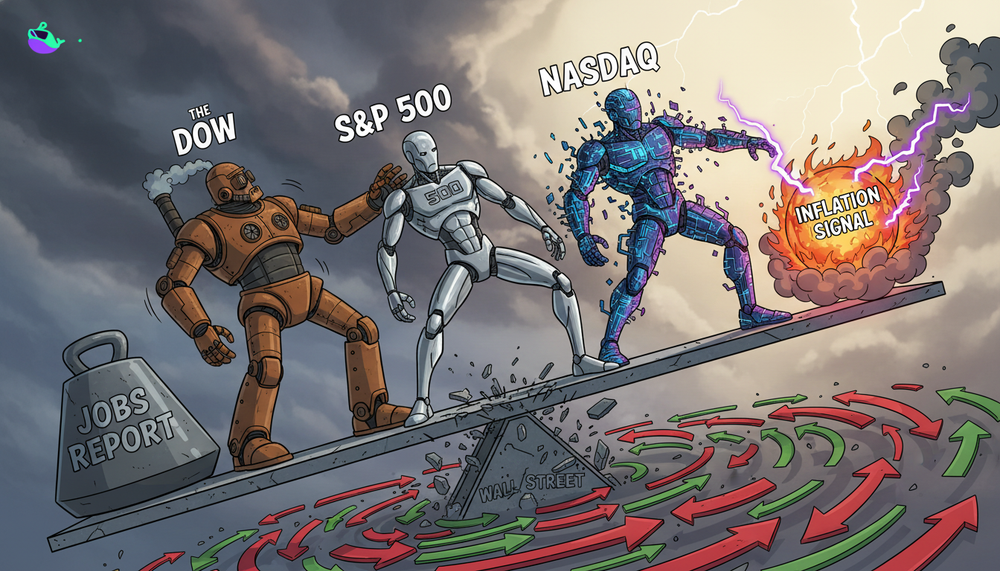

US stock futures experienced a slight decline overnight, potentially extending recent losses as investors grapple with the implications of the latest jobs report on Federal Reserve policy and the overall health of the American economy.

- Dow Jones Industrial Average futures (YM=F) edged into negative territory.

- S&P 500 futures (ES=F) decreased by approximately 0.1%.

- Nasdaq 100 futures (NQ=F) fell by 0.2%. This follows a mixed performance on Wall Street during Tuesday's trading session.

Jobs Data and Interest Rate Expectations

After a period with limited economic data, Wall Street is analyzing the November jobs report to determine the likely direction of interest rates in the coming year. The data released on Tuesday presented a mixed picture: a higher-than-expected number of jobs added alongside the highest unemployment rate observed since 2021.

However, analysts have cautioned that the data may contain a significant margin of error due to a prolonged government shutdown that disrupted data collection and releases. Consequently, the market's expectations for a January rate cut remained virtually unchanged at just 25%.

Fed Speakers and Inflation Data

Two key Federal Reserve officials, John Williams of the New York Fed and Fed Governor Chris Waller, are scheduled to make public appearances on Wednesday, potentially offering insights into the future path of monetary policy. Furthermore, reports indicate that Chris Waller is also being interviewed by President Trump as the President nears the decision of a replacement for current Chair Jerome Powell.

Attention is also shifting to Thursday's release of the November Consumer Price Index (CPI), a crucial inflation indicator. Federal Reserve Chair Jerome Powell has highlighted the CPI as a key factor influencing the Fed's interest rate decision next month.

Tech Stocks and Key Earnings

Investor sentiment towards technology stocks remains a focal point, particularly amid ongoing discussions surrounding the AI sector. Micron Technology's (MU) quarterly earnings report, due after the closing bell on Wednesday, is being closely watched as concerns within the sector persist, despite the US semiconductor manufacturer benefiting from the memory chip shortage.

Tesla (TSLA) has recently contributed to a more positive outlook for tech stocks. On Tuesday, the company achieved its first record closing price in roughly a year, fueled by increasing investor optimism regarding its robotaxi ambitions.

FAQs

Why are stock futures down slightly today?

Stock futures are experiencing a slight decline as investors analyze the latest jobs report and its potential impact on Federal Reserve policy and the overall health of the economy. The market is trying to decipher whether the jobs data will influence interest rate decisions.

What economic data should investors watch this week?

Investors should pay close attention to Thursday's release of the November Consumer Price Index (CPI), a key inflation indicator closely monitored by the Federal Reserve. Also, statements from Fed officials John Williams and Chris Waller could provide insights into monetary policy.

Why is Micron Technology's earnings report important?

Micron's earnings report is being closely watched as it will provide insights into the health of the technology sector, particularly amid ongoing discussions surrounding AI and concerns within the semiconductor industry. Investors are looking for signs of strength or weakness in the sector.

You've got the context, now make it count. Capitalize on your financial knowledge and explore informed investment opportunities on a cutting-edge crypto premarket platform powered by Whales Market.