The crypto community is grappling with an uncomfortable truth: despite Bitcoin's resilience and selective recoveries among major coins, the 2025 market cycle has proven uniquely punishing for altcoin investors. Veterans who weathered 2018 and 2022 crashes find themselves in uncharted territory, facing unprecedented challenges.

Why Is the Market Playing by Different Rules Now?

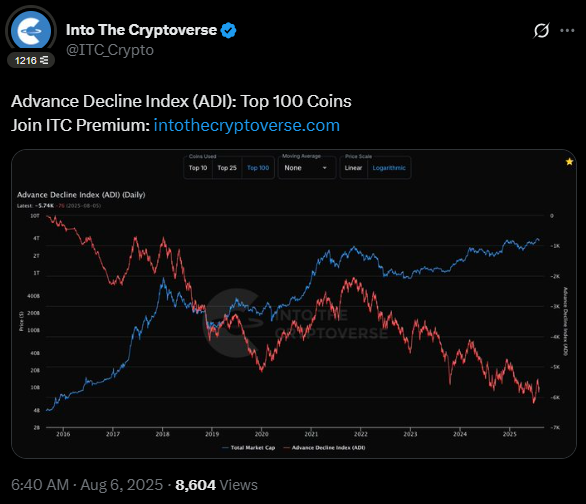

The Advanced Decline Index (ADI) for the top 100 cryptocurrencies reveals a disturbing pattern since 2021: declining altcoins consistently outnumber advancing ones, even as overall market cap climbs. This metric exposes the harsh reality that most tokens are bleeding while only a select few thrive.

Current Market

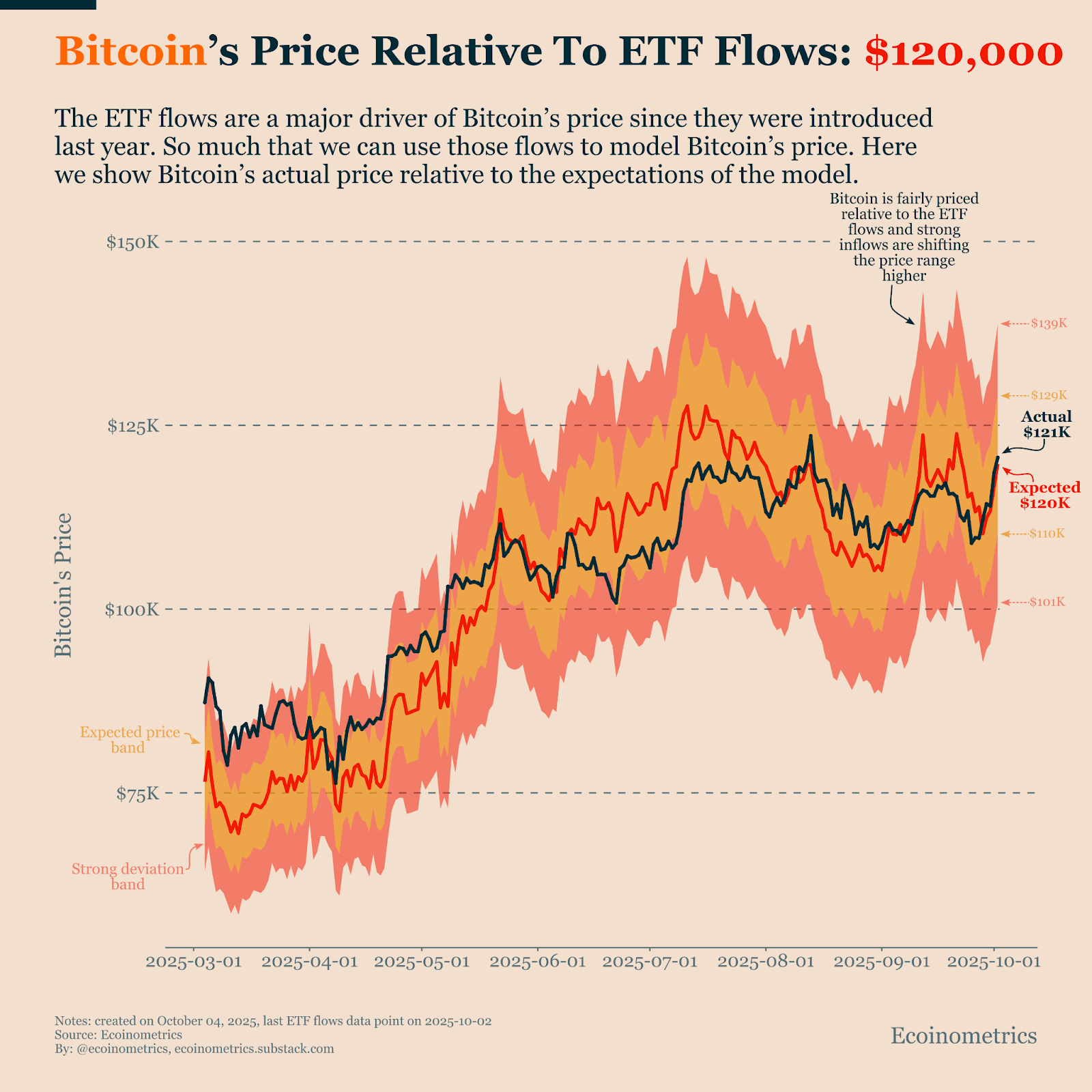

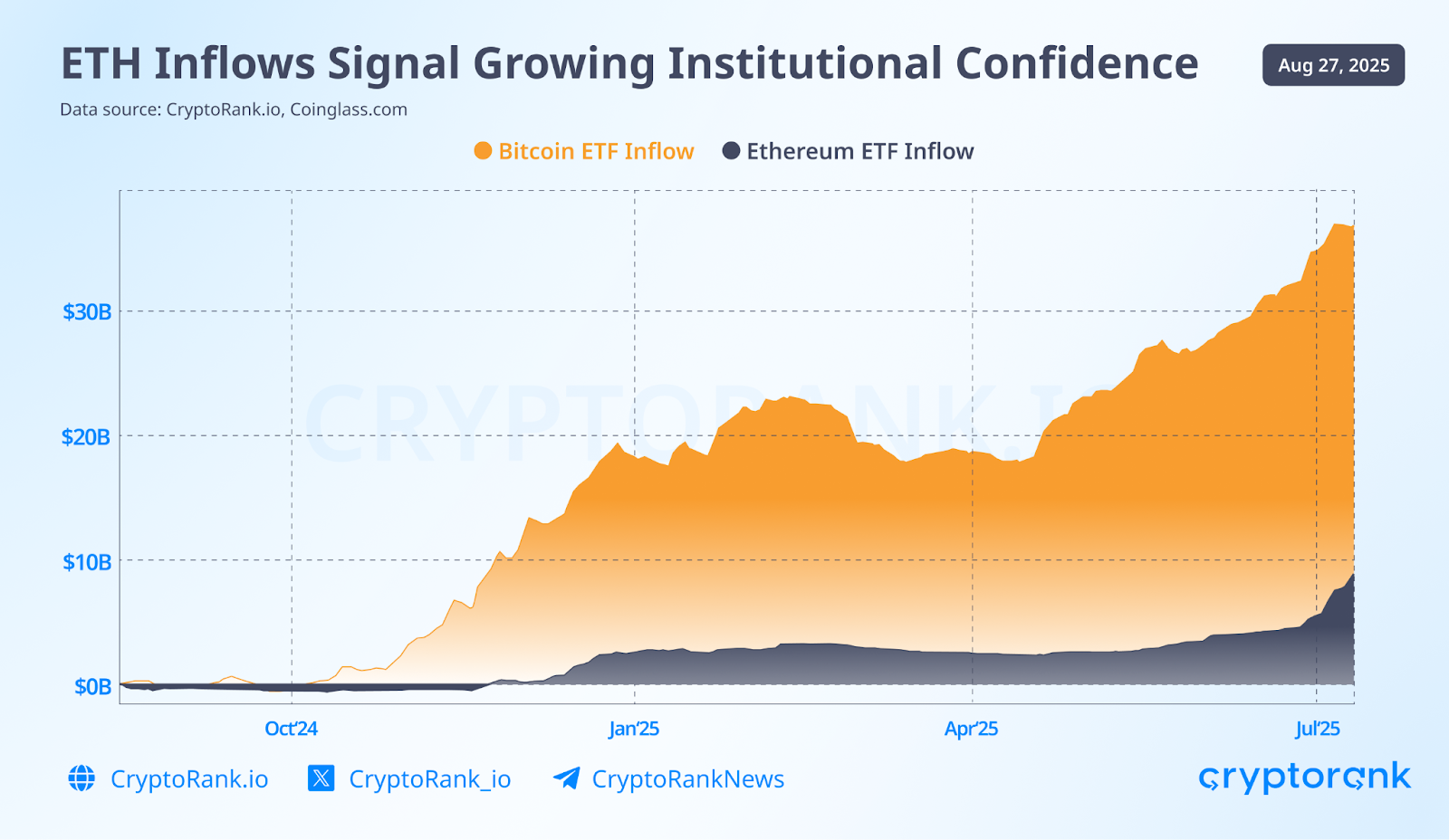

October 2025 marked a significant milestone as U.S. Bitcoin ETFs recorded historic inflows. In the first week alone, Bitcoin ETFs attracted $3.24 billion, with a single-day record of $1.19 billion on October 7. The total net asset value of Bitcoin ETFs has exceeded $164 billion, representing 6.74% of Bitcoin's market cap, clear evidence that institutional capital is flooding in, but focused solely on Bitcoin.

Meanwhile, the stablecoin market hit a record $314 billion in October, with major institutions like Citigroup and Visa announcing plans to launch their own stablecoins. This shows liquidity is growing, but it's sitting in stablecoins rather than flowing into altcoins.

Bitcoin surpassed $125,000 in early October, touching $126,219, while Bitcoin Dominance declined from over 60.5% in April to below 58%. The total altcoin market cap (TOTAL2) reached an all-time high of $1.18 trillion, though these are only early signals.

The Reality of Capital Rotation

Instead of broad market rallies, capital rotates rapidly between sectors. The hottest narratives in 2024-2025 have been Memecoins, AI, RWA, and DePIN. AI and Memecoins delivered average returns of 2,939.8% and 2,185.1% respectively in 2024, but the weekly reality differs sharply.

One week Memecoins surge, the next AI leads, then DePIN, then RWA. After each brief pump, liquidity flows back to Bitcoin and Ethereum. Major institutions like Morgan Stanley and Wells Fargo have only recently opened crypto access for clients, viewing Bitcoin primarily as a hedge against inflation and geopolitical risk.

Altcoins haven't presented use cases compelling enough to attract serious institutional capital. ETF flows pour billions into Bitcoin weekly, while altcoins chase short-term narratives for liquidity.

What's Creating This Perfect Storm?

The Mathematics of Oversupply

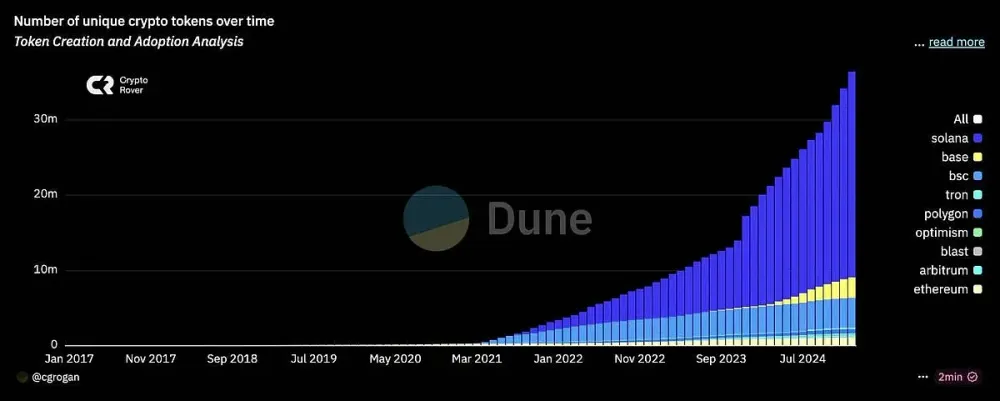

The 2020-2021 bull run created millionaires overnight when zero interest rates and money printing made every investment profitable. Today's reality is starkly different: $3.7 trillion market cap barely exceeds 2021's peak, yet token count exploded from 3 million to 37 million projects.

Without massive new capital inflows, existing players shuffle the same money between ever-growing token supplies. This mathematical impossibility intensifies competition to breaking point, ensuring most projects will fail.

The Liquidity Crisis Nobody Saw Coming

October 10's liquidation event devastated even giants like Wintermute when Binance's ADL triggered at irrational levels. Market makers suffered catastrophic losses, trapped with underwater positions and unable to re-hedge effectively.

The aftermath continues: market makers pulled liquidity, creating paper-thin order books where tokens nearly hit zero. With Wintermute still awaiting Binance compensation, liquidity constraints will persist indefinitely, making altcoins increasingly vulnerable to manipulation.

Traditional Finance's Selective Embrace

TradFi arrived in crypto but only focuses on Bitcoin and Ethereum, ignoring the altcoin wasteland. The altcoin ecosystem offers nothing attractive: excessive tokens without utility, overlapping technologies solving non-problems, and projects lacking real customers or revenue.

Institutional investors apply strict criteria, real users, genuine revenue, authentic demand, actual problem-solving. Most altcoins fail these basic tests, destined for elimination like dot-com casualties from 2000.

Token Unlocks

The "low float, high FDV" model haunts 2025 as billions in locked tokens from 2023-2024 launches prepare for release. Projects like Worldcoin, launching at $20 billion valuation with unlocks through 2028, showcase relentless price decline without recovery.

Throughout 2025, continuous unlock waves create perpetual selling pressure across hundreds of projects. VCs and teams wait to dump their allocations, making sustainable price appreciation nearly impossible for affected tokens.

How Do You Survive When the Old Playbook Fails?

Adaptation, not complaints, represents the only path forward in this transformed landscape. Success requires accepting new rules and evolving strategies accordingly.

- Portfolio Construction: Allocate 70–80% to Bitcoin/Ethereum, 10–20% to carefully researched altcoins, and ≤5–10% to speculation. Conservative positioning beats aggressive gambling when markets turn hostile.

- Skill Development: Master fundamental analysis, trading, content creation, or network building to create competitive advantages. Crypto rewards competence regardless of credentials, offering income opportunities for dedicated participants who develop genuine expertise.

- Long-term Perspective: Recognize crypto's evolution through necessary cleansing rather than death spiral. Current hardships eliminate weak projects while strengthening survivors, building foundations for sustainable future growth despite painful present conditions.

Conclusion

This challenging environment could persist through 2026. Capital preservation matters more than chasing quick gains when survival is the goal.

Difficult periods separate temporary players from long-term winners through adaptation. The 2025 cycle's brutality reflects structural changes, those who recognize and adapt will emerge stronger. Success isn't about luck. It's about accepting that the market has evolved and evolving with it.

FAQs

Q1: Why is the 2025 crypto cycle considered more brutal than 2018 or 2022 bear markets?

37 million tokens compete for liquidity versus 3 million in 2021. Massive unlocks and institutional focus on Bitcoin/Ethereum starve altcoins.

Q2: What is the Advanced Decline Index (ADI) and why does it matter?

ADI tracks daily advancing versus declining top 100 cryptos. Since 2021, more coins decline than advance despite rising market cap.

Q3: How should investors adapt their strategies for this brutal market?

Allocate 70-80% to Bitcoin/Ethereum, 10-20% to vetted altcoins, maximum 5-10% speculation. Prioritize capital preservation over quick profits.

Q4: Why are institutional investors avoiding altcoins despite entering crypto?

Institutions require real users, revenue, and problem-solving. Most altcoins lack these. Bitcoin hedges inflation; Ethereum provides infrastructure; altcoins remain speculative.

Q5: How can platforms like Whales Market help navigate this difficult cycle?

Whales Market enables pre-market trading before public listings, allowing strategic positioning at better valuations before open market volatility hits.

Q6: Will altcoins eventually recover or is this permanent market structure change?

Quality projects with real utility will survive. Indiscriminate altcoin pumps are over. Success now requires rigorous fundamental analysis.