.

- Link Twitter/Discord to boost points.

- Keep positions open and provide liquidity.

Read More: Paradex Price Prediction: What will Paradex FDV be one day after launch?

Variational

Variational is a Perp DEX built on Arbitrum, with its flagship app Omni, a platform that lets traders trade leveraged perps across thousands of pairs. What is unique about Variational is its fully zero-fee model (no maker/taker fee, only 0.1 USDC for deposit/withdraw) and a Loss Rebate program that refunds 2–4% of losses to traders.

Variational has raised $11.8M across 2 rounds. Investors include Coinbase Ventures, Dragonfly Capital, North Island Ventures, HackVC, and more. The founding team previously included a VP of Engineering at Genesis Trading and a Head of Quantitative Research at DCG.

Variational is currently in a pre-points closed beta phase, with a commitment that 50% of tokens $VAR will be distributed to the community. Points are calculated based on cumulative trading volume and activities like OLP deposits and referrals.

Points are live.

— Variational (@variational_io) December 17, 2025

Today, we launched the Variational Omni points program and retroactively awarded points to existing traders.

1/🧵 pic.twitter.com/XiCVNe7xr7

Here are some steps on how to get the Variational airdrop:

- Visit omni.variational.io and connect an Arbitrum wallet.

- Deposit USDC and start trading perps.

- Take advantage of Loss Rebate when you lose trades.

- Build consistent volume to climb the ranks.

Read More: How to get Variational Airdrop? A Detailed Guide

edgeX

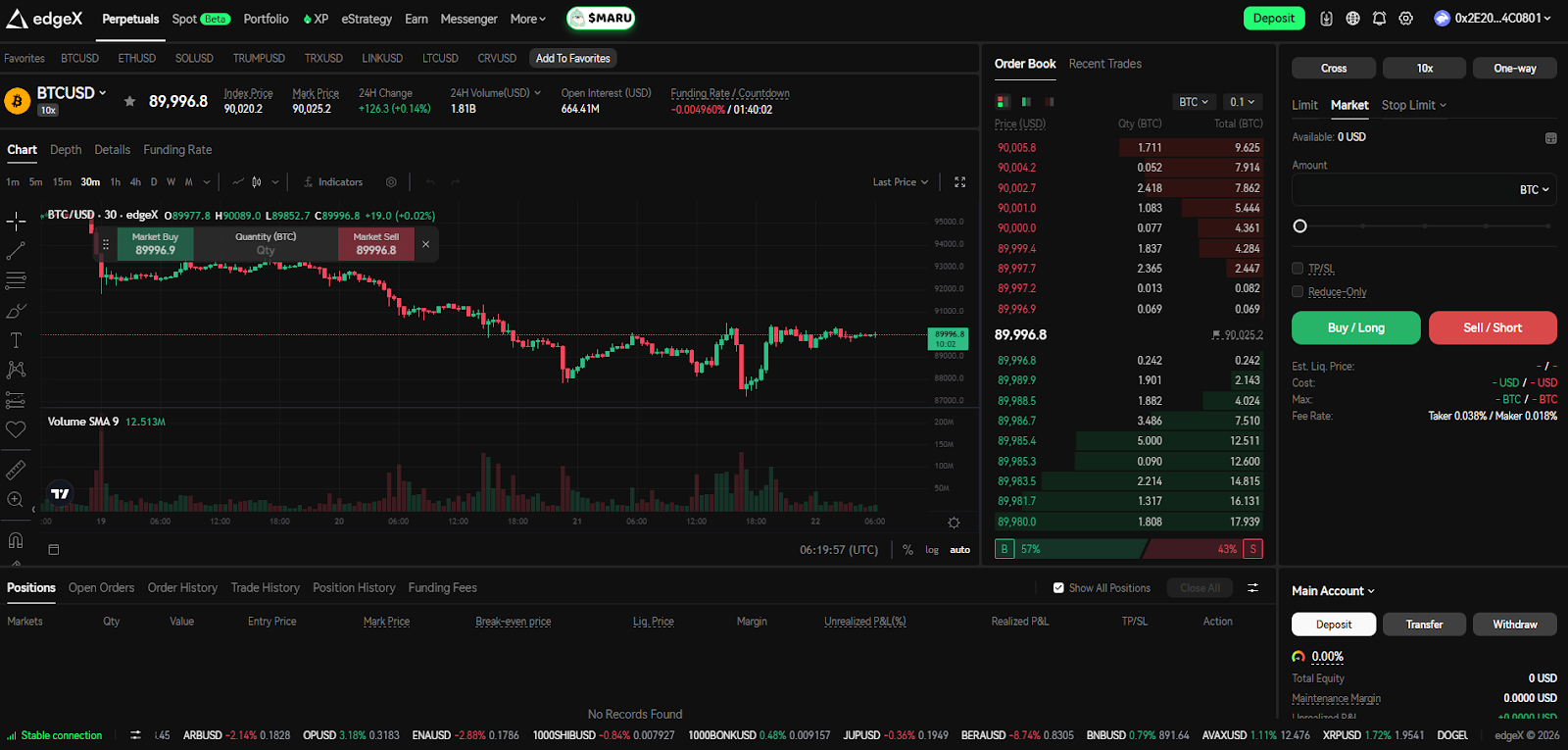

edgeX is a high-performance Perp DEX incubated by Amber Group, one of the largest digital asset managers with about $5B AUM. The platform uses StarkEx ZK-Rollup on Ethereum Layer 2 and can process 200,000 orders/second, with matching latency under 10ms, basically CEX-level speed.

edgeX is especially strong in Korea and is considered to have the best mobile app experience among Perp DEXs. Driven by airdrop hype, edgeX has attracted over $600B in user trading volume, TVL is over $400M, and Open Interest is above $1B, according to DefiLlama.

edgeX is running Open Season (Season 2) with 300,000 points distributed weekly (snapshot Tuesday, rewards Wednesday). Around 20–35% of supply will be distributed to users. Notably, edgeX also launched the memecoin $MARU, with 70% allocation dedicated to airdrops.

The points distribution for the final week of edgeX Open Season is now complete.

— edgeX🦭 (@edgeX_exchange) December 3, 2025

A total of 300,000 points were distributed to 13,669 addresses this week.

To date, a cumulative total of 7,311,219.3 points has been distributed to our community users. pic.twitter.com/s4j4LulhEs

Here are some steps on how to get the edgeX airdrop:

- Visit pro.edgex.exchange or download the mobile app.

- Connect an EVM wallet (Ethereum, Arbitrum, BNB Chain).

- Deposit USDC and trade perps daily.

- Deposit into the eStrategy Vault to earn extra points.

- Invite friends via referral for bonus points.

Read More: edgeX Price Prediction: What Will edgeX FDV Be One Day After Launch?

Liquid

Liquid is a Perp DEX aggregator app that integrates exchanges like Hyperliquid, Lighter, and Ostium into one non-custodial interface. Instead of switching between platforms, traders can manage all positions, yield, risk, and analytics in a single app.

Liquid completed a $7.6M seed round (November 2025) led by Paradigm, with participation from General Catalyst and angel investors like Vlad Novakovski (founder of Lighter) and Eric Wu (co-founder of Opendoor).

Liquid is in Season 1 of its Points program, distributing 100,000 points weekly. Season 0 (May 2025 – November 2025) distributed 600,000 points.

Users earn points through trading, providing liquidity, and referrals. The key advantage: when you trade via Lighter inside the Liquid app, you can farm points for both Liquid and Lighter Season 3, and it may also count toward Hyperliquid Season 2.

An estimated 25% of $LIT tokens will be airdropped to users.

Points are distributed each season based on your contribution.

— Liquid (@liquidtrading) November 18, 2025

Season 0: May 1-Nov 3 (600k)

Season 0.5: Nov 3-17 (200k)

Season 1: Nov 18+ (100k weekly)

Here are some steps on how to get the Liquid airdrop:

- Visit beta.tryliquid.xy or download the iOS/Android app.

- Sign up and enter the referral code PAYJWWWQ (if any).

- Deposit via crypto, PayPal, or MoonPay.

- Trade via Lighter to farm 2 airdrops at once.

- Use the Yield Vault (~10% APR) to boost points.

Pacifica

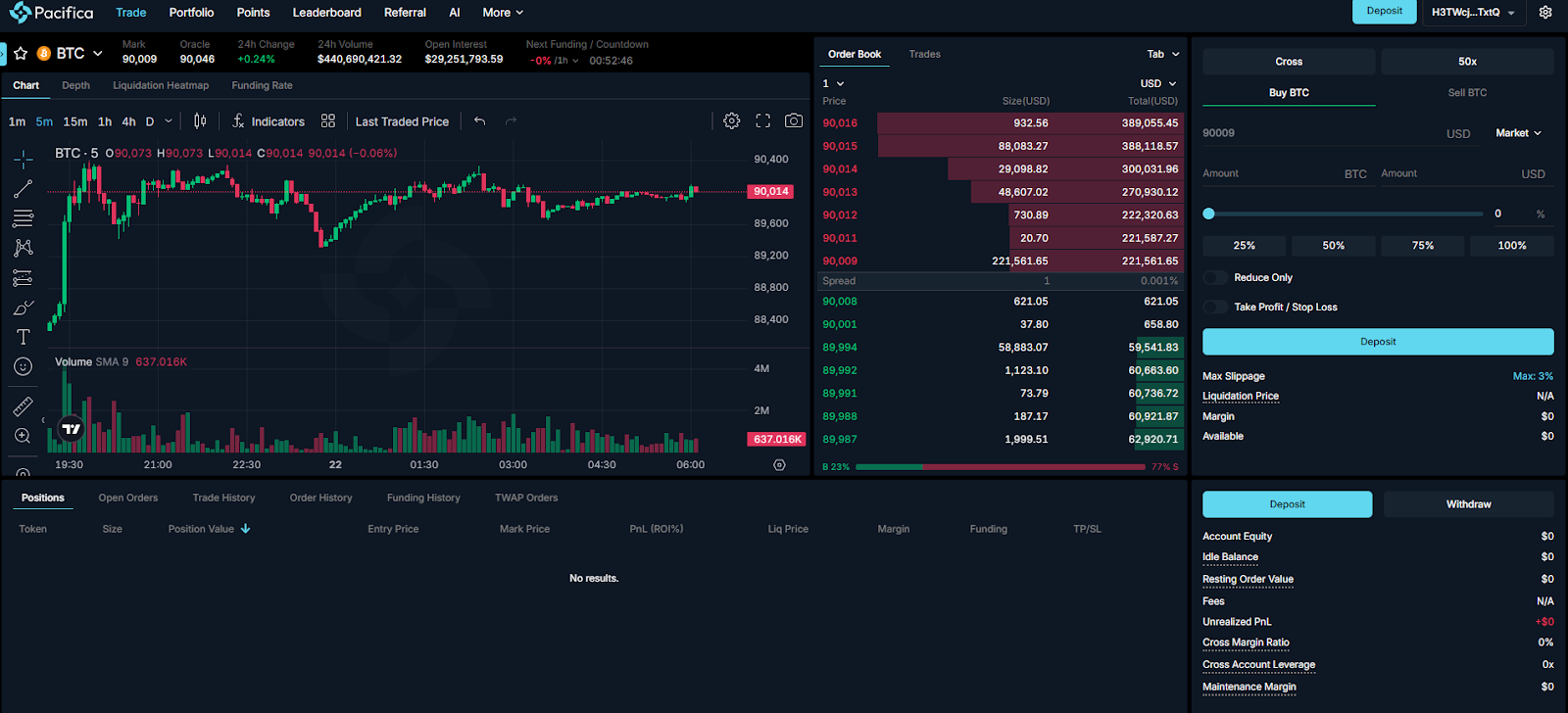

Pacifica is a next-gen Perp DEX built on Solana, co-founded by Constance Wang (former COO of FTX), together with José (ex-NFTperp) and Tony (AsyncBlock). The most unique part: Pacifica is fully self-funded, with no VC funding, similar to Hyperliquid.

The platform uses a hybrid architecture combining off-chain matching speed with on-chain settlement, reaching latency under 20ms. Pacifica also integrates AI trading agents to help analyze risk and suggest trades.

As of January 21, 2026, the project hit $100B in volume. It is still modest compared to the giants, but it is definitely a milestone worth noticing.

Pacifica is running a closed beta with 10,000,000 points distributed every Thursday. Points are based on trading volume, with an anti-sybil system that can slash points retroactively for wash traders.

Pacifica's Points Program is now live! 🥳

— Pacifica (@pacifica_fi) September 4, 2025

Come to https://t.co/mL0onjiaOh for more details.

Keep Swimming!

🌊 pic.twitter.com/LauLXccHzL

Here are some steps on how to get the Pacifica airdrop:

- Visit app.pacifica.fi and connect a Solana wallet.

- Deposit USDC and start trading perps.

- Trade consistently every week (snapshot Thursday 00:00 UTC).

- Avoid wash trading, points can be slashed.

GRVT

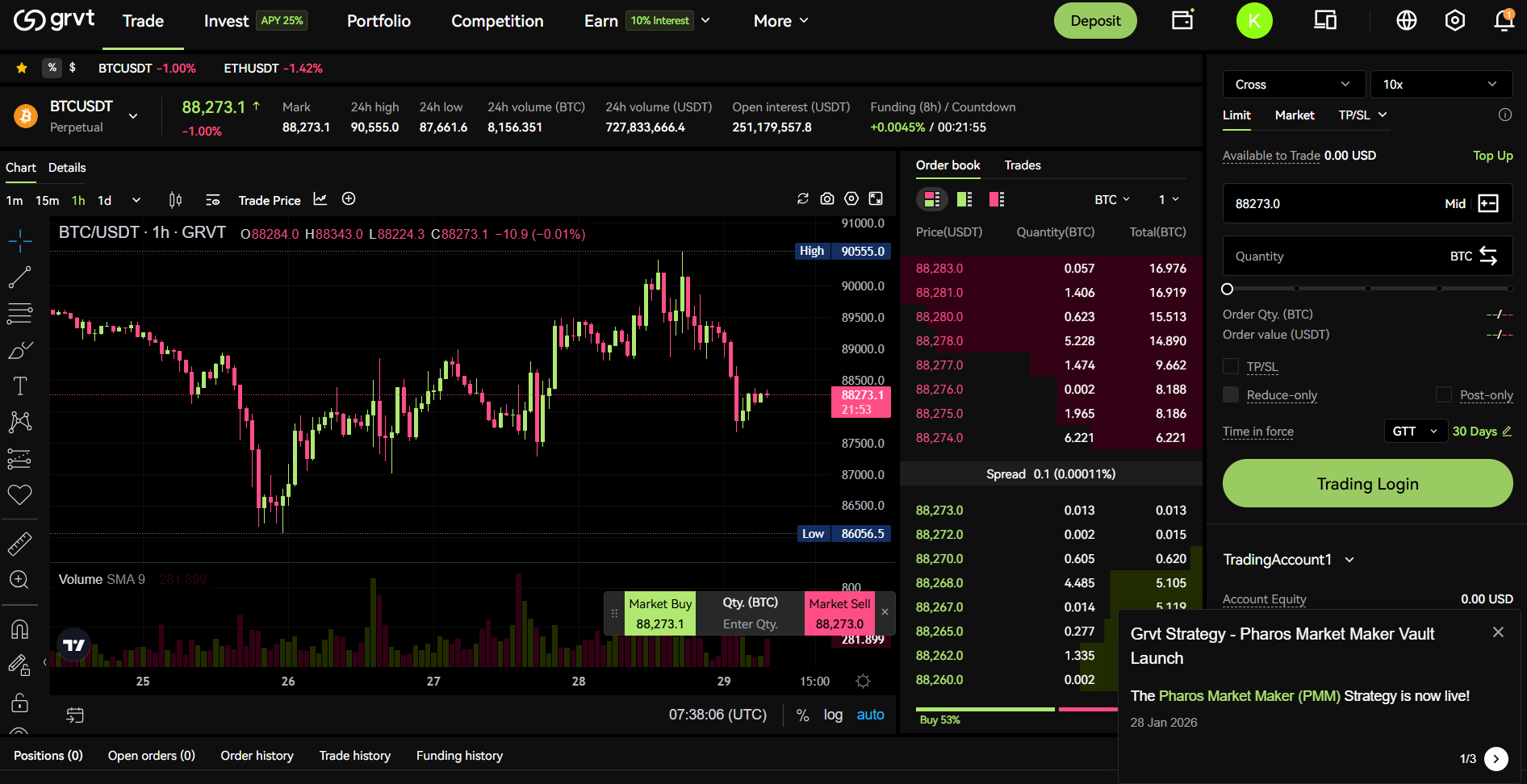

GRVT is a hybrid DEX built on ZKsync, combining the user experience of a CEX with the self-custody security of a DEX. It is the first DeFi exchange to be fully licensed, holding a VASP license in Lithuania since 2023 and applying for MiCA (EU), VARA (Dubai), and ADGM (Abu Dhabi).

GRVT has raised a total of $33.3M across multiple rounds, led by Further Ventures, ZKsync, Further Ventures, EigenCloud, and 500 Global. The platform currently ranks in the top 5 Perp DEXs by volume.

GRVT is running Rewards Season 2.0. Users earn points through trading, holding positions, and referrals. Points are distributed every Tuesday. 22% of total token supply has been allocated for airdrops for Seasons 1 and 2 (10% for the first, 12% for the second).

Announcing Grvt airdrop split

— Grvt (@grvt_io) October 13, 2025

Total airdrop for the community now 22% → up from 20%

☼ Season 1: 10% locked for early adopters

☼ Season 2: A little surprise. We’re bumping up the pool to 12% to account for newcomers without diluting our OGs.

TGE target Q1 2026 pic.twitter.com/Y8HjdGXvsZ

Here are some steps on how to get the GRVT airdrop:

- Visit grvt.io and register an account

- Complete KYC to unlock all features

- Deposit USDC and trade perps / spot / options

- Deposit into the GLP Vault (48% APR) to earn additional points

- Invite friends via referral to boost your points

Extended

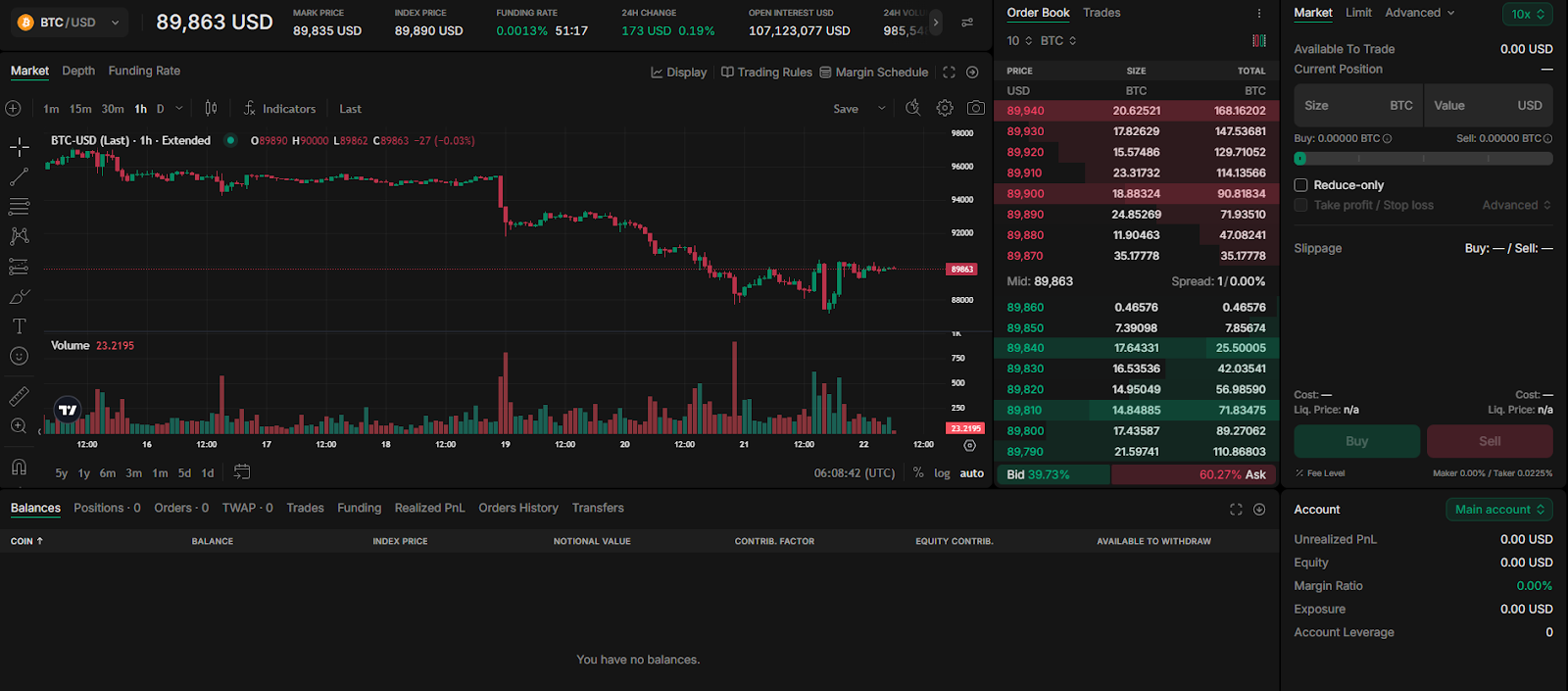

Extended is a high-performance Perp DEX running on Starknet with a hybrid CLOB architecture: off-chain matching for speed under 10ms, and on-chain settlement for self-custody. Extended supports over 50 markets, including TradFi (EUR/USD, Gold, S&P 500, Brent Oil), with leverage up to 100x.

The project raised $6.5M from Tioga Capital, Semantic Ventures, Prelude, StarkWare, Cyber Fund, and more.

According to DefiLlama, Extended is currently the #1 Starknet app by TVL with over $200M, with total volume above $100B, and it has previously recorded $2.6B+ daily volume.

Extended is running Season 1 of its Points program with 1.2M points distributed every Tuesday (00:00 UTC).

Users can earn points across three categories:

- Trading: Earn points through organic trading activity.

- Providing Liquidity: Deposit funds into the vault or provide tight liquidity in relevant markets.

- Referring: Earn a share of the points generated by your referrals. Affiliates earn more.

Season 1 of Extended’s points program is Live

— Extended (@extendedapp) April 30, 2025

1,200,000 points will be distributed weekly to Extended users.

Points are earned through trading, referring, and providing liquidity. Exact criteria won’t be made public, but all organic activity is tracked and will be rewarded.… pic.twitter.com/2gKZG6Rv5Q

Here are some steps on how to get the Extended airdrop:

- Visit app.extended.exchange and connect an EVM wallet.

- Deposit USDC from any EVM chain.

- Trade perps with a maker-focused strategy (0% fee).

- Deposit into the LP Vault to earn yield + points.

- Invite friends and enter a referral code for a boost.

trade.xyz (TradeXYZ)

trade.xyz is a next-gen perpetual trading platform built by the Hyperunit team, one of the key contributors to the Hyperliquid ecosystem. The platform enables 24/7 trading with leverage up to 20x and extremely low fees (after HIP-3 Growth Mode, taker fees dropped to ~0.009%).

Right now, trade.xyz does not have its own token and has not announced an official points program. However, as the first and most important HIP-3 deployer on Hyperliquid, airdrop speculation is strong. Trading on trade.xyz may also count toward Hyperliquid Season 2 rewards.

This is a multi-farm opportunity, you may be able to get a trade.xyz airdrop while also earning Hyperliquid S2 points.

Here are some steps on how to get the trade.xyz airdrop:

- Visit trade.xyz and connect a Hyperliquid wallet.

- Deposit USDC and start trading.

- Trade consistently to build volume (may count for HL S2).

Ostium

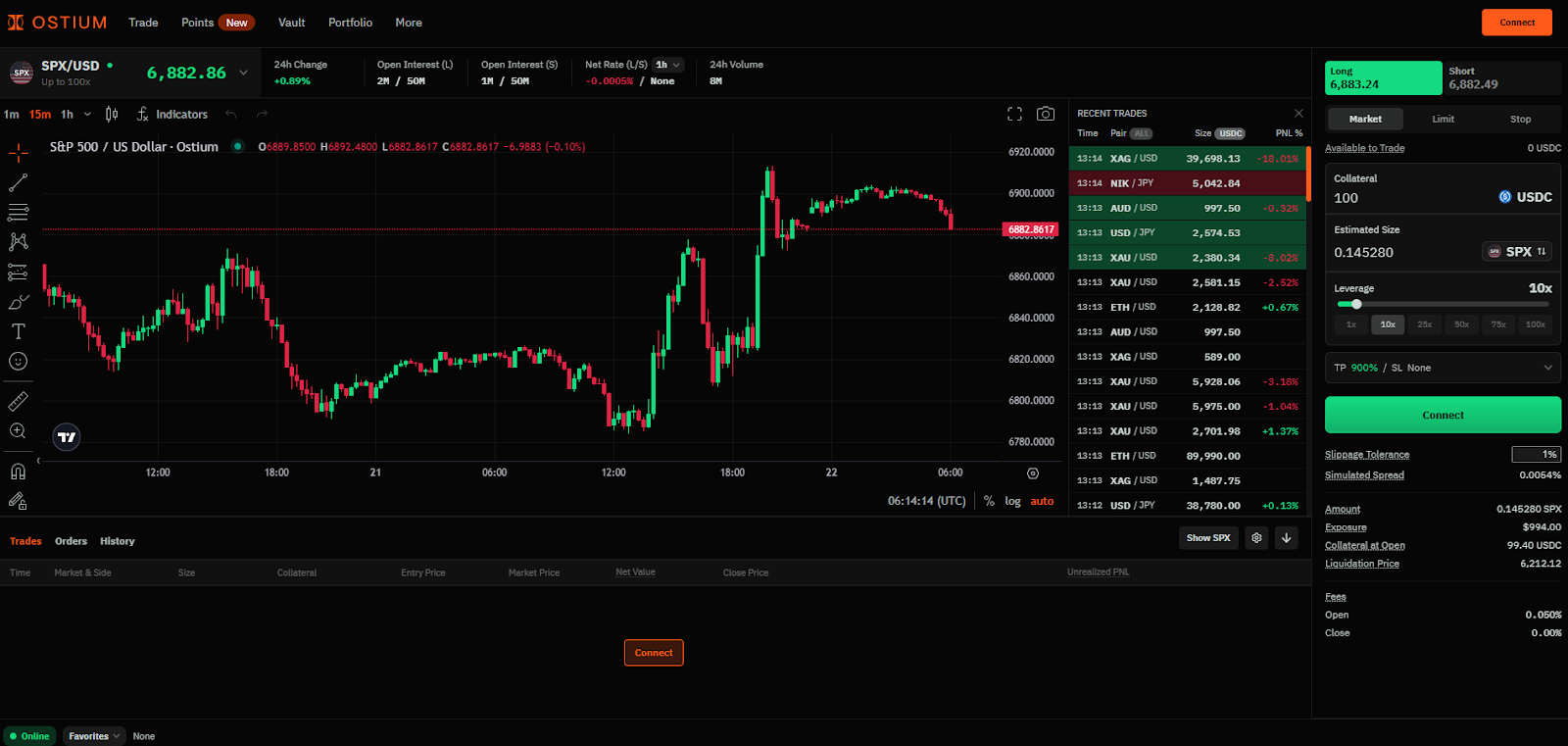

Ostium is a Perp DEX built on Arbitrum, focused on perpetual swaps for Real World Assets (RWAs) such as stocks, commodities, indices, forex, and crypto. Its standout feature is a perpification model that brings on-chain price exposure without tokenizing the underlying assets, with leverage up to 200x, deep liquidity from off-chain sources, and a custom oracle setup (Chainlink Data Streams for crypto, plus dedicated oracles for RWAs).

Ostium raised a total of $23.5M from Coinbase Ventures, Wintermute Ventures, GSR, Susquehanna (SIG), Crucible Capital, and more. The founding team includes Harvard alumni: Kaledora Kiernan-Linn (CEO, previously at Bridgewater) and Marco Antonio Ribeiro.

Ostium is running Season 2 of its Points program, distributing 500,000 points per week. An estimated 20% of token supply is reserved for the community airdrop.

Points Season 1 is complete. Season 2 starts today!

— Ostium (@OstiumLabs) January 5, 2026

With the new season, we’re introducing Boost Windows: rolling week-long periods where a group of assets will be incentivized. pic.twitter.com/6vlPGafETu

Here are some steps on how to get the Ostium airdrop:

- Visit app.ostium.com and connect an Arbitrum wallet.

- Deposit USDC from supported chains (Arbitrum, Base, Solana, etc.).

- Trade perps on RWAs/crypto to build volume (prioritize Boost Windows).Deposit into the OLP Vault to earn points from liquidity (~28% APR).

- Invite friends via referral for bonus (e.g., code PAYJWWWQ if any).

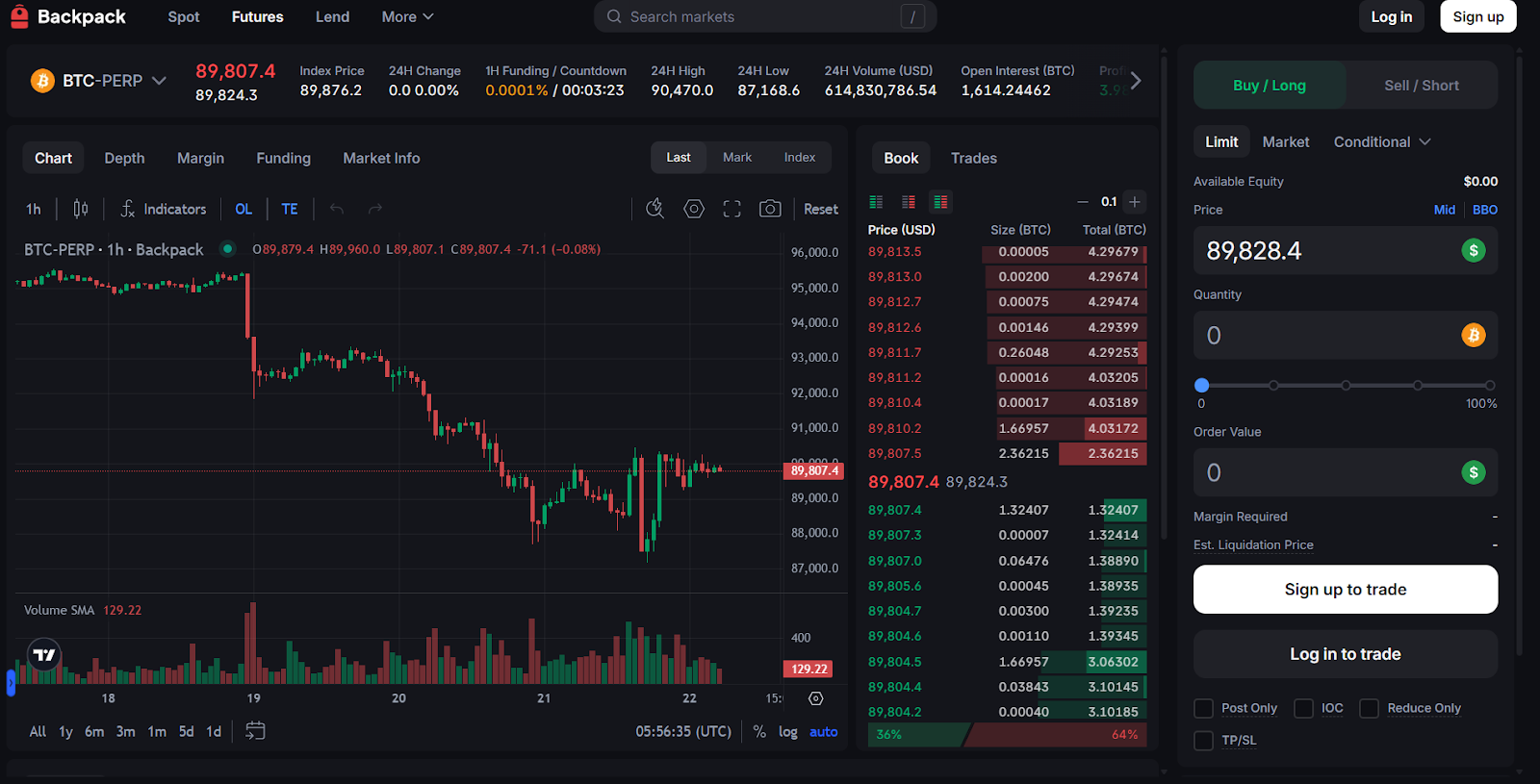

Backpack

Backpack is a centralized exchange (CEX) built by the team behind the popular Mad Lads NFT collection on Solana. What makes Backpack stand out is how it combines CEX-level speed and deep liquidity with strong security features like zero-knowledge proof of reserves (zk-proofs) and Multi-Party Computation (MPC).

Although Backpack is technically a CEX, the community often treats it like a Perp DEX because most points and activity are driven by perpetual trading.

The exchange also supports Spot, Futures, and Lending, and it acquired FTX EU in January 2025 for $32.7M to expand derivatives services in Europe.

Backpack has raised a total of $37M across 2 rounds, including a $17M Series A (February 2024) valuing the company at $120M. Investors include Jump Crypto, Multicoin Capital, Wintermute, and Delphi Digital,... The platform has reached over $380B in cumulative trading volume, with more than 650,000 KYC users.

Right now, Backpack is running Season 4 of its Points program. Each week, points are distributed on Friday based on activity across Spot, Futures, and Lending. Points are expected to convert into tokens at TGE.

Season 4, Week 9

— Backpack 🎒 (@Backpack) January 23, 2026

Points have dropped 🪂

Show us what you’ve got! 👇 pic.twitter.com/PdPSqKmQLz

Here are some steps on how to get the Backpack airdrop:

- Visit backpack.exchange and register an account.

- Complete KYC and enable 2FA.

- Deposit funds via Solana or Ethereum.

- Trade Spot and Futures weekly to earn points.

- Track your rank and points every Friday.

Read More: Backpack Price Prediction: What will Backpack FDV be one day after launch?

Conclusion

Perp DEX is no longer an experimental trend. It has become core trading infrastructure in DeFi, where volume, users, and incentives are all converging. With many projects still pre-TGE, offering large airdrop allocations (20–50% of supply) and competing through points, zero-fee models, and rebates, this is a moment where airdrop hunters have a clear advantage if they move early and move smart.

Instead of farming everything, focus on Perp DEXs with real volume, real users, and a strong narrative, because that is where the rewards will go to the most patient people in 2026.

FAQs

Q1. Do you need a large budget to farm Perp DEX airdrops?

Not necessarily. Many platforms score users based on activity frequency, how long positions stay open, and behavior patterns, so smaller capital can still be optimized.

Q2. How many Perp DEXs should you farm at the same time?

Ideally 2–4 projects with strong narratives and clear points programs. Farming too many spreads your volume thin and usually lowers airdrop efficiency.

Q3. How can you reduce risk while farming Perp DEX airdrops?

Use low leverage, avoid overtrading and wash trading, allocate funds around snapshot cycles, and prioritize platforms with real volume and stable liquidity.

Q4. What are the most important metrics when choosing a Perp DEX to farm?

Focus on total volume, user growth, airdrop allocation ratio, transparent points mechanics, and strong ecosystem support.

Q5. When farming Perp DEX, should you focus on trading or holding positions longer?

You should mix both. Many projects reward consistent activity, open-position duration, and long-term engagement, not just short-term trading volume.

Q6. Is Backpack a Perp DEX?

No. Backpack is technically a centralized exchange (CEX), but it is included due to its strong focus on perpetual trading and its points program, which is primarily driven by Perp and Spot trading activity.