Crypto can turn an investor into a millionaire overnight, but it can also wipe out entire portfolio in a single mistake. Thousands of new projects launching every year, trying to navigate data manually often feels like searching for needle in a haystack.

That’s why crypto research tools were created, to help users save time, avoid costly errors, and make smarter, data-backed decisions. Below is a list of the Top 10 Most Useful Crypto Research Tools, designed to give users a real edge in this fast-moving market.

Why Investors Should Use Research Tools in Crypto

The crypto market moves at an unimaginable pace, funding flows shift within hours, new projects appear constantly, and information overload everywhere. If an investor relies only on emotion or social media noise, it’s easy to fall into FOMO or miss key opportunities.

Research tools exist for one reason: to turn chaotic data into actionable insights. Here are three key reasons why research tools have become essential for every crypto investor today:

Faster and Smarter Decisions

Research tools collect data from multiple sources, on-chain metrics, social media, exchanges, and fundraising rounds, and combine them into one clean dashboard or chart.

Instead of manually checking dozens of tabs, users can view everything on one screen to instantly understand where the money is flowing.

Save Time and Avoid Misinformation

Platforms like DefiLlama, Dune, and Nansen continuously update their databases in real-time. This ensures users aren’t relying on outdated or misleading data, a common cause behind buying at the top or missing early entries.

Increase Accuracy and Objectivity

These tools remove emotion by visualizing specific metrics: how much TVL has increased, which wallets are buying, which L2s are generating higher protocol fees, and more.

This allows investors to identify real trends, analyze capital behavior, and avoid being swayed by unverified “news.”

In short, in a market that runs 24/7 and changes every second, research tools aren’t just helpful, they’re essential to survival.

Top 10 Most Useful Crypto Research Tools

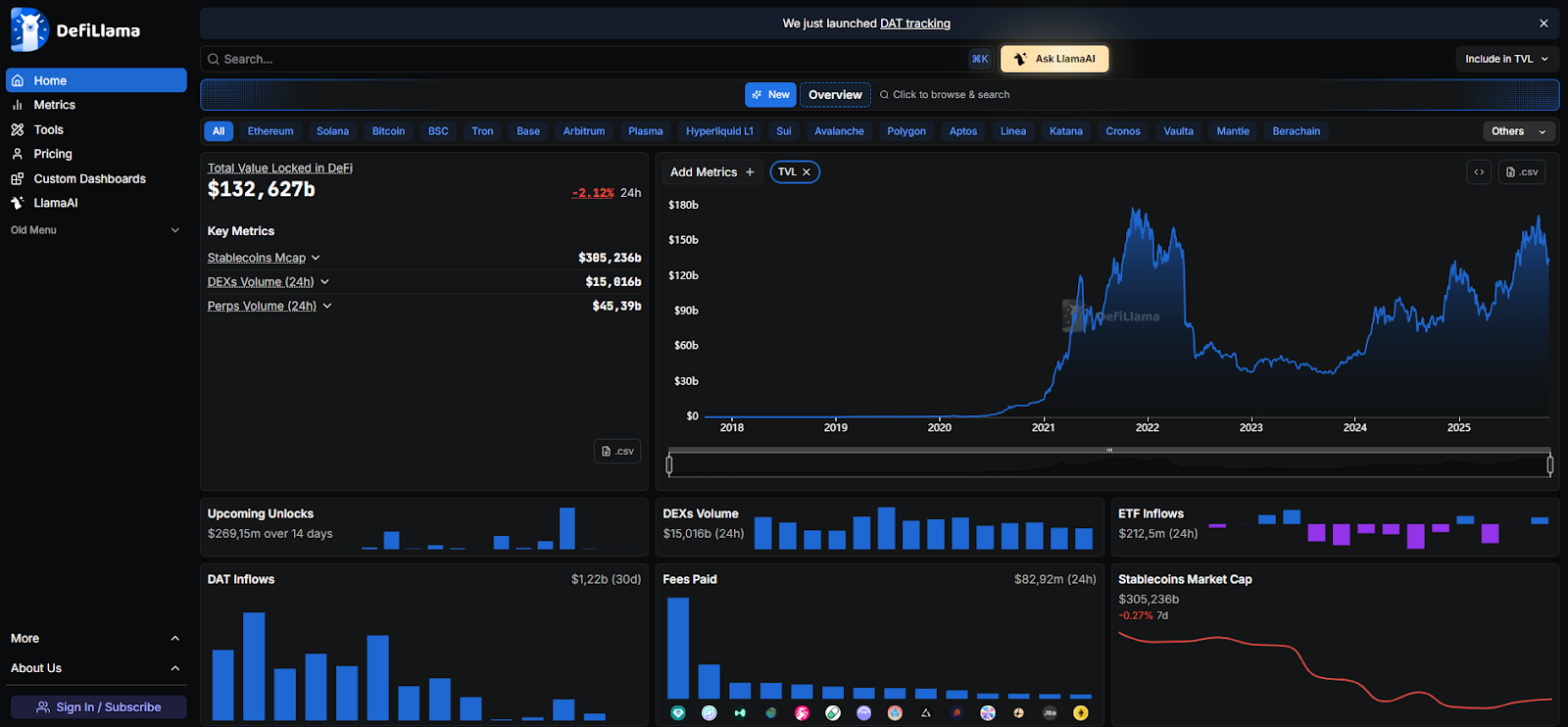

DefiLlama

DefiLlama is one of the most popular DeFi data analytics platforms. It serves as the largest TVL aggregator, tracking locked value across over 3,000 DeFi projects, 242 blockchains (Layer 1 & Layer 2), and nearly 11,000 pools. The platform provides real-time insights into TVL, stablecoin market cap, DEX and perpetual volume, protocol rankings, fees, revenue, and more.

Pros:

- Free basic features, no ads, near real-time data updates (e.g., TVL by chain, stablecoin market cap, 24h DEX volume).

- API support and premium version for advanced metrics like protocol rankings, fees, and perpetual volumes.

- LlamaSwap compares DEX prices, slippage rates, liquidity depth, and estimated gas fees across chains.

Cons:

- The interface may be overwhelming for beginners.

- Primarily focuses on DeFi with limited data on NFTs or GameFi.

Dune

Dune is a free, open-source blockchain analytics platform that lets users query on-chain data directly using SQL. It enables the creation of custom dashboards, charts, and visualizations across DeFi, NFTs, tokens, and transaction data, perfect for traders, investors, and developers seeking deep transparency.

Pros:

- Multi-chain data and a vibrant community sharing dashboards, showing active addresses, transaction count, and gas usage.

- Thousands of ready-made templates for learning and customization, covering metrics like token holders, NFT mint volume, and DEX volume.

- Free basic features, supporting queries for wallet balances, smart contract calls, and daily users.

Cons:

- Requires SQL knowledge for custom analytics.

- Complex queries may take time to execute.

DEXScreener

DEXScreener delivers real-time analytics for tokens traded on decentralized exchanges (DEXs). It supports over 30 blockchains such as Solana, Ethereum, and Base. Users can monitor price charts (powered by TradingView), trading volume, liquidity pools, and even detect emerging tokens or memecoins before they go mainstream.

It also allows direct wallet trading without needing a separate account, acting as a one-stop “screener” for fast-moving crypto opportunities.

Pros:

- Completely free with all features, including price changes (5m/1h/24h), market cap, and tokenomics (unlock schedule).

- Handles 15 million requests daily with no downtime, supporting metrics like 24h volume, buys/sells count, and token holders.

- Integrated TradingView charts with indicators like RSI, MACD, moving averages, and volume profile for technical analysis.

- Detects contract verification status, honeypot risks, and ownership renouncement, checking tax rate, max transaction amount, and rug risk score.

Cons:

- High risk of scam tokens since listings aren’t fully filtered.

- Lacks advanced portfolio tracking tools.

- The abundance of data can overwhelm beginners.

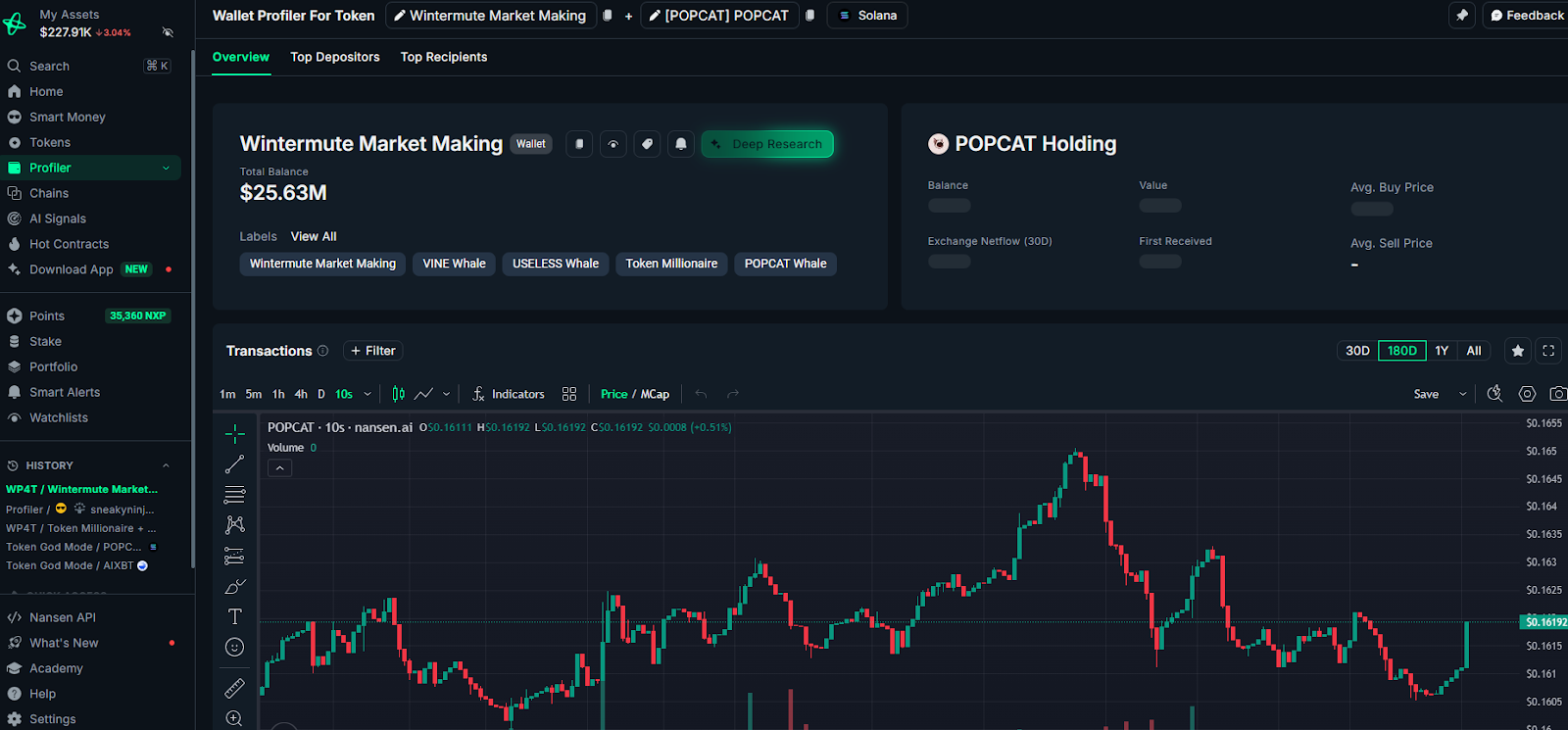

Nansen

Nansen labels and tracks over 250M wallets across 30+ blockchains (Ethereum, Solana, BNB Chain, Avalanche, and more). It transforms raw blockchain data into actionable insights, helping investors track smart money flows, detect anomalies, and monitor portfolios.

Pros:

- Detailed wallet labels: Smart Money, Exchange, Airdrop Pro, NFT Collector, Blue Chip Funds, showing wallet balances, transaction history, and inflows/outflows.

- Recently integrated Solana with Wallet PnL, Signals, and Token Screener, supporting metrics like PnL percentage, signal strength, and token volume.

- Supports 30+ blockchains with 250+ million wallet addresses, tracking active wallets, whale movements, and anomaly scores.

Cons:

- High subscription cost for retail users.

- Learning curve despite intuitive dashboards.

- Limited visibility once assets move to centralized exchanges.

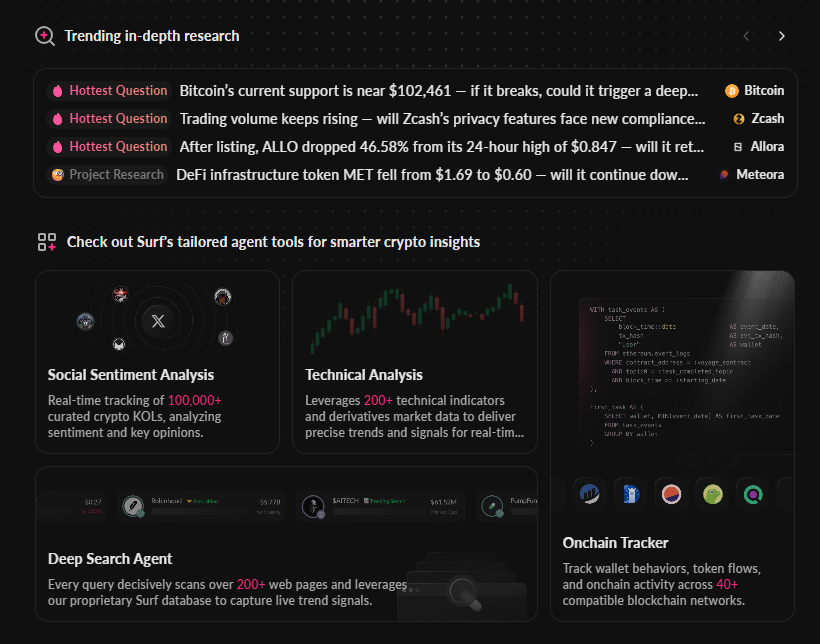

Surf

Surf is an AI-powered crypto research platform that functions as a “copilot” for traders. It analyzes on-chain data, real-time social sentiment, and market fundamentals, and can even execute on-chain actions automatically.

The platform aggregates data from over 40 blockchains, 300+ protocols (like Uniswap, Aave), and 20,000+ reputable X accounts to deliver actionable insights for every user, from newcomers to professionals.

Pros:

- More accurate than GPT-5 in tokenomics and trend analysis, showing supply distribution, price volatility, and holder concentration.

- Automatically executes crypto tasks (airdrops, DeFi actions), supporting metrics like yield rate, gas cost, and success rate.

- User-friendly interface displaying how AI reaches conclusions, showing sentiment score, correlation index, and confidence level.

Cons:

- Requires a paid plan for full functionality.

- High complexity for beginners.

- Still in active development.

CryptoRank

CryptoRank aggregates data from over 35,000 crypto assets, including live prices, market caps, trading volumes, fundraising events, and airdrops. It’s similar to CoinMarketCap or CoinGecko but focuses more on analytics and actionable insights for traders.

Pros:

- Drop Hunting and Airdrop tools with guided task systems.

- Portfolio tracking with detailed PnL analysis, supporting metrics like ROI, drawdown, and Sharpe ratio.

- Subscription plans unlock higher API rate limits and premium analytics, offering metrics like fundraising rounds, investor count, and valuation history.

- Mobile app for both Android and iOS, tracking real-time price alerts, market cap ranking, and 24h volume.

Cons:

- Not every prices refresh in real time.

- The interface could be complex for first-time users.

- Some premium features are relatively expensive.

L2Beat

L2Beat specializes in analyzing Ethereum Layer 2 (L2) ecosystems. It provides transparent data on scaling solutions like rollups, including TVL, risk levels, development stages, and data availability layers (DA). The platform helps investors and developers evaluate the safety and performance of L2 networks like Arbitrum, Optimism, and Base.

Pros:

- Clear security data, real-time TVL updates, showing TVL per L2, activity count, and TPS.

- Open-source and community-trusted, supporting metrics like risk score, stage level, and DA usage.

- Stages framework for evaluating rollup maturity, showing stage 0/1/2, security proofs, and exit windows.

- Detailed L2 tech comparison, with metrics like tech stack (ZK/Optimistic rollup), operator decentralization, and sequencer failure risk.

Cons:

- Only focused on Ethereum’s Layer 2 ecosystem.

- Highly technical language can be hard for beginners.

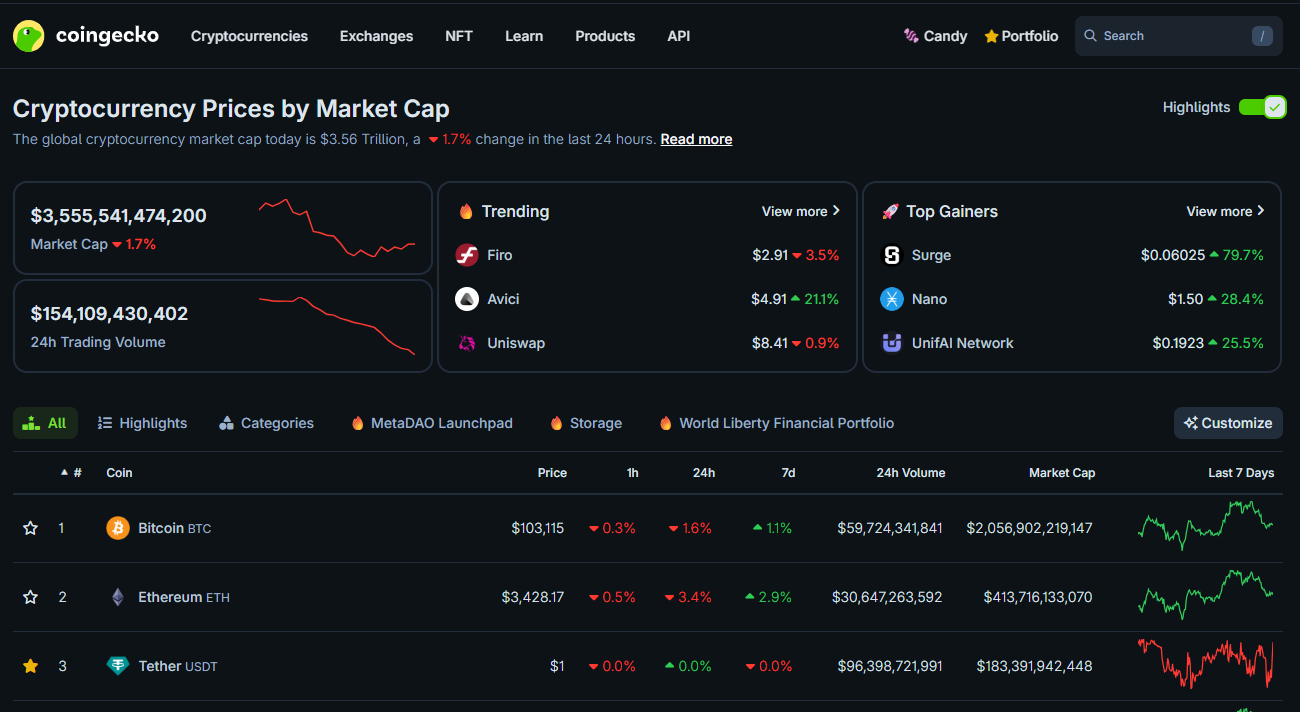

CoinGecko

CoinGecko is a free and independent crypto data aggregator that provides live prices, rankings, NFT stats, and market trends for over 10,000 coins. It’s one of the most trusted platforms due to its neutrality and ease of use.

Pros:

- User-friendly with convenient price comparison charts, showing 24h/7d price change, market cap ranking, and volume trends.

- Offers API and a quality research team, supporting metrics like circulating supply, dominance %, and ATH/ATL.

- Easy for beginners, with portfolio tracking, price alerts, and mobile app support, tracking PnL, asset allocation, and NFT floor price.

Cons:

- Some advanced tools require a paid plan.

- Minor delays compared to real-time feeds.

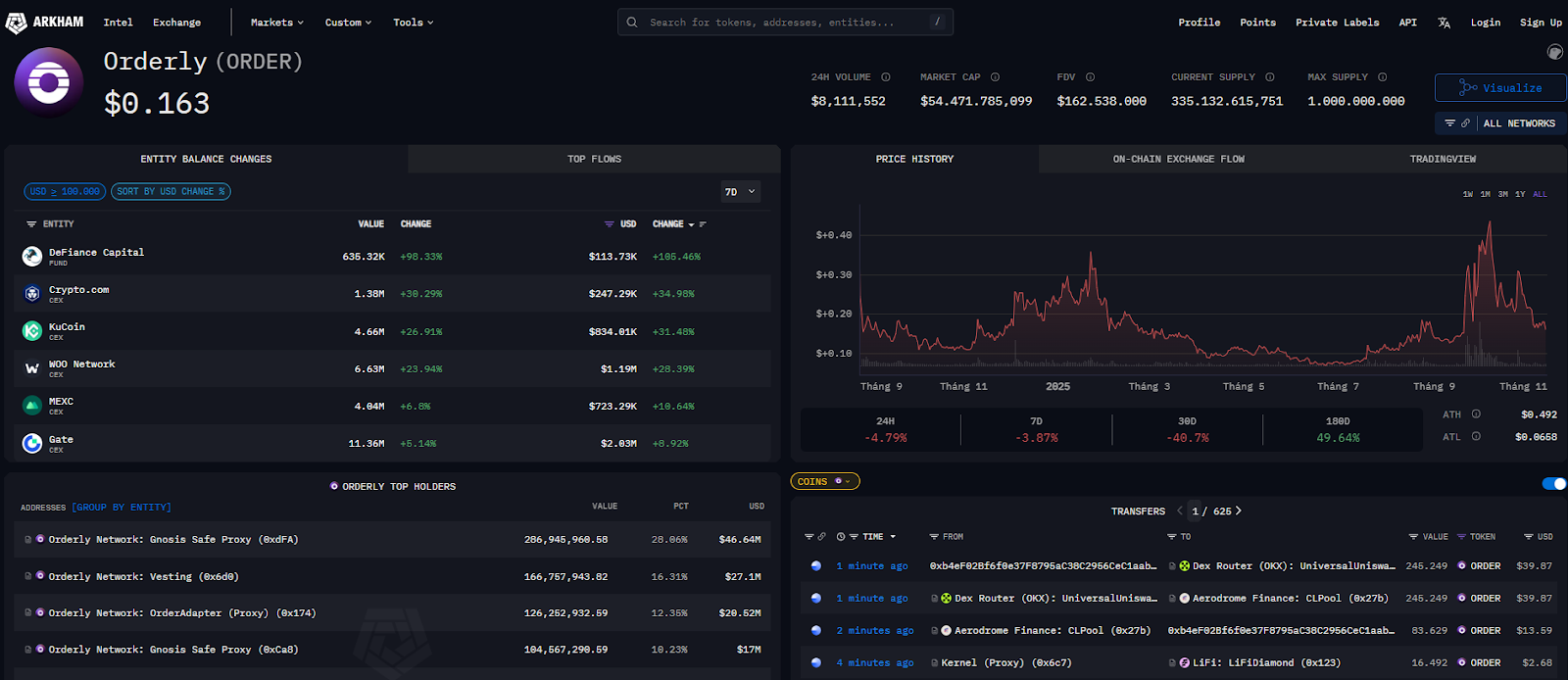

Arkham

Arkham uses AI to deanonymize blockchain data, identifying wallet owners, tracking entities, and analyzing activity across multiple chains. Its Intel Exchange allows users to buy or sell crypto intelligence, while the ARKM token rewards community contributions under a “dox-to-earn” model.

Pros:

- Translates raw blockchain transactions into clear network maps, showing inflow/outflow amounts, connection counts, and entity balances.

- Intel Exchange allows buying and selling crypto intelligence, supporting metrics like bounty value, intelligence accuracy score, and trade volume.

- Arkham Visualizer provides a bird's eye view of all transactions, displaying total tx volume, address clustering, and historical flows.

Cons:

- Privacy concerns raised by parts of the community.

- Steeper learning curve for advanced tools.

- Some exchange features are complex for new users.

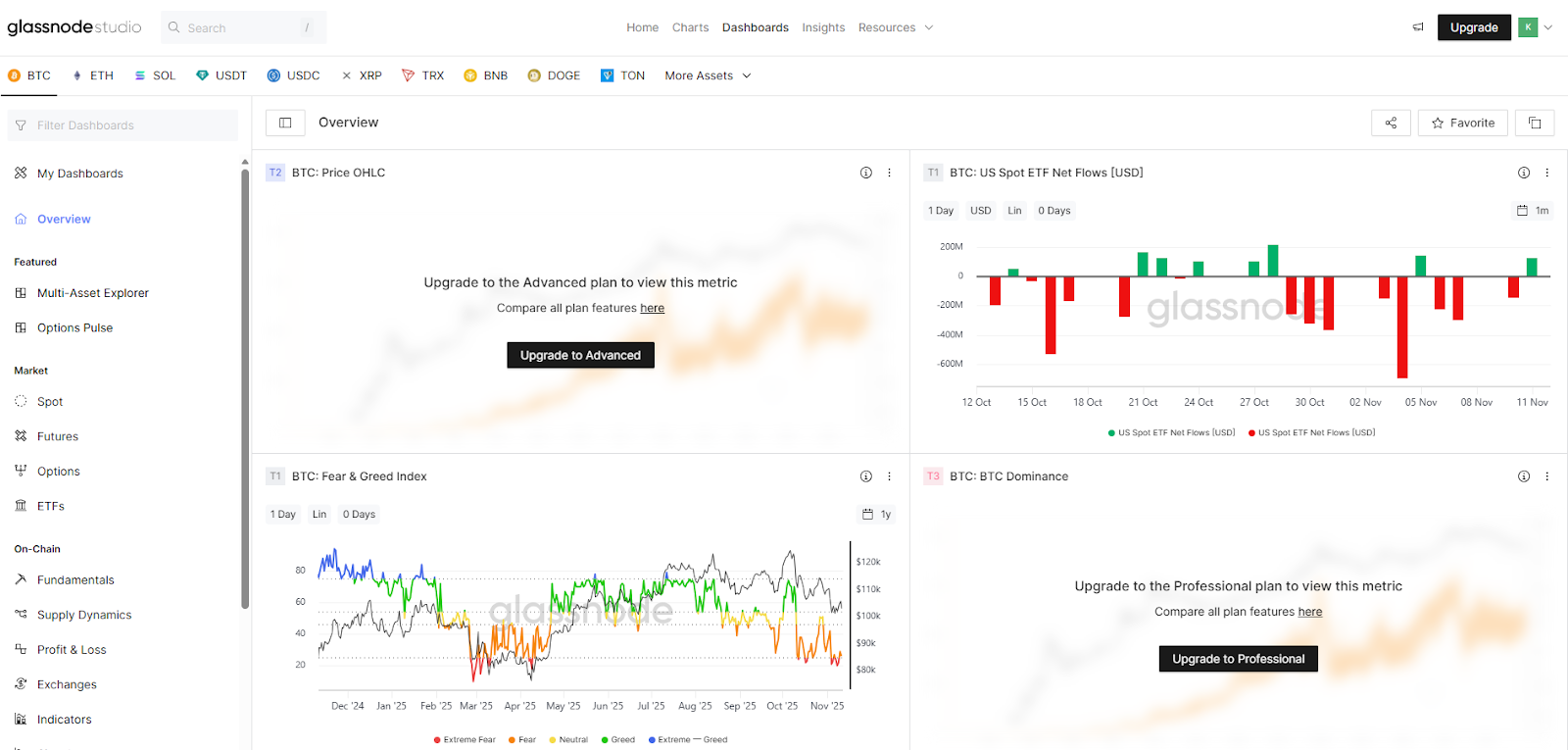

Glassnode

Glassnode is a pioneer in on-chain analytics, providing institutional-grade insights into Bitcoin, Ethereum, and select altcoins. It tracks whale behavior, capital inflows/outflows, and market sentiment through advanced blockchain metrics.

Pros:

- Provides hundreds of high-quality on-chain metrics, such as SOPR, whale activity, to detect early market signals and analyze institutional-grade data, including MVRV ratio, NUPL, and exchange inflows.

- Offers in-depth reports in collaboration with major organizations, supporting metrics like market sentiment indices, capital flows, and macro trends.

- API access for data and integration, allowing real-time updates, customizable queries, and data exports.

Cons:

- Focused mainly on BTC and ETH.

- Expensive subscription tiers for advanced data.

- Free users may experience slower updates.

Conclusion

In a market where every second counts, accurate data is the greatest advantage. Choosing the right tools helps investors save time, remove emotional bias, and clearly understand market direction. Combining multiple tools, from on-chain analytics to sentiment trackers, consistently gives users a clearer, faster, and more confident perspective on the crypto landscape.

Disclaimer: This article is for informational purposes only and not financial advice. Whales Market is not responsible for any investment decisions.

FAQs

Q1. Can crypto research tools completely replace manual analysis?

No. Tools help process data faster and more accurately, but final investment decisions still rely on user experience and interpretation.

Q2. Which tools are best for beginners?

Beginners can start with CoinGecko or DefiLlama, as they offer free access, simple dashboards, and clear data for quick learning.

Q3. How can users identify trustworthy data sources?

Choose open-source platforms that update in real time and are community-verified, such as Dune or L2Beat, to minimize misinformation.

Q4. Are paid subscriptions required to access advanced analytics?

Most platforms have free plans, but premium versions unlock deeper data access, higher API limits, and exclusive insights.

Q5. Should users combine multiple research tools?

Yes. Using several tools together offers a multi-dimensional view, covering on-chain activity, social sentiment, and Layer 2 growth, for more reliable investment strategies.