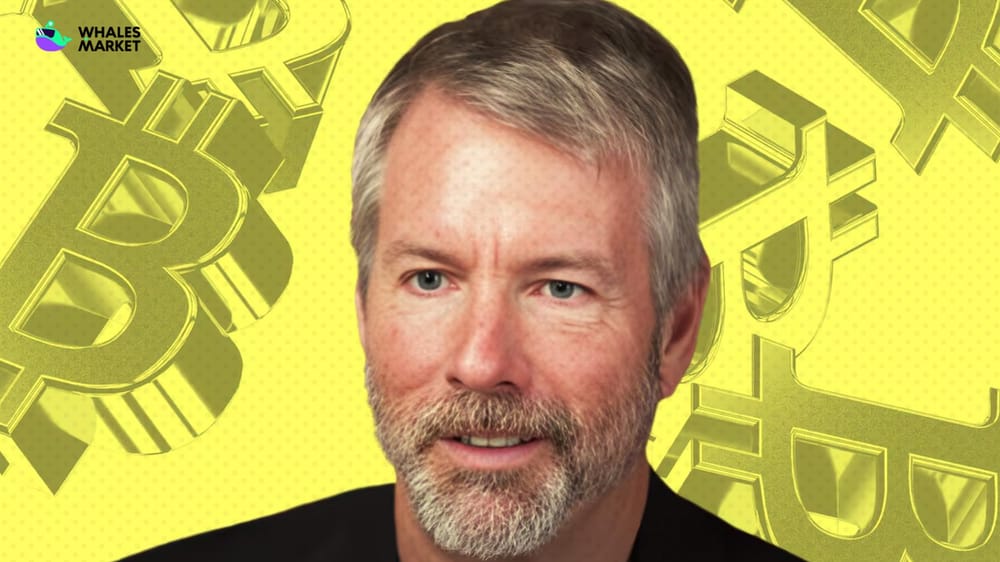

Michael Saylor, a prominent Bitcoin advocate, has recently stated his belief that Bitcoin serves as the "foundation of economic markets." This declaration reinforces Saylor's long-held conviction regarding the cryptocurrency's significance in the global financial landscape. His statement highlights the potential for Bitcoin to underpin future economic systems.

Saylor's Endorsement of Bitcoin's Foundational Role

Michael Saylor's assertion positions Bitcoin as more than just a digital asset; he views it as a fundamental component of the broader economic structure. This perspective aligns with his previous statements and actions, which have consistently promoted Bitcoin as a superior store of value and a hedge against inflation. Saylor's continued advocacy reinforces his commitment to Bitcoin's long-term potential.

MicroStrategy's Bitcoin Holdings

Saylor's company, MicroStrategy, has famously adopted a strategy of accumulating Bitcoin as a primary treasury reserve asset. As of recent reports, MicroStrategy holds a substantial amount of Bitcoin. This strategic investment reflects Saylor's confidence in Bitcoin's ability to preserve and grow capital over time. The company's holdings make it one of the largest corporate holders of Bitcoin worldwide.

Bitcoin's Market Performance and Adoption

Bitcoin's market capitalization and increasing adoption rate support the argument for its growing importance in economic markets. Institutional investors are increasingly allocating portions of their portfolios to Bitcoin. This trend indicates a broader acceptance of Bitcoin as a legitimate asset class. The increasing liquidity and infrastructure surrounding Bitcoin further solidify its position in the financial ecosystem.

Conclusion

Michael Saylor's continued advocacy for Bitcoin as the "foundation of economic markets" underscores the cryptocurrency's evolving role in the global financial system. As adoption grows and infrastructure develops, Bitcoin's potential to influence economic structures becomes increasingly apparent. The future will reveal the extent to which Saylor's vision materializes.

FAQs

What are some alternative perspectives on Bitcoin's role in economic markets?

While Michael Saylor views Bitcoin as a foundational element, other perspectives exist. Some economists and financial analysts remain skeptical, citing Bitcoin's volatility and regulatory uncertainties as potential impediments to widespread adoption. They argue that traditional assets and established financial systems will continue to dominate the global economy. These differing viewpoints contribute to an ongoing debate about the future of finance and the role of cryptocurrencies.

How does Bitcoin's limited supply contribute to its perceived value?

Bitcoin's protocol dictates a maximum supply of 21 million coins, creating scarcity. This limited supply is a key factor in its value proposition, as it contrasts with fiat currencies that can be printed by central banks. The scarcity of Bitcoin is often compared to that of precious metals like gold, which have historically served as stores of value. This controlled supply contributes to Bitcoin's appeal as a hedge against inflation and currency devaluation.

What are the potential risks associated with investing in Bitcoin?

Investing in Bitcoin carries inherent risks, including price volatility, regulatory uncertainty, and security concerns. Bitcoin's price can fluctuate significantly in short periods, leading to potential losses for investors. Regulatory frameworks surrounding cryptocurrencies are still evolving, and changes in regulations could impact Bitcoin's value and usability. Additionally, the risk of theft or loss of Bitcoin holdings due to hacking or mismanagement remains a concern for investors.

How might Bitcoin influence traditional financial institutions?

Bitcoin and other cryptocurrencies are prompting traditional financial institutions to adapt and innovate. Many banks and investment firms are exploring ways to incorporate digital assets into their offerings, such as providing custody services or launching cryptocurrency-related investment products. The rise of decentralized finance (DeFi) is also challenging traditional financial models, potentially leading to greater competition and innovation in the financial sector. The long-term impact on traditional institutions remains to be seen.